For high-net-worth expatriates establishing a life in Thailand, securing the right health insurance is a foundational strategic decision. This is not a matter of mere paperwork; it is a critical investment ensuring immediate access to the country's world-class private medical facilities without financial friction. A premium private medical plan is your non-negotiable key to this exclusive tier of care.

A Strategic Overview for Expat Healthcare

Residing in Thailand offers an unparalleled lifestyle, but the quality of that experience is contingent upon your peace of mind. While the Kingdom is a globally recognized hub for medical tourism, attracting millions for its exceptional treatments, this standard of care exists almost exclusively within the private sector.

For the discerning expat, relying on public hospitals is not a viable strategy. These facilities can be overburdened, and the potential for a language barrier during a medical emergency introduces an unacceptable level of risk.

A premium private health insurance plan is best understood as your direct-access pass to an entirely different system of care. It unlocks a network where long queues and administrative hurdles are non-existent, ensuring immediate, high-quality medical attention when it matters most.

The Clear Advantages of Premium Coverage

Selecting the right insurance is an investment in certainty and comfort. The primary advantage is seamless, direct access to leading international hospitals such as Bumrungrad International and Samitivej Hospital. These institutions are staffed with internationally trained physicians and feature the latest medical technologies.

The benefits extend further. A well-structured policy provides:

- English-Speaking Support: From reception to your specialist consultation, communication is clear and precise. This is mission-critical when you are unwell and require absolute clarity.

- Immediate Specialist Access: The lengthy referral process is bypassed. You can secure an appointment with the necessary specialist without delay.

- Financial Peace of Mind: Your insurer liaises directly with the hospital, settling significant medical expenses so your personal assets remain untouched.

Securing the right health insurance in Thailand is an essential step in safeguarding not only your well-being but also your financial stability. It is the foundation upon which a secure and enjoyable expatriate life is built.

A Market That's Growing With You

The demand from expatriates and affluent locals for superior healthcare has fueled a boom in the private insurance market. Insurers are responding with increasingly sophisticated products designed for clients who expect a higher standard of care.

The health insurance market in Thailand was valued at USD 2.87 billion in 2023 and is projected to reach USD 5.10 billion by 2030, exhibiting a compound annual growth rate (CAGR) of 8.5%. This data signifies a clear and sustained trend of more individuals prioritizing access to premier hospitals and comprehensive coverage. You can read the full research about the health insurance market growth for more details.

For you, this growth translates into greater competition, superior products, and more refined policy options. It empowers you to select a plan that is precisely tailored to your personal health requirements and lifestyle—a topic we will explore next.

Navigating Public and Private Healthcare Systems

When structuring your health insurance in Thailand, a clear understanding of the profound differences between the public and private healthcare systems is paramount. They operate on entirely different philosophies, and for an expat, the experience in each is starkly contrasting.

This division is the primary reason why robust private medical coverage is not merely an option—it is an absolute necessity for those accustomed to a high standard of care.

Thailand's public healthcare system is commendable in its ambition to provide universal coverage for its citizens. However, for an expatriate, navigating this system for significant medical issues presents considerable challenges. You will almost certainly encounter language barriers at a time when clear communication is most vital. Furthermore, the long queues for appointments and treatments can be a source of significant stress. These factors alone render it an impractical choice for the majority of expats' healthcare needs.

The private sector, conversely, represents a different echelon of medical care. It is architected around patient comfort, efficiency, and cutting-edge treatment. This is the system that has established Thailand's reputation as a world-class destination for medical tourism.

The Private Sector Advantage for Expats

Enter a private international hospital in Bangkok, Chiang Mai, or Phuket, and you will find specialists trained in the United States, United Kingdom, or Europe. You will gain immediate access to state-of-the-art diagnostic equipment and receive a level of service akin to a five-star hotel.

- Immediate Access to Specialists: The need for a referral from a general practitioner is eliminated. You can book an appointment directly with a leading specialist, significantly reducing the time from diagnosis to treatment.

- State-of-the-Art Facilities: Major private hospitals are equipped with the latest medical technology, ensuring the care you receive is on par with the best available globally.

- Uncompromised Comfort and Privacy: Expect private rooms, personalized nursing attention, and English-speaking staff who make a stressful situation feel managed and reassuring.

Opting for private healthcare is choosing a system that values your time and prioritizes your comfort, allowing you to focus entirely on your recovery. This is precisely why a strong private health insurance plan is the bedrock of a secure and worry-free life in the Kingdom.

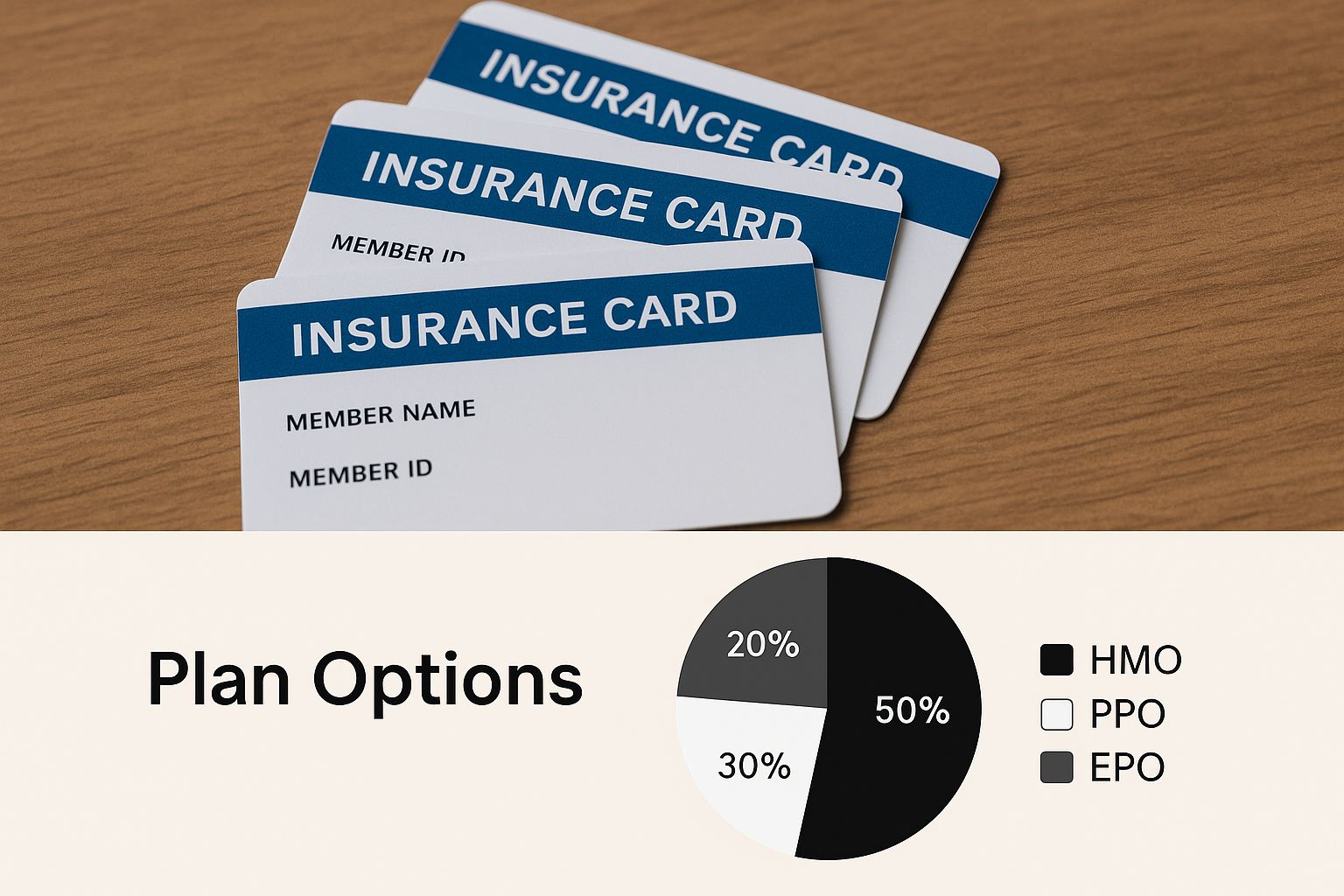

This infographic provides a concise visual breakdown of the different plan types designed to grant you access to this level of private care.

The sheer variety of available plans underscores a key point: you must select a policy that guarantees access to the best facilities, without exception.

Public vs Private Healthcare for Expats in Thailand

To delineate the distinction further, let's compare the systems feature by feature. For an expatriate residing in Thailand, the choice is a strategic balance of cost against convenience, comfort, and quality of communication.

| Feature | Public Healthcare System | Private Healthcare System |

|---|---|---|

| Cost | Low-cost or free for Thai citizens; variable for expats | Significantly higher; requires robust insurance or self-payment |

| Wait Times | Often very long for appointments and non-emergency procedures | Minimal to no wait times; appointments are prompt |

| Facilities & Equipment | Can be basic, especially in rural areas; often overcrowded | Modern, state-of-the-art technology and comfortable facilities |

| Staff & Language | Primarily Thai-speaking staff; language barrier is common | English-speaking doctors and staff are standard |

| Access to Specialists | Usually requires a referral and involves long waits | Direct and immediate access to specialists is typical |

| Comfort & Privacy | Shared wards are common; privacy is limited | Private rooms and a high level of personal service |

While the public system provides a critical safety net for the local population, the private system is explicitly engineered to meet the standards and expectations of international residents. The right insurance makes that superior level of care readily accessible.

Public Coverage Versus Private Demand

Thailand's public system is anchored by three main schemes that cover nearly 99% of the population. Despite this wide net, the demand for private health insurance is climbing, now covering around 6% of all residents.

The driver of this trend is a growing affluent class and the expatriate community, who are prepared to pay a premium for expedited service, superior facilities, and a more comfortable patient experience—particularly when compared to the often overstretched rural public hospitals.

This underscores a critical point: while public healthcare is available, the standard of care you undoubtedly expect is found exclusively within the private network. Having the right Thailand health insurance is what enables you to access these top-tier facilities without concern for the cost.

The choice between public and private healthcare in Thailand isn't just about money. It's about the quality of care, how quickly you can get it, and the entire patient experience. For discerning expats, the private system is really the only way to go.

Understanding how different insurance policies connect you to these hospitals is the final piece of the puzzle. You can explore our detailed guide on the various medical networks available to expats to see how it all works. At the end of the day, your insurance plan is the key that unlocks this superior tier of medical care, ensuring your health is always in the best possible hands.

Decoding Your Health Insurance Policy Options

Selecting the right health insurance in Thailand is not an off-the-shelf purchase. It is a bespoke process of constructing a financial safety net—one designed component by component to align with your lifestyle, travel frequency, and long-term health requirements. A sound decision begins with understanding the fundamental architecture of any policy.

The first critical decision is whether to opt for a local Thai plan or a global international policy. This single choice dictates your geographic scope of medical care and represents a crucial fork in the road.

Local vs International Plans The Geographic Divide

A local Thai health insurance plan is precisely as its name implies: it is structured for medical treatment exclusively within Thailand's borders. For expatriates who reside permanently in the Kingdom with minimal international travel, these plans can be a cost-effective solution, providing solid access to Thailand's excellent network of private hospitals.

However, for the globally mobile professional, a local plan presents a significant vulnerability. A medical event during a business trip to Singapore or a holiday in Europe would be entirely uncovered. This is a critical gap in protection for anyone leading an international life.

This is where an international health insurance plan is indispensable. These policies are engineered for the expatriate lifestyle, offering coverage not just in Thailand but across a designated region or even worldwide. The objective is seamless, borderless protection, ensuring you receive premier medical care regardless of your location. For frequent travelers, it is the only logical choice.

Think of a local plan as a high-quality key that only opens doors within one building—Thailand. An international plan is a master key that grants you access to premier facilities in every city you visit.

Understanding the mechanics of these policy types is essential. You can go deeper into which expat medical insurance policy is right for you in our dedicated guide.

Inpatient vs Comprehensive Coverage

Once your geographic requirements are established, the next layer of decision-making involves the depth of your coverage. This typically comes down to two main structures.

-

Inpatient-Only Plans: This is the bedrock of any robust health insurance policy. It is designed to shield you from the significant costs associated with hospital admission—such as surgery, overnight stays, and major treatments. It is your financial firewall against a catastrophic medical event that could otherwise erode your assets.

-

Comprehensive (Inpatient + Outpatient) Plans: This is the premium offering. It includes all inpatient benefits while adding coverage for medical care that does not require hospitalization. This outpatient module covers specialist consultations, diagnostic tests (like MRIs or blood work), prescription medications, and physical therapy.

For those who wish to proactively manage their health, a comprehensive plan is the superior choice. It enables you to address health issues early and consult doctors for routine care without direct personal expense for each visit.

Building Your Bespoke Policy with Add-Ons

The final step is customization. This is where optional benefits—or add-ons—are integrated to construct a plan that is truly tailored to your life. These modules allow you to add coverage for specific healthcare needs.

Some of the most valuable add-ons include:

- Dental and Vision Care: This can cover everything from routine examinations and cleanings to more complex procedures like root canals or new prescription eyewear.

- Wellness and Preventative Care: A strategic benefit that often covers annual health check-ups, cancer screenings, and vaccinations, helping you to identify potential issues before they escalate.

- Maternity Coverage: For those planning to start or expand a family, this add-on covers prenatal care, delivery costs, and postnatal treatment. It is critical to note that this benefit almost invariably includes a waiting period of 10-12 months before claims can be made.

By thoughtfully combining these components—geographic reach, depth of coverage, and specific add-ons—you are no longer simply "buying insurance." You are strategically constructing a personalized plan to protect both your health and your assets.

Essential Coverage for Comprehensive Protection

Selecting the appropriate policy type is only the initial step. The true measure of your Thailand health insurance is not its premium but its performance during a medical crisis. For expatriates who demand uncompromising health security, several areas of coverage are non-negotiable.

Consider your insurance plan a high-performance vehicle. The basic structure—inpatient versus outpatient—is the chassis. It's essential, but it’s the advanced safety systems and engineering that provide protection in a collision. Let's examine these critical components to ensure your plan is engineered to safeguard you when it matters most.

The Cornerstone of Your Plan: Inpatient Care

High-limit inpatient coverage is the absolute foundation of any serious health insurance policy. This is what stands between you and financial catastrophe in the event of hospitalization. A serious accident or a sudden illness can easily generate invoices in the tens or even hundreds of thousands of dollars at a premier international hospital in Bangkok.

Your plan must provide robust coverage for:

- Hospital Accommodation: A private room at a leading facility like Bumrungrad International or Bangkok Hospital should be a covered benefit.

- Surgery and Anesthesia: This entails full coverage for all surgical procedures, including the fees for the surgeon and anesthesiologist.

- Intensive Care Unit (ICU): ICU costs are exceptionally high. Your policy must cover these without imposing restrictive sub-limits on this critical care.

- Specialist Consultations: While hospitalized, various specialists may be consulted. Their fees must be included in your coverage.

A policy's annual limit is its ultimate backstop. For true peace of mind in Thailand's best private hospitals, you should be looking for a coverage limit of at least $1,000,000 USD. This is the recommended minimum to ensure you never have to second-guess your treatment options during a serious medical event.

Beyond the Hospital Bed: Outpatient Benefits

While inpatient care protects against large-scale costs, outpatient benefits are utilized for day-to-day health management. A plan with strong outpatient coverage encourages proactive healthcare, allowing you to address minor issues before they escalate into more serious conditions.

Key outpatient benefits to look for include:

- Specialist Visits: The ability to consult a cardiologist or an orthopedist without requiring hospital admission.

- Diagnostic Tests: Full coverage for essential scans like MRIs and CTs, as well as comprehensive blood work.

- Prescription Medications: Reimbursement for pharmaceuticals prescribed by your doctor.

- Physiotherapy: Coverage for rehabilitation services necessary after an injury or surgery to ensure a full recovery.

The policy details are paramount for these benefits. For a more detailed analysis of how fine print can impact your out-of-pocket expenses, review our guide on understanding excesses and deductibles in your policy.

The Ultimate Safety Net: Evacuation and Repatriation

For any expatriate, this coverage provides ultimate protection against worst-case scenarios where the required medical care is not available in Thailand, or when transport to your home country for long-term treatment is necessary.

Medical evacuation coverage finances an emergency airlift to a major hospital in Bangkok—a transport that could be life-saving. Repatriation covers a medically supervised flight back to your home country for ongoing care. It is an essential layer of security, ensuring access to the best possible care, regardless of where in the world that may be.

Seamless Access: Direct Billing Networks

Finally, the feature that ensures the smooth operation of your coverage is the direct billing network. This is a crucial arrangement wherein your insurance company pays the hospital directly for your care.

Upon admission to an in-network hospital, you present your insurance card to receive cashless treatment. The hospital's administration coordinates directly with your insurer, meaning you are not required to pay a large deposit upfront and seek reimbursement later. For expatriates accustomed to a high level of service, this is not a luxury—it is a fundamental component of a premium Thailand health insurance plan.

Comparing Top International Insurance Providers

Choosing the right international health insurance is not merely a transaction. It is about selecting a partner entrusted with your health and financial security while living abroad. For discerning expatriates, the list of premier providers narrows to a handful of Tier-1 global insurers.

These firms provide a complete service infrastructure, not just an insurance policy. They possess sterling reputations, extensive global networks, and the operational efficiency required to manage stressful medical situations with ease. Rather than an exhaustive list, we will focus on three industry leaders: Cigna Global, Bupa Global, and Allianz Care. Each serves its clientele with distinct nuances, focusing on service quality, hospital network strength, and claims processing efficiency.

Cigna Global: A Leader in Flexibility and Digital Service

Cigna Global is often the provider of choice for professionals who value digital convenience and policy customization. Their online platform is exceptionally well-designed, allowing you to manage your Thailand health insurance policy, file claims, or locate a physician with minimal friction. This digital-first approach is a significant advantage for those who prefer efficient self-management.

Their key strength lies in the modular architecture of their plans. You begin with a core inpatient plan and then add modules for outpatient care, wellness, or dental and vision. This allows for the construction of a highly personalized policy, ensuring you do not pay for benefits you will not utilize.

Bupa Global: The Benchmark for Premium Service

Bupa Global is synonymous with white-glove service. The company has cultivated a reputation for providing comprehensive, high-limit coverage designed for senior executives and families who demand the absolute best. For this clientele, compromise is not a consideration.

What distinguishes Bupa is its focus on the client experience. This is evidenced by features like dedicated medical consultants and a multilingual support team that understands the complexities of expatriate life. Their direct billing network in Thailand is exceptionally robust, with deep relationships at top-tier hospitals like Bumrungrad International and Samitivej Hospital, guaranteeing a truly cashless experience for virtually any major medical event.

For many, the ultimate measure of an insurer is their claims process. A top-tier provider should handle claims with speed and transparency, removing financial stress from an already difficult medical situation. This is where providers like Bupa and Allianz truly excel.

Allianz Care: A Powerhouse in Global Reach

As part of the formidable Allianz Group, Allianz Care offers an immense global network and an ironclad reputation for financial stability. Their plans are ideally suited for individuals who travel extensively or may relocate in the future. The sheer scale of their operation ensures access to an in-network, direct-billing hospital in nearly any major city worldwide.

In Thailand, their presence is strong and well-established. They offer a suite of comprehensive plans with high annual limits and generous benefits, including excellent options for wellness and preventative care. Their customer service is professional and efficient, geared toward rapid problem resolution—a highly valued attribute when requiring medical assistance far from home. This global consistency provides a layer of security that is invaluable.

To help you see how these providers stack up, here's a quick comparison of their key features.

Feature Comparison of Leading International Insurers

This table provides a high-level overview of what each top-tier provider offers to expats in Thailand, focusing on their core strengths and network capabilities.

| Provider | Key Strengths | Coverage Scope | Direct Billing Network in Thailand |

|---|---|---|---|

| Cigna Global | Highly customizable modular plans, excellent digital platform for self-service. | Global, with flexible modules for outpatient, dental, and wellness. | Strong, with good coverage across major cities and expat hubs. |

| Bupa Global | Premium, white-glove service, very high coverage limits, dedicated support. | Comprehensive global coverage, often considered the gold standard for executives. | Exceptional, with deep partnerships at premier hospitals like Bumrungrad and Samitivej. |

| Allianz Care | Unmatched global network reach, financially robust, great for frequent travelers. | Extensive global coverage with strong wellness and preventative care benefits. | Well-established and comprehensive, ensuring access across the country. |

Ultimately, the "best" provider is entirely dependent on your personal requirements. If you prioritize maximum control and a sophisticated digital experience, Cigna is a strong contender. If you demand the highest level of service and comprehensive benefits without exception, Bupa is likely your answer. And if you are a global citizen requiring reliable coverage anywhere in the world, Allianz's network is difficult to surpass.

Your Top Questions, Answered

When arranging health insurance for a move to Thailand, several critical questions invariably arise. You are not merely purchasing a policy; you are ensuring the comprehensive protection of yourself and your family.

Here are direct answers to the most common and important queries.

Can I Just Use My Insurance from Back Home?

The answer is unequivocally no. Your domestic health plan, whether it's from the UK, the US, or elsewhere, is designed to operate within that specific country's healthcare system.

It is entirely unsuitable for an expatriate lifestyle. While some plans may cover a true emergency during a short holiday, they will not be recognized for ongoing or significant care in Thailand. The country's premier international hospitals are private entities that require either substantial upfront payment or a payment guarantee from a recognized global insurer. For seamless, high-quality care, a dedicated international health insurance policy is essential.

Is Health Insurance a Must-Have for a Thai Retirement Visa?

Yes, for certain long-stay visas, it is mandatory. If you are applying for the popular Non-Immigrant O-A (Retirement) visa, Thai immigration authorities require documented proof of a comprehensive health insurance policy.

This is not a procedural formality. The government stipulates specific minimum coverage amounts for both inpatient (hospitalization) and outpatient (doctor visits) care. To ensure a smooth visa application process, you must select a plan from an insurer that is approved and explicitly satisfies these immigration regulations.

How Does Direct Billing Actually Work in Thai Hospitals?

This is where a superior insurance plan demonstrates its value. Direct billing is the mechanism that prevents you from having to pay large hospital bills from your personal funds and then undertake a lengthy reimbursement process.

The process is straightforward. Upon admission to a hospital within your insurer's network, you present your insurance card. The hospital's billing department then communicates directly with your insurance company to arrange a 'Guarantee of Payment'. This means the insurer settles the bill on your behalf, rendering the experience cashless and removing financial stress. This is standard operating procedure at all major international hospitals in Thailand.

Is It Possible to Get Coverage for Pre-Existing Conditions?

Obtaining coverage for a pre-existing condition can be complex, but it is often achievable. Insurers' approaches to this vary significantly.

Some providers may offer coverage for a condition after a specified waiting period, known as a moratorium, during which claims for that issue are excluded. Others may agree to cover it in exchange for a higher premium.

The key is the application process, which involves full medical underwriting where you must disclose your complete health history. Absolute transparency is critical—failure to disclose a condition can lead to claim denial or policy cancellation. Partnering with an expert broker can be invaluable here, as they can identify an insurer whose underwriting policies are best suited to your specific health profile.

At Riviera Expat, we specialize in this precise area of expertise. Our purpose is to provide expert guidance, ensuring you secure a policy that is perfectly aligned with your life in Thailand. Discover the difference clear, expert advice can make by exploring our services at https://riviera-expat.com.