In the PPO vs HDHP evaluation, the decision rests on a precise financial calculation: Is your priority immediate access and predictable costs, for which you will pay a premium? Or do you seek a vehicle for long-term, tax-advantaged wealth accumulation? A PPO provides a broad, flexible network for a higher monthly premium. An HDHP, conversely, pairs lower premiums with a formidable, tax-advantaged Health Savings Account (HSA), but requires you to assume greater initial cost-sharing.

Your choice is a direct reflection of your financial strategy—prioritizing predictable, high-touch coverage or leveraging your health plan as a tool for wealth preservation and growth.

An Executive Summary for Global Professionals

For a professional managing a global asset portfolio, selecting a health plan is not merely an administrative task; it is an integral component of your international financial strategy. The decision between a Preferred Provider Organization (PPO) and a High-Deductible Health Plan (HDHP) directly impacts both your liquidity and your capacity to preserve wealth. This choice must be analyzed through the lens of your financial objectives, risk tolerance, and anticipated healthcare requirements while operating abroad.

A PPO is structured for convenience and cost predictability. It grants direct access to an extensive network of specialists without requiring a referral—a significant advantage for expatriates who require immediate, unrestricted access to premier medical care anywhere in the world. The higher monthly premiums are the cost associated with this level of service and the lower out-of-pocket expenses incurred at the point of care.

An HDHP operates on a fundamentally different financial principle. It features substantially lower monthly premiums in exchange for a higher deductible. This structure means you will cover a greater share of your initial healthcare costs. For a high-net-worth individual, the strategic value of an HDHP lies in its exclusive eligibility for a Health Savings Account (HSA).

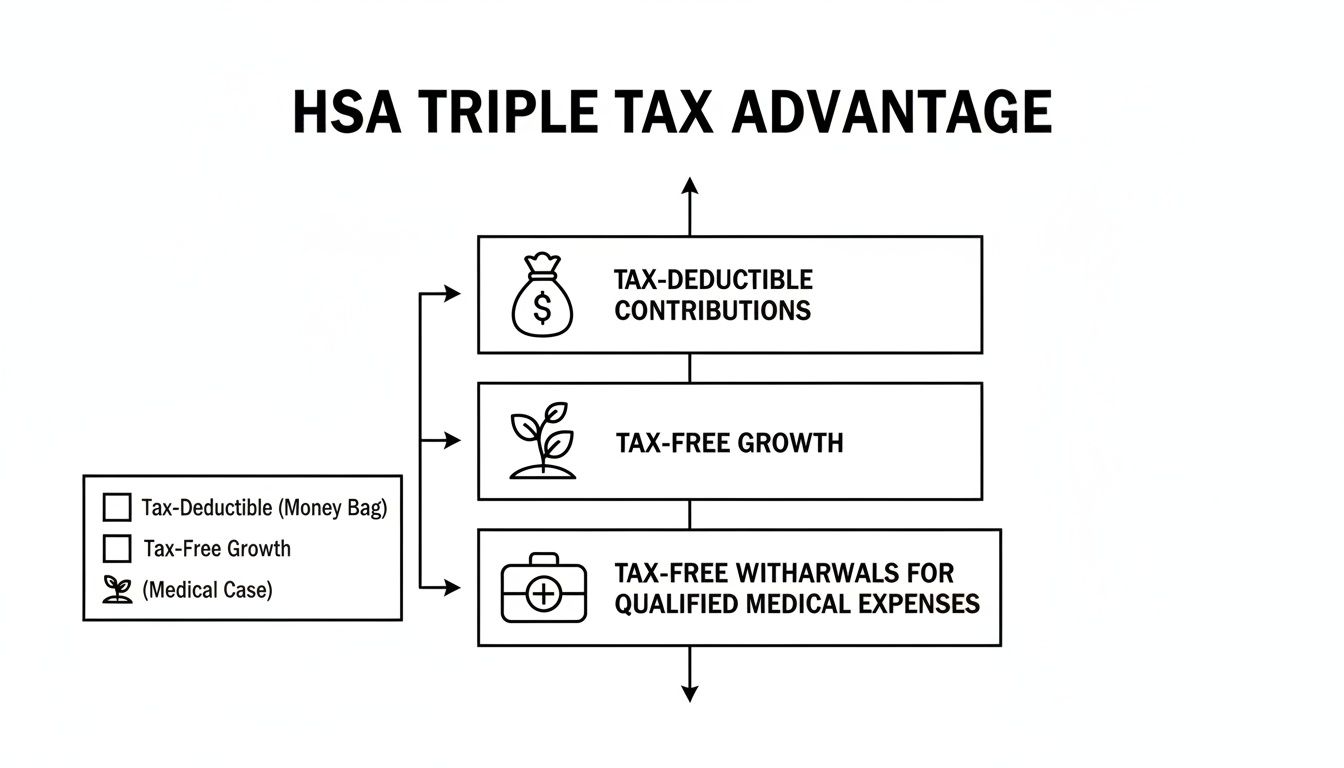

An HSA is a formidable financial instrument. It offers a triple tax advantage: tax-deductible contributions, tax-free investment growth, and tax-free withdrawals for qualified medical expenses. Consider it a specialized IRA for medical purposes, precisely aligning your healthcare funding with your long-term investment objectives.

For high-net-worth expatriates, sophisticated cross-border financial planning is imperative, particularly when a health plan choice carries such significant tax and investment implications.

At-a-Glance Comparison: Core Attributes of PPO and HDHP Plans

This table delineates the fundamental distinctions between PPO and HDHP plans, focusing on the factors most relevant to international finance professionals. It offers a concise overview of how each plan's structure aligns with different priorities and financial strategies.

| Attribute | PPO (Preferred Provider Organization) | HDHP (High-Deductible Health Plan) | Ideal Expat Profile |

|---|---|---|---|

| Monthly Premiums | Higher, reflecting immediate network access and lower cost-sharing for services. | Lower, freeing up capital for investment or other financial priorities. | PPO: Values budget predictability. HDHP: Seeks to minimize fixed monthly costs. |

| Deductibles | Lower, meaning insurance coverage begins sooner for most medical services. | Higher, requiring significant out-of-pocket spending before plan benefits activate. | PPO: Prefers lower financial risk. HDHP: Comfortable with initial cost exposure. |

| Specialist Access | Direct access to in-network specialists is standard; no referrals are needed. | Access is unrestricted, but costs are fully borne by the member until the deductible is met. | PPO: Prioritizes convenience. HDHP: Financially prepared for upfront costs. |

| Financial Strategy | Primarily a risk management tool for healthcare expenses, offering peace of mind. | A dual-purpose tool for both healthcare funding and tax-advantaged investing via an HSA. | PPO: Focus on health security. HDHP: Focus on wealth accumulation. |

Ultimately, the optimal plan is the one that integrates seamlessly into your personal financial ecosystem. A PPO is an investment in certainty and convenience, while an HDHP is a mechanism for leveraging your health plan as another performing asset in your portfolio.

Deconstructing PPO and HDHP Plan Fundamentals

To make an informed decision in the PPO vs HDHP debate, a precise understanding of each plan's mechanics is essential. They differ not only in price but are built on distinct philosophies for managing healthcare and capital.

One is engineered for immediate, frictionless access to care. The other serves as a conduit to one of the most powerful investment vehicles available. For a global professional, comprehending this distinction elevates a routine insurance selection to a strategic financial decision.

The PPO Framework: Unrestricted Access and Network Power

A Preferred Provider Organization (PPO) is engineered for maximum flexibility. Its principal value proposition is a large, curated network of physicians, hospitals, and specialists that you can access directly, without delay.

This structure eliminates the need for a primary care physician's referral, a critical time-saver for a busy executive requiring immediate specialist consultation. This is particularly valuable for individuals operating in major financial hubs.

Consider a private wealth manager based in Singapore requiring consultation with a top cardiologist. With a PPO, they simply schedule the appointment. Should they desire a second opinion from a world-renowned expert in London who is outside the network, a PPO typically still provides coverage, albeit at a reduced rate, resulting in a higher out-of-pocket cost for the member.

The plan's architecture is built on a two-tier coverage model:

- In-Network Care: You receive the most favorable financial terms when utilizing providers who have a contractual agreement with the insurer. This translates to lower copayments and coinsurance.

- Out-of-Network Care: You retain the freedom to consult any provider globally, but the plan covers a smaller percentage of the cost, with the remainder being your responsibility.

This model's dominance is well-documented. In the U.S. group health insurance market—a sector with revenues of $1.1 trillion in 2023—PPO plans command a significant 47% of the market share. This prevalence underscores why many globally mobile professionals select PPO-style international private medical insurance (IPMI). It delivers the seamless, referral-free access to world-class care they require.

The HDHP Mechanism: A Financial Instrument for the Disciplined

A High-Deductible Health Plan (HDHP) operates under a different paradigm. It is designed to place you in control of your healthcare spending, a control that is accompanied by greater upfront financial responsibility.

Its defining characteristic is a high deductible, a specific monetary threshold set annually by the IRS. You must pay this amount out-of-pocket for medical services before the insurance plan begins to cover costs, with the exception of certain preventive care services.

This design incentivizes proactive management of healthcare consumption. When your own capital is allocated for each visit and prescription, you are more inclined to evaluate options and manage costs diligently. You can familiarize yourself with these terms by reviewing our guide on expat medical insurance policy terms.

The strategic advantage of an HDHP is not its low monthly premium. It is the fact that it is the only plan type that permits you to open and contribute to a Health Savings Account (HSA). The high deductible is the legal prerequisite that unlocks what is arguably the most potent tax-advantaged savings vehicle available in the United States.

For a disciplined investor, an HDHP ceases to be a limitation and becomes a strategic financial tool. It reframes healthcare costs as an opportunity for long-term, tax-free wealth accumulation, shifting the focus from simply paying for medical care to actively integrating healthcare funding into a broader wealth preservation strategy.

The Strategic Financial Advantage of Health Savings Accounts

A PPO is a straightforward instrument for managing healthcare risk. An HDHP, by contrast, provides access to a far more powerful financial tool: the Health Savings Account (HSA).

For an individual accustomed to optimizing every asset, viewing an HSA merely as a healthcare fund is a significant miscalculation. It is one of the most tax-efficient wealth-building vehicles available, often outperforming traditional retirement accounts in tax-adjusted returns.

The power of the HSA lies in its triple tax advantage. This structure is engineered to shield capital from taxation at every critical juncture, a benefit not even a 401(k) or IRA can fully replicate.

Understanding the Triple Tax Advantage

To fully appreciate the financial leverage an HSA provides, it is essential to analyze how its three tax benefits synergize to accelerate wealth accumulation.

- Tax-Deductible Contributions: Every dollar contributed to an HSA directly reduces your taxable income for the year, similar to a traditional IRA contribution. For 2024, the maximum contribution is $4,150 for an individual and $8,300 for a family.

- Tax-Free Growth: Capital within an HSA can be invested in a portfolio of securities, including stocks and bonds. All capital gains, dividends, and interest accrue completely free of federal income tax.

- Tax-Free Withdrawals: Funds may be withdrawn at any time to pay for qualified medical expenses without incurring any income tax liability.

This combination creates a uniquely protected environment for your capital, enabling it to compound far more effectively over time. As an expatriate, a nuanced understanding of filing US taxes from abroad is critical to ensure you capitalize on every available benefit.

An HSA is more than a health plan feature; it is a private investment account with a healthcare utility. After age 65, it functions like a traditional IRA for non-medical withdrawals (subject to ordinary income tax), making it an incredibly flexible long-term asset.

An HSA Versus a PPO Over a Decade

The long-term financial divergence between choosing an HDHP with an HSA and a standard PPO is substantial. Let's analyze a simplified scenario for a high-earning professional over a ten-year period.

High-Deductible Health Plans paired with a savings option are increasingly favored by financially sophisticated individuals. Currently, 31% of covered U.S. workers are enrolled in such a plan. While PPOs still lead with 47% enrollment, the trend toward HDHPs is clear. The lower premiums—an average of $7,910 annually for single coverage versus a PPO's $8,435—are a key driver, as they free up capital for investment in vehicles like an HSA.

Let's model this premium savings. We will invest the annual difference of $525 directly into an HSA, along with the maximum family contribution.

Scenario A: The PPO Path

You pay higher premiums for ten years. You benefit from lower deductibles, but no investment vehicle is attached. The additional premium paid is a sunk cost for risk mitigation.

Scenario B: The HDHP and HSA Strategy

You redirect the $525 in annual premium savings into an HSA. You also contribute the maximum family amount (using the 2024 limit of $8,300 for consistency) each year.

- Total Annual HSA Contribution: $525 (premium savings) + $8,300 (max contribution) = $8,825

- Total Contributions Over 10 Years: $88,250

- Projected Value After 10 Years (assuming a 7% average annual return): Approximately $122,000

In this direct comparison, the HDHP selection not only provides healthcare coverage but also creates a $122,000 tax-advantaged asset. This fund can cover future medical liabilities or serve as a powerful supplement to your retirement portfolio—a strategic advantage a PPO cannot offer. This financial firepower is a critical factor in the PPO vs HDHP decision for any serious investor. To better understand how deductibles factor in, you can read our spotlight on excesses and deductibles.

Putting the Numbers to Work: Real-World Cost Scenarios

Theoretical frameworks are useful, but financial outcomes are what matter. To truly assess how the PPO vs. HDHP choice performs, we must move beyond plan documents and into practical financial modeling—a stress test for your healthcare decisions.

These scenarios are not academic; they are designed to identify the financial inflection point at which one plan clearly outperforms the other, based on lifestyle, health profile, and financial objectives. Let's analyze the numbers for several common expatriate profiles.

Scenario 1: The Healthy Fintech Entrepreneur in Dubai

Consider a young, healthy fintech founder based in Dubai with minimal medical needs, such as an annual physical examination. For this individual, the primary financial objective is aggressive wealth accumulation and tax optimization.

For this persona, an HDHP paired with an HSA functions less as health insurance and more as a potent investment tool. The low monthly premiums immediately free up capital that can be funneled directly into the HSA, converting a recurring expense into a high-growth, tax-advantaged asset.

- The PPO Path: Higher monthly premiums purchase a sense of security, but this is a sunk cost. Barring a significant medical event, that capital is expended with no potential for return.

- The HDHP+HSA Path: Premium savings are instead channeled into tax-deductible HSA contributions. These funds are then invested, creating a new, tax-free growth engine within their global investment portfolio.

For the disciplined investor who regards routine healthcare as a predictable, manageable expense, the HDHP is the superior choice for building wealth.

Scenario 2: The Expat Family with Children in Zurich

Now, let's shift to an investment banker's family with two young children residing in Zurich. Their situation involves a consistent pattern of pediatric visits, occasional specialist appointments, and the absolute requirement for immediate access to top-tier physicians without administrative delays.

In this context, a PPO plan is almost invariably the more prudent and efficient choice. The higher premium is an investment in predictability. They know their exact copayment for a doctor's visit or a prescription, which prevents the financial shock of having to meet a large family deductible on an HDHP due to routine pediatric care.

For a globally mobile family, a PPO's value is as much about operational efficiency as it is about cost. It eliminates tedious receipt tracking for minor expenses for HSA reimbursement. It provides direct, hassle-free access to specialists—a convenience that becomes non-negotiable when a child is ill.

While an HDHP offers lower premiums, a few unexpected illnesses could quickly erode those savings and create a cash-flow challenge long before the high deductible is satisfied. The PPO's structure is simply better aligned with the higher, more consistent healthcare utilization of a young family.

And for those considering an HDHP, the main draw is the Health Savings Account (HSA). This infographic breaks down the "triple-tax advantage" that makes the HSA such a compelling wealth-building tool, exclusive to HDHP plans.

This potent mix of tax benefits—deductible contributions, tax-free growth, and tax-free withdrawals for medical costs—makes the HSA a superior investment vehicle for many financially savvy expats.

Scenario 3: The Senior Executive with a Managed Condition in London

Finally, let's analyze a senior executive in London managing a chronic condition such as hypertension. This profile involves regular prescriptions, specialist monitoring, and predictable, ongoing medical expenses. Here, the decision requires precise calculation.

The entire choice hinges on one metric: the total annual out-of-pocket cost. This is the sum of annual premiums plus all expenditures up to the plan's out-of-pocket maximum. While an HDHP's premiums are lower, this executive can anticipate meeting their deductible—and likely their out-of-pocket maximum—every year.

This is where a clear understanding of the premium differential is critical. According to 2023 KFF data for employer-sponsored plans in the U.S. health insurance market, the average annual family premium for PPOs is $23,968. For HDHPs, the average is $22,344. You can explore more of these market dynamics in this industry analysis by IBISWorld.

The $1,624 annual premium savings with the HDHP must be weighed directly against its higher deductible and out-of-pocket exposure. If the PPO's higher premium is less than the difference in out-of-pocket maximums between the two plans, the PPO becomes the more cost-effective choice, delivering financial certainty for known medical expenditures.

Scenario-Based Annual Cost Projection: PPO vs HDHP

To make this even clearer, let's model out the total annual costs for two of our expat profiles. The table below projects the financial outcomes for an expat family with moderate healthcare usage versus a healthy individual with low usage, factoring in premiums, deductibles, copays, and potential HSA benefits.

| Cost Component | PPO Expat Family Scenario | HDHP Expat Family Scenario | PPO Healthy Individual Scenario | HDHP Healthy Individual Scenario |

|---|---|---|---|---|

| Annual Premium | $18,000 | $12,000 | $7,200 | $4,800 |

| Deductible | $1,000 (met) | $6,000 (met) | $500 (not met) | $3,000 (not met) |

| Copays/Coinsurance | $1,500 | $2,000 | $150 (for preventive care) | $300 (for preventive care) |

| Max HSA Contribution | $0 (N/A) | $8,300 (2024 family limit) | $0 (N/A) | $4,150 (2024 single limit) |

| Tax Savings from HSA | $0 | ($2,490) (assuming 30% rate) | $0 | ($1,245) (assuming 30% rate) |

| Total Annual Outlay | $20,500 | $17,510 | $7,350 | $3,855 |

| HSA Account Value (EOY) | $0 | $8,300 (plus investment growth) | $0 | $4,150 (plus investment growth) |

As the numbers illustrate, the HDHP generates significant savings and asset growth for the healthy individual. For the family with higher utilization, while the HDHP's total outlay is lower after tax benefits, the PPO offers far greater predictability and avoids a $6,000 upfront deductible payment—a crucial cash flow consideration. The "best" plan is truly contingent on your specific financial and medical circumstances.

Matching the Right Plan to Your Lifestyle and Financial Goals

Selecting between a PPO and an HDHP is not merely a healthcare choice; it is a strategic financial decision that must align with your professional life, risk tolerance, and long-term wealth objectives. The optimal plan for a self-employed consultant is fundamentally different from that required by a senior executive with a family. A precise evaluation of your own circumstances is the only way to make the correct determination.

This requires looking beyond premiums and deductibles to assess how each plan supports your operational reality. For some, the predictability and frictionless access of a PPO are paramount. For others, the financial efficiency and investment power of an HDHP combined with an HSA is the decisive factor.

The Case for a PPO: A Senior Executive and Family

Consider a senior executive with a family, frequently moving between global financial centers like London and Hong Kong. For this profile, a PPO plan is almost always the superior instrument for managing healthcare risk. Its value extends beyond monetary considerations to operational efficiency.

The core benefits directly address the challenges of a demanding international career and family life:

- Immediate Specialist Access: When your child requires a pediatric specialist, there is no time for referral processes or network verification. A PPO provides direct, immediate access to premier medical experts. For many, this peace of mind is non-negotiable.

- Global Network Reliability: A true international PPO offers a vetted global network, ensuring consistent, high-quality care whether you are at your home base or traveling for business. This eliminates uncertainty.

- Predictable Costs: With fixed copayments and lower deductibles, you achieve budget certainty. This structure removes the cash flow volatility of a large, unexpected medical bill that could instantly negate any premium savings from an HDHP.

For this type of professional, the critical question is straightforward: Is immediate, unrestricted access to any specialist a non-negotiable priority? If the answer is affirmative, then the higher premium of a PPO represents a sound investment in convenience and certainty.

The HDHP Advantage: The Disciplined Investor and Consultant

Now, consider a different profile: a healthy, self-employed consultant or a young investment professional. This individual is financially disciplined, has a high tolerance for calculated risk, and is focused on maximizing every available investment vehicle. For them, an HDHP is an optimal strategic fit.

The decision-making process here is driven by a distinct set of priorities. The lower monthly premium is not just a cost saving; it is capital that can be deployed immediately. When combined with a Health Savings Account (HSA), the plan transitions from a mere insurance policy to a powerful wealth-building engine. You can explore which medical insurance policy type is right for you in our detailed guide.

This structure is perfectly suited for those who:

- Anticipate infrequent use of medical services and can comfortably cover the high deductible with existing liquid assets.

- Are committed to funding their HSA to its maximum annual limit consistently.

- View their HSA as another long-term investment account, managed in concert with their primary retirement portfolio.

For this professional, the key decision driver is: Is maximizing tax-advantaged investments a primary financial goal? If so, the HDHP's function as the exclusive gateway to the triple-tax-advantaged HSA makes it the clear financial victor in the PPO vs HDHP analysis. It integrates healthcare funding as a core component of their wealth strategy.

Making Your Final Decision with Confidence

Choosing between a PPO and an HDHP is a strategic financial move that reflects your approach to capital and risk management. At its core, you are weighing one clear trade-off against another: immediate, flexible network access versus lower fixed costs and a powerful wealth-building instrument.

Your final choice must be deliberate, functioning as a natural extension of your international career, financial objectives, and personal risk tolerance. To achieve this, you must shift from analyzing plan features to conducting an honest self-assessment.

A Framework for Your Decision

Before engaging with a broker or insurer, you must have clear answers to several critical questions. This internal audit places you in control, allowing you to lead the conversation rather than passively receiving a sales presentation. Your answers will guide you directly to the plan that serves as an asset, not a liability, to your global financial life.

Ask yourself these three questions:

- Financial Liquidity: Could you write a check for the full HDHP deductible tomorrow without disrupting your investment strategy? If this prospect causes hesitation, the predictable, lower out-of-pocket costs of a PPO will provide essential peace of mind.

- Investment Priority: Is optimizing the value of every tax-advantaged account a core tenet of your wealth plan? If the answer is an unequivocal "yes," then the HSA—accessible only through an HDHP—is a non-negotiable tool for your financial arsenal.

- Global Mobility Needs: How frequently do you require access to a top-tier specialist in London one month and Singapore the next, without referral delays? For professionals operating between financial hubs, a PPO’s seamless network access is often worth the premium.

Ultimately, the best plan is the one that removes friction from your life. Whether that is the quiet confidence derived from a robust PPO network or the financial empowerment of a fully-funded HSA, the objective is the same: to make your health insurance a silent partner in your success.

Securing a policy that meets these exacting standards requires a clear, objective analysis of the data. We built our proprietary comparison engine for this exact purpose—to allow you to model these scenarios with real data. It ensures the final call in your PPO vs HDHP evaluation is one you can make with complete confidence.

Frequently Asked Questions

When managing a global financial footprint, the choice between a PPO and an HDHP is a matter of asset management. Here are precise answers to the most common questions from professionals navigating this decision.

Can I Use My HSA for Medical Expenses Incurred Outside the US?

Yes, absolutely. This is a critical feature for global professionals. Your Health Savings Account (HSA) funds can be utilized tax-free for any qualified medical expense as defined by the IRS, irrespective of the geographic location where the care is received.

The determining factor is not where the service is rendered, but whether it meets the IRS definition of qualified medical care. You can pay for a consultation in Singapore or a procedure in London with pre-tax dollars. However, to continue making contributions to your HSA, you must remain enrolled in a qualifying HDHP.

Which Plan Offers Better Continuity of Care for a Mobile Family?

For families who divide their time between countries or relocate frequently, an international PPO is almost always the superior choice for ensuring seamless continuity of care. Its primary advantage is a broad, pre-vetted network of premier providers across major international hubs.

This structure eliminates administrative friction—no referrals are required, specialists are directly accessible, and paperwork is minimized. When predictable, immediate access for your family is a priority, the PPO's design is purpose-built for a mobile lifestyle.

When your family's well-being is at stake in a foreign country, the immediate, referral-free access of a PPO network provides invaluable peace of mind that often justifies its premium cost.

How Do International PPO Networks Compare to US-Based Ones?

The focus is on quality over quantity. International PPO networks are specifically curated for the expatriate community. They are not designed to be as expansive as a domestic US network; rather, they concentrate on partnerships with the premier clinics and hospitals in key global cities.

The strategic value lies in the logistics. These networks feature providers experienced in treating international patients and, crucially, often have direct billing agreements in place. This means the insurer settles the cost directly with the hospital, which dramatically reduces the large out-of-pocket sums you might otherwise have to pay upfront and later claim for reimbursement.

How Are Prescription Drugs Handled in an HDHP?

This is a critical detail that can determine the financial viability of an HDHP for many individuals. Under most HDHP plans, you are responsible for 100% of the negotiated cost of your prescriptions until your annual deductible has been met.

For individuals with recurring medication needs, this can result in significant out-of-pocket expenditures at the beginning of each plan year. While some plans may cover a specific list of preventive drugs pre-deductible, it is essential to verify this in the plan's documentation. Always review a plan’s drug formulary, as this single factor can completely alter the cost-effectiveness analysis between a PPO and an HDHP for your specific situation.

Making the right call demands a clear-eyed look at how these plans perform against your specific financial and lifestyle realities. At Riviera Expat, we cut through the noise with objective, data-driven analysis. To explore your personalized options and get total confidence in your decision, see what we can do for you at https://riviera-expat.com.