For discerning professionals managing a global lifestyle, optimizing every asset—including health coverage—is a financial imperative. Many individuals mistakenly view multiple insurance policies as redundant. This perspective, however, overlooks a significant strategic advantage.

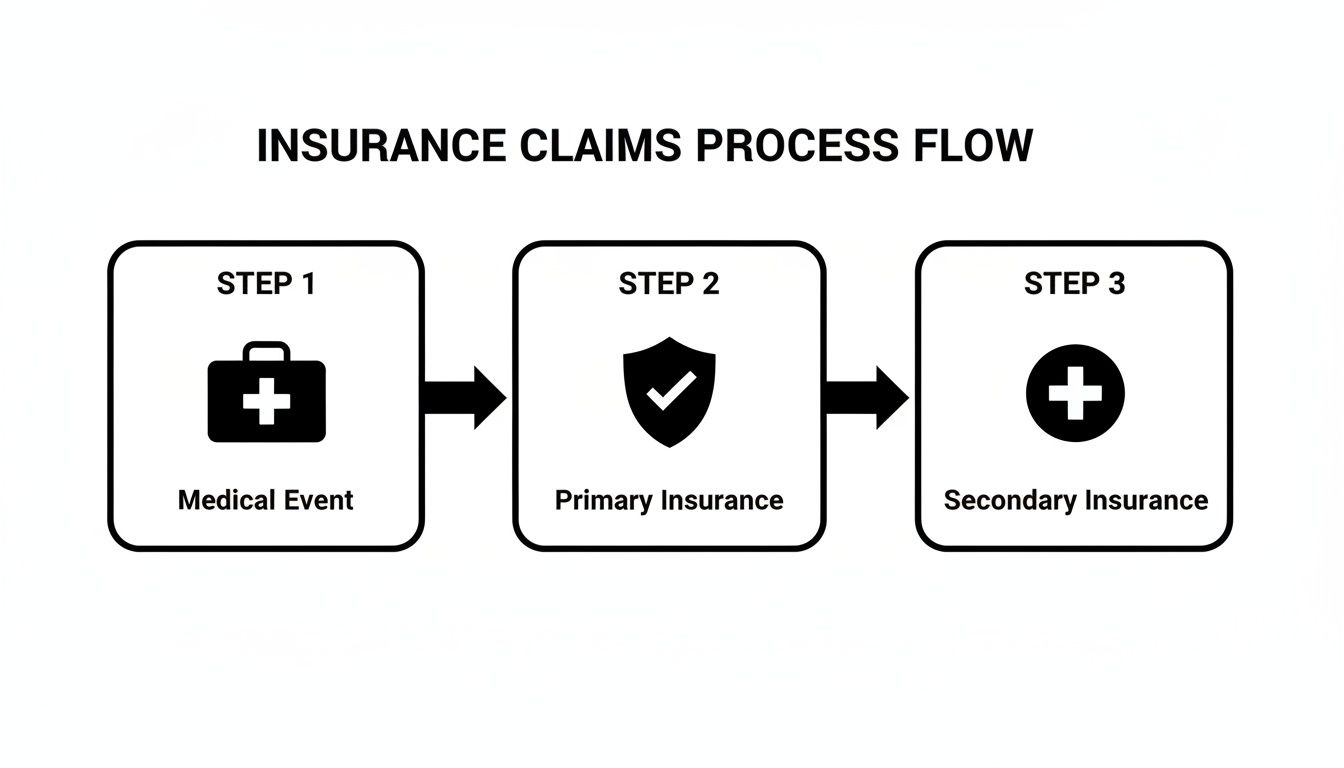

Viewing primary and secondary insurance as a sophisticated financial instrument, not merely overlapping coverage, is the key to maximizing protection. The mechanism is straightforward: the primary plan processes claims first, and the secondary plan is structured to cover eligible costs left behind.

Understanding Your Global Insurance Framework

To conceptualize this structure, consider your primary policy as the first line of defense, designed to absorb the initial financial impact of a medical event. Your secondary policy serves as strategic reinforcement, stepping in to address any remaining financial exposure.

This layered approach is essential for expatriates and global citizens. Operating across different countries necessitates seamless, high-level medical access without the risk of unforeseen expenses. For professionals navigating financial hubs like Hong Kong, Singapore, or London, this structure is not a luxury—it is a foundational component of a secure international life.

The entire system hinges on a process known as coordination of benefits. This is the protocol through which your insurers communicate to ensure claims are paid correctly, preventing overpayment while maximizing the value of your coverage. You can find more insights on the global health insurance market and its key trends to understand how this fits into the broader landscape.

The Role of Each Policy

Clarifying these roles is critical for managing claims effectively and controlling your out-of-pocket costs.

-

Primary Insurance: This is your principal policy, the first to which a claim is submitted. It is frequently the plan provided by your employer. It assesses your medical claim and pays according to its specific terms and limits. Once it has paid its share, its immediate obligation is fulfilled.

-

Secondary Insurance: This policy is your backstop. After your primary insurer pays and issues an Explanation of Benefits (EOB), you submit that document along with the remaining bill to your secondary plan. It then reviews what remains—deductibles, copayments, or services not covered by the primary plan—and pays based on its own terms.

To provide absolute clarity, the following table summarizes how each policy functions.

Primary vs Secondary Insurance At a Glance

This table delineates the fundamental differences between your primary and secondary policies, offering an at-a-glance view of their distinct roles.

| Attribute | Primary Insurance | Secondary Insurance |

|---|---|---|

| Payment Order | Pays claims first. | Pays after the primary plan has paid. |

| Main Function | Provides initial and principal coverage. | Fills coverage gaps (deductibles, copays). |

| Typical Source | Employer-sponsored group plan. | Individual policy or spouse's plan. |

| Claim Process | You submit your claim directly to them first. | You submit the primary's EOB and remaining bill. |

Understanding these roles enables you to navigate the claims process efficiently and accurately forecast your financial responsibility.

The objective of this coordinated approach is to manage your medical costs with precision, not to profit from a claim. The ideal outcome is achieving up to 100% coverage for your eligible medical expenses without any duplication of payments.

Ultimately, holding both a primary and secondary policy creates a powerful financial safety net. It protects your health and your wealth from the shock of a major medical event, regardless of your global location. It transforms your insurance from a simple expense into a strategic asset management tool.

How Insurers Coordinate Your Benefits

The protocol governing how your policies interact is a process called Coordination of Benefits (COB). This is not an ad-hoc negotiation; it is a standardized set of rules that all insurers follow to determine the order of payment. The purpose is to prevent duplicate reimbursement for the same expense and to ensure your claims are processed efficiently.

Consider COB as the air traffic controller for your insurance claims. When a claim is filed, these rules are invoked immediately, designating one policy to take the lead (the primary) and the other to act as support (the secondary). This clear structure eliminates ambiguity and the frustrating delays that arise when insurers dispute liability.

The Claims Journey Step by Step

This entire process follows a specific, logical sequence. For American expatriates, it is especially critical to recognize that domestic plans do not always offer adequate international coverage. For instance, understanding Medicare coverage when abroad is a common point of confusion, as its rules change dramatically upon leaving the United States.

The path from a medical event to a fully paid invoice is methodical. Here is a breakdown of how it functions, showing exactly where each insurer fits in.

As illustrated, the secondary insurer will not review your claim until the primary insurer has completely fulfilled its obligations.

Let’s walk through a real-world example. Consider an American executive working in Dubai. She has a local health plan through her employer (her primary insurance) and a personal International Private Medical Insurance (IPMI) policy for enhanced protection (her secondary insurance).

- The Medical Visit: She consults a specialist and receives a substantial bill.

- Submit to Primary First: The claim is submitted directly to her local Dubai employer plan. They process it based on their policy terms, covering a significant portion of the cost but leaving a balance due to her deductible and coinsurance.

- Receive the EOB: The primary insurer sends her an Explanation of Benefits (EOB). This is not a bill—it is the pivotal document that details what they paid, what they did not, and the exact amount she still owes.

- Submit to Secondary: She then forwards the outstanding bill, along with the EOB from her primary insurer, to her secondary IPMI provider.

- Final Payout: The IPMI policy reviews the remaining costs, checks them against its own coverage, and pays its share. This dramatically reduces, or even completely eliminates, her out-of-pocket expenses.

The Explanation of Benefits (EOB) is the single most important document in this entire process. It serves as official proof that your primary insurer has met its obligation, providing the necessary clearance for your secondary insurer to review the remainder of the claim.

Executing this workflow correctly is key. For more complex treatments, you will also likely encounter pre-authorisation requirements. Understanding how pre-authorisation and direct settlement work in tandem can streamline the process, especially for planned surgeries or hospital stays, as it secures all financial approvals before treatment begins.

Structuring Coverage for Global Lifestyles

For high-level professionals, structuring an insurance portfolio is as critical as managing financial assets. The rules determining which policy pays first—the primary—and which pays second are not abstract theories. They are practical realities dictated by your location, employment status, and policy structure. A miscalculation in this area can result in significant, unexpected financial liability.

Crucially, you rarely choose your primary insurer. This is dictated by established industry rules. An employer-sponsored plan, for example, is almost always designated as the primary policy. Any personal plan you hold, such as a comprehensive International Private Medical Insurance (IPMI) policy, will automatically be positioned as secondary.

Real-World Scenarios for Global Professionals

Let’s examine how these primary and secondary insurance rules apply in common situations for expatriates. The logic is consistent, but its application shifts depending on local healthcare systems and employment arrangements.

Scenario 1: The Financier in London

Consider a financier residing in London. They have access to the public National Health Service (NHS) and a corporate Private Medical Insurance (PMI) plan provided by their firm.

- Primary Payer: If they opt for private treatment, their employer's PMI plan is always the first payer.

- Secondary Payer: The NHS serves as a public safety net but does not function as a traditional "secondary payer" for private care. If the corporate PMI has coverage limits, a separate IPMI policy would act as the true secondary layer. It would cover costs exceeding the company plan’s cap or provide access to elite specialists outside the PMI’s approved network.

Scenario 2: The Entrepreneur in Singapore

Now, imagine an entrepreneur in Singapore. They hold a local Singaporean health plan to satisfy residency requirements, complemented by a personal IPMI policy for comprehensive global coverage.

- Primary Payer: For any treatment within Singapore, their local plan is designated as primary.

- Secondary Payer: Their robust IPMI policy functions as the secondary insurer. Its purpose is to cover what the local plan leaves behind—deductibles, co-payments—and, more critically, to finance high-cost events. This includes advanced cancer treatments, medical evacuations, and access to world-class hospitals, capabilities that extend far beyond the scope of a standard local plan.

Your IPMI policy is your strategic reserve. It is engineered to close critical coverage gaps, ensuring that an unforeseen medical event does not derail your financial strategy, whether that means covering a multi-million-dollar treatment or arranging a private medical jet.

For high-net-worth individuals in hubs like Bangkok and Kuala Lumpur, mastering these primary and secondary insurance rules is non-negotiable. Europe adds another layer of complexity; Ireland has a private health insurance uptake of approximately 45%, while in Germany, roughly 11% of the population relies on full private insurance as their primary coverage. In these countries, the national system often acts as the primary payer, making an IPMI a vital secondary policy for prompt access to private care. This contrasts with the GCC, where employer-sponsored schemes are frequently the dominant primary insurer. You can find more on the dynamics of the private health insurance market to sharpen your strategy.

Executing Flawless Claims and Documentation

Possessing sophisticated coverage is one matter; ensuring it performs seamlessly when needed is another. For expatriates and high-net-worth individuals, a smooth, discreet claims process is a requirement, not a luxury. Successfully navigating a claim involving two insurers depends on precision and a clear understanding of the primary and secondary insurance rules.

This is not a process to be figured out under pressure. The entire system hinges on one mission-critical document: the Explanation of Benefits (EOB) from your primary insurer.

Think of the EOB as the key that unlocks your secondary coverage. Without it, your claim is effectively stalled.

The Step-By-Step Process for Secondary Claims

Following a strict sequence transforms a potentially bureaucratic ordeal into a predictable, efficient process. This method cuts through the administrative friction that causes needless delays and financial complications.

-

Receive the Initial Invoice: After receiving medical care, the provider will issue an invoice. Do not pay it yet.

-

Submit to the Primary Insurer: Immediately file the claim with your designated primary insurer. For most expatriates, this is the plan provided by their employer.

-

Await the EOB: Your primary plan will process the claim and send you the EOB. This document is vital—it details precisely what was covered, the amount paid to the provider, and the remaining balance that is now your responsibility.

-

Assemble Your Secondary Claim Package: Next, prepare a new claim for your secondary insurer. This package must include two items: the provider's original invoice and a copy of the primary insurer’s EOB.

-

Submit to the Secondary Insurer: Send the complete package to your secondary plan. They will now assess the remaining balance against your policy’s benefits.

The most common error is submitting a claim to the secondary insurer first. This action guarantees an immediate denial or a request for more information, as they cannot proceed without the primary insurer's EOB. Following this sequence is not a suggestion; it is essential for a smooth reimbursement.

Maintaining Control and Confidentiality

For a white-glove experience, meticulous organization is paramount. I advise my clients to maintain a secure digital file for all medical invoices, EOBs, and related correspondence.

When submitting sensitive medical documents for claims, data protection is non-negotiable. It is prudent to use secure transmission methods, such as HIPAA-compliant internet faxing for data protection, to ensure your records remain confidential.

Of course, the claims process is only one part of the equation. Understanding the mechanics of your policy is equally crucial. For a closer look at the terms that can define the outcome of a claim, I recommend reviewing this guide on expat medical insurance policy terms. When you master both the paperwork and the policy language, you maintain complete control of your healthcare journey.

Avoiding Common Pitfalls in Dual Coverage

Holding two insurance policies appears to be an ideal safety net, but even the most carefully constructed portfolio can conceal significant liabilities. Navigating dual coverage requires a proactive strategy, not passive ownership. A prevalent mistake is assuming that more insurance automatically equates to better protection. This assumption can lead to costly errors.

The most common trap is redundant coverage, where you pay high premiums for two policies that cover the exact same risks without delivering additional value. Another major risk is conflicting policy definitions. What one insurer defines as a "medical necessity" may differ entirely from another's definition, creating unexpected gaps in your coverage precisely when it is needed most.

Strategic Risk Mitigation

It is not only the high-level strategy that requires attention; minor procedural details can also present challenges. Simply submitting a claim to the wrong insurer first can trigger denials, delays, and significant administrative burdens. Fortunately, every one of these risks can be managed with foresight and expert guidance.

Your first line of defense is a professional policy audit. This review is designed to identify and eliminate costly redundancies, ensuring every premium dollar is allocated toward expanding your protection, not merely duplicating it. This is also the time to reconcile any conflicting terms between policies to prevent disputes before they arise. To delve into specifics, it is wise to understand the fine print on excesses and deductibles in your policy, as these details directly control your out-of-pocket costs.

Proactive risk management transforms your insurance portfolio from a potential liability into a fortified asset. The objective is to ensure your policies work in concert, creating a seamless financial shield against any medical contingency, anywhere in the world.

Mastering these dynamics is critical as global healthcare demands continue to rise. For family offices and investment bankers who manage complex claim payment hierarchies, understanding primary and secondary insurance rules is non-negotiable. We observe this playing out differently across the globe. In Asian markets where health insurance is growing rapidly, IPMI often acts as the primary plan for expatriates. In the UK, where the gross written premium for private medical insurance reached £6.7 billion in 2022, the NHS is primary, and private plans are used to bridge service gaps. You can discover more insights about the global insurance market to help shape your own strategy.

Common Pitfalls and Proactive Solutions

To help you stay ahead, I have summarized the most frequent challenges associated with dual insurance and the expert strategies used to resolve them. Consider this your reference for protecting your financial well-being.

| Common Pitfall | Risk to The Policyholder | Strategic Solution |

|---|---|---|

| Redundant Coverage | Inflated premiums for overlapping benefits that provide no additional value. | Conduct an annual policy audit to identify and eliminate duplicate coverage. |

| Conflicting Definitions | Unexpected coverage gaps due to different interpretations of terms like "medical necessity." | Reconcile policy language between insurers to ensure consistent coverage. |

| Procedural Missteps | Claim denials and delays from submitting to the secondary insurer first. | Establish a clear, documented claims process adhering to COB rules. |

A proactive approach in this area yields significant returns. By identifying these potential traps in advance, you ensure your policies function as a cohesive shield, not as a source of confusion and frustration.

Frequently Asked Questions

When managing multiple insurance policies, complexity can arise quickly. However, once you grasp a few core principles, the logic behind how primary and secondary insurance work becomes clear. Here are direct answers to the questions we hear most often from global professionals.

Can I Choose Which Policy Acts As Primary?

This is a frequent question, and the answer is definitively no. The policyholder does not choose the primary plan. The order is determined by industry-wide Coordination of Benefits (COB) rules that all insurers follow. These rules create a predictable, standardized process.

As a general rule, your employer-sponsored health plan will almost always be designated as the primary payer. Any individual plan you purchase, such as a global IPMI policy, will naturally be positioned as secondary. This hierarchy is non-negotiable and exists to maintain order in the claims process.

Is Secondary Insurance Necessary If My Primary Plan Is Strong?

For a global professional, this question misframes the issue. It is not about redundancy; it is about strategic planning. A primary plan may be excellent within its home country, but its limitations often become apparent outside its network. International access, choice of top-tier specialists, or a critical medical evacuation are precisely the benefits a domestic plan often fails to provide.

Your secondary IPMI policy is your global safety net. It is specifically designed to plug the high-stakes gaps left by a domestic plan. This isn't just about healthcare—it's about protecting your financial well-being, no matter where in the world you find yourself.

What Happens If I Submit A Claim To The Wrong Insurer?

Submitting a claim to your secondary insurer first will result in a guaranteed denial or a lengthy delay. The secondary insurer cannot—and will not—process the claim until they receive the official documentation from the primary plan.

That key document is the Explanation of Benefits (EOB). It is the primary insurer's official report, detailing exactly what it paid and what you still owe. The sequence is rigid for good reason: primary insurer first, secondary insurer second. Adhering to this order is the only way to ensure a smooth, efficient reimbursement process.

Navigating these rules is precisely where an expert adviser provides immense value. Riviera Expat specializes in structuring international health insurance portfolios correctly, giving you the clarity and confidence that you are always protected. For a complimentary consultation to optimize your coverage, visit us at Riviera Expat.