A career in private equity is not merely a job; it is a long-term strategic commitment. It is a demanding apprenticeship that forges astute financial minds into masters of capital allocation, one transaction at a time. The path is meticulously structured, typically commencing with an Analyst position and, for those with exceptional tenacity, culminating in a Partner role over a 15 to 20-year trajectory.

Throughout this journey, you will master extraordinarily complex financial models, execute transactions with considerable capital at stake, and eventually oversee a portfolio of companies, all with the objective of generating substantial returns for your investors. It is a unique synthesis of profound analytical rigor and high-stakes strategic decision-making, which is why it offers some of the most significant compensation in the financial services industry.

Mapping Your Journey in Private Equity

Embarking on a private equity career path is akin to becoming a master architect. You do not begin by designing skyscrapers. You start by mastering the fundamentals—analyzing blueprints, understanding material strength, and verifying every calculation. Only after mastering the foundation can you progress to designing landmark structures, managing entire construction projects, and ultimately, shaping the city's skyline.

This is not a career for the casual participant. It is a long-term engagement that attracts the absolute elite of the finance world. Why? Because it merges three powerful drivers: deep, intellectual analytical work, strategic leadership, and the tangible potential for significant wealth creation. At its core, private equity is about identifying a company's latent potential and transforming it to unlock exceptional value.

The Stages of Advancement

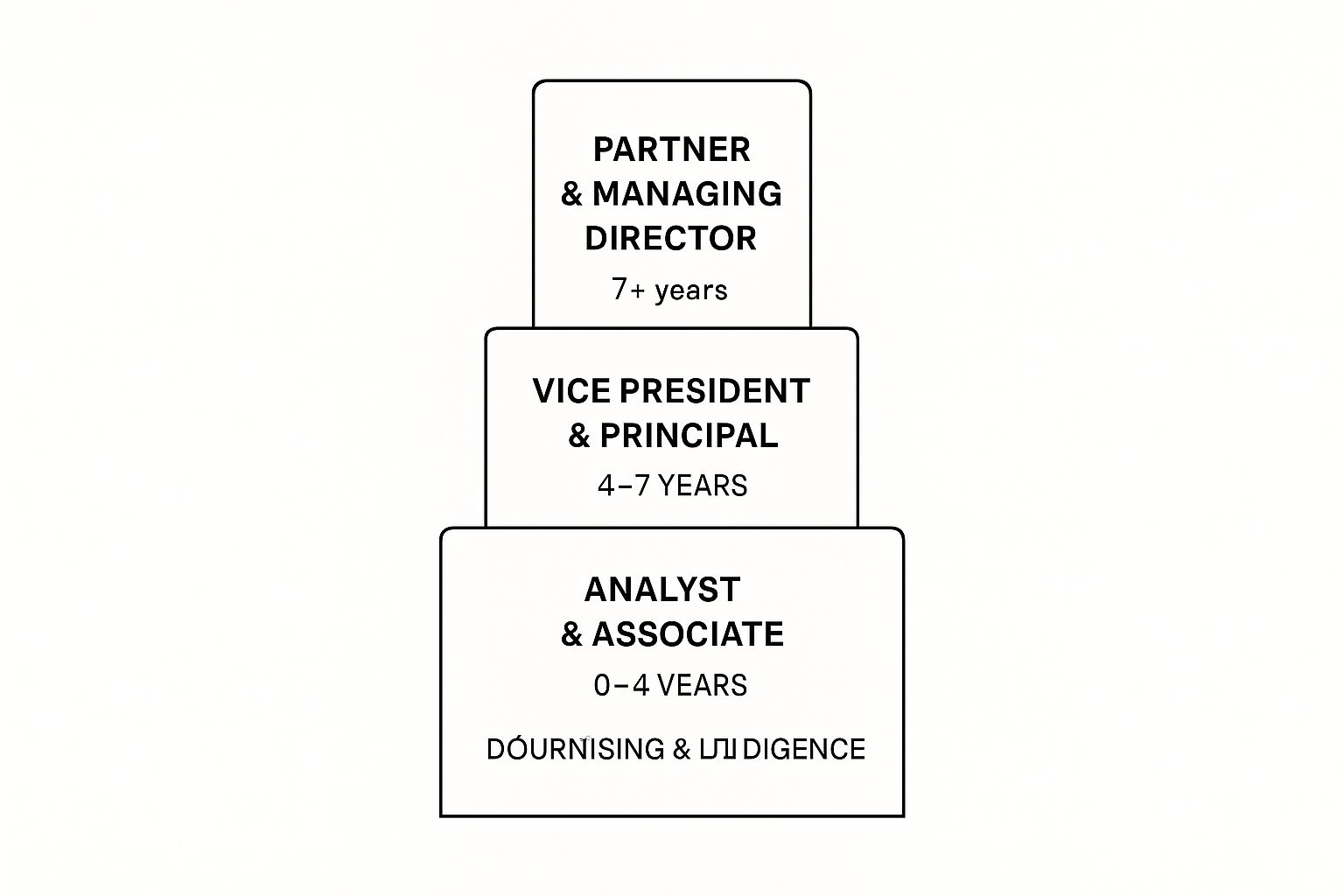

The career ladder is methodical. Each level builds directly upon the skills mastered in the preceding one. You begin in the trenches, immersed in spreadsheets and due diligence documents, honing your technical skills to perfection. From there, you graduate to roles demanding more finesse—deal execution, challenging negotiations, and hands-on management of the companies within your firm's portfolio.

The final ascent involves a distinct skill set. You will be responsible for raising capital, setting the firm's overarching strategy, and making the final determination on which investments receive approval.

This infographic illustrates the three primary tiers you will navigate.

As you can observe, the nature of the work evolves dramatically. You transition from being the individual conducting the hands-on analysis to the one providing high-level strategic direction and securing the capital that fuels the entire operation.

To provide a clearer picture, here is a summary of what to expect at each stage.

Private Equity Career Path at a Glance

| Role | Typical Experience | Primary Responsibilities |

|---|---|---|

| Analyst / Associate | 0-4 years | Financial modeling, due diligence, industry research, preparing investment memoranda. |

| Senior Associate | 3-6 years | Managing junior team members, leading elements of the deal process, interacting with advisors. |

| Vice President (VP) | 5-9 years | Sourcing deals, leading deal execution, managing portfolio companies, developing investment theses. |

| Principal / Director | 8-12 years | Leading investment teams, negotiating terms, serving on company boards, mentoring junior staff. |

| Managing Director / Partner | 12+ years | Firm strategy, fundraising from LPs, final investment decisions, managing key relationships. |

This table shows the clear, progressive nature of the career, with responsibilities expanding significantly at each level.

Getting Started and Potential Earnings

Let us be unequivocal: this journey is as lucrative as it is intensely competitive. A career in private equity is one of the highest-paying paths in finance. At the outset, Analysts can anticipate a base salary between $100,000 and $150,000, which is supplemented by a bonus, typically adding another $20,000 to $50,000.

Of course, securing an entry-level position is the most formidable challenge. Success requires more than just technical proficiency; it demands an impeccable interview preparation strategy. You must be able to construct a financial model under pressure and articulate a cogent investment thesis spontaneously. For a thorough examination of what is required to secure that first offer, this complete private equity interview guide is an indispensable resource. It is a skill that only comes with dedicated, focused practice.

Building Your Foundation as an Analyst and Associate

Consider your first few years in private equity as a rigorous, high-stakes apprenticeship. Put grand strategy aside for a moment. As an Analyst or Associate, your world revolves around mastering the craft with absolute precision, much like a surgeon learning to wield a scalpel.

This is where you earn your credibility. The role is a relentless exercise focused on the core mechanics of a transaction. You will live and breathe intricate leveraged buyout (LBO) models, conduct exhaustive due diligence that leaves no stone unturned, and draft the investment memoranda that form the very bedrock of every single deal.

Success is not merely a function of intellect; it is about being meticulous to the point of obsession. A single misplaced decimal in a model or an overlooked risk during diligence can jeopardize a deal worth hundreds of millions. Meticulousness is not a "nice-to-have"—it is the absolute minimum requirement for survival.

The Core Responsibilities of a Junior Professional

As an Analyst or Associate, you are the engine room of the deal team. Your function is execution and analytical support. You produce the data-driven materials that senior partners use to make high-consequence investment decisions.

Your day-to-day will almost certainly revolve around these three pillars:

- Financial Modeling: You will spend countless hours building complex financial models from a blank Excel sheet, forecasting a company's performance, and stress-testing potential returns under every conceivable scenario.

- Due Diligence: This is the deep dive. You will scrutinize everything from financial statements and customer contracts to market dynamics and competitive threats. No detail is too small.

- Preparing Materials: You will be responsible for creating the detailed presentations and investment committee memos that distill vast amounts of information into a clear, persuasive narrative about why a deal should—or should not—proceed.

The true test for an Associate is taking an overwhelming sea of data and converting it into a coherent story that either validates or refutes an investment thesis. This singular skill—distilling complexity into clarity—is the foundation of a successful private equity career.

The Highly Competitive Entry Funnel

Breaking into this world is exceptionally difficult. The recruitment pipeline for junior roles is exceedingly narrow, and it overwhelmingly favors candidates who have already proven themselves in top-tier investment banking analyst programs.

Why? Because private equity firms require individuals already seasoned by the high-stakes world of M&A advisory. They need analysts who possess proven technical skills and a work ethic that can withstand immense pressure from day one. This pre-selection ensures new hires can contribute effectively to live deals immediately.

The path in private equity is a well-defined hierarchy, with compensation increasing substantially at each level. Starting as an analyst requires a top-tier finance education, expert-level Excel skills, and a deep understanding of financial modeling and valuation. The journey from analyst to partner is a long one, marked by significant increases in both salary and bonus structures. You can learn more about the journey from analyst to partner and gain insights on compensation along the way.

Advancing to Vice President and Principal

Ascending to the Vice President (VP) and Principal levels represents the most critical pivot in a private equity career. This is where you transition from being an executor of tasks to an architect of deals. The days of relentless Excel modeling and diligence grinding yield to a much broader mandate, one that demands strategic vision, sharp commercial judgment, and genuine leadership.

At this stage, you truly begin to own the investment process. You are no longer just supporting the deal; you are the one driving it forward. Your purview expands to cover the entire deal lifecycle, from identifying opportunities to managing portfolio companies long after the transaction has closed.

From Execution to Leadership

As a VP or Principal, your value is not measured by your Excel shortcuts but by your ability to lead, influence, and deliver results. This shift manifests in several critical ways, most notably in how you manage your team. You are now expected to mentor the junior deal team, ensuring their analytical work is flawless while you focus on the larger strategic picture.

This is a make-or-break test of your management capabilities. Success hinges on your ability to delegate effectively, guide Associates through complex analyses, and cultivate the next generation of talent at your firm.

Key Responsibilities of a Mid-Career Professional

Your duties expand significantly, calling for a mix of hard and soft skills that were far less critical in your junior years.

- Deal Sourcing and Origination: You will be actively generating deal flow. This involves leveraging your growing network of bankers, lawyers, and industry contacts to unearth proprietary investment opportunities that others might overlook.

- Leading Due Diligence: While Associates are immersed in the data room, you are directing the entire diligence process. You will manage external advisors, such as law firms and consultants, and your role is to pinpoint the key risks and opportunities that truly matter.

- Negotiation and Execution: You will now have a primary role in negotiating term sheets and purchase agreements. This requires a strong command of both financial details and the subtle art of interpersonal dynamics.

- Portfolio Company Management: Post-acquisition, you will often work closely with the management teams of your portfolio companies, assisting them in driving strategic initiatives and monitoring their performance against your investment thesis.

This is the stage where soft skills become as valuable as technical acumen. Your ability to build rapport with a CEO, persuasively defend an investment thesis to skeptical partners, and navigate complex firm politics will ultimately determine your trajectory toward Partner.

The Proving Ground for Partnership

Performing well as a VP or Principal is your final audition for the partnership. The compensation structure begins to reflect this reality. Base salaries for VPs often fall in the $350,000 to $500,000 range, but the real prize is gaining meaningful access to carried interest.

This period, typically spanning from year five to nine of your career, is where you must prove you are not just an exceptional dealmaker but a future leader of the firm. You must demonstrate an owner’s mindset, consistently generating value for investors and establishing yourself as a trusted advisor, both inside and outside the firm.

Reaching the Summit as a Partner or Managing Director

Making Partner or Managing Director is not simply the next step up the ladder; it is an entirely different domain. After a decade or more in the industry, the role transforms. You are no longer merely executing deals—you are shaping the entire future of the firm.

This is the pinnacle of the private equity world. It is a position of immense influence, where you are no longer just a part of the deal flow. You are the deal flow—its source, its final arbiter, and the trusted steward of the capital that fuels every activity.

The Three Pillars of a PE Partner

The role of a Partner is a demanding balancing act, requiring a rare combination of financial expertise, strategic vision, and a compelling personal brand. Your value is not measured in the models you can build, but in the capital you can raise, the opportunities you unearth, and the value you help create across the entire portfolio.

Your world will revolve around three core responsibilities:

- Fundraising: You are now the face of the firm to the Limited Partners (LPs)—the pension funds, endowments, and high-net-worth families who provide the capital. Your reputation and track record are what convince them to invest billions into your funds.

- Deal Origination: At this level, your professional network is your single most valuable asset. The best deals are not found in crowded auctions; they are sourced from trusted, decade-long relationships with bankers, lawyers, and industry executives.

- Strategic Oversight: You are the one making the final decision on nine-figure investments. This means you will sit on the boards of multiple portfolio companies, guiding C-suite leaders on the difficult decisions that drive growth and, ultimately, returns.

A Partner's true currency is their reputation. It is what allows them to raise a billion-dollar fund on the strength of their name and convince a founder to sell the business they spent a lifetime building.

Compensation at the Top

Once you reach this level, your compensation structure changes fundamentally. Your base salary remains substantial, but it becomes a much smaller component of your total earnings. The primary engine of wealth creation is now carried interest, or "carry."

Think of carry as a direct share—typically 20%—of the fund's profits. This powerful mechanism aligns your financial interests perfectly with those of your investors. Your personal fortune becomes directly tied to the success of the investments you champion, creating a powerful incentive to generate outstanding returns.

The Ultimate Responsibility

Becoming a Partner means the ultimate accountability rests with you. You bear responsibility for the firm’s performance and its culture. You are a leader, a mentor to the next generation of talent, and a primary architect of the firm's investment strategy. The pressure is immense, but the rewards—both financial and professional—are equally significant.

Understanding Your Compensation Structure

It is essential to discuss compensation. It is a significant motivator for those pursuing a career in private equity, and the structure is designed to reward one thing above all else: long-term success. Your pay package comprises three key elements: a base salary, an annual bonus, and—at the senior levels—the coveted carried interest.

This structure is intentional. As you ascend the ranks, your personal wealth becomes directly tied to the returns you generate for the firm’s investors. You transition from thinking like an employee to acting like an owner with a vested interest. That alignment is the entire foundation of the private equity compensation model.

Demystifying Carried Interest

The most discussed and often least understood component of PE compensation is carried interest, or "carry." Consider it a highly leveraged profit-sharing plan. Here is how it operates: after a fund has returned all initial capital to its investors (the Limited Partners), it must also clear a "hurdle rate"—typically an 8% annual return.

Only after that benchmark is met does the firm (the General Partners) receive its share of the remaining profits, which is usually 20%. That 20% profit share constitutes the "carried interest" pool. It is then distributed among the firm's investment professionals based on seniority. It is the ultimate reward for a successful investment.

Carried interest is not simply a large bonus. It is a long-term payout that only materializes after a fund's investments have matured and proven highly successful. It is the mechanism that can generate substantial wealth, but it demands patience and, most importantly, stellar performance.

Compensation Growth by Role

Your earning potential in private equity does not merely grow—it expands exponentially as you gain seniority. An Analyst's compensation is predominantly salary and bonus. A Partner's total compensation, in contrast, is almost entirely driven by their share of the carry.

To provide a clearer picture, here is a breakdown of how compensation typically progresses at each level.

Private Equity Compensation by Role

The table below illustrates the dramatic shift in earning potential as you advance in your private equity career. Note how the base salary and bonus provide a solid foundation, but true wealth creation stems from carried interest at the senior levels.

| Role | Typical Base Salary Range | Typical Annual Bonus Range | Carried Interest Potential |

|---|---|---|---|

| Associate | $150,000 – $300,000 | 100% – 150% of Base | Minimal to None |

| Vice President (VP) | $350,000 – $500,000 | 100% – 150% of Base | Entry-Level Participation |

| Principal / Director | $500,000 – $800,000 | 100% – 200% of Base | Meaningful Participation |

| Partner / MD | $750,000 – $1.2M+ | Variable | Substantial; a major component of total compensation |

As you can see, the journey from Associate to Partner is not just a change in title; it is a fundamental shift in how you are compensated, moving from a salaried employee to a principal with a significant stake in the fund's success.

What Comes After Private Equity? Exploring Your Next Move

Spending a decade ascending the private equity ladder is an intense undertaking, but it forges a skill set that opens doors to other high-caliber opportunities. Not everyone remains on the partner track indefinitely. A background in private equity is a powerful launchpad into other high-stakes, lucrative fields.

Your time in private equity serves as a masterclass in value creation. You have learned to dissect a business, identify its weaknesses, drive strategic change, and deliver tangible financial results. This is a universally valuable talent. Moving on from private equity is not so much a career change as it is a redeployment of elite skills into a new arena.

The Most Common Exit Ramps

After years of honing your analytical and strategic capabilities, several well-established paths emerge for those seeking a new challenge. These roles often offer a different work-life dynamic or an opportunity for direct operational involvement.

Here is where many private equity professionals land next:

- Hedge Funds: This is a natural pivot. You can apply your deep analytical skills to the public markets, often focusing on long/short equity strategies grounded in the same fundamental company analysis you have already mastered.

- Portfolio Company Leadership: Taking a C-suite role (such as CFO or Head of Strategy) at a current or former portfolio company offers the chance to be on the front lines, executing the very plans you once helped create.

- Entrepreneurial Ventures: Armed with a powerful network and an intimate understanding of what drives business success, many private equity veterans go on to launch their own companies or even their own investment firms.

The essential insight from private equity training is that it teaches you to think like an owner. That mindset—relentlessly focused on growth, efficiency, and long-term value—is the master key that unlocks opportunities in almost any industry.

For those considering a move, the options are plentiful. Whether shifting to hedge funds, taking the helm at a portfolio company, or launching a new venture, the skills you have cultivated are in high demand.

If you decide to explore other opportunities, remember that framing your experience correctly is paramount. Knowing how to tailor your resume for a career change is critical for showcasing how your private equity skills translate directly to these new roles.

A Few Common Questions

If you are mapping out a career in private equity, a few significant questions invariably arise. Let us address them directly to provide clarity on the major decisions you will face.

Do I Absolutely Need an MBA to Move Up?

This was once a straightforward "yes," but the landscape has evolved. For a long time, an MBA from a top-tier business school was the non-negotiable prerequisite to advance from an Associate role. That is no longer universally the case.

Many successful middle-market firms are now more inclined to promote their proven high-performers directly. If you are an exceptional Associate who knows the deal process intimately, they often value that real-world experience over two years in an academic setting.

However, if your ambition is to join a mega-fund, an MBA remains the standard path. It is more than an academic credential; it is a powerful networking platform and a clear signal of long-term commitment. It is what opens the door for those highly competitive Vice President roles and beyond.

What is the Real Difference: Mega-Fund vs. Middle-Market?

The distinction truly boils down to three factors: the size of the transactions, the degree of specialization in your role, and the overall firm culture.

Mega-funds like KKR and Blackstone operate at the highest level, executing incredibly complex, multi-billion dollar transactions. Because the deals are so massive, junior roles become highly specialized. You might spend all your time focused on a single element of the deal process, such as financial modeling or a specific type of due diligence.

Middle-market firms, conversely, provide a much broader experience. You will be involved in the entire lifecycle of smaller deals, from sourcing and execution to hands-on work with portfolio companies. The lifestyle can be slightly more manageable (emphasis on slightly), and the path to Partner is often more direct. The trade-off is that the absolute upper echelon of compensation will always be higher at the mega-funds.

Let us be candid about work-life integration. When a deal is active, expect to work 70-90+ hours per week, especially as an Analyst or Associate. The hours may lessen marginally as you advance, but the pressure and responsibility increase dramatically. The work occurs in intense sprints—frenetic periods followed by slower times—but it is fundamentally incompatible with a typical nine-to-five schedule.

At Riviera Expat, we understand. The lifestyle of a finance professional is exceptionally demanding. That is why we offer specialized international health insurance brokerage services, ensuring you and your family have access to top-tier medical coverage, no matter where your career takes you. Allow us to handle the complexities of your healthcare so you can focus on closing your next deal with complete peace of mind. Find your ideal international health insurance plan with us today.