For discerning individuals and families with a global footprint, standard health insurance plans present unacceptable gaps in coverage. An international health insurance broker serves as your personal health advocate on the world stage—a strategic partner adept at navigating the intricate landscape of global healthcare, policy nuances, and elite hospital networks on your behalf.

The Indispensable Role of International Health Insurance Brokers

For those who live, work, or travel extensively outside their country of origin, a domestic insurance plan is fundamentally inadequate.

The maze of cross-border healthcare—from varying country regulations to direct payment arrangements with premier medical facilities—demands specialized expertise. This is where a dedicated broker provides an essential layer of protection, convenience, and financial assurance.

Consider this: you would not manage a global investment portfolio without a seasoned private banker. It is equally imprudent to manage your global health security without an expert broker. Their role extends far beyond simply procuring a policy.

A Strategic Partner for Your Global Wellbeing

An international health insurance broker is not merely an intermediary. They are a specialist consultant whose mandate is to champion your best interests. They conduct a thorough market analysis to source coverage that aligns precisely with your unique lifestyle and medical requirements.

This partnership affords several crucial advantages:

- Access to Elite Networks: Brokers cultivate relationships with the world’s leading global insurers, providing access to plans and benefits often unavailable to the general public.

- Objective, Personalized Advice: As brokers are compensated by the insurer you ultimately select, their counsel remains impartial. Their mission is to identify the optimal solution for you, not to promote a specific company’s product.

- Complex Case Expertise: They possess extensive experience in managing sophisticated underwriting scenarios, such as securing coverage for pre-existing conditions or for individuals residing in multiple countries throughout the year.

The value of this expertise is underscored by market growth. The global health insurance market was valued at approximately USD 2.65 trillion in 2023 and is projected to reach USD 4.45 trillion by 2032. This expansion is driven by escalating healthcare costs and the increasing necessity for robust, borderless health plans.

A top-tier broker’s primary function is to deliver clarity, control, and confidence. They transform the often bewildering process of securing global health coverage into a seamless, managed experience. This allows you to focus on your personal and professional pursuits, secure in the knowledge that your health safety net is firmly in place.

Ultimately, engaging one of the best international health insurance brokers is a strategic decision to protect your most valuable asset—your health. They provide the framework and support necessary to ensure you have access to the highest standard of medical care, regardless of where your ventures take you. For a deeper understanding of what these plans entail, our guide on international private medical insurance provides foundational knowledge.

Why Sophisticated Expats Partner With a Broker

When managing significant assets, one does not simply approach the nearest bank. You retain a private banker who comprehends the entire market and constructs a financial portfolio tailored to your life. The bank is merely the institution holding the assets; your banker is the architect of your financial strategy.

This is precisely how you should approach your global health coverage.

Engaging one of the premier international health insurance brokers is akin to retaining a private banker for your well-being. The broker is your strategic advisor. The insurer is the institution that underwrites the risk.

Approaching an insurer directly is like asking a single bank to manage your entire wealth—you will only be exposed to their products, not the universe of what is possible. A broker, in contrast, works exclusively for you. This partnership saves you money, but more importantly, it conserves your most valuable asset: time.

Access to Exclusive and Bespoke Policies

A little-known fact is that the most superior international health insurance plans are not publicly advertised. Insurers often reserve their most flexible, high-limit policies for a select cadre of trusted brokerage partners. These are the plans engineered for individuals who cannot afford any gaps in their coverage.

Partnering with a broker provides entry to this exclusive tier of products. It unlocks a world of advantages that are simply unattainable when acting alone.

- Unadvertised Plan Options: Brokers have access to policies with substantially higher benefit limits, more comprehensive coverage for specific high-cost treatments, and broader geographic scopes that you will not find on a public website.

- Truly Bespoke Policies: A top broker does not just sell you a policy; they construct one around your life. This could mean securing guaranteed coverage at an elite clinic in Zurich, arranging direct billing with your preferred specialist in Singapore, or crafting a single plan that seamlessly protects your family across several countries.

- Negotiating Power: Brokers possess deep market knowledge and long-standing relationships with insurers. They can often negotiate more favourable terms on your behalf, whether it involves adding specific riders or adjusting policy details to fit your unique circumstances.

An expert broker’s role is to transform a standard insurance product into a personalized shield. They ensure your policy is not just a document, but a real-world instrument that guarantees access to the world’s best medical care, on your terms.

A Buffer Against Administrative Burdens

The administrative dimension of global healthcare can be formidable. Attempting to manage claims across different countries, languages, and currencies is a significant burden, particularly during a medical event. A broker removes this entire layer of complexity, acting as your dedicated administrator and advocate.

This hands-on support is one of the most tangible benefits of the relationship. It is the difference between navigating a crisis alone and having an expert team manage every detail on your behalf.

Imagine a serious medical event occurs. Instead of you managing paperwork and liaising with call centres, your broker is coordinating directly with the hospital and the insurer. They handle the necessary forms, arrange for guarantees of payment to mitigate large upfront costs, and oversee the entire claims process to ensure you are reimbursed swiftly and accurately.

This frees you to focus entirely on your recovery, secure in the knowledge that the financial and logistical complexities are being managed by a professional. This level of service is the hallmark of top-tier international health insurance brokers.

How a Broker Delivers Concierge-Level Service

Working with a top-tier international health insurance broker is not a simple transaction. It is the commencement of a sophisticated, white-glove service relationship designed to be as meticulous and discreet as your financial planning. This extends far beyond the mere delivery of a policy document.

Think of a premier broker as the project manager for your global well-being. They guide you through a detailed process that begins with understanding your world and culminates in unwavering support, long after your policy is in effect. It is a structured approach that builds clarity and confidence at every stage.

Stage 1: The In-Depth Consultation

A robust health plan cannot be built on a weak foundation. The process invariably begins with a deep discovery session, not a standard insurance questionnaire. This is a confidential dialogue where your broker gains a comprehensive understanding of the specific contours of your life.

This conversation delves much deeper than basic demographics. It is where you discuss your family’s needs, typical travel patterns, preferred medical facilities in various countries, and any long-term health objectives. It is also where you can be candid about your expectations for privacy, access to specific specialists, or high-end wellness benefits.

A broker’s first responsibility is to develop a complete profile of your life. This profile—encompassing your personal, professional, and medical priorities—becomes the blueprint for all subsequent actions. It ensures the final plan is constructed for you, not for a generic client.

Stage 2: The Global Market Analysis

Armed with this unique profile, your broker becomes your personal research team. They do not just execute a search on a public database; they leverage their extensive network of premier global insurers to identify policies that genuinely align with your requirements.

This is where their deep market knowledge is invaluable. They will vet multiple providers, comparing not just headline premiums but also the critical details embedded in the fine print. This involves analysing definitions for pre-existing conditions, assessing the quality of direct billing networks in your key locations, and even evaluating the claims-handling efficiency of each insurer.

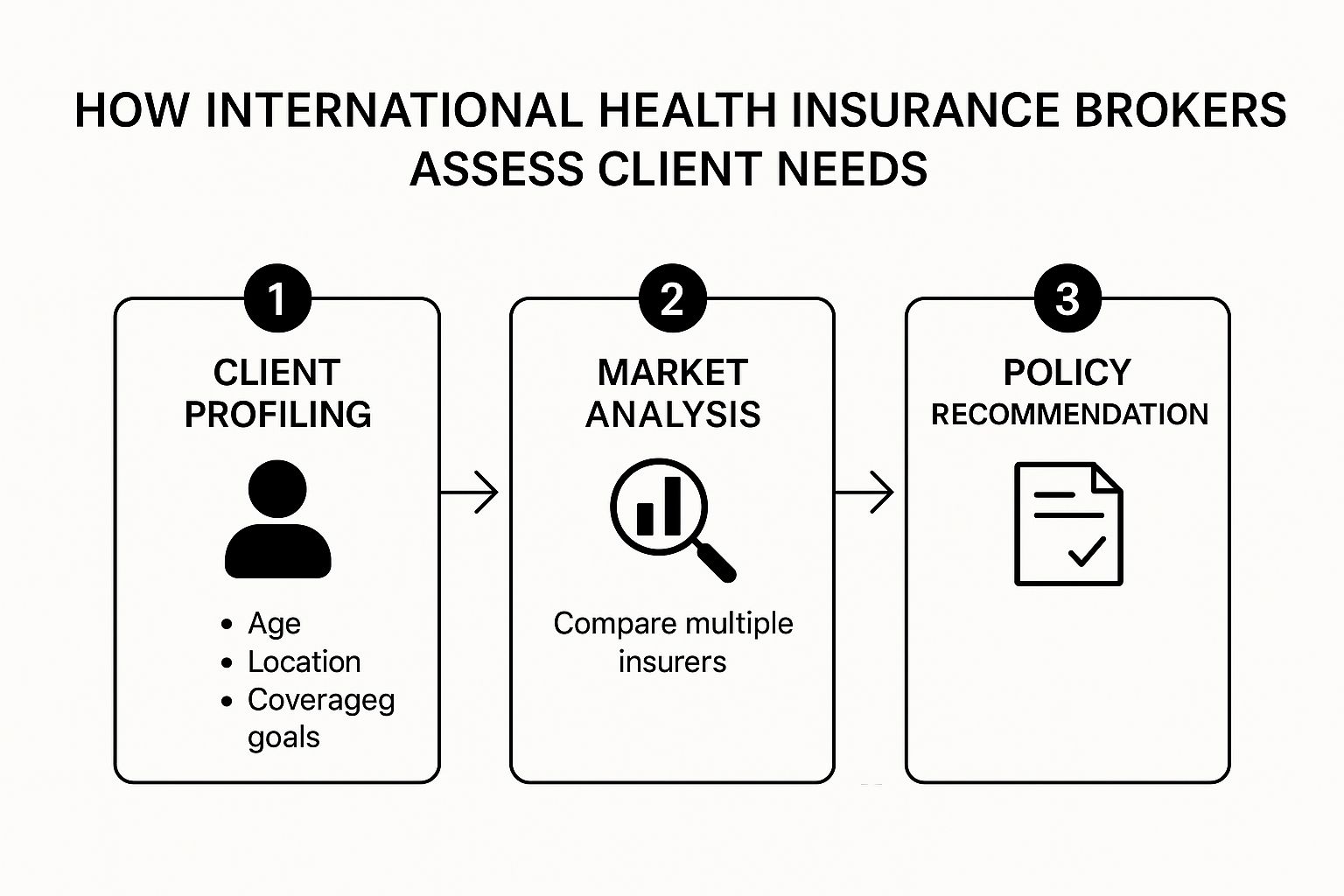

This visual illustrates how a broker systematically filters the entire market to find your optimal match.

The objective is to progress from broad requirements to a specific, actionable recommendation, saving you the immense time and effort of conducting this complex research yourself.

This methodical market sweep is vital in a rapidly expanding sector. With the global health insurance market projected to grow from USD 2.65 trillion in 2023 to USD 4.45 trillion by 2032, having an expert ensures you secure the best possible value in a complex landscape. You can explore more about this global health insurance market outlook on Actupool.com.

Stage 3: Tailored Recommendations and Implementation

Following their analysis, the broker presents a curated shortlist—typically two or three of the best options. This is not a data dump of brochures. It is a clear, side-by-side comparison that translates complicated insurance terminology into tangible benefits and potential trade-offs.

Each recommendation is directly linked back to your initial consultation. The broker will explain precisely how one plan addresses your need for coverage in Singapore, how another caters to your preference for a specific clinic in London, or how a third option prepares for your family’s future needs. They serve as your trusted advisor, highlighting the strengths and weaknesses of each choice with complete objectivity.

Once you have made an informed decision, the broker manages the entire process. They oversee the application, ensure all paperwork is flawless, liaise with the insurer’s underwriting team to address any complexities, and follow through until your policy is issued correctly and without delay.

Working Directly With an Insurer vs Partnering With a Broker

It can be tempting to assume that going directly to an insurance company saves time or money. The reality is often the opposite. This table delineates the fundamental differences in the experience.

| Attribute | Direct to Insurer | With an International Broker |

|---|---|---|

| Market Access | Limited to one company’s products. You receive a biased, narrow view of the market. | Access to the entire global market. Your needs drive the search, not the insurer’s sales targets. |

| Advice Quality | Sales-focused. The objective is to sell you their policy, regardless of suitability. | Objective and impartial. The broker’s goal is to find the best policy for you, period. |

| Complexity | You must decipher complex policy documents and compare plans independently. High risk of overlooking crucial details. | Complex jargon is translated into clear benefits and trade-offs. You receive a simple, expert summary. |

| Application Process | You handle all paperwork and underwriting queries alone. Errors can cause delays or denials. | The broker manages the entire process, ensuring accuracy and liaising with underwriters on your behalf. |

| Claims Support | You deal directly with the insurer’s claims department. Disputes can be stressful and time-consuming. | The broker acts as your advocate, intervening on your behalf to resolve claim issues and ensure fair payment. |

| Ongoing Service | Transactional. The relationship often concludes after the sale. Annual reviews are your responsibility. | Relational. The broker provides continuous support, including policy amendments and proactive annual reviews. |

As illustrated, a specialist broker transforms the process from a risky, time-consuming task into a strategic, supported partnership.

Stage 4: Ongoing Advocacy and Annual Review

This is where the best international health insurance brokers truly demonstrate their worth. The relationship does not conclude once your policy is active—in fact, this is often where the most significant value emerges. They become your permanent advocate and support system.

This long-term support includes:

- Claims Advocacy: Should you encounter any issues with a claim, your broker intervenes. They communicate directly with the insurer to resolve disputes and expedite payments, relieving you of that stress entirely.

- Policy Management: If you need to add a newborn to your plan or update your details following a move, they handle all the administrative work for you.

- Annual Reviews: Your life changes, and your coverage should adapt accordingly. Every year, your broker will proactively schedule a review to ensure your plan remains perfectly aligned with any shifts in your family, career, or travel patterns.

This continuous cycle of service ensures your global health protection is never static. It evolves with you, providing a reliable shield no matter where you are in the world.

Vetting Criteria for Selecting Your Global Health Advisor

Choosing your global health advisor, or international health insurance broker, is as critical as selecting the right policy. This is not about finding a persuasive salesperson. It is about forging a long-term professional relationship built on trust, discretion, and proven expertise.

Your advisor must be capable of managing a health portfolio as complex as your financial one.

The right partner brings a deep, intuitive understanding of the global medical landscape. Their primary responsibility is to ensure your coverage is comprehensive, functions seamlessly wherever you are, and aligns perfectly with your lifestyle. This requires looking beyond marketing materials and applying rigorous vetting criteria.

The global insurance brokerage market is substantial, reaching an estimated USD 119.37 billion in 2024 and continuing to grow. This is not a random statistic; it highlights the degree to which individuals rely on expert guidance to navigate this complexity.

Global Reach and Insurer Partnerships

A broker’s true value is directly proportional to the strength and depth of their network. The first inquiry should concern their relationships with premier global insurers. A small, limited network translates to limited—and likely inferior—options for you.

A top-tier broker will have partnerships not just with many insurers, but with the right ones: major firms known for impeccable service, financial stability, and powerful global provider networks. This provides you with privileged access to superior policy terms and exclusive plan designs not available to the general public.

An advisor’s reach is not measured by the number of logos on their website. It is measured by their ability to contact a senior underwriter and negotiate bespoke terms specifically for you. That is the difference between an off-the-shelf product and a custom-built solution.

Expertise in Complex Case Management

Your life is not standard, so your health coverage cannot be. This is where a broker’s skill becomes paramount. You need an advisor with a proven track record of handling sophisticated underwriting scenarios with creativity and finesse.

Challenge them. Inquire about their experience with situations relevant to you:

- Pre-existing Conditions: How have they secured comprehensive coverage for clients with complex medical histories? Request anonymized examples of their methodology.

- Multi-Jurisdictional Lifestyles: What is their process for designing a plan that provides seamless, high-level care for a family residing across multiple continents?

- High-Risk Activities or Destinations: If your work or personal pursuits take you to remote or challenging locations, confirm they can arrange specialized coverage, including the logistics of medical evacuation.

A broker’s ability to navigate these complexities is the clearest indicator of their expertise. Before you can question them, however, it is beneficial to know what to look for. You can familiarize yourself with our guide on choosing the right expat medical insurance policy type for you.

The Service Model and Support Structure

Finally, look beyond the initial sale. A broker who becomes unavailable after you sign the policy is of no use during a real medical crisis. You are not seeking a transaction; you are seeking a dedicated partner who provides continuous, concierge-level support.

This is about their post-sale commitment. Are you assigned a dedicated contact for all inquiries? What is their documented process for managing claims and emergencies? A great broker acts as your relentless advocate, dealing with insurers and hospitals so you do not have to, especially when you are under stress.

The relationship should be built for the long term, with proactive annual check-ins to ensure your plan keeps pace with your life. This dedication to ongoing management is not a “nice-to-have”—it is the absolute hallmark of a true global health advisor.

How Broker Expertise Solves Real-World Challenges

Theory is one thing, but the true test of a top-tier international health insurance broker is their performance under pressure. Their value lies not just in finding a policy, but in resolving complex, high-stakes problems that would overwhelm anyone attempting to manage them alone.

The following anonymized case studies are not hypotheticals. They are real-world examples of how a skilled broker transforms a potential crisis into a managed, stress-free process. This is where a broker transitions from a salesperson to a guardian of your health and peace of mind, regardless of your location.

Case Study 1: The Globally Mobile Executive

A senior partner at a private equity firm required a single, comprehensive policy for frequent travel between New York, London, and Singapore. Her absolute requirement was guaranteed, immediate access to a specific group of orthopaedic and cardiac specialists in Manhattan and Singapore, with no pre-authorization delays or out-of-pocket payments.

She attempted to deal directly with insurers and encountered significant obstacles. Every standard plan had restrictive networks or cumbersome reimbursement processes that were unworkable for her demanding schedule.

The Broker’s Solution:

In this scenario, relationships supersede algorithms. The broker bypassed standard “off-the-shelf” products and engaged directly with senior underwriters at several elite global insurers with whom they had established relationships. They did not just find a plan; they constructed one.

The final policy included:

- A Custom Global Network: The broker arranged for all the executive’s preferred specialists in New York and Singapore to be added to her plan as in-network providers, ensuring seamless, direct billing.

- Waiver of Pre-authorization: For her designated specialists, the pre-authorization requirement was completely waived, allowing her to book appointments at a moment’s notice.

- A Dedicated Service Line: The broker secured a dedicated account manager at the insurance company, providing her with a single, high-level point of contact for any issue.

The outcome was a policy that functioned less like insurance and more like a passport to premier healthcare, perfectly tailored to her non-negotiable demands.

Case Study 2: Navigating Complex Family Underwriting

A family relocating to Hong Kong faced a significant roadblock. The husband had a well-managed chronic condition, and their youngest child required access to specialized paediatric care for severe allergies. After applying directly to insurers, they received either outright denials or policies with so many exclusions as to be practically useless.

The uncertainty was immense, threatening to derail their entire relocation. They were caught in a frustrating cycle of applications, rejections, and vague explanations from administrators.

When standard processes fail, a broker’s real work begins. They act as your translator and negotiator with the insurer’s underwriting department, turning a “no” into a carefully constructed “yes.”

The Broker’s Solution:

An experienced broker took immediate control. Recognizing that automated application systems were flagging the case, they compiled a comprehensive medical file, complete with detailed reports from the family’s current physicians proving the conditions were being managed effectively.

- Direct Underwriter Engagement: The broker presented this detailed file directly to senior underwriters at three different global insurers, bypassing front-line staff and automated systems. This compelled a nuanced, human review of their situation.

- Negotiating Favourable Terms: Instead of a blanket denial, the broker secured two viable options. One insurer agreed to a moratorium period on the husband’s condition. Another offered full coverage with a modest premium loading, providing the family with a choice.

- Securing Specialist Access: Critically, the broker confirmed the chosen plan provided open access to the top paediatric allergists in Hong Kong, satisfying the family’s other vital requirement.

The result was a comprehensive policy that fully protected the family—an outcome that was impossible to achieve through direct channels.

Case Study 3: Crisis Management During a Medical Emergency

While on a family holiday in a rural part of Italy, a broker’s client suffered a serious accident, resulting in multiple fractures requiring urgent, complex surgery. The local hospital was not equipped for the procedure, and the language barrier created immediate and intense stress.

The Broker’s Solution:

The client made a single phone call—to their broker. That one call initiated a full-scale crisis response. The broker’s team became the central command centre for the entire emergency.

Here’s what they did immediately:

- Arranged a Guarantee of Payment: They contacted the insurer and had a guarantee of payment issued to the local Italian hospital for stabilization care, removing any financial concerns for the family.

- Coordinated Medical Evacuation: They worked with the insurer’s 24/7 emergency assistance partner to arrange a medically-staffed air ambulance to a leading orthopaedic centre in Milan.

- Managed All Logistics: The broker’s team handled every phone call and piece of paperwork between the family, both hospitals, and the insurer, completely removing the administrative burden from the family’s shoulders.

The broker’s intervention was the difference between a terrifying ordeal and a fully managed event. It ensured the client received the best possible care without delay and shielded the family from the immense logistical and financial stress of a medical crisis abroad. This is the ultimate demonstration of a broker’s value.

Answering Your Key Questions on Global Health Coverage

Even with a clear understanding of the broader concepts, specific questions often arise when considering the engagement of a global health advisor. For anyone managing significant personal and professional assets, clarity on cost, confidentiality, and crisis response is essential.

This final section provides direct, straightforward answers to the most critical questions we hear from our clients. The aim is to offer complete transparency and demonstrate the tangible value an expert broker brings to protecting your health, wherever you are in the world.

What Is the Actual Cost of Using an International Health Insurance Broker?

This is a significant consideration, and a common misconception is that adding an expert to your team incurs a direct fee. In the realm of international health insurance, this is not the case.

There is typically no direct cost to you for a broker’s service. Brokers are compensated by the insurance provider you ultimately choose, through commissions that are already integrated into the insurer’s standard pricing structure.

This means you pay the exact same premium whether you engage an expert broker or approach the insurance company directly. The crucial difference is that by using a broker, you receive impartial market analysis, truly personalized advice, and a dedicated advocate for life—all for no additional cost. It is a value proposition designed entirely for your benefit.

You receive a concierge-level advisory service without any out-of-pocket expense. The broker’s compensation model ensures their sole objective is to find the best possible plan for your needs, fostering a relationship built on objective guidance, not a quick sale.

Can a Broker Secure Better Premiums Than I Can Directly?

While a broker may not secure a lower list price on a standard, off-the-shelf plan, their real power lies in delivering far superior overall financial value. They achieve this by discerning what is truly efficient and suitable for you with an expert’s eye.

A proficient broker knows the landscape intimately. They can pinpoint the most cost-effective plan that meets your specific, often complex, requirements. This prevents you from overpaying for benefits you will never use or, far worse, being dangerously underinsured in critical areas. For instance, they can identify a plan with a robust direct-billing network in the cities you frequent, saving you from substantial out-of-pocket expenses later.

Their established relationships with insurers also play a significant role. Brokers often have access to unique plan structures or the leverage to negotiate specific terms that are not offered to the public. The result is frequently a policy that delivers much greater value and protection for a comparable premium, leading to real long-term savings.

How Does a Broker Handle Emergency Medical Situations Abroad?

This is where the distinction between possessing a policy document and having a true service partner becomes starkly clear. During a medical emergency, a top-tier broker becomes your single point of contact and unwavering advocate, shielding you from administrative chaos.

When an emergency occurs, your sole responsibility is to get to safety and make one call—to your broker. From that moment, their team takes command.

- Immediate Insurer Liaison: They connect directly with the insurer’s 24/7 emergency team to initiate action instantly.

- Guarantee of Payment: They work to have a guarantee of payment issued to the hospital or clinic promptly, so you can receive care without being asked for large upfront payments.

- Logistical Coordination: If a medical evacuation is required, they help manage the incredibly complex logistics, coordinating between physicians, transport teams, and the receiving hospital.

- Continuous Communication: They serve as the central hub for information, keeping you and your family informed while they manage the stressful backend details.

This level of intervention allows you to focus solely on your health and recovery, confident that a professional team is managing the intricate and often overwhelming administrative process. For those who wish to explore common queries further, you can review a broader set of frequently asked questions on our website.

What Level of Confidentiality Can I Expect?

For high-net-worth individuals, discretion is a non-negotiable requirement. A professional relationship with a top-tier international health insurance broker is built on a foundation of absolute confidentiality.

Your broker is privy to sensitive personal health and financial information. They are bound by strict professional ethics and robust data protection regulations (such as GDPR) to safeguard that information with the utmost gravity. This duty of care is central to their professional identity.

Regard them as you would your private banker or legal counsel. The entire relationship is predicated on trust, and any breach of that trust would constitute a catastrophic professional failure. This commitment ensures your global health strategy is managed not just effectively, but with the complete privacy you rightly demand. It is this trusted bond that enables a broker to truly serve your best interests for years to come.

At Riviera Expat, we provide this exact level of expert, confidential, and dedicated service to our clients. We specialize in securing world-class private medical insurance for financial professionals in global hubs, turning complexity into clarity. If you are ready to secure your global health with confidence, explore how we can assist you at https://riviera-expat.com.