Navigating the lexicon of health insurance is the foundational step toward securing your financial portfolio and healthcare strategy. At its core, an insurance policy is a contract: you remit a fee, and the insurer assumes a calculated portion of your risk. This guide is designed to dissect the jargon, illuminating the core tenets that govern your coverage.

Decoding Your Private Medical Insurance Policy

Deciphering the complexities of international private medical insurance can feel akin to learning a new language. This guide provides clarity and, more importantly, empowers you to make astute decisions regarding your health and financial future. Mastering your policy's terms is not a mere administrative task; it is an essential component of managing your life and ensuring you are adequately protected, regardless of your global location.

To begin, one must have a solid grasp of the fundamentals, including how various understanding insurance policies are structured. The inherent complexity of these documents often leads to cursory review, yet within the fine print lies the entire framework for your access to medical care and your shield against significant financial exposure.

The Growing Importance of Clarity

The global health insurance market is expanding, underscoring its pivotal role in personal financial planning. It was valued at USD 2.8 trillion in 2023 and is projected to reach approximately USD 5.9 trillion by 2032.

This represents a compound annual growth rate (CAGR) of 8.6%, indicating a clear global trend toward securing private medical coverage.

This substantial growth makes it more vital than ever to discern the nuances between plans and select coverage that truly aligns with an international lifestyle. We will deconstruct the essential terminology, beginning with the fundamental financial concepts and progressing to the practical details of accessing care across the globe.

Mastering this vocabulary is a direct investment in your health and financial future. It ensures the plan you choose is a precise and powerful tool in your personal toolkit.

We will provide the knowledge you need to select and manage a health plan that fits your life perfectly. For those who wish to explore further, our guide on essential terms for expatriate health insurance policies offers more context at https://www.riviera-expat.com/assurance-sante-pour-expatries-explication-des-termes-de-la-police/. Ultimately, this foundational knowledge is what allows you to take complete control of your healthcare decisions.

Mastering the Financial Architecture of Your Plan

To truly command your international private medical insurance, you must understand its financial architecture. These core financial terms are the levers that control your out-of-pocket costs and the intrinsic value of your policy. Comprehending their interplay is the key to structuring a plan that aligns with both your budget and your risk tolerance.

Your policy’s financial terms are interconnected. Adjusting one component—such as your deductible—will invariably affect another, like your premium. As you become conversant with the financial mechanics of your health plan, you must be familiar with terms like deductibles, copayments, and the crucial insurance policy limits that define the ceiling of your coverage.

The Foundation of Your Financial Commitment

The most visible component is the premium. This is the non-negotiable, regular payment you make to the insurer to maintain your policy's active status. It is your recurring fee for financial protection, a predictable expense to be budgeted for monthly or annually.

However, the premium is merely the entry point. A conspicuously low premium often signifies that you are assuming more financial risk through other mechanisms. This is where a sophisticated understanding of your insurance becomes invaluable—it allows you to perceive the complete financial landscape, not just the initial cost.

This trade-off is most evident in the relationship between the premium and the deductible. Your deductible is the specific amount you must pay out-of-pocket for covered medical services before your insurance company begins its financial contribution. For instance, in the U.S., the average deductible for an individual on an ACA marketplace plan was $5,309 in 2024. This highlights a common strategy: accepting a higher deductible to secure a lower premium, effectively balancing the risk allocation between you and the insurer.

Understanding Your Cost-Sharing Responsibilities

Once you have satisfied your annual deductible, your financial obligations shift. This is where two other key terms—copayment and coinsurance—come into play.

A copayment (or copay) is a straightforward, fixed fee you pay for a specific service. It is a flat rate for a physician's consultation or a prescription.

For example, your plan may stipulate a $50 copay for a specialist visit. Whether the total invoice for that visit is $200 or $500, your contribution is fixed at $50. It is predictable and paid at the point of service, which simplifies budgeting for routine care.

A policy is a financial instrument designed to manage risk. Your ability to adjust its components—premium, deductible, copayments, and coinsurance—is your primary means of aligning that instrument with your personal financial objectives.

Coinsurance, conversely, is based on percentages. After your deductible has been met, you and your insurer share the cost of subsequent medical bills based on a predetermined ratio, such as 80/20.

In an 80/20 coinsurance arrangement, the insurance company covers 80% of the cost, and you are responsible for the remaining 20%. This percentage becomes critically important during major medical events, where your 20% share could represent a very significant sum.

The Strategic Interplay of Financial Terms

The art of selecting the right policy lies in understanding how these components function in concert. By strategically balancing these four core financial terms, you can design coverage that is both comprehensive and economically sound for your specific circumstances.

To visualize this, here is a summary of the core financial components of a health insurance plan and their relation to your costs.

Core Financial Terms at a Glance

| Term | What It Is | When You Pay It | Analogy |

|---|---|---|---|

| Premium | The fixed amount you pay regularly (monthly or annually) to keep your insurance policy active. | Regularly (e.g., monthly), whether you use medical services or not. | A retainer for your financial safety net. |

| Deductible | The amount you must pay out-of-pocket for covered services before your insurance starts to pay. | When you receive medical care, until the annual deductible amount is met. | Your initial capital contribution to medical costs for the year. |

| Copayment | A fixed fee you pay for a specific service, like a doctor's visit or a prescription. | At the time of a specific service, after your deductible has been met (in some plans). | A per-use service fee. |

| Coinsurance | The percentage of costs you share with your insurer after you've paid your deductible. | After your deductible is met, for each covered service, until you hit your out-of-pocket maximum. | A cost-sharing partnership with your insurer. |

This table illustrates how each term represents a different method of contributing to your healthcare costs, from the regular premium to the cost-sharing that activates when you utilize your insurance.

Here is how they typically interact in practice:

- Higher Premium: This usually secures a lower deductible, smaller copayments, and a more favorable coinsurance split (e.g., 90/10). It is designed to minimize your out-of-pocket expenses for each instance of care.

- Lower Premium: This almost always corresponds with a higher deductible and greater cost-sharing responsibilities (higher copays or a less advantageous coinsurance ratio). It is a cost-effective choice if you are in excellent health and do not anticipate requiring significant medical care.

This interplay allows for extensive personalization. An individual with a higher risk tolerance and sufficient liquid assets might opt for a high-deductible plan to reduce fixed premium costs. Conversely, a person who values maximum predictability will likely select a higher-premium plan to limit exposure to large, unexpected medical invoices.

Ultimately, mastering this financial architecture empowers you to construct a precise and resilient financial shield for your health.

Navigating Your Access to Medical Care

Understanding the financial mechanics of your health plan—the deductibles and copays—is only one part of the equation. True mastery comes from comprehending the rules that dictate how and where you can access medical care. This is particularly salient when residing abroad, where a simple misunderstanding can result in a denied claim and a substantial personal liability.

Consider your policy as having an operational rulebook. It specifies which physicians you can consult, which hospitals are approved, and which procedures require prior consent from the insurer. Grasping these logistical terms transforms your policy from a simple safety net into a potent tool for managing your health anywhere in the world.

The Importance of the Provider Network

One of the first concepts to internalize is the provider network. This is the curated list of physicians, hospitals, and clinics with which your insurance company has a contractual agreement, including pre-negotiated, preferential rates. Adhering to this network is the most effective way to manage your costs.

When you consult a physician or utilize a hospital from this list, they are considered in-network. Due to the pre-negotiated rates, your insurer covers a significantly larger portion of the invoice once your deductible is met.

Conversely, if you consult a physician who is not on that list, they are out-of-network. This action will almost certainly result in higher out-of-pocket expenses. Your insurer will cover a much smaller percentage of the bill, and some plans will provide no reimbursement at all. The financial difference is not trivial; it can be the distinction between a manageable expense and a financially debilitating one.

Procedural Gateways: Pre-authorization and Referrals

Beyond selecting the right physician, certain treatments and specialist consultations involve administrative protocols. These are not intended as obstacles but as checkpoints to ensure the care you receive is medically necessary and appropriate for your condition.

A referral is essentially an authorization from your primary doctor—your primary care physician (PCP)—to consult a specialist. Many insurance plans mandate this to ensure your care is coordinated and clinically appropriate.

Pre-authorization is a more formal process. Also known as prior approval, this is where your insurer must formally agree that a specific service, treatment, or high-cost medical equipment is medically necessary before you receive it. This is a critical checkpoint for major surgeries, advanced diagnostic imaging, and expensive pharmaceuticals.

The significance of this step cannot be overstated. It confirms that your insurance will cover the expense before you become financially liable. Neglecting this requirement is a primary reason for claim denials, leaving you responsible for the entire bill.

Defining Your Scope of Coverage

Finally, we address the most fundamental question: what does your plan actually cover? The answer lies in two opposing but equally critical sections of your policy documents.

Covered services are the specific treatments and medical benefits your plan agrees to finance, provided you have adhered to all other rules (such as using the network and obtaining pre-authorization).

Conversely, exclusions are the items your policy will not cover under any circumstances. Common examples include elective cosmetic surgery or experimental treatments not yet validated by clinical evidence.

A meticulous review of these two sections is imperative. It is the only way to understand the true boundaries of your financial protection. When consulting with specialists, this knowledge is power. For instance, knowing the right questions to ask your cardiologist enables you to discuss treatment options within the context of what your policy will and will not cover.

By gaining a firm command of these logistical terms—networks, referrals, pre-authorizations, and your specific scope of coverage—you can confidently and effectively utilize your health plan, no matter your global location.

Comparing Major Health Plan Structures

Selecting the appropriate private medical insurance extends far beyond a simple price comparison. One must examine the very architecture of the plan. How a plan is structured dictates everything—which providers you can see, the process for accessing them, and the administrative burden involved. It is the difference between complete autonomy and a more managed, cost-controlled framework.

At their core, different plan structures represent a trade-off between provider choice and cost. Some are engineered to contain costs through a curated network of physicians, while others offer the flexibility to consult nearly any provider, anywhere in the world, at a premium price.

The Health Maintenance Organization (HMO) Model

A Health Maintenance Organization (HMO) is predicated on integrated, network-based care. The defining principle of an HMO is straightforward: you must utilize doctors, hospitals, and specialists within its network to receive coverage. If you seek care outside of it, you are typically responsible for the entire bill.

Think of it as a private club. Your premium is the membership fee, granting you access to the club's services and facilities (the provider network) at a predictable cost. Should you choose to visit a different club, you bear the cost yourself.

Another key component of the HMO model is the Primary Care Physician (PCP). This is your designated main doctor, who functions as a "gatekeeper" to the rest of the network. To see a specialist, you generally require a referral from your PCP. This system is designed to coordinate care and manage costs, which often results in lower premiums for you.

The HMO model is a significant force in the global health insurance market. The HMO segment holds a dominant market share, particularly in North America, due to its value-based approach that emphasizes network-based care and preventative services, which typically translates to lower premiums and deductibles. You can discover more insights about the health insurance market at Fortune Business Insights.

The Preferred Provider Organization (PPO) Model

At the other end of the spectrum is the Preferred Provider Organization (PPO), which offers considerably more freedom. Like an HMO, a PPO has a network of "preferred" providers with whom it has negotiated discounted rates. The crucial difference is that a PPO will still contribute to the cost of care you receive outside that network.

This model is far less restrictive. You are not required to select a PCP, and you can consult a specialist at your discretion without a referral. This level of autonomy is a major advantage for individuals who wish to direct their own healthcare, consult specific world-renowned experts, or require reliable care while traveling.

Naturally, this freedom is priced accordingly. Your out-of-pocket costs will always be lowest when you stay within the PPO’s network. If you go out-of-network, the plan still pays a portion, but you will face a higher coinsurance percentage and a separate, often much larger, deductible.

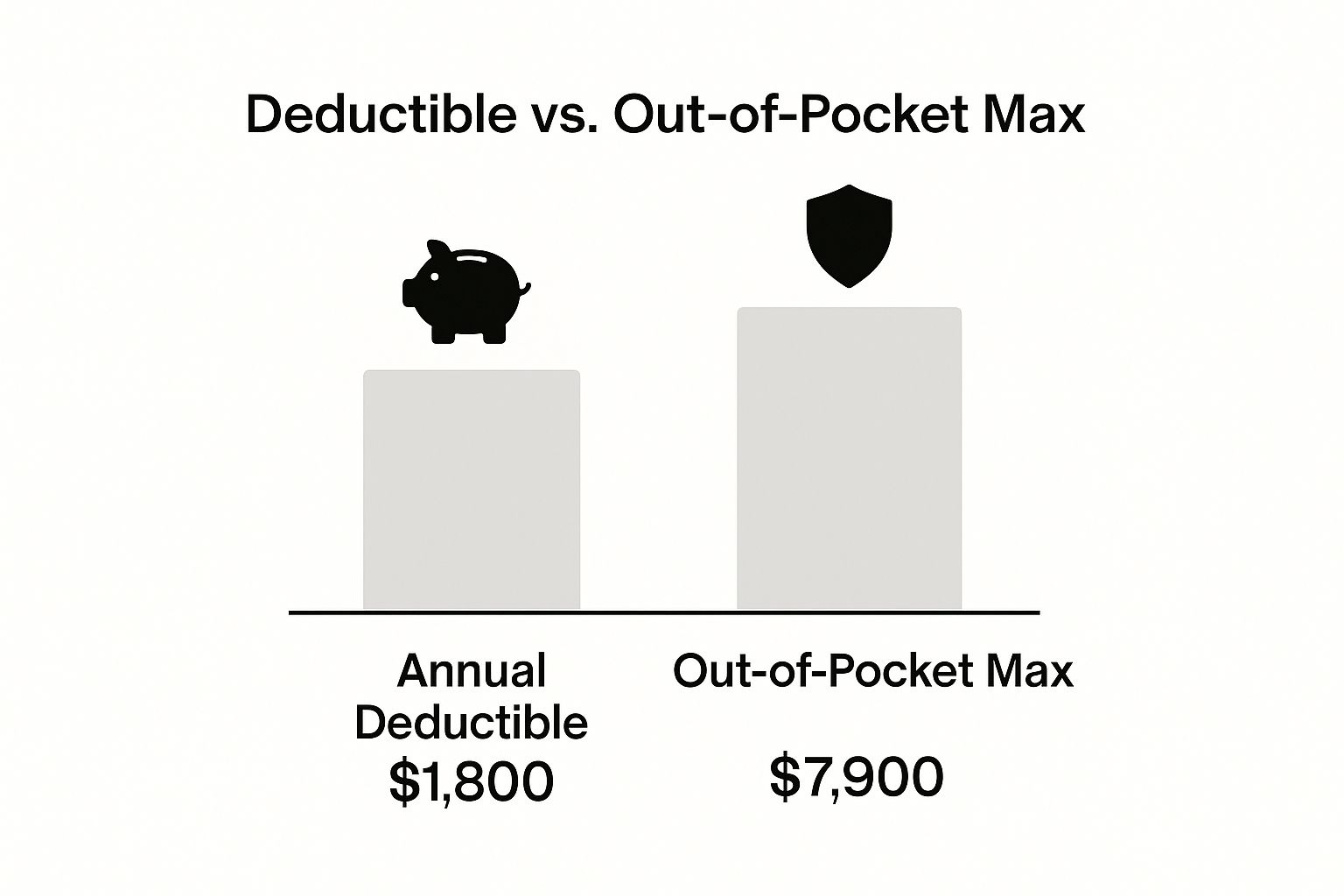

This image illustrates two of the most important cost concepts you will encounter, regardless of plan type.

It clearly shows the difference between the initial financial threshold you must meet (your Annual Deductible) and the ultimate financial safeguard (your Out-of-Pocket Maximum)—both of which function very differently in HMOs versus PPOs.

The Point of Service (POS) Plan: A Hybrid Approach

For those who desire a blend of features, the Point of Service (POS) plan exists. It attempts to merge the cost-containment structure of an HMO with the flexibility of a PPO.

It operates like an HMO in that you will typically need to select a PCP from the network and obtain referrals for specialist care. However, it borrows from the PPO model by permitting you to seek care out-of-network. As with a PPO, choosing to do so will result in higher out-of-pocket costs. It is a compromise: you receive the coordinated care and lower costs of an HMO but retain the option to go outside the network when necessary. Your choice at the "point of service" determines your costs.

To clarify these options, a side-by-side comparison is useful.

Comparison of Major Health Plan Types

| Feature | HMO (Health Maintenance Organization) | PPO (Preferred Provider Organization) | POS (Point of Service) |

|---|---|---|---|

| Provider Choice | Limited to in-network providers only. | High flexibility; you can see both in-network and out-of-network providers. | A hybrid model; you can go out-of-network, but at a higher cost. |

| Referrals | Required. You must get a referral from your PCP to see a specialist. | Not required. You can self-refer to any specialist. | Required. You typically need a referral from your PCP for specialist care. |

| Out-of-Network Coverage | None. Except for true emergencies, there is no coverage out-of-network. | Yes. Covered, but at a higher cost-sharing rate (higher deductible and coinsurance). | Yes. Covered, but with higher out-of-pocket costs compared to in-network care. |

| Primary Care Physician (PCP) | Required. You must select a PCP to coordinate your care. | Not required. You are not required to have a designated PCP. | Required. You must choose a PCP from the plan's network. |

| Cost | Generally lower premiums and out-of-pocket costs. | Generally higher premiums in exchange for more flexibility. | A middle-ground cost structure between HMOs and PPOs. |

Ultimately, the optimal plan type depends entirely on your priorities. If your primary objective is cost containment and you are comfortable with a structured approach to care, an HMO is a strong contender. However, if you value autonomy, require direct access to specialists, and are willing to pay a premium for it, a PPO is likely a more suitable fit. The POS plan occupies the middle ground, offering a practical compromise for those who desire elements of both.

Advanced Terms for Global Health Coverage

When your personal and professional life transcends borders, a standard domestic health plan is inadequate. It is simply not designed for the complexities of global healthcare. International private medical insurance employs its own lexicon, one that must account for geography, emergency logistics, and the critical process of managing pre-existing conditions.

Mastering these terms is not merely an academic exercise—it is fundamental to safeguarding your health and finances, regardless of your location. These concepts form the bedrock of any robust global health strategy. They define the boundaries of your policy map, dictate the handling of your medical history, and establish the emergency protocols that can be life-saving. For any global citizen, fluency in this vocabulary is non-negotiable.

Defining Your Geographical Reach

The first, and arguably most critical, term to establish in any international plan is the Area of Coverage. This is not a guideline; it is a firm boundary that defines the geographical regions where your policy is valid. Seeking treatment outside this area will almost certainly result in a denied claim.

Consider it the jurisdiction of your financial protection. While some plans offer truly global access, many policies include a crucial distinction with significant financial implications.

The two most common variations are:

- Worldwide: This is the premier option, providing coverage in every country. It is the definitive choice for individuals who travel or reside anywhere without restriction.

- Worldwide Excluding the USA: This is a popular and far more cost-effective alternative. It provides comprehensive global coverage but carves out the United States. This is due to the exceptionally high cost of healthcare in the U.S., which can dramatically inflate premiums.

Selecting the right area of coverage is a strategic decision. If your life and travels do not include the United States, a "Worldwide Excluding the USA" policy can yield substantial savings on premiums without compromising the quality of your protection elsewhere.

Underwriting Your Health History

How an insurer assesses your past and present health is a pivotal moment in securing coverage. This process, known as underwriting, directly determines whether your pre-existing conditions will be covered. There are two primary approaches, each with profoundly different outcomes for you.

Moratorium underwriting is the expedited approach. You are not required to disclose your complete medical history at the outset. Instead, the insurer imposes a waiting period, typically 24 months. During this period, any condition you had prior to the policy's inception (or anything related to it) is not covered. If you remain free of symptoms, treatment, or advice for that condition for the entire period, it may become eligible for coverage thereafter.

This method is swift and simple at inception, but it involves a trade-off. You exchange upfront simplicity for long-term uncertainty. The final decision on covering a pre-existing condition is deferred until a claim is filed, which can be a considerable risk.

Full Medical Underwriting (FMU) is the antithesis. It is a detailed, transparent process where you disclose your entire medical history on the application form. The insurer’s medical team then reviews this information and provides a clear decision upfront. They may accept your conditions for full coverage, apply a premium surcharge (a "loading") to cover the additional risk, or place a permanent exclusion on a specific condition.

While it requires more effort initially, FMU provides absolute certainty. You know precisely what is and is not covered from the moment the policy begins. There are no surprises when you can least afford them. For any individual who values clarity and predictability, FMU is almost always the superior path.

Emergency Protocols and Financial Ceilings

For anyone living or working internationally, a robust emergency plan is essential. Medical Evacuation is the benefit that covers the cost of transporting you from a location with inadequate medical facilities to the nearest hospital capable of providing appropriate treatment. This is a critical lifeline if you are in a remote or less-developed region.

Repatriation is often paired with evacuation and covers the cost of returning you to your home country for further treatment or recovery once you are stable. Together, these benefits create a logistical and financial safety net that is indispensable in a crisis.

Finally, you must be aware of your policy's financial limits. The Annual Limit is the maximum amount the insurer will pay for all your claims within a single policy year. Similarly, the Lifetime Maximum is the total amount the insurer will pay out over the entire duration of the policy. While many premium international plans now offer unlimited benefits, it is crucial to verify these figures. You must be confident they are high enough to cover a catastrophic medical event without exposing your personal assets to risk.

How to Select the Right Health Plan

You have now acquired the necessary vocabulary, distinguishing your deductible from your coinsurance. The next step is to apply this knowledge effectively.

Choosing the right international health plan is not an exercise in reciting definitions. It is about leveraging your understanding to make a sophisticated, strategic decision that is perfectly aligned with your life. This is the process of tailoring a critical component of your financial safety net to match your unique global footprint.

The initial step is a thorough self-assessment. Your areas of residence and travel, as well as your profession, will shape the type of coverage you require. You must determine your absolute priorities. Is it minimizing monthly premiums? Securing the highest possible benefit limits for complete peace of mind? Or is it the freedom to consult any physician, anywhere in the world?

Gaining clarity on your non-negotiables transforms a complex choice into a confident decision.

A Strategic Checklist for Evaluation

When engaging with a broker or insurer, approach the process as you would any other major investment. It is imperative to ask precise, incisive questions that leave no room for ambiguity. This is the time for due diligence.

Here are the critical questions to pose to any potential provider:

- Network Access: In the countries I frequent most, what is the true extent of your direct billing network? If I must pay for care out-of-network, what is the exact, step-by-step process for reimbursement?

- Emergency Protocols: Detail the precise procedure for a medical evacuation. What are the specific steps? What is your typical response time, and what is your global reach in a genuine crisis?

- Underwriting Clarity: If I undergo Full Medical Underwriting, will you provide a definitive, written list of any exclusions or premium surcharges before I commit to the policy?

- Cost vs. Flexibility: Let's discuss specific figures. What is the precise premium differential between a PPO and an HMO plan? And can you illustrate exactly how my premium changes if I add or remove coverage in the USA?

Insisting on this level of detail transforms a dense policy document into a clear value proposition. Your objective is to secure a plan that you know will perform exactly as expected when you need it most.

For a deeper analysis of choosing the right policy structure, our guide on selecting the right expat medical insurance policy type can help you weigh the advantages and disadvantages. Making the correct choice is the final step in truly taking control of your health and financial security abroad.

Got Questions? We’ve Got Answers.

Even after mastering the fundamentals, a few nuanced terms often arise. Let's address some of the most common questions individuals have when finalizing their international health coverage. Clarifying these details is key to ensuring you are not caught off guard by unexpected expenses.

What's The Real Difference Between Coinsurance and a Copayment?

These terms are frequently confused, but they function very differently at the point of payment. They represent two distinct methods of cost-sharing with your insurer after your deductible has been met.

A copayment is simple and predictable. It’s a flat fee for a specific service, such as the $50 you might pay for a specialist consultation. It is irrelevant whether the total invoice is $200 or $500; your portion remains fixed at $50.

Coinsurance, in contrast, is a percentage. If your plan has an 80/20 coinsurance structure, this means that after your deductible is satisfied, your insurance company pays 80% of the medical bill, and you are responsible for the remaining 20%. That 20% will be a modest sum for a minor procedure but can become a significant figure for major surgery.

It all comes down to predictability. A copayment provides a fixed, known cost for routine care, which simplifies financial planning. Coinsurance is variable and directly correlated with the cost of larger, more complex medical treatments.

Can an Insurer Actually Refuse to Cover My Pre-Existing Condition?

The short answer is yes, they can—but it is highly dependent on the type of plan and its regulatory jurisdiction. In the United States, for example, plans governed by the Affordable Care Act (ACA) are legally prohibited from denying coverage or charging higher premiums due to a pre-existing health condition.

However, the international private medical insurance market operates under a different set of regulations. The vast majority of these plans are not subject to ACA rules.

With Full Medical Underwriting, the insurer conducts a thorough review of your health history. Based on their findings, they can legally place an exclusion on a specific pre-existing condition, decline to cover it entirely, or charge a higher premium to account for the increased risk.

Another common method is Moratorium underwriting. In this scenario, the insurer automatically excludes any condition you have had in the recent past (typically 24 months). The advantage is that if you remain symptom- and treatment-free for that condition for a set period, the plan may begin to cover it in the future.

At Riviera Expat, our singular focus is on eliminating this kind of confusion. We provide the expert, direct guidance you require to make sense of these complexities, ensuring your health plan is a perfect fit for your life abroad. Secure your confidential consultation today and gain the clarity you deserve.