For high-net-worth individuals residing in Hong Kong, the right Hong Kong health insurance is more than a safety net; it is a foundational component of a sophisticated wealth preservation strategy. A premium health plan stands between you and a significant, unforeseen financial event, affording you the peace of mind to concentrate on what truly matters.

Protecting Your Health and Wealth in Hong Kong

In a city as dynamic and demanding as Hong Kong, your well-being is your most valuable asset. For discerning individuals, securing premier medical care is not about simple convenience—it is about maintaining absolute control, privacy, and immediate access to the best possible outcomes. This guide is crafted to cut through the complexity of the local health insurance market, providing the clarity required to make a strategic choice that aligns with your exacting standards.

We will begin by dissecting Hong Kong’s two-tiered healthcare system. You will see precisely why the public option, while excellent for acute emergencies, often falls short of the expectations of HNWIs. From there, we will pivot to the indispensable role of private health insurance, framing it as the definitive solution for accessing world-class medical facilities without frustrating—and potentially compromising—delays.

The Strategic Imperative of Private Coverage

Consider your financial portfolio as a meticulously engineered skyscraper. An unexpected medical crisis is akin to a sudden, violent earthquake, threatening to shake its foundations with exorbitant costs and life-altering disruptions. A top-tier private health plan acts as a sophisticated seismic damper, absorbing these financial shocks and preserving the integrity of your wealth.

However, the value extends far beyond mere cost management. It is about securing a standard of care that mirrors your lifestyle and expectations. This includes:

- Priority Access: Bypass the notoriously long public sector waiting lists for specialist appointments and elective surgeries, ensuring you receive a diagnosis and treatment on your own schedule.

- Unrivaled Comfort and Privacy: Secure private rooms in Hong Kong's elite hospitals, guaranteeing a confidential and restorative environment when you are most vulnerable.

- Choice of Specialists: Hand-pick from the world’s leading physicians and surgeons—both in Hong Kong and abroad—to manage your care. You decide who treats you.

A superior health insurance policy is your gatekeeper. It ensures your healthcare experience is defined by choice and excellence, not by system limitations or budget constraints. It transforms medical care from a reactive burden into a proactive component of your life strategy.

Ultimately, the right Hong Kong health insurance is an investment in certainty. It is the assurance that should you or your family ever require it, you will receive immediate, exceptional care without compromising your financial security or personal standards. This is the confidence that allows you to navigate life and business, knowing your most critical assets are completely protected.

Understanding the Hong Kong Insurance Market

To make an informed decision on Hong Kong health insurance, you must first appreciate the local landscape. It presents a paradox: on the surface, Hong Kong appears to be a city where most have coverage, but a closer look reveals a critical issue: many individuals are dangerously underinsured.

Most rely on basic company health plans that are simply not designed for the comprehensive care a high-net-worth individual or seasoned expatriate would demand. This chasm between having some insurance and having the right insurance is fueling significant demand for high-quality private policies.

For affluent residents and expatriates, it has become abundantly clear that a standard-issue plan is an unacceptable risk. The motivation is straightforward and financial: they need to protect their assets from soaring medical inflation and plug the gaping holes left by generic coverage.

This is not merely about ticking a box. It is a strategic move to secure access to the best doctors and hospitals while insulating your wealth from the financial shock of a major health event.

The Numbers Behind the Strategy

The data tells a compelling story. While it is true that a significant portion of Hong Kong residents have some form of medical insurance, this figure can be misleading. A concerning number of individuals have no private insurance at all, leaving a massive protection gap.

This situation is compelling people to act. For high-net-worth individuals, the urgency is even greater, with many intending to purchase new or upgraded plans.

Their reasons are clear:

- Closing Protection Gaps: Many recognize their current coverage is insufficient and seek to rectify it.

- Managing Medical Inflation: A significant percentage are concerned about the relentless rise in healthcare costs.

- Mitigating Financial Risk: An equal number wish to shield their finances from unexpected medical bills.

The core challenge in the market is balancing the need for robust protection with the cost of securing it. You can explore the full Hong Kong insurance market outlook to see how these dynamics create unique opportunities for discerning buyers.

Why Standard Employer Plans Fall Short

Relying on your company’s group plan is a classic oversight for any senior executive or finance professional. These policies are built for the masses, designed to be affordable for the company, not to provide the high-level, bespoke care that leaders require.

A corporate health plan provides a foundational layer of protection. However, for those who demand uncompromising quality and control, it should be viewed as a starting point, not the final solution.

Corporate plans are almost invariably riddled with limitations that become serious liabilities when you actually need to use them. Consider low annual limits that could be exhausted in a single hospital stay, restrictions on which doctors you can see, and no portability if you change jobs or leave Hong Kong.

This is precisely why supplementing—or completely replacing—your corporate plan with a personal policy is not a luxury, but a necessity. A top-tier private plan ensures your coverage is driven by your health needs, not your employer’s budget. It’s a strategic decision that buys you continuity, control, and the caliber of care you expect.

A Strategic Comparison of Public and Private Healthcare

When it comes to Hong Kong health insurance, you are not just choosing a plan; you are choosing an entire experience. For high-net-worth individuals, the difference between the public and private systems is not merely a matter of minor pros and cons. It is about control, time, and the quality of your patient journey.

The two systems deliver vastly different standards of care, and understanding this is the first step in making a sound insurance decision.

To truly grasp the disparity, let's consider a common, non-emergency scenario: you have a persistent joint injury and require a proper diagnosis. We will map out how this plays out in both the public and private systems. This illustration will show you precisely why premium private insurance is not a luxury—it is an essential tool for anyone who values their time and well-being.

The Patient Journey: Public Versus Private

In the public system, managed by the Hospital Authority (HA), your journey begins with a referral from a general practitioner. That first step immediately places you in a queue. You are now awaiting a specialist appointment, and that wait can stretch for months, sometimes well over a year for certain specialties. All the while, your condition could be deteriorating, and your peace of mind is certainly eroding.

When you finally secure that appointment, if the specialist determines you need an MRI or another diagnostic test, you are placed back in another queue. The public system is exceptionally effective at handling life-threatening emergencies, but it is completely overwhelmed by non-urgent demand. Your experience becomes one of waiting, uncertainty, and having zero control over who you see or when.

Now, let's examine the private system, which you access with premium insurance. It is a completely different world.

The real difference is this: the public system dictates when you will be seen. The private system asks when you are available. This shift from being a passive patient to an active participant is the single greatest advantage of top-tier private coverage.

With a quality plan, you can book an appointment directly with a top orthopaedic specialist—often within days. That specialist can order an MRI at a private hospital, and you can usually have it done that same week. The entire process, from initial concern to a clear diagnosis, shrinks from a timeline of many months to just a few days.

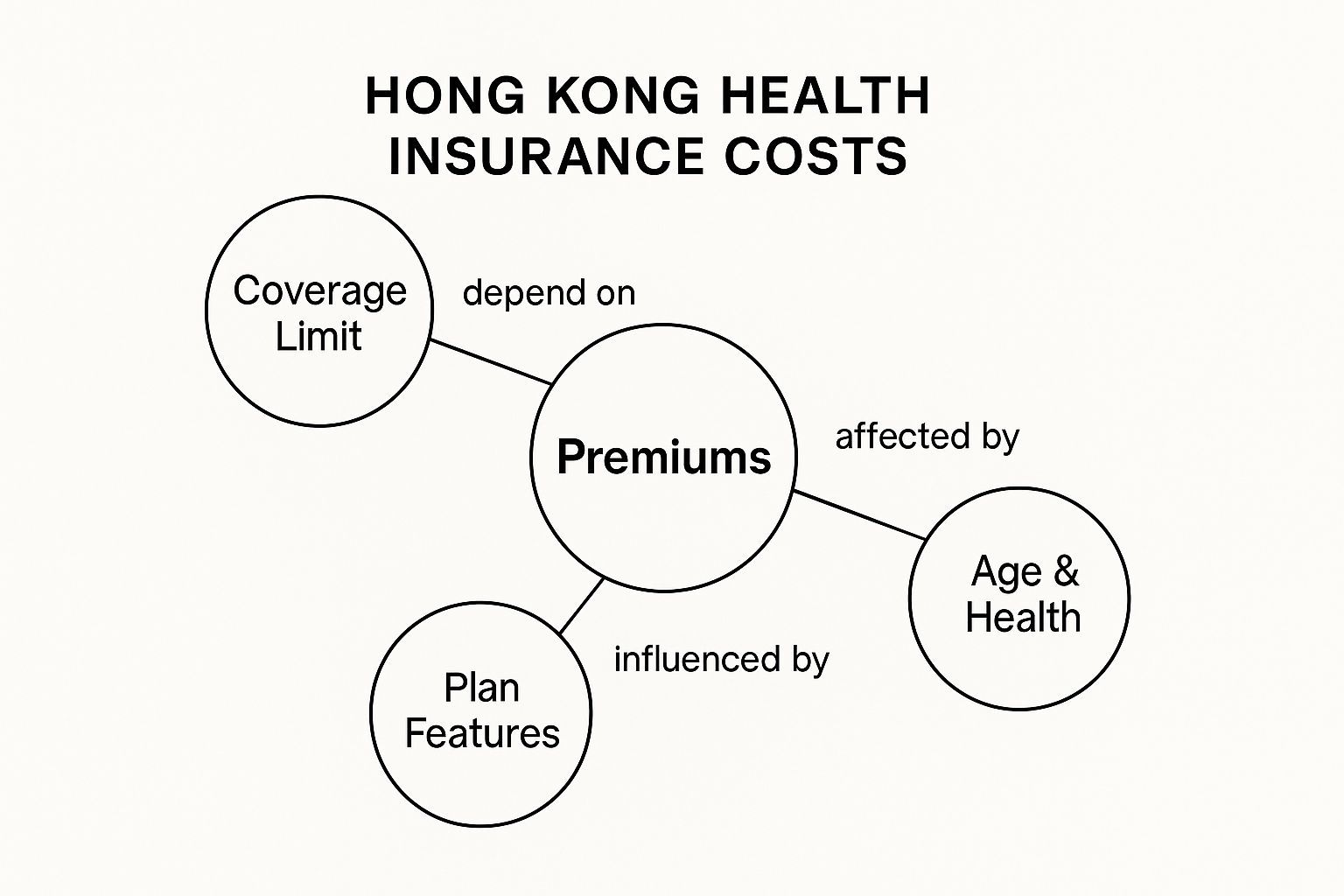

What does it cost to attain this level of speed and access? This infographic breaks down the key factors.

As you can see, the premium you pay is directly tied to your coverage limit, the features you select, and your personal profile. Together, these elements provide the key to unlocking the private system on your own terms.

To put it all together, here's a side-by-side look at the patient experience.

Patient Journey Comparison: Public vs. Private Healthcare

Here is a typical patient journey in Hong Kong for non-emergency care, comparing the public system managed by the Hospital Authority (HA) with the experience in the private system when using a premium health insurance plan.

| Feature | Public System (HA) | Private System (with Premium Insurance) |

|---|---|---|

| Specialist Access | GP referral required, then a long wait (months to over a year) for an appointment. | Direct access or fast referral to a specialist of your choice, often within days. |

| Doctor Choice | You are assigned the next available doctor. No choice. | You select your preferred specialist based on reputation or recommendation. |

| Diagnostic Tests | Another long waiting list for tests like MRIs or CT scans. | Tests are scheduled quickly, often within the same week. |

| Treatment Timeline | The entire process from GP visit to diagnosis can take many months. | The entire process is compressed into a matter of days. |

| Environment & Comfort | Crowded waiting rooms and shared wards are common. | Private rooms, comfortable waiting areas, and a focus on personal service. |

| Control | The system dictates the schedule, process, and personnel. | You are in control of scheduling, physician choice, and location of care. |

This table clearly illustrates the trade-off: the public system offers low-cost care at the expense of time, choice, and comfort, while the private system, accessed via good insurance, prioritizes efficiency and personal control.

Beyond Speed: Access to a Higher Standard of Care

The advantages of the private route extend far beyond mere expediency. They directly impact the quality of care and the environment in which you recover.

- Choice of Physician: You are not just a number assigned to a doctor. You have the ability to choose your physician based on their reputation, specialty, or your personal comfort. Having that continuity with an expert you trust is invaluable.

- Cutting-Edge Technology: Private hospitals in Hong Kong compete for patients, which means they invest heavily in the latest medical equipment. This can lead to faster, more accurate diagnoses and access to more advanced treatment options.

- Privacy and Comfort: Forget crowded, noisy wards. In the private system, a private room is the norm. This ensures confidentiality and provides a quiet, restorative space in which to heal.

- Personalized Attention: With lower patient-to-staff ratios, you receive more time with your doctors and nurses. Your questions are answered, and your needs are met without feeling rushed.

For any discerning individual, these are not just nice-to-haves; they are fundamental. The public system is a vital safety net for the city and a lifesaver in a true emergency. But for everything else, it simply cannot deliver the service, speed, and discretion that high-net-worth individuals require and expect. Your Hong Kong health insurance is the key that unlocks this far superior standard of care.

Decoding Your Premium Insurance Options

Choosing a Hong Kong health insurance plan is not just about selecting benefits; you are deciding on the fundamental architecture of your healthcare access.

This choice dictates your freedom, your geographic reach, and the control you have over your medical journey. For anyone with a global footprint, getting this right is non-negotiable.

Your first major decision point is between a local plan and an international private medical insurance (IPMI) policy.

Think of a local plan as a high-performance city car—it is engineered perfectly for navigating Hong Kong's private healthcare system with incredible efficiency. It gives you excellent access within the city’s borders, connecting you to a robust network of top-tier local hospitals and specialists.

An international plan, however, is the luxury grand tourer. It is built for crossing borders without ever sacrificing performance or comfort. These plans deliver elite, comprehensive global coverage, ensuring you receive the same high standard of care whether you find yourself in Hong Kong, London, New York, or Singapore.

Local vs. International: The Core Differences

For a high-net-worth individual, the confines of a local plan can become apparent quickly.

While they are cost-effective for someone living exclusively in Hong Kong, they are inherently restrictive. Coverage effectively stops at the border, except for minimal emergency benefits that are often insufficient for a serious medical event abroad.

International plans, on the other hand, offer features that are absolutely essential for a global lifestyle:

- Global Geographic Coverage: This is the game-changer. You have the freedom to seek treatment from the world's leading specialists and facilities, wherever they may be, depending on your chosen area of cover.

- Guaranteed Lifetime Renewability: This feature is your long-term security. It ensures the insurer cannot terminate your policy due to your age or the number of claims you have made. It protects you as you get older, when you need coverage the most.

- Seamless Portability: If you ever relocate from Hong Kong, an international plan moves with you. This provides invaluable continuity of care, saving you from the challenge of finding new insurance and undergoing medical underwriting again in a new country.

An international plan isn’t just about receiving care abroad; it's about future-proofing your health. It gives you the certainty that no matter where life or business takes you, your access to premier medical care remains constant and uninterrupted.

Understanding Plan Frameworks: PPO vs. EPO

Beyond the local-versus-international divide, you need to understand the plan's network structure. The two most common frameworks you will encounter are Preferred Provider Organizations (PPOs) and Exclusive Provider Organizations (EPOs).

These structures determine which doctors and hospitals you can use.

A PPO plan provides a network of "preferred" providers with whom the insurer has negotiated preferential rates. You have the flexibility to see specialists both inside and outside this network, though you will pay less out-of-pocket if you stay with in-network doctors. This model strikes a balance between choice and cost.

An EPO, as the name implies, is more restrictive. You must use providers exclusively within its network. If you go outside it, you typically have no coverage at all, except in a true emergency. While this limits your options, EPOs can offer more predictable costs.

The Hong Kong health insurance market is growing rapidly, with one report projecting it to expand from $20.13 billion in 2024 to $24.39 billion by 2032. Interestingly, the EPO segment is forecast to be the fastest-growing part of this market, with a compound annual growth rate of 4.66%, indicating a trend toward more structured, network-based plans. You can explore the data in this Hong Kong health insurance market research.

For HNWIs who value absolute freedom of choice above all else, a PPO or a plan with a completely open network is almost always the superior option. This is a critical step, and you can get a deeper understanding by reading our guide on which expat medical insurance policy type is right for you. This ensures your policy truly aligns with your expectation of accessing the world’s best medical expertise, without question.

High Annual and Lifetime Maximums

This is the single most critical feature of any premium health insurance plan: its annual benefit limit. This figure represents the absolute maximum an insurer will pay for your medical bills in a single policy year. On a standard plan, this limit can be distressingly low. A single complex surgery or a prolonged stay in one of Hong Kong's private hospitals could exhaust it completely.

A premium international plan, in contrast, offers extremely high or even unlimited annual maximums. This is not about extravagance; it is a practical necessity. Consider a battle with cancer requiring cutting-edge treatment, a scenario that can easily run into millions of Hong Kong dollars. A plan with a substantial limit means your treatment will not be curtailed by cost, providing a critical buffer against catastrophic expenses.

The annual maximum is the ultimate ceiling on your protection. A low limit creates a dangerous financial exposure, while a high or unlimited one provides the absolute peace of mind that your care will never be compromised by cost.

Comprehensive Inpatient and Outpatient Care

A first-class policy has you covered whether you are admitted to the hospital (inpatient) or just visiting a specialist (outpatient).

- Inpatient Care: This should cover 100% of the significant items: a private room, surgeon’s fees, anaesthetist fees, intensive care, and all other hospital charges. Look for policies that offer “full cover” for these items, meaning the insurer pays the entire bill without hidden sub-limits.

- Outpatient Care: This is where many plans reveal their weaknesses. An elite plan will be generous here, covering specialist consultations, diagnostic tests like MRIs and CT scans, prescription drugs, and physiotherapy. This allows you to proactively manage your health without paying out-of-pocket every time you need a consultation.

Non-Negotiable Benefits for a Global Lifestyle

If you travel extensively or have a family to consider, a few benefits become absolutely essential.

Medical Evacuation and Repatriation

This is non-negotiable for anyone who travels. If you become seriously ill or injured in a location with substandard medical care, this benefit covers the cost of transporting you to the nearest center of medical excellence. Repatriation covers the cost of returning you to your home country for treatment. For an executive traveling through Southeast Asia, this is not a luxury—it is a lifeline.

Comprehensive Dental and Maternity Coverage

High-end plans offer dental benefits that go far beyond simple cleanings to include major work like crowns and orthodontics. Similarly, top-tier maternity benefits will cover everything from prenatal consultations to delivery in a private hospital and postnatal care. These are usually optional modules, but they are vital for complete family protection.

Coverage for Pre-Existing Conditions

This is a crucial point. Securing coverage for health issues you already have can be a major challenge. Top-tier international plans are often more flexible in this regard. They might offer a moratorium, where a condition can be covered after a waiting period (typically 24 months) provided you have had no symptoms or treatment. Another option is full medical underwriting, where you declare everything upfront, and the insurer may offer to cover it, perhaps with a higher premium. This transparency is crucial for your long-term security. How a policy handles these conditions is a fundamental test when choosing the right Hong Kong health insurance.

Navigating Premiums and Market Costs

Think of a premium Hong Kong health insurance policy less as a fixed cost and more as a strategic investment in your well-being. The price you pay—the premium—is not an arbitrary number. It is a carefully calculated figure based on the precise level of protection and flexibility you require.

Understanding what drives that cost is key to designing a plan that provides maximum value without paying for features you will never use.

The foundation of your premium is built on your age and current health—that is the statistical baseline. From there, the two biggest levers you can pull are the level of coverage and the geographic scope of your plan. Logically, a policy with an unlimited annual payout that covers you anywhere on the planet will command a higher price than one with a set limit that excludes North America.

The Levers of Cost Control

For high-net-worth individuals, the objective is not to find the cheapest plan, but to optimize value. You can adjust certain levers in your policy to manage the final cost without sacrificing the quality of your core protection.

The key elements you can adjust to influence your premium are:

- Deductibles: This is the amount you agree to pay out-of-pocket before your insurer begins to cover the bills. Opting for a higher deductible is the most direct way to lower your annual premium. It is a common strategy for those who can comfortably manage smaller medical expenses themselves.

- Co-insurance: This is the percentage of a medical bill you share with the insurer after your deductible is met. For example, a 90/10 co-insurance split means the insurer pays 90%, and you cover the remaining 10%.

- Geographic Coverage: If you do not require regular access to the US healthcare system, limiting your coverage to "Worldwide excluding USA" can generate significant savings on your premium.

Think of your deductible as your personal stake in your healthcare. By agreeing to manage minor costs yourself, you’re signaling a shared responsibility to the insurer. This lowers their risk for major, catastrophic events and, in turn, reduces your premium.

This balancing act allows you to maintain elite-level protection for serious health issues while achieving a much more efficient premium. It is a financially savvy way to secure comprehensive coverage.

Understanding Market Dynamics and Premium Growth

The price of Hong Kong health insurance does not exist in a vacuum. It is directly shaped by powerful market forces, especially medical inflation and intense consumer demand. The numbers tell a clear story.

For the first quarter of 2024, total gross insurance premiums in Hong Kong reached HK$165.1 billion. New premiums for long-term business, which includes health insurance, surged by 39.1% year-over-year to HK$63.7 billion. This is not just a statistic; it is a massive vote of confidence from consumers who are willing to invest in high-quality protection. You can explore the full details of this strong growth in the Hong Kong insurance market to get a better feel for the landscape.

This boom is partly fueled by the rising cost of healthcare itself, which inevitably leads to premium adjustments over time. The reality is, premiums for top-tier plans tend to increase annually. This is not arbitrary; it reflects the ever-increasing cost of advanced medical technology, new drugs, and general inflation for hospital and specialist fees. For a deeper dive, you may wish to read our explanation on why medical insurance premiums rise year after year.

Knowing this allows you to plan ahead, viewing your premium not as a static bill, but as a dynamic investment in continuous, world-class health security.

Frequently Asked Questions

When it comes to Hong Kong health insurance, the details can become complex. For high-net-worth individuals and expatriates, obtaining clear answers to a few key questions is the difference between a sound decision and a costly error. Let’s clarify some of the most common points of confusion.

Do I Need Private Insurance if My Company Provides It?

Relying solely on your company's plan is a strategic blind spot. Corporate plans are built around a company's budget, not an executive's needs, and this almost always creates dangerous gaps in your protection. A personal plan is not a luxury; it is a necessary layer to ensure your coverage meets your standards.

Think of it this way: your company plan is a safety net with some considerable holes. A serious medical event can tear right through it.

Key limitations you will almost always find in corporate plans include:

- Low Coverage Limits: A major health crisis can exhaust the annual maximum in a flash, leaving you exposed to massive bills.

- Restrictive Networks: You may be confined to a small, pre-approved list of doctors and hospitals, not the ones you would actually choose.

- Zero Portability: The moment you leave your job, that coverage evaporates. You are left completely uninsured.

- Minimal Benefits: Features like comprehensive outpatient care, wellness, or high-end dental are usually minimal or completely absent.

What Is the Core Difference Between Local and International Plans?

The real difference comes down to two things: geography and freedom. An international plan provides global coverage, which is non-negotiable if you travel frequently or want the option to seek treatment outside Hong Kong. It is also fully portable, meaning it follows you wherever you go should you decide to relocate.

A local plan, on the other hand, confines your coverage to Hong Kong. For a high-net-worth individual whose life and business do not stop at the border, an international plan is the only way to get the flexibility and access you require. It guarantees your standard of care remains high, no matter where you are in the world.

How Are Pre-Existing Conditions Handled?

This is where matters can get complicated, so it pays to understand the rules. Insurers in Hong Kong typically handle pre-existing conditions in one of two ways. Getting this right is critical to avoid unpleasant surprises when you need to make a claim.

The underwriting method an insurer uses is a critical detail. It determines whether your past health history becomes a permanent exclusion or a manageable condition under your new policy.

Here are the two main approaches you will encounter:

- Moratorium Underwriting: This is a "wait-and-see" approach. The insurer imposes a waiting period, usually 24 months, during which anything related to a pre-existing condition is not covered. If you remain symptom-free and do not require any advice, care, or treatment for that condition during the moratorium, it may be covered thereafter.

- Full Medical Underwriting (FMU): This is the more transparent route. You disclose your entire medical history upfront. The insurer then assesses the risk and makes a clear decision. They might exclude a specific condition permanently, or—in some cases—they may offer to cover it for a higher premium. This provides certainty from day one.

At Riviera Expat, we cut through the noise. We specialize in securing world-class international health insurance for discerning professionals in global hubs like Hong Kong. Our role is to provide clear, objective advice so you can choose a policy that offers the control, confidence, and white-glove service you expect.

To explore your options and get a personalized consultation, visit us at Riviera Expat.