For discerning global professionals, managing unpredictable healthcare expenses is no longer a peripheral concern—it is a critical component of sophisticated wealth preservation. Consider healthcare cost transparency tools as the essential financial instruments for this mandate, providing the precise data required to execute strategic decisions and illuminating the often-opaque pricing of premier medical services worldwide.

The New Financial Imperative in Global Healthcare

In a world of escalating medical costs, it is imperative to treat healthcare spending as a manageable financial liability. The era of reactive, uninformed medical expenditure is decisively over. We have entered a new paradigm of proactive, data-driven strategy.

For high-net-worth individuals leveraging international private medical insurance (IPMI), this is not a discretionary enhancement; it is fundamental to protecting both health and financial assets.

Imagine planning an elective procedure. Without price clarity, you are effectively signing a blank check. With a sophisticated transparency tool, however, you can compare the costs of top-tier surgeons in Zurich versus Singapore, factor in your IPMI coverage, and calculate your precise out-of-pocket exposure. This simple step transforms a potentially volatile liability into a predictable, planned investment in your well-being.

Navigating Rising Global Costs

The financial pressure is intensifying across all markets. According to the WTW 2025 Global Medical Trends Survey, medical costs are projected to increase by a notable 9.9% in 2025.

What is driving this trend? A significant factor, cited by 75% of European insurers, is the perceived decline in public healthcare quality. This shift increases demand—and consequently, cost—for private-sector solutions. You can explore a deeper analysis of these cost drivers and learn more about why medical insurance premiums rise year after year in our detailed guide.

This chart from the survey paints a vivid picture, illustrating the significant gap between general inflation and the much faster rate of medical cost increases.

The data is unequivocal. Medical cost inflation consistently outpaces general economic inflation, making strategic cost-containment instruments more urgent than ever.

Furthermore, a significant inefficiency stems from the overuse or misuse of care, often because practitioners recommend excessive services—a concern reported by 72% of insurers globally. This points to a critical systemic flaw that transparency tools can help you counteract.

By arming yourself with precise cost data, you shift from being a passive recipient of care to an active manager of your health and wealth. This empowerment is the cornerstone of modern financial planning in a global context.

Differentiating Between Pricing Tools

It is crucial to understand that not all healthcare cost transparency tools are created equal. You must comprehend the landscape, as the quality of financial insight varies dramatically between platforms. Consider it the difference between a rough map and a high-resolution satellite image.

The market for these tools is bifurcated. On one side are the portals provided by your insurer, integrated directly into your health plan. On the other, you find independent, third-party platforms that aggregate data from myriad sources, offering a broader—but sometimes less precise—view of the market. Identifying which solution aligns with your international private medical insurance (IPMI) strategy is the first step toward mastering your medical expenditures.

The Critical Distinction: Estimates vs. Negotiated Rates

This is the most pivotal distinction for any individual managing significant wealth. Does the tool present a general cost estimate, or does it reveal the actual, negotiated rates your insurer has secured? The difference is not merely semantic; it is fundamental to your financial planning.

An estimate is an educated guess based on historical data. While useful for establishing a budgetary range, it leaves a considerable margin for error. Relying on an estimate for a major medical procedure is analogous to making an investment based on projected earnings instead of a firm share price.

A tool that displays the negotiated rate, conversely, provides actionable financial intelligence. This is the exact price your insurer has contracted to pay a specific provider for a specific service. This figure directly determines your out-of-pocket costs, such as deductibles and coinsurance.

Knowing the precise, contracted cost before committing to a procedure is not a minor detail. It is the core function that elevates a transparency tool from a general guide into a powerful financial instrument. This clarity is paramount for managing your liabilities effectively.

Essential Features: Core Functions and Capabilities

Beyond data sources, these platforms differ in their functional capabilities. A basic tool might only allow price comparisons for a few common procedures. More sophisticated solutions, however, offer a suite of functions designed for serious financial management.

The key features that provide tangible value include:

- Out-of-Pocket Expense Calculation: Premier tools allow you to input your specific IPMI plan details to generate a precise calculation of what you will owe after your insurance has paid its portion. This eliminates guesswork.

- Provider Quality Metrics: Price is only one part of the equation. You require access to data on metrics such as hospital infection rates, patient satisfaction scores, and physician credentials. This enables you to weigh cost against clinical quality.

- Geographic Cost Comparison: Top-tier tools permit you to compare negotiated rates for a procedure across different cities or countries, creating strategic options for medical tourism or locating more cost-effective care during your travels.

Ultimately, your objective is to find a platform that transcends generic price lists. The right healthcare cost transparency tools deliver a clear, detailed picture of your financial obligations, empowering you to make decisions that protect both your health and your capital.

How Global Regulations Are Forcing a New Era of Price Transparency

The global movement toward clarity in healthcare pricing is not a transient trend. It is a fundamental market shift, driven by significant regulatory force. In major economic hubs, governments are compelling hospitals and insurers to finally lift the veil on their labyrinthine pricing structures. This represents a permanent move away from opaque billing toward a model where the consumer holds a position of power.

For anyone who relies on premium healthcare services globally, monitoring this regulatory landscape is absolutely critical. These new laws are the engine powering the very healthcare cost transparency tools that savvy global professionals now depend on. As regulations tighten, the data within these platforms improves, affording you an unprecedented level of control over your medical expenditures.

This is not merely about consumer rights; it is about fostering a functional market. Regulators understand that hidden prices stifle competition and allow costs to spiral. By forcing providers to disclose their prices, these laws create an environment where you can finally compare options based on tangible value and quality, not just a hospital's reputation.

The Ripple Effect of US Policy on Global Standards

As the world's largest healthcare market, developments in the United States often have a global impact. Currently, the US is a major catalyst in the transparency movement. Recent federal policies are creating ripple effects that influence standards worldwide, pushing beyond vague estimates to demand the disclosure of real, final prices for medical care.

A key development is the Final Rule effective January 1, 2024, which strengthens requirements under the Hospital Price Transparency regulations. This rule mandates that hospitals provide comprehensive, machine-readable files of all standard charges, making data more accessible and usable. You can delve into the details and see the latest on US healthcare price transparency regulations to gain a complete understanding.

This is a complete game-changer. It provides the power to know the precise cost of a procedure before you commit—an indispensable component of any sound financial plan.

This regulatory pressure is what transforms modern transparency tools from helpful estimators into indispensable financial instruments. The data becomes more reliable and standardized, allowing for genuinely strategic decisions.

What This Means for Your International Strategy

As these regulations become the global norm, the advantages for individuals with international private medical insurance (IPMI) are unequivocal. The data unlocked by these laws is the key to managing your costs far more effectively on an international scale.

Here is how this translates into practical application:

- Genuine Negotiation Power: When you or your advisors are armed with verified pricing data, you are in a much stronger position to discuss costs with providers, particularly for planned procedures.

- Smarter Plan Selection: You can more accurately forecast potential out-of-pocket expenses under different IPMI plans, ensuring your coverage is perfectly aligned with your financial objectives.

- Strategic Medical Choices: With clear cost and quality data, you can confidently compare top-tier hospitals in different countries, optimizing for both superior clinical outcomes and financial efficiency.

Ultimately, this regulatory momentum is building a more predictable and manageable healthcare market. For the discerning global professional, it provides the foundation for converting what was once a major financial unknown into a well-managed component of your portfolio.

Selecting the Right Healthcare Transparency Solution

Choosing the appropriate platform is the single most important step in gaining genuine control over your healthcare costs. The challenge is that not all healthcare cost transparency tools deliver the same caliber of intelligence, and for a global professional, that difference is paramount.

Your objective is not simply to find a price list. It is to find a tool that provides a clear, strategic advantage. This requires looking beyond superficial dashboards and focusing on what truly matters: the accuracy of the pricing data, the breadth of its provider network, and its capability to deliver personalized out-of-pocket calculations. A basic tool provides numbers; a strategic one provides financial clarity.

Key Evaluation Criteria

To select a solution that delivers tangible value, you must be relentless in focusing on three non-negotiable pillars. These are the criteria that separate a simple online directory from a powerful financial planning instrument.

-

Data Source and Accuracy: The first and most critical question is the origin of the data. You must prioritize tools that source their information directly from insurer-negotiated rates. Avoid any solutions that rely on historical claims data or public averages. This is the only method to ensure the figures you see reflect the actual, contracted price your IPMI plan will be billed, providing a rock-solid foundation for your financial decisions.

-

Geographic and Network Scope: Your healthcare needs are not confined to one city, and neither should your tool be. A truly useful solution must offer extensive coverage across the global financial hubs you frequent. It needs to provide detailed insights into the specific providers within your IPMI network, allowing you to compare top-tier facilities in London, Singapore, and Hong Kong with equivalent confidence. To understand why this is so critical, you can learn more about navigating extensive medical networks in our complete guide.

-

IPMI Plan Integration: The platform must do more than display sticker prices. The best solutions allow you to input your specific IPMI policy details—your deductible, copayments, and out-of-pocket maximums. This feature is what transforms raw pricing data into a personalized cost forecast for any procedure you might require.

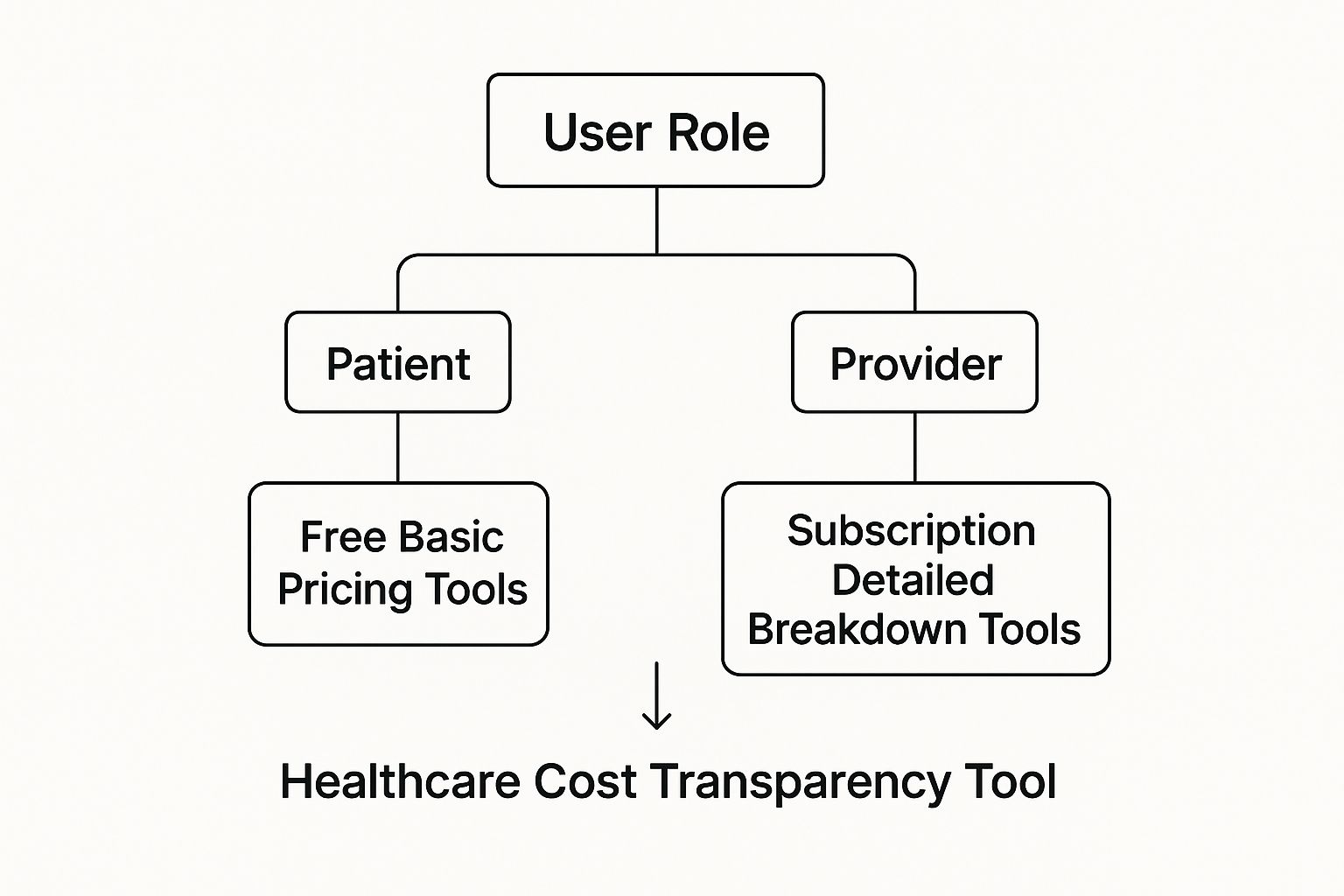

This simple decision tree illustrates how your role—whether as a patient seeking general information or a financial planner requiring hard data—determines which type of tool is most appropriate.

As you can see, while basic pricing information is widely available, obtaining the detailed, actionable intelligence required for serious planning often necessitates a more specialized tool designed for in-depth analysis.

Comparative Analysis of Tool Archetypes

To aid in your selection, it is useful to compare the common types of healthcare cost transparency tools side-by-side. Each category serves a different purpose and offers a vastly different level of precision.

Comparative Analysis of Healthcare Cost Transparency Tool Archetypes

This table breaks down the key features of different types of cost transparency tools. Use it to identify the best fit for your international healthcare strategy and avoid tools that provide misleading or irrelevant data.

| Feature | Insurer-Provided Portals | Independent Third-Party Platforms | Government-Mandated Databases |

|---|---|---|---|

| Data Source | Direct negotiated rates from the insurer's own network. | Aggregated data from various sources, including claims and public records. | Publicly reported "chargemaster" or standard rates. |

| Accuracy | High. Shows actual, contracted prices for your specific plan. | Variable. Accuracy can be inconsistent depending on the data sources. | Low. Often shows inflated list prices, not what is typically paid. |

| Scope | Limited to providers within your specific insurance network. | Broad market view, often covering providers outside a single network. | Usually restricted to a specific country or region. |

| Best For | Precise out-of-pocket cost planning for in-network care. | General market research and comparing broad price differences. | Basic compliance checks and understanding list price benchmarks. |

Ultimately, if you are serious about strategically managing your healthcare expenditures, an insurer-provided portal or a premium third-party platform with direct data feeds is the only viable option. These are the tools that provide the financial certainty required to make intelligent healthcare decisions part of a sophisticated wealth management strategy.

Weaving Transparency Tools into Your Financial Strategy

A powerful instrument is only useful when expertly wielded. This is particularly true for healthcare cost transparency tools. They transition from being another data source to a genuine financial asset when you integrate their insights into your broader financial framework. The objective is to take one of life's most unpredictable expenses and transform it into a manageable, predictable cost.

The true value is realized when you begin using these tools proactively rather than reactively. The days of waiting for a surprise bill are over. Now, you can model potential healthcare costs with a remarkable degree of accuracy. This enables you and your financial advisor to plan for them with the same rigor as any other major expenditure.

Putting Proactive Planning into Practice

This is not a theoretical exercise. Integrating this data has immediate, practical applications for anyone managing healthcare costs across borders. The goal is to move beyond simple price-shopping into the realm of sophisticated financial forecasting.

Here are three real-world applications for embedding this data into your strategy:

- Planning Elective Procedures Abroad: Suppose you are considering an elective surgery. A top-tier tool allows you to compare the all-in cost of the same procedure at leading hospitals in London, Zurich, and Singapore. You can input your specific International Private Medical Insurance (IPMI) details and see the final, precise out-of-pocket cost for each option. Suddenly, you are making a decision based on both clinical excellence and financial reality.

- Vetting Specialists for Second Opinions: When seeking a second opinion from a world-renowned specialist, the costs can vary significantly. Transparency tools allow you to vet these experts not only on their credentials but also on their consultation and diagnostic fees. You secure premier medical advice without unnecessary financial surprise.

- Optimizing Your IPMI Plan: The data from these tools provides the intelligence needed to structure your health coverage more effectively. By analyzing cost projections for your likely needs, you can make informed decisions about your policy. To master this, it is crucial to understand the fine print, excesses, and deductibles, which dramatically affect your actual liability.

By forecasting health-related liabilities with precision, you transform healthcare from a financial wildcard into a predictable component of your portfolio. This control is the essence of modern wealth preservation.

Collaborating with Your Financial Advisor

Your financial advisor is a key partner in this process. When you provide them with precise cost projections, you empower them to build these potential expenses directly into your long-term financial models. This ensures your portfolio is robust enough to accommodate these costs without derailing your objectives. It is a collaborative approach that ensures your health and wealth strategies are perfectly synchronized.

Ultimately, sound financial management requires understanding all variables. Learning how to calculate investment returns is a foundational skill, but applying that same analytical discipline to your healthcare costs is the next logical step. By using healthcare cost transparency tools, you are equipping yourself with the data to make sophisticated, forward-thinking financial decisions that protect both your assets and your well-being.

The Future of Financial Empowerment in Healthcare

The drive for genuine financial control in healthcare is gaining significant momentum. The healthcare cost transparency tools available today are merely the foundation for a far more competitive, data-driven marketplace. For the forward-thinking global professional, understanding the trajectory of this evolution is key to identifying—and seizing—future opportunities.

Of course, the path to complete transparency is not without challenges. One of the primary obstacles is the inconsistent state of data standardization across different health systems and countries. A procedure code in Singapore may not directly correspond to one in London, creating friction when attempting a true apples-to-apples comparison.

However, the market forces demanding change are powerful. As major insurers and multinational corporations insist on cleaner, comparable data, healthcare providers will have no alternative but to adopt more universal standards. This single shift will dramatically enhance the power and precision of the next generation of transparency tools, making them indispensable for financial planning.

The Emerging Financial Upside of Transparency

The potential for savings is not marginal; it is substantial. When clear pricing becomes the norm, it injects healthy competition into the healthcare market. High-cost providers must justify their prices or risk losing discerning clients. The result is a more efficient system where value—excellent outcomes at a fair price—becomes the true currency.

Recent analysis highlights the scale of this financial opportunity. One study by Mathematica Policy Research projects that price transparency has the potential to reduce U.S. national health spending on certain services by 4% to 12%. This is not an accounting trick; it is driven by a shift from opaque, negotiated rates toward more competitive pricing—a significant advantage for consumers. You can explore the full findings on healthcare transparency's market impact to examine the data yourself.

As this market matures, the ability to analyze and act on transparent cost data will become a defining skill. It will separate the proactive financial stewards from those left reacting to unpredictable, and often inflated, medical bills.

Anticipating a More Patient-Centric Market

The future of healthcare financing places the patient firmly in a position of control, armed with actionable data. This patient-centric model will be built on several key pillars:

- Integrated Quality Metrics: The next generation of tools will not just display a price tag. They will seamlessly blend cost data with detailed clinical outcome metrics, allowing you to make decisions based on true, measurable value.

- AI-Powered Recommendations: Generic advice will become obsolete. Advanced platforms will utilize AI to provide personalized recommendations based on your specific health profile, IPMI plan, and financial objectives.

- Predictive Cost Modeling: Imagine tools capable of accurately forecasting your future healthcare expenses based on your personal health data. This will enable an entirely new level of precision in long-term financial planning.

For the strategic investor or global professional, this evolution is not just an interesting trend—it is a clear opportunity. By staying ahead of the curve and integrating the best healthcare cost transparency tools into your financial toolkit now, you are positioning yourself to master an increasingly efficient, competitive, and predictable global healthcare landscape.

A Few Common Questions

Can These Tools Be Used Across Different Countries?

Yes, but with an important caveat. The best healthcare cost transparency tools, particularly those integrated into top-tier international private medical insurance (IPMI) plans, possess robust data for major global hubs.

However, the level of detail can vary significantly depending on local privacy regulations and the willingness of providers to share data. The key is to select a tool with strong coverage in the specific regions where you are most likely to require care.

How Accurate is The Pricing Data?

This is a critical question, and the answer is straightforward: it is entirely dependent on the data source.

Platforms that pull information directly from your insurer's network are the gold standard, as they display the actual, negotiated rates your plan will pay. Conversely, tools that scrape public databases often show inflated "chargemaster" prices—the list price for healthcare that is rarely paid. Those figures are unsuitable for serious financial planning. Always verify the data source before trusting the information.

For expert, objective guidance in selecting an IPMI plan with the best integrated transparency tools, contact Riviera Expat today. Visit us at https://riviera-expat.com to ensure your healthcare strategy aligns with your financial goals.