Welcome to Canada. While our country is renowned for its exceptional healthcare system, it is crucial for visitors to understand that these services are funded by residents and are not complimentary for non-residents. Consider medical insurance for a visitor to Canada not as a discretionary travel expense, but as a fundamental component of a well-planned visit. It is your financial safeguard and the key to ensuring peace of mind throughout your stay.

Safeguarding Your Visit to Canada

Arranging a trip to Canada extends beyond flight bookings and accommodation. It involves prudent risk management. An unforeseen illness or minor accident can rapidly escalate into a significant personal liability, as visitors are responsible for the full cost of their medical care. This reality underscores why visitor medical insurance is not an afterthought, but a critical element of your travel preparations.

This guide will articulate why this coverage is indispensable. We will analyze the necessity of such a policy before delving into the specifics of selecting the right plan, understanding its coverage, and navigating the claims process should the need arise.

The Financial Imperative of Securing Coverage

The financial exposure of foregoing insurance is considerable. To illustrate, a healthy younger visitor seeking a standard $100,000 coverage policy might anticipate a monthly premium of approximately $70 to $90.

In contrast, an older visitor, perhaps in their 80s with pre-existing medical conditions, could see premiums for the same $100,000 coverage exceed $450 per month. These figures are not arbitrary; they reflect the substantial potential costs of Canadian medical care that would otherwise be your direct responsibility. Canada's publicly funded healthcare is an excellent system, but it is structured for residents, not visitors.

Visitor medical insurance should not be viewed as a mere travel cost. It is a strategic investment in your financial security, acting as a buffer against unexpected medical expenses that can disrupt your visit and allow you to focus on your objectives in Canada.

To provide a clear perspective on what is at stake, the following table summarizes the key considerations.

Key Considerations for Visitor Medical Insurance

| Consideration | Key Takeaway for Visitors |

|---|---|

| High Cost of Canadian Healthcare | Without insurance, a minor emergency room visit can result in thousands of dollars in expenses. A major medical event can be financially devastating. |

| Public System Inaccessibility | Canada's provincial health plans, such as Ontario's OHIP, do not extend coverage to tourists, temporary visitors, or Super Visa applicants upon their arrival. |

| Visa & Entry Requirements | For certain visa categories, like the Super Visa for parents and grandparents, proof of adequate medical insurance is a mandatory condition for entry. |

| Peace of Mind | Comprehensive coverage allows you to enjoy your visit without the underlying concern of "what if?" scenarios related to health emergencies. |

Ultimately, securing the right insurance is about protecting your financial interests from arrival to departure.

Of course, a seamless and protected visit begins before policy acquisition. The first step is ensuring your entry is straightforward by understanding Canada's ETA and visa requirements. With your travel documents in order, securing appropriate medical coverage is the next vital step.

Determining Eligibility and Appropriate Coverage Levels

Before selecting medical insurance for a visitor to Canada, one must first ascertain eligibility and determine the appropriate level of financial protection required for the visit. Eligibility is broad, encompassing tourists, professionals on work permits, and international students.

However, for one specific group, this insurance is not merely advisable—it is a mandatory requirement. This applies to parents and grandparents visiting family under the Super Visa program, for whom the Canadian government has established specific, non-negotiable insurance criteria.

The Super Visa Insurance Mandate

For Super Visa applicants, the insurance requirement is absolute. The application is contingent upon providing proof of a private medical insurance policy that satisfies three distinct criteria:

- It Must Be from a Canadian Insurer: The policy must be underwritten by an insurance company based in Canada.

- It Needs at Least $100,000 in Coverage: The plan must provide a minimum of $100,000 in coverage for healthcare, hospitalization, and repatriation.

- It Has to Be Valid for One Full Year: The coverage must be effective for at least one year from the date of entry into Canada.

Failure to meet any of these stipulations will result in the denial of the visa application. It is therefore imperative to secure a compliant policy well in advance of the planned travel date.

How to Assess Your Personal Coverage Needs

For visitors not applying for a Super Visa, how does one determine the appropriate coverage amount? The decision should be a strategic one, based on the specific parameters of the visit.

A standard $100,000 policy is often sufficient for a short, low-risk visit. However, for extended stays or itineraries that include more strenuous activities, increasing this limit is a prudent measure.

Consider the visitor's planned activities. If they intend to ski in Whistler, hike in remote national parks, or engage in adventure sports, their risk profile increases. In such cases, a higher limit—for instance, $500,000 or more—provides a more robust financial safety net. The costs associated with specialized emergency care and medical evacuations, particularly from remote locations, can be exceptionally high.

The visitor's health profile is the other critical component. A younger individual with no pre-existing conditions may be adequately protected by a basic policy. Conversely, for an individual with a chronic health issue, higher coverage is essential to ensure that any unexpected exacerbations or complications are managed without incurring catastrophic personal expense.

Ultimately, the selected policy should be a direct reflection of the visitor's health, duration of stay, and planned activities. This thoughtful approach ensures your coverage is a functional tool designed to protect your financial well-being while in Canada.

Deconstructing Your Policy: Understanding Core Features

When evaluating visitor insurance policies, it is easy to focus on the headline coverage amount—the $100,000 or $200,000 figure. However, the true value of a policy is found not in this total, but in the specific features that become active when you require assistance.

Let us examine the components that constitute a truly effective policy.

At its core, every robust plan is built around emergency medical care. This is not a vague assurance but a defined list of services designed to address a sudden health crisis. This includes hospitalization, physician's fees, diagnostic services such as X-rays, and prescription medications required for stabilization.

However, a serious medical event often has broader implications. This is where other critical benefits provide layers of protection that can be invaluable.

- Emergency Dental: For sudden, acute dental pain or accidental injury to teeth.

- Medical Evacuation: This is a crucial benefit. If you are in a remote area where local medical facilities are inadequate, this covers the cost of transportation to a suitable medical center.

- Repatriation: This covers the expense of returning you to your home country for ongoing treatment or, in the gravest circumstances, the arrangements for the return of remains.

These features transform a basic plan into a comprehensive safety net, managing a crisis from the initial treatment through to a safe return home.

The Critical Issue: Pre-Existing Conditions

This is where policies require careful scrutiny. A commonly misunderstood aspect of visitor insurance is its treatment of pre-existing conditions. Insurers draw a critical distinction between a 'stable' condition and an 'unstable' one.

A condition is generally deemed stable if there have been no changes in treatment, medication, or symptoms for a specified period—often 90 to 180 days—prior to the policy's effective date.

Most policies will cover a sudden, unexpected flare-up of a stable pre-existing condition. However, if a condition is unstable, any related medical event will almost certainly be excluded. It is for this reason that complete transparency regarding one's entire health history is paramount. Nondisclosure is the most direct path to a denied claim.

Comparing Essential and Optional Insurance Features

To assist in determining which features are non-negotiable versus those that are supplementary, here is a breakdown of standard versus enhanced benefits. This can help you prioritize coverage based on your specific requirements and budget.

| Coverage Feature | Typical Inclusion | Importance Level |

|---|---|---|

| Emergency Hospital Care | Standard | Critical |

| Physician Services | Standard | Critical |

| Prescription Drugs | Standard (for emergencies) | High |

| Medical Evacuation | Often Standard | Critical |

| Emergency Dental | Standard (limited) | High |

| Repatriation | Standard | High |

| Stable Pre-existing Conditions | Optional/Add-on | Depends on Individual |

| Trip Interruption/Cancellation | Optional/Add-on | Moderate |

| Accidental Death & Dismemberment | Optional/Add-on | Moderate |

Ultimately, the optimal mix of features is dictated by your personal health, the nature of your trip, and your risk tolerance.

Understanding the Financial Terminology

To fully command your policy, you must understand its financial architecture. The most important term is the deductible.

The deductible represents your portion of the cost. It is the fixed amount you must pay out-of-pocket for an approved medical expense before the insurance company begins its contribution. For example, with a $500 deductible, you are responsible for the first $500 of any approved bill.

Selecting a higher deductible will typically lower your monthly premium, which can be an attractive option. However, it also increases your immediate out-of-pocket expense in the event of a claim. A lower deductible results in a higher premium but less financial impact during a claim. This is a strategic trade-off, and the correct choice depends on your personal financial strategy and risk appetite.

It is worth noting that many visitors mistakenly assume that coverage from a credit card or a home-country plan will suffice. In reality, these plans are often inadequate, which is precisely why a dedicated visitor insurance policy is necessary. For complex policy documents, a tool like an AI-powered Healthcare Policy Analyzer can help identify key features and limitations.

How Much Will Your Insurance Plan Actually Cost?

Determining the cost of visitor medical insurance for Canada is not a simple matter of selecting a product with a fixed price. The final premium is a carefully calculated figure that reflects the specific risk being underwritten by the insurance provider for you or your guest.

The insurer assesses several key factors to create a premium that aligns precisely with the protection being purchased. It is a balance between your requirements and their potential financial exposure.

The Four Primary Drivers of Your Premium

The cost of your plan is primarily determined by four core elements.

- The Visitor's Age: This is the most significant factor influencing cost. Statistically, the likelihood of requiring medical care increases with age. Consequently, a policy for a 70-year-old parent on a Super Visa will be priced higher than one for a healthy 30-year-old on a brief holiday.

- Your Coverage Maximum: The size of your financial safety net is a key determinant. Choosing a $100,000 coverage limit versus a $500,000 limit will have a substantial impact on the premium. A higher limit provides greater financial security, and this enhanced protection is reflected in the cost.

- Length of the Visit: This is a straightforward calculation. A policy covering a two-week visit represents a smaller window of risk than one spanning an entire year. The longer the duration of the stay, the greater the opportunity for an insurable event to occur, and the price adjusts accordingly.

- The Deductible: This is the amount you agree to pay out-of-pocket before your insurance coverage activates. By selecting a higher deductible, you assume more of the initial risk, which in turn lowers your premium. It is a strategic trade-off between your upfront costs and your potential liability in the event of a claim. If you are interested in the mechanics of premium pricing, our article on why medical insurance premiums rise year after year provides further insight.

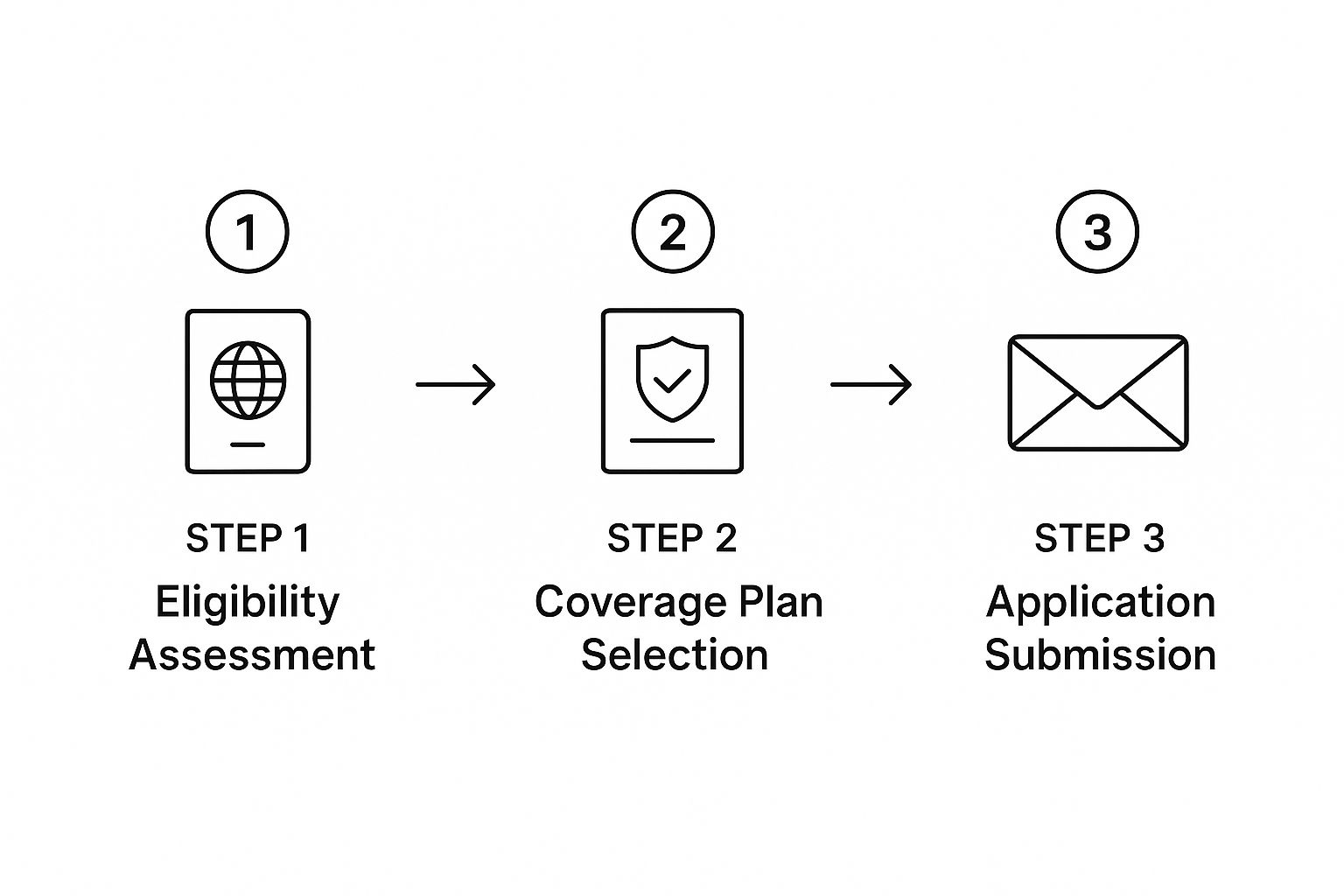

Once these factors are decided, obtaining your plan is a methodical process, as illustrated in this infographic.

It is a systematic progression, moving from assessment to final purchase, ensuring every detail is meticulously addressed.

The Impact of Pre-Existing Conditions

Beyond these four primary factors, a visitor’s personal health history is a significant variable in the pricing equation.

The presence of a pre-existing health condition—even one that is stable and well-managed—introduces an additional layer of risk from the insurer's perspective. It is logical, therefore, that policies which offer coverage for stable pre-existing conditions command a higher premium.

While this may seem like an additional expense, securing this specific coverage is one of the most prudent investments you can make. It provides essential protection against a sudden recurrence or complication that could otherwise result in substantial personal medical debt.

How to Select and Purchase Your Policy

Securing the right medical insurance for a visitor to Canada is a deliberate process. It begins with foundational information: the visitor’s full legal name, their date of birth, and their precise travel dates. These details are the non-negotiable basis for any insurance quote.

With this information, you can begin to survey the market. Canada has a number of excellent insurance carriers, each with distinct strengths. Utilizing an online comparison tool is an efficient way to juxtapose multiple quotes, offering a clear overview of coverage limits and premiums.

Seeking Bespoke Counsel

While online tools provide a valuable market overview, they cannot replicate the nuanced guidance of a professional. For any situation that is not entirely straightforward—particularly when pre-existing health conditions are a factor—consulting a licensed insurance advisor is a highly recommended course of action.

A proficient advisor offers more than a price comparison. They are experts in policy language and can clarify the real-world implications of exclusions, ensuring the chosen plan is perfectly aligned with the visitor’s health profile and travel itinerary. The objective extends beyond the premium to assess factors that deliver genuine security:

- Insurer Financial Stability: Is the underwriting company financially sound and reputable?

- Client Service Reputation: What is their service record? Do they process claims efficiently and provide exemplary client support?

- Policy Language Precision: Is the wording unambiguous? It is vital to understand precisely how terms like "emergency" or the "stability" period for a pre-existing condition are defined.

The goal is not merely to find the least expensive policy, but to identify the one that offers the most robust value and security. This involves selecting an insurer known for its integrity and a policy with fair, transparent terms, ensuring support is available when it matters most.

Finalizing Your Application

Once you have selected the optimal policy, the application phase demands meticulous attention. The paramount rule is to provide full and accurate disclosure. Be completely forthright with all requested information, especially concerning medical history.

Even a minor omission or misstatement can provide an insurer with grounds to void a policy or deny a claim, rendering your investment useless. This final step is absolutely critical to ensuring the validity and protective power of your policy. For further reading, our guide on choosing the right type of health insurance policy offers additional valuable perspectives.

Navigating a Medical Emergency: The Claims Process

This is the contingency for which you have planned. A fall on an icy surface, a sudden fever, or an unexpected allergic reaction—medical emergencies are indiscriminate. In such a moment, your visitor medical insurance policy transitions from a document to a vital resource.

Understanding the correct protocol when a crisis occurs is key to accessing prompt, effective care without incurring significant financial distress.

The first, most critical action in nearly any medical emergency is to contact your insurer's 24/7 emergency assistance number. Unless the situation is imminently life-threatening, this call should be your immediate priority, made before receiving treatment if possible. This is not a mere call center; it is your dedicated care coordination team.

Your Assistance Team is Your First Call

Consider the emergency assistance service as your medical concierge during a crisis. Their role extends far beyond answering a telephone.

Upon contact, they will direct you to an appropriate hospital or clinic within their network. Crucially, they will arrange for direct payment to the medical facility whenever possible. This single action is designed to prevent you from having to pay thousands of dollars out-of-pocket at the point of service.

By establishing direct billing, the assistance team manages the financial logistics on your behalf. This allows you and your family to concentrate on the medical situation at hand, rather than contending with hospital administration and credit card limits during a period of extreme stress.

Keeping Records When You Pay Upfront

In some instances, direct billing may not be feasible, such as in a remote location or at a small clinic. In these cases, you will be required to pay for the services directly and subsequently file a claim for reimbursement. When this occurs, meticulous record-keeping is essential.

You must retain every original document related to the medical event. To process a claim efficiently, insurers require a specific and complete paper trail.

- Original Itemized Receipts: Obtain detailed, itemized receipts for all services—physician's fees, hospital charges, prescriptions, and any treatments. A simple credit card receipt will not suffice.

- Physician’s Medical Report: A report from the attending physician is required. It should clearly state the diagnosis and the treatment administered.

- Proof of Travel: Keep copies of flight itineraries or passport entry stamps available to confirm your travel dates.

A simple but effective tip: Keep your policy number and the insurer's emergency contact information readily accessible. The most efficient method is to take a photograph of your insurance card and save it on your smartphone. In a high-pressure emergency, you will not want to be searching through luggage for a telephone number.

A Few Common Questions, Answered

When arranging visitor insurance for Canada, several questions frequently arise. Let us address the most common inquiries with clear, direct answers.

Can I Just Buy Insurance After I Land in Canada?

Yes, it is possible. Many insurance companies offer policies for purchase after arrival in Canada. However, this approach comes with a significant caveat: a waiting period.

Policies purchased from within Canada almost invariably include a delay, typically 48 hours or more, before coverage for sickness becomes effective. While accidents may be covered immediately, this creates a coverage gap where any new illness would not be protected. The most prudent strategy is to secure your policy before departing for Canada. This ensures you have comprehensive protection from the moment you arrive.

What's So Special About "Super Visa" Insurance?

Super Visa insurance is not merely a different plan option; it is a specific, government-mandated requirement for parents and grandparents visiting under the Super Visa program. It should be viewed not as a recommendation, but as a non-negotiable condition of entry.

The following criteria distinguish it from a standard visitor policy:

- It Must Be Canadian: The policy must be issued by a Canadian insurance company.

- Serious Coverage: It must provide a minimum of $100,000 in emergency medical coverage.

- One-Year Commitment: The policy must remain valid for a full 365 days from the date of entry into Canada.

Does Visitor Insurance Cover COVID-19?

In most cases, yes. The majority of Canadian visitor insurance plans now treat COVID-19 like any other new illness that may be contracted after the policy's effective date.

The crucial condition is that there must be no symptoms or a positive diagnosis prior to the policy becoming effective. Of course, the specific language can vary between insurers. It is always advisable to review this section of the policy carefully or consult an advisor to confirm the exact limits and conditions related to COVID-19 coverage.

At Riviera Expat, our role is to provide clarity on these important details and assist you in selecting the appropriate insurance for your needs. Allow us to help you secure the peace of mind that comes with proper coverage. Learn more at Riviera Expat.