Embracing a location-independent lifestyle offers unparalleled professional freedom. This autonomy, however, is accompanied by a critical responsibility: safeguarding your health and assets, regardless of your global position.

For discerning digital nomads, standard travel insurance is insufficient. What your lifestyle demands is comprehensive international health insurance—a strategic investment that guarantees access to premier medical care, anywhere your endeavors take you.

Securing Your Global Lifestyle With Premier Health Insurance

For the modern global professional, freedom and security are intrinsically linked. Your capacity to operate from any corner of the map is contingent upon a safety net that mirrors your ambitions. In this context, dedicated health insurance for digital nomads becomes a cornerstone of your global strategy, not merely a budgetary line item.

A common—and potentially costly—misconception is to confuse this with travel insurance.

Consider travel insurance as a temporary solution for trip-related incidents. It is designed for a short vacation, covering eventualities such as lost luggage, a cancelled flight, or a minor, acute illness. It was never intended for an individual living and working abroad for extended periods.

International Private Medical Insurance (IPMI), conversely, is engineered for long-term, comprehensive health management, irrespective of location. It represents the difference between a temporary patch and a full medical contingency plan. It affords the peace of mind that comes from knowing you are covered for a spectrum of needs, from routine check-ups and preventative care to major medical emergencies.

Many nomads mistakenly believe a basic travel policy is adequate, only to discover its extensive exclusions and limitations when assistance is required. To make a judicious choice, it is vital to understand the fundamental distinctions between these two types of plans.

Here is a precise breakdown:

| Feature | Typical Travel Insurance | International Health Insurance (IPMI) |

|---|---|---|

| Primary Purpose | Short-term travel contingencies (e.g., lost baggage, trip interruption) | Comprehensive medical care for long-term residents abroad |

| Duration | Days or weeks (per trip) | Annually renewable (long-term) |

| Medical Coverage | Emergency accidents and sudden illness only | Emergencies, routine care, chronic conditions, specialist consultations |

| Geographic Scope | Limited to specific trip destinations | Broad, often worldwide coverage (with or without USA) |

| Renewability | Must be repurchased for each trip | Typically guaranteed renewable, protecting against changes in health status |

| Routine Care | Almost never covers check-ups, dental, or wellness | Often includes options for outpatient, dental, and vision care |

| Pre-existing Conditions | Usually excluded | May be covered, subject to medical underwriting and specific terms |

| Cost Structure | Low (per-trip premium) | Higher (annual premium reflecting comprehensive coverage) |

As delineated, travel insurance is for tourists. International health insurance is for professionals building a life abroad. Selecting the appropriate coverage is one of the most significant financial decisions you will make as a digital nomad.

The Growing Market for Nomad Health Solutions

The demand for this specialized coverage is no longer a niche concern; it is a direct reflection of a significant shift in professional lifestyles.

The global market for health insurance tailored to expatriates and digital nomads is substantial and expanding. Market analyses project this sector’s value to reach several billion dollars, with a compound annual growth rate (CAGR) often cited between 5% and 10%. This data underscores a powerful trend toward long-term, location-independent work.

This growth signifies that insurers are increasingly attuned to the sophisticated needs of mobile professionals. The result is a greater availability of refined, high-quality products, affirming that an investment in a dedicated plan is a prudent decision aligned with a global professional trajectory.

Of course, a secure global lifestyle extends beyond health coverage. It involves mastering the art of balancing professional objectives with travel. For further insights on this, you can learn more about blending remote work with travel.

Why This Distinction Matters

The implications of choosing incorrectly are profound. For high-net-worth individuals, inadequate insurance can have devastating financial and personal consequences.

A robust IPMI plan ensures your focus remains where it belongs: on your professional and personal pursuits, secure in the knowledge that your health is protected by a plan designed for the realities of a global career.

Understanding International Private Medical Insurance

For any successful professional operating across borders, mistaking simple travel insurance for a comprehensive health plan is a fundamental error. The definitive solution for this lifestyle is International Private Medical Insurance (IPMI). It is specifically designed to provide the high-level, long-term health security that a truly global life demands.

Conceptualize IPMI as your worldwide ‘all-access pass’ to premier healthcare. In sharp contrast, standard travel insurance is akin to a ‘single-entry ticket,’ valid only for short-term emergencies. IPMI is engineered for continuity of care, ensuring you have access to the best medical facilities and specialists wherever you are, not just when an accident occurs. This is the gold standard of health insurance for digital nomads who require coverage they can depend upon.

Core Components of a Premier IPMI Plan

Unlike basic policies, a proper IPMI plan is structured around a core of comprehensive benefits designed for your long-term well-being. This architecture allows for significant personalization, ensuring your investment aligns precisely with your lifestyle and health requirements. Understanding these components is the first step toward building a plan that delivers genuine peace of mind.

Key structural elements of an IPMI plan include:

- Area of Coverage: This defines the geographic regions where your policy is valid. The most common options are “Worldwide” and “Worldwide excluding the USA.” The latter is often a more cost-effective choice for professionals who do not spend significant time in the United States, given its uniquely high healthcare costs.

- Deductible: This is the initial amount you agree to pay out-of-pocket for medical care before the insurance provider begins to cover costs. Electing a higher deductible can substantially lower your annual premium—a strategic choice if you are comfortable self-insuring for minor expenses but require absolute protection for major medical events.

- Co-payment/Co-insurance: This is a fixed fee or a percentage of the cost you pay for a specific service, such as a specialist consultation or a prescription, after your deductible has been met. It is a cost-sharing feature that helps maintain manageable overall premiums.

These features work in concert to create a flexible framework. For example, a professional based in Singapore who travels extensively through Asia and Europe might select a “Worldwide excluding USA” plan with a moderate deductible. This strikes an optimal balance between global access and premium efficiency.

For discerning individuals, the objective is not merely coverage; it is control. A well-designed IPMI plan grants you control over where, when, and how you receive medical care, ensuring your standards for quality are met irrespective of your location.

Beyond Emergencies: The Scope of True Health Security

The intrinsic value of IPMI becomes evident when you look beyond emergency care. While travel insurance is limited to addressing sudden, unforeseen events, an IPMI policy is designed to manage your overall health proactively.

This means it covers a much broader spectrum of medical services. Premium plans provide robust coverage for both inpatient (services requiring hospital admission) and outpatient (clinic visits, diagnostics) care. This includes access to specialist consultations, advanced diagnostic imaging, and routine health screenings—services essential for long-term health but almost universally excluded from travel policies.

Furthermore, IPMI plans are structured for continuity. They are annually renewable, meaning your coverage persists year after year, protecting you even if your health status changes. This is a critical distinction, providing a level of security that temporary policies cannot match. For a deeper examination of how these policies are structured for expatriates and global professionals, you can explore the fundamentals of international private medical insurance. This continuity ensures your health strategy remains as mobile and resilient as your career.

Essential Coverage for the Global Professional

When evaluating a premium health insurance plan, meticulous attention to detail is paramount. This is not about sourcing the lowest-cost policy; it is about securing a suite of non-negotiable benefits that protect your health, your assets, and your freedom to operate anywhere in the world.

A generic benefits checklist is insufficient. You must look beyond marketing language and comprehend the real-world value of each feature and how it supports a dynamic, international lifestyle. This requires a granular analysis of the core components that distinguish a standard policy from a premier one.

The Foundation: High Coverage Limits and Comprehensive Care

The primary indicator of a superior plan is its annual or lifetime maximum benefit. For a high-net-worth professional, this figure must be substantial—typically in the millions of dollars. Anything less introduces an unnecessary financial risk, placing a potential ceiling on your care when you need it most.

A high maximum is not a luxury; it is a strategic necessity. It ensures that in a worst-case scenario—a complex surgical procedure in Switzerland, an extended hospitalization in the US, or a serious chronic diagnosis—your focus remains on recovery, not the prohibitive cost of treatment.

Equally important is the scope of that care. A top-tier plan must offer robust coverage for both inpatient and outpatient services. The distinction is critical:

- Inpatient Care: This encompasses all services rendered once you are formally admitted to a hospital, such as surgery, accommodation, and intensive care.

- Outpatient Care: This includes all services that do not require hospital admission, such as specialist consultations, vital diagnostic tests (MRIs, CT scans), and follow-up appointments.

A policy that inadequately covers outpatient care leaves a significant and dangerous gap, as a vast portion of modern medicine is delivered outside of a hospital setting.

The Pillars of a Global Safety Net

Beyond these fundamentals, several key features provide the structural support for a truly effective global health plan. These elements are designed to deliver not just medical treatment, but also convenience and long-term security.

A prime example is the direct billing network. Through this arrangement, the insurer settles payment directly with the hospital or clinic. While seemingly basic, this feature is transformative. It eliminates the logistical burden of paying enormous sums out-of-pocket and awaiting reimbursement. For professionals who value liquidity and efficiency, direct billing is an absolute necessity.

Another non-negotiable is emergency medical evacuation. If you suffer a serious injury or fall ill in a location lacking adequate medical facilities, this benefit covers the cost of transporting you to the nearest center of excellence. This could involve a chartered medical flight costing tens, or even hundreds, of thousands of dollars—a catastrophic expense without appropriate coverage.

True peace of mind stems from knowing your plan functions seamlessly in every scenario—from a routine check-up in Singapore to a medical emergency in a remote location. It is about frictionless access to quality care without financial or logistical impediments.

Long-Term Well-Being and Lifestyle Alignment

Finally, a premier plan recognizes that your health needs extend far beyond emergencies. It must provide for your long-term wellness and align with your life plans. This includes robust coverage for:

- Chronic Conditions: Ensures that the ongoing management of long-term illnesses is fully covered.

- Mental Health Services: Provides access to therapy and psychiatric support, vital for managing the unique pressures of a global career.

- Maternity Care: For those planning a family, this benefit is essential, covering everything from prenatal to delivery and postnatal care.

These elements are often absent from standard, off-the-shelf policies but are crucial for your sustained well-being. The market is adapting, with some forward-thinking insurers now offering plans with high limits and global access that can be secured without initial health checks for certain groups. You can discover more about the best digital nomad health insurance plans that are at the forefront of this evolution.

Customizing Your Plan for Optimal Value

For a global professional, the insurance objective is not to find the cheapest policy, but to secure the greatest value. An off-the-shelf plan is a blunt instrument. A tailored International Private Medical Insurance (IPMI) plan, in contrast, is a precision tool, sculpted to fit the exact contours of your life and financial strategy.

The final premium is a direct reflection of your choices in three key areas. By understanding these levers, you can strategically balance ironclad protection with cost-efficiency, ensuring you pay only for what you truly need without compromising on the quality of your care.

The Impact of Your Geographic Footprint

The single most significant factor influencing your premium is your chosen area of coverage. Global insurers typically offer two primary options: “Worldwide” and “Worldwide excluding the USA.” The rationale is purely economic—healthcare costs in the United States are substantially higher than in nearly any other country.

If you do not anticipate spending significant time in the U.S., selecting a plan that excludes it can reduce your premium by as much as 30-50%. For professionals based in hubs like Singapore, Dubai, or London who travel predominantly through Asia, the Middle East, and Europe, this is often the most prudent financial decision. However, if seamless access to American physicians and hospitals is required, including U.S. coverage is a non-negotiable, albeit more significant, investment.

Strategic Use of Deductibles and Co-insurance

The next layer of control involves how you elect to share costs with your insurer. This is where deductibles and co-insurance (or co-payments) are utilized. A deductible is the portion of a medical bill you agree to cover yourself before your insurance coverage activates.

A higher deductible is a strategic financial decision. It signals to the insurer your capacity to manage smaller, routine medical costs out-of-pocket, reserving your premier insurance for its intended purpose: significant, high-cost, and potentially catastrophic events.

This is a powerful strategy for reducing your annual premium. By selecting a higher deductible—for example, $2,000 or $5,000—you can achieve substantial savings while retaining full protection against medical expenses that could derail your financial future. It reframes your policy from a tool for minor ailments into a robust financial shield for major events.

Adding Optional Riders for Complete Care

Finally, true customization is achieved by selecting optional riders or add-on benefits. Your core IPMI plan will cover essential hospital and medical care. From there, you can append modules that align with your personal health priorities.

Common add-ons include:

- Comprehensive Dental and Vision Care: This extends far beyond emergency dental work, covering routine examinations, cleanings, major restorative work, orthodontics, and prescription eyewear.

- Wellness and Preventative Care: Select plans offer benefits for health screenings, vaccinations, and other proactive measures to maintain optimal health.

- Maternity Coverage: For those planning to start or expand a family, this rider covers prenatal care, delivery, and postnatal support.

These riders allow you to construct a policy that reflects your complete health and lifestyle needs. A professional based in Southeast Asia might opt for a lower deductible and add a top-tier dental rider to leverage the region’s excellent, affordable dental services. Conversely, an individual dividing time between Europe and Latin America might prioritize a “Worldwide ex USA” plan with a high deductible to keep premiums low, focusing their investment on core medical and evacuation coverage.

This level of granular control ensures your health insurance for digital nomads is not a generic product but a bespoke solution, delivering precisely what you require for your life on the move.

Comparing Leading International Insurance Providers

Selecting the right international health insurance provider is a significant decision that transcends a mere comparison of monthly premiums. For a global professional, the true measure of an insurer is their performance under pressure. It is a function of their operational infrastructure, the quality of their medical network, and a reputation for seamless, efficient execution.

You are not merely purchasing a policy; you are selecting a strategic partner responsible for delivering on its promises, often in the most challenging of circumstances.

We will examine several leading providers known for catering to this discerning clientele—insurers such as Cigna Global, GeoBlue, and Allianz Care. This is not an exhaustive list, but a focused analysis of what distinguishes these specific firms. Their value proposition lies not just in an extensive list of benefits, but in the strength of their direct billing networks, their claims processing efficiency, and the intelligent flexibility engineered into their plans.

Cigna Global: A Legacy of Global Reach

Cigna Global is frequently the first name considered by seasoned expatriates and high-achieving digital nomads, for valid reasons. Its primary asset is an immense and deeply established global network. With decades of experience, Cigna has cultivated direct relationships with an extraordinary number of hospitals, clinics, and specialists worldwide.

The tangible benefit for you is a powerful direct billing system. For a professional operating across multiple jurisdictions, this translates to less administrative burden and, critically, minimal out-of-pocket expenditure for major medical care. Their plans are also renowned for being highly customizable, enabling you to construct a policy that precisely fits your global footprint and health requirements.

GeoBlue: Specialized Access in the US

GeoBlue has carved a strategic niche by integrating with the formidable Blue Cross Blue Shield (BCBS) network within the United States. If you are a professional who divides time between the U.S. and international locations, this is a decisive feature.

Their entire model is predicated on providing top-tier access to one of America’s largest and most respected healthcare networks. This positions them as the provider of choice for U.S. citizens living abroad who require seamless care when returning home, or for non-U.S. citizens who need reliable, high-quality medical access when traveling in the States. GeoBlue’s plans are often lauded for their straightforward structure and superior support for any U.S.-based medical needs.

Allianz Care: A Focus on High-Level Service

Allianz Care, a division of the globally recognized Allianz Group, has built its reputation on premium service and comprehensive support. They place a significant emphasis on the client experience, offering multilingual support and dedicated case managers for complex medical situations.

Their plans are clearly designed for the long-term expatriate, with high coverage limits and extensive benefits for a full spectrum of care, from hospitalization to specialist consultations. Allianz also receives high marks for its sophisticated digital tools, including a genuinely user-friendly application for managing claims and policy information on the move—a significant advantage for any tech-savvy global professional. Of course, the specifics of any policy are paramount. To fully comprehend coverage, it is wise to read also about medical conditions and potential policy exclusions to prevent any future surprises.

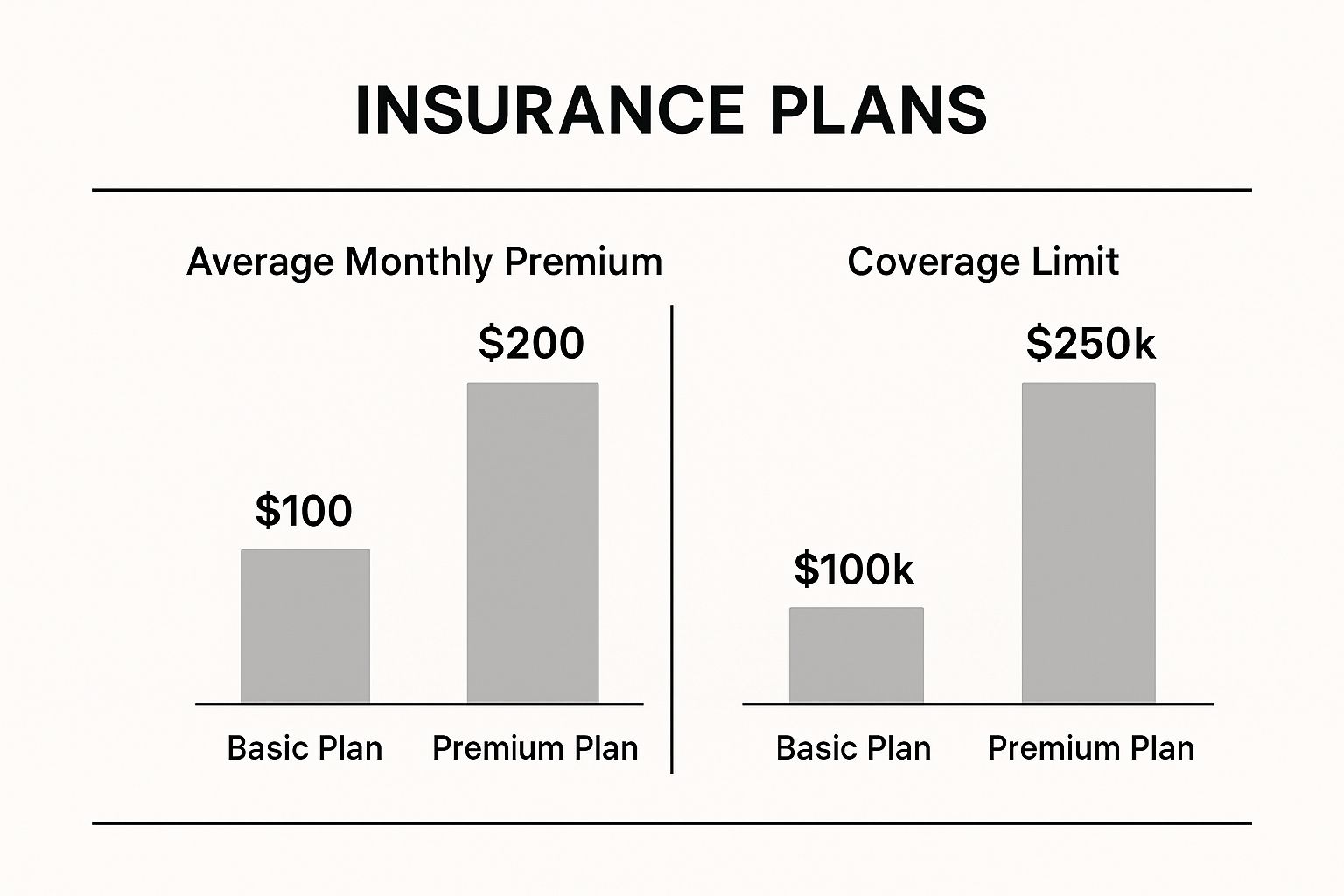

This visual provides a concise, at-a-glance comparison of how premiums and coverage levels correlate between standard and premium insurance plans.

As illustrated, a higher premium typically secures a substantially higher coverage limit—a critical factor when protecting against a major medical event.

To facilitate a more strategic comparison, here is a snapshot of what each provider offers.

Premium IPMI Provider Snapshot

| Provider | Best For | Typical Annual Limit | Key Strengths |

|---|---|---|---|

| Cigna Global | Expats requiring a vast, established global network and high plan customization. | $2,000,000+ | Extensive direct billing network, highly flexible plans, long-standing global reputation. |

| GeoBlue | U.S. citizens abroad or expats frequently visiting the U.S. who need elite stateside access. | $1,000,000+ | Unmatched access to the Blue Cross Blue Shield network in the U.S., strong U.S.-based support. |

| Allianz Care | Professionals prioritizing high-touch customer service and digital convenience. | Up to €4,500,000 | Premium client service, dedicated case management, excellent digital tools, very high coverage limits. |

This table serves as a starting point, designed to help you identify the provider whose strengths align with your personal requirements and travel patterns.

The optimal provider is not always the one with the most features. It is the one whose core strengths directly address your primary concerns about living and working globally.

Ultimately, this overview should serve as a framework for your decision-making process. Use it to determine which of these top-tier providers is best suited to your need for robust, reliable health insurance for digital nomads. The objective is to choose a plan that functions as a true asset, providing the confidence to pursue your global life without reservation.

Your Strategic Checklist for Selecting a Plan

Having covered the core concepts, it is time to transition from theory to execution.

Selecting the right international health insurance is not an incidental purchase; it is a strategic decision that underpins your entire global lifestyle. A correct choice provides freedom. An incorrect one creates a significant liability.

This final checklist distills our key insights into a practical, step-by-step framework. Use it to bypass marketing hyperbole and choose a plan with precision and confidence.

Assess Your Authentic Travel Patterns

First, conduct a rigorous and honest assessment of your geographic presence over the next 12 to 24 months.

Map out your intended destinations, as well as your probable ones. Will you realistically remain within Southeast Asia and Europe? Or do your ambitions and business plans genuinely necessitate frequent travel to the United States?

This single analysis is the most powerful lever on your premium. Opting for a “Worldwide excluding USA” policy can yield significant cost savings if you have no plans to be in America. For those who do, however, securing a plan with strong U.S. network access is the primary filtering criterion.

Evaluate Your Health and Wellness Needs

Next, conduct a candid personal health assessment.

Do you have any pre-existing conditions requiring consistent management? Irrespective of your current health, what does your family medical history suggest? And what is your personal standard for preventative care and wellness?

Your answers to these questions will dictate the level of coverage necessary for true peace of mind. Prioritize plans that are transparent about their underwriting process for pre-existing conditions. If services like comprehensive dental, vision, or proactive wellness check-ups are important to you, consider them as specific riders.

A superior plan is not merely an emergency response mechanism. It should function as a proactive partner in your long-term health, providing the resources you need to perform at your peak, regardless of the time zone.

Scrutinize the Policy Fine Print

Every insurance policy contains an exclusions list. It is your responsibility to review it before committing.

Delve into the policy documents and examine the details. What are the waiting periods for benefits such as maternity care? What specific activities or sports are explicitly excluded from coverage? The critical details reside here.

Pay meticulous attention to the definitions of medical evacuation and repatriation. Understanding the insurer’s precise interpretation of these terms is vital to avoiding a catastrophic misunderstanding during a medical crisis. To assist with this, you can check out our guide on finding the right expat medical insurance policy type to better comprehend the nuances.

Consult an Independent Insurance Specialist

Finally, seek expert counsel.

Engaging with a qualified international insurance broker who specializes in serving globally mobile professionals adds an invaluable layer of expertise. Their experience provides personalized advice based on your unique circumstances, helping you compare top-tier providers without bias.

This step transitions you from a spreadsheet of options to a confident final decision. A true specialist can navigate the complexity on your behalf, ensuring the policy you choose is not just a document, but a reliable asset for your global career.

Frequently Asked Questions

Here are direct answers to the most common questions regarding global health insurance.

Does International Health Insurance Cover Me In My Home Country?

Yes, but the specifics must be verified within the policy. This is a critical feature for professionals who divide their time or return home for extended periods.

The best International Private Medical Insurance (IPMI) plans incorporate this need, typically providing coverage in your designated home country for a set period, often 90 to 180 days per policy year. This allows you to visit family or conduct business at home without a lapse in health coverage. Ensure the plan you select aligns with your actual travel patterns.

How Are Pre-Existing Conditions Handled?

This is a key differentiator for premium IPMI. Unlike basic travel insurance, which almost universally excludes pre-existing conditions, a quality health insurance for digital nomads plan will often provide coverage.

You will undergo a confidential medical underwriting process where the insurer assesses your health history to determine the terms of coverage.

It is imperative that you provide a complete and honest medical declaration during this process. Non-disclosure of a material fact can lead to claim denial or, in severe cases, policy cancellation. Your transparency is what ensures the policy’s integrity when you need it most.

What Is the Difference Between Medical Evacuation and Repatriation?

These terms are often confused but represent two distinct, non-negotiable benefits. Misunderstanding them can have serious consequences.

- Medical Evacuation: This benefit is designed to transport you to the best possible care, quickly. If you are seriously ill or injured in a location with inadequate medical infrastructure, this covers the cost of transporting you to the nearest center of medical excellence equipped to manage your condition. The priority is immediate, superior treatment, wherever that may be located.

- Medical Repatriation: This benefit facilitates your return home. It covers the cost of transporting you back to your home country for treatment, provided it is medically safe and appropriate. This is often the preferred option for long-term recovery, where proximity to your personal support network is as valuable as the medical care itself.

Consider them a two-part safety net. Together, they ensure that no matter where you are, you will receive the highest possible standard of care.

At Riviera Expat, we specialize in these details. Our expertise lies in assisting high-net-worth professionals to navigate the complexities and secure premier international health insurance that is precisely tailored to their lifestyle. Your health and financial security are too important to be left to chance. Find your ideal IPMI plan with our complimentary expert consultation.