Consider medical flight insurance the ultimate contingency plan for a health crisis abroad. It is the bespoke service that transports you from a foreign hospital to a premier medical institution of your choice, typically in your home country.

This is a critical distinction. A standard travel insurance policy is engineered to get you to the nearest adequate facility. Medical flight insurance is designed for a different, far more precise purpose: delivering you to your hospital of choice.

Your Non-Negotiable Lifeline for Global Travel

Imagine a scenario that occurs with unfortunate frequency. You suffer a serious medical emergency while living or traveling overseas. The local hospital provides proficient stabilization, but it becomes apparent they lack the specialized expertise or advanced equipment required for your condition.

This is the precise moment the chasm between basic travel insurance and a dedicated medical flight plan becomes starkly evident. One policy takes you to a safe, nearby hospital. The other grants you executive control. It empowers you to dictate where you receive definitive, high-stakes medical care.

For high-net-worth individuals and expatriates accustomed to a superior caliber of medical services, this is not merely an ancillary benefit. It is a core component of a sophisticated global risk management strategy.

Beyond Standard Travel Coverage

It is most accurate to view medical flight insurance as a highly specialized instrument. It does not replace your primary health insurance; it functions in concert with it. While your international private medical insurance (IPMI) covers the cost of treatment, the medical flight policy finances the exceptionally expensive journey to access that treatment.

This fills a perilous gap that most individuals do not recognize until it is too late. The cost and logistical complexity of a private air ambulance are staggering, frequently reaching six figures. This insurance is specifically structured to absorb that entire financial impact.

A medical flight is not a mere transport service. It is a comprehensive, meticulously managed, bed-to-bed solution. The process encompasses everything from ground ambulance coordination at both departure and arrival points to a dedicated medical team in the air, ensuring a seamless and secure transfer between facilities.

Why This Coverage Is Essential

To be clear: this coverage is not about circumventing all foreign hospitals, many of which are excellent. It is about securing guaranteed access to the right hospital when a situation becomes critical. In a genuine crisis, the last concern you should have is navigating an unfamiliar and potentially bureaucratic healthcare system. You require the ability to return to your own physicians and specialists within a system you know and trust.

This type of plan ensures a medical emergency does not escalate into a logistical and financial catastrophe. It provides a pre-arranged, unambiguous solution for a worst-case scenario. For a global professional, this is not just another policy. It is a guarantee of access to premier care, irrespective of your location, protecting both your health and your financial assets when you are most vulnerable.

What Does Medical Flight Insurance Actually Cover?

To fully appreciate the value proposition of medical flight insurance, one must look beyond marketing platitudes. This is not a travel perk; it is a high-stakes logistical operation, fine-tuned to transport you safely to a hospital of your choosing when a crisis erupts abroad.

The entire framework is engineered to restore your control and ensure you receive the highest standard of care when you are at your most vulnerable.

At the core of any premier policy is medically necessary evacuation. This is the trigger. If a local physician and the insurance provider’s own medical director concur that your condition is severe enough to warrant transfer to a better-equipped hospital, the entire apparatus is set in motion. It is a critical distinction—this is not for elective procedures, but a direct response to a bona fide medical emergency.

This is a world apart from standard travel insurance. That market, with a global size of around USD 5.24 Billion in 2022, primarily covers unforeseen medical bills and transport to the nearest suitable facility. It functions as a financial safety net, not a personal medical logistics service. You can discover more about this growing market and its trends.

The Hallmark of Elite Service: Bed-to-Bed Coordination

The single most defining feature of a premium medical flight plan is comprehensive bed-to-bed service. This is not a mere buzzword. It signifies a completely managed, seamless transfer from the moment the evacuation is approved until you are admitted and settled at your destination hospital.

Think of it as a personal, medically supervised relay where every single handoff is executed with precision.

- Ground Ambulance Coordination: The process begins with a fully equipped ground ambulance arriving at your local hospital.

- Airport Logistics: The provider's operations center manages all logistical complexities—tarmac access, flight clearances, and departure coordination.

- In-Flight Medical Team: You will fly with a dedicated medical crew, typically a physician and a critical care nurse, utilizing equipment specifically selected for your condition.

- Arrival and Transfer: Upon landing, another ground ambulance is waiting on the tarmac for the final transfer to the receiving hospital.

This end-to-end management removes an enormous burden from you and your family. The last thing anyone needs during a medical crisis is to become an impromptu expert in international transport logistics.

Repatriation to Your Hospital of Choice

Another crucial benefit is repatriation to a hospital of your choice. A basic policy might only transport you to the closest major medical hub. A premium plan, however, empowers you to return home. This facilitates treatment from your own physicians within a healthcare system you know and trust—a factor that provides a level of comfort and confidence that is impossible to quantify.

This is not simply about geography; it is about continuity of care. Access to your complete medical history, your trusted specialists, and a support network of family and friends can significantly impact your recovery. It represents the ultimate control over your own healthcare.

Finally, any high-caliber plan will include coverage for a traveling companion. This ensures a family member or trusted associate can accompany you, providing vital emotional support throughout the journey. The policy typically covers their travel costs, which is one less detail to manage during an already stressful time.

Together, these core benefits create a powerful safety net, transforming a potential disaster into a managed, controlled process.

Navigating Policy Exclusions and Limitations

This is where the true value of any insurance policy is determined. It is not the bold promises on the brochure that matter, but the precise language in the exclusions section. A medical flight insurance plan is no different—what it will not cover is as important as what it will.

Overlooking these details is a significant oversight. You cannot afford to discover a coverage gap amidst a medical crisis. For discerning expatriates, scrutinizing the fine print is not merely good practice; it is fundamental risk management.

The Critical Issue of Pre-Existing Conditions

Let us address the single most common reason for claim denials: pre-existing medical conditions. This clause is the gatekeeper that determines whether your evacuation is approved. Each provider has its own definition, making a direct, side-by-side policy comparison non-negotiable.

So, what constitutes a pre-existing condition? Generally, it is any health issue for which you have experienced symptoms, received treatment, or been prescribed medication within a specific time frame before your policy's inception. This "look-back" period can range from 90 days to several years.

The broader travel medical insurance market, valued at approximately USD 30.59 billion in 2022, grapples with this challenge. It represents a significant hurdle for many international travelers who require truly reliable coverage.

Do not underestimate this detail. A policy might decline to cover transport for a cardiac event if your heart medication was adjusted a month prior to your trip. It is imperative to secure a policy that genuinely aligns with your complete health profile.

An insurance policy is a precise contract. A provider’s interpretation of a "stable" versus an "unstable" pre-existing condition can be the deciding factor in whether a multi-hundred-thousand-dollar transport is covered. Absolute clarity on this point is essential.

Other Common Coverage Gaps to Scrutinize

Beyond pre-existing conditions, several other standard exclusions can leave you dangerously exposed. These typically relate to the circumstances under which the medical incident occurred.

Ignoring these can result in a substantial financial liability. For example, a heli-skiing excursion could end with an injury that your standard policy will not cover. For a more detailed analysis of how these clauses operate, our guide on medical conditions and what to watch out for in policy exclusions is an essential resource.

Maintain a sharp eye for these common exclusions:

- High-Risk Activities: Most basic policies will not cover injuries from activities they deem hazardous. This often includes scuba diving, mountaineering, or competitive motorsports. If you lead an adventurous lifestyle, you must secure a policy that explicitly includes these activities.

- Travel Advisories: Your coverage can be voided if your emergency occurs in a country for which your home government had issued a "Do Not Travel" advisory prior to your departure. Insurers view traveling there as a risk you knowingly accepted.

- Self-Inflicted Injuries: This is a universal exclusion. Incidents resulting from substance abuse or intentional self-harm are never covered.

By identifying these potential gaps beforehand, you can ask the right, incisive questions. This diligence is what transforms a policy document into a reliable safety net, ensuring your medical flight insurance will perform as expected without any unwelcome surprises.

The Financial Reality of Medical Air Transport

The decision to secure medical flight insurance becomes unequivocally clear the moment you consider the alternative: financing an emergency air ambulance out-of-pocket. The costs are not merely high; they can be financially catastrophic, easily rivaling the price of a luxury automobile or a down payment on a prime property.

Without a dedicated policy, the entire financial burden of a medical evacuation rests squarely on you. A single flight can range from $25,000 for a short, regional transport to well over $200,000 for a long-haul international flight. This is not an exaggeration; it is the stark financial reality of a worst-case scenario.

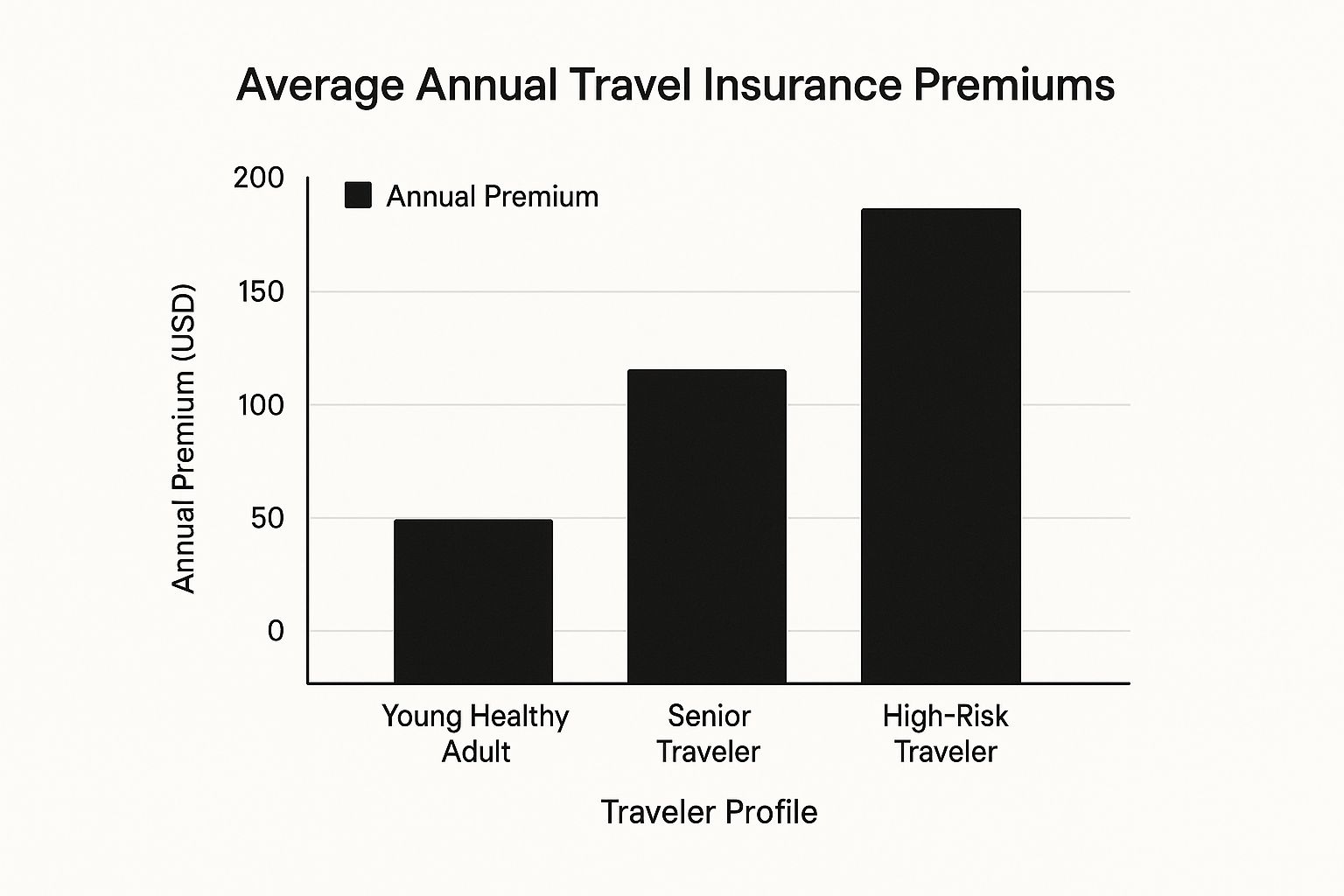

This infographic provides a clear illustration of typical annual premiums for medical flight insurance, demonstrating the affordability of this essential peace of mind.

As is evident, even for individuals considered higher risk, the annual cost of a robust policy represents a minute fraction of what a single uninsured flight would demand.

Anatomy of a Six-Figure Invoice

To understand why these costs escalate so dramatically, one must examine the components of such a flight. It is a complex logistical operation where every element carries a significant price tag. The final invoice is a composite of multiple, high-cost variables that are entirely beyond your control during an emergency.

Here are the key factors that determine the final cost:

- Flight Distance and Duration: This is the primary driver. Longer distances equate to more fuel, increased hours for the flight crew, and higher operational costs. Transport from Southeast Asia to Europe is fundamentally more expensive than a flight from the Caribbean to the U.S.

- Type of Aircraft: The patient's medical condition dictates the aircraft required. A fully equipped medical jet with ICU capabilities has a vastly higher hourly operating cost compared to a smaller turboprop used for shorter transfers.

- Onboard Medical Team: The cost includes the salaries for a specialized flight crew—often a critical care physician, a flight nurse, and respiratory therapists. Their expertise is non-negotiable and commands a premium.

- Landing and Overflight Fees: International flights accrue numerous fees for landing rights, airport services, and permission to traverse foreign airspace. These alone can add thousands to the final bill.

Global Evacuation Cost Scenarios

To bring this into sharp focus, let us examine the actual cost of an uninsured medical flight. An evacuation from a remote resort in South America back to a major U.S. hospital could easily cost between $80,000 to $120,000. Should a crisis occur in Southeast Asia requiring transport to a top facility in Europe, that invoice could climb to $220,000 or more.

Let's break down the staggering difference between paying out-of-pocket versus having insurance.

Estimated Medical Flight Costs vs. Insurance Premiums

| Evacuation Route | Estimated Uninsured Cost | Typical Annual Insurance Premium |

|---|---|---|

| Mexico to U.S. | $25,000 – $45,000 | $250 – $900 |

| Caribbean to U.S. | $35,000 – $60,000 | $250 – $900 |

| Western Europe to U.S. | $80,000 – $110,000 | $250 – $900 |

| South America to U.S. | $90,000 – $130,000 | $250 – $900 |

| Southeast Asia to U.S. | $180,000 – $250,000+ | $250 – $900 |

This table makes one point abundantly clear: a modest annual premium neutralizes a potentially life-altering financial risk.

When facing a serious health crisis, the last calculation you should be making is whether you can afford the flight that could save your life. Medical flight insurance removes this impossible choice from the equation entirely.

This is precisely why this coverage is not a luxury—it is an essential component of asset protection. It transforms a potentially ruinous financial shock into a predictable, manageable annual expense. This is especially true when you delve into policy specifics. To better understand how the fine print can affect your financial exposure, review our guide to excesses and deductibles in insurance plans.

For a small premium, you transfer a massive and unpredictable financial risk to an insurer. You secure not just your finances, but the peace of mind that you will have access to the best possible care, no matter where life or business takes you.

How to Select the Right Insurance Plan

Choosing the right medical flight insurance is less about selecting a policy and more about selecting the provider behind it. For those accustomed to a certain standard of service, this is not a simple purchase. It is an investment in a critical, life-saving response, and the quality of that response is dictated entirely by the provider.

When evaluating your options, a clear framework is essential. Move beyond a simple premium comparison and instead focus on the provider's operational integrity, medical expertise, and the fundamental structure of their business model. Let's examine the criteria that truly matter when ensuring a flawless evacuation.

Evaluating the Provider’s Operational Network

A provider’s true strength lies in its global operational network. An emergency can occur anywhere, from a remote island to a bustling metropolis with a strained healthcare infrastructure. The company you choose must possess the proven logistical capability to manage a complex evacuation from inception to completion. This requires established relationships with ground services, airports, and regulatory bodies worldwide.

The most critical distinction to make is whether the provider owns and operates its own fleet of aircraft or if it merely brokers flights from third-party charter services.

- Fleet Owners: Providers with their own dedicated, medically-equipped aircraft maintain direct control. They manage maintenance, crew scheduling, and can deploy immediately. This model almost invariably guarantees a higher standard of quality, faster response times, and consistent medical protocols.

- Brokers: Companies that charter planes on a case-by-case basis introduce a dangerous number of variables. They are entirely dependent on the availability of aircraft from partners, which can lead to delays, inconsistencies in equipment quality, and a lack of standardized medical care.

For any individual who demands precision and reliability, a provider that owns its fleet is unequivocally the superior choice.

In a crisis, you are not merely purchasing a flight. You are activating a highly skilled emergency response team. The pertinent question is: do you want the team that owns its own fire trucks, or the one that must call around to find one for you?

Scrutinizing Medical Credentials and Accreditations

The medical team accompanying you is as critical as the aircraft itself. You are entrusting them with your life in a high-stakes environment. Verifying the credentials of the provider’s medical staff is a non-negotiable step. The team should be comprised of experienced critical care physicians, nurses, and paramedics who have specific training in aviation medicine.

Beyond individual credentials, look for internationally recognized industry accreditations. These serve as an objective, third-party validation of a provider's commitment to the highest standards of safety and quality. The two most respected accreditations in the air ambulance industry are:

- EURAMI (European Aero-Medical Institute): A certification focused on long-range, fixed-wing air ambulance services with exceptionally rigorous standards for medical practices, aircraft, and operational procedures.

- CAMTS (Commission on Accreditation of Medical Transport Systems): A peer-review organization that audits providers to ensure they meet stringent patient care and safety standards across both air and ground transport.

Selecting an accredited provider adds a significant layer of assurance that you are engaging with a top-tier organization.

Understanding the Policy Structure

Finally, you must gain a clear understanding of how the coverage is delivered. Is it a standalone membership program, or an integrated feature of a broader insurance policy?

Standalone memberships often provide direct service from the provider itself, which can dramatically simplify the process in an emergency. To ensure you are working with a legitimate and regulated entity, particularly in certain jurisdictions, you can use official resources like the FSCA Search FSP tool to verify their credentials.

This decision also connects to your broader financial and travel patterns. The global travel insurance market is projected to grow, driven by a clear preference for annual multi-trip and long-stay policies among frequent international travelers. Understanding these dynamics helps you position your medical flight coverage within your overall insurance portfolio.

Ultimately, the objective is to find a provider and a plan structure that aligns with your expectations for excellence. For a deeper examination of policy types, you might find our guide on choosing the right expat medical insurance policy type for you helpful. This methodical approach ensures your choice is built on a solid foundation of operational excellence, medical expertise, and verified credentials.

Answering Your Key Questions

When exploring specialized insurance, numerous questions naturally arise. Obtaining clear, direct answers is the only way to feel confident in your decision. Let's address the most common questions about medical flight insurance so you can understand precisely how it fits into your global lifestyle.

Consider this the fine print, explained with clarity. Understanding these details helps illuminate why this coverage is such a critical component of a robust personal risk strategy.

Is This Different From My Credit Card Benefit?

Yes, and the difference is profound. It is a critical distinction that many people overlook until it is too late.

The "evacuation" benefit included with a premium credit card is designed for one purpose: emergency stabilization. It transports you to the "nearest adequate" medical facility. The operative words are "nearest" and "adequate"—a determination made by the benefit administrator, not you. Their objective is simply to get you to a location that can manage the immediate crisis.

A dedicated medical flight insurance plan operates on an entirely different philosophy. Its singular purpose is medical repatriation—transporting you to a hospital of your choice, which for most expatriates means returning home. This places you back in control, allowing you to return to your trusted physicians and a healthcare system you understand. For anyone who values access to a specific specialist or hospital, this is not a minor detail; it is paramount.

Here is the simplest way to conceptualize it: A credit card benefit is a generic ambulance service that takes you to the closest safe harbor. True medical flight insurance is a private jet on standby to fly you to your specific, chosen destination.

Does This Insurance Cover My Hospital Bills?

No, and this is a fundamentally important point to grasp. Medical flight insurance is not health insurance. It is a highly specialized transport policy.

Its sole function is to cover the staggering costs of the air ambulance journey itself. This includes the jet, the in-flight medical team, ground ambulances at both departure and arrival, and all associated complex logistics.

Your actual medical bills—surgeons' fees, hospital accommodation, treatments, and tests—are covered by your primary international private medical insurance (IPMI). The two policies are designed to work in perfect concert.

- Medical Flight Insurance: Pays for the journey to access world-class care.

- Health Insurance (IPMI): Pays for the medical treatment you receive upon arrival.

This two-part strategy ensures there are no gaps. You are protected from both the logistical challenge of transport and the significant financial weight of the actual medical care.

Should I Get an Annual Plan or Per-Trip Coverage?

This decision comes down to your travel patterns.

If you are planning a single, one-off international trip—perhaps an extended stay in one country for several months—a short-term, per-trip policy is a logical choice. It is a targeted solution for a specific, temporary need.

However, for anyone who travels internationally more than once or twice a year, an annual plan or membership is almost always the more prudent option. It provides seamless, year-round protection and eliminates the administrative task of securing a new policy for each trip. For expatriates and global professionals, an annual plan is the standard. It provides set-it-and-forget-it peace of mind.

How Are Evacuations From Remote Areas Handled?

This is where the distinction between a good provider and a truly elite one becomes evident. Extracting an individual from a remote or challenging location is a masterclass in logistics and separates the best from the rest. The top providers operate sophisticated 24/7 command centers staffed by medical professionals and logistics experts.

The process is often a multi-stage operation. It might begin with a smaller aircraft, such as a helicopter or a turboprop plane, to access a location with a short or unpaved runway. From there, you are flown to a larger regional airport where a long-range medical jet is waiting on the tarmac.

Throughout this entire chain of custody, your medical care is continuous and perfectly coordinated. It is a seamless, secure handoff from one medical team to the next until you are literally wheeled through the doors of your destination hospital.

At Riviera Expat, we specialize in helping high-net-worth professionals secure the right international private medical insurance that works in concert with these essential transport solutions. Our expert guidance ensures your entire healthcare strategy is robust, clear, and perfectly aligned with your global needs. Contact us today for a complimentary consultation.