As a high-net-worth individual operating on the global stage, you demand precision and control in every aspect of your life. This must extend to your health. When navigating the complexities of international private medical insurance (IPMI), a single document frequently holds the key to the sophisticated care you require: the medical necessity letter.

This is not merely another piece of administrative paperwork. It is your physician’s formal, clinical justification for a specific treatment, procedure, or medication. For the discerning global citizen, it is the critical instrument that unlocks the full potential of a premium insurance policy, especially when a standard request is met with resistance.

Securing Premier Global Healthcare for Modern Expats

If you are an expatriate managing significant interests in a demanding financial hub like Hong Kong or Singapore, mastering the function of this document is non-negotiable. It is the mechanism that ensures your premium insurance delivers its promised value, transforming a simple request into a clinical imperative, particularly when encountering a pre-authorization barrier or a claim dispute.

Consider your international health policy as a high-performance vehicle; it possesses extraordinary capabilities, yet some of its most advanced features require a specific key for activation. The medical necessity letter is that key. It provides the clear, evidence-backed rationale your insurer requires to approve treatments that fall outside their standard, algorithm-driven protocols.

Why This Letter Is Your Most Important Advocacy Tool

In the high-stakes environment of IPMI, a letter of medical necessity (LMN) frequently stands between you and the advanced treatment you require. This is particularly true in the current climate of escalating medical costs. According to WTW’s Global Medical Trends Survey, global medical insurance costs are projected to increase by 9.9% in 2024, following a sharp 10.7% rise in 2023, the highest in nearly 15 years. You can read the full insights on 2025 global medical trends for a deeper analysis of these projections.

A meticulously crafted letter is not merely a suggestion. It is a formal, evidence-based argument that aligns your physician’s expert recommendation with the insurer’s policy requirements, ensuring your access to premier care is never compromised.

This document functions as a professional translator, bridging the gap between your doctor's clinical judgment and your insurer's administrative frameworks. It proactively furnishes answers to the critical questions every claims reviewer is trained to ask:

- Is this treatment supported by established medical standards of practice?

- Why are less expensive, conventional alternatives not clinically appropriate for this specific patient?

- How, precisely, will this intervention improve the patient's health outcome and functional status?

By addressing these points with clinical authority, the letter cuts through administrative red tape and streamlines the approval process. It proves that the requested care is a clinical necessity, not an elective preference, thereby protecting both your health and your financial interests. Understanding its strategic power is the first step to mastering your international healthcare portfolio.

Crafting a Compelling Medical Necessity Letter

Let us be unequivocal. A medical necessity letter is not a simple request submitted to your insurer. It is a formal, clinical argument for your health, and its construction must be flawless. Conceive of it as a legal brief that your physician composes to prove, beyond any reasonable doubt, why a specific course of treatment is imperative for your condition.

To secure approval, this letter must be precise, logical, and substantiated by objective evidence. Every detail—from your policy number to your specific clinical history—must align perfectly to build an unassailable case. It is part medical record, part persuasive legal argument, engineered to convince an insurance administrator who has never met you that the recommended care is absolutely essential.

The Anatomy of an Unassailable Letter

A successful letter is constructed from several non-negotiable components. If even one of these is absent or ambiguous, you can anticipate immediate delays or an outright denial. Your physician's task is to anticipate the insurer's queries and address them before they are formulated.

These are the foundational elements:

- Precise Patient and Physician Identifiers: This administrative data must be perfect. It includes your full name, date of birth, and policy number, alongside your physician’s full name, credentials, and their provider identification number. This ensures the letter is routed correctly and receives appropriate professional consideration.

- Clear Diagnosis with ICD-10 Codes: The letter must state your diagnosis without ambiguity. The critical component here is the ICD-10 code. This is the universal classification system insurers use for diseases and medical conditions; without the correct code, the claim cannot be processed.

- Detailed Clinical History: This section narrates the progression of your condition. It must provide a concise summary of symptom onset, a chronological account of treatments already attempted, and their outcomes. This narrative supplies crucial context for why the newly recommended treatment is necessary.

This structured methodology elevates the letter from a simple request into a professional, clinical directive that commands respect from the insurer's review board.

Building the Clinical Justification

This section constitutes the core of the letter. It is where your physician articulates precisely why the proposed treatment is not merely a beneficial option, but a medical requirement specific to you. A generic, templated explanation is insufficient. The argument must be tailored to your case and rooted in credible evidence.

Your physician must demonstrate that the recommended care is not a matter of convenience or preference but a clinical necessity supported by established medical standards. This section must prove why standard alternatives are inadequate or contraindicated for your unique situation.

For expatriates managing responsibilities between locations such as London, Kuala Lumpur, and Singapore, a robust letter can be the definitive factor in accessing premier care. The global healthcare landscape is notoriously inconsistent. This is why insurers scrutinize every high-cost claim, demanding clear justification for every expenditure.

To build an irrefutable case, your physician should:

- Detail the Recommended Treatment: They must be specific about the exact treatment, service, or device, including dosage, frequency, and duration of care.

- Explain the Inadequacy of Alternatives: This is critical. The letter must explicitly state which standard treatments have been attempted and failed, or provide a clinical explanation for why they are medically inappropriate for you.

This may include contraindications due to comorbidities or documented adverse reactions. - Cite Clinical Evidence: Referencing established clinical practice guidelines from authoritative bodies or peer-reviewed studies that support the treatment for your diagnosis adds a powerful layer of objective authority.

This level of detail renders a letter bulletproof. It is also vital to understand your policy's terms intimately, especially its limitations, as you can learn more about medical conditions and policy exclusions in our dedicated guide.

Getting Inside the Insurer's Head to Avoid Denials

To secure approval for your physician’s request for specialized care, you must first understand the perspective of the entity you are addressing. International private medical insurers are not healthcare providers; they are sophisticated risk management organizations. Their operations are founded on contracts, financial oversight, and strict policy adherence. Their primary function is to ensure every claim is legitimate and perfectly aligns with the terms of your insurance contract.

When a claims administrator receives your physician's medical necessity letter, they are effectively running it through a detailed verification checklist. They need to confirm that the treatment is a recognized standard of care, not experimental, and certainly not a matter of convenience. This process involves procedural codes, clinical guidelines, and policy-specific terminology. Adopting this perspective is the secret to drafting a letter that is approved efficiently, rather than one that becomes mired in a protracted review cycle.

Common Red Flags That Trigger an Instant "No"

Insurers review thousands of these letters. They are adept at identifying patterns that signal a high probability of denial or, at a minimum, a "request for more information." By understanding these red flags, you and your physician can proactively address them before the letter is submitted. This can save an extraordinary amount of time and frustration.

Here are the most common tripwires:

- Vague or Ambiguous Language: Phrases such as "the patient would benefit from this therapy" are insufficiently robust. The letter must draw a direct, causal link between a documented clinical problem and the proposed solution, explaining why this specific treatment is essential to manage or resolve the diagnosis.

- Insufficient Clinical Proof: A physician's opinion, in isolation, is not enough. The letter must be built upon a foundation of objective data—referencing diagnostic test results (e.g., lab values, imaging studies) and clear clinical notes from previous treatments that proved ineffective.

- Failure to Address Alternatives: Your insurer requires documented proof that less costly, more standard treatments are unsuitable for you. The letter must clearly explain what other options were tried (or considered) and why they were clinically inappropriate or ineffective for your specific case.

Think of the review process as a rigorous customs inspection. Your letter is the passport to obtaining the care you need. Any missing information, ambiguous details, or questionable justifications will result in being pulled aside for a lengthy and frustrating inquiry. Before drafting the letter, it helps to have a solid grasp of the rationale behind these requests, such as understanding what prior authorization in healthcare entails.

Speaking the Insurer's Language

To be effective, you and your physician must communicate in the insurer's language. A few key terms carry significant weight and can determine the difference between approval and denial. Misunderstanding them can lead to critical errors in your justification. For a deeper dive into this, you may wish to learn more about how key expat medical insurance policy terms are defined.

An insurer's decision often hinges on whether a treatment is deemed 'Medically Necessary' versus 'Investigational' or 'Experimental'. A strong letter provides the evidence to place your request firmly in the first category.

Here are a few concepts you must master:

| Insurer Term | What It Really Means to Them | How to Address It in Your Letter |

|---|---|---|

| Generally Accepted Standards of Medical Practice | Is this treatment a widely recognized, evidence-based approach that other skilled physicians would use for this condition? | Cite established clinical practice guidelines from reputable medical organizations (e.g., NICE in the UK, American College of Cardiology). |

| Investigational or Experimental | Is this treatment still in clinical trials? Is there insufficient long-term data to prove its safety and efficacy? | Provide peer-reviewed studies published in reputable medical journals that demonstrate the treatment has a track record of success for your exact diagnosis. |

| Medical Necessity vs. Convenience | Is this treatment vital for your health, or is it primarily for comfort, lifestyle, or convenience? | Clearly document how the treatment will restore function, prevent disease progression, or relieve debilitating symptoms that impair daily activities. |

When you anticipate these questions and build the answers directly into the medical necessity letter, you completely reframe the conversation. You are no longer merely requesting a service; you are presenting an airtight clinical case that satisfies all their criteria for a first-pass approval.

Using Strategic Language in Your Letter

While your physician authors the medical necessity letter, you play a crucial role in its development. Consider yourself the director of the process. By understanding what makes a letter persuasive to an insurance reviewer, you can help your doctor construct the strongest possible case for your care.

This is not about dictating medical terms to your physician. It is about fostering a strategic partnership. The objective is to elevate a standard form letter into a powerful advocacy tool that leaves no room for doubt or misinterpretation. This means moving beyond generic statements and employing precise, evidence-backed language that satisfies every item on an insurer’s review checklist.

Structuring the Letter for Maximum Impact

A successful letter tells a clear and logical story. It guides the reviewer from your diagnosis to the unavoidable conclusion that the recommended treatment is the only rational next step. It functions like a legal argument where each piece of evidence builds upon the last, creating an unassailable case.

An effective structure invariably includes these key elements:

- A Direct Introduction: State the purpose immediately. The opening paragraph should identify the patient by name, the diagnosis with the correct ICD-10 code, and the specific treatment being requested. No preamble.

- A Concise Clinical History: This section answers the question, "What has been attempted thus far?" It should detail previous treatments and explain precisely why they failed or were medically inappropriate for your specific situation.

- The Core Clinical Justification: This is the heart of the letter. It must explain why this specific treatment is medically necessary at this time. How will it improve your health outcomes? Why is it superior to any other standard alternatives still available?

- Supporting Evidence: This adds a layer of objective authority. Referencing established clinical practice guidelines or peer-reviewed medical studies demonstrates the recommendation is not just one physician's opinion—it is supported by the broader medical community.

This framework transforms a simple request into a compelling clinical directive that is difficult to dismiss.

Choosing Words That Get Approvals

The difference between a denial and an approval often hinges on specific terminology. Vague, subjective language is a significant red flag for insurance companies. Your physician’s letter must be objective, clinical, and definitive. It must demonstrate necessity, not just suggest it.

For instance, instead of stating a treatment "would be beneficial," the letter should state that it is "clinically indicated to prevent disease progression" or "required to restore functional capacity." This subtle shift in language changes the entire tone from a discretionary suggestion to a medical imperative.

The goal is to prove that the requested care is the only logical and clinically sound option for your specific medical circumstances. Every sentence should be crafted to reinforce this central point, leaving no doubt in the reviewer's mind.

This level of precision is what makes a letter command attention and respect from the review board.

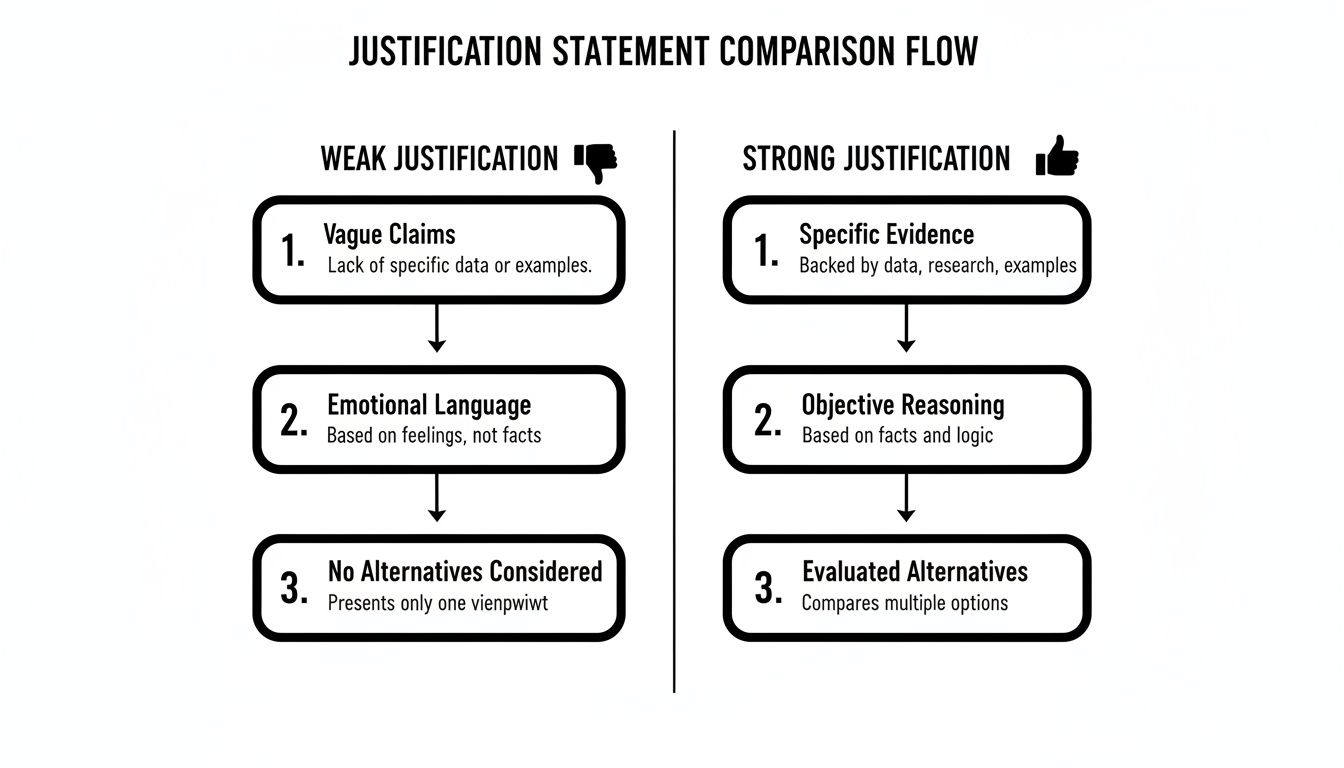

From Weak Statements to Strong Justifications

Let's examine how a few changes in phrasing can completely transform a letter's impact. The table below illustrates the difference between weak language that practically invites a denial and the kind of strong, evidence-based statements that pave the way for an approval.

Weak vs. Strong Justification Statements

| Scenario | Weak Statement (Likely to be Questioned) | Strong Statement (Likely to be Approved) |

|---|---|---|

| Requesting an Advanced Imaging Scan | "The patient's back pain continues, so an MRI would be helpful to see more." | "The patient presents with lumbar radiculopathy (ICD-10: M54.16) unresponsive to a six-week course of physical therapy and NSAIDs. An MRI is medically necessary to rule out nerve root compression." |

| Justifying a Biologic Medication | "We believe a biologic drug is the next best step for the patient's arthritis." | "The patient's rheumatoid arthritis (ICD-10: M05.79) has failed to respond to methotrexate and sulfasalazine, as evidenced by persistently elevated CRP levels. Per ACR guidelines, initiation of a TNF inhibitor is clinically indicated to prevent irreversible joint damage." |

| Prescribing Specialized Physical Therapy | "The patient needs a special type of physical therapy for their recovery." | "Post-operative ACL reconstruction requires aquatic therapy to facilitate non-weight-bearing movement and reduce joint inflammation, a critical component for achieving full range of motion that is not possible with land-based therapy at this stage." |

When you collaborate with your physician to ensure your medical necessity letter employs this level of specific, confident language, you are not just completing a form. You are presenting a meticulously constructed clinical case designed for one purpose—securing the care you need and deserve.

Navigating the Submission and Appeals Process

Obtaining a well-written medical necessity letter is a significant milestone, but it is not the conclusion of the process. To maintain control and minimize uncertainty, you must understand the entire claim lifecycle—from the moment the letter is transmitted to the insurer's final determination. This phase of the process demands precision, patience, and a well-defined strategy.

Once your physician has finalized the letter, it must be submitted. Ensure it is sent to the correct department—typically designated 'Pre-Authorization' or 'Clinical Review'—using the insurer's preferred method, whether a secure online portal or registered mail. After submission, follow-up is not merely advisable; it is essential. Maintain a detailed log of all communications: dates, times, and the names of any representatives you speak with.

Tracking and Managing Your Submission

Treat this submission as you would a high-stakes transaction that requires careful oversight. Never assume "no news is good news." You must proactively track your request to ensure it does not become lost in an administrative bottleneck.

Here is how to manage this phase effectively:

- Confirm Receipt: A few business days after sending the letter, contact the insurer. Confirm they have received it and request a case or reference number.

- Request a Timeline: Politely inquire about their standard timeline for a decision. Knowing this allows you to follow up at appropriate intervals without appearing overly persistent.

- Be Prepared for Queries: Insurers may request additional information. Responding promptly and thoroughly to these requests can significantly accelerate the review process.

Executing these initial steps correctly is crucial. For a deeper understanding of this process, you can find more details on how pre-authorization and direct settlement for expats work.

Strategically Handling a Denial

Receiving a denial letter is disheartening, but it is imperative that you do not view it as the final word. Consider it the commencement of a structured negotiation. The initial 'no' is often an automated response generated by a system that checks requests against standard criteria. A well-planned appeal can, and frequently does, lead to this decision being overturned.

First, obtain the denial in writing. This document is your roadmap, as by regulation, it must state the specific reason for the rejection. Vague justifications are not acceptable; you are entitled to a crystal-clear explanation.

This graphic illustrates the crucial difference between weak justifications that lead to denial and the strong, evidence-based arguments required for a successful appeal.

As you can see, winning an appeal is about shifting from subjective statements to objective, evidence-backed arguments that directly address the insurer's stated reason for denial.

Once you have dissected the denial letter, work with your physician again to craft a response. Your appeal must serve as a point-by-point rebuttal of the insurer's logic.

A successful appeal is not an emotional plea; it is a clinical and logical counter-argument. You must systematically dismantle the insurer's reasons for denial by providing targeted, supplementary evidence.

For example, if the denial states the treatment is "investigational," your appeal must include peer-reviewed studies that prove its effectiveness and acceptance within the mainstream medical community. If the rejection was for "insufficient information," provide the exact records requested with a clear cover letter that references the original claim number.

The appeals process can feel formidable, but resources are available. For example, there are excellent guides explaining what to do if your long-term disability claim is denied, and the principles are applicable to many complex insurance disputes. By approaching the appeal with a methodical strategy, you can transform a significant setback into a winnable challenge, ensuring you receive the first-class care your policy was designed to provide.

Your Questions Answered: Medical Necessity Letters

When navigating international health insurance, precise details are paramount. To eliminate confusion, I have compiled answers to the questions I most frequently encounter regarding medical necessity letters. Consider this the practical, real-world counsel you require.

How Long Is A Medical Necessity Letter Valid?

This is a critical point. It is often incorrectly assumed that a letter is valid indefinitely. While policies can vary slightly among insurers, a reliable rule of thumb is that a letter is valid for one calendar year from the date it is signed by your physician.

If you are undergoing a course of treatment that will extend beyond that year, a new letter from your physician will be required. A prudent strategy is to schedule an appointment to have it renewed well in advance of its expiration. This prevents any lapse in coverage or interruption of care—the last thing one desires is for a pre-approval to expire mid-treatment.

Who Is Qualified To Write This Letter?

The authority of a medical necessity letter is derived directly from its author. It must be written by a licensed healthcare provider who is actively managing your care.

This may be your primary care physician, a specialist such as a cardiologist or oncologist, or another licensed practitioner intimately familiar with your case. The key is their direct clinical knowledge of your condition, which lends credibility to their recommendation. Insurers will verify this, so the letter must be signed and presented on official practice letterhead.

An unsigned letter or one from a source the insurer cannot verify is without value. It will be rejected immediately. The physician’s credibility is as critical as the medical facts presented within the letter itself.

Can I Use One Letter For Multiple Treatments?

No, and attempting to do so is a common error that causes significant delays. A letter of medical necessity must be laser-focused. Each letter should justify one specific treatment, service, or piece of medical equipment.

If your physician recommends several distinct treatments that all require prior authorization, a separate, dedicated letter is required for each one. This practice keeps the clinical argument for each request clean, unambiguous, and directly linked to your diagnosis. Bundling multiple requests into a single letter is a certain way to have it delayed by queries or denied outright.

At Riviera Expat, we eliminate the guesswork from complex international health insurance. Our purpose is to provide high-net-worth professionals like you with total clarity and control over your global healthcare. If you require precision and certainty, explore our bespoke insurance consultations to secure your peace of mind.