For discerning expatriates and high-net-worth professionals residing in Thailand, securing the right medical insurance in Thailand transcends a mere administrative task. It is a foundational element of your comprehensive financial and wellness strategy.

This insurance is your key to accessing the nation's world-class private hospitals without exposure to the significant, and often unexpected, financial liabilities that can follow. Consider it less a safety net and more an essential instrument for the preservation of both your health and your wealth.

Understanding Thailand's Healthcare Landscape

Thailand's healthcare system is distinctly bifurcated, presenting a clear choice for sophisticated expatriates.

On one side lies the public system. While extensive and serviceable for the local population, it is frequently characterized by substantial wait times and resource constraints. It is not the environment one would choose when time and quality of care are of the essence.

Conversely, the private healthcare sector is a dynamic, internationally-acclaimed industry. It features state-of-the-art hospitals, many boasting JCI accreditation, delivering a standard of care that rivals premier medical institutions worldwide. This elite level of service commands a premium price, rendering robust private medical insurance an absolute necessity. It provides access to immediate specialist consultations, advanced medical technology, and the comfort of private suites when they are most needed.

To articulate the distinction with precision, consider the following comparison:

Public vs Private Healthcare in Thailand

| Attribute | Public Healthcare System | Private Healthcare System |

|---|---|---|

| Target Audience | Primarily Thai citizens and legal residents | Expats, medical tourists, and affluent Thais |

| Cost | Low-cost or free for eligible individuals | High, with costs comparable to Western countries |

| Waiting Times | Can be extensive for specialists and non-urgent procedures | Minimal, with prompt access to specialists and services |

| Facilities & Comfort | Basic amenities, often crowded shared wards | Hotel-like private rooms, modern facilities, multilingual staff |

| Technology | Functional but may lack the latest advanced equipment | State-of-the-art diagnostic and treatment technology |

| Choice of Doctor | Limited or no choice of physician | You can select your specialist and obtain second opinions |

This table elucidates why astute expatriates do not leave their healthcare to chance within the public system. They invest in a private plan that guarantees access to the premium care they expect.

The Foundation of Coverage

The Thai government has established a commendable public healthcare framework for its citizens. Nevertheless, a significant portion of Thais elect to purchase private insurance to bypass the public system's limitations.

This domestic demand, augmented by the influx of expatriates and medical tourists, fuels a flourishing healthcare industry. The market was valued at approximately 680 billion Thai baht in 2022 and is projected to grow substantially. You can explore the drivers of this growth in this detailed healthcare industry outlook.

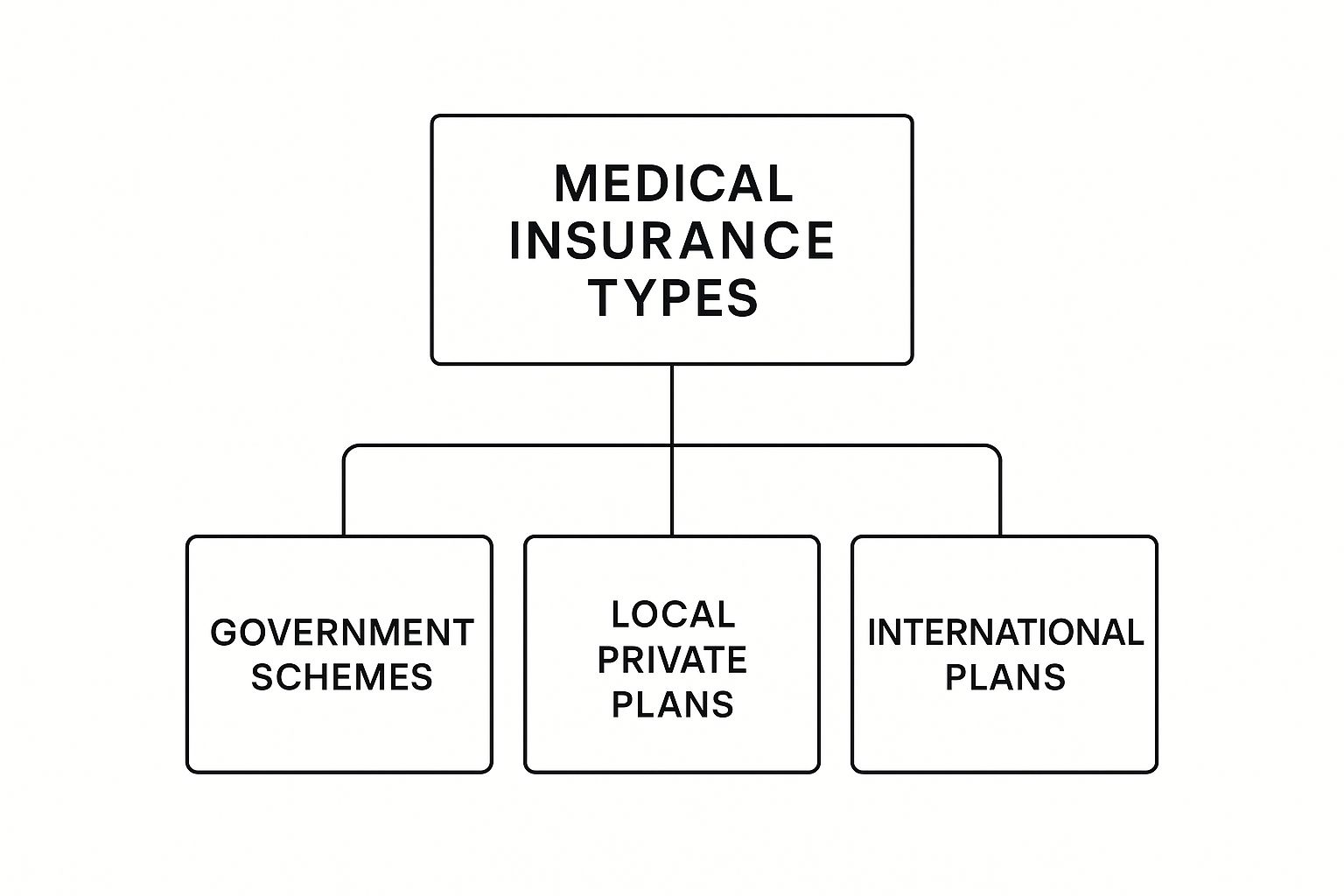

The image below delineates the different insurance tiers available within the country.

While government schemes form the base, it is the private plans—both local and international—that deliver the standard of service and access that most global professionals require. The pivotal decision for you will be selecting between a local Thai policy and a comprehensive international one.

The decision to secure private medical insurance in Thailand is not a matter of necessity; it is one of strategy. It is about ensuring your healthcare experience aligns with the high standards you uphold in every other aspect of your life.

Ultimately, your insurance plan is a financial shield. It prevents a single, unforeseen medical event from jeopardizing your financial stability. It transforms a potentially devastating, unpredictable expense into a manageable, budgeted premium. Such foresight is the hallmark of a well-managed global lifestyle.

Choosing Your Coverage: Local vs. International Plans

This represents one of the most critical decisions you will face. The optimal structure for your medical insurance in Thailand depends on your lifestyle, travel frequency, and long-term personal and professional trajectory.

Your choice is between two distinct options: a local Thai policy or a comprehensive international health plan. Making the correct selection from the outset is fundamental to ensuring your coverage performs as expected when you require it most.

A local Thai plan can be likened to a high-performance scooter: exceptional for navigating within a specific city—in this case, within Thailand's borders. It is cost-effective and provides excellent access to a network of quality private hospitals. However, the moment you cross an international border, its utility ceases. Its protection is strictly confined to one country.

An international plan, in contrast, is the private jet of the insurance world. It is engineered for a global lifestyle, offering seamless, high-level protection not only in Thailand but almost anywhere your life or business endeavors may lead. This is the only viable choice for senior executives, frequent travelers, and families who may eventually repatriate or relocate to another international post.

The Scope of Local Thai Policies

Local plans are precisely as they sound—underwritten by Thai insurance companies and regulated within Thailand. They are often less expensive and can satisfy basic visa insurance requirements.

Their primary attractions are affordability and straightforward access to a defined network of Thai hospitals. For an individual who intends to reside exclusively in Thailand with minimal international travel, a local plan might appear to be a sufficient solution.

However, for a globally mobile professional, the limitations quickly become significant liabilities.

- Geographic Constraints: Coverage terminates the moment you depart Thailand. A sudden illness during a business trip to Singapore or a planned medical procedure in your home country would result in you bearing the full cost out of pocket.

- Lower Coverage Ceilings: Local policies invariably feature lower annual benefit limits. More critically, they often impose restrictive "sub-limits" for specific treatments like major surgery or oncology. These caps can be quickly exhausted during a serious medical event at a top-tier hospital, leaving you with a substantial financial shortfall.

- Lack of Portability: Should you decide to permanently leave Thailand, you cannot take your policy with you. You would be compelled to start anew in your next country of residence, facing fresh underwriting. Any health condition developed in Thailand would then be classified as a "pre-existing condition," likely to be excluded from a new plan.

The Advantages of International Plans

For any individual who values flexibility and demands an uncompromising quality of care, international private medical insurance (IPMI) operates in a different echelon. These plans are designed to be a constant in your life, providing a consistent standard of care regardless of your location.

An international plan offers true peace of mind. It eliminates the concern of arranging new coverage for every business trip or managing healthcare logistics during a relocation. It creates a stable, reliable foundation for your health, no matter where you are in the world.

The key benefits of an IPMI plan are transformative:

- True Worldwide Coverage: These policies offer protection globally or within a large, specified region (e.g., "Worldwide excluding the USA"). This ensures you are covered during business trips, holidays, or if you divide your time between Thailand and your home country.

- Substantial Benefit Limits: International plans feature much higher—often multi-million dollar—annual limits and generous sub-limits. This is designed to ensure you are fully protected against the six- or seven-figure costs associated with complex medical care.

- Cashless, Direct Billing Networks: This is a significant advantage. Premier IPMI providers maintain extensive direct billing agreements with elite hospitals worldwide. This means the insurer settles the bill directly with the hospital, so you are not forced to pay enormous sums out-of-pocket and subsequently seek reimbursement.

- Complete Portability: This is a crucial benefit. If your career takes you from Bangkok to Dubai or back to London, your coverage moves with you. There are no gaps in coverage, no new medical questionnaires, and no new exclusions. You can learn more about how to choose the right type of expat insurance policy here.

Ultimately, choosing between a local and international plan for your medical insurance in Thailand is a strategic decision. A local plan might seem adequate for a quiet, budget-focused life contained within Thailand. But for the discerning individual leading a dynamic, global life, the security and superior benefits of an international plan aren't just a luxury—they're indispensable.

Decoding High-Value Policy Benefits

Selecting between a local or international plan for your medical insurance in Thailand is the initial major step. The next is to look beyond the plan’s basic structure and examine its core components—the high-performance features that determine its true value.

A policy’s worth is not found in a glossy brochure; it is embedded in the fine print of its coverage terms.

For the discerning expatriate, a meticulous review of these specifics is paramount. It is the difference between possessing a policy that is merely a document and one that delivers robustly during a medical crisis. This requires a dissection of the core benefits that are critical when your health is at stake.

Inpatient Care: The Gold Standard

Inpatient care—any treatment requiring hospital admission—is the absolute bedrock of any serious health plan. For a premium policy, the presence of this coverage is the minimum expectation. The true markers of quality are in the details that ensure comfort, privacy, and an absence of financial surprises during a stressful period.

When comparing plans, look for these non-negotiable benefits:

- Private Suite Accommodations: Your recovery should not be compromised by a chaotic, shared hospital ward. A top-tier plan will cover the full cost of a private room in a premium hospital, affording you the quiet and space essential for healing.

- Unrestricted Surgical Fee Coverage: The best international plans often provide "paid in full" cover for surgeon and anesthetist fees. This is critical. Complex surgeries performed by leading specialists can easily exceed the sub-limits found in lesser plans, leaving you with a substantial bill.

- Intensive Care Unit (ICU) Costs: An ICU stay can incur costs of tens of thousands of dollars per day. Your policy must cover these expenses completely, without restrictive daily caps that could result in a financially crippling shortfall.

Outpatient Services: Access and Diagnostics

While less dramatic than a hospital admission, outpatient services are the workhorse of your proactive health management. This is the area of your policy you will interact with most frequently, and where its day-to-day quality is most apparent. An excellent plan provides immediate access to the best care without financial friction.

Think beyond a simple GP visit. A high-value policy should deliver:

- Specialist Consultations: You should have direct access to leading cardiologists, oncologists, or neurologists with their fees fully covered—ideally without requiring a referral.

- Advanced Diagnostic Imaging: This means immediate, fully-paid access to MRI, CT, and PET scans. These are essential for rapid, accurate diagnosis but carry a significant cost that your policy must absorb.

- Prescription Medications: You require comprehensive coverage for all prescribed drugs, not just a limited formulary of generics. This ensures you receive the precise treatment your doctor deems most effective.

The purpose of a premier outpatient benefit is to remove barriers. It allows you to seek expert opinions and undergo necessary diagnostic tests the moment a concern arises, rather than deferring care due to concerns about cost or administrative hurdles.

Emergency Safeguards and Lifestyle Enhancements

For anyone leading a global life, two other areas of coverage are non-negotiable: emergency medical evacuation and holistic wellness benefits. These are the features that demonstrate a plan's true understanding of the modern, international professional's needs.

Emergency Medical Evacuation is an indispensable safety net. In the event of a serious medical emergency in a location lacking adequate facilities, this benefit covers the substantial cost of transportation to the nearest center of medical excellence—be it in Bangkok, Singapore, or your home country. This is an essential feature for any frequent traveler.

Beyond emergencies, the best plans cater to a complete health profile. Optional riders for comprehensive dental and vision care extend far beyond basic check-ups to cover major restorative work, orthodontics, and high-quality eyewear. For those planning a family, a robust maternity rider covering all prenatal, delivery, and postnatal care at a premier hospital is essential. If you wish to delve deeper, you may find our guide that unveils the full spectrum of private international health insurance advantages useful.

By carefully examining these specific benefits, you can confidently distinguish between a truly exceptional policy and one that is merely adequate. This ensures the plan you choose is perfectly aligned with your health needs and lifestyle.

What Does Top-Tier Health Insurance in Thailand Actually Cost?

In the context of expatriate financial planning, understanding the investment required for first-class medical insurance is non-negotiable. The premium is not an arbitrary figure; it is a meticulously calculated amount based on a precise risk assessment.

Several key factors directly influence the final cost of your policy. Comprehending how these levers interact is the first step toward securing appropriate coverage without overpaying.

Your age, medical history, desired coverage level, and geographic scope are the primary determinants. A younger applicant with a clean bill of health will naturally secure lower premiums than a retiree managing chronic conditions. Similarly, a plan providing global access—including high-cost jurisdictions like the USA—will command a higher price than one limited to Southeast Asia.

Key Factors That Shape Your Premiums

At its core, your premium is a direct reflection of your personal profile and lifestyle. Insurers use sophisticated actuarial models to evaluate a handful of variables and gauge the probability of a claim.

Here is what they examine most closely:

-

Your Age and Health Profile: This is the most significant factor. Premiums increase with age due to the statistical rise in the likelihood of needing medical care. Any pre-existing conditions will be closely scrutinized, which may result in a premium loading (an additional cost) or an exclusion for that specific issue.

-

Level of Coverage: This is determined by your choices. Opting for a plan with high annual limits, comprehensive outpatient benefits, and access to elite hospitals like Bumrungrad or the Bangkok Hospital network will increase the cost. These premier facilities have higher charges, which the insurance premium must reflect.

-

Geographic Area of Cover: A plan that only covers you within Thailand will be significantly less expensive than an international plan offering worldwide protection. The largest price differential typically involves adding coverage for high-cost countries, particularly the United States.

-

Deductibles and Co-payments: You have a degree of control here. By selecting a higher deductible (the amount you pay out-of-pocket before the insurer begins payment), you can strategically lower your premium. You are essentially agreeing to share more of the initial risk, for which the insurer rewards you with a lower annual or monthly payment.

The Overlooked Reality of Medical Inflation

A critical factor that many overlook is medical inflation. In Thailand, the cost of private healthcare consistently outpaces general economic inflation, rising much faster than the standard cost of living.

This is not a marginal increase. The average annual rate is between 8-10%, with some years seeing spikes as high as 15%.

This relentless upward trend means that a major medical event will be substantially more expensive next year than it is today. A robust insurance plan is your only effective defense against this, protecting your capital from the corrosive effect of escalating medical costs.

For a more detailed analysis of this financial pressure, our article explaining why medical insurance premiums rise year after year provides a comprehensive breakdown.

What to Realistically Expect to Pay as an Expat

To put this into perspective, let us examine some illustrative figures. The estimates below provide a tangible sense of the investment required for quality international plans, categorized by different expatriate profiles.

These are indicative figures, of course, but they offer a realistic baseline for budgeting while residing in Thailand.

Estimated Annual Premiums for International Plans

| Expat Profile / Age Bracket | Mid-Range Coverage (Includes Inpatient/Outpatient) | Premium Coverage (Global, High Limits, Top Hospitals) |

|---|---|---|

| Young Professional (Age 30-39) | $2,500 – $4,000 USD | $5,000 – $7,500 USD |

| Established Professional (Age 45-54) | $4,500 – $6,500 USD | $8,000 – $12,000 USD |

| Senior Executive / Retiree (Age 60-69) | $7,000 – $10,000 USD | $13,000 – $20,000+ USD |

These figures make it clear: premium medical insurance is a significant but essential investment. It is a calculated exchange—a predictable annual premium for ironclad protection against unpredictable and potentially devastating healthcare expenses.

Finding Your Ideal Insurance Partner

Selecting the right policy is only half the task. The choice of the company that underwrites it is of equal importance. For high-net-worth professionals in Thailand, the quality of service and financial strength of the insurer are as vital as the coverage limits.

This is not a matter of browsing a list of providers. It is about establishing a partnership with a company you can trust implicitly when your health is on the line. The right partner for your medical insurance in Thailand should operate as an invisible, hyper-efficient extension of your personal advisory team. They must understand what is at stake and deliver a level of service commensurate with your expectations. This requires looking beyond marketing materials and conducting your own due diligence.

Evaluating the Hospital Network

The most immediate, tangible benefit of a premium plan is its hospital network. A superior provider does not just offer a long list of hospitals; they cultivate deep relationships that create a seamless, cashless experience for their clients.

During an admission to a top-tier hospital like Bangkok Hospital or Bumrungrad International, your focus should not be on billing logistics. A robust direct-billing network is non-negotiable. This is the mechanism whereby the insurer pays the hospital directly, obviating the need for you to pay large sums upfront and then seek reimbursement. You must verify that the insurer has solid agreements with the specific world-class hospitals you would choose to utilize.

A provider's hospital network is a direct reflection of their influence and commitment to a region. A deep, high-quality network with direct-billing capabilities is the clearest indication that an insurer is a serious, long-term player in Thailand's healthcare market.

The Real Test: Claims and Customer Service

A policy is a promise on paper. An insurer's true character is revealed during the claims process. You need a provider known for a streamlined, digital claims process for routine outpatient visits and proactive, hands-on case management for major inpatient events.

For a global professional, responsive, intelligent customer support is absolutely critical. This entails:

- 24/7 Multilingual Support: Medical needs do not adhere to business hours. Access to round-the-clock support from a team that communicates clearly in English is not a luxury; it is a fundamental requirement.

- A Dedicated Point of Contact: For serious medical situations, premier service often includes a dedicated case manager—a single, knowledgeable expert who guides you through the entire process.

Consider it the difference between a private banker and a generic call center. One provides personalized, expert guidance; the other often leads to frustration. You must demand the former from your insurance partner.

Financial Stability and Reputation

An insurance policy represents a long-term commitment. You pay premiums today for a guarantee of protection that may be required years or even decades in the future. This makes the financial stability and longevity of the insurer critically important.

Seek out providers with strong credit ratings from major agencies like A.M. Best or Standard & Poor's. These ratings are an independent, expert assessment of an insurer’s ability to meet its financial obligations. A company with a long-standing presence in the international private medical insurance market is another indicator of stability and deep expertise.

To assist in your evaluation, here is a checklist of incisive questions to ask any potential insurer or broker before committing:

- Can you provide a complete, current list of your direct-billing hospitals in Thailand?

- What is your average turnaround time for processing an outpatient reimbursement claim?

- Do you have a 24/7 emergency hotline staffed by multilingual case managers?

- What is your company's current financial strength rating from a major agency?

- How do you handle pre-authorizations for major surgeries to ensure no last-minute financial surprises?

- Can you provide anonymized case studies or testimonials from other expatriate clients in Thailand?

By asking these sharp, direct questions, you transform the conversation from a sales pitch into a serious evaluation of their real-world capabilities. This methodical approach ensures the partner you select possesses the proven reliability to protect your most valuable assets: your health and your wealth.

Common Questions About Thai Medical Insurance

As you delve into the specifics of medical insurance in Thailand, a number of practical questions will arise. Having advised expatriates for years, we have addressed them all. This section provides direct, clear answers to the most common queries.

Is My Home Country Insurance Valid in Thailand?

In virtually all cases, the answer is no. This is a hard truth many expatriates discover too late. Your national health service or domestic insurance policy from your home country offers little to no effective coverage once you become a resident abroad.

While it might cover a small fraction of a true, life-threatening emergency, it is entirely unsuitable for long-term residency. Critically, these plans do not facilitate direct billing with Thailand’s premier private hospitals, leaving you to pay upfront and seek reimbursement later. Travel insurance is equally inadequate for residency; it is designed for short trips and explicitly excludes routine care, elective procedures, and the management of ongoing health conditions.

For any serious expatriate, a dedicated international health plan is the only viable solution.

What Are the Visa Requirements for Health Insurance?

This is a critical consideration. Certain long-stay visas, notably the Non-Immigrant O-A (Retirement) and the Long-Term Resident (LTR) visas, have mandatory health insurance requirements. For the O-A retirement visa, you will typically need a policy providing at least 3 million THB in medical expense coverage.

The LTR visa has similarly high coverage demands. It is imperative that you obtain a plan from a government-approved insurer that meets these specific regulations. Always verify the latest requirements directly with the Royal Thai Embassy or Thai immigration authorities before applying, as these rules are subject to change.

How Do Insurers Handle Pre-existing Conditions?

This is a highly personalized aspect of the application process. Insurers will always require a full disclosure of your medical history. Any lack of transparency is a serious misstep, as it can be grounds for voiding your entire policy at the time of a claim.

Upon reviewing your medical history, an underwriter will typically take one of four actions: 1) offer full coverage with no modifications, 2) apply a waiting period before the condition is covered, 3) add a premium surcharge (a 'loading'), or 4) exclude the condition from coverage entirely.

This is an area where premium international insurers often demonstrate greater flexibility, as they may have more sophisticated methods for covering well-managed chronic conditions. This makes a thorough comparison of how different underwriters view your specific history extremely important.

Can I Get Coverage for My Family?

Certainly. Leading international insurers specialize in this area. They offer comprehensive family plans that can cover you, your spouse, and your dependent children under a single policy. This is not only more convenient but can also be more cost-effective than purchasing individual plans.

These family plans are designed to provide every member with the same high level of benefits, from premium pediatric care and wellness checks to optional maternity riders. When evaluating these options, pay close attention to the age limits for dependent children and ensure the overall benefit levels are appropriate for each individual's health needs.

At Riviera Expat, we specialize in demystifying the complexities of international private medical insurance for high-net-worth professionals. Our expert consultants provide clarity and control, ensuring you select a plan that delivers the uncompromising quality and service you expect. Secure your confidential consultation today.