For high-net-worth expatriates and professionals in Thailand, navigating the healthcare system is a critical component of a comprehensive financial and lifestyle strategy. A robust medical insurance plan is the bedrock of that strategy, ensuring your health and wealth are equally protected within the Kingdom.

This guide provides a clear framework for the fundamental choice between a local Thai insurance policy and a comprehensive International Private Medical Insurance (IPMI) plan, empowering you to make a decision that aligns with your exacting standards.

Securing Premier Healthcare in Thailand

When accustomed to a certain standard of service, one expects the same from their healthcare. Thailand is home to world-class private hospitals, such as Bumrungrad International and Bangkok Hospital, yet seamless access to these facilities without financial friction or bureaucratic delays depends entirely on the insurance you choose.

This is a matter of asset protection. A single major medical event can create a significant financial liability, making the right insurance a non-negotiable part of any sophisticated financial plan.

The Growing Importance of Private Coverage

Thailand's public Universal Coverage Scheme (UCS) provides basic care for the majority of the population, but it rarely meets the expectations of global professionals. This gap is fueling a substantial demand for private insurance.

According to the National Health Security Office (NHSO), the UCS covers approximately 47 million people, or about 70% of the population, but access and service levels can vary. This reality has driven the growth of the private sector. The Thai health and medical insurance market was valued at approximately USD 2.66 billion in 2022 and is projected to grow significantly, reflecting a clear trend among discerning individuals.

This trend signals that affluent Thais and the expatriate community are increasingly investing in private medical insurance to guarantee a superior standard of care.

Your Strategic Decision Framework

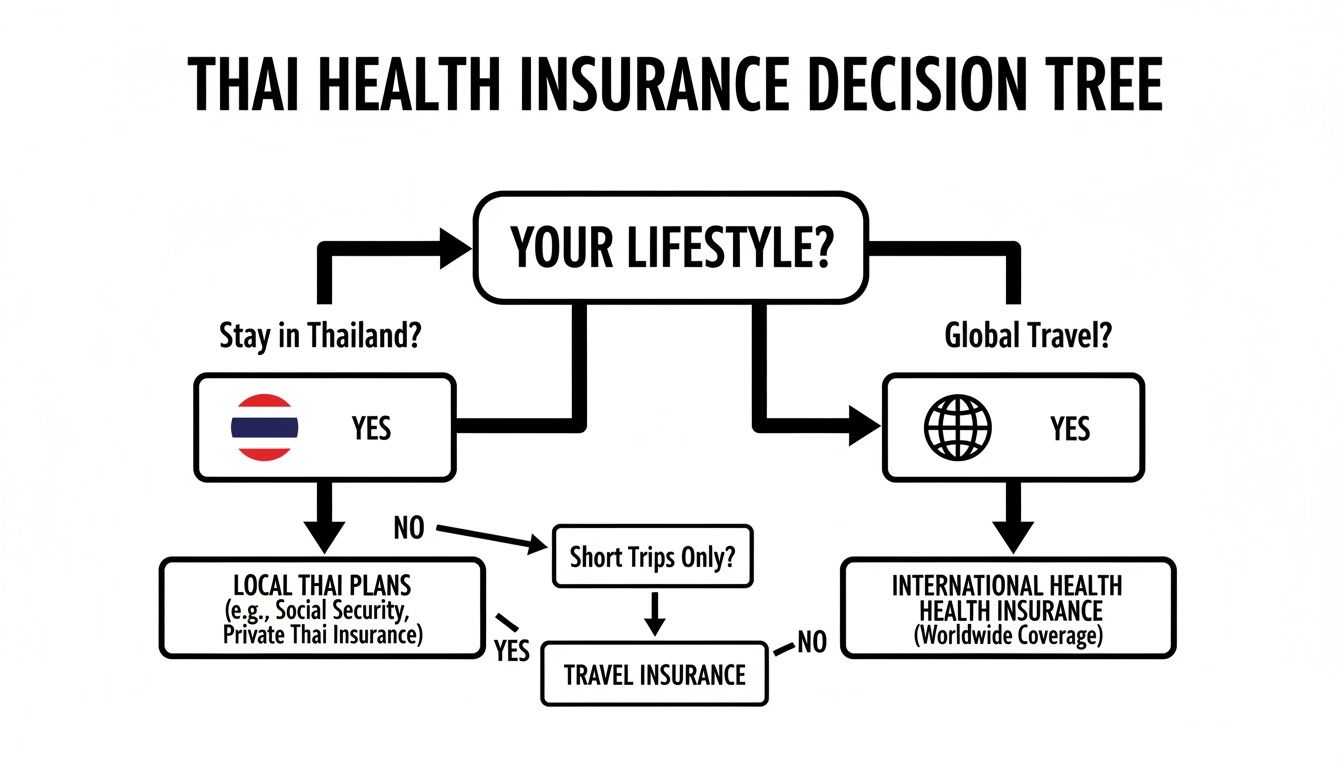

Choosing the right medical insurance in Thailand comes down to a careful analysis of your lifestyle, international travel patterns, and long-term residency plans. The decision boils down to two distinct paths:

- Local Thai Insurance: These plans are typically more budget-friendly and are designed for individuals residing primarily in Thailand. They provide excellent access to an extensive network of local hospitals.

- International Private Medical Insurance (IPMI): Engineered for the globally mobile, IPMI offers worldwide coverage, substantially higher benefit limits, and is portable across borders. This is the definitive choice for anyone who travels frequently or anticipates future relocation.

The differences between local and international plans are stark. One is designed for life within Thailand's borders; the other is built for a life without them.

Local vs. International Insurance At a Glance

| Feature | Local Thai Insurance | International Private Medical Insurance (IPMI) |

|---|---|---|

| Geographic Coverage | Primarily Thailand only | Worldwide, with optional exclusions for high-cost regions like the USA |

| Benefit Limits | Lower (e.g., THB 1-30 million) | Substantially higher (e.g., USD 1-5 million or unlimited) |

| Portability | Not portable; terminates upon relocation from Thailand | Fully portable; moves with you to other countries of residence |

| Direct Billing | Extensive network within Thailand | Global direct billing network with premier hospitals |

| Currency | Thai Baht (THB) | Major currencies (USD, EUR, GBP), providing currency stability |

| Best For | Expatriates residing full-time in Thailand with minimal international travel | Globally mobile professionals, frequent travelers, and high-net-worth individuals |

This table provides a high-level overview, but the nuances are critical. The correct choice depends on aligning your healthcare strategy with your personal and professional life. In the following sections, we will dissect these options, exploring the critical differences in coverage, geographic scope, and service levels to provide the clarity needed for a decision that protects both your health and your assets.

Comparing Local and International Insurance Plans

Choosing the right medical insurance in Thailand is a strategic decision that must align with your lifestyle, travel habits, and long-term financial plans. At its core, the choice is between a local Thai insurance plan or a premium International Private Medical Insurance (IPMI) policy.

Understanding the operational differences between these two frameworks is crucial to ensure your healthcare coverage meets your personal and professional standards.

A local Thai plan is designed for one purpose: healthcare within the Kingdom. It is often more affordable and provides excellent access to a wide network of private hospitals across Thailand. If your life and business are firmly based in Thailand with infrequent international travel, a local plan can be a sensible and effective solution.

However, for a globally mobile professional, a local plan presents a critical vulnerability. Your coverage effectively ceases at the border, leaving you exposed to significant financial risk should a medical issue arise while traveling for business or leisure.

The IPMI Advantage for Global Citizens

This is where International Private Medical Insurance (IPMI) becomes the non-negotiable choice for discerning expatriates. An IPMI policy is not designed for a specific country; it is engineered for a specific lifestyle—one not constrained by geography. Consider it less a local utility and more a personal global asset.

IPMI plans are distinguished by several features that are critical for high-net-worth individuals:

- Worldwide Coverage: Your policy functions seamlessly whether you are in Bangkok, London, Singapore, or New York, delivering consistent, high-level medical care regardless of your location.

- Significantly Higher Benefit Limits: While local plans may have limits of THB 1-30 million, premium IPMI policies offer limits of USD 1-5 million or are often unlimited, providing absolute peace of mind against a catastrophic medical event.

- Portability: Should your career or life path lead you away from Thailand, your IPMI policy moves with you. This eliminates the need to re-apply for a new plan and risk exclusions for pre-existing conditions that may have developed.

This chart helps visualize the core decision-making process, which ultimately hinges on your degree of international mobility and your long-term plans.

As the flowchart illustrates, the deciding factor is your international mobility and whether you envision a permanent, long-term future exclusively within Thailand.

Strategic Financial and Service Considerations

Beyond geography, IPMI plans are structured to meet the service expectations of senior professionals. Policies are typically denominated in major currencies such as USD, EUR, or GBP, providing stability against currency fluctuations—a key detail for serious long-term financial planning.

The service model is also fundamentally different. IPMI providers maintain vast global networks for direct billing, enabling top-tier hospitals worldwide to settle accounts directly with your insurer. This eliminates the need to pay large sums out-of-pocket and navigate a cumbersome reimbursement process, ensuring a frictionless experience during a stressful time.

To put it simply: a local plan is a high-performance regional vehicle—excellent on its home turf. An IPMI plan is a global-spec luxury vehicle, engineered for superior performance, security, and reliability, wherever your journey takes you.

A frank assessment of your needs is required. To organize your thoughts and compare policy features, a tool like a sample comprehensive health insurance selection form can be invaluable. A methodical approach ensures your final decision is based on a clear-eyed view of what each framework truly offers, protecting both your health and your wealth.

Analyzing Policy Inclusions and Exclusions

The true value of a medical insurance policy lies not in the summary page, but in the fine print. For a discerning expatriate, scrutinizing these details is fundamental risk management. Knowing precisely what is covered—and, more importantly, what is not—is the only way to guarantee your policy will perform when you need it most.

The foundation of any worthwhile medical insurance in Thailand is its core benefits. These are the non-negotiables that shield you from financial ruin in the event of a serious medical incident.

Core Policy Inclusions

A premier policy must provide robust coverage for major medical events. These are the pillars of your healthcare security.

- Comprehensive Inpatient Care: This is paramount. It covers all costs associated with a hospital admission—room and board, surgery, ICU, specialist fees, and medications administered during your stay. Without this, you lack meaningful protection.

- Outpatient Services: High-quality plans extend beyond hospital admissions to cover specialist consultations, diagnostic scans like MRIs, and prescription drugs without requiring an overnight stay.

- Emergency Medical Evacuation: For anyone residing or traveling outside major metropolitan centers like Bangkok, this is vital. It covers the substantial cost of transportation to the nearest premier hospital equipped to handle your emergency.

These core benefits create a powerful safety net.

Navigating Pre-Existing Condition Exclusions

The most significant potential pitfall in any policy is the exclusion for pre-existing conditions—any health issue known before the policy's inception. Insurers handle this in two distinct ways, and understanding the difference is critical.

Moratorium Underwriting: This is a "wait and see" approach. The insurer automatically excludes conditions for which you have received treatment in the recent past (typically 24 months). If you remain symptom-free and require no treatment for that condition for a set period (usually 2 years) after the policy begins, the exclusion may be lifted.

Full Medical Underwriting (FMU): This is the more transparent method. You disclose your entire medical history upfront, and the insurer provides a clear decision: they will cover the condition, apply a premium surcharge (a loading), or exclude it permanently. For high-net-worth individuals who require certainty, FMU is almost always the superior choice as it eliminates ambiguity.

Premium Benefits for a Superior Standard of Care

Beyond the essentials, elite international plans offer benefits tailored to the lifestyles and expectations of senior professionals and their families, transforming a good policy into a comprehensive wellness solution.

These premium add-ons often include:

- Comprehensive Dental and Optical: Coverage for everything from routine check-ups to major work like crowns and orthodontics, plus prescription eyewear.

- Maternity and Newborn Care: A crucial benefit for those planning a family, covering prenatal appointments, delivery costs, and care for the newborn.

- Preventative Wellness: This includes annual health check-ups, cancer screenings, and vaccinations, encouraging proactive health management rather than reactive treatment.

By meticulously analyzing these inclusions and exclusions, you shift from simply purchasing a product to making a strategic investment in your health and financial security.

Understanding Premiums, Deductibles, and Costs

When evaluating the cost of medical insurance in Thailand, the monthly premium is only one component. A policy’s true cost is a combination of its premiums, deductibles (also known as an excess), and any co-payments. Understanding how these elements interact is key to making a sound investment in your health.

The premium is the recurring payment to keep the policy active. The amount is determined primarily by your age, the geographic scope of coverage—from ASEAN-only to worldwide—and the overall benefit limits you select.

Key Levers of Cost Control

One of the most effective strategies for managing the cost of a top-tier medical plan is the strategic use of a deductible. A deductible is the amount you agree to pay out-of-pocket for medical care before your insurance coverage begins. It is, in effect, self-insuring for manageable, minor expenses.

By selecting a higher deductible, you can significantly reduce your annual premium. This is a particularly powerful strategy for expatriates who can comfortably cover smaller medical bills but require absolute protection against a catastrophic, high-cost health event. For a deeper analysis of this mechanism, you can check out our guide on excesses and deductibles in the fine print.

Opting for a USD 5,000 deductible on a premium international plan can often reduce the annual premium by 30-40% or more. This makes it a powerful tool for optimizing your policy's value while maintaining protection against major financial shocks.

Benchmarking Annual Premiums

To provide a clearer picture of potential costs, the following are illustrative annual premium benchmarks. These are not quotes but serve as a solid reference for what different expatriate profiles might encounter. Costs vary widely between geographically limited local plans and international plans that deliver global coverage and substantially higher limits.

The health coverage market in Thailand is robust. According to the Thai Life Assurance Association, new business premiums for health riders have shown consistent growth, reflecting a strong demand for private solutions to counter rising medical costs.

This strong domestic market offers an attractive pricing landscape for global citizens. The average insurance premiums in Thailand are substantially lower than in high-cost countries like the United States, making it a compelling base for expatriates.

The table below provides sample annual premium ranges to illustrate the cost differences.

Sample Annual Premium Benchmarks

These are illustrative annual premium ranges for different expatriate profiles in Thailand, comparing local and international plan options.

| Expat Profile | Typical Local Plan Premium (USD) | Typical International Plan Premium (USD) |

|---|---|---|

| Single Professional (Age 35) | $1,200 – $2,500 | $3,500 – $7,000 |

| Family of Four (Parents 40, Children 8 & 10) | $3,000 – $6,000 | $10,000 – $18,000 |

| Retiree (Age 65) | $2,500 – $5,000+ | $8,000 – $15,000+ |

These figures illustrate a clear trade-off. While local plans are more economical, international plans provide a far superior level of security, portability, and service that meets the needs of globally mobile professionals and their families.

Navigating Hospital Networks and the Claims Process

An insurance policy's true worth is only realized at the point of use. For expatriates in Thailand, understanding how a policy functions within the country's top hospitals is as crucial as the coverage limits themselves. During a medical event, administrative complications are the last thing one desires.

The gold standard is direct billing, also known as cashless service. For holders of a premium international policy, this should be the expectation. World-class hospitals like Bumrungrad International, Bangkok Hospital, and Samitivej have well-established relationships with major global insurers, allowing them to bill the insurance company directly. You simply present your insurance card, and the financial settlement is handled behind the scenes. It is a seamless process.

Direct Billing vs. Pay-and-Claim

Direct billing may not apply in all situations, particularly for certain outpatient visits or at clinics outside your insurer's primary network. In these instances, you will encounter the pay-and-claim model.

This requires you to pay the medical bill out-of-pocket initially. You then compile all necessary documentation and submit it to your insurer for reimbursement.

This process demands meticulous record-keeping. It is imperative to retain all original receipts, medical reports, and prescriptions. A complete and well-organized claim is essential for prompt reimbursement. Understanding your insurer's network and relationship with your preferred hospitals is vital for a stress-free experience.

The Critical Step of Pre-Authorization

A term you will frequently encounter is pre-authorization. It is a mandatory step for any planned medical care, such as non-emergency surgery.

This process confirms that your treatment is medically necessary and, crucially, that it is covered by your policy before you incur the expense. Bypassing this step can result in a denied claim, leaving you responsible for the entire bill. For more detail, there are excellent resources for understanding prior authorization.

Consider it a financial green light before proceeding. It removes guesswork and ensures all parties are aligned. It is a core component of professional healthcare management.

A notable regulatory change impacting Thailand's insurance market was the introduction of new Standard Health Insurance Policies by the Office of Insurance Commission (OIC). These standards, which include clear definitions for terms like "pre-existing condition" and standardized exclusions, aim to increase transparency for consumers. This change underscores the importance of understanding the precise terms of your policy to avoid unexpected out-of-pocket expenses at the time of a claim.

Ultimately, a smooth claims process distinguishes a good insurance product from a great one. It is the final, crucial piece of the puzzle—the guarantee that when you require support, the system works for you, not against you.

Aligning Insurance with Thai Visa Regulations

A common oversight for expatriates is failing to align their health insurance with Thailand's stringent visa requirements. For many long-term residents, possessing the correct medical policy is not merely about healthcare access; it is a non-negotiable prerequisite for maintaining legal residency.

Thai Immigration has established specific, unambiguous insurance rules for several key visa categories. Your policy is no longer just a safety net—it is a critical component of your application dossier. Adherence to these regulations ensures a smooth visa process, whereas non-compliance can lead to frustrating and disruptive delays.

Retirement Visa Insurance Mandates

The popular Retirement Visas—specifically the Non-Immigrant O-A and O-X types—come with precise health insurance requirements. The Thai government mandates this to ensure that retirees do not become a financial burden on the public healthcare system.

For the O-A visa, your policy must provide a minimum of THB 3,000,000 in total coverage. This must specifically include at least THB 400,000 for outpatient care and THB 40,000 for inpatient care. These are not suggestions; they are firm requirements, and an official insurance certificate is required as proof.

Long-Term Resident (LTR) Visa Requirements

The Long-Term Resident (LTR) Visa, designed to attract high-value professionals, affluent retirees, and investors, also has strict insurance stipulations. The principle is the same: demonstrate medical and financial self-sufficiency.

Applicants for an LTR visa must show proof of health insurance with a minimum of USD 50,000 in coverage. Alternatively, applicants with substantial assets may provide evidence of a deposit of at least USD 100,000.

A critical detail often missed: the policy must be issued by an insurer officially approved and listed by the Thai General Insurance Association (TGIA). An excellent international policy from a globally recognized but non-listed provider is likely to be rejected by immigration, causing significant and avoidable delays.

This specific rule highlights the importance of working with a broker who possesses deep knowledge of both the insurance market and the intricacies of Thai immigration procedures.

The Documentation and Approval Process

Securing the right coverage is only half the task; you must also have the correct documentation. Your insurance company must issue a specific certificate, often in a government-mandated format, that clearly outlines your coverage levels and confirms compliance with visa requirements.

The process is as follows:

- Select an Approved Policy: Choose a plan that meets the minimum coverage requirements from a government-approved insurance provider.

- Obtain the Official Certificate: Once the policy is active, request the "Foreign Insurance Certificate" from your insurer or broker. They will be familiar with the exact format required for Thai Immigration.

- Submit with Your Application: This certificate is submitted along with all other visa application or renewal documents.

Ensuring your medical insurance in Thailand is perfectly aligned with these legal demands is a foundational step for any individual serious about long-term residency. It is a detail where precision protects both your health and your legal right to reside in the Kingdom.

Your Questions, Answered

Navigating medical insurance for a move to Thailand presents numerous questions. It is a complex subject where the details are paramount. Here are direct answers to the most common queries from expatriates and high-net-worth individuals.

Can I Use My Insurance From My Home Country?

The answer is almost invariably no. A standard domestic health plan from the US, UK, or Australia—including government programs like Medicare—is designed for use within that country's borders. Once you reside in Thailand, it will not provide coverage. Relying on such a policy is a significant financial risk, as you would be personally liable for all medical expenses. A dedicated international health plan is essential.

What is the Minimum Insurance Required for a Thai Visa?

This is highly specific and depends entirely on the visa category.

For the common Retirement Visa (O-A), a policy with at least THB 3,000,000 in total coverage is required. This must include specific sub-limits for both inpatient and outpatient care.

For the Long-Term Resident (LTR) Visa, the requirement is a minimum of USD 50,000 in medical coverage. Crucially, for most long-stay visas, the policy must be issued by an insurer on the Thai government's approved list.

Are International Hospitals in Thailand Prohibitively Expensive?

While healthcare in Thailand is generally more affordable than in Western countries, premier international hospitals command significant fees. A major surgery or an extended stay in the ICU at a world-class facility like Bumrungrad or Bangkok Hospital can easily generate a bill exceeding USD 50,000.

This is precisely why a high-limit international health plan is not a luxury but a core component of asset protection. A single serious medical event without adequate coverage can inflict a devastating financial blow.

How Do Insurers Handle Pre-Existing Conditions?

In Thailand, insurers typically use one of two underwriting methods for pre-existing conditions:

-

Moratorium Underwriting: A "wait-and-see" approach. Conditions from your recent medical history are automatically excluded for a set period, usually 24 months. If you remain symptom-free and treatment-free for that condition during this period, it may become eligible for coverage.

-

Full Medical Underwriting (FMU): The more transparent method. You disclose your full health history upfront. The insurer then provides a definitive decision: to cover the condition, exclude it permanently, or cover it with an additional premium (a "loading"). This provides absolute clarity from day one.

Does a Local Thai Plan Cover Me When I Travel?

No. A standard local Thai insurance policy is designed exclusively for use within Thailand. Your coverage ceases the moment you depart the country. For anyone who travels internationally—for business, leisure, or family visits—a local plan creates a significant gap in protection, leaving you completely exposed to medical costs abroad. This is the single most compelling reason why globally mobile professionals opt for international medical insurance.

Making the right decision on your medical insurance in Thailand requires more than just choosing a product; it demands expert guidance to align a plan with your specific lifestyle. At Riviera Expat, we provide a specialized, white-glove brokerage service to ensure your health and wealth are properly protected. Schedule your complimentary consultation with us today.