Your policy number on health insurance is the definitive identifier for your health plan—the master account number that governs the entire contract.

Consider it analogous to a private wealth management account number. It connects you, your spouse, and any dependents—everyone covered—to the specific, high-level benefits package you have secured with your insurer.

What Your Policy Number Represents

In the administration of your healthcare benefits, your policy number is the singular key that provides access to your entitlements. It is the unique code assigned to the insurance contract itself, functioning as the primary reference for every interaction with your insurer.

From verifying your eligibility for a premier specialist to processing a claim or settling a premium, this number orchestrates the entire process. Its purpose is to ensure every detail is executed with precision and efficiency, eliminating administrative discrepancies.

The Foundation of Your Coverage

A critical distinction to appreciate is that your policy number differs from your member ID. The policy number identifies the entire contract, whereas a member ID identifies a specific individual covered under that contract.

This is particularly relevant for family coverage. For example:

- A family of four will be covered under a single policy number.

- Each person within that family will be assigned their own unique member ID.

This structure allows an insurer to accurately attribute a claim for a dependent's medical consultation back to the family's master policy. It ensures all communications and financial transactions related to anyone on the plan are routed with precision.

Your policy number is the cornerstone of your relationship with your insurer. It is the definitive link that unlocks access to your contracted network of elite medical professionals and facilities, ensuring the sophisticated, seamless care you expect is delivered without administrative friction.

Why This Number Is Crucial for Your Healthcare

Regard your policy number as the master key to your healthcare portfolio. It is the single most important piece of information that unlocks the entire system, creating a direct and efficient channel between you, your medical provider, and your insurance carrier.

This number enables hospitals and private clinics to instantly verify your eligibility, ascertain the specifics of your plan's coverage, and bill your insurer accurately. Without it, the process is invariably delayed.

When you provide your policy number on health insurance, you initiate a rapid, seamless data exchange between the medical provider and the insurer. Using the correct number is what prevents frustrating administrative delays, erroneous billing, and other impediments to receiving timely and appropriate care.

Enabling Financial Precision and Access

Your policy number also functions as your financial safeguard. It ensures that every service, from a routine consultation to a complex surgical procedure, is billed with precision against your specific schedule of benefits.

If a provider cannot validate your policy number, they cannot confirm the financial arrangements of your plan. This may lead to requests for upfront payment or, in certain scenarios, a delay in rendering non-emergency services.

The policy number is what makes your insurance tangible. It transforms an abstract contract into a practical tool that guarantees swift claims processing and uninterrupted access to world-class medical care.

In an era of escalating medical costs, its importance is amplified. According to the 2025 Global Medical Trends Survey from Willis Towers Watson, global medical costs are projected to rise by an average of 9.9% in 2024, with 64% of insurers anticipating even higher cost increases over the next three years. Your policy number is the unique identifier that allows for precise, automated claims processing, ensuring your benefits are correctly applied in this complex financial environment. You can delve into the specifics in the full global medical survey from WTW.

Ultimately, this number converts your insurance policy into a functional key for accessing healthcare. Understanding its function is the first step toward confidently managing your health benefits. For answers to other common inquiries, our comprehensive FAQ section is an excellent resource.

How to Locate Your Policy Number Instantly

Finding your health insurance policy number is a straightforward matter, provided you know where to look. This string of characters is the direct link to your coverage, so having it readily available is essential for efficient interactions with physicians, hospitals, and your insurer.

The most direct method is to consult your insurance card, whether it is the physical card in your wallet or a digital version accessible via your smartphone.

Your card contains several important codes, but the policy number is the master identifier. Look for explicit labels such as “Policy Number,” “Policy #,” or “Contract #.” It is typically printed near your name or the plan's name. It is important not to confuse it with other numbers on the card.

Consider your insurance card a summary of your entire benefits contract. The policy number is its unique identifier, separate from the group number (which identifies your employer's plan) or the Rx BIN (used for pharmacy claims). Each number serves a distinct, critical purpose.

A Quick Guide to Common Locations

To ensure you can always access your policy number on health insurance documents, here are the most reliable sources to consult:

- Your Insurance Card: This is your primary, portable reference. The number is almost always clearly printed on the front.

- Policy Welcome Packet: When you first enrolled, your insurer provided a package of documents. The policy number is featured prominently, often on the first page of the policy schedule.

- Secure Digital Portal: Log in to your insurer’s website or mobile application. Your dashboard will display a complete view of your plan details, including the policy number.

- Explanation of Benefits (EOB): Following any medical service, you will receive an EOB statement. Your policy number is listed on it for reference and verification.

Mastering this key detail is fundamental to managing your healthcare finances, especially when analyzing the factors that influence your plan's cost. For more on that topic, you may find our guide on why medical insurance premiums rise year after year insightful.

Policy Number vs Member ID vs Group Number

Deciphering a health insurance card can seem like interpreting a complex code. However, each number has a highly specific function, and confusing them is a common error that creates unnecessary complications when seeking care.

The policy number on health insurance is the master key, but it does not operate in isolation. It functions in concert with two other critical identifiers.

Consider your family’s health plan as an exclusive residential building.

- The Policy Number is the building's street address. It identifies the entire structure—the master contract that covers you and your family.

- The Member ID is the unique key to your specific residence. Every individual covered by the plan is assigned their own Member ID, granting them personal access to the building’s amenities and services.

- The Group Number is the name of the property developer. It identifies the sponsoring organization, such as your employer, that has arranged the plan.

Distinguishing The Core Identifiers

This framework ensures every interaction with a clinic or hospital is routed correctly. When a provider submits a claim, they use your unique Member ID to identify you as the patient. This ID is then cross-referenced with the Policy Number to determine the specific benefits, deductibles, and coverage limits applicable to your family’s plan. The Group Number simply informs the insurer which corporate agreement's rules apply.

Using these numbers incorrectly can lead to claim rejections or billing delays. Understanding the precise function of each one empowers you to communicate with clarity and authority, ensuring every interaction with your insurer and providers is efficient and seamless.

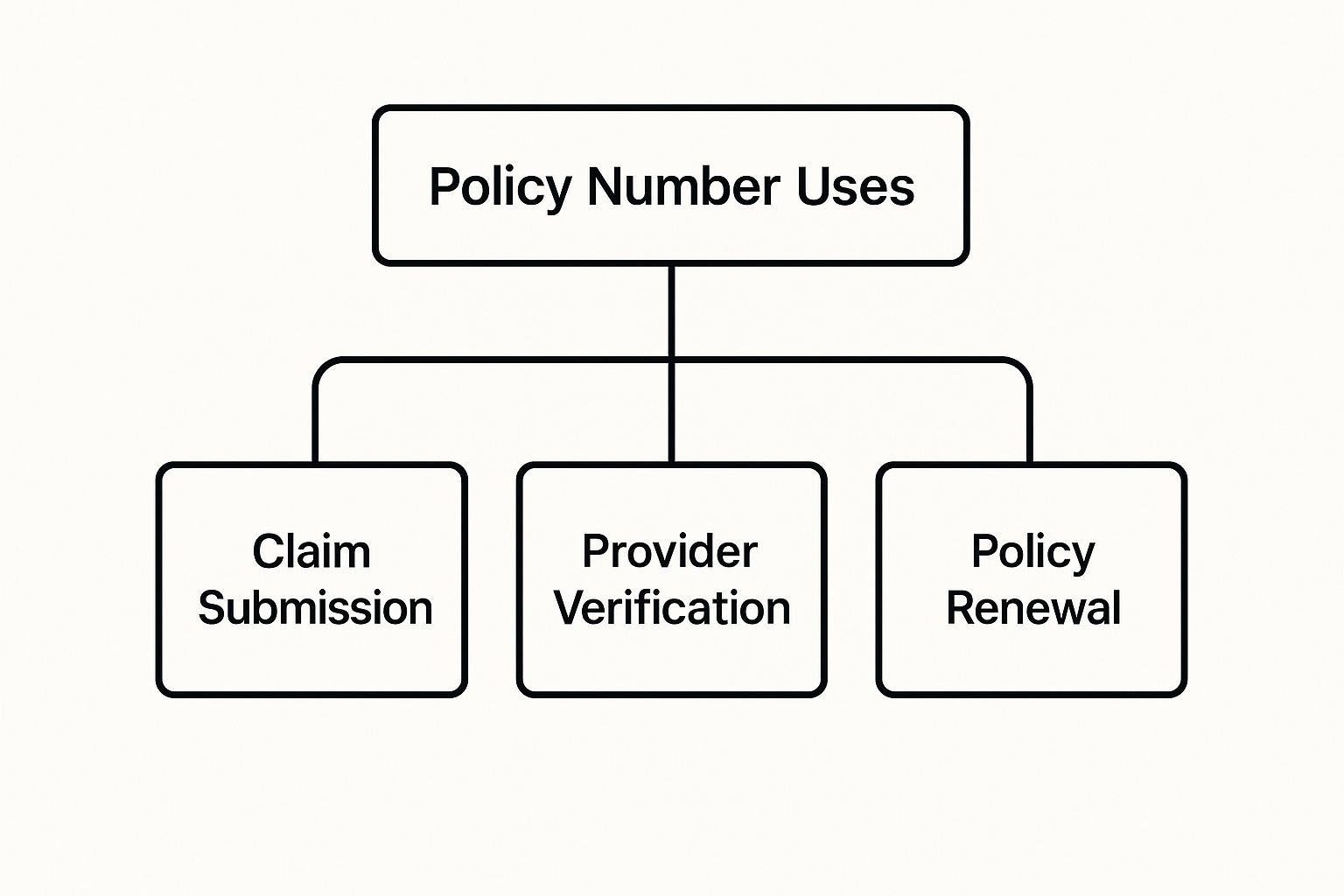

This infographic breaks down the main functions tied directly to your policy number.

As illustrated, the policy number is the central pillar for verifying your plan, submitting claims, and managing your contract renewal. This single number is the linchpin for the most critical administrative functions of your health coverage.

To provide further clarity, this reference table places all three identifiers side-by-side.

Your Insurance Card Identifiers At a Glance

| Identifier | What It Represents | Primary Use |

|---|---|---|

| Policy Number | The master insurance contract for your family or household. | Identifying the overall plan, its benefits, and terms. Used for renewals and high-level inquiries. |

| Member ID | Your unique personal identifier under the master policy. | Identifying you as an individual patient for claims, prescriptions, and appointments. |

| Group Number | The organization (e.g., your employer) that sponsors the plan. | Administering benefits according to the group's specific agreement with the insurer. |

A firm grasp of these three numbers enables you to navigate the administrative side of your healthcare with confidence.

Grasping the distinction between these numbers isn't just an academic exercise; it's a practical necessity for managing your healthcare with authority. It ensures that from the moment you present your card at a world-class clinic to the final settlement of a claim, the process operates with the accuracy you demand in all your affairs.

For a deeper dive into these and other key definitions, please review our comprehensive guide where we have expat medical insurance policy terms explained.

Your Policy Number is Your Global Healthcare Passport

For those who travel internationally for business or reside as expatriates, your health insurance policy number transcends its role as a local identifier. It becomes your access credential to premier healthcare services worldwide.

Think of it as a universal key. It is the single data point that unlocks your health plan’s benefits, whether you are in New York, London, or Singapore. It is the consistent thread that connects millions of individual policies across a complex web of countries and regulatory environments.

This number is the engine of a vast global system. It allows international insurance carriers to process claims seamlessly, analyze market trends, and, critically, prevent fraud on a global scale. Without this unique identifier, the integrity of the international private medical insurance system would be compromised.

The Key to a Multi-Trillion Dollar Global Market

The sheer scale of the global health insurance market underscores the critical importance of this number. Valued at approximately USD 2.32 trillion in 2024, the market is projected to reach USD 4.45 trillion by 2032.

This represents a compound annual growth rate (CAGR) of 8.5%. Every new insured individual—over 92% of the U.S. population alone holds health coverage—requires a unique policy number. Accurate tracking is not merely important; it is essential for the financial integrity of this massive ecosystem. You can discover more insights about the global health insurance market outlook on Actupool.com.

This identifier functions as the universal language between global healthcare providers and international insurers. It ensures that your high-value policy is recognized and honored anywhere in the world, providing the financial security and access you expect, regardless of location.

Ultimately, your policy number serves as your passport to health benefits. It is what grants you access and ensures smooth administration wherever your personal or professional life takes you, confirming you are a recognized participant in a vast, interconnected network designed to deliver care when and where you need it most.

Your Top Questions Answered

When managing the practicalities of your health coverage, certain questions consistently arise. Here are direct answers to help you administer your insurance with professional acumen.

What If I Cannot Find My Policy Number?

Should you misplace your card or be unable to locate your policy number on health insurance documents, the most direct course of action is to contact your insurer’s member services line. Their representatives are equipped to verify your identity through security protocols and provide this key information promptly.

For even faster resolution, log in to your insurer's secure online portal or mobile application. Your complete policy details, including the policy number, are invariably displayed on your primary account dashboard. If your plan is sponsored by your employer, your Human Resources department is another reliable point of contact.

Are My Policy Number and Member ID the Same Thing?

In almost all cases, they are not. While they may appear similar, they perform distinct functions. A very small number of insurers may consolidate them for simplicity, but this is not standard industry practice.

The policy number identifies the master insurance contract—the plan itself. The Member ID, conversely, is assigned to each individual covered by that contract. For instance, your dependents will share your policy number, but each will have a unique Member ID to distinguish their individual claims and medical records.

Your policy number is the contract's address, while the Member ID is the key to your specific apartment inside. This separation ensures every medical consultation is billed to the correct individual under the proper plan, preemptively mitigating billing discrepancies.

Why Do Providers Ask for My Policy Number at Every Single Visit?

While it may seem repetitive, this is a crucial step in the revenue cycle management process for healthcare providers. Upon check-in, the provider uses your policy number to conduct a real-time eligibility verification with your insurer to confirm that your coverage is active.

This verification provides them with all necessary information: your eligibility for benefits, applicable copayment, deductible status, and coinsurance details. It is the key to submitting an accurate claim, ensuring your benefits are applied correctly and preventing subsequent billing disputes.

How Should I Protect My Policy Number?

Treat your policy number with the same discretion you would a credit card or bank account number. It is a core component of your protected health information (PHI) and provides direct access to your insurance benefits.

Disclose it only to legitimate healthcare providers, your pharmacy, and your insurance company or its authorized representatives. Safeguarding your policy number on health insurance is your first line of defense against medical identity theft and insurance fraud. Never post an image of your insurance card on social media or share the number with unverified parties.

At Riviera Expat, we deliver the clarity and control you demand for your international health coverage. We eliminate the complexity of choosing the right plan, providing objective, expert guidance tailored to the needs of financial professionals in global hubs. Explore your IPMI options with us today.