When a significant medical event occurs in a location with inadequate healthcare facilities, medical evacuation insurance becomes an indispensable asset. This is not standard travel insurance that addresses lost luggage or flight cancellations. It is a highly specialized coverage designed to transport you from a crisis location to a premier medical institution.

For individuals whose personal and professional lives are global, this coverage is not a luxury. It is a foundational component of a comprehensive personal security and wealth preservation strategy.

Your Global Lifeline in a Medical Crisis

Consider this scenario: you are an executive on assignment in a developing nation and suffer a major cardiac event. The local clinic can provide initial stabilization, but it lacks the specialized cardiac intensive care unit and cardiothoracic surgeons required for definitive treatment and optimal recovery. What is the next step?

This is precisely where a medical evacuation policy demonstrates its intrinsic value. It functions as your private emergency service, bridging the gap between your location and the world-class medical care you require.

Without such a policy, you and your family are forced to orchestrate a complex international medical transfer under extreme duress. This is a logistical and financial challenge that few are prepared to manage independently.

The Reality of Global Medical Logistics

Transporting a patient from a hospital in one country to another via air ambulance is an operation of immense complexity. It is a high-stakes logistical undertaking that demands the expertise of a dedicated provider to ensure flawless execution.

Here is a brief overview of the process:

- Immediate Medical Assessment: The insurer’s physicians consult directly with the local attending physicians to obtain a real-time evaluation of your condition and confirm the medical necessity for evacuation.

- Specialized Transport: A private, medically configured jet—effectively a mobile ICU—is dispatched. It is staffed by a critical care physician and a flight nurse, both specialists in aeromedical transport.

- Complex Clearances: The provider manages all administrative and regulatory hurdles, from landing permits and customs clearances to arranging ground ambulances at both the departure and arrival points.

This is not merely a flight; it is the maintenance of a seamless continuum of care from the point of origin to the receiving hospital. The costs for this level of service are substantial, often exceeding six figures, which is precisely why a robust policy is essential.

For discerning individuals who travel or reside abroad, medical evacuation insurance is a non-negotiable backstop. It ensures that in a moment of crisis, your focus remains on recovery, not on logistics or devastating out-of-pocket expenses.

This specialized coverage is a critical element of a broader personal protection strategy. While it manages emergency transport, it operates in concert with a comprehensive global health plan. To understand how these policies integrate, you can learn more about the structure of international private medical insurance.

Understanding the True Cost of an Emergency Abroad

When a significant medical crisis occurs abroad, the bill from the local hospital is often the least of your financial concerns. The primary financial impact stems from the extraordinary cost of medical transport.

This is an expense that standard health or travel insurance policies are not designed to cover. We are discussing a medically configured jet, a critical care team, and a transcontinental flight—a logistical operation with costs that can profoundly affect your financial standing.

This is not a hypothetical risk. Consider a high-net-worth individual based in Singapore who travels to Southeast Asia for a business engagement. A sudden neurological event requires care unavailable locally. A medical evacuation from this region to Europe or North America can easily surpass $250,000. We have reviewed actual invoices for air ambulance services from the Middle East to the U.S. that have reached $186,200. These figures represent the reality of executing life-saving transport across international borders.

The Anatomy of an Air Ambulance Bill

Why does the cost reach such levels? A medical evacuation involves far more than a private jet; it is a mobile intensive care unit, and each component carries a significant cost. The cumulative expense can have a material impact on personal and family assets.

Here is a breakdown of the primary cost drivers:

- The Specialized Aircraft: The largest single expense is chartering a long-range jet specifically retrofitted for intensive care. The cost reflects the premium for maintaining these aircraft on constant standby.

- The Critical Care Medical Team: This is not a standard paramedic crew. An evacuation requires elite medical professionals—typically a critical care physician, a flight nurse, and respiratory therapists—whose expertise is billed at professional rates.

- Advanced Medical Equipment: The aircraft is equipped with life-support systems, cardiac monitors, ventilators, and a full complement of specialized medications, all contributing to the total cost.

- Global Logistical Coordination: A 24/7 operations team manages all logistics, from flight plans and overflight permits to coordinating ground ambulances at both departure and arrival locations.

Each of these elements contributes to a formidable total expense. Understanding this cost structure clarifies why a dedicated, high-limit medical evacuation insurance policy is not a mere travel accessory but a critical tool for wealth preservation for any global professional.

Beyond the Flight Costs

The expenses do not conclude upon landing. Ancillary costs often include medical consultations to certify fitness for air travel, translation of medical records, and securing a bed at the receiving hospital. The evacuation provider manages these details, all of which are factored into the final invoice.

A medical evacuation is a white-glove, high-stakes service designed to save a life. The associated cost reflects the immediate deployment of world-class medical personnel and aviation assets anywhere on the globe, an operation that is financially untenable for an individual to arrange out-of-pocket during a crisis.

While medevac insurance is focused on transport, it is beneficial to understand the broader context. Examining the various options for medical care without insurance starkly illustrates the financial exposure one faces without appropriate coverage.

Ultimately, the right policy ensures a medical crisis remains a health issue, not a financial one.

Distinguishing Between Key Insurance Coverages

For those living an international life, precision in financial and health planning is fundamental to protecting personal and family assets. Many successful expatriates and frequent travelers assume their premium credit card benefits or standard health plan provides an adequate safety net. The dangerous gaps in such coverage often become apparent only during a crisis.

The confusion is understandable. The insurance market is saturated with overlapping terminology for policies that perform vastly different functions. In an emergency, these distinctions have life-altering consequences. Let's delineate these policies to clarify their specific roles.

Standard Travel Insurance: A Financial Reimbursement Tool

A standard travel insurance policy is best understood as a financial buffer for travel inconveniences. Its primary function is to reimburse prepaid, non-refundable expenses when a trip is disrupted. It is designed to protect your travel investment, not your life.

A typical travel policy covers common travel issues, such as:

- Trip Cancellation: Reimburses you for covered reasons forcing a cancellation before departure.

- Trip Interruption: Recoups costs if you must curtail your trip and return home unexpectedly.

- Lost or Delayed Luggage: Covers essential purchases while awaiting the arrival of your baggage.

While some policies include a nominal medical benefit, it is typically capped at a low amount, sufficient for minor ailments treated at a local clinic. It will not cover the six-figure cost of a private air ambulance. Reimbursing a canceled flight is entirely different from chartering a medically equipped jet.

Emergency Medical Insurance: For Local Treatment Only

Emergency medical insurance is a more robust product, specifically designed to cover the costs of necessary medical care received in a foreign country. This is a vital component of any international health plan, ensuring access to a local hospital for treatment without incurring substantial out-of-pocket expenses.

However, its scope is generally limited to the immediate location. It covers treatment received where you are. If that local facility is not equipped to manage your specific, complex medical needs—such as severe trauma or a major cardiac event—this policy alone will not facilitate your transfer to a more appropriate hospital.

It’s a common and dangerous assumption: many people believe a policy that covers emergency treatment automatically covers the logistics and cost of a medical evacuation. They are two completely different functions that require separate, specialized coverage.

To avoid these costly misunderstandings, a thorough review of policy language is essential. For a more detailed analysis, refer to our guide on understanding expat medical insurance policy terms.

Medical Evacuation Insurance: The Transport Specialist

This is the exclusive domain of a dedicated medical evacuation insurance plan. It performs one highly specialized and critical function: it arranges and pays for your transport from a location with inadequate medical care to a world-class facility capable of providing definitive treatment. The trigger is medical necessity, not convenience.

The entire focus is on logistics and transport. This includes the air ambulance, the onboard medical team, flight clearances, and ground transport at both ends of the journey. It is the policy that bridges the gap between a medical disaster and superior care.

Insurance Coverage Comparison for Global Professionals

To make these distinctions unambiguous, the following table compares the primary roles and limitations of each policy type. This highlights why a dedicated medical evacuation plan is indispensable for anyone living or working on a global scale.

| Coverage Type | Primary Purpose | Typical Coverage Limit | Common Exclusions |

|---|---|---|---|

| Travel Insurance | Financial shield for trip costs | Trip cancellation, lost luggage, some minor medical. | High-cost medical transport, significant overseas hospital bills. |

| Emergency Medical | Payment for local medical care | Doctor's fees, hospital stays, and surgery in a foreign country. | Transport to another facility or back home. |

| Medical Evacuation | Emergency medical transport logistics | Air ambulance, medical crew to move you to a better-equipped hospital. | The cost of medical treatment once you arrive at the new hospital. |

These policies are not interchangeable. They are distinct instruments designed to mitigate entirely different risks. For the global professional, layering these coverages is the only method to construct a truly seamless shield against the medical and financial hazards of an international lifestyle.

How to Select Your Optimal Medical Evacuation Plan

Selecting the appropriate medical evacuation insurance is not an exercise in minimizing premiums. For individuals whose lives and work span the globe, the decision rests on three pillars: capability, clarity, and control. A policy that appears adequate on its surface may fail in a real-world crisis if the contract language is not aligned with your needs.

This selection process should be approached as a high-stakes risk management exercise. The quality of the emergency response is dictated entirely by the policy's terms and conditions, which requires a forensic examination of the details. You require a plan that functions as a seamless, powerful extension of your personal security.

Scrutinize the Coverage Limits

The most direct starting point is the policy’s maximum benefit. As a complex international medical evacuation can readily exceed a quarter-million dollars, a plan with an insufficient limit introduces an unacceptable financial risk.

For global professionals and their families, any coverage limit below $1,000,000 should be viewed with caution. A higher limit ensures that cost will not be a determining factor in a life-or-death decision. It must be sufficient to cover not only the flight but also the associated medical teams, logistics, and ground support without compromise.

Define Who Decides and Where You Go

This is, without question, the most critical and frequently overlooked aspect of any medical evacuation policy. The substantive difference between a standard plan and a truly premium one lies in the allocation of decision-making authority.

You require definitive answers to two questions:

- Who Determines Medical Necessity? Does the final decision to evacuate rest with an anonymous medical director at the insurance company, or is it made in consultation with your attending physician? A superior policy will always give significant weight to the opinion of the treating doctor.

- Where Will You Be Taken? The distinction between a "nearest adequate facility" clause and a "hospital of choice" provision is monumental. The former grants the insurer the right to transport you to the closest hospital they deem acceptable, which could be in a neighboring country but still thousands of miles from your home and trusted medical network.

A "hospital of choice" provision gives you the ultimate control. It allows you to be flown back to your trusted medical team and family support network. For anyone who values precision and certainty in a crisis, this feature is non-negotiable.

That single clause can mean the difference between recovering in a world-class hospital you know, surrounded by family, or in a foreign facility far from your support system.

Evaluate the Assistance Network and Exclusions

A medical evacuation policy is only as effective as the global response team that supports it. Before committing, it is essential to assess the provider's logistical capabilities. Do they operate a proven, 24/7 global network? Are their coordinators multilingual? Do they have established relationships with air ambulance operators worldwide? Their ability to navigate complex international clearances and medical protocols under extreme pressure is the core service you are purchasing.

Equally important is a meticulous review of the policy's exclusions. These are the contractual conditions that can invalidate your coverage when you need it most. Pay close attention to common clauses such as:

- Pre-existing Conditions: Scrutinize the "look-back" period and any stability requirements.

- High-Risk Activities: If you engage in activities like diving, mountaineering, or motorsports, ensure they are not explicitly excluded.

The demand for this caliber of protection is increasing. According to data from a leading travel insurance marketplace, sales of travel insurance plans that include emergency medical and evacuation benefits increased by 215% in the summer of 2023 compared to the previous summer. This signals a growing awareness among sophisticated travelers that having the right kind of protection is paramount. You can read a full analysis on the evolution of the US travel insurance market.

This is precisely where a specialist brokerage like Riviera Expat provides its true value. We move beyond surface-level comparisons to analyze the intricate mechanics of each policy, matching its capabilities to your specific lifestyle and destinations. Our objective is to ensure your protection is absolute.

The Evacuation Process: From Crisis to Care

When a serious health crisis occurs in a location with inadequate medical facilities, the abstract concept of a medical evacuation policy becomes an immediate reality. What you have purchased is not merely an insurance document but a direct line to a world-class logistics team and expert physicians. They initiate a highly choreographed operation designed to transport you from a position of extreme vulnerability to a center of medical excellence with maximum speed and efficiency.

It begins with a single telephone call. One urgent, critical call to your provider’s 24/7 hotline sets a powerful chain of events in motion.

Activating the Global Response Network

The moment your call is connected, the provider's medical team engages in a peer-to-peer consultation with the physicians at your local hospital or clinic. They assess your condition, confirm the diagnosis, and—most importantly—determine if the local standard of care is insufficient for your needs. This is the crucial first step that provides the medical justification for the evacuation.

Simultaneously, a logistics coordinator activates a global network of resources. This is a complex, behind-the-scenes operation managing details that would be overwhelming to handle during a health crisis.

An elite medical evacuation is a white-glove service. It is a fully managed, end-to-end solution where every intricate detail—from flight clearances to ground transport—is handled by experts. Your only focus should be recovery.

From Logistics to Liftoff

Once medical necessity is confirmed, the logistical machine operates at full capacity. Your provider manages every step, which typically includes:

- Air Ambulance Arrangement: An appropriate, medically-equipped aircraft is chartered. This is a mobile ICU, staffed with a specialized aeromedical crew—often a critical care physician and flight nurse—selected based on your specific medical condition.

- Clearance and Coordination: The team manages all administrative and regulatory requirements, including diplomatic and aviation clearances, flight plans, landing permits, and customs for the medical crew and patient.

- Bed-to-Bed Transfer: This service extends beyond the flight itself. It includes arranging ground ambulances at both departure and arrival points, ensuring a seamless, unbroken chain of medical supervision from one hospital bed to the next.

This intricate process is where the true value of your policy is demonstrated. The provider’s established relationships and expertise in navigating bureaucracy are paramount. This is why we meticulously evaluate the global medical networks behind every plan we recommend. It ensures that when you require assistance, the response is swift and flawless.

Frequently Asked questions About Medical Evacuation

Even the most seasoned global professionals have questions when examining the details of a medical evacuation insurance policy. Below, we address some of the most common and critical inquiries to provide the clarity required to protect yourself and your family.

Does This Insurance Cover Pre-Existing Conditions?

This is a critical question, and the answer varies significantly between policies. Most premium policies designed for expatriates and frequent travelers can cover pre-existing conditions, but specific terms apply. They often require the policy to be purchased within a defined window—typically 14 to 21 days—of your initial trip payment.

It is absolutely essential to provide a full and accurate disclosure of your medical history during the application process. Nondisclosure can lead to the voiding of your policy at the time of a claim. A specialist advisor can help you identify policies with more favorable terms, such as shorter "look-back" periods, to ensure your medical history does not compromise your future protection.

Can I Choose My Destination Hospital?

This question distinguishes a basic plan from a premium one. Most standard policies contain a "nearest adequate facility" clause. This gives the insurer—not you—the authority to decide what is "adequate," which could be a hospital in a nearby country, distant from your trusted physicians and family.

A top-tier medical evacuation plan, however, will include a "hospital of choice" provision. This is a pivotal feature. It grants you the power to be transported to any hospital you select, whether it is back home or another world-class institution you trust. For any individual who values control over their healthcare decisions, this feature is non-negotiable.

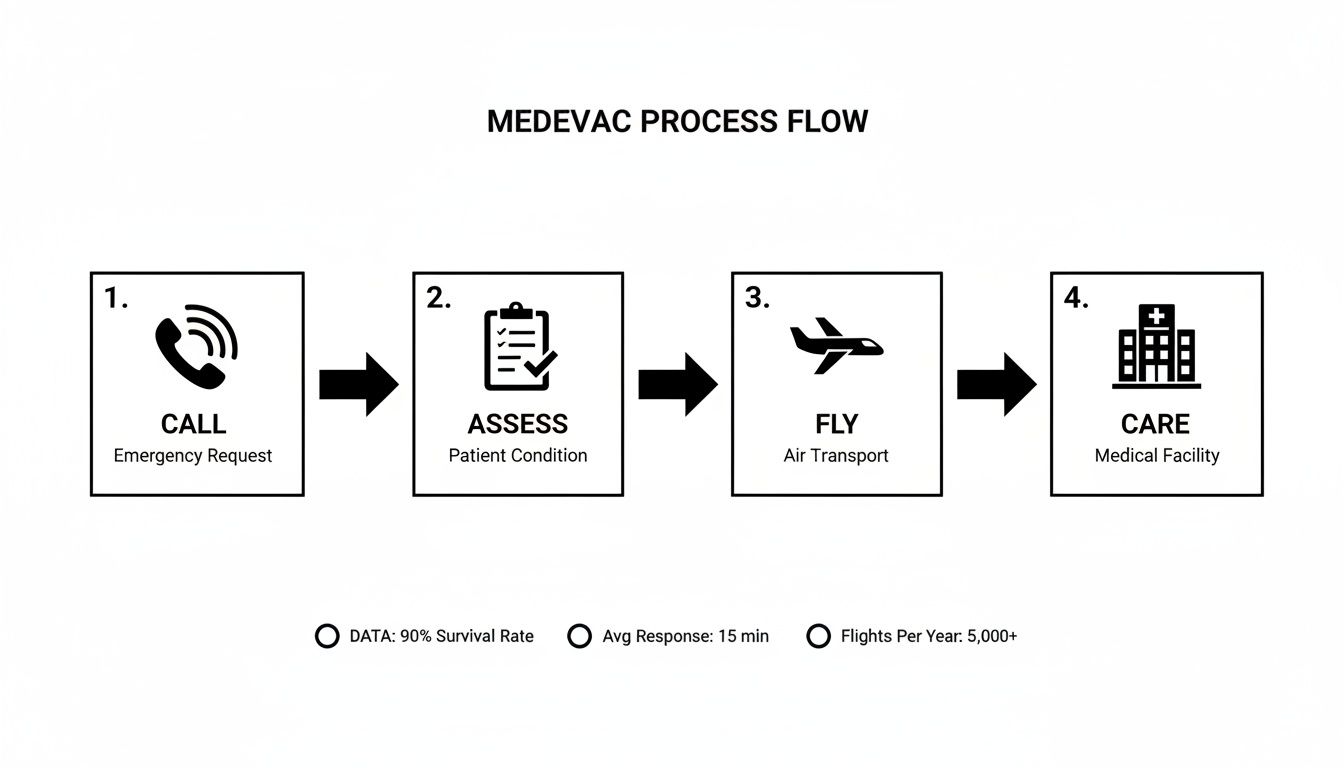

Once the call for assistance is made, a high-caliber provider initiates a streamlined process, as illustrated below.

This visual underscores the rapid, four-stage response—from your initial call to definitive care—that a quality provider manages on your behalf.

What About My Family During an Evacuation?

A medical crisis affects your entire family. The best policies acknowledge this. Most include a "companion benefit" or "bedside visit" provision.

This feature typically covers the transportation costs for one designated family member to join you at the hospital or accompany you during the evacuation. It is a detail that provides immense value, ensuring you have personal support during a period of extreme stress. It allows your family to focus on what is most important—your recovery—rather than travel logistics.

Navigating the nuances of these policies is our expertise. At Riviera Expat, we specialize in identifying and structuring medical evacuation insurance that meets the exacting standards of global professionals. Allow us to provide the clarity and confidence you deserve. Contact us today for a personalized consultation.