Relocating abroad is a significant investment in your professional and personal future. A critical oversight many successful individuals make is assuming their domestic health insurance will suffice.

It will not.

Even premium domestic health plans are engineered for a single country and its specific healthcare system. They are designed for short-term travel emergencies, not the reality of establishing a life in a new country. Relying on your home-country plan creates unacceptable gaps in your financial and health security.

Why Your Domestic Health Plan Is Not Enough

Living as an expatriate demands a sophisticated approach to protecting your health and assets. The excellent health insurance you have at home is simply not structured for the complexities of a global lifestyle. Using it abroad is akin to navigating the Tokyo Metro with a map of the Paris Métro—it is the wrong tool for the task and will lead to costly errors.

The inadequacies become glaringly obvious the moment you require anything beyond a simple emergency room visit. Your domestic plan almost certainly will not cover routine check-ups, specialist consultations, or any planned medical procedures outside its home territory. This leaves you exposed to paying for everything out of pocket, often at exorbitant international rates.

The Critical Gaps in Domestic Coverage

The fundamental difference isn't merely geographic; it is the entire support infrastructure. True international health insurance for expats is built around a worldwide network of pre-vetted, high-quality hospitals and clinics, providing seamless access to elite care.

Domestic plans cannot offer this level of service. They lack key features essential for a global life:

- No Direct Billing: You will likely be required to pay the full, often substantial, cost of your medical care upfront. Subsequently, you face the administrative burden of seeking reimbursement from your domestic insurer, with no guarantee of claim approval.

- Limited Global Assistance: Dedicated 24/7 multilingual support and expert assistance in navigating a foreign hospital system are not standard features of domestic plans.

- Exclusion of Core Expat Needs: Should you require a medical evacuation to a center of excellence for specialized surgery, this is a standard feature in premier international plans but is almost never included in domestic coverage.

A direct comparison starkly illustrates why relying on a domestic plan is a financial risk most high-net-worth individuals find unacceptable.

Domestic vs. International Health Insurance: A Comparative Analysis

| Feature | Typical Domestic Health Plan | Comprehensive International Health Plan |

|---|---|---|

| Geographic Coverage | Limited to your home country; very basic emergency-only travel cover | Global or regional coverage, including your home country |

| Routine & Specialist Care | Not covered abroad | Covered, allowing for check-ups, specialist visits, etc. |

| Provider Network | Restricted to a specific network within one country | Access to a global network of hospitals and doctors |

| Direct Billing | Almost never available abroad; pay first, claim later | Widely available, with the insurer settling payment directly with the hospital |

| Medical Evacuation | Rarely included | A standard, essential feature for serious conditions |

| 24/7 Assistance | Basic customer service, often only in one language | Multilingual emergency and case management support |

| Portability | Lost if you move your official residence abroad | Designed for a mobile lifestyle, moves with you |

This table makes it clear: a domestic plan is for a stationary life, while an international plan is for a life without borders.

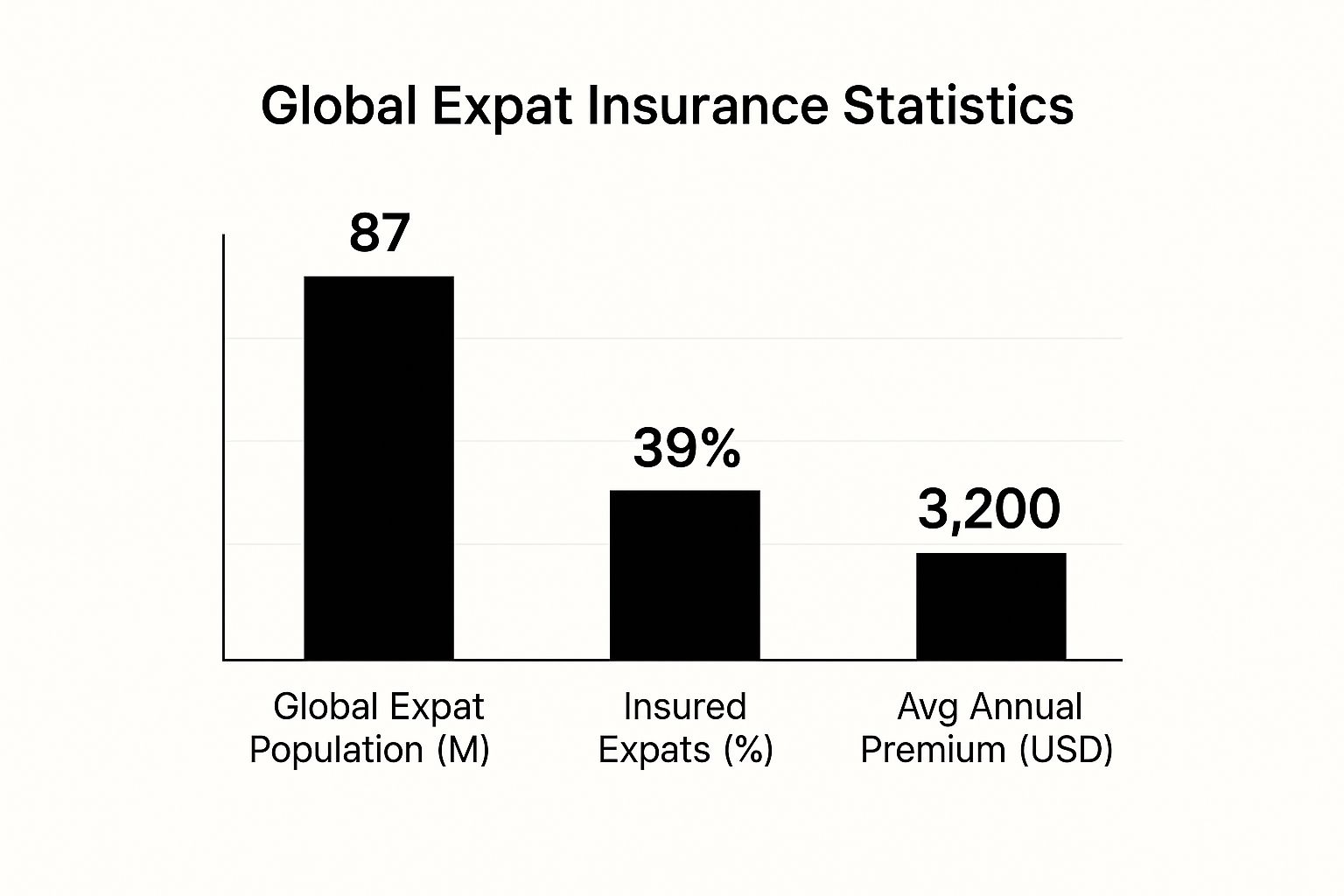

This chart shows just how many people are living the expat life and highlights some key insurance stats.

The numbers speak for themselves. While the global expatriate community is substantial, a concerning number are underinsured. They are exposed to significant financial risk, even though bespoke plans designed for their needs exist.

From Expense to Essential Asset

Let’s consider a realistic scenario. You are residing in Singapore and require non-emergency surgery with a leading specialist. Your domestic plan will not cover a single dollar. A proper international policy, however, not only covers the cost but also connects you with a pre-approved network of top-tier specialists, ensuring you receive world-class care.

An international health plan is not merely an insurance policy; it is your portable healthcare system. It delivers access, choice, and financial security, transforming a significant potential liability into a manageable component of your global life.

Ultimately, viewing international health insurance for expats as just another expense is a strategic error. It is a core asset, an investment in your health and financial stability. It ensures that whether your ambitions take you to London or Hong Kong, your well-being is protected to the highest standard. This isn't just about surviving as a global citizen—it's about having the freedom to truly thrive.

The Global Healthcare Cost and Quality Equation

Here is a reality every expatriate learns, sometimes through costly experience.

The price of a hospital stay in Singapore bears little resemblance to one in Spain. The quality of care in Dubai can be worlds apart from that in a neighboring country. As a global citizen, you quickly realize that the value of anything—from real estate to healthcare—is dictated by location.

This is the single most important factor when selecting your international health insurance for expats. Your policy is not just a document; it is your key to a specific country's healthcare system. If it is not designed for that exact system, it may not deliver the value you expect for the premium you pay.

Why Healthcare Costs and Standards Vary So Widely

Why does healthcare differ so profoundly from one border to the next? It is a complex interplay of a country's economics, politics, and culture. Some nations view world-class healthcare as a public right, investing national resources into state-of-the-art hospitals and rigorous medical training. In others, you will find exceptional private facilities operating alongside a more basic public system.

A few key ingredients shape the local healthcare landscape:

- National Healthcare Philosophy: Is healthcare a government responsibility or a private market? A country's core belief on this point dictates everything from funding mechanisms to the standard of care you can expect.

- Medical Infrastructure: The level of investment a country makes in technology, research, and modern facilities directly impacts the quality of care you receive.

- Regulatory Environment: Government mandates, particularly regarding compulsory insurance, create the framework within which both residents and expatriates must operate.

Attempting to use a one-size-fits-all insurance plan in this varied environment is not just ill-advised—it is a significant financial risk.

A Tale of Two Systems: Switzerland and the Netherlands

Let's examine two of Europe's premier destinations: Switzerland and the Netherlands. Both offer outstanding healthcare, but their approaches are distinct. This is where you see precisely how critical it is to understand the local rules of engagement.

The cost of international health insurance for expats is shaped significantly by the highly variable healthcare costs and systems across top expat destinations. Your plan must be designed not just for your health needs, but for the specific country you call home.

Consider Switzerland, a country consistently ranked among the world's best for healthcare outcomes. As an expatriate resident, you have a three-month window to secure mandatory private health insurance. Premiums for this LAMal coverage typically range between CHF 300 and CHF 550 (approximately USD 330-600) per month for an adult, depending on the canton and deductible chosen. This system guarantees access to their elite network of hospitals and specialists.

Now look at the Netherlands. It also requires all residents, including expats, to hold basic private health insurance, with average premiums around €145 per month. This policy provides access to a system renowned for its efficiency and focus on primary care. These figures demonstrate the cost variance, yet in both nations, having the correct insurance is a legal requirement, not a choice. To understand these differences further, you can explore more data on the world's leading healthcare systems and see how they impact insurance needs.

Aligning Your Plan with Local Excellence

The examples of Switzerland and the Netherlands underscore a critical point: in countries with top-tier healthcare, possessing the right insurance is not merely advantageous; it is your key to entry.

This is precisely why a generic, low-cost international plan often proves to be a costly mistake. If it fails to meet the legal requirements of your new country or does not provide access to the best doctors and hospitals, its value is questionable.

Think of your international health insurance as a precision instrument. It must be perfectly calibrated to the local environment, providing both financial peace of mind and, more importantly, access to the best available care when you need it most.

Anatomy of a Premium International Health Plan

To make a truly informed decision, one must look beyond the monthly premium and analyze what a high-quality international health policy delivers. It is analogous to analyzing a blue-chip stock; you must examine the fundamentals that create its value. A top-tier plan is not just a safety net—it is a sophisticated tool engineered for a global life.

The best policies are built on non-negotiable pillars of coverage. Understanding these components is the only way to avoid unwelcome surprises at the moment you require care. The objective is to feel completely confident that your health, well-being, and finances are protected to the highest standard, anywhere in the world.

Inpatient and Outpatient Care: The Core Engine

At the very heart of any international health insurance for expats, you will find two primary categories of coverage: inpatient and outpatient care. The distinction is simple, but it is absolutely critical for understanding the value of your policy.

Inpatient care is any treatment that requires formal admission to a hospital. This covers significant medical events: major surgeries, overnight stays for observation, and intensive care. It is the most crucial—and often most expensive—component of a policy, covering the substantial costs associated with hospital rooms, surgeon’s fees, and anesthetics.

Conversely, outpatient care covers every medical service that does not require hospital admission. This includes consultations with general practitioners or specialists, diagnostic tests like MRIs or blood work, and prescription drugs. A robust outpatient benefit is the hallmark of a superior plan because it supports proactive health management, not just reactive treatment of emergencies.

Medical Evacuation and Repatriation: Your Lifeline

For any serious expatriate, there is perhaps no single benefit more vital than medical evacuation and repatriation. This coverage is your absolute guarantee that you can access world-class medical care, regardless of your location.

Imagine you are in a country with adequate general healthcare, but you suddenly require a highly specialized cardiac procedure that is only performed at a center of excellence in another country.

Medical evacuation covers the often staggering cost of transporting you from your current location to the nearest facility that can provide the life-saving treatment you need. This is not limited to remote locations; it applies to any situation where local expertise is insufficient.

Repatriation is a related benefit that covers the cost of flying you back to your home country for treatment if it is deemed medically necessary. The cost for these air ambulance services can easily reach six figures, making this coverage an absolute essential.

Valuable Optional Benefits for Complete Protection

Beyond the core essentials, premium plans allow you to add optional benefits to construct a truly comprehensive health solution. These are not mere afterthoughts; they are key modules that address your specific lifestyle and family needs.

- Comprehensive Dental and Vision: This extends far beyond routine check-ups to cover major dental work like crowns and orthodontics, as well as prescription glasses and contact lenses. For families, this is often a non-negotiable addition.

- Maternity Coverage: If you are planning to grow your family abroad, this is essential. It covers everything from prenatal consultations and delivery costs to postnatal care for mother and baby. Be aware that these benefits almost always have a waiting period of 10-24 months, so advance planning is crucial.

- Wellness and Preventive Care: The best plans increasingly include benefits for routine health screenings, vaccinations, and wellness programs. This encourages a proactive approach to your long-term health.

Understanding these different building blocks is the first step toward making a wise choice. For a deeper dive into how these components all fit together, you can find more information about which expat medical insurance policy type is right for you. This knowledge empowers you to analyze any policy and know with confidence that it truly aligns with your requirements.

Understanding Your Premiums and Global Cost Drivers

Let's discuss the price of your international health insurance for expats. It is not an arbitrary figure. The premium you pay is a direct reflection of the healthcare realities in your chosen areas of coverage. Understanding the drivers of these costs is key to moving beyond simple price comparison to assessing the true value of a policy.

Your final premium is a combination of your personal profile—such as age and medical history—and your selected level of coverage. However, the most significant factor is your geographic area of cover. This is where you see the most dramatic variations in price, because world-class medical care in one city can cost a fraction of what it does in another.

The Regional Spectrum of Healthcare Costs

The cost of your insurance is intrinsically linked to the cost of healthcare in the countries you select. For instance, any policy that includes the United States will command a much higher premium. This is because the cost of medical services there is exceptionally high. Policies that specifically exclude the USA are instantly more affordable.

This same principle applies across different regions. The local cost of living and the maturity of the private healthcare market create a vast range of price points.

- Southern Europe: Locations like Spain and Portugal offer a high quality of life with relatively moderate healthcare costs. They have robust public systems complemented by a competitive private sector, which helps manage prices.

- Central America: Destinations such as Costa Rica are popular with expatriates, but you may find insurance premiums are somewhat higher. This often reflects a private healthcare system designed to serve a discerning expatriate and tourist population.

- Major Financial Hubs: Consider Singapore, Hong Kong, and Dubai. These cities feature some of the finest medical facilities on the planet. That level of excellence comes at a premium, and insurance costs reflect that reality.

The cost of private international health insurance for expats varies dramatically worldwide, making it a critical line item in any relocation budget. In Southern Europe, Spain offers a clear example where tax-paying residents can access the public system, but the private market is also highly accessible. A quality private plan in Spain can be secured for as low as €70 per month, with top-tier comprehensive plans for a 45-year-old typically ranging from €150-€250 monthly.

Compare this to the UAE (Dubai), where mandatory, high-quality private cover for the same individual might range from USD 400 to USD 800 per month. This significant price differential points to very different healthcare infrastructures and market dynamics at play.

The Engine of Rising Costs: Medical Trend Rate

Beyond your location, a universal force pushes premiums up annually: the global medical trend rate. This is the yearly rate at which medical costs are increasing, fueled by powerful global factors. It is the primary reason your renewal premium is almost always higher than the previous year's, even if your health status has not changed.

The medical trend rate is a measure of medical inflation. It accounts for the rising costs associated with new technologies, advanced prescription drugs, and an increased demand for healthcare services worldwide.

This is not standard consumer price inflation. It is a specific, accelerated inflation unique to the healthcare sector. Grasping this concept is vital for long-term financial planning, as it provides a realistic forecast of future insurance costs. You can learn more in our article about why health insurance premiums increase each year.

When budgeting for health insurance, it is prudent to consider the broader financial landscape of your new home. For instance, you might analyze a comprehensive guide to understanding costs in Dubai to ensure your healthcare budget aligns with the total cost of living. By considering both regional price drivers and the relentless medical trend, you can make insurance decisions with the strategic foresight required for long-term financial security.

How to Select Your Ideal Expat Insurance Plan

Selecting the right international health insurance for expats is not a transactional purchase. It is a critical strategic decision that directly impacts your family's well-being and financial stability while living abroad.

An error in this choice could expose you to staggering medical bills or deny you access to the best care when you need it most. This is not about comparing monthly premiums; it is about a detailed analysis of your personal needs, a thorough understanding of policy details, and a realistic assessment of healthcare costs worldwide.

A methodical approach is your best strategy. Let's break down how to execute it correctly.

Define Your Personal and Geographic Needs

First, you need a precise assessment of your family's health. Document everything—any chronic conditions, anticipated medical needs, and even lifestyle factors that influence your healthcare requirements. This personal audit is the foundation of your search. Without it, you are operating on assumptions.

Next, you must define exactly where you require coverage. This is one of the largest drivers of your plan's cost. Consider your primary country of residence, destinations for business travel, and any personal trips you anticipate.

- Worldwide excluding USA: For most expatriates, this is the optimal choice. It provides comprehensive global coverage while avoiding the exceptionally high costs of the US healthcare system.

- Worldwide including USA: This is non-negotiable if you travel to the US frequently or wish to retain the option of receiving treatment there. The premiums are significantly higher, but it offers complete geographic freedom.

- Regional Plans: Some insurers offer plans tailored to specific regions like Europe or Southeast Asia. This can be an intelligent, cost-effective choice if your life and travel are primarily contained within one part of the world.

Analyze Financial Structure and Insurer Reputation

Once your needs are defined, it's time to analyze the financial architecture of the policy and the reputation of the insurer. You must understand how deductibles, co-payments, and out-of-pocket maximums function. A higher deductible will lower your monthly premium, but ensure you are comfortable with this level of initial self-funding before your insurance takes over.

An insurer's reputation for service is as important as the policy's written benefits. You are not just buying coverage; you are securing a service partner who must perform flawlessly during a medical event.

Vetting the insurer is paramount. What is their claim processing time? What is their payment record? You must investigate their track record. Look for the quality of their direct billing network in your new country of residence. Direct billing—where the insurer settles payment with the hospital on your behalf—is a crucial service, protecting you from large upfront payments and administrative complexity.

For a deeper dive into the different kinds of policy structures, you can review our guide on choosing the right type of expat insurance policy.

Account for Global Medical Cost Trends

Finally, you must think long-term. The cost of medical care is not static; it is rising rapidly. International health insurance trends show a steady increase in healthcare costs worldwide, with some projections showing the global average medical trend rate—the annual increase in medical costs—reaching 10.1% in 2024. This is fueled by new medical technologies, innovative pharmaceuticals, and an increased prevalence of chronic conditions.

This medical inflation means your premiums will likely increase each year. By selecting a robust, well-structured plan from a reputable insurer now, you are making a sound investment in your future. It is about securing both your immediate health and your long-term financial security in a world where medical costs are only heading in one direction.

Your Expat Health Insurance Questions Answered

When planning a move abroad, the landscape of international healthcare can seem opaque. For individuals who value precision, vague answers about a subject as critical as international health insurance for expats are unacceptable. This section addresses the most common questions with the direct, specific clarity you require.

Will My Premium Home Country Insurance Cover Me Abroad?

The direct answer is almost certainly not for long-term residency.

Even the most elite domestic health plans are engineered for a single country's healthcare system. They are designed for short-term travel, not for an individual residing overseas. Attempting to use a local library card in another country is a fitting analogy—it is simply not integrated into the system.

Relying on a home-country plan creates dangerous financial and medical exposure. It is highly unlikely to cover routine check-ups, ongoing management of chronic conditions, or any non-emergency care in your new country. Critically, it almost never includes essential services like medical evacuation or direct billing arrangements with international hospitals, leaving you to pay enormous sums upfront and navigate a complex reimbursement process from abroad.

For a true expatriate, a domestic plan is a high-risk liability. A dedicated international policy is not a luxury; it is a foundational asset for continuous, high-quality care without geographic and financial gaps.

What Is the Difference Between Area of Coverage and Worldwide Coverage?

These terms define the geographic scope of your insurance and are a primary determinant of your premium. An "area of coverage" plan specifies the regions where you have full benefits, such as 'Europe' or 'Southeast Asia.' This is a strategic way to avoid paying for coverage you do not need.

'Worldwide' coverage offers the broadest protection, covering you almost anywhere on the planet. However, a crucial distinction exists: the "Worldwide excluding USA" option. Because US healthcare costs are exceptionally high, plans that carve out the United States are substantially more affordable. If you require access to care in the US, you must select a plan that explicitly includes it. Aligning your coverage area with your actual residency and travel patterns is key to securing the right protection without overpaying.

How Do Pre-existing Conditions Affect My Insurance Options?

This is a critical consideration. An insurer's handling of your medical history is a pivotal part of the application process. Complete transparency on your application is non-negotiable to ensure the validity of your policy when you need to make a claim.

Insurers typically approach pre-existing conditions in one of several ways. Based on your declared medical history, they might:

- Offer full coverage with a premium loading: You pay a higher premium to cover the increased risk associated with your condition.

- Cover you, but apply a specific exclusion: The policy will not cover any treatment related to the declared pre-existing condition.

- Offer "moratorium" underwriting: This is a common feature of premium plans. A pre-existing condition may become eligible for coverage after a specified waiting period (typically 24 months) during which you have been free of symptoms, treatment, and medical advice for that condition.

- Decline the application: If the condition presents a level of risk the insurer is unwilling to underwrite, they may decline to offer a policy.

This is a complex area. The optimal strategy is to discuss your medical history openly with a specialist broker who understands which insurers are best equipped to handle your specific circumstances.

Why Is Medical Evacuation an Essential Benefit for Expats?

Medical evacuation is an absolute, non-negotiable component of any serious international health insurance for expats. It covers the potentially staggering cost—often well into six figures—of transporting you from a location with inadequate medical facilities to the nearest center of excellence that can provide the life-saving treatment you require.

This is not a benefit reserved for individuals in remote locations. Even major global cities may lack certain highly advanced medical specializations. Evacuation ensures you are never constrained by the limitations of the local healthcare system. A related benefit, repatriation, covers transport back to your home country for treatment if medically appropriate. For any expatriate, this is a critical risk-management tool that guarantees access to the highest standard of care, regardless of where you are when a medical crisis occurs.

Beyond health coverage, understanding essential aspects of living abroad, such as visa requirements, is crucial for expats. For instance, you might want to learn more about the Dubai Golden Visa requirements to ensure every aspect of your relocation is handled with professional care.

At Riviera Expat, we provide the clarity and control you demand for your healthcare decisions. We offer expert, objective guidance to help you select the precise international health insurance that aligns with your global lifestyle. Secure your consultation with Riviera Expat today.