Moving from the US to China is not merely a change of address; it is a significant strategic undertaking. Consider it less a simple relocation and more a detailed merger of your professional and personal spheres. Executing this successfully requires a precise blueprint focused on critical pillars: mastering the visa process, structuring your finances across international borders, securing appropriate accommodation, and arranging for premier global health coverage.

Your Executive Relocation Blueprint To China

Successfully relocating to China from the US hinges on a phased, strategic approach, not a last-minute checklist. For senior executives and high-net-worth individuals, the complexity and stakes are significantly higher, demanding that planning commences long before a single item is packed.

One of the logistical hurdles that is frequently underestimated is the process of importing household goods. A robust plan for navigating China's customs clearance procedures is essential to avoid costly delays and administrative complications.

It is also pertinent to note the current environment for such a move. Relocating from the USA to China has become a more specialized path in recent years, diverging from the trends of previous decades. In fact, data from China's National Bureau of Statistics shows the total foreign resident population in mainland China experienced a significant decline from a peak of over 845,000 in 2018 to just over 600,000 in the 2020 census.

While there has been a renewed effort to attract foreign talent post-2023, the profile of the American expatriate has evolved. Today, those making the move are overwhelmingly career-focused, with a substantial percentage of new arrivals relocating for professional assignments.

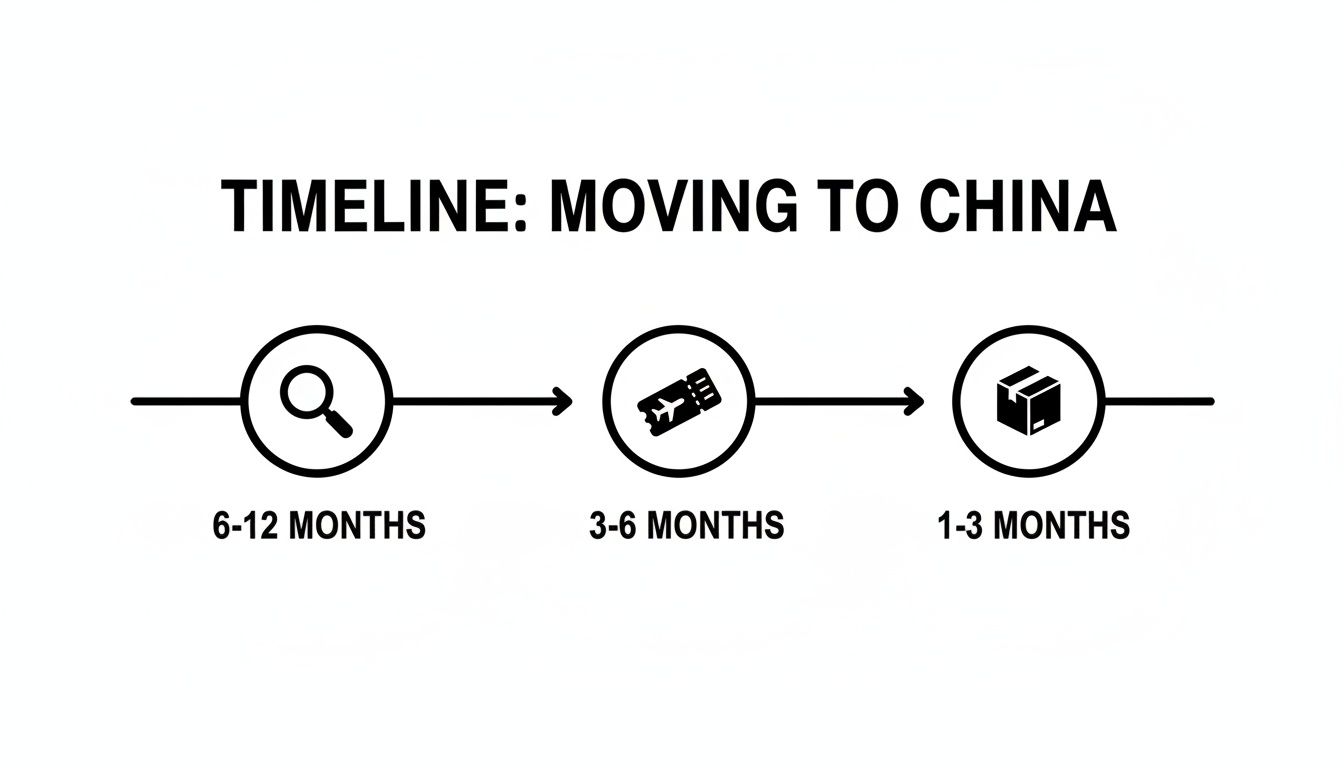

This timeline provides a strategic overview of the key phases for a well-managed executive relocation.

As illustrated, a seamless transition is effectively a year-long project, beginning with in-depth research and strategic planning and culminating in the final logistical execution.

The Core Pillars of Your Move

Your entire relocation strategy should be built on four critical pillars. Each demands specialized, professional guidance to ensure you and your family transition smoothly and can operate effectively from day one. For a closer look at these early stages, our guide on preparing for your move abroad is an excellent starting point.

- Immigration and Legal Residency: Securing the correct Z-Visa and subsequently your Residence Permit is the absolute first—and most critical—step. There are no shortcuts.

- Financial and Tax Structuring: You must proactively manage your US tax obligations while determining the optimal strategy for managing assets across two distinct financial systems.

- Lifestyle and Family Establishment: This extends beyond merely finding accommodation. It involves securing a residence in an exclusive neighborhood and enrolling your children in a top-tier international school.

- Comprehensive Health Coverage: Your family's health is of paramount importance. Arranging for premium International Private Medical Insurance (IPMI) is non-negotiable.

A successful executive relocation is not merely a change of address but a calculated strategic initiative. It requires foresight in legal, financial, and personal planning to mitigate risk and ensure continuity from day one.

To help you visualize the process, here is a high-level timeline outlining the key milestones for an executive-level move from the USA to China.

Executive Relocation Timeline At-a-Glance

| Phase (Months Pre-Move) | Key Action Items | Primary Focus |

|---|---|---|

| 12-9 Months | Engage relocation consultant; Begin visa eligibility assessment; Initial tax & financial planning consultations. | Strategic Planning & Feasibility |

| 9-6 Months | Secure job offer & employment contract; Start document authentication for visa; Research schools & housing. | Foundational Legal & Personal |

| 6-3 Months | Apply for Z-Visa; Finalize international school enrollment; Arrange for shipping of household goods. | Execution & Logistics |

| 3-1 Months | Book flights; Finalize temporary housing; Arrange IPMI; Notify banks & set up cross-border banking. | Final Preparations |

| Arrival in China | Complete local police registration; Apply for Residence Permit; Open local bank account; Set up utilities. | On-the-Ground Integration |

This timeline serves as a strategic roadmap. Each item involves multiple sub-steps that require careful attention to detail and, in most cases, professional guidance to navigate effectively.

Navigating The Evolving Immigration Landscape

To be direct, securing your legal residency when moving to China from the USA is a matter of precision, not approximation. The process is exacting and leaves zero room for error. Your entire professional engagement in-country hinges on obtaining the correct visa and residence permit, making this your first and most critical focus.

The cornerstone of your move will be the Z-Visa, the specific work visa designated for foreign professionals. This is not an item for which one can apply spontaneously. It must be sponsored by your employer in China, and that sponsorship is the key that unlocks the entire process. Your employer must initiate the procedure by applying for your Work Permit Notification Letter.

The Critical Path to Your Z–Visa and Residence Permit

Your journey begins long before you set foot inside a Chinese consulate in the US. It starts with meticulous document preparation. This is precisely where I have seen numerous high-level relocations encounter frustrating and expensive delays.

The two most important documents you will require are your highest academic degree and a federal criminal background check. Simple photocopies are insufficient. These documents must undergo a rigorous, multi-step authentication process:

- Notarization: First, they must be notarized by a licensed public notary in the United States.

- State-Level Authentication: Next, they are sent to the Secretary of State's office in the state where they were issued.

- Embassy Legalization: The final step is submitting the authenticated documents to the appropriate Chinese Embassy or Consulate in the US for final legalization.

This authentication chain is absolutely non-negotiable and can easily take several weeks to complete. It is paramount that you begin this process at the earliest opportunity.

The most common pitfall I observe is an underestimation of the time and precision required for document authentication. A minor misstep can reset the timeline, throwing your entire relocation schedule into disarray.

Once your employer possesses your authenticated documents, they will apply for your Work Permit Notification Letter from the local labor bureau in China. Only upon your receipt of that letter can you finally apply for the Z-Visa at a Chinese consulate in the US.

The good news is that the landscape is shifting. Post-pandemic, China has reopened its borders with a renewed focus on attracting foreign talent. Policies have been introduced to streamline visa processes and reforms like electronic Work Permits can smooth out the administrative journey. For US movers, this signals improved access, but it is also paired with stricter enforcement of immigration laws.

From Visa Holder to Legal Resident

Obtaining your Z-Visa is a significant milestone, but the process is not yet complete. The Z-Visa is typically a single-entry visa valid for only 30 days from your arrival. You have a very narrow window to convert this temporary status into a long-term legal residency.

First, you will need a mandatory medical examination at a government-designated health center. This is a standard examination to ensure you meet China's health requirements for residency.

With the health check cleared, you must immediately apply for your Residence Permit. This is the official document that permits you to live and work in China for the duration of your contract, typically issued for one year initially. This application is processed at the local Public Security Bureau (PSB) Exit-Entry Administration office.

Securing Visas for Your Family

For executives relocating with family, their transition is equally important. Your spouse and children will apply for dependent visas, known as S1-Visas for long-term stays (over 180 days) or S2-Visas for shorter visits.

The S1-Visa application runs parallel to your own Z-Visa process. You will need to provide authenticated marriage and birth certificates to establish your relationships. Upon their arrival in China, your dependents must also complete the process of obtaining Residence Permits linked to yours. This can become complex depending on family structure and nationalities, but our in-depth country guides offer more clarity on these specific nuances.

Structuring Your Cross-Border Finances

For high-net-worth individuals, a successful move to China is not just about logistics—it is about architecting a sophisticated financial bridge. An error in this domain can result in significant tax burdens and operational complications. Executed correctly, you can protect and grow your assets seamlessly across two continents.

When you relocate from the US to China, you are entering a dual-system reality for your wealth. This is far more complex than simply opening a new bank account. You must engineer a financial structure that respects US tax law, navigates Chinese currency controls, and preserves your wealth across jurisdictions.

Don't Close Your US Accounts—Upgrade Them

A common miscalculation is assuming a move abroad means severing ties with the US financial system. For a high-net-worth professional, the opposite is true. It is imperative to maintain your US-based investment portfolios, retirement accounts, and banking relationships.

However, your status as a non-resident can be a red flag for many retail banks and brokerage firms. Due to complex compliance rules (e.g., KYC, AML), they often restrict or close accounts for clients residing overseas.

Before you relocate, you must:

- Contact your financial institutions. Inform them of your impending move to China and inquire directly about their policies for non-resident clients.

- Consolidate your assets. Consider moving funds to firms with dedicated international or expatriate client desks, such as the international arms of major brokerage houses. These institutions are structured to handle the specific needs of Americans living overseas.

- Establish a durable power of attorney. Designate a trusted individual in the US to manage financial matters that may require a physical presence. This serves as a crucial failsafe.

Managing your US portfolio from China is an active endeavor. Failure to engage with financial institutions that explicitly welcome and understand the complexities of serving expatriates risks frozen accounts or forced liquidation of assets. This is not a theoretical risk; it is a frequent occurrence.

Uncle Sam's Reach: Navigating US Taxes from Abroad

Your US passport signifies a lifelong tax obligation. The United States taxes its citizens on worldwide income, meaning your fiscal responsibilities do not end at the border. Overlooking this is one of the most costly errors an expatriate can make.

As an American in China, you will file a US federal tax return annually. You will also be subject to Chinese income tax on your local earnings. To prevent double taxation, the US tax code provides two powerful mechanisms:

- Foreign Earned Income Exclusion (FEIE): This allows you to exclude a significant portion of your foreign-earned income from US taxes. The exclusion amount is indexed for inflation annually; for the 2023 tax year, it was $120,000.

- Foreign Tax Credit (FTC): This provides a dollar-for-dollar credit for income taxes paid to the Chinese government, which can be used to offset any remaining US tax liability.

Your cross-border tax advisor will determine which strategy yields the greatest tax efficiency, but compliance is non-negotiable. Your reporting duties also extend beyond income.

The Alphabet Soup of Reporting: FBAR and FATCA

The US government is highly focused on tracking foreign financial assets to combat tax evasion. You must familiarize yourself with two key regulations: FBAR and FATCA.

- FBAR (Report of Foreign Bank and Financial Accounts): If the aggregate value of all your foreign financial accounts exceeds $10,000 at any point during the calendar year, you are required to file FinCEN Form 114. This includes your Chinese bank accounts, brokerage accounts, and other financial instruments.

- FATCA (Foreign Account Tax Compliance Act): This law requires you to report specified foreign financial assets on Form 8938, filed with your tax return. The reporting thresholds are substantially higher than FBAR's, but the penalties for non-compliance are severe.

These are two separate reporting obligations. Failure to comply can lead to staggering fines. Diligent record-keeping and professional tax advisory services are not just advisable; they are essential.

Setting Up Your Financial Life in China

One of your first priorities upon arrival will be opening a local bank account. It is necessary for nearly everything: receiving salary, paying rent, and accessing China's ubiquitous mobile payment systems like WeChat Pay and Alipay. Major institutions such as Bank of China, ICBC, and China Construction Bank are standard choices for expatriates.

It is critical to understand that China's currency, the Renminbi (RMB), is not freely convertible. The government maintains strict capital controls, which directly affects your ability to move large sums of money out of the country.

While Chinese citizens face an annual limit of $50,000 for converting RMB to foreign currency, the regulations for foreigners are different. To repatriate your legitimately earned income out of China, you must provide a comprehensive set of documents, including your employment contract, proof of salary payments, and individual income tax payment receipts. This is not a casual process.

Planning to move significant funds requires meticulous coordination with your bank and a robust paper trail. This underscores why maintaining diligent documentation of your financial life in China from day one is so important.

Securing Your Ideal Lifestyle And Schooling

Once the financial and legal frameworks are established, a successful executive move truly hinges on curating a lifestyle that meets your standards. For anyone moving to China from the USA with family, this translates to securing premium housing and elite schooling in Tier-1 cities such as Shanghai, Beijing, or Shenzhen.

This is not a market that can be casually browsed online. It demands specialist knowledge and the capacity for swift action.

The high-end residential market in these hubs is sophisticated and intensely competitive. Your options generally fall into two categories: luxury serviced apartments located in the central business district or spacious private villas within exclusive expatriate compounds.

Serviced apartments offer turnkey convenience, often including housekeeping, club facilities, and 24-hour concierge services—ideal for an immediate start. Villas, such as those in Shunyi (Beijing) or Jinqiao (Shanghai), provide a more suburban, family-oriented lifestyle with significantly larger living spaces and private gardens.

Engaging The Right Real Estate Expertise

Securing the right property requires more than online listings. You must connect with a reputable, high-end real estate agent who specializes in the expatriate market. These agents possess the critical relationships and off-market intelligence necessary to access premier properties.

You must also be prepared to act decisively. The most desirable residences are often leased within days of becoming available. A standard lease in China is for one or two years. Expect to provide a substantial security deposit—typically two months' rent—in addition to the first month's rent upfront.

Your lease agreement, along with the official receipt (fapiao), is more than a rental contract. It is a critical document required for your Residence Permit application and other official matters. Ensure your agent provides fully compliant paperwork from the outset to avoid bureaucratic complications.

While negotiation is part of the process, it tends to focus less on the monthly rent and more on inclusions, such as management fees, club memberships, or specific furnishings. A skilled agent will manage these negotiations to structure the contract to your advantage.

Navigating The International School Landscape

For families, securing a place in a top-tier international school is arguably the most critical—and challenging—aspect of the entire relocation. Demand for places at elite institutions far outstrips supply, with waitlists that can extend for years. You must initiate this search the moment a move to China becomes a distinct possibility.

The international school scene in major cities is diverse, offering curricula to suit different educational philosophies and university pathways. The primary options include:

- American Curriculum: Schools like the American International School of Guangzhou (AISG) or Shanghai American School (SAS) offer Advanced Placement (AP) courses and a US-style high school diploma.

- British Curriculum: Institutions such as Dulwich College and Harrow International School follow the English National Curriculum, leading to IGCSEs and A-Levels.

- International Baccalaureate (IB) Programme: Many leading schools, including the Western Academy of Beijing (WAB), offer the full IB continuum (PYP, MYP, DP), a globally recognized and academically rigorous framework.

When evaluating schools, it is vital to understand the distinctions between curricula. For instance, comprehending the nuances of the International Baccalaureate vs A Levels will help you align the choice with your child's future academic ambitions.

The admissions process is rigorous, often involving detailed applications, interviews, and academic assessments. The costs are also substantial. Tuition fees frequently range from $30,000 to $50,000 USD per child, per year, exclusive of capital levies, transportation fees, or extracurricular activities.

It is absolutely crucial to factor these significant expenses into your compensation and relocation package. Begin the application process as early as possible, have all required documentation prepared, and pursue multiple options to ensure your child’s education continues without interruption.

Arranging Premier International Healthcare

For senior executives and their families, access to premier healthcare is a fundamental requirement, not an optional benefit. Upon landing in China, your US domestic health insurance plan becomes effectively void. It is imperative to have a premier global health plan in place before you relocate to ensure your family's well-being is never compromised.

Navigating China’s healthcare system requires understanding its two-tiered structure. Public hospitals can be crowded and present significant language barriers for non-Mandarin speakers. Conversely, a growing private sector caters specifically to expatriates and affluent local residents. Your entire healthcare strategy should be centered on the latter.

Understanding Your High-End Healthcare Options

Private healthcare in cities like Shanghai and Beijing is of a world-class standard, but it operates differently from the US system. It is wise to familiarize yourself with the key providers before a medical need arises.

- International Hospitals and Clinics: These are the gold standard for expatriates. Facilities such as Parkway Health and United Family Healthcare deliver a standard of care and service comparable to private US hospitals. They feature multilingual, often Western-trained physicians, seamless direct billing with major global insurers, and the highest clinical standards.

- VIP Wards in Public Hospitals: Many of China's top public hospitals have VIP wings (gaogan bingfang). They offer private rooms and enhanced service levels compared to the general wards, often at a lower cost than fully international clinics. However, administrative processes can still be bureaucratic, and English proficiency is not always guaranteed among all staff.

For most executives, international clinics are the preferred choice as they remove the friction and uncertainty one might encounter in a public facility. You can explore the specifics in greater detail in our complete guide to health insurance for expatriates in China.

Selecting a World-Class IPMI Plan

The key to accessing this top-tier care is an International Private Medical Insurance (IPMI) plan. A basic local policy is insufficient—it will severely limit your access to premium facilities and almost certainly will not provide coverage for treatment outside mainland China. A robust IPMI policy is an investment in certainty and peace of mind.

It is worth noting the shifting demographics. The number of Americans living in China has contracted, creating a smaller, more concentrated expatriate community. While Chinese immigration to the US remains significant, China's foreign-born population has seen fluctuations. For a US citizen, this underscores the necessity of robust personal infrastructure—such as a comprehensive healthcare plan—within a system that may not always be intuitively navigated. You can read more on these asymmetric migration patterns and their effects on the CIS.org website.

When evaluating IPMI policies, you must look beyond the premium to scrutinize the fine print. You are seeking features that support an executive lifestyle.

Non-Negotiable Policy Features for Executives

A superior IPMI plan functions more like a global health concierge than merely a payment mechanism. For an executive and their family, these features are absolutely non-negotiable.

- High Annual Coverage Limits: Do not consider a plan with less than $2 million USD in annual coverage. A high limit ensures that any serious medical event, from complex surgery to a prolonged hospital stay, is fully covered without financial concern.

- Extensive Direct Billing Network: This is critical. Direct billing means the hospital invoices your insurer directly. Without it, you could be required to pay tens of thousands of dollars out-of-pocket and subsequently seek reimbursement. Confirm that top-tier facilities like United Family Healthcare are in-network.

- Comprehensive Medical Evacuation and Repatriation: This is your ultimate safety net. It guarantees that if you face a medical crisis requiring care unavailable locally, your policy will cover the cost of transportation to the nearest center of medical excellence or even back to the US.

- Full Inpatient and Outpatient Coverage: Your plan must cover the full spectrum of care, from a routine specialist consultation to emergency surgery. Be wary of plans with significant co-pays or deductibles on outpatient services, as these can accumulate rapidly.

- Worldwide Coverage (Including the USA): You need a plan that provides coverage not just in China, but globally—especially for trips home. Most premier plans offer USA coverage as an optional add-on, which is essential for protection during family visits or business travel stateside.

For a high-net-worth individual, the true value of an IPMI plan lies not just in its coverage limits, but in its ability to eliminate administrative and financial friction during a medical crisis. The objective is zero-stress access to the best possible care, anywhere in the world.

To illustrate the difference, consider how a basic local plan compares to the comprehensive IPMI policy an executive requires.

Comparing IPMI Policy Features For US Expats in China

The table below outlines the essential differences between a typical local health plan and the robust IPMI coverage necessary for a senior executive relocating to China.

| Feature | Typical Local Plan | Comprehensive IPMI Plan | Why It Matters For HNWIs |

|---|---|---|---|

| Coverage Area | Mainland China Only | Worldwide, with USA coverage option | Ensures seamless care during international business travel or trips home. |

| Direct Billing | Limited network, often public hospitals | Extensive network including top international clinics | Eliminates the need for large out-of-pocket payments and reimbursement claims. |

| Annual Limit | Low (e.g., ~$150,000 USD) | High (e.g., $2M – Unlimited) | Provides absolute certainty for any medical event, no matter how costly. |

| Medical Evacuation | Not included or very basic | Comprehensive, including repatriation | Guarantees access to the best global medical facilities in a true emergency. |

| Specialist Access | Often requires GP referral | Direct access to specialists | Saves time and allows for immediate consultation with leading medical experts. |

Ultimately, the choice is a matter of risk management. A local plan exposes you to financial risk and potential gaps in care, whereas a comprehensive IPMI plan provides a true global safety net for you and your family.

Burning Questions About Your Move to China

Even with the most meticulous planning, a move of this magnitude invariably raises specific questions. Here are some of the most common concerns I hear from high-net-worth professionals transitioning from the US to China, along with direct answers based on extensive experience.

How Will This Move Affect My US Taxes?

As a US citizen, you are subject to taxation on your worldwide income, regardless of your place of residence. Therefore, filing a US tax return annually is non-negotiable.

However, this does not necessarily mean you will owe US tax. You can almost always utilize the Foreign Earned Income Exclusion (FEIE) and the Foreign Tax Credit (FTC) to substantially reduce, or even entirely eliminate, your US tax liability on income earned in China. Concurrently, China will tax the income you generate within its borders. The US-China tax treaty is designed specifically to prevent double taxation on the same income.

Engaging a tax advisor who specializes in US expatriate taxation is not merely a good idea—it is an absolute necessity for maintaining compliance and ensuring your financial strategy remains sound.

Can I Bring My Dog or Cat From the US?

Yes, you can bring your pet, but the process requires military-like precision. The general rule is one pet per passport holder, and the regulations are strictly enforced.

You will need to have the following in order:

- A health certificate issued by a USDA-accredited veterinarian.

- Proof of a recent rabies vaccination (with specific timing requirements).

- An ISO-compliant microchip.

Upon arrival in China, your pet will be subject to a mandatory quarantine period of 7 to 30 days in a government-designated facility. The exact duration varies depending on your port of entry. I strongly advise hiring a professional pet relocation service. They navigate the complex bureaucracy so that you (and your pet) do not have to.

How Do I Handle My Assets Back in the States?

Your US-based assets require active management from abroad. If you own real estate, you will need a reputable property management company to act as your representative on the ground.

For your financial portfolio, you must inform your banks and brokerage firms of your new non-resident status. Some institutions are hesitant to service overseas clients and may restrict account activities. It is often prudent to consolidate assets with firms that have dedicated divisions for serving American expatriates.

Here is a critical compliance point: you must continue to report your foreign financial accounts to the US Treasury. If the aggregate value of your accounts in China exceeds $10,000 at any time, you are legally obligated to file a Foreign Bank and Financial Accounts Report (FBAR). This is not optional.

What's the Best Way to Pay for Things Day-to-Day?

Forget cash and do not rely on your American Express card. China is a near-cashless society operating on two dominant mobile payment platforms: WeChat Pay and Alipay.

Immediately after opening your local Chinese bank account, your next task is to link it to both of these applications. They are indispensable for daily life. You will use them for virtually everything—from purchasing coffee and paying rent to hailing a taxi.

While high-end hotels and restaurants in Shanghai or Beijing may accept international credit cards, for everyday transactions, mobile payments are the standard. Attempting to operate with only foreign cards or cash will be a constant source of inconvenience.

At Riviera Expat, we specialize in securing world-class international private medical insurance for financial professionals in Asia's key hubs. We provide the clarity and confidence you need to make the right healthcare decisions for you and your family. For a complimentary consultation and to compare premier IPMI plans, visit us at https://riviera-expat.com.