When orchestrating a trip from India to the United States, selecting the appropriate travel insurance is not a mere administrative task—it is a cornerstone of your financial strategy. A meticulously chosen US visitor insurance policy is the only reliable buffer between you and the formidable costs of American healthcare.

Why US Visitor Insurance Is a Strategic Necessity

A sojourn to the US presents an unparalleled experience, yet it is accompanied by financial risks that demand prudent preparation. The most significant of these is the liability of unexpected medical expenses. To view travel insurance as simple trip protection is a grave miscalculation; it is a critical layer of financial armor.

The American healthcare system operates on an economic scale that is vastly different from most of the world. A minor visit to an emergency room for a seemingly simple ailment can rapidly escalate into a bill for several thousand dollars. A more serious medical event requiring hospitalization can generate expenses so substantial they could be financially catastrophic without premier coverage. This is where specialized travel insurance from India to US becomes an indispensable asset.

Why Standard Indian Policies May Be Insufficient

While procuring a standard travel policy in India may seem convenient, these plans are seldom architected for the realities of the US medical system. Many Indian travel insurance policies are simply not designed to handle the high-cost environment or the specific operational protocols of American healthcare.

They often feature lower coverage limits, may not offer direct billing (requiring you to pay substantial sums upfront and seek reimbursement later), and can present significant logistical challenges in the claims process when managed from overseas. You can learn more about why US-based insurance is recommended for travelers from India on VisitorGuard.com.

Consider this: Opting for a US-based visitor insurance plan is not merely about having coverage. It is about securing coverage that is functionally effective within the United States. It grants access to direct billing, recognized physician and hospital networks, and dedicated support teams operating in US time zones.

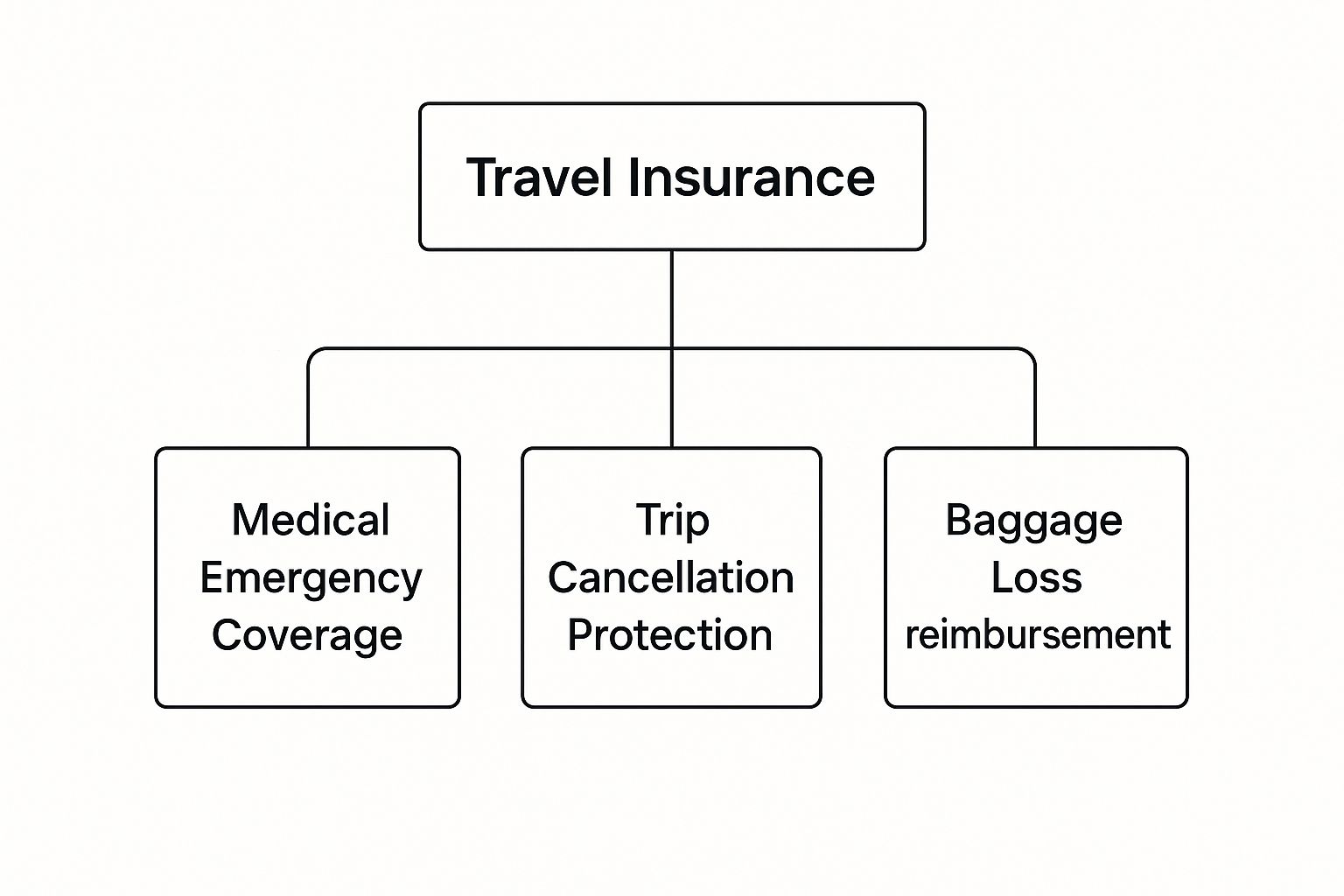

The infographic below deconstructs the essential components of a robust travel insurance policy. While each element has its place, one is clearly the foundation.

As illustrated, while protecting luggage and travel investments is a valid concern, the true core of any superior plan is substantial medical emergency coverage. This is what preserves your wealth.

Indian Policy vs. US Visitor Insurance: A Comparative Analysis

The distinctions between a typical policy procured in India and a specialized US-based plan are stark. This table highlights the critical differences that must be understood before making a selection.

| Feature | Typical Indian Travel Policy | Recommended US Visitor Insurance |

|---|---|---|

| Coverage Limits | Often capped at levels like $50,000 to $100,000, which can be grossly insufficient for serious US medical events. | Higher, appropriate limits (e.g., $250,000 to $1,000,000+), designed for US healthcare costs. |

| Provider Network | Limited or no direct PPO network in the US, leading to potential out-of-network costs and billing complexities. | Access to extensive PPO networks, ensuring negotiated rates and facilitating direct billing with medical facilities. |

| Claims Process | Predominantly a reimbursement model; you pay upfront and claim later. This process can be slow and arduous from abroad. | Direct billing is the standard. The insurer settles payment directly with the hospital, minimizing your out-of-pocket exposure. |

| Client Support | Based in India, making real-time coordination during a US emergency difficult due to time zone disparities. | US-based support, available during US business hours to assist with claims and provider liaison. |

| Policy Architecture | General travel protection, not specifically tailored to the unique US healthcare billing and administrative system. | Specifically engineered to navigate the US healthcare system, including compliance and billing practices. |

This comparison makes it evident: while an Indian policy might appear convenient, a US-based plan is built for the specific financial and logistical challenges you will face.

An Indispensable Asset Protection Strategy

Ultimately, this insurance must be viewed not as a travel expense, but as a non-negotiable strategy to protect your personal assets. It is the mechanism that ensures a medical emergency does not erode your savings or place your family in a precarious financial position.

A specialized US visitor insurance plan provides peace of mind. It allows you to focus on the purpose of your trip, secure in the knowledge that a formidable financial shield is in place.

Decoding Your US Travel Insurance Policy

Let us be forthright—reviewing the fine print of an insurance policy is a tedious exercise. The language can feel arcane and complex. But when securing travel insurance from India to US, overlooking these details is a direct route to significant financial risk.

Your policy is a financial agreement that delineates precisely who bears the cost when an unforeseen event occurs. A few key terms define the parameters of this partnership. Once you master them, you can ascertain exactly where your financial responsibility begins and ends.

The Four Pillars of Your Financial Responsibility

These four terms are the bedrock of any policy, determining your out-of-pocket costs in a medical emergency. Understanding them is the only way to compare plans beyond their premium price.

-

Policy Maximum: This is the absolute ceiling on what the insurance company will pay for all covered medical expenses during your trip. Given the exceptional cost of American healthcare, an insufficient maximum is an unacceptable gamble. One should seek policies with a substantial limit—ideally $500,000 or higher—to afford genuine protection.

-

Deductible: This is your initial contribution. It is the fixed amount you must pay yourself before the insurance company begins to contribute. With a $500 deductible, you are responsible for the first $500 of a covered medical expense, after which your insurance cost-sharing provisions are triggered.

-

Co-insurance: After your deductible is met, co-insurance dictates the next phase of cost-sharing, where you pay a percentage of the subsequent bill. A common arrangement is an 80/20 split, where the insurer covers 80% of the cost, and you are responsible for the remaining 20%.

-

Out-of-Pocket Maximum: This is your most critical financial safeguard. It represents the absolute limit on what you will be required to pay for covered care during your policy period, including your deductible and all co-insurance payments. Once you reach this cap, the insurance company assumes 100% of all subsequent covered costs, up to your policy maximum.

A policy's true value lies not just in its maximum coverage, but in the interplay of these four elements. A low premium can easily mask a high deductible or an unfavorable co-insurance split, leaving you dangerously exposed in the event of a claim.

A Crucial Clause for Visiting Parents and Seniors

Beyond these four pillars, one benefit is of paramount importance, especially for parents visiting from India or any traveler with a managed health condition: Acute Onset of a Pre-existing Condition.

To be clear, this is not coverage for routine or elective care. It will not cover prescription refills or a scheduled consultation for a known issue. Rather, this benefit is a financial lifeline for a sudden, unexpected crisis related to a stable, pre-existing condition that requires immediate medical intervention.

For instance, if a visitor with well-managed hypertension were to suffer a sudden stroke, this benefit would cover the emergency treatment. Most high-quality US-based visitor insurance plans include this, but the coverage amounts and age restrictions can vary significantly. Its inclusion is often what distinguishes a rudimentary plan from one that provides meaningful, real-world protection.

By deconstructing these key components, you can look past marketing and price tags. This knowledge empowers you to analyze any travel insurance from India to US policy with precision, ensuring your choice is a strategic shield for your finances.

The Advantages of US-Based Provider Networks

When evaluating travel insurance from India to US, the choice between an Indian and a US-based provider may seem like a minor detail. It is not. It is a strategic decision that fundamentally impacts your experience should a medical issue arise.

The single greatest advantage of a US-based provider is access to its extensive Preferred Provider Organization (PPO) networks. This is an integral feature of the American healthcare system.

A PPO network is an exclusive consortium of hospitals, clinics, and physicians that have pre-negotiated service rates with your insurance company. When you require care and utilize a provider within this network, the entire financial and logistical process becomes remarkably efficient. This is a level of integrated efficiency that most policies from India cannot replicate.

It is this network access that enables direct billing—often referred to as "cashless" service. The hospital submits the invoice directly to the insurer, not to you. This is a crucial benefit, saving you from the predicament of paying a substantial bill out-of-pocket and subsequently pursuing a complex reimbursement process.

Engineered for the American Healthcare Environment

Let us be direct: American medical care is exceptionally expensive. US-based visitor insurance plans are architected from the ground up with this financial reality in mind. They offer substantial policy maximums, often ranging from $250,000 to over $1,000,000. This figure represents tangible protection against a health crisis that could otherwise deplete a lifetime of savings.

This has never been more critical. A single emergency room visit for a seemingly minor issue can easily result in a bill for thousands of dollars. Possessing robust insurance is not merely a good idea; it is a vital financial shield for any individual from India traveling to the United States.

A US-based policy operates with an intrinsic understanding of the local system. This institutional knowledge translates to smoother claims, better-negotiated prices on medical services, and a support team that operates on your local time zone—an absolutely vital asset during an emergency.

Seamless Processing and Compliance

Beyond billing, the entire claims adjudication process is far more streamlined with a US provider. They are experts in the billing codes, required documentation, and standard procedures. This expertise helps prevent the frustrating delays and denials that can occur when foreign insurers attempt to navigate the complex US system. You can gain a better understanding of how these crucial medical networks function by reviewing our related article.

Furthermore, these plans are specifically designed to meet US visa requirements, such as those for J-1 exchange visitors, ensuring compliance from the outset. This alignment with both the financial and regulatory landscape makes a US-based plan a practical necessity for the discerning traveler.

Selecting the Right US Insurance Provider

Choosing a US-based insurance provider is one of the most consequential decisions for your trip. It directly determines the integrity of your financial safety net while you are abroad. The market is saturated with options that can appear confusingly similar at first glance.

Your objective is to identify a plan tailored to your specific profile. The optimal choice for a J-1 student differs entirely from that of a business traveler, which in turn is different from the ideal plan for parents visiting family for an extended period.

You will quickly encounter two primary plan structures: fixed-benefit and comprehensive. A fixed-benefit plan is akin to a basic, à la carte menu. It pays a set, predetermined amount for each specific medical service—for example, $500 for an ER visit or $1,500 for a particular surgery. While the premiums are lower, you are liable for any costs exceeding those modest limits. In the high-cost US medical system, this can be a formula for financial distress.

A comprehensive plan, by contrast, is a true financial shield. After you satisfy your deductible, the plan covers a high percentage of your medical bills, typically 80% to 100%, up to the policy maximum. For any individual who values genuine peace of mind, a comprehensive plan is the only strategic choice for travel insurance from India to US.

Analyzing Key Provider Features

When comparing providers, do not be guided solely by the premium. The lowest-priced plan is seldom the best value. Instead, focus on providers renowned for superior client service, efficient claims processing, and specific benefits that align with your needs, such as robust coverage for seniors. To explore this further, our guide on choosing the right expat medical insurance policy type offers more context on the features that truly matter.

A clear indicator of a quality provider is their affiliation with a major PPO (Preferred Provider Organization) network, such as UnitedHealthcare or First Health. This affiliation is your key to seamless acceptance by physicians and hospitals and, more importantly, facilitates direct, cashless billing.

Your primary goal should be financial security, not simply minimizing cost. Investing slightly more in a comprehensive plan from a reputable provider with a strong PPO network is not an expense—it is an investment in preventing a catastrophic financial loss.

To facilitate your decision, the following table compares some of the leading comprehensive plans that are popular and well-regarded for travelers from India, allowing for a straightforward comparison of their most important features.

Comparing Leading US Visitor Insurance Plans

This table provides a side-by-side analysis of leading plans, helping you align their strengths with your specific travel requirements.

| Provider/Plan | Max Coverage Options | Acute Onset of Pre-existing Conditions | Best Suited For |

|---|---|---|---|

| Atlas America (WorldTrips) | Up to $2,000,000 | Covered up to the policy maximum for travelers under 80. | Healthy travelers of all ages seeking high coverage limits and flexibility. |

| Patriot America Plus (IMG) | Up to $1,000,000 | Covered up to the policy maximum for travelers under 70. | Individuals and families seeking a balance of strong benefits and a trusted PPO network. |

| Safe Travels USA Comprehensive (Trawick) | Up to $1,000,000 | Covered up to the policy maximum for travelers up to 89. | Seniors and visiting parents requiring robust protection for sudden medical emergencies related to stable conditions. |

| Visitors Protect (IMG) | Up to $250,000 | Covers pre-existing conditions with certain limitations (requires 90-day minimum purchase). | Travelers with less stable pre-existing conditions who need a specialized plan for longer stays. |

As you can see, each provider serves a distinct niche. A healthy 35-year-old on a short business trip might gravitate toward the high maximums of Atlas America. In contrast, an individual arranging coverage for their 75-year-old parent would likely prioritize the strong acute onset benefits found in a plan like Safe Travels USA Comprehensive.

Finalizing Your Insurance Purchase

Having completed the rigorous work of comparing plans and features, it is time to execute the purchase of your policy. This is more than a simple online transaction; it is the moment you secure your financial safety net for your time in the US. Diligence at this final stage ensures the travel insurance from India to US you have selected is robust and perfectly aligned with your itinerary.

First and foremost, timing is paramount. You must secure your policy before you depart from India. This is a simple but non-negotiable step that guarantees your coverage is active from the moment you arrive in the US, leaving no dangerous gaps in protection. Waiting until after you have landed is an unnecessary and ill-advised risk.

This is not merely expert advice; it has become standard practice for sophisticated international travelers. A recent study revealed that 85% of Indians traveling internationally intend to purchase travel insurance, underscoring its perceived necessity. You can explore these trends in the full Allianz Partners India Travel Index report for deeper insight.

Executing Your Policy with Precision

Finalizing your purchase extends beyond entering payment details. It involves meticulous data entry and making several final strategic decisions that will directly influence your policy's efficacy should you need to file a claim.

One of the most critical aspects of this process is the declaration of a full and accurate medical history. The temptation to omit what may seem like a minor detail should be resisted. Non-disclosure is one of the most common reasons for a subsequent claim to be denied. Insurance is underwritten on the principle of "utmost good faith," a formal tenet requiring complete transparency from the applicant.

Regard the policy's deductible and maximum coverage not as abstract figures, but as instruments for managing your personal financial risk. A higher deductible may yield a lower premium, but it also increases your initial out-of-pocket liability. The policy maximum is your ultimate shield against truly catastrophic medical expenses.

Managing Your Coverage for Extended Stays

Travel itineraries can evolve. Should you decide to extend your stay in the US, your insurance must be equally adaptable. Fortunately, most high-quality US-based plans offer a straightforward process for extending coverage, provided the request is made before your current policy expires.

Before finalizing the purchase, conduct a final review using this checklist:

- Review All Details: Double-check every data field for accuracy. Correct spelling of names and precise birth dates are essential to prevent administrative complications later.

- Confirm Coverage Start/End Dates: Ensure the policy's effective date is your departure day and the end date covers your entire planned trip, up to and including the day you return home.

- Understand the Extension Process: Before committing, be clear on the provider's rules for policy extensions. What are the deadlines? Are there any restrictions or changes in terms?

By methodically addressing these final points, you transform a simple purchase into a prudent investment in your financial security. It is the final step to ensuring you are fully protected before your American journey begins.

Frequently Asked Questions

Even with the most thorough planning, certain questions may arise before a significant trip. Here are direct answers to the most common queries regarding travel insurance from India to the US, designed to resolve any remaining ambiguity and allow you to finalize your arrangements with confidence.

Can I Buy US Travel Insurance After Arriving in the USA?

Technically, yes, it is possible to purchase a visitor insurance policy after you have landed in the US. However, this is an inadvisable strategy.

The fundamental purpose of insurance is to provide a safety net from the moment it is needed. Purchasing your policy before you leave India ensures your coverage commences upon arrival, eliminating any hazardous gaps. Furthermore, many policies impose a waiting period for illnesses if purchased after arrival, leaving you without immediate protection. Always secure your policy before you travel. It is the only prudent course of action.

What Is the Difference Between Fixed and Comprehensive Plans?

Understanding this distinction is absolutely critical. A "Fixed Coverage" plan functions like a limited discount voucher. It pays a modest, pre-determined amount for a specific medical service. You are personally liable for all costs exceeding that low cap, a scenario that can be financially devastating in the US.

A "Comprehensive Coverage" plan provides genuine protection. Once you have satisfied your deductible, the plan covers a substantial portion of your eligible medical bills—often 80% to 100%—up to the policy maximum. Given the exceptionally high cost of US healthcare, a comprehensive plan is the only choice that effectively manages your financial risk.

How Do I Use My Insurance for a Medical Emergency in the US?

In a true emergency, your first priority is to seek immediate medical attention at a hospital or clinic. Your US-based insurance provider will furnish you with a digital ID card and a 24/7 assistance number. Present this card upon check-in.

The primary advantage of a US-based plan is its provider network. If the hospital is within your plan’s PPO (Preferred Provider Organization) network, they will typically bill the insurance company directly for all covered services. This is a significant benefit, as it prevents you from having to pay massive sums out-of-pocket. If you must go out-of-network, you may need to pay first and file a claim for reimbursement.

As soon as is practical, contact your insurance company. Adhering to their procedures will ensure the claims process is as smooth as possible. For a more detailed exploration, you can also consult our guide that answers more frequently asked questions about expat insurance.

Does Visitor Insurance Cover Trip Cancellations?

This is a very common point of confusion. The policies discussed herein are properly termed "Visitor Medical Insurance." Their sole function is to protect you from the financial shock of unexpected medical emergencies that occur within the United States. While they may offer a nominal benefit for lost luggage, their core purpose is health-related.

"Trip Insurance" is an entirely different product. It is designed to reimburse you for non-refundable travel costs—such as flights and hotel bookings—if you must cancel or interrupt your trip. For travel to the US, the paramount financial threat is a medical event, making a robust visitor medical plan your top priority. If you also wish to protect your travel investments, you can purchase a separate trip insurance policy to complement your medical plan.

At Riviera Expat, we specialize in providing sophisticated insurance solutions that offer clarity, control, and confidence. Our expertise ensures high-net-worth individuals and their families receive the precise level of protection required for international travel. Secure your peace of mind with our expert guidance today.