For discerning individuals residing in or relocating to Thailand, securing exceptional healthcare is a foundational requirement. While the country possesses a public health system, premium private health insurance is the definitive key to unlocking priority access to world-class medical facilities and safeguarding the lifestyle you have meticulously constructed.

Securing Premier Healthcare in Thailand

For high-net-worth individuals, Thailand presents a unique duality: a vibrant, sophisticated lifestyle combined with a highly respected medical sector. However, gaining seamless entry into this premier healthcare ecosystem requires a deliberate strategy, the cornerstone of which is a meticulously selected health insurance plan. This instrument is your conduit to navigating the country's best hospitals with confidence and absolute peace of mind.

This is not a matter of acquiring a basic safety net. It is about guaranteeing a standard of care that aligns with your exacting expectations. The right policy ensures that when a medical need arises, your focus remains entirely on recovery, not on navigating bureaucracy or confronting staggering, unexpected financial liabilities.

The Value of Proactive Health Management

A proactive approach to health is a cornerstone of a well-managed life. In Thailand, this translates to a health insurance plan that extends far beyond emergency coverage. It should function as a sophisticated tool that facilitates routine check-ups, specialist consultations, and wellness benefits, enabling you to maintain peak physical condition.

Consider your health insurance an integral component of your personal asset protection strategy. It safeguards your well-being—your most valuable asset—against unforeseen events.

The most effective plans deliver:

- Priority Access: The ability to enter leading international hospitals without queues or administrative delays.

- Choice of Specialists: The freedom to consult with top-tier medical experts in any field, on your terms.

- Comprehensive Financial Protection: Robust coverage that insulates you from significant out-of-pocket costs, irrespective of treatment complexity.

Navigating Rising Medical Costs

The financial dimension of healthcare in Thailand is another critical consideration. Medical treatment costs have been escalating by approximately 8% annually, a trend that significantly outpaces general inflation and underscores the necessity of robust insurance coverage. Consequently, the Thai Life Assurance Association (TLAA) projects continued industry growth, fueled by this rising awareness. You can explore a more detailed analysis of the Thai insurance market forecast to understand these economic dynamics.

A premium health insurance plan is not an expense; it is a calculated investment. It secures certainty in an uncertain world, ensuring the highest standard of medical care is always within immediate reach, regardless of cost inflation.

Ultimately, securing the right health insurance in Thailand is about maintaining control. It empowers you to dictate the terms of your healthcare—selecting the best facilities, physicians, and treatments available—ensuring your life in the Kingdom remains as exceptional as you demand.

When selecting an insurance plan, it is crucial to weigh several factors particularly relevant for high-net-worth individuals seeking care in Thailand. These considerations transcend basic coverage, touching upon the quality of life and financial security you expect.

The following table summarizes these key factors and their specific importance.

Key Considerations for Expat Health Insurance in Thailand

| Factor | Importance for High-Net-Worth Individuals |

|---|---|

| Global Coverage & Portability | Essential for frequent international travel, ensuring seamless, high-quality care whether in Bangkok, London, or New York. |

| High Annual Limits | Critical for covering complex procedures, extended hospital stays, or catastrophic events without risk of financial exposure. |

| Direct Billing Network | Provides convenience and peace of mind by eliminating the need for upfront payments at top-tier international hospitals. |

| Choice of Medical Providers | Guarantees the freedom to choose leading specialists and facilities, rather than being restricted to a narrow network. |

| Comprehensive Outpatient Care | Vital for proactive health management, including specialist consultations, diagnostics, and wellness check-ups. |

| Medical Evacuation & Repatriation | A non-negotiable feature ensuring transport to the best possible medical facility, even if it is in another country. |

| Guaranteed Renewability | Protects your long-term health security by ensuring the insurer cannot arbitrarily cancel your coverage as you age or if you develop a chronic condition. |

Evaluating these elements ensures your chosen plan is not merely an insurance policy, but a comprehensive healthcare solution that aligns with your global lifestyle and high standards.

Navigating The Thai Healthcare Landscape

Before selecting a health insurance plan in Thailand, it is imperative to understand the operational dynamics of the medical system. It is a system characterized by two distinct tiers.

On one hand, there is a competent public system. On the other, a world-renowned private sector. Comprehending the significant disparity between these two is the first—and most critical—step in formulating a health strategy that meets your standards.

Thailand's public healthcare system is commendable, structured around a network of government hospitals and clinics. It effectively provides a safety net for its citizens, with public schemes covering over 99% of the Thai population. For context, private insurance penetration remains significantly lower. For more details on this, see Thailand's healthcare industry outlook from Intellify Global.

However, for most expatriates, particularly those accustomed to a superior standard of service, the public system presents challenges. One can expect extended waiting times, crowded facilities, and potential language barriers. While functional, it is not designed to deliver the immediate, premium, and personalized service one would expect or require.

The Private Sector Advantage

This is the arena where Thailand truly excels on the global stage. The private healthcare sector is not merely an alternative; it is a completely different ecosystem. We are referring to internationally accredited hospitals that resemble five-star hotels, staffed by elite, often Western-trained, physicians. They are equipped with the latest medical technology and are architected for a superior patient experience.

Opting for the private route provides access to a different reality:

- Immediate Access: An appointment with a top specialist can often be secured within days, sometimes even hours, bypassing the lengthy queues of the public system.

- Superior Comfort: Expect private rooms, high-quality dining options, and dedicated staff to coordinate all aspects of your care. It is an environment designed for recovery, not stress.

- Cutting-Edge Technology: Private hospitals compete to possess the best equipment, from the latest MRI machines to advanced robotic surgery systems.

The fundamental difference lies in control and quality. The private system places you in command. You select your doctor, your hospital, and your treatment schedule, ensuring your healthcare meets your standards without compromise.

A Clear Distinction in Service

To illustrate, consider the need to consult a leading cardiologist.

In the public system, one could wait weeks, or even months, for an initial consultation.

In the private system, with the appropriate health insurance Thailand plan, you could be in that specialist's office the following day at a world-class facility like Bumrungrad International or Bangkok Hospital.

This is not merely a matter of convenience; it is a matter of outcomes. Rapid access to diagnostics and specialist care can be the difference between a minor issue and a significant health event. The private system is predicated on this principle of speed and excellence, which is why a top-tier private insurance plan is not a luxury—it is an absolute necessity for any individual who refuses to compromise on their health while residing in the Kingdom.

Decoding Your Health Insurance Policy

An insurance policy is not just a document; it is the definitive rulebook for your healthcare. It is a precise, legally binding contract that dictates the exact medical care you are entitled to and how your financial interests are protected.

For individuals accustomed to making incisive, informed decisions, mastering this contract is essential. It is the only way to circumvent costly surprises and ensure your coverage performs as expected when it is most needed.

Let us dissect the most critical components of a premium health insurance policy in Thailand. This is not about abstract definitions; it is about understanding how these terms impact your finances and your real-world experience.

Core Financial Terms Explained

First, let us address the financial components. Three key terms define your out-of-pocket expenses: the deductible, co-payment, and the out-of-pocket maximum. Understanding their interplay is crucial for accurately forecasting your costs.

A deductible is the initial amount you are responsible for before your insurance company begins to contribute. Consider it your initial financial commitment. If your policy has a $1,000 deductible, you must cover the first $1,000 of approved medical expenses within the policy year.

Once the deductible is met, the co-payment or co-insurance is activated. This is a cost-sharing arrangement. A common structure is 80/20, where the insurer pays 80% of the bill, and you are responsible for the remaining 20%.

Your out-of-pocket maximum is your ultimate financial safeguard. This is the absolute ceiling on what you will pay for covered medical care in a policy year, encompassing both your deductible and all co-payments. Once this threshold is reached, the insurer assumes 100% of all approved costs, shielding you from financially crippling hospital bills.

Area Of Coverage: Local Versus Global

The area of coverage is a critical clause that establishes the geographical limits of your policy. For professionals who travel frequently, this is one of the most important details to finalize.

- Local Coverage: These plans are restricted to Thailand. They are more affordable but are only suitable if you do not travel internationally or anticipate needing medical care abroad.

- Regional Coverage: This option typically covers Thailand plus other countries in Southeast Asia or Asia more broadly, representing a sound choice for those who travel often within the region.

- Global Coverage: This is the premier standard for individuals leading an international life. It provides access to medical care virtually anywhere in the world. Be aware that some global plans exclude the USA due to its exceptionally high medical costs, offering it as a separate, premium add-on.

An error in selecting your area of coverage can be a financially disastrous mistake. A global plan offers the most flexibility and peace of mind, aligning with a lifestyle not tethered to a single country.

The Crucial Convenience Of Direct Billing

Beyond financial mechanics, certain features profoundly impact the quality of your healthcare experience. The most important of these is direct billing, a standard feature of any truly premium health insurance plan in Thailand.

Direct billing is the seamless process whereby the hospital sends the invoice for inpatient care directly to your insurer. This means you can be admitted for major surgery without providing a large deposit or settling a substantial bill upon discharge. The entire financial transaction occurs discreetly between the institutions.

Without direct billing, you are compelled to pay the hospital out-of-pocket and then navigate the often slow, bureaucratic process of filing for reimbursement. For a deeper understanding of this process, you can explore the mechanics of pre-authorization and direct settlement procedures. This convenience is non-negotiable for those who value their time and wish to avoid a cash-flow crisis during a medical emergency.

Choosing Your Ideal Coverage Plan

Selecting the right health insurance plan in Thailand is one of the most consequential decisions for your life here. This is not merely about satisfying a visa requirement; it is about constructing a safety net that is congruent with your lifestyle, health profile, and expected standard of care. The choice you make will define your access to hospitals, your financial security, and ultimately, your peace of mind.

The Thai insurance market offers a wide spectrum of options. To choose correctly, you must first grasp the core differences between the main plan types and determine how they align with your personal circumstances.

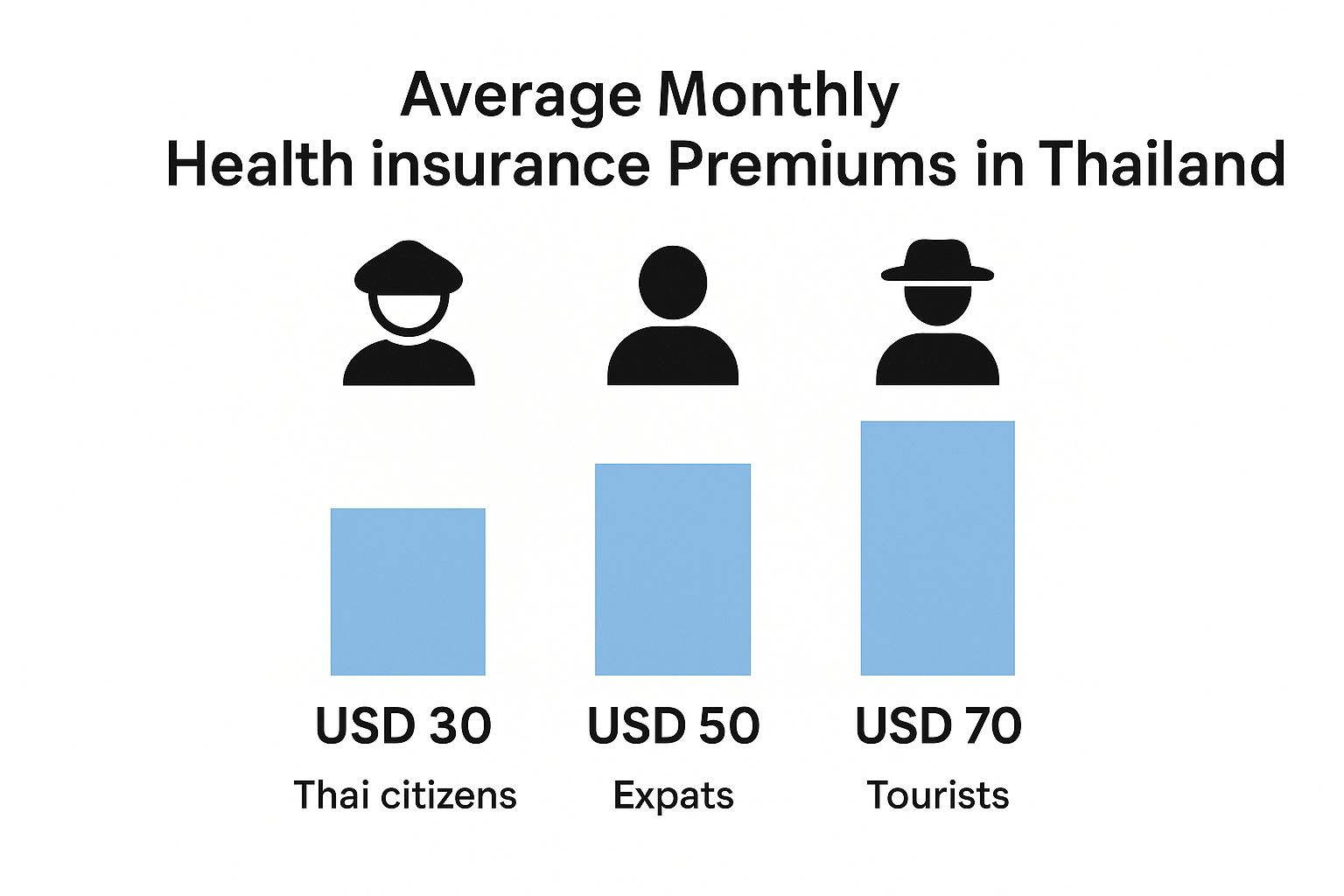

This chart provides a quick snapshot of how monthly premiums can vary. As illustrated, costs are shaped by your profile and the level of coverage you require.

It is clear that expats and tourists typically face higher premiums than Thai citizens. This reflects different plan structures, hospital networks, and risk factors that insurers incorporate into their pricing models.

Inpatient Only (IPD) Plans: The Essential Safeguard

An Inpatient (IPD) Only plan should be considered the foundational layer of protection. Its sole function is to shield you from the substantial costs associated with hospitalization, whether for a planned surgery or an unforeseen emergency. This is your catastrophic coverage—the mechanism that prevents a multi-million-baht hospital bill from derailing your finances.

These plans are well-suited for individuals who are generally healthy, seek a robust safety net for major events, and are comfortable paying for routine physician visits or prescriptions out-of-pocket.

Consider this example:

- The Healthy Professional: A 40-year-old executive in excellent physical condition who travels infrequently. Their primary concern is ensuring that a major accident or illness resulting in hospitalization is fully covered. They are willing to self-fund occasional GP visits. An IPD-only plan provides precisely that—essential protection without the higher cost of benefits they are unlikely to utilize.

IPD + OPD: The Comprehensive Solution

For those who desire more than a disaster-only safety net, a plan combining both Inpatient (IPD) and Outpatient (OPD) coverage is the logical choice. This type of policy covers the full spectrum of care, from major hospital stays to everyday medical needs.

OPD coverage typically includes:

- Consultations with your general practitioner or a specialist.

- Prescription medications and diagnostic tests such as blood work or X-rays.

- Minor procedures performed in a clinical setting.

This is the gold standard for families, individuals with ongoing health needs, or anyone who values the convenience of having all medical expenses managed. If this aligns with your requirements, you can explore our detailed guide on how to choose the right type of policy for expatriates.

To further clarify these distinctions, let's examine the common plan structures available in Thailand.

Comparison of Health Insurance Plan Tiers in Thailand

The table below outlines the typical insurance tiers available to expatriates. Understanding these structures is the first step in matching a plan to your specific needs and budget, helping you avoid paying for unnecessary coverage or, more critically, being underinsured when it matters most.

| Plan Type | Typical Coverage | Ideal For | Estimated Cost Factor |

|---|---|---|---|

| Inpatient Only (IPD) | Hospitalization, surgery, emergency room, major medical events. | Healthy individuals, budget-conscious expats needing a robust safety net. | $ |

| IPD + OPD | All inpatient benefits plus GP/specialist visits, prescriptions, diagnostics. | Families, individuals with routine medical needs, comprehensive coverage seekers. | $$ – $$$ |

| Premier Global | All IPD/OPD benefits plus dental, vision, wellness, maternity, global coverage. | Executives, families wanting top-tier care, those needing global access. | $$$$ |

Ultimately, the objective is to find the optimal balance where your coverage aligns perfectly with your life, providing robust protection without excessive expenditure.

Premier Global Plans: The Apex Of Coverage

At the pinnacle of the market are premier global plans. These are elite policies offering the most extensive health insurance Thailand provides. They integrate IPD and OPD coverage with a full suite of high-value ancillary benefits. These plans are designed for individuals who view healthcare not as a contingency, but as a key component of a well-managed global life.

A premier plan transforms insurance from a reactive safety net into a proactive wellness tool. It provides the financial backing to not only treat illness but also to actively maintain and optimize your health year-round, wherever you are in the world.

These top-tier plans almost invariably include coverage for:

- Dental and Vision: Comprehensive care including routine check-ups, major dental work, and prescription eyewear.

- Wellness and Health Screenings: Proactive benefits such as annual physicals, vaccinations, and advanced cancer screenings.

- Maternity Care: Complete coverage for prenatal consultations, delivery, and postnatal care at leading hospitals.

This level of coverage is virtually essential for an expatriate family. Consider a family of four residing in Bangkok. The children require regular dental check-ups, the parents desire annual health screenings, and they may need access to a pediatric specialist. A premier global plan consolidates all of this into one seamless policy, often with direct billing, providing total financial clarity and access to the best care without compromise. It is the definitive choice for those who refuse to place limitations on their family’s health and well-being.

Understanding The Cost Of Premium Healthcare

Evaluating the cost of premium health insurance in Thailand requires a strategic mindset. It is not merely an expense; it is a calculated investment in your health and financial stability, particularly when residing in one of Asia’s premier medical hubs.

The premium you pay is a direct reflection of the certainty and quality of care you are securing. Insurers assess several specific factors to construct a risk profile, meaning no two individuals will pay the exact same price. Once you understand the drivers of these costs, the figures become logical.

Key Factors Influencing Your Premium

The cost of your policy is determined by several core pillars. These are standard across the industry, but each insurer assigns different weights to them.

- Age: This is the most significant factor. As age increases, the statistical probability of needing medical care rises, and premiums adjust accordingly.

- Scope of Coverage: A basic plan covering only hospitalization will be significantly less expensive than a comprehensive global policy that includes outpatient care, dental, and wellness benefits.

- Area of Coverage: A policy restricted to Thailand will naturally cost less than one providing coverage across Asia or worldwide. The most expensive plans are those that include the USA, due to its exceptionally high healthcare costs.

- Deductibles and Co-payments: You can opt for a higher deductible—the amount you pay out-of-pocket before insurance activates. This is a strategic trade-off: a higher deductible lowers your annual premium, but requires you to cover more of the initial costs if you need care.

Illustrative Cost Scenarios

To put this into perspective, a single executive in their late 30s seeking a robust inpatient-only plan will face a very different premium than a family of four requiring comprehensive global coverage, including maternity and dental benefits.

Lifestyle choices also play a role. Insurers will inquire about factors such as smoking, which is directly linked to higher health risks and, consequently, a higher premium. If you have pre-existing conditions, they will be assessed and may result in an increased premium or specific exclusions. Absolute transparency on your application is critical.

The premium is the price you pay for absolute peace of mind. It ensures that should a medical event occur, your only concern is recovery, not navigating costs or questioning the quality of care available to you.

This investment is also made against the backdrop of medical inflation. For a better grasp of this, our article explaining why health insurance premiums increase year after year provides valuable context on these economic drivers.

The market for health insurance Thailand is not static; it is a dynamic and growing sector. Projections indicate the market value will expand from approximately $2.58 billion USD in 2023 to a forecasted $4.92 billion USD by 2030. This growth reflects a broader recognition that private coverage is essential as healthcare costs rise. You can discover more insights about the Thai health insurance market's growth trajectory. For you, this growth translates to a more competitive landscape and a wider selection of sophisticated insurance products.

The Strategic Value Of An Insurance Broker

For sophisticated expatriates, time and expert counsel are your most valuable resources. While approaching an insurance company directly is an option, partnering with a top-tier, independent insurance broker provides a significant strategic advantage when seeking premium health insurance Thailand coverage.

A specialist broker does not simply sell a policy. They provide high-level consultation, enabling you to cut through the complexity of the market, and act as your dedicated advocate. This is not a transactional event; it is a long-term professional relationship designed to ensure your healthcare protection remains perfectly aligned with your life in Thailand.

Beyond Comparison Shopping

Engaging an expert broker immediately provides access to a broader, more carefully curated selection of plans than you could discover independently. Brokers cultivate deep relationships with a vast number of insurers, including niche providers offering specialized policies not available on public comparison platforms. This access is crucial for identifying a plan that genuinely fits your specific requirements, not one that is merely adequate.

However, their true value is most apparent in the tailoring of the policy itself. An experienced broker can:

- Negotiate Favorable Terms: They leverage their industry influence and expertise to advocate for better terms on your behalf, particularly concerning the coverage of pre-existing conditions.

- Clarify Policy Language: They translate dense, ambiguous policy jargon into clear, concise terms, ensuring you understand precisely what is covered—and what is not.

- Optimize Value: They assist in structuring your plan to maximize its utility, finding the optimal balance between your premium, deductible, and overall coverage limits.

A Powerful Advocate When It Matters Most

Perhaps the most compelling reason to retain a broker becomes evident only when you need to utilize your insurance. During a medical emergency or a complex claim, your broker serves as your personal champion, managing the entire process so you can focus on your recovery.

A broker works for you, not the insurance company. Their mandate is to ensure the insurer honors its contractual obligations—promptly and fully—thereby relieving you of a significant burden during an already stressful time.

This advocacy is invaluable. They manage the administrative workload, liaise between the hospital and the insurer, and resolve any disputes over coverage. This level of "white-glove" service transforms your insurance from a static document into a responsive, real-world support system.

Ultimately, a premier broker delivers clarity, control, and confidence—the three pillars of a secure and well-managed life abroad.

Frequently Asked Questions

When arranging health insurance in Thailand, several common questions inevitably arise. Let us address them directly to provide you with complete clarity as you finalize your healthcare strategy.

Is My International Health Insurance Plan Valid In Thailand?

In most cases, yes. Thailand's leading private hospitals are highly experienced in collaborating with premium international health insurance providers. However, simple acceptance does not tell the whole story.

Two details are absolutely critical for the seamless experience you expect.

First, you must meticulously review your policy documents to confirm that Thailand is explicitly included in your 'area of coverage.' Second, and equally vital, you must verify that your insurer has direct billing agreements with the specific Thai hospitals you intend to use.

Direct billing is the gold standard for high-quality insurance. It signifies that the hospital will invoice your insurer directly, removing you from the financial transaction. This prevents you from having to outlay substantial funds for a major medical event and then pursue reimbursement.

Without direct billing, you would be required to settle the entire hospital bill personally and then navigate the administrative process of claiming your money back, which can be a significant inconvenience and strain on your cash flow.

How Are Pre-Existing Conditions Handled?

This is a nuanced area. The handling of a health condition that existed prior to your application is a matter of careful negotiation. In Thailand, insurers will typically adopt one of three approaches:

- Premium Loading: They will agree to cover the condition but will charge a higher premium for the policy.

- Exclusion: They will issue the policy but will permanently exclude any claims related to that specific pre-existing condition.

- Waiting Period: They may impose a moratorium, typically for 12-24 months. If you remain free of symptoms and do not seek treatment for the condition during this period, they may agree to extend coverage to it thereafter.

Failing to be completely transparent about your medical history on your application is a grave error. If an insurer discovers an undisclosed pre-existing condition, they have the right to void your entire policy, leaving you completely without coverage at the moment you need it most. This is an area where a proficient broker proves their value, negotiating with insurers to secure the most favorable terms possible for your specific health profile.

What Documents Are Needed To Apply For Insurance?

The application process is designed to be thorough. Having your documentation in order from the outset will streamline the process considerably. While specific requirements may vary slightly between insurers, a standard set of documents will be necessary.

- A clear, high-quality copy of your passport's main information page.

- The fully completed application form, which includes a detailed medical history questionnaire.

- Proof of your visa or residency status in Thailand.

If you are applying for a plan with very high coverage limits or are over a certain age, you should anticipate a request for a medical examination. The insurer will provide a list of their approved local clinics for this purpose. The key to a swift and successful application is ensuring all information provided is accurate and complete from the very beginning.

For a truly personalized approach to securing premier health insurance in Thailand, the expertise of a specialist broker is indispensable. Riviera Expat offers bespoke consultation to help you navigate the market with clarity and confidence. Contact us today for a complimentary, in-depth review of your healthcare needs.