For individuals whose lives and careers are global, a standard domestic health insurance policy is functionally obsolete. This is a critical realization many expatriates encounter too late.

For high-net-worth professionals and globally mobile individuals, international health insurance for an expatriate is not a luxury—it is a non-negotiable component of a global strategy, designed to protect both your health and your wealth.

Protecting Your Health and Assets Globally

When your personal and professional life crosses borders, your healthcare strategy must evolve accordingly. A domestic plan is engineered for a life lived in a single country, tied intrinsically to that nation’s provider networks, regulations, and currency. The moment you establish residency abroad, it becomes a relic.

An international health insurance expatriate plan is an entirely different class of asset. It is best conceptualized not as a simple policy, but as a global passport to elite medical care. It is designed from the ground up for portability, moving with you seamlessly whether you are relocating to Singapore for a new venture or spending several months at your residence in the Swiss Alps.

The Inadequacy of Local Plans

A common consideration is to acquire a local plan in one's new country of residence. While this may appear cost-effective initially, it is a dangerously restrictive option for anyone with a global lifestyle. These plans anchor you to one country's healthcare system.

They seldom provide coverage during international travel, feature limited provider networks, and almost never offer the multilingual, 24/7 support that is essential when navigating a medical issue in an unfamiliar environment.

For the modern expatriate, a healthcare strategy must deliver two certainties: access to the highest standard of care and absolute financial predictability. A localized plan can guarantee neither when your world is not localized.

This is the key distinction. A premier international plan ensures you are not just covered for an unexpected injury, but that you have direct access to a network of world-class specialists for everything from routine diagnostics to complex, life-saving surgery, anywhere in your covered region.

Securing Your Global Lifestyle

Ultimately, selecting the appropriate coverage is a strategic decision that underpins your ability to operate effectively on the global stage. This extends beyond simple risk management. It is about safeguarding your well-being, shielding your portfolio from catastrophic medical expenditures, and preserving your peace of mind.

The critical elements are:

- Global Portability: Your coverage must be seamless, with no gaps or degradation in quality as you move between countries.

- Access to Premier Networks: You require direct, cashless access to the world's leading hospitals and physicians, not just those in a single city or country.

- Financial Security: The plan must possess the financial strength to cover major medical events without causing you to be concerned about the financial implications.

Of course, thriving as an expat goes beyond just healthcare. To get a broader picture, this complete guide to thriving as an expat in the Netherlands offers some great insights.

What Exactly Is Expatriate Health Insurance?

It is imperative to be clear: an international health insurance expatriate policy is not an enhanced travel plan. Nor is it a domestic policy with a "global" add-on.

Consider this analogy. A domestic plan is akin to a local gym membership—excellent for its intended location, but useless elsewhere. Travel insurance is a first-aid kit; it is designed for unforeseen, short-term emergencies, not for the long-term management of your health.

An expatriate health plan is a distinct, purpose-built financial instrument. It is engineered for a life lived across borders, providing a level of access and security that other products cannot match. It functions as an all-access pass to high-quality healthcare, irrespective of your location.

The Core Design of True Global Coverage

The intrinsic value of these specialized plans is defined by several key features. These are not amenities; for a globally mobile professional, they are absolute necessities.

-

Comprehensive Worldwide Coverage: This is the bedrock of the policy. It signifies that your coverage is active and recognized whether you are at your primary residence in Singapore, visiting family in the United States, or attending business meetings in London. It provides true peace of mind.

-

Direct-Settlement Networks: This feature is a paradigm shift in healthcare access. Premier plans maintain direct billing relationships with elite hospitals and clinics worldwide. In the event of a significant medical need, the insurer settles the invoice directly with the provider. You are insulated from the stress and complexity of paying a substantial bill upfront and seeking reimbursement later.

-

Robust Medical Evacuation: Should a medical crisis occur in a location with inadequate medical facilities, this coverage becomes critical. It finances the considerable cost of transporting you to the nearest center of medical excellence, which may be in another country entirely. It is both a logistical and financial lifeline.

Understanding how to choose the right type of expat health insurance policy is crucial, as different structures are built for different needs.

More Than a Safety Net—It's Wealth Protection

For high-net-worth individuals, an international health insurance expatriate plan is a powerful asset management tool.

A stark reality is that catastrophic medical expenses are one of the fastest ways to erode wealth. A six- or seven-figure medical emergency is not an abstract risk; it is a reality in many parts of the world, particularly in countries with highly privatized healthcare systems like the United States.

These policies are engineered to absorb that financial shock completely. They feature extremely high annual limits—often several million dollars, or even unlimited—providing absolute certainty that a health crisis will never jeopardize your financial stability or long-term objectives. That financial peace of mind is as valuable as the medical access itself.

The real purpose of a premier expat health plan is to make the world's best healthcare accessible and affordable, effectively removing geography as a barrier to your well-being.

This growing need is transforming the insurance market. According to Technavio's 2024 analysis, the global health insurance market is projected to grow by USD 875.1 billion between 2023 and 2028. This expansion is fueled by an increasing number of expatriates and a heightened awareness of the need for plans that cover services across multiple countries, including emergency evacuations and access to international hospital networks. With the Asia-Pacific region expected to be a major contributor to this growth, it is clear this class of coverage is becoming a non-negotiable part of life for any serious global professional.

Evaluating Core Coverage And Premium Benefits

A common misconception regarding top-tier health insurance is viewing it as a monolithic product. A truly superior international health insurance expatriate plan is a carefully constructed portfolio of benefits, designed to protect both your health and your wealth.

To derive maximum value from your plan, a detailed analysis is required. You must differentiate between the foundational coverage that ensures your safety and the premium benefits that enhance your global lifestyle.

Consider it analogous to acquiring a high-performance automobile. The core coverage represents the powerful engine and state-of-the-art chassis—the non-negotiable components delivering safety and performance. The premium benefits are the custom leather interior, advanced navigation, and concierge service—they elevate the experience from merely functional to truly exceptional.

Differentiating Inpatient and Outpatient Essentials

Every health plan is constructed upon two pillars: inpatient and outpatient care. Understanding this distinction is fundamental.

Inpatient care pertains to major medical events. It includes any treatment requiring hospital admission, such as major surgery, an extended recovery period, or intensive care. This forms the absolute core of your policy, the primary safety net designed to shield you from the astronomical costs of a serious medical crisis.

Outpatient care encompasses all other medical services received without a hospital admission. This includes consultations with specialists, diagnostic imaging like MRIs, laboratory work, and prescription medications. While some basic plans may limit this coverage, a proper international health insurance expatriate policy offers robust outpatient benefits. This ensures you can manage your day-to-day health proactively without constant financial consideration.

A truly effective policy handles a catastrophic event and a routine check-up with the same seamless efficiency. The real goal is to remove money from the equation when you're making health decisions, whether it's for a planned operation or a quick visit to a specialist.

Analyzing the Financial Architecture

Beyond the scope of coverage, it is crucial to understand the financial mechanics of the policy. For any individual who manages their finances with diligence, this means translating insurance terminology into a clear assessment of financial risk.

-

Deductible: This is the initial amount you pay out-of-pocket before the insurer's contribution begins. A higher deductible typically corresponds to a lower premium, representing a classic trade-off between upfront cost and potential exposure.

-

Co-insurance: After your deductible is met, you will likely share subsequent costs with your insurer. An 80/20 split is common, where the insurer covers 80% of the bill and you cover the remaining 20%, up to a specified out-of-pocket maximum.

-

Annual Limit: This is the absolute maximum your insurer will pay within a policy year. For a high-net-worth individual, a multi-million-dollar or unlimited cap is not a luxury—it is an essential requirement for true risk mitigation.

Navigating policy documents can be a formidable task, as the language is often dense. For assistance in deciphering complex terms, this plain-English guide to understanding legal documents can be a useful resource.

Comparing Core vs. Elective Benefits in Expat Health Plans

To deconstruct a plan effectively, it is helpful to separate the standard, essential features from the optional, high-end benefits. The table below provides a comparative breakdown to help you prioritize your needs and decide where to invest your premium.

| Benefit Category | Typical Core Coverage (Included in Standard Plans) | Typical Elective Coverage (Add-on Modules) |

|---|---|---|

| Hospital Stays | Semi-private or private room, surgery, intensive care. | Choice of premium suites, access to exclusive hospitals. |

| Outpatient Care | Specialist consultations, diagnostic tests (MRIs, CTs), lab work. | Unlimited specialist visits, direct billing arrangements. |

| Emergency | Ambulance transport, emergency room treatment, stabilization. | Full medical evacuation to a center of excellence and repatriation. |

| Dental & Vision | Emergency dental treatment due to an accident. | Routine dental check-ups, major restorative work, crowns, orthodontics, high-end eyewear. |

| Wellness | Basic health screenings, often with defined limits. | Comprehensive annual physicals, cancer screenings, vaccinations, alternative therapies (acupuncture, chiropractic). |

| Maternity | Often excluded or available with a long waiting period (e.g., 10-12 months). | Full prenatal, delivery, and postnatal care, including newborn coverage from birth. |

This comparison illustrates where standard plans typically draw the line and how elective modules allow for the construction of a plan that truly reflects your lifestyle and health priorities.

Assessing Premium Add-On Benefits

This is the stage where you transition from purchasing a generic product to designing a personalized financial safety net. These elective modules distinguish a standard plan from a world-class one, allowing you to tailor coverage to your precise lifestyle.

High-value additions worth careful consideration include:

-

Comprehensive Dental and Vision: This extends far beyond emergency treatment, covering routine cleanings, major restorative work like implants and crowns, and designer prescription eyewear.

-

Maternity and Newborn Care: An absolute necessity if you are planning to expand your family abroad. This module covers everything from prenatal consultations and delivery to postnatal care for both mother and child. It is critical to note that these benefits almost universally have a waiting period, making advance planning essential.

-

Wellness and Preventive Care: This reflects a modern, proactive approach to health, focusing on prevention rather than solely treatment. It covers services like comprehensive annual physicals, advanced cancer screenings, and vaccinations.

By deconstructing the plan into these core and elective components, you can strategically build a policy that provides robust protection where you need it most. This empowers you to create an international health insurance expatriate plan that is a perfect fit for your life, not an off-the-shelf compromise.

Choosing Your Geographic Area of Coverage

Selecting the appropriate geographic scope for your international health insurance expatriate plan is one of the most significant decisions you will make. It is a choice that directly impacts both your premium and the practical utility of your policy. This is not a matter of simply checking a box; it is a strategic decision that must align with where you live, work, and travel.

The entire decision hinges on one critical question: do you require coverage in the United States? That single choice bifurcates the world of international health plans into two primary categories:

- Worldwide Coverage: A truly global plan providing access to healthcare anywhere, including the high-cost U.S. system.

- Worldwide Coverage Excluding the USA: A plan that covers you everywhere on the planet except for the United States.

The price differential is substantial. Including the U.S. in your policy can increase your premium by 50% to 100%, and in some cases, even more.

The United States Premium

Why does the inclusion of the U.S. cause premiums to escalate so dramatically? The reasons are rooted in the unique and exceptionally expensive American healthcare system.

First, the cost of medical care is an order of magnitude higher. A standard surgical procedure or a few nights of hospitalization in a U.S. facility can generate an invoice many times greater than the cost for equivalent care in Europe or Asia. Insurers must price this massive financial risk into your premium.

Second, the U.S. is a uniquely litigious environment. This inflates medical malpractice insurance costs for physicians and hospitals, a cost that is passed directly to patients and, consequently, to the insurers covering the bills. For an international health insurance expatriate provider, this represents a significant liability.

A Strategic Framework for Your Decision

There is no single "best" answer, only the one that is right for your specific circumstances. This requires a rigorous, objective assessment of your life and future plans.

Let's examine a few scenarios.

Scenario 1: U.S. Coverage is Essential

You are an American citizen residing abroad but return to the U.S. for extended family visits annually. You desire the security of knowing you can consult your trusted physicians without facing financial ruin or relying on inadequate travel insurance. For you, a "Worldwide" plan is a necessity.

Scenario 2: U.S. Coverage is a Prudent Option

You are a French national working in Singapore. Your firm has indicated potential plans to open a New York office within the next few years. While you have no immediate travel plans to the U.S., securing coverage now is a savvy strategic move. It provides flexibility and helps you avoid the complexities of seeking underwriting later should your health status change.

Scenario 3: U.S. Coverage is an Unnecessary Expense

You are a Canadian who has permanently relocated to Dubai. You have no familial or business connections to the United States and no plans to travel there. In this instance, selecting a "Worldwide excluding USA" plan is the most astute financial decision. You will realize substantial premium savings that can be allocated more effectively.

The decision to include or exclude the U.S. is the single most powerful lever you have to control your premium. Your choice should be a direct reflection of your actual, anticipated lifestyle—not a vague 'what if'.

This is particularly true because the U.S. market for international health insurance expatriate plans is both mature and incredibly complex. U.S.-based insurers offer excellent access to domestic provider networks and cutting-edge services like telemedicine. However, they also operate in a challenging environment defined by high medical inflation and continuous regulatory changes, a dynamic detailed in this S&P Global report on the U.S. health insurance sector.

Ultimately, you must make a deliberate, informed choice, weighing the significant cost against your real-world requirements.

Understanding Your Financial Investment

When you purchase a premium international health insurance for an expatriate plan, you are not merely buying a policy; you are making a strategic financial investment. Understanding how your premium is calculated allows you to appreciate its value and anticipate how that investment might evolve over time.

Your policy’s price is not an arbitrary figure. It is a meticulously calculated amount, a direct reflection of risk based on several key personal factors. These are the levers that directly shape your financial commitment.

Ultimately, your premium is the sum of these variables, each one contributing to the insurer's model of your unique risk profile.

Core Factors Driving Your Premium

The primary drivers of your premium are directly correlated with your personal profile and the level of protection you select. At its core, an insurer's task is to calculate the probability—and potential cost—of you filing a claim.

The factors under closest scrutiny are:

- Your Age: This is arguably the most significant factor. With age, the statistical likelihood of requiring medical care increases, and premiums reflect this actuarial reality.

- Geographic Coverage: As discussed, your decision between 'Worldwide' and 'Worldwide excluding USA' coverage is a major determinant of cost. Including the U.S. can substantially increase your premium due to its outlier healthcare costs.

- Level of Benefits: The more comprehensive your plan, the higher the premium. When you add elective modules such as comprehensive dental, vision, and wellness benefits, your premium will rise commensurate with that expanded safety net.

Behind the Scenes: Global Market Influences

Beyond your personal data, your premium is also subject to powerful global forces. Your policy does not exist in a vacuum; it is part of a dynamic global marketplace, and its price is influenced by large-scale trends that affect every insurer.

This is where a more sophisticated understanding of your investment is particularly valuable.

The most critical external factor is medical inflation. This is the rate at which healthcare costs—from hospital accommodation to prescription pharmaceuticals—are increasing in a specific region. It almost always outpaces standard consumer price inflation, meaning the cost of delivering care is in a constant state of growth.

A premium international health insurance plan is an asset that must be priced against a backdrop of global economic realities. Your annual investment reflects not only your personal risk but also the fluctuating cost of world-class medical care in the regions you frequent.

This is a key reason premiums often adjust annually. To gain a deeper understanding of this dynamic, you can read our detailed article explaining why medical insurance premiums rise year after year.

The broader insurance market also plays a significant role. The behavior of the global insurance market directly impacts the pricing of international health insurance for an expatriate. For instance, recent market analysis reveals a complex picture. While overall global commercial insurance rates have moderated, casualty insurance rates have increased, particularly in the U.S., driven by the rising severity of claims. This environment pressures insurers to offer competitive pricing while managing the very real risk of covering expensive international medical claims, especially with medical inflation on the rise. For more on these global insurance market trends, check out marsh.com.

By understanding both the personal and the market-driven components of your premium, you can reframe your policy from a mere expense to a carefully priced financial instrument designed to protect your most valuable assets: your health and your wealth.

How to Choose the Right Plan: A Strategic Framework

Choosing the right international health insurance expatriate plan is a serious executive decision, not a simple purchase. It demands a clear, methodical approach, progressing from a high-level assessment of your lifestyle to a detailed analysis of specific policies. This framework provides a step-by-step process to ensure your final choice is not merely adequate, but perfectly aligned with your global requirements.

The entire process must begin with an objective evaluation of your family's healthcare needs. Are there chronic conditions requiring ongoing management? Do you anticipate needing specialized care, such as maternity services or advanced dental work? Clarifying these details at the outset prevents you from overpaying for benefits you will not use or, far worse, finding yourself dangerously underinsured when it matters most.

A Step-by-Step Selection Process

Once you have a clear picture of your medical requirements, you can proceed through a logical sequence of decisions. This structured approach eliminates guesswork and grounds your choice in practical reality.

-

Define Your Geographic Footprint: First, map your life. Where will you be primarily domiciled? Where will your business or leisure travel take you? This single factor determines whether you require a comprehensive 'Worldwide' plan or if a 'Worldwide excluding USA' policy is the more financially prudent choice.

-

Evaluate Provider Networks: Next, you must investigate the insurer's network in your key locations. A premier plan is of little value if it does not provide access to top-tier hospitals and specialists on the ground. It is essential to verify that the insurer has direct-settlement agreements with the leading facilities in your primary country of residence.

-

Methodically Compare Quotes: Obtain proposals from several high-quality insurers and conduct a side-by-side comparison. Do not focus solely on the headline premium. Scrutinize the details—deductibles, co-insurance levels, and annual limits. Your objective is to identify the optimal balance: robust, ironclad protection that remains cost-effective.

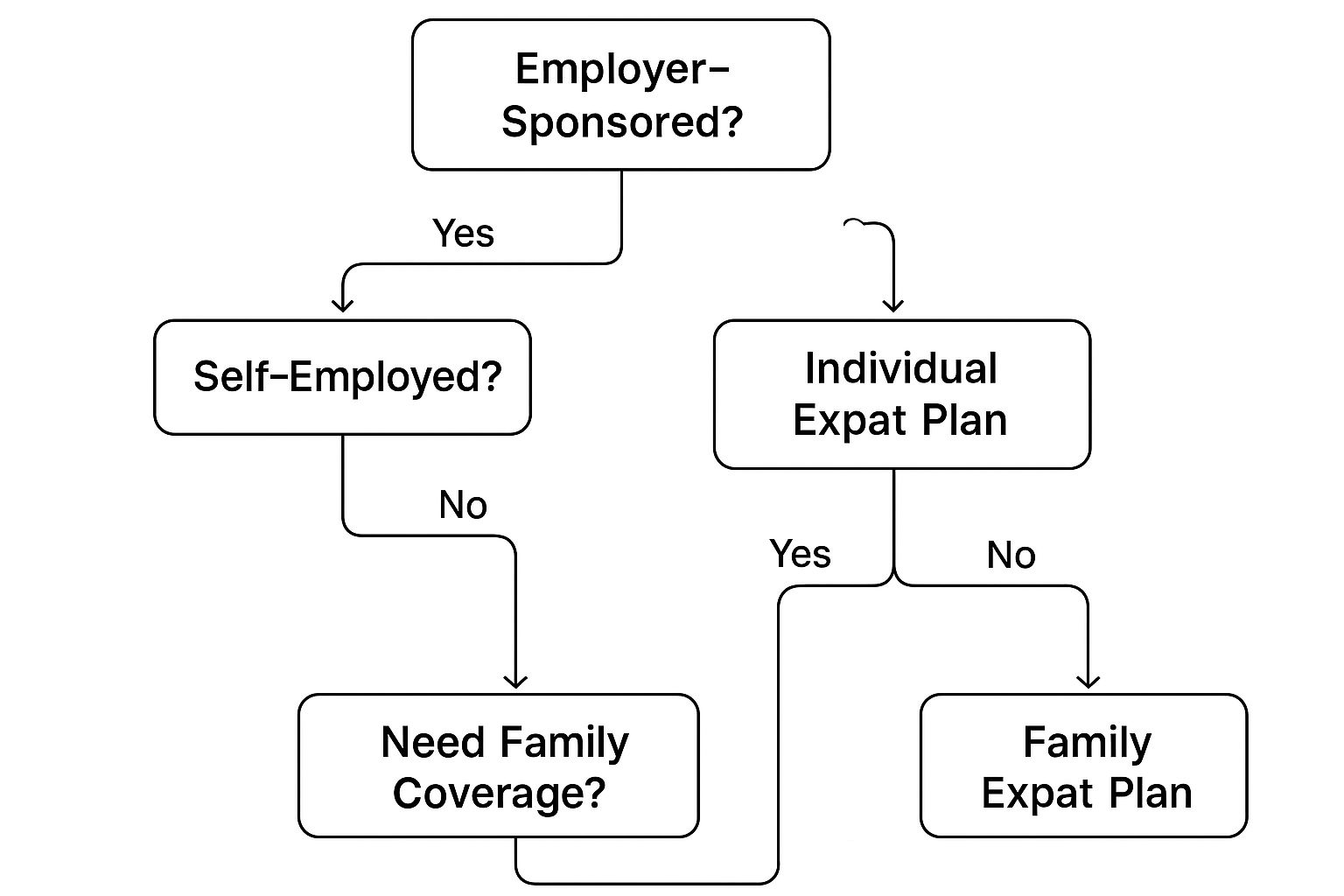

This visual decision tree helps simplify the first major choice you'll make about what kind of policy is right for your situation.

It lays out the main pathways to getting coverage, whether through your company or on your own, steering you toward the right category of plan from the very beginning.

The Role of a Specialized Broker

Attempting to navigate this complex market independently is a formidable undertaking. Policy documents are filled with arcane jargon, the options are extensive, and the financial consequences of a misstep are significant. This is precisely where the value of a specialized broker becomes clear.

An expert broker acts as your personal advocate and strategist, translating convoluted insurance language into clear, actionable business decisions. They provide an objective, market-wide analysis that enables you to select a plan with total confidence, ensuring it aligns perfectly with both your financial and personal requirements.

A broker's expertise is especially vital when examining the fine print. They are trained to identify critical exclusions or limitations that you might otherwise overlook—a service that provides an immense amount of peace of mind. To dig deeper into this, you might find our guide on which expat medical insurance policy type is right for you helpful.

Ultimately, a broker ensures your final decision on an international health insurance expatriate policy is the most informed and strategic one you can possibly make.

Frequently Asked Questions

When evaluating an international health insurance expatriate plan, a few critical questions invariably arise. For globally-minded professionals, obtaining clear, precise answers is not just helpful—it is absolutely essential for making a sound decision that protects your finances and well-being. Here are direct answers to the most common inquiries we receive.

How Do Premium Plans Handle Pre-existing Conditions?

This is a paramount concern for many individuals. Elite international plans do not issue a blanket denial for pre-existing conditions. Instead, your application undergoes a process known as medical underwriting, which can result in several outcomes:

- Full Coverage: Your condition is covered without restrictions. This is often the outcome for well-managed, stable conditions that present a low risk.

- Premium Loading: The insurer agrees to cover the condition but applies a surcharge to your premium to offset the increased risk.

- Exclusion: The insurer provides coverage for all health matters except for the specific pre-existing condition and any related treatments.

Complete transparency on your application is non-negotiable. A qualified, specialized broker can be your most valuable ally in this process, assisting you in presenting your medical history to underwriters in a manner that secures the most favorable terms possible.

Can My Plan Move With Me to a New Country?

Yes, and this is a core tenet of this type of insurance.

True international plans are engineered for a mobile lifestyle, offering genuine portability. As long as your new country of residence is within your chosen area of coverage (e.g., 'Worldwide' or 'Worldwide excluding the USA'), your policy travels with you seamlessly. You simply need to notify your insurer of your new address to ensure your file remains current.

What Is the Process for a Medical Evacuation?

In a true emergency, when local medical facilities are inadequate for your needs, the process is designed to be as seamless as possible for you. You, or an associate, would contact your insurer's 24/7 emergency assistance hotline. Their medical team then liaises directly with your treating physician to confirm that an evacuation is medically necessary.

Once approved, the insurer assumes full control of the logistics. They manage every detail—from chartering an air ambulance to coordinating your admission at the receiving hospital—and they cover the costs directly. This level of concierge service removes an immense logistical and financial burden from your shoulders during a crisis.

Your choice of an international health insurance expatriate plan is a cornerstone of your global strategy. At Riviera Expat, we provide the expert, objective guidance required to navigate this complex market with confidence.