A copay is a predetermined, fixed fee you pay for a specific healthcare service at the point of delivery. Consider it a standard service charge; it is your initial contribution before your International Private Medical Insurance (IPMI) settles the remainder of the invoice. For high-net-worth professionals, understanding how copays work is not merely about nominal fees; it is a critical component of sophisticated global healthcare cost management.

Understanding How Copay Works: An Executive Summary

For discerning individuals accustomed to premium services, absolute clarity on financial matters is non-negotiable. A copayment, or copay, is one of the most frequent touchpoints with your policy's cost-sharing framework. It is engineered to introduce predictability into your medical expenditures. You know the precise upfront cost of a consultation or prescription, irrespective of the provider's final billing total.

This fixed fee is a cornerstone of the financial relationship among you, your healthcare provider, and your insurer. It functions as a financial governor, promoting judicious use of healthcare services. By requiring a modest contribution from the member, insurers can more effectively manage overall financial risk. This, in turn, contributes to the long-term stability of premiums for the entire portfolio.

The Three Key Players in Every Healthcare Transaction

Every utilisation of your insurance policy initiates a financial transaction among three parties. A clear understanding of these roles is the first step toward mastering your IPMI policy.

- You (The Member): As the recipient of medical care, your primary financial obligation at the time of service is typically the settlement of the copay.

- The Medical Provider: This entity—be it a hospital, clinic, or specialist—provides the care. They invoice your insurer for the full service cost, less the copay you have already remitted.

- The Insurer: Your insurance partner covers the substantial portion of the bill, as stipulated by the terms of your policy, after your contribution has been made.

For global executives, a copay is more than a fee; it is an instrument for financial control. It converts potentially variable medical costs into fixed, predictable expenses, providing a clear forecast of your out-of-pocket responsibilities for routine care anywhere in the world.

This system establishes a balanced and equitable cost-sharing structure. It encourages responsible healthcare consumption while ensuring access to premier medical services whenever required.

By grasping this fundamental concept, you are better positioned to select an IPMI plan that aligns precisely with your financial strategy and global lifestyle. To delve deeper, you can learn more about key expat medical insurance policy terms in our detailed guide. This framework is the starting point for demystifying more complex policy elements, such as deductibles and coinsurance, which we will address next.

Decoding Your Health Insurance Cost Structure

To fully comprehend how a copay functions within your international private medical insurance (IPMI), it must be viewed in its broader context. It is one part of a triad of key terms—copay, deductible, and coinsurance—that collectively define your out-of-pocket costs. A firm command of these three concepts is fundamental to mastering your policy.

View them not as complex obstacles, but as strategic levers to align your coverage with your financial objectives. Each applies at a different stage of your healthcare journey and is calculated differently. A misunderstanding can result in unforeseen expenses, but with proper knowledge, you can navigate your policy with complete confidence.

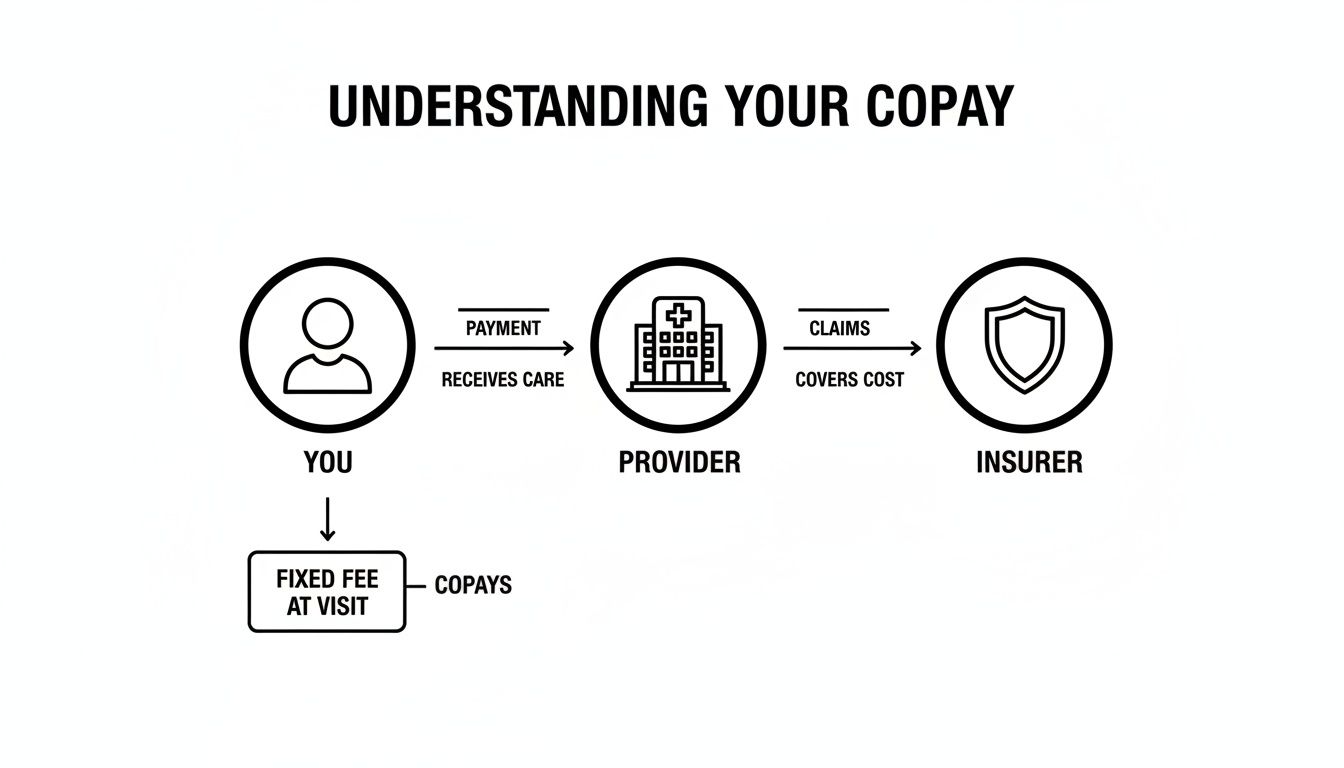

This diagram illustrates the straightforward flow of funds among you, your provider, and your insurer when a copay is involved.

As depicted, the copay is a direct, upfront payment made to the provider. It is the most predictable element of the entire financial equation.

Copay: The Predictable Service Fee

A copay is best understood as a fixed fee for a specific service, paid at the time care is rendered. It is a set amount, for instance €50 for a specialist visit or €25 for a prescription. Critically, this fee remains constant regardless of the total billed amount for the service.

This provides immediate financial certainty. Whether a specialist consultation in Singapore ultimately costs €300 or €500, your share is locked in at your €50 copay. It is the most straightforward cost-sharing element to understand.

Deductible: The Annual Threshold

Your deductible is the total amount you are required to pay out-of-pocket for healthcare services each year before your insurance plan begins to cover most expenses. It is an annual threshold that must be met.

Consider your deductible as a personal spending account for your health. You must first exhaust this amount by covering your own medical bills. Once you have met this annual threshold, your insurer assumes the primary financial responsibility.

If your policy has a €2,000 deductible, for example, you are responsible for the first €2,000 of your covered medical costs for that policy year. Only after you have met this €2,000 threshold does the next phase of your coverage, typically coinsurance, become active. For a more detailed analysis, consult our guide on the finer points of excesses and deductibles in IPMI policies.

Coinsurance: The Shared Responsibility Phase

Coinsurance commences after you have satisfied your annual deductible. It is a cost-sharing model where you and your insurer divide the cost of services based on a predetermined percentage. Instead of a flat fee like a copay, you pay a specified percentage of the remaining costs.

A common arrangement is 80/20 coinsurance. This signifies that after your deductible is met, your insurer pays 80% of the approved medical bill, and you are responsible for the remaining 20%. This arrangement continues until you reach your plan's out-of-pocket maximum for the year.

This table provides a simple differentiation:

| Concept | Nature of Cost | When It Is Paid | Financial Analogy |

|---|---|---|---|

| Copay | A fixed, flat fee | At the time of service, for specific visits or prescriptions. | A predictable service charge. |

| Deductible | A cumulative annual amount | Paid over time as you incur medical expenses. | An annual investment threshold. |

| Coinsurance | A percentage of the cost | After the annual deductible has been fully met. | A cost-sharing partnership. |

When evaluating various plans, remember that certain services, such as determining dental implant insurance coverage for treatment abroad, may have their own specific rules. By deconstructing these three core components—copay, deductible, and coinsurance—you will possess the foundational knowledge to analyze any IPMI policy and ensure its suitability for your international lifestyle.

Copays in Action: Real-World Scenarios for Global Executives

Theoretical understanding is valuable, but observing how a copay functions in practice provides true clarity. For a global executive, healthcare needs can arise unexpectedly, anywhere in the world. Analyzing the financial outcomes is essential for effective planning and policy selection.

Let us examine three distinct scenarios—a specialist visit, an emergency, and a high-value prescription—each occurring in a major international hub. These examples will demonstrate precisely how your copay interacts with your deductible and coinsurance to determine your final out-of-pocket expenditure.

For clarity, we will use a hypothetical International Private Medical Insurance (IPMI) policy with the following structure:

- Annual Deductible: €2,000

- Specialist Visit Copay: €50

- Emergency Room Copay: €150

- Coinsurance: 10% (your share), which applies after the deductible is met.

We will assume that at the start of the policy year, €0 of the annual deductible has been met.

Scenario 1: A Specialist Consultation in Singapore

You are in Singapore for business when a persistent cough prompts a visit to a pulmonologist at a private hospital. The consultation is comprehensive.

- Total Bill from Specialist: €450

- Your Policy's Specialist Copay: €50

Your initial step at the clinic is to pay the €50 copay. As your €2,000 annual deductible has not yet been met, you are responsible for the remainder of the bill.

The financial breakdown is as follows:

- You pay your €50 copay at the time of service.

- The remaining balance is €400 (€450 total – €50 copay).

- This €400 is applied against your annual deductible.

- Total Out-of-Pocket for this Visit: €450 (€50 copay + €400 toward the deductible).

- Your Remaining Deductible for the Year: €1,600 (€2,000 – €400).

In this instance, the copay was the initial charge. The primary cost was applied to the deductible because the annual threshold had not yet been reached.

Scenario 2: An Emergency Room Visit in London

Several months later, while in London, a sudden, severe allergic reaction necessitates a visit to a hospital emergency room. The visit includes an evaluation, medication, and several hours of observation.

- Total ER Bill: €2,500

- Your Policy's ER Copay: €150

Upon discharge, you pay the €150 ER copay. The remaining balance will first satisfy your deductible, after which your coinsurance will apply.

The calculation unfolds as follows:

- You pay the €150 ER copay.

- The remaining balance is €2,350 (€2,500 total – €150 copay).

- The first €1,600 of this amount satisfies the remainder of your annual deductible. Your deductible is now met for the year.

- This leaves a balance of €750 (€2,350 – €1,600).

- Your 10% coinsurance now applies. You pay €75 (10% of €750). The insurer pays the other 90%, which is €675.

- Total Out-of-Pocket for this Visit: €1,825 (€150 copay + €1,600 deductible + €75 coinsurance).

- Remaining Deductible for the Year: €0.

This scenario perfectly illustrates the interplay of copay, deductible, and coinsurance following a significant medical event. Understanding these mechanics is vital for navigating complex billing.

Your copay is the one constant, predictable fee. It is a fixed entry point for a service, regardless of whether your deductible is met. The broader financial outcome is always dictated by the status of your deductible and coinsurance.

Scenario 3: A High-Value Prescription in Hong Kong

Following a diagnosis, your physician in Hong Kong prescribes a specialised monthly medication. As your deductible was met during the London ER visit, only your coinsurance and any specific prescription costs apply. For this example, let us assume your plan has no separate copay for this class of medication.

- Total Cost of Prescription: €1,200

The cost is calculated as follows:

- Your annual deductible is met, so it is not a factor.

- Your 10% coinsurance applies directly to the full cost of the medication.

- You pay 10% of €1,200, which is €120.

- Your insurer covers the remaining 90%, or €1,080.

- Total Out-of-Pocket for this Prescription: €120.

This final example shows how your costs transition to a simple cost-sharing model with your insurer once initial thresholds are cleared. For executives managing health across borders, seeing how these principles apply to specific services like therapy can be very illuminating. You can explore understanding therapy service pricing and copays to see another practical application of these cost structures.

The Strategic Role of Copays in Global Medical Insurance

A copay should not be viewed as a mere fee. It is a fundamental component of your global health insurance architecture, a tool deliberately employed by insurers to influence healthcare utilisation. A copay is a calculated instrument designed to foster a partnership in managing expenses.

When you contribute a small, predictable amount for each service, it encourages a more considered approach to seeking care. This shared responsibility is a key factor in maintaining the stability of the entire insurance system. Mindful consumption by members helps prevent the overuse of services, which in turn helps control the insurer's overall financial exposure. This prudent management ultimately enables them to offer more competitive and sustainable premiums over time.

The Copay as a Premium Control Lever

Herein lies your opportunity for strategic control. A powerful feature of the copay is its direct, inverse relationship with your monthly premium. This provides a crucial lever for customising your policy to suit your financial strategy and anticipated healthcare needs.

Consider it a financial fulcrum. A policy with higher copays—for example, €100 for a specialist visit instead of €25—will almost invariably feature a lower monthly premium. Conversely, a plan with minimal or zero copays will command a higher monthly premium. This presents a clear choice:

- Higher Copay, Lower Premium: You accept a greater share of the cost at the time of service in exchange for lower fixed monthly payments. This is an excellent strategy for individuals who are generally healthy and do not anticipate frequent medical needs.

- Lower Copay, Higher Premium: You invest more in premiums for the assurance of minimal out-of-pocket costs when care is required. This approach offers maximum predictability for those who prioritise budget certainty.

By understanding this dynamic, you can fine-tune your IPMI plan to match your personal risk tolerance and cash flow, ensuring your coverage is not only comprehensive but also financially prudent.

A Buffer Against Global Medical Inflation

The strategic importance of the copay is further magnified by the persistent rise of global medical costs. As healthcare becomes more expensive worldwide, insurers must adjust premiums accordingly. A well-designed copay acts as a critical buffer, absorbing some of this pressure and mitigating the full impact of premium increases.

In the IPMI market, a copay is often a fixed amount or a percentage (typically 10-20% per claim) intended to share costs and discourage overuse. This is more critical than ever. According to the WTW 2026 Global Medical Trends Survey, global medical costs are projected to increase by 10.3% in 2026, with the Asia Pacific region facing a steeper 14% rise. For a globally mobile professional, strategically customising an IPMI plan—perhaps waiving copays for major inpatient care while accepting them for routine outpatient visits—can reduce long-term costs by 15-25%.

With 56% of insurers anticipating these cost increases to persist for more than three years, driven largely by new medical technologies, the humble copay becomes a vital instrument for your long-term financial health.

By consciously selecting a copay structure that aligns with your lifestyle, you are not just paying a fee. You are actively employing a strategy to contain your long-term healthcare spending and protect your financial well-being.

Ultimately, the copay is far more than a simple service charge. It is a sophisticated financial planning tool that empowers you to influence your premiums, encourages responsible healthcare use, and offers a durable defense against the economic realities of modern global medicine.

Advanced Strategies for Optimizing Your IPMI Policy

Understanding the definition of a copay is the first step. True mastery of your healthcare finances, however, requires a broader, strategic approach to optimising your entire International Private Medical Insurance (IPMI) policy.

For global professionals, this extends well beyond the flat fee for a doctor's visit. It involves understanding how all policy components synergise to protect your wealth and guarantee access to premier care without friction. It is time to move beyond the basics and leverage your policy as the powerful financial instrument it is.

Leveraging Copay Caps and Out-of-Pocket Maximums

The most critical financial safeguard in any premium IPMI plan is the annual out-of-pocket maximum. While sometimes referred to as a "copay cap," its scope is far broader. This figure represents the absolute ceiling on your financial liability for covered medical services within a single policy year.

Once your combined payments from deductibles, coinsurance, and copays reach this limit, your insurer covers 100% of all subsequent approved costs.

This is not a minor detail; it is your ultimate financial shield. For a high-net-worth family, a major, unexpected illness could otherwise trigger astronomical and unpredictable costs. The out-of-pocket maximum imposes a firm limit on your financial exposure, providing invaluable peace of mind.

The Financial Advantage of In-Network Providers

Regard your insurer's network of preferred hospitals and clinics as a curated ecosystem, designed for both quality and cost-efficiency. Utilising these in-network providers unlocks significant financial advantages that extend beyond a simple copay.

- Lower Copays: Insurers negotiate preferential rates with their network partners. They often pass these savings directly to you in the form of reduced copayments for in-network services.

- Direct Billing: This is a substantial convenience. In-network facilities typically offer direct billing (or "cashless service"), invoicing the insurer directly. You are only responsible for your copay. This eliminates the need to pay large sums upfront and await reimbursement.

- Quality Assurance: These providers are generally vetted for quality and standards, adding a crucial layer of confidence, particularly when seeking care in an unfamiliar country.

Making in-network care your default choice is one of the most effective strategies for reducing your out-of-pocket spending and administrative burden. You are simply aligning your decisions with your policy's design for maximum value.

The Role of Concierge Services in Cost Management

Premium IPMI policies often include a powerful asset: concierge services. This is far more than a standard customer service line. It is a white-glove support system that functions as your personal healthcare advocate, assisting you throughout your entire healthcare journey.

A dedicated concierge team can help you evaluate complex treatment options, arrange for second opinions, and, where feasible, assist in negotiating costs for certain procedures. This level of personalised support ensures the financial structure of your policy works optimally for you.

By utilising these services, you ensure you are making the most informed decisions possible. This invariably leads to better health outcomes and more efficient use of your insurance benefits—an especially valuable asset when coordinating care across multiple countries.

According to the Lockton 2026 Global Healthcare Cost Trend Report, with carrier cost trends averaging 11.0%, high-net-worth families gain significant protection from out-of-pocket caps—annual limits such as €2,000 that prevent financial shock from a major health crisis. This is especially vital in regions like Asia Pacific, which faces a 14% inflation rate. Selecting plans that reduce copays to just 5% for using direct billing networks can lower total costs by 20%. And with 55% of insurers preparing for multi-year cost increases, mastering these policy features is no longer a luxury—it is essential for financial control.

Your Copay Questions, Answered

When navigating the complexities of International Private Medical Insurance (IPMI), the details are paramount. For high-net-worth individuals, precision in these matters is not merely about convenience—it is a critical component of astute financial planning. Here are direct answers to the most common questions regarding how copays function on a global scale.

Does My Copay Count Towards My Annual Deductible?

This is an excellent question, and the answer highlights a critical distinction among policies. In many standard domestic insurance plans, copays are treated as separate costs—they do not contribute to meeting your annual deductible.

However, within the premium IPMI landscape, it is more common for all out-of-pocket costs, including copays, to count toward your out-of-pocket maximum. The out-of-pocket maximum should be viewed as your ultimate financial safety net for the policy year.

The definitive answer lies within your policy's "Schedule of Benefits." This document is essential reading. An expert can help you dissect these terms to ensure there are no costly surprises when you need to utilise your plan.

Are Copays Different for In-Network Versus Out-of-Network Providers?

Yes, and the difference is almost always substantial. Insurers cultivate exclusive networks of preferred hospitals, clinics, and specialists with whom they have negotiated preferential rates. To incentivise the use of these trusted partners, your IPMI plan will offer powerful financial advantages for staying in-network.

These incentives typically include:

- Lower copayments for appointments and treatments.

- Reduced coinsurance percentages, resulting in a smaller share of the final bill for you.

- The significant convenience of direct billing, where the facility invoices the insurer directly, leaving you with minimal or zero upfront cost.

Seeking care outside this curated network will almost certainly result in higher personal costs. For any global professional, familiarity with your insurer's network in your primary city of residence and frequent travel destinations is a cornerstone of effective healthcare cost management.

Your choice of provider directly impacts your out-of-pocket expenses. Consistently using in-network facilities is the single most effective strategy for maximizing the value of your IPMI policy and minimizing financial friction.

Can I Have a Policy with a Zero Copay?

Certainly. Many high-end IPMI plans offer "nil deductible" or "zero copay" options, particularly for major medical events such as hospitalisation. These policies are structured for individuals who desire maximum coverage and the peace of mind that comes with minimal financial obligation at the time of service.

However, this convenience represents a calculated trade-off. A policy with zero or very low cost-sharing will invariably have a significantly higher annual premium. It is a strategic financial decision: would you prefer to pay more upfront in premiums for predictable, low costs later, or pay less in premiums and assume a larger share of the cost if and when care is needed?

Navigating that trade-off is where expert guidance becomes invaluable. At Riviera Expat, we specialise in providing the clarity and control you need to select an IPMI policy that aligns perfectly with your global life and financial strategy. Explore our tailored solutions today.