It’s a common—and potentially costly—misconception that Canada’s famed universal healthcare system extends its coverage to everyone who sets foot in the country. This is incorrect.

For discerning visitors, medical insurance for visitors to canada is not merely a travel accessory; it's an essential financial instrument designed to shield your assets from the significant expense of unexpected medical care.

Why Visitor Medical Insurance Is Non-Negotiable

Planning a trip to Canada, whether for a high-value business venture or personal leisure, requires meticulous preparation. You arrange meetings, book flights, and secure accommodations. However, the most critical component of your preparation is the mitigation of financial risk.

Canada’s healthcare is of a high standard, but it is funded by Canadian taxpayers for the benefit of Canadian residents. As a visitor, you are personally liable for the full cost of any medical care you receive. These costs can be exceptionally high.

Consider visitor insurance as you would any other vital protection for your assets. It is a strategic measure to safeguard your wealth from the extreme volatility of out-of-pocket medical expenditures. Without it, a sudden illness or a minor accident can precipitate a substantial financial liability.

The Financial Reality of Canadian Healthcare

The cost of medical care for an uninsured visitor in Canada can be startling. A visit to an emergency room for a seemingly minor issue can easily amount to several thousand dollars before any significant treatment is administered.

To provide specific context, a standard hospital room in a major Canadian city can exceed $5,000 per day. Should intensive care (ICU) be required, that figure can escalate to over $10,000 per day.

These figures do not include ancillary services. Procedures such as MRI scans, specialist consultations, or prescription medications each contribute significant additional costs. A minor fracture requiring surgery or a brief hospitalization for an unexpected infection could rapidly accumulate into a five- or even six-figure expense.

It's About More Than Just Emergencies

A robust medical insurance policy for visitors to Canada provides more than just a safeguard against worst-case scenarios. It delivers a comprehensive framework for managing any health issue that may arise, protecting both your physical and financial well-being.

- Immediate Access to Care: With a quality policy, you avoid delays or reluctance from medical providers concerned about payment. You receive necessary care promptly.

- Comprehensive Protection: Premier plans cover a full spectrum of potential expenses—from ambulance services and emergency dental work to prescription drugs and medical repatriation. It is a complete financial shield.

- Total Peace of Mind: This is the ultimate benefit. The assurance that a health issue will not derail your trip or impose a crippling financial burden allows you to focus on your objectives with complete confidence.

Securing robust visitor insurance is not an optional extra; it is a fundamental component of responsible travel planning for any sophisticated individual travelling to Canada. It is a non-negotiable step to protect your health and preserve your wealth.

Determining Your Eligibility for Coverage

Before securing the appropriate medical insurance for your travel to Canada, it is essential to first ascertain your eligibility. Insurers assess several key factors to evaluate risk, and meeting these criteria is the initial step toward obtaining reliable coverage.

Your eligibility is not a singular checkbox. It is defined by your identity and the purpose of your visit to Canada. Whether you are a tourist, a business professional attending meetings, or a relative on an extended stay, your visitor status directly influences the policies available to you.

Core Eligibility Factors for All Visitors

Regardless of your reason for visiting, nearly every insurance provider will begin with the same fundamental inquiries. These are the non-negotiable criteria that form the basis of your application.

- Current Location: This is a critical detail. You must almost always purchase your policy before you arrive in Canada. If you delay until after landing, you will likely be subject to a waiting period—typically 48 to 72 hours—during which any claims for new illnesses will be denied.

- Health Status: You must be in stable health at the time of application. This means you are not actively seeking treatment for a serious condition or travelling against medical advice.

- Age: While plans are available for all ages, the terms change for older visitors. Expect premiums and coverage options to differ, particularly if you are over the age of 70.

Specific Requirements for Visitor Categories

Once the basic criteria are met, the requirements become more specific based on your visitor type. Identifying your category is crucial for selecting a policy that is both effective and compliant.

Tourists and Business Travelers

For short-term visits, eligibility is generally broad. As long as you are a non-resident visiting temporarily, you will qualify. This allows for significant flexibility in choosing your coverage amount and deductible, enabling you to tailor the policy to your precise risk tolerance.

Temporary Foreign Workers and International Students

Individuals coming to work or study may eventually qualify for provincial health coverage after a waiting period, which varies by province. However, this creates a significant coverage gap upon arrival. Private visitor insurance serves as the necessary bridge, and proof of such insurance is often a condition of your work or study permit.

Organizing your finances is a critical piece of the process. Beyond insurance, you must understand all financial requirements for your visit. It is advisable to review official guidelines for requirements like proof of funds for Canada to ensure a seamless application process.

Parent and Grandparent Super Visa Applicants

For this category, the insurance requirements are exceptionally strict. They are mandated by Immigration, Refugees and Citizenship Canada (IRCC), and there is no flexibility. Failure to meet these exact criteria will result in the rejection of your Super Visa application.

To qualify, you must provide proof of a policy that meets these four conditions:

- Issued by a Canadian Insurer: Your policy must originate from a Canadian insurance company.

- Minimum Coverage: It must provide at least $100,000 in medical coverage.

- Minimum Duration: The policy must be valid for a full 365 days from your date of entry into Canada.

- Proof of Payment: You must demonstrate that the policy has been paid in full.

These are not arbitrary rules; they constitute a framework designed to ensure Super Visa holders do not place a burden on Canada's healthcare system. By determining your visitor category at the outset, you can efficiently identify a policy that provides complete peace of mind.

Evaluating Your Visitor Insurance Coverage Options

Selecting the right medical insurance for visitors to Canada is not a perfunctory task. It is a serious financial decision, analogous to a key investment. A superficial review is insufficient.

You must dissect the policy's components to understand precisely what you are acquiring. View it not as a single product, but as a specific portfolio of financial protections. Your responsibility is to ensure each component of that portfolio is robust enough to withstand a worst-case scenario.

Core Coverage Areas You Must Scrutinize

Every top-tier visitor insurance plan is constructed upon several non-negotiable pillars. These are the absolute essentials that will protect you from financial ruin in the event of a medical emergency.

- Emergency Medical Services: This is the foundation. It covers unexpected illnesses or accidents, including the costs of physician consultations, emergency room visits, and any immediate procedures required for stabilization.

- Hospitalization: A medical crisis often necessitates a hospital stay—the point at which costs can escalate dramatically. Your policy must cover a semi-private room, nursing care, and in-hospital treatments. With a single day in a Canadian hospital easily exceeding $5,000, this coverage must be unequivocal.

- Diagnostic Services: Effective treatment requires accurate diagnosis. Ensure your plan covers critical diagnostic tools like X-rays, laboratory work, and MRI or CT scans. These costs accumulate more rapidly than many anticipate.

- Prescription Medications: Your coverage should extend to medications prescribed during an emergency and for a defined period post-discharge, typically up to a 30-day supply.

- Medical Evacuation: In a severe case, you may need to be transferred to a more specialized facility or repatriated to your home country. This is an extremely costly service, and its inclusion is a clear indicator of a premium insurance plan.

The market for this type of protection is expanding. The Canada Travel Insurance Market was valued at USD 542.9 million in 2023 and is projected to more than double to USD 1101.2 million by 2030. This growth presents more options, but it also demands greater diligence in your evaluation.

Understanding the Financial Mechanics of Your Policy

Beyond the scope of coverage, you must master the financial terms that dictate your out-of-pocket expenses. Three key figures define your financial arrangement with the insurer.

1. The Policy Maximum

This is the absolute limit the insurance company will pay for all your covered medical expenses. For visitors to Canada, $100,000 is a common baseline, but given the high cost of care, a policy with a $500,000 maximum or higher provides genuine peace of mind.

2. The Deductible

This is the amount you are responsible for paying before the insurance company begins its payments. Opting for a higher deductible can reduce your premium, but it also increases your initial financial exposure in the event of a claim.

3. Co-insurance

After your deductible has been met, co-insurance may apply. It is a cost-sharing arrangement between you and the insurer. An 80/20 split, for example, means they pay 80% of the bill and you pay the remaining 20% up to a specified limit. The best plans often offer 100% coverage after the deductible is satisfied.

The Critical Issue of Pre-Existing Conditions

For many visitors, this is the single most important clause in the entire policy. Insurers typically define a pre-existing condition as any health issue for which you experienced symptoms, received treatment, or took medication before your policy's effective date.

A policy's true value often hinges on how it defines a 'stable' pre-existing condition. This generally means your condition has not changed—no new symptoms, treatments, or medications—for a specified period, often 90 to 180 days, prior to your trip.

If your condition meets this stability clause, a sudden emergency related to it will likely be covered. If it is deemed unstable, you will be personally liable for those costs. Complete transparency regarding your medical history is not merely advisable; it is essential to ensure your policy's validity when you need it most.

For a broader perspective on how various travel-related risks are covered, this guide to train travel insurance in Australia offers some valuable parallels.

Understanding the distinction between a basic plan and one offering robust protection is key. The following comparison highlights the advantages of more comprehensive coverage.

Standard vs. Enhanced Visitor Insurance Coverage

| Coverage Feature | Standard Plan | Enhanced Plan |

|---|---|---|

| Policy Maximum | Often capped at $100,000 or less | Typically $500,000 to $1 million+ |

| Pre-Existing Conditions | Limited or no coverage for unstable conditions | May cover stable conditions with a longer look-back period |

| Medical Evacuation | Often excluded or has a very low limit | Comprehensive coverage for evacuation and repatriation |

| Follow-up Visits | Usually not covered | May cover a limited number of follow-up visits after an emergency |

| Dental Emergencies | Basic pain relief only | More extensive coverage for accidental dental injuries |

| Out-of-Pocket Maximum | May have high co-insurance with no cap | Often has a clear out-of-pocket maximum for your protection |

Ultimately, while a standard plan may appear more economical upfront, an enhanced plan provides the comprehensive protection necessary to prevent a medical emergency from becoming a financial catastrophe.

Choosing the right policy requires a careful balancing of these factors against your health profile and your personal threshold for risk. If you are exploring various types of health coverage, you may find value in a deeper analysis of which expat medical insurance policy type is right for you.

Understanding the Cost of Your Medical Insurance

Determining the premium for visitor medical insurance in Canada is not an opaque process. It is a direct calculation of risk based on specific variables. Understanding how these key factors influence your final cost allows you to make an informed financial decision that aligns with your risk tolerance.

Consider these factors as levers; adjusting one, such as your coverage amount, directly impacts the price. By examining these elements with clarity, we can remove the guesswork, enabling you to construct a policy that delivers substantial protection at a rational price point.

The Primary Drivers of Your Insurance Premium

Your premium is calculated based on a handful of core data points. Insurers use these to assess the probability of a claim and the potential payout amount.

- Your Age: This is a primary factor. Statistically, the likelihood of requiring medical care increases with age. Consequently, premiums rise accordingly.

- Coverage Amount: The maximum payout you select—whether $100,000 or $1 million—directly affects the price. A larger financial safety net for you represents a greater potential liability for the insurer.

- Deductible Level: Your deductible is the amount you agree to pay out-of-pocket before the insurance coverage activates. Selecting a higher deductible indicates a willingness to assume more initial risk, which almost always results in a lower premium.

- Duration of Your Stay: This is a matter of simple mathematics. A longer visit corresponds to a longer period of potential risk; therefore, a six-month policy will cost more than a two-week policy.

Real-World Premium Scenarios

To illustrate how these factors interact, let us consider two distinct visitor profiles.

First, a healthy 35-year-old professional visiting for two weeks who selects a $100,000 policy with a minimal deductible. Their risk profile is low due to their age, health, and short stay, resulting in a very affordable premium.

Next, a 68-year-old visitor staying for six months who requires coverage for a stable pre-existing condition and desires a comprehensive $500,000 policy. This profile represents a higher risk due to age, the extended duration of the stay, and the existing health factor. The premium will be substantially higher, but it is a prudent cost for that level of asset protection.

The widespread purchase of this insurance among visitors indicates a sophisticated awareness of the risks. Without a Canadian health card, you are liable for every dollar of your medical bills. Insurance is the critical financial tool that prevents a medical event from becoming a financial crisis.

The data supports this. Over 70% of visitors to Canada purchase emergency medical insurance. The cost variation by age is significant. For a 30-day trip with $100,000 in coverage, a healthy 25-year-old might pay approximately $72.30. A 75-year-old could expect to pay around $240 for the same basic plan. If that 75-year-old requires coverage for pre-existing conditions, the premium can exceed $328.80 per month. You can find more specific data on visitor insurance costs in Canada by reviewing these findings.

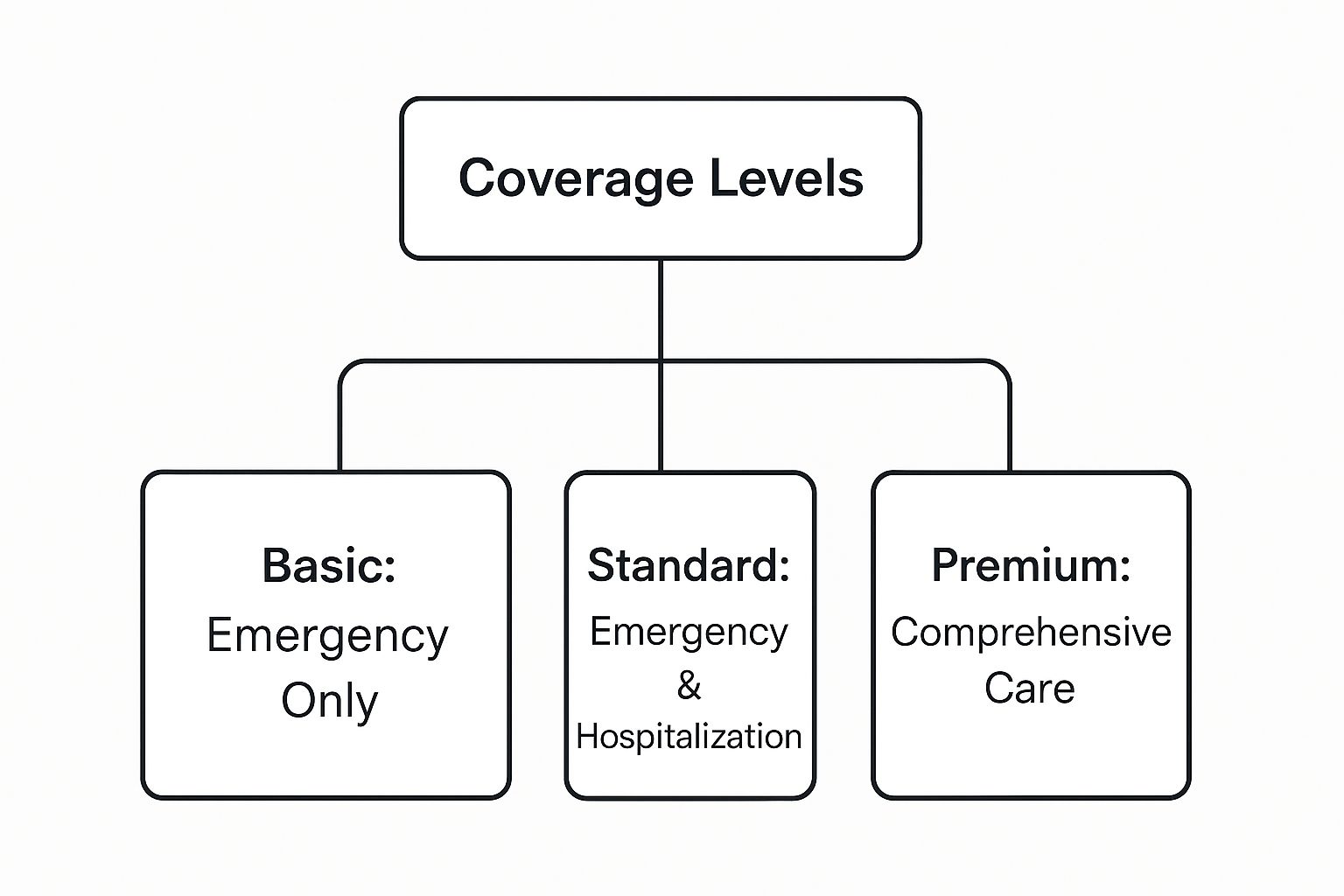

Visualizing Your Coverage Options

The diagram below illustrates the typical tiers of medical insurance available, from basic emergency protection to more comprehensive care.

As shown, advancing from a Basic to a Premium plan significantly expands your financial protection, and the policy's cost will reflect that increased value. By understanding these factors, you can achieve the optimal balance between cost and coverage, ensuring your insurance is a sound investment in your financial security while in Canada.

Selecting the Right Insurance Provider

A common error when purchasing medical insurance for visitors to Canada is to focus solely on the lowest price.

The true value of an insurance policy is not its acquisition cost, but its performance at the time of a claim. A low premium is rendered worthless if the provider is unresponsive or erects barriers during a medical emergency.

Choosing an insurer demands the same due diligence you would apply to selecting a major financial partner. You are not purchasing a simple product; you are securing a promise of support during a time of significant vulnerability.

Assessing Financial Stability and Reputation

Your initial assessment should focus on the insurer's financial strength. Do they possess the capital to honour a large claim? This is determined by ratings from independent agencies like A.M. Best, which evaluates the financial health of insurance companies. An “A” rating or higher is a strong indicator of their ability to meet financial obligations.

Beyond financial metrics, reputation provides a crucial narrative. Seek providers with a long-standing presence in the Canadian market. Longevity often correlates with stability and a deep understanding of the Canadian healthcare system. When reading online reviews, do so with a critical eye, looking for patterns in claims handling and customer support rather than isolated complaints.

The ultimate test of an insurance provider is its performance under pressure. A financially sound company with a sterling reputation is your best guarantee that support will be available and efficient when you need it most.

Scrutinizing the Policy Language

The critical details of an insurance agreement are embedded in the policy wording. This document is a legal contract that must be unequivocally clear. Vague or ambiguous language can create loopholes that are unlikely to benefit you during a claim.

Pay meticulous attention to the sections on exclusions and limitations. This is where the policy specifies what it will not cover and is the source of most disputes. A trustworthy provider will define these terms clearly, without resorting to jargon. If you cannot easily understand the limitations regarding certain activities, pre-existing conditions, or follow-up care, consider it a significant red flag.

Evaluating the Claims Process and Emergency Support

The efficacy of an insurance plan is determined by its claims process and emergency support infrastructure. In a crisis, you require immediate, clear guidance, not a bureaucratic labyrinth. Your investigation should focus on the following:

- 24/7 Multilingual Assistance: The provider must offer a round-the-clock emergency hotline. It should be staffed by professionals capable of communicating in multiple languages, coordinating with medical personnel, and arranging critical services like medical evacuation.

- Direct Billing Network: The best insurers maintain direct payment agreements with an extensive network of Canadian hospitals and clinics. This is a crucial feature. It means the provider pays the hospital directly, saving you from having to settle a massive bill out-of-pocket and then seek reimbursement.

- Claim Submission Process: For less urgent matters, how is a claim filed? A modern provider will feature a streamlined online portal with clear instructions. A cumbersome, paper-based process indicates outdated systems and potential delays.

For those planning an extended stay or potential relocation, exploring more comprehensive health coverage is a wise step. You can learn more about securing health insurance for expatriates in Canada to understand how long-term plans are structured.

By methodically evaluating each potential provider against these key criteria—financial stability, policy clarity, and service quality—you transform a guess into a strategic decision. This approach ensures you partner with an organization that provides genuine security, not just a document.

A Few Common (and Costly) Misconceptions About Visitor Insurance

When addressing medical insurance for visitors to Canada, several common assumptions can lead to catastrophic financial errors. These misunderstandings of risk can transform a simple medical issue into a life-altering financial event.

It is time to dismantle these myths with precision.

One of the most significant errors is believing that a standard travel insurance policy from one's home country is sufficient for medical care in Canada. It is not. While those policies are excellent for flight cancellations or lost luggage, their medical coverage is almost always inadequate.

They are simply not structured to handle the substantial cost of a hospital stay or emergency surgery in this country. The coverage limits are often far too low, leaving you exposed to the full financial weight of Canadian healthcare bills.

The Credit Card Coverage Fallacy

Another perilous assumption is relying on the complimentary travel medical insurance offered by a premium credit card. While presented as a valuable benefit, it is rarely a viable substitute for a dedicated visitor medical policy. The coverage is typically an illusion—thin in scope and brief in duration.

These credit card plans often have remarkably low maximums, sometimes only $25,000. While that may seem like a large sum, it could be exhausted by a single day in a Canadian ICU. Furthermore, they are filled with restrictive clauses and exclusions, designed for a short weekend trip, not an extended business stay or family visit. Using this as your primary safety net is a significant and entirely avoidable gamble.

Believing your credit card insurance is comprehensive medical protection is like thinking a first-aid kit can replace a fully staffed emergency room. It’s useful for a scraped knee, but it’s fundamentally useless in a real crisis.

Even Canadians Misunderstand This

To appreciate how easily insurance needs can be misjudged, one need only look at Canadians travelling within their own country. It serves as a perfect case study.

A recent survey revealed a startling gap: while 73% of Canadians planned to travel, a mere 42% secured emergency travel medical coverage. The reason? Many incorrectly assume their provincial health plan covers all medical expenses anywhere in Canada.

This is false. Critical services, such as an ambulance transport in another province—which can easily cost over $700—are often not included. If even residents underestimate their financial risk when travelling domestically, it becomes clear that international visitors are in a far more precarious position. You can discover more about these travel insurance misconceptions and draw the relevant parallels.

By seeing past these common myths, you can approach your decision with the necessary clarity. A dedicated visitor medical insurance policy is not an ancillary expense; it is a specific financial instrument engineered to shield your assets from the very real and very high costs of Canadian healthcare.

Frequently Asked Questions

Regarding visitor medical insurance, several practical questions arise consistently. Clarifying these points is key to a seamless and secure stay in Canada. Let us address the most important ones.

Can I Purchase Insurance After Arriving in Canada?

While technically possible, it is strongly inadvisable. It represents an enormous and unnecessary risk.

A few providers will sell a policy after you have landed, but it almost invariably includes a mandatory waiting period for illnesses, typically 48 to 72 hours. While accidents may be covered from the policy's start, any sickness that manifests during that waiting period will be your full financial responsibility.

This creates a dangerous gap in your protection. The only prudent and intelligent strategy is to secure your policy before you travel, ensuring you are covered from the moment you arrive.

What Differentiates Visitor Insurance and Super Visa Insurance?

The primary distinction is that Super Visa insurance is governed by specifications set by the Canadian government. It is a specific type of medical insurance for visitors to Canada designed to meet the strict criteria mandated by Immigration, Refugees and Citizenship Canada (IRCC).

If you are applying for a Super Visa, your policy must:

- Be issued by a Canadian insurance company.

- Provide a minimum of $100,000 in coverage.

- Be valid for at least 365 days from your date of entry.

Standard visitor insurance offers greater flexibility. It is designed for shorter trips and allows for a choice of different coverage amounts and policy durations. For a more detailed review of common questions, please consult our comprehensive FAQ page.

How Is a Medical Claim Processed in Canada?

In a genuine medical emergency, your sole priority is to obtain help. Proceed to the nearest hospital or clinic immediately.

As soon as is practical, you or a family member must call your insurer’s 24/7 emergency assistance line. This call is critical, as it initiates the claims process. They will open a claim file on your behalf.

For most hospitalizations, the assistance team will arrange for direct billing with the hospital. This is a significant advantage, as it means you will not have to pay a substantial bill upfront and await reimbursement. For any non-emergency care, always contact your insurer before consulting a doctor to confirm coverage and follow their established procedure. Keep your policy number and the emergency contact number in a location that is always accessible.

For expert guidance in securing premium international medical insurance that aligns with your professional and personal requirements, contact Riviera Expat. Our specialized advisory services ensure your health and financial well-being are protected, wherever your work takes you. Discover your options at https://riviera-expat.com.