For high-net-worth individuals, global professionals, and expatriates, the medical necessity form is far more than administrative paperwork. It is the pivotal communication between your chosen physician and your international insurance carrier, dictating access to premier medical care.

This document is the formal vessel through which your physician articulates the clinical justification for a specific treatment, particularly when seeking advanced or specialized care on a global scale. Mastering this process is paramount to advocating for your health and securing the sophisticated care you expect, without unnecessary delays.

Your Key to Global Healthcare Approvals

This guide serves as your strategic roadmap. We will delineate what "medical necessity" signifies from an insurer's perspective and outline the precise steps required to construct a case that ensures approval. Our objective is to empower you to circumvent the costly delays and administrative friction that can compromise your access to care. A thorough understanding of this document ensures you receive the treatment you deserve, wherever your personal or professional life may lead.

What Is a Medical Necessity Form, Precisely?

At its core, a medical necessity form is a structured, evidence-based argument. It is the formal mechanism for your physician to communicate to your insurer that a specific procedure, treatment, or medical device is not merely advantageous—it is clinically indispensable for your diagnosis or condition.

This justification has become increasingly critical as insurers endeavor to manage escalating healthcare expenditures. According to the WTW 2025 Global Medical Trends Survey, the gross cost of medical care is projected to increase by 9.9% globally in 2025, continuing a trend of significant growth. This data is available in the full survey analysis.

Securing Approvals with Precision

The submission of these forms involves the transmission of highly sensitive personal health information. Ensuring this data is protected in compliance with stringent healthcare regulations is a non-negotiable component of the process.

Any organization managing this data must employ robust security protocols. It is prudent to utilize specialized HIPAA risk assessment tools to maintain compliance and secure sensitive information.

This guide will furnish you with the insights to oversee the entire process with confidence, ensuring every submission is clear, comprehensive, and strategically positioned for swift approval.

Decoding an Insurer's Definition of Necessity

It is critical for every globally-mobile individual to comprehend this distinction: what your world-class physician deems essential for your care may differ entirely from your insurer's contractual definition of necessity. To secure treatment approval, one must transition from a patient's mindset to that of a sophisticated underwriter.

The concept of "medical necessity" has evolved from a matter of a physician's professional discretion to a detailed, rules-based system engineered to manage financial risk as much as clinical outcomes.

Consider the medical necessity form as the formal business case for your health. It is not a mere request; it is a structured proposal wherein your doctor must construct an evidence-backed argument that resonates with the insurer's specific criteria. Their objective is not only to verify a treatment's efficacy but to confirm it represents the most appropriate and cost-effective option available under the terms of your policy.

Why "Because I Said So" No Longer Suffices

Historically, insurance covered treatments that were broadly accepted as “medically necessary” and “non-experimental.” As healthcare costs escalated, however, insurers were compelled to adopt more specific criteria to manage their financial exposure.

This precipitated a significant shift, leading to the detailed forms utilized today. These forms demand comprehensive clinical data to justify every proposed treatment before it is authorized. A clear overview of how these standards have evolved is detailed in this overview of modern healthcare coverage.

The conclusion is clear: a simple note from your physician stating a procedure is "needed" is now insufficient. The justification must align perfectly with the insurer's established clinical policies and guidelines.

The Three Pillars of Insurance Approval

When an insurer reviews a medical necessity form, they are fundamentally assessing three questions. The proposed care must be:

- Clinically Appropriate: Does the service align with the diagnosis and meet the accepted standards of medical practice for the specific condition?

- Not for Convenience: Is this treatment required for the patient's condition, or is it primarily for the convenience of the patient or the physician?

- Most Cost-Effective Option: Is this the most economical service that can safely and effectively achieve the desired clinical outcome?

For example, requesting a specialized MRI for a minor sprain represents a classic red flag for an insurer. It will almost certainly be denied if a standard X-ray—at a fraction of the cost—can provide an adequate diagnosis. The form must articulate precisely why the more expensive option is indispensable, not merely preferable.

Understanding this framework is absolutely crucial, particularly for high-net-worth individuals and expatriates who may be pursuing innovative therapies or non-standard procedures.

A vague submission signals unacceptable risk to an insurer. Conversely, a precise, evidence-based argument that satisfies their business logic is the key to approval. This process begins with understanding the specific definitions within your policy, which is why we consistently recommend a thorough review of key expat medical insurance policy terms. Your success hinges on presenting a case that speaks to the insurer’s rulebook as much as to your doctor’s clinical judgment.

When a Medical Necessity Form is Required

It is imperative to understand the specific circumstances that will trigger a request for a medical necessity form from your insurer. This is not a routine document; it is a formal, evidence-based justification required at critical junctures in your healthcare journey.

Essentially, this form functions as the insurer's investment proposal. Before committing significant capital to your care—particularly for specialized surgeries, innovative treatments, or premier specialists outside their network—they demand a detailed "business case" from your physician. It is the document that bridges your physician’s expert recommendation with the insurer’s stringent coverage protocols.

Key Triggers for a Medical Necessity Request

The requirement for this form typically arises in three primary scenarios. Each demands a meticulously constructed argument to secure your insurer's financial commitment. An error in this process can result in substantial personal financial liability.

-

Pre-Authorization for Major Procedures: This is the most frequent trigger. For any significant, non-emergency procedure such as a complex surgery, advanced MRI, or a course of high-cost medication, insurers require a medical necessity form in advance. This process, known as prior authorization, confirms that the treatment is indispensable before any costs are incurred. You can explore this process in greater detail in our guide to pre-authorisation and direct settlement for expats.

-

Justifying High-Cost Claims Post-Treatment: In an emergency, your health is the priority and documentation follows. Once a patient is stabilized, the hospital or clinic will submit a medical necessity form to the insurer to justify the urgent actions taken and secure reimbursement for the high-value services already rendered.

-

Securing Out-of-Network Coverage: This is a common challenge for expatriates and global professionals. When you require the expertise of a leading specialist who is not part of your insurer's approved network, a robust medical necessity form is your instrument for obtaining coverage. The form must present a compelling case as to why that specific provider's expertise is indispensable for your condition and superior to any in-network alternative.

To provide further clarity, the following table outlines these common triggers and the associated risks.

Common Triggers for a Medical Necessity Form

| Triggering Event | Typical Insurance Requirement | Potential Consequence of Non-Compliance |

|---|---|---|

| Major Planned Surgery | Pre-authorization with a medical necessity form submitted weeks in advance. | Claim denial; you could be personally liable for the full cost of the surgery. |

| Advanced Imaging (MRI, PET) | Pre-authorization required before the scan is performed. | The insurer may refuse to cover the high cost of the diagnostic test. |

| High-Cost Medications | Form required to justify the specific drug over less expensive alternatives. | Coverage is denied; you must pay the full price for the prescription. |

| Emergency Hospitalization | Form submitted retrospectively to justify urgent care and procedures. | Partial or complete denial of the hospital bill if necessity is not proven. |

| Out-of-Network Specialist | Pre-approval needed, arguing why an in-network option is clinically insufficient. | The insurer will not cover the specialist's fees, leaving you to pay. |

Failure to provide this form when required almost invariably results in the same outcome: a denied claim and a significant, unexpected financial obligation.

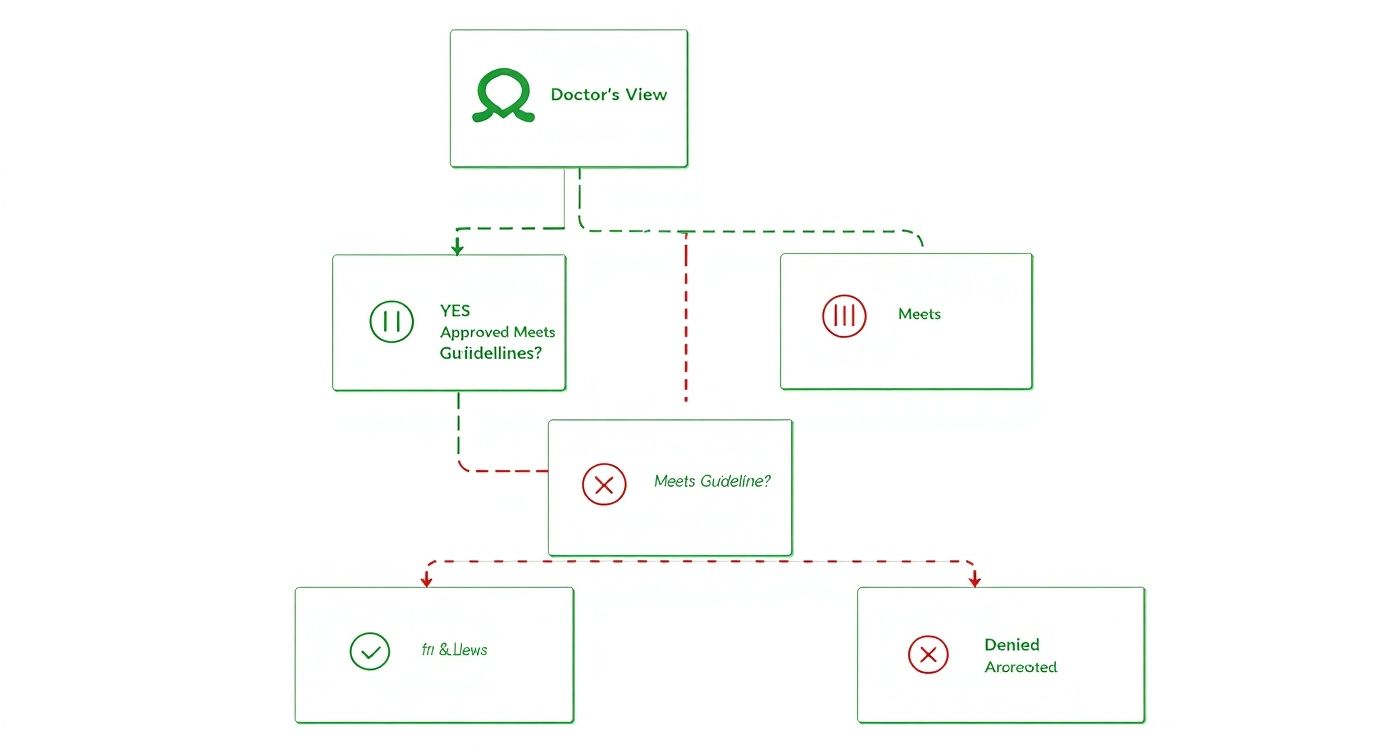

This flowchart illustrates a simplified view of how an insurer evaluates a medical necessity request based on the information provided by your doctor.

As depicted, approval is entirely contingent on the alignment between your doctor's justification and the insurer's clinical guidelines. A misalignment is the primary cause of denials, highlighting the critical importance of a precise and well-documented form.

Anticipating these triggers allows you and your physician to prepare a compelling case, ensuring access to world-class care without financial surprises.

Crafting a Compelling Justification for Your Care

The strength of your case rests on meticulous detail and absolute clarity. A well-constructed medical necessity form should be viewed not as a simple request, but as a persuasive, evidence-based argument for your care. Securing approval requires moving beyond simple assertions to build an undeniable case that speaks the insurer’s language—one of clinical and financial logic.

Every component, from diagnostic codes to your physician's narrative, must integrate to form a cohesive story. The objective is to articulate precisely why a specific treatment is essential, why it is superior to less costly alternatives, and why it is firmly grounded in established medical standards. This approach resonates with insurance reviewers and efficiently navigates administrative hurdles.

The Anatomy of a Powerful Submission

An effective medical necessity form is constructed upon several key pillars. Each element contributes to a complete and convincing clinical picture that leaves no room for ambiguity.

The essential components your physician must include are:

-

Accurate Diagnostic Codes (ICD-10): This is the foundation. The International Classification of Diseases, 10th Revision (ICD-10) codes serve as the universal language of healthcare billing, providing a precise diagnosis that underpins all subsequent justifications. An incorrect or vague code is an immediate red flag for any reviewer.

-

Detailed Patient History: This section must narrate your clinical story, detailing symptom onset, previous treatments and their outcomes, and the specific impact of your condition on your daily life. Organizing complex records into a clear timeline is crucial for impact; learning how building a winning medical chronology template can be instrumental here.

-

The Physician’s Narrative: This is the heart of the form. It is your doctor's detailed, clinical explanation of why the recommended service is not merely beneficial, but indispensable. They must connect your specific condition to the proposed treatment, clearly explaining why standard alternatives are clinically inappropriate for you.

Building an Evidence-Based Argument

A simple declaration that something is "needed" is insufficient. Submissions that secure approval are substantiated by objective, verifiable evidence that directly addresses the insurer's criteria. Your physician's argument should be a masterclass in clinical reasoning, supported by hard data.

A vague statement such as "the patient requires this advanced therapy" is easily dismissed. A far more powerful justification would be: "Standard protocols have proven ineffective over the past six months, as documented in the attached progress notes. This advanced therapy is supported by peer-reviewed studies for this specific patient profile and is necessary to prevent irreversible functional decline."

The distinction is clear. This level of detail transforms a subjective opinion into a factual, data-driven recommendation. The goal is to provide the reviewer with a clear, logical path that leads them to the same conclusion as your physician.

To further strengthen the case, clinicians can translate abstract risks into concrete figures. For instance, stating that "13 out of 1,000 women smokers age 50 will die of heart disease within 10 years" to justify preventive care frames the need for treatment in clear, undeniable terms that insurance reviewers understand and respect.

How Your Broker Can Expedite Approvals

In the realm of international insurance, simply completing forms is insufficient. An expert advocate is essential. For discerning professionals, time is an irreplaceable asset, and a high-service insurance broker acts as your strategic partner in navigating the medical necessity approval process.

Consider them your personal advocate within a complex bureaucratic system.

An experienced broker does far more than forward your medical necessity form to an insurer. Their true value is realized before submission, where they scrutinize every detail. This is a critical step. They ensure the clinical justification from your physician is not only complete but is presented in a manner that aligns perfectly with what they know the insurer requires for an expeditious approval.

The Power of Proactive Intervention

A premier broker functions as a quality control expert, identifying potential red flags long before an underwriter reviews the case. They ensure the physician’s narrative is clear, the supporting evidence is robust, and the entire request is framed to elicit a swift "yes." This proactive intervention transforms a standard request into a polished, undeniable case for your care.

Their role extends beyond submission. This is where their established relationships become invaluable. Brokers cultivate long-term connections with key decision-makers at insurance carriers. These are not mere contacts; they are professional relationships built over years, essential for bypassing procedural delays, clarifying complex requests, and obtaining real-time updates.

A skilled broker does not simply ask, "What is the status?" They ask, "What specific piece of information does the clinical review team require now to move this to an approval?" This targeted communication penetrates administrative layers and dramatically accelerates the entire process.

From Submission to Approval

This caliber of expert support can be the difference between a rapid, seamless approval and a protracted, stressful appeals battle. When a broker is engaged, you can be confident that every step is managed with precision.

Here is how a broker adds tangible value at each stage:

- Initial Review: They often collaborate directly with your physician's office to ensure the form is flawless, checking for common errors like mismatched billing codes or vague clinical details that would trigger a denial.

- Strategic Submission: They do not submit your form to a general inbox. They deliver the complete package directly to their high-level contacts at the insurance company, bypassing standard queues.

- Active Follow-Up: A good broker maintains communication with the insurer’s review team, proactively addressing questions and providing any supplementary information needed to prevent the file from stalling.

- Troubleshooting: Should an issue arise, they address it immediately to resolve it—often preventing a formal denial from ever being issued.

Ultimately, this level of service allows you to focus entirely on your health, secure in the knowledge that the administrative complexities are being managed by a specialist who is unequivocally committed to getting your care approved.

Common Pitfalls and How to Avoid Them

Securing approval for a medical necessity form demands precision. Countless cases demonstrate how minor, seemingly insignificant oversights can lead to significant delays or an outright denial. This is not merely an administrative inconvenience; it disrupts your access to care at the most critical moments.

Proactive planning is your most effective defense. The most common mistakes—such as submitting an incomplete medical necessity form, failing to attach clinical evidence, or providing justifications that are too generic—are entirely preventable. Each error, however small, erects a roadblock that you and your medical team must then expend valuable time to dismantle.

Incomplete Forms and Missing Documentation

One of the most direct paths to rejection is a simple clerical error. A form with a missing signature, a typographical error in the policy number, or an unchecked box will not be reviewed. It will be returned immediately, resetting your timeline to zero.

The same principle applies to evidence. If your physician’s letter references a specific lab result or an MRI report, but that report is not attached, the entire submission is deemed incomplete and will be rejected.

To avoid this pitfall, employ a pre-submission checklist for every submission:

- Verify Patient Details: Is your name, date of birth, and policy ID exactly correct? Double-check every character.

- Confirm Physician Credentials: Ensure the physician’s name, signature, and license number are present and legible.

- Cross-Reference Attachments: Review the narrative line by line. Every time it states "see attached report," confirm that the report is physically or digitally appended.

Treat your submission package as a legal brief. Every claim made must be substantiated by direct, easily accessible evidence. If you force the reviewer to search for information, the probability of denial increases exponentially.

Vague Justifications and Weak Clinical Arguments

The second critical error is a weak or generic justification. Statements such as "this treatment is medically necessary" or "it will improve the patient's condition" are devoid of value to an insurer.

The form must articulate precisely why this specific treatment is essential for your unique clinical situation, and, crucially, why the standard, less expensive alternatives are clinically inappropriate.

For instance, if you are requesting an expensive, out-of-network surgeon, the justification must specify what makes their expertise indispensable. Does this surgeon possess unique experience with a rare procedure? Do they utilize a specific technique that in-network physicians do not? This must be explicitly stated.

An effective submission also anticipates the insurer's potential objections. To do this, you must understand your policy's limitations thoroughly. It is advisable to review our guide on how to watch out for policy exclusions to ensure your justification does not inadvertently conflict with a hidden clause. This level of strategic foresight transforms a simple request into a compelling, difficult-to-deny case for approval.

Frequently Asked Questions

Even with a robust strategic plan, questions will inevitably arise when confronting a medical necessity form. Here are direct answers to the questions we most frequently receive from global professionals.

How Long Does the Approval Process Take?

Timelines can vary significantly based on the insurer and the complexity of the medical situation.

For a straightforward pre-authorization, a decision may be rendered within 5 to 10 business days. However, for more complex cases involving highly specialized treatment or out-of-network care, the review can easily extend to 30 days or longer.

This is a scenario where an expert broker provides significant value. We can often accelerate the process by ensuring the initial submission is impeccable, thereby preventing the frustrating back-and-forth that causes most delays.

What Are My Options If a Request Is Denied?

First, a denial is not a final refusal. It is the insurer’s signal that more compelling information is required.

Every insurer has a formal appeals process. Your first step should be to analyze the precise reason for denial as stated in your explanation of benefits (EOB). Most often, the issue is a lack of specific clinical data or a justification that was not sufficiently robust.

Your physician and broker should collaborate to construct a formal appeal with supplementary evidence. This frequently triggers a peer-to-peer review, where your physician can communicate directly with the insurer's medical director—a step that very often leads to the reversal of the initial decision.

Can I Complete the Medical Necessity Form Myself?

You will provide the personal details and policy number. However, the substantive portion—the clinical justification—must be completed by your treating physician.

That section forms the core of the request and requires a physician's specialized knowledge to provide precise diagnostic codes and construct a case based on clinical evidence that only a licensed provider can supply. Your role is that of a project manager, ensuring your physician’s office submits a flawless and timely form to your insurer or broker.

At Riviera Expat, we provide the expert advocacy you require to ensure your medical necessity requests are managed with the precision and speed your health demands. Contact us today for a complimentary consultation and gain the clarity and support you deserve.