Poland offers a compelling, if somewhat unexpected, proposition for high-net-worth individuals. If you're seeking a strategic European base that combines a dynamic economy with a genuinely sophisticated quality of life, it deserves serious consideration.

This guide moves beyond surface-level advice. We will delve into the details that matter for your unique situation—from securing a premier residence and navigating wealth management to accessing world-class private healthcare. Let’s explore how living in Poland delivers a rare blend of historical charm and modern energy.

Exploring Poland's Appeal for Affluent Expats

For the discerning global citizen, Poland presents an increasingly attractive mix of financial opportunity and an elevated standard of living. This is not the Poland of decades past. Today, the country stands as a testament to dynamic growth within the European Union, providing a secure and stable environment for both personal wealth and professional ambition.

It's a place where centuries of rich, complex history coexist with a forward-thinking business climate and genuine innovation. This balance creates an atmosphere that is both intellectually stimulating and comfortably familiar. Whether it's the meticulously restored Old Towns of Warsaw and Kraków or the booming tech hubs in cities like Wrocław, the country offers a diverse tapestry of experiences. This fusion of old-world elegance and contemporary drive is precisely what's drawing more affluent individuals to consider a move.

A Dynamic Yet Stable Environment

One of Poland's most significant advantages is its remarkably resilient economy, which has consistently outperformed many of its European peers. This economic strength provides a solid foundation of social and political stability, creating a secure environment for residents.

The country's population dynamics have also shown nuanced changes, with a slight growth of 0.02% in the past year, bringing the total to approximately 37,903,063. More importantly, the population density is a comfortable 121.2 inhabitants per square kilometer. This means more space and a less crowded environment compared to many Western European nations.

For many, the true luxury of living in Poland lies in its unhurried pace. It affords the space to appreciate life's finer aspects—whether that's an evening at the philharmonic or a weekend exploring the Masurian Lakes—without the relentless pressure found in other global capitals.

What Makes Poland a Premier Choice?

Beyond its solid economic credentials, Poland’s appeal is multifaceted. It offers a quality of life that is both enriching and surprisingly accessible, providing a platform to build a genuinely rewarding life. For those weighing different European options, our comprehensive country guides offer valuable comparative perspectives.

So, what really sets Poland apart?

- Exceptional Value: You can attain a premium lifestyle, including luxury properties and private services, for a fraction of what you would spend in cities like London or Geneva.

- Cultural Depth: This is a nation with a profound appreciation for the arts, history, and culinary excellence. It is home to 17 UNESCO World Heritage Sites, each telling a unique story.

- Strategic Location: Situated in the heart of Europe, Poland serves as an ideal gateway for both business and leisure travel across the continent and beyond.

Understanding the Cost of a Premium Lifestyle

When people say Poland is affordable, they are often referring to everyday expenses. For a high-net-worth individual, that conversation misses the point. The real financial advantage of living in Poland isn't merely about cost savings—it's about the extraordinary value received for a premium lifestyle.

Here, a life filled with comfort, luxury, and top-tier services is attainable for a fraction of the expenditure required in places like Geneva or London.

This value extends to almost every aspect of high-end living. Consider memberships at exclusive city clubs, tuition at first-rate international schools, fine dining, or hiring private domestic staff. The cost differential is significant. It frees up capital for what truly matters—investments, travel, or personal passions—without ever compromising on the quality you expect.

Benchmarking High-End Expenditures

Let's move past generalities and look at specific examples. Take a premier international school in Warsaw, for instance. The annual tuition is significantly more manageable than at comparable institutions across Western Europe. The same applies to retaining private staff, such as a full-time housekeeper or a personal driver; the costs are simply on a different scale.

This financial efficiency means your capital can work much harder. The funds you save on daily luxuries and essential premium services can be channeled directly back into your portfolio or other strategic goals. It makes living in Poland a shrewd financial decision, not just a lifestyle choice.

The key takeaway isn’t that Poland is inexpensive. It's that it offers an asymmetrical return on your lifestyle investment. The standard of luxury you can achieve is disproportionately high for its cost, giving affluent residents a distinct financial edge.

A Sample Budget for a Premium Lifestyle

So, what might a monthly budget actually look like for an individual or family enjoying a high-end lifestyle in a major Polish city? This breakdown offers a tangible benchmark, showing just how accessible a life of comfort and convenience can be.

The following budget assumes a lifestyle with significant discretionary spending, including frequent fine dining, full-time private schooling for a child, and memberships at elite wellness and social clubs.

Estimated Monthly Expenses for a High-Net-Worth Lifestyle

This table provides a sample budget for an expatriate couple or family, focusing on premium services and discretionary spending in a major Polish city like Warsaw.

| Expense Category | Estimated Monthly Cost (EUR) |

|---|---|

| Luxury Apartment Rental (City Center) | €2,500 – €4,500+ |

| International School Tuition (per child) | €1,200 – €2,000 |

| Groceries (Premium & Organic) | €800 – €1,200 |

| Dining Out & Entertainment | €1,000 – €1,800 |

| Private Domestic Staff (e.g., Housekeeper) | €700 – €1,100 |

| Utilities & High-Speed Internet | €300 – €500 |

| Transportation (Car Lease, Fuel, Taxis) | €500 – €800 |

| Health & Wellness (Club, Personal Trainer) | €300 – €600 |

Even at the higher end of these estimates, the total monthly expenditure is considerably lower than what one would see for a similar lifestyle in Paris or Amsterdam. This difference highlights Poland's unique position as a place where financial prudence and a first-class living standard go hand-in-hand. This efficiency allows for a far more robust and flexible financial strategy while you enjoy all the benefits of life in the heart of Europe.

Finding Your Place: Premier Polish Real Estate

Finding the right home is the anchor for your new life in Poland. For the discerning expat, this means acquiring a property that delivers more than just luxury. It needs to offer security, prestige, and a seamless link to the lifestyle you expect.

Poland's high-end property market has matured, offering sophisticated options that rival those of any major European capital, but with a unique value proposition that is hard to ignore.

The journey starts with choosing the right enclave. The main hubs for premier real estate are Warsaw, Kraków, and Wrocław. Each city has its own distinct character. Whether you envision yourself in a sleek, modern penthouse with full concierge services or a painstakingly restored historic villa, the market is deep enough to meet the most exacting standards. These properties are typically located in secure, private districts known for their proximity to fine dining, exclusive clubs, and cultural hotspots.

Elite Neighborhoods and What to Expect

In Warsaw, the most prestigious addresses are usually found in Śródmieście, especially around the beautifully reconstructed Old Town and the gleaming modern business district. For those seeking more greenery and a residential feel, districts like Mokotów and Wilanów offer elegant villas and high-end, secure apartment complexes.

In Kraków, the elite gravitate towards the historic charm of the Old Town and the bohemian Kazimierz district, or the quiet, leafy avenues of Wola Justowska. These areas are defined by the quality of life they offer.

- Warsaw: Think modern, full-service buildings with amenities like private gyms, 24/7 security, and underground parking. Penthouses here often feature stunning panoramic city views and expansive terraces perfect for entertaining.

- Kraków: The market here is known for its gorgeously restored kamienice (historic tenement houses) that have been converted into spacious, luxury apartments, blending old-world architecture with cutting-edge interior design.

- Wrocław: Known for its vibrant market square and picturesque river islands, Wrocław offers unique loft-style apartments in converted industrial buildings alongside brand-new, high-spec developments right on the Odra River.

Buying Property as a Non-EU Citizen

The legal framework for purchasing property in Poland is straightforward but requires careful navigation. As a non-EU citizen, the key step is obtaining a permit from the Ministry of Interior and Administration. While this may sound daunting, for a legitimate buyer, it is more of a procedural formality than a significant obstacle.

The permit process is designed to verify your ties to Poland and ensure the transaction is transparent. For a high-net-worth individual making a clear investment in the country, this is typically a smooth process with the right legal team.

Engaging a reputable Polish law firm specializing in real estate is essential. Your lawyer will manage the entire permit application, perform due diligence on the property's title, and structure the sales agreements to protect your interests completely. The process generally involves showing proof of funds and demonstrating a connection to Poland, which could be your business activities or your intention to reside there.

The High-End Rental Market

If you prefer more flexibility before establishing permanent roots, the luxury rental market is an excellent alternative. Premium apartments in prime city-center locations are readily available and often fully furnished to an executive standard.

A typical high-end lease in Poland runs for a minimum of 12 months. For premier properties in a city like Warsaw, expect rents to be in the €2,500 to €5,000+ per month range.

Lease agreements are almost always in Polish, so obtaining a professional translation and a legal review is a non-negotiable step. Landlords of these premium properties are accustomed to dealing with international clients and will typically require a security deposit equal to one or two months' rent. This route offers a superb opportunity to experience life in Poland before committing to a purchase, ensuring your final choice is perfectly aligned with your long-term vision.

Navigating Healthcare and Private Medical Insurance

For high-net-worth individuals, immediate access to world-class medical care is a non-negotiable component of life. When in Poland, understanding the healthcare landscape is critical to ensuring your family's well-being is never left to chance.

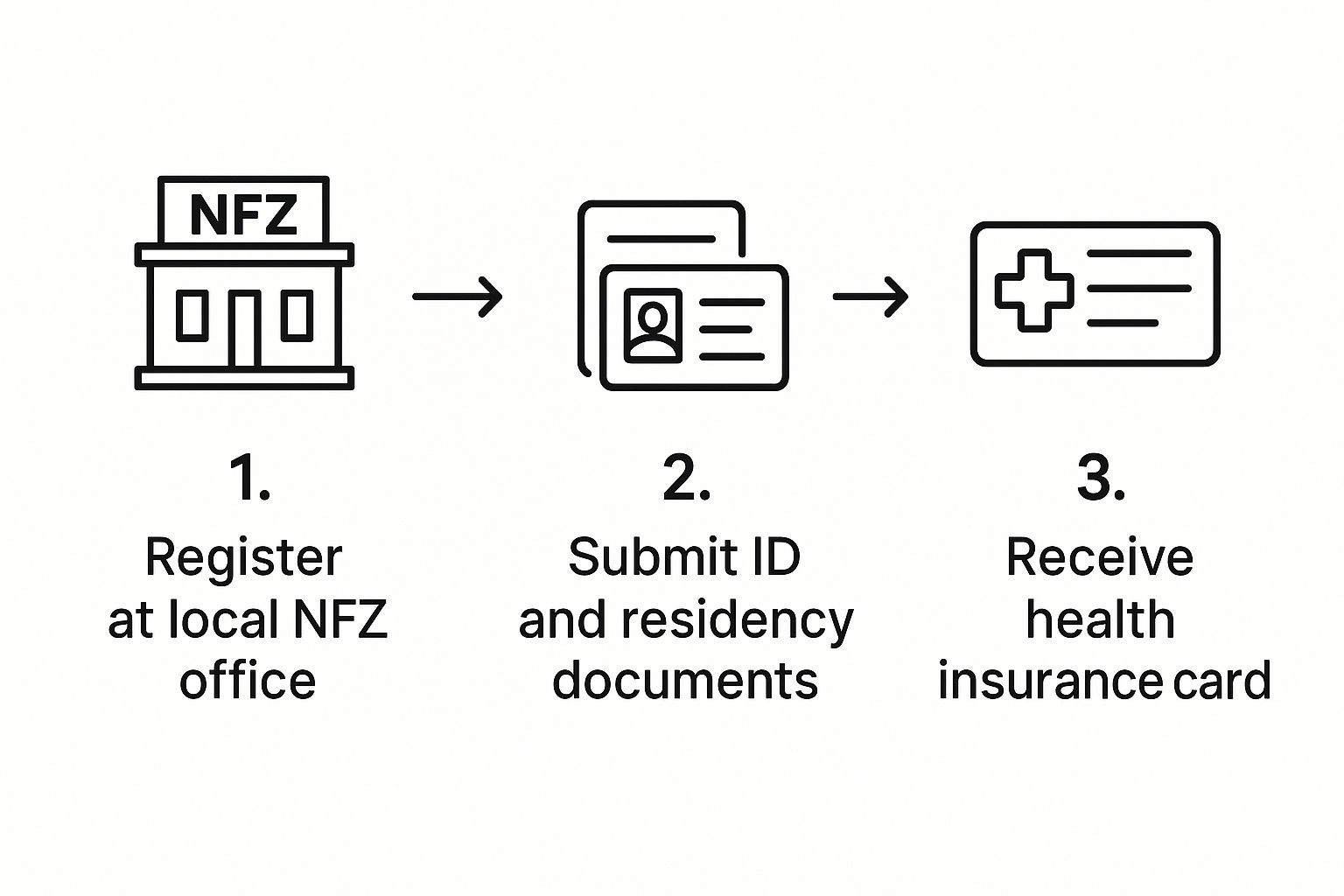

The system here operates on two parallel tracks: the public National Health Fund (NFZ) and an efficient, rapidly growing private sector.

While the NFZ provides a comprehensive safety net, the private system is where most expatriates receive their care. It delivers the standard you expect: minimal to no waiting times, access to top English-speaking specialists, and modern facilities equipped with the latest medical technology. For anyone who values their time and demands a superior level of service, this distinction is crucial.

The Public System Versus The Private Sector

The public healthcare system, the NFZ, is funded by mandatory health insurance contributions deducted from salaries or paid by the self-employed. It covers a broad range of services but is known for long queues, especially for specialist appointments and non-urgent procedures. For someone accustomed to seamless, on-demand service, this can be a major source of frustration.

This is where the private sector excels.

Leading private providers such as Medicover, LUX MED, and Enel-Med have built their reputations on patient-focused care, a stark contrast to the often bureaucratic public system. Here, you can schedule specialist appointments in days, not months, and the entire experience is designed for comfort and efficiency.

It is also worth noting that Poland's population has a median age of approximately 42.5 years. This demographic shift places increasing pressure on the public healthcare system. While the NFZ is adapting, the private sector has surged ahead to meet the demand from those who require immediate, specialized care. This reality underscores the value of robust private medical insurance to bypass queues and access a network of modern, well-equipped private facilities.

International Private Medical Insurance: An Essential Investment

For a global citizen, a local Polish health plan is insufficient. Your life and business interests do not stop at the Polish border, and neither should your health coverage. This is why International Private Medical Insurance (IPMI) is not just an option; it is a core component of your personal security strategy.

An IPMI policy is designed for the expatriate lifestyle. It offers comprehensive, worldwide coverage, ensuring you receive the highest standard of care whether you are in Warsaw, London, or Singapore. These plans offer a degree of flexibility and coverage that local policies simply cannot match.

Think of a top-tier IPMI plan as your personal health concierge. It ensures seamless access to the best medical outcomes anywhere in the world, removing financial stress and administrative roadblocks so you can focus purely on your health.

Key Features of a Premier IPMI Policy

When selecting an IPMI plan, a few features are absolutely non-negotiable. A superior policy does far more than just cover the basics; it delivers a full suite of services designed for your lifestyle. Knowing what to look for is the first step, and our guide on choosing the right expat health insurance policy can help you delve deeper.

Here’s what you should insist on:

- Global Coverage: Your plan must cover you not just in Poland, but in any country you travel to—including your country of origin.

- Direct Billing with Top Hospitals: The best plans have direct payment agreements with leading private hospitals. This means you avoid paying out-of-pocket for major treatments and waiting for reimbursement.

- Emergency Medical Evacuation: This is critical. If you have a serious medical emergency in a location without the necessary facilities, this feature covers the cost of transportation to a center of excellence.

- Choice of Specialists: Your policy should grant you the freedom to choose your own doctor and hospital, ensuring you always have access to the most respected specialists in their field.

- Comprehensive Outpatient and Inpatient Care: Ensure you have full coverage for everything from routine check-ups and specialist consultations to complex surgeries and extended hospital stays.

A Strategic Guide to Polish Residency and Visas

Securing your legal residency is one of the first and most critical steps in any successful relocation. For Poland, this is about laying a solid legal foundation for your new life in the European Union from day one.

While the process is well-defined, it requires a strategic approach. Think of it less as paperwork and more as an investment in your future. For non-EU citizens, the clearest paths are for those who can demonstrate financial independence, establish a business, or bring in-demand professional skills. Poland welcomes individuals who contribute to its economy, and the system is designed to facilitate that.

Key Residency Pathways for HNWIs

For a person of means, the most effective routes to residency are tied directly to your financial and business activities. This is about presenting a clear, well-documented case that aligns with Poland's criteria for stable, value-adding new residents. Your application is essentially a formal introduction of your personal and business portfolio to the Polish government.

The three primary options are:

- Business-Based Residency: This is often the most straightforward route. It involves registering a Polish limited liability company (Sp. z o.o.) and demonstrating that it is a genuine, active business. It provides a clean structure for your investments and operations in the country.

- Skilled Professional Permit: If you possess high-demand management or specialist expertise, a work permit can be an efficient path forward. This is an excellent fit if you are expanding an existing global business into Poland.

- Financially Independent Status: While not as formally defined as in some other countries, this is a viable angle. Demonstrating significant personal wealth and a steady, passive income from outside Poland—especially when paired with a property purchase—can strongly support a residency application.

Engaging a specialized immigration lawyer is not an optional extra; it is a core requirement for a successful outcome. A good lawyer will manage everything from notarizing documents to liaising with the provincial voivodeship offices, ensuring every detail is perfect. If you're planning your move, our guide on preparing for your move abroad has more practical tips.

From Temporary Residence to a Permanent Future

Your initial residency permit will typically be a temporary one, valid for up to three years. This is your foundational period—the time to establish your life, home, and business activities in Poland.

After five years of continuous, uninterrupted legal residence, you become eligible to apply for permanent residency. This is a significant milestone, granting you rights nearly identical to those of a Polish citizen and solidifying your place in the country.

This long-term perspective is important. Poland's history is one of incredible resilience and adaptation. The country has managed major demographic shifts for centuries, and its legal frameworks are built on a deep understanding of how to integrate new populations. For an expatriate today, that history provides a welcome layer of stability.

The path from a temporary permit to permanent residency—and potentially citizenship—is a clear, merit-based progression. It rewards commitment and genuine integration, offering a secure and valuable European base for you, your family, and your assets.

For anyone considering Poland as a primary or secondary home, this structured pathway provides a predictable route to securing a permanent foothold in the EU. It makes the initial investment in top-tier legal and advisory services a very wise decision.

Managing Your Wealth in the Polish Financial System

Once settled in Poland, managing your financial life requires a sophisticated approach. The country's financial system is modern, stable, and fully integrated into the broader European market, providing a secure environment for your assets.

For high-net-worth expats, the first decision is where to bank. This typically involves choosing between the convenience of a global bank with a Polish presence or the personalized service of a top-tier local institution.

Major international names like Citibank or Santander offer the advantage of an established global network, which can simplify cross-border transactions. Conversely, Poland's domestic banks have developed impressive private banking divisions tailored to clients like you, often delivering a level of personal attention and local expertise that global giants may not match.

Opening Your Private Bank Account

Opening an account as a non-resident is a well-established process. Polish banks are experienced in dealing with international clients and have streamlined their procedures. A little preparation makes the process seamless.

While the exact checklist may differ slightly between banks, you should have a standard set of documents ready.

- Proof of Identity: Your passport is non-negotiable.

- Proof of Address: You will need to show a registered address in Poland, typically with a rental contract or property deed.

- Residency Permit: Your valid visa or residence card is crucial to prove your legal status.

- PESEL Number: This is your Polish national identification number. While not always mandatory to open the account, obtaining one vastly simplifies almost every financial and administrative task in Poland.

One of the most powerful tools you'll use is a multi-currency account. These accounts allow you to hold, send, and receive funds in various currencies—such as EUR, USD, and PLN—within a single account. This is indispensable for managing international investments, receiving income from abroad, or paying for travel without incurring punitive conversion fees on every transaction.

Sophisticated Wealth Management and Advisory

Beyond everyday banking, you need expert guidance to protect and grow your wealth. Poland's wealth management sector has matured significantly, with numerous reputable firms offering astute investment advice and asset management. The key is finding an advisor who not only understands the Polish market but also the complexities of international finance.

Choosing a financial advisor is not just about chasing returns. It's about finding a strategic partner who understands the intricate web of your global financial life. Their expertise in cross-border tax planning and international investment strategies is what will ultimately preserve and grow your wealth.

When interviewing potential advisors, inquire specifically about their experience with other expatriates and their fluency in international tax treaties. A competent advisor will structure your portfolio to be tax-efficient across all relevant jurisdictions, keeping you compliant while maximizing performance.

Ultimately, building a solid financial foundation is paramount when moving to Poland. By selecting the right banking partners and obtaining expert wealth management advice, you can ensure your assets are not just safe—they are positioned to thrive in one of Europe's most dynamic economies.

Your Key Questions About Living in Poland, Answered

As you evaluate a strategic move to Poland, a handful of practical questions inevitably arise. Let’s address the most common queries we hear from discerning individuals and families.

Consider this a practical supplement to the deeper insights we've shared, designed to bring clarity to the final details of your decision.

Are There High-Quality International Schools for My Children?

Yes, absolutely. Poland’s major cities—especially Warsaw, Kraków, and Wrocław—have a strong ecosystem of highly-regarded international schools. These institutions are adept at catering to the expatriate community, ensuring a smooth educational transition for your children.

You will find globally recognized curricula, including:

- The International Baccalaureate (IB) Diploma Programme

- The British system (IGCSE and A-Levels)

- The American High School Diploma and Advanced Placement (AP) courses

These schools offer a top-tier education entirely in English, complete with modern facilities and a genuinely international student body. A word of advice: admission can be competitive. We always recommend initiating the application process well in advance of your move.

What Does the Tax Situation Look Like for Affluent Foreigners?

Poland's tax system is multi-layered, beginning with a progressive income tax scale. However, for high-net-worth individuals and business owners, several frameworks can be highly attractive. For instance, a "lump-sum tax" on registered revenues is available for specific business activities, which can significantly simplify reporting and potentially lower your overall tax burden.

Let us be direct: navigating international tax law is not a DIY project. Engaging a specialist tax advisor is essential. An expert who specializes in expatriate finance can structure your affairs for maximum efficiency, ensuring full compliance in both Poland and your home country.

This level of professional guidance is the only way to correctly manage cross-border liabilities and leverage available incentives.

How Safe Are the Major Cities?

Personal safety is a cornerstone of Poland's high quality of life. The country consistently ranks as one of the safest in Europe, with exceptionally low rates of violent crime. This sense of security is particularly palpable in the affluent residential districts popular with expatriates.

You will find a visible and professional police presence in all major cities. Furthermore, it is standard for luxury apartment buildings and gated communities to have their own private, 24/7 security services, controlled access, and modern surveillance systems. This multi-layered approach to security provides genuine peace of mind, making Poland a remarkably comfortable and safe place to call home.

Navigating international healthcare is a critical component of any successful relocation strategy. At Riviera Expat, we specialize in securing world-class International Private Medical Insurance for high-net-worth professionals and their families. We provide the clarity and confidence you need to ensure your health is protected, no matter where your life or business takes you. Learn more about how we can build your personalized global health plan.