Expanding your enterprise onto the global stage is a significant achievement. To assume, however, that a domestic insurance policy will suffice is a fundamental miscalculation—one with potentially severe consequences. Far from being a mere operational expense, a meticulously crafted international business insurance portfolio is the strategic foundation that secures your personnel, your assets, and your entire operation across international borders.

Your standard domestic policy is engineered for a single jurisdiction. It is inherently incapable of addressing the complex variables of operating overseas, leaving your enterprise exposed to considerable financial and legal vulnerabilities. A specialized international policy is what transforms a high-risk global ambition into a secure, resilient, and thriving global venture.

Protecting Your Global Ambitions

Entering global markets presents unparalleled opportunities for growth, but it concurrently introduces a sophisticated new spectrum of risks. A domestic policy is entirely inadequate when navigating foreign legal systems, disparate regulatory frameworks, or dynamic geopolitical landscapes.

Relying on such a policy is analogous to navigating Tokyo with a map of New York City. You are operating without crucial information, exposing your business to liabilities that could neutralize your international venture before it gains traction. This is precisely why a dedicated international insurance portfolio is not an option—it is an absolute necessity for sophisticated global operators.

The Strategic Necessity of Global Coverage

Consider this specialized insurance as the structural framework for your global expansion. It is designed to manage the specific perils of operating abroad, ensuring a lawsuit in Germany or a supply chain disruption in Vietnam does not destabilize your entire organization. It is a proactive, strategic measure that builds resilience in otherwise unpredictable environments.

The sheer scale of the global insurance market underscores its critical importance. According to the latest available data, the worldwide insurance industry's total premium income has reached an impressive €6.1 trillion (approximately $6.6 trillion USD). This figure is predominantly allocated across life, property and casualty (P&C), and health insurance sectors, with North America representing a significant share of global premiums. You can explore more on this growth in the global insurance market insights from Allianz Research.

International business insurance is not merely a compliance obligation; it is a strategic asset. It signals to partners, investors, and high-caliber talent that your enterprise is stable, prudently managed, and prepared for the complexities of the global stage.

Domestic vs International Insurance At A Glance

It is easy to underestimate the fundamental differences between domestic coverage and the robust protection required abroad. The following table delineates the stark contrast, illustrating why a domestic-only approach is untenable for any enterprise with global aspirations.

| Coverage Aspect | Domestic Insurance Limitations | International Insurance Protections |

|---|---|---|

| Jurisdictional Reach | Defense ceases at the national border; offers no protection in foreign courts. | Responds to legal action wherever you operate, from London to Lima. |

| Regulatory Compliance | Not structured to meet mandatory insurance statutes in other countries. | Designed to satisfy local legal requirements for workers' compensation or auto liability. |

| Employee Duty of Care | Health and accident policies often become void once an employee is overseas. | Provides global access to premier medical care and emergency assistance for your team. |

| Political & Social Risks | Offers zero protection against political upheaval, strikes, or civil unrest. | Can cover losses from political violence, expropriation, or currency inconvertibility. |

This comparison clarifies the imperative: entering the world stage without tailored insurance is akin to navigating treacherous waters without a life raft. International policies are purpose-built to manage the complexities that domestic plans were never designed to handle.

Key Areas Where Domestic Policies Fall Short

Your domestic policy is fundamentally constrained by geography. The moment your personnel or assets cross a border, that coverage typically evaporates, creating critical vulnerabilities that a purpose-built international policy is designed to address.

Here are the principal gaps that require your attention:

-

Jurisdictional Reach: A domestic policy will almost certainly decline to defend you in a foreign court. International liability coverage, conversely, is specifically designed to respond to legal challenges irrespective of their global origin.

-

Regulatory Compliance: Each country maintains its own distinct set of mandatory insurance regulations, from specific workers' compensation laws to auto liability requirements. International policies are engineered from the ground up to satisfy these local legal mandates.

-

Employee Protection: Your standard health and accident policies frequently become invalid overseas. Specialized international coverage ensures your team has access to superior medical care and emergency services anywhere in the world, fulfilling your crucial duty of care.

Understanding Your Core Coverage Options

A robust international insurance plan is not a single policy. It is a carefully architected portfolio of distinct coverages, each designed to mitigate a specific, high-stakes risk inherent in foreign operations. This is about understanding how each component functions to protect your company's balance sheet and maintain operational agility in a global market.

Consider these core coverages as the foundational pillars supporting your entire international venture. They are the bulwark between your enterprise and a catastrophic financial loss.

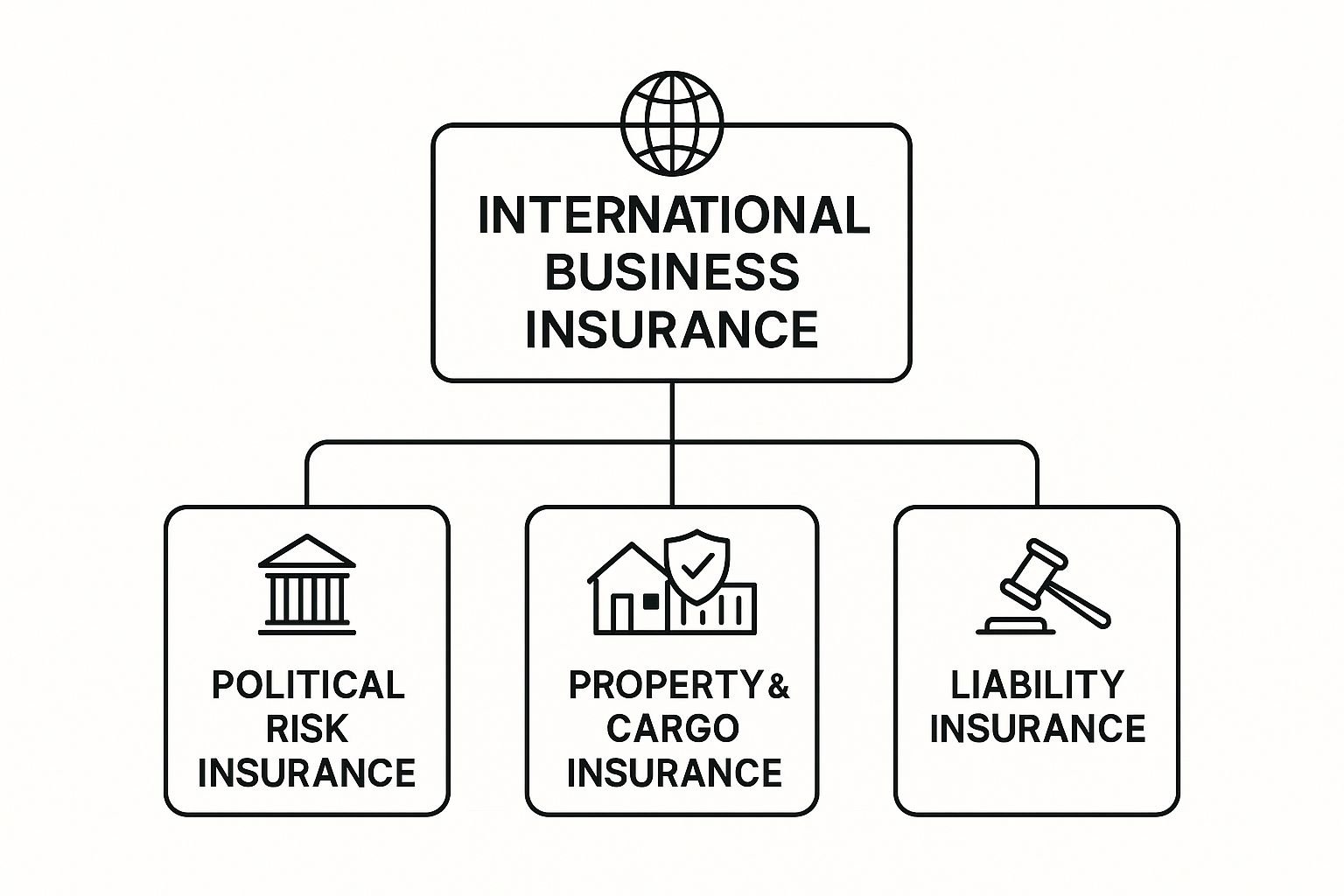

To gain a clearer perspective, it is useful to visualize how the primary branches of international business insurance integrate. This diagram illustrates the main categories of protection you will require.

As illustrated, various policy types—covering everything from political instability to property damage—combine to create a comprehensive safety net for your global operations.

Global General Liability: The Shield Against Foreign Lawsuits

Consider this scenario: one of your products allegedly causes an injury in France. Your standard, domestic general liability policy is rendered completely ineffective in a Parisian court. This is precisely why Global General Liability (GGL) is non-negotiable. It is structured to handle claims of bodily injury or property damage that occur outside your home country.

This policy serves as your legal defense fund in foreign jurisdictions. It covers the potentially crippling costs of legal fees, settlements, and judgments that could otherwise jeopardize your business. If you maintain any physical presence, sales force, or even simply sell products overseas, GGL is your primary line of defense. It prevents a localized issue from escalating into a full-scale international financial crisis.

Securing Tangible Assets with Commercial Property Insurance

Your physical assets—a manufacturing facility in Vietnam, a sales office in London, or high-value inventory in transit—are the lifeblood of your operation. International Commercial Property Insurance is the instrument that protects them from events such as fire, theft, or natural disasters.

However, the application is more nuanced. Insuring international assets requires a detailed assessment of local factors. The cost to rebuild a warehouse in Germany differs substantially from rebuilding one in Mexico. For a deeper analysis of this topic, consulting resources on understanding rebuild costs for insured assets is a prudent step. It clarifies how valuations are calculated abroad and helps ensure your coverage is sufficient to restore operations, not merely provide a partial indemnity.

The strategic value of a well-structured international property policy lies in its ability to manage different currencies and local regulations. It must be designed to pay claims in the local currency and comply with local statutes, ensuring a swift and efficient recovery without bureaucratic impediments.

Mitigating Government-Related Threats with Political Risk Insurance

Operating in politically dynamic or emerging markets presents a unique category of risk—one over which you have no control. Political Risk Insurance is the specialized tool designed to shield your investments from arbitrary and adverse government actions.

This is not about market volatility. It pertains to specific, hostile government interventions. Consider a foreign government freezing your company's local bank accounts, expropriating your factory without fair compensation, or civil unrest making it impossible to operate. Any of these scenarios could result in a total loss of your investment.

Political Risk Insurance functions as the financial shock absorber for these events. It provides the confidence to invest in high-growth regions by converting a potentially catastrophic event into a manageable, insurable risk.

Protecting Your Most Valuable Asset: Your People

Ultimately, while physical assets and legal standing are vital, your human capital is paramount. Protecting the health and security of your executives and key staff abroad is not merely a best practice; it is a fundamental duty of care.

This is where policies like Kidnap & Ransom (K&R) Insurance become critical in certain regions. In some parts of the world, executives can be targeted. K&R coverage provides more than just financial resources; it grants immediate access to elite crisis management teams with expertise in navigating and resolving these high-stakes situations safely.

Beyond physical security, premier medical care is an absolute requirement. Standard travel insurance is inadequate. A proper international health plan must cover everything from routine consultations to emergency medical evacuations, ensuring your team is protected regardless of their global location.

Addressing Specialized Risks in a Global Marketplace

As your business transcends national borders, the risks you face multiply and increase in complexity. Your standard insurance policies provide a solid foundation, but they were never designed for the unique challenges of a global operation.

This is where specialized international insurance becomes indispensable. View these policies not as optional add-ons, but as essential instruments built to address modern, borderless threats. From a data breach spanning three continents to an executive facing litigation in a foreign court, each policy serves a highly specific and critical purpose.

Defending Against Digital Threats Across Borders

Imagine your corporate data in constant transit, moving between offices in different countries, each governed by a distinct and complex set of privacy laws. A data breach at your Singapore office that exposes the information of your European clients is not just a technical issue; it is an immediate, multi-jurisdictional legal crisis.

A standard cyber policy is unlikely to be sufficient. It is simply not engineered to navigate the intricate requirements of regulations like the EU's General Data Protection Regulation (GDPR) from a distance.

This is precisely why you require specialized Cyber Liability Insurance. It is structured to manage cross-border incidents, covering the substantial costs of regulatory fines, client notifications in multiple languages, and mounting a legal defense in several countries simultaneously. It prevents a digital incident in one region from escalating into a global compliance catastrophe.

Protecting Your Leadership with Directors and Officers Liability

Decisions made in your boardroom have global repercussions. An executive in London could approve a financial strategy that, months later, triggers litigation from shareholders in Hong Kong. Without appropriate protection, that executive's personal assets are at risk.

Directors & Officers (D&O) Liability Insurance acts as a personal safeguard for your leadership team. It protects their personal wealth from lawsuits alleging wrongful acts committed while managing the company. A robust international D&O policy is non-negotiable for attracting and retaining top-tier executive talent, giving them the confidence to make the decisive, strategic decisions your company requires to thrive.

D&O coverage is more than a legal defense fund. It is a powerful statement that you support your leaders, protecting them from personal financial ruin for decisions made in the company's best interest.

Maintaining Continuity When the Global Supply Chain Breaks

Visualize your global supply chain as an intricate timepiece. Every component—a key supplier in Thailand, a logistics hub in Germany—must function flawlessly. What happens if one of those critical components fails due to a fire, flood, or political event? The entire mechanism can cease to function.

A disruption thousands of miles away can halt your revenue stream overnight.

Business Interruption Insurance is designed for this exact scenario. It extends beyond covering the cost of a damaged facility; it covers the lost income and ongoing expenses incurred while your operations are suspended. A well-designed policy understands these international dependencies, ensuring a disaster on one side of the globe does not precipitate a financial catastrophe for your entire business.

This type of protection is more critical than ever. Between 2014 and 2023, natural catastrophes caused approximately $2.35 trillion in global economic losses. Critically, only $944 billion of that was insured, leaving a staggering $1.4 trillion protection gap. This data illustrates how easily a single event can have devastating financial consequences without the right coverage. You can dive deeper into these findings on the global insurance protection gap from EY.

Shielding Your Most Valuable Intangible Assets

Finally, we address your intangible assets. Your patents, trademarks, and proprietary code are often the true value drivers of your company. Protecting this Intellectual Property (IP) is challenging enough in your home country; it becomes a formidable task in jurisdictions with weak or inconsistent legal enforcement.

Intellectual Property Insurance provides the financial resources to combat infringement. It covers the often-exorbitant legal costs associated with litigating against an entity that misappropriates your IP in a foreign market. This coverage allows you to expand into new territories with confidence, knowing you have the means to defend the very core of your company’s value.

Navigating Complex Regulatory Frameworks

Operating across borders means navigating a labyrinth of local laws and insurance regulations. This is a complex matrix where each country operates under a different set of rules. What constitutes comprehensive coverage in one jurisdiction may be insufficient—or even non-compliant—in another.

Compliance is not a suggestion; it is an absolute mandate. A single misstep can lead to substantial fines or even the suspension of your operations. This is why the structure of your international insurance program is of paramount importance. It is not about simply having a policy; it is about having the right type of policy that local authorities recognize and accept.

Admitted Versus Non-Admitted Policies Explained

Grasping the distinction between "admitted" and "non-admitted" insurance is the most critical concept in this domain.

Consider this analogy: you would not retain a lawyer who is not licensed to practice in the jurisdiction where you face a legal challenge. The principle is identical for insurance.

-

An admitted policy is issued by an insurer that is licensed and regulated by the local insurance authority in the country where you operate. This is the gold standard. It guarantees your policy complies with all local laws, that taxes are paid correctly, and that you are protected by local guarantee funds in the event of insurer insolvency.

-

A non-admitted policy is issued by an insurer that is not licensed in that specific country. While these can be useful for covering highly specialized risks that local insurers will not underwrite, using one for legally mandated insurance is a recipe for disaster.

Relying on a non-admitted policy where an admitted one is required is a significant risk. Local courts may refuse to recognize it, claims may not be payable locally, and your business could be left exposed to the full financial and legal consequences of a claim.

Compulsory Insurance Requirements in Key Markets

Many countries will not permit you to commence operations, hire an employee, or operate a company vehicle without specific types of insurance. These regulations are non-negotiable and vary significantly between jurisdictions. Your international insurance program must be built upon a solid foundation of local, admitted policies that satisfy all these requirements.

Consider a few common examples:

- Workers' Compensation: In a country like Australia, a global policy is insufficient. You are required to have specific, state-regulated workers' compensation insurance for any employee on your payroll. There are no exceptions.

- Auto Liability: Operating a company vehicle anywhere in the European Union legally requires a minimum level of third-party auto liability insurance.

- Professional Liability: If you are an architect or financial advisor in the UK, your professional governing body will mandate that you carry a specific type of Professional Indemnity insurance.

Attempting to cover these mandatory risks with a single, non-admitted global policy is a classic strategic error. It often leads to non-compliance, which can result in severe penalties or prevent you from securing business licenses or government contracts. It is a swift way to have your operations suspended before they are fully established.

Structuring a Compliant Global Insurance Program

The solution is a meticulously constructed program that provides consistent, high-level protection worldwide while ensuring local compliance. This is typically achieved through a "master-and-local" policy structure.

The global master policy acts as a comprehensive umbrella. It establishes a uniform, high standard of coverage for all your operations, regardless of location. It is designed to intervene and fill any gaps where local policies may have lower limits or narrower terms.

Beneath this umbrella, you have individual local admitted policies for each country of operation. These are your "boots on the ground." They are tailored to meet every legal requirement in that specific location, satisfying local regulators.

This two-layer system offers the best of both worlds. You are fully compliant everywhere you operate, and the master policy provides high-level, comprehensive protection across your entire enterprise. Managing the specifics of how claims are processed locally, for instance, is a critical component. Understanding concepts like the difference between direct billing and pre-authorization is vital. While the context differs, the principles of local compliance are just as crucial in healthcare, as detailed in our analysis of direct billing and pre-authorization in health insurance. A well-architected structure like this provides the confidence to grow your business without the constant threat of legal or regulatory challenges.

Building Your Custom Insurance Portfolio

Assembling an effective international insurance program is not a matter of procuring standard policies. It is a strategic exercise in precision, where each component is carefully selected to align with your company's unique global footprint. When executed correctly, insurance transitions from a mere expense into a powerful enabler of international growth and stability.

The objective is to move beyond generic solutions and create a bespoke shield that perfectly mirrors your operational realities. This requires a methodical approach, beginning with a deep, candid assessment of your specific vulnerabilities in every country of operation. Only then can you engage with insurance professionals as an informed partner, prepared to build a program that truly serves your global ambitions.

Conducting a Meticulous Risk Assessment

Before constructing a defense, you must thoroughly understand the threats. A comprehensive risk assessment is the absolute cornerstone of any sound international business insurance strategy. This involves a forensic examination of your operations to pinpoint every potential point of failure, liability, and loss.

This analysis extends far beyond a simple checklist. It demands a granular review of your specific activities in each country, mapping potential exposures tied to your industry, the nature of your assets, and the mobility of your personnel.

Consider these key areas of analysis:

- Operational Footprint Analysis: Where are your offices, factories, or key personnel located? Each location presents a unique profile of political, legal, and environmental risks that must be quantified.

- Industry-Specific Exposures: A financial services firm in Singapore faces vastly different liability concerns than a manufacturing company with a supply chain extending through Southeast Asia. Your industry dictates your primary vulnerabilities.

- Personnel Mobility and Duty of Care: How frequently do your executives and employees travel? To which destinations, and for what purpose? This analysis is fundamental to structuring appropriate medical, evacuation, and security coverage, as we detail in our guide to international private medical insurance.

Selecting a Broker with True Global Expertise

The single most critical decision in this process is the selection of your insurance broker. A domestic broker, regardless of their proficiency on home ground, lacks the requisite expertise for the international arena. You require a partner with a genuinely global perspective and the infrastructure to support it.

The global insurance market is vast and complex, making expert guidance essential. Valued at approximately $1.1 trillion in 2021, the market for general insurance (non-life) is projected to grow significantly. With North America and Europe dominating market share, a skilled broker can access premier carriers and solutions from these mature markets to serve your global needs. You can discover more insights about the insurance market's growth and segmentation.

A world-class international broker acts as your strategic risk advisor, not merely a policy vendor. Their value lies in their ability to anticipate cross-border challenges, access specialized markets, and manage claims seamlessly across time zones and legal systems.

When vetting potential partners, their credentials and experience must be rigorously scrutinized. A broker with superficial international connections is a liability; you need one with a proven, on-the-ground network.

Critical Questions for Potential Insurance Partners

Engaging with potential brokers should resemble a high-level strategy session more than a sales presentation. Your questions must be designed to probe the true depth of their capabilities and their experience with challenges analogous to your own.

Use this list as a starting point to vet their expertise:

- Global Network and Claims Handling: How do you manage a claim that occurs in a different time zone and jurisdiction? Describe your network of local partners and your protocol for activating them.

- Regional Expertise: What specific experience do you have in the key regions where we operate or plan to expand? Can you provide case studies of clients you have assisted in those markets?

- Admitted Policy Placement: How do you ensure our program is fully compliant with local compulsory insurance laws in each country? Detail your process for placing admitted policies.

- Carrier Relationships: With which global insurance carriers do you have the strongest relationships? How does this benefit our organization in terms of coverage scope and pricing?

- Crisis Response Capabilities: In the event of a serious incident—such as a medical emergency or a security situation—what resources can you deploy immediately to assist our team on the ground?

Their responses will reveal the true extent of their global prowess, empowering you to select a partner capable of building a truly resilient and bespoke international business insurance portfolio.

Frequently Asked Questions

For those managing a global business, the world of international insurance can appear labyrinthine. The stakes are high, and obtaining clear, direct answers is non-negotiable. This section addresses the most pressing questions we hear from business leaders and high-net-worth individuals.

This is a direct discussion, free of jargon, providing the practical insights necessary for making intelligent decisions to protect your assets and your people, wherever they may be.

What Is the Difference Between Admitted and Non-Admitted Policies?

The distinction is straightforward but absolutely critical: it centers on local compliance.

An 'admitted' policy is issued by an insurer licensed and regulated in the specific foreign country where you operate. This is the gold standard, guaranteeing the policy meets all local laws and ensuring compliance. It is analogous to retaining a lawyer who is a fully licensed member of the bar in the relevant jurisdiction.

A 'non-admitted' policy, conversely, is from an insurer that is not licensed in that country. While these can be useful for covering highly specialized risks that local insurers may not underwrite, they represent a significant gamble for mandatory coverage. Using a non-admitted policy where required can lead to substantial fines, and local courts may not recognize it.

The most prudent global strategy almost always involves a carefully layered approach. A global 'master' policy sets a high standard of protection across all operations, while local 'admitted' policies in each country ensure you are satisfying every legal requirement on the ground.

This combination provides the best of both worlds: comprehensive, high-level protection and ironclad local compliance.

How Do Master and Local Insurance Policies Work Together?

Imagine a two-layer security system for your entire global operation. This is precisely how master and local policies function.

At the highest level is your 'master policy'. This serves as your global umbrella, providing a single, high standard of coverage across every country in which you operate. It ensures your core protections are consistent everywhere, from London to Singapore.

Beneath this umbrella are individual 'local policies' for each country. These are the "admitted" policies discussed previously. They function as your on-the-ground presence, ensuring your business is fully compliant with every local insurance mandate and regulation.

The true strategic advantage lies in their interaction. If a major incident occurs at your German office and the claim exhausts the limits of the local German policy, the master policy intervenes to cover the excess. It is an elegant solution that ensures you are always compliant locally while maintaining a high level of financial protection across your entire enterprise.

Are My Employees Covered When They Travel for Business?

This is a critical blind spot for many companies. Your standard domestic plans are fundamentally inadequate for protecting employees working or traveling abroad. Relying on them constitutes a significant liability and a failure of your duty of care as an employer.

To properly protect your team—your most valuable asset—a specific set of international policies is required. These are not optional; they are essential.

- Foreign Voluntary Workers' Compensation: Your domestic workers' compensation coverage ends at the border. This policy fills that gap, covering work-related injuries or illnesses that occur outside your home country.

- Business Travel Accident (BTA) Insurance: This provides crucial coverage for accidental death or dismemberment while an employee is traveling on company business.

- International Health and Medical Evacuation: This is arguably the most critical component. It ensures your personnel have access to quality medical care anywhere in the world. More importantly, it covers emergency medical evacuation to transport them to a suitable facility or repatriate them if necessary.

Protecting your team is not merely a legal requirement; it is a strategic imperative. Providing them with world-class international health coverage demonstrates their value to the organization and ensures their security, no matter where business takes them.

At Riviera Expat, we specialize in securing world-class international private medical insurance for financial services professionals in global hubs. We provide the clarity and expert guidance needed to ensure your health and well-being are protected without compromise. Discover your ideal IPMI plan with our complimentary consultation.