For high-net-worth professionals establishing a presence in Cambodia, superior healthcare is not a mere convenience; it is a non-negotiable component of a sophisticated expatriate strategy. A robust expat insurance Cambodia plan is the critical asset that guarantees access to international-standard medical care, securing both your health and your peace of mind. Your standard travel policy is fundamentally inadequate for the realities of long-term residence in the Kingdom.

Securing Your Health in Cambodia: An Executive Overview

Navigating healthcare in Cambodia requires a discerning approach. While the country is developing at a significant pace, its medical infrastructure presents a clear duality. A substantial gap in the quality of care exists between public and private facilities.

For discerning expatriates, this reality means the private clinics and hospitals in Phnom Penh are the only prudent choice for reliable medical treatment.

This landscape underscores why a premier international health insurance policy is indispensable. A well-designed plan functions as your personal health passport, granting access to the best physicians and facilities without the concern of immediate, substantial out-of-pocket payments.

A superior insurance plan is less about reacting to emergencies and more about proactively managing your health security. It is an investment in certainty, ensuring that your standards for medical care are met, regardless of your location.

Why Standard Insurance Falls Short

Relying on a domestic plan from your home country or a basic travel policy is a common—and potentially costly—oversight. These plans are seldom engineered for the unique challenges of living abroad and typically fail in several key areas for an executive residing in Cambodia:

- Limited Network Access: They rarely have direct billing agreements with Cambodia's premier private hospitals. This structure forces you to pay upfront for what can be very substantial medical costs and then pursue reimbursement later.

- Inadequate Coverage Limits: The financial caps on these policies are often insufficient for a serious medical event, leaving you dangerously exposed to significant financial liability.

- Exclusion of Medical Evacuation: This is arguably the most critical benefit. For any complex medical emergency, the standard of care is an evacuation to world-class hospitals in Bangkok or Singapore. The cost for an air ambulance can readily exceed $50,000—a liability a proper expat plan is designed to cover in its entirety.

Ultimately, selecting the right expat insurance in Cambodia is a strategic decision that protects your most valuable asset: your health. It provides a clear path to excellent care locally and ensures a seamless transition to a higher level of treatment abroad if the need arises.

While comprehensive insurance is vital, staying on top of your health proactively is just as important. You might be interested in learning about easy tips and methods for checking your heart health at home.

Understanding Cambodia's Healthcare Landscape

To select the appropriate insurance, one must first comprehend the medical reality on the ground in Cambodia. The country operates two distinct healthcare systems in parallel: public and private. The chasm between them in quality, resources, and accessibility is vast. For a high-net-worth professional accustomed to a certain standard of care, this is the single most important factor shaping your health strategy.

The public system is developing but faces significant challenges. It often contends with underfunding, a shortage of specialized physicians, and equipment that does not meet international benchmarks. Consequently, for any ailment more serious than a common cold, the expatriate community almost universally relies on the private sector.

The Private Sector Advantage in Phnom Penh

Private hospitals and clinics, particularly within the capital city of Phnom Penh, represent a different echelon of care. These facilities are designed to meet the expectations of international patients, offering a standard that is much more aligned with what you would find in your home country.

What makes them the definitive choice?

- International Staff: Leading clinics often employ expatriate doctors or Cambodian physicians trained overseas, immediately mitigating language barriers and ensuring a familiar standard of medical practice.

- Modern Equipment: Private facilities invest heavily in advanced diagnostic and treatment technology, resulting in more reliable and sophisticated care.

- Specialized Services: Accessing a cardiologist or an orthopedic surgeon is far more straightforward within the private network, which has the necessary specialists available.

This superior quality, of course, is commensurate with a higher cost. A consultation, procedure, or hospital stay at a top-tier facility can be exceptionally expensive without a robust insurance plan. This is precisely why a comprehensive expat insurance Cambodia policy is not a luxury but a necessity for seamless access to this level of care.

Comparing Healthcare Options for Expats in Cambodia

To provide clear perspective, the following table offers a direct comparison of what one can generally expect from the public versus private healthcare systems. This should clarify why an informed choice about where to seek treatment is so critical for expatriates.

| Attribute | Public Healthcare System | Private Healthcare System |

|---|---|---|

| Quality of Care | Highly variable, often below international standards. | Generally aligns with Western standards, especially in major cities. |

| Cost | Significantly lower, but may require informal payments. | High out-of-pocket costs, comparable to Western private care. |

| Staff & Language | Primarily Khmer-speaking staff; few international doctors. | Often employs expatriate doctors or English-speaking staff. |

| Facilities & Equipment | Can be basic, with older or limited technology. | Modern facilities with advanced diagnostic and treatment equipment. |

| Accessibility | Wider geographic coverage, but specialized care is limited. | Concentrated in Phnom Penh and Siem Reap; excellent specialist access. |

| Wait Times | Can be long for consultations and non-emergency procedures. | Shorter wait times for appointments and access to specialists. |

Ultimately, while the public system serves a vital role for the local population, the private system is specifically structured to meet the standards and expectations of the international community.

A Market in Motion: The Cambodian Insurance Industry

As the demand for superior healthcare from expatriates and affluent Cambodians grows, the insurance market has accelerated to meet it. Insurers are introducing more sophisticated products, with premiums adjusting to reflect this evolution. This is not merely about rising costs; it is the hallmark of a maturing market where you are investing in genuinely better, more reliable coverage.

Consider this: the rising cost of private medical care in Cambodia directly reflects its improving quality. A premier insurance plan transforms that high cost from a potential financial catastrophe into a predictable, manageable investment in your health.

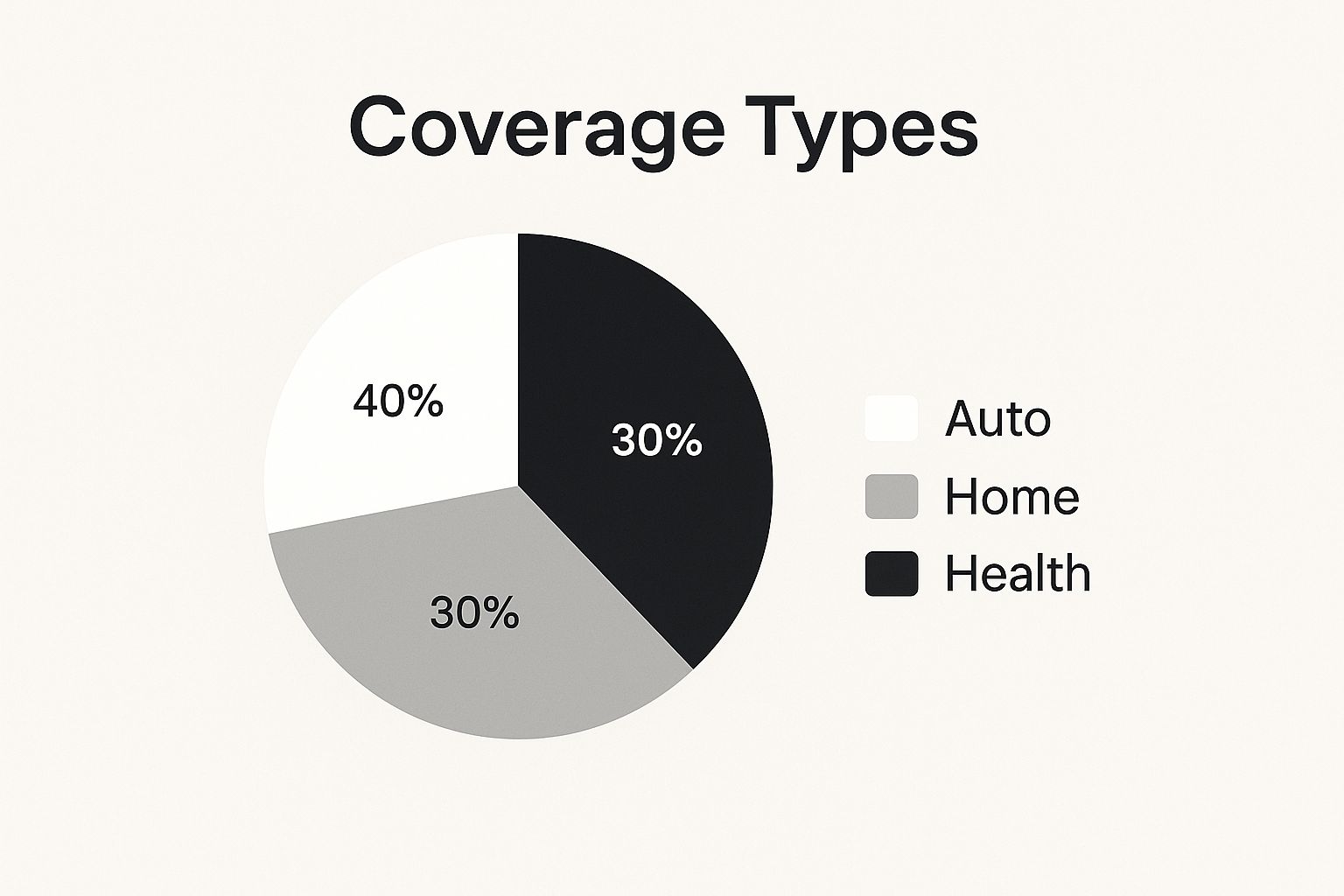

The infographic below highlights key coverage features that high-net-worth individuals consistently prioritize when selecting their plan.

As you can see, the focus extends beyond basic hospitalization. Critical features like medical evacuation and robust outpatient care are what distinguish a basic policy from a truly secure one.

The data illustrates this rapid expansion. According to the Insurance Regulator of Cambodia (IRC), the nation's insurance market generated $196.4 million in gross premiums in the first semester of 2023, a 9.5% increase year-on-year. While the country's overall insurance penetration remains modest, this growth signals a market that is becoming increasingly essential. You can find more details about the Cambodian insurance market's development on InsuranceAsia.com.

In this evolving environment, selecting an insurance plan is a strategic decision. You require a policy that provides direct, cashless access to a network of elite hospitals and clinics, not just in Cambodia but across the region. This is particularly important if you travel frequently to other Southeast Asian hubs. For a wider view, take a look at our collection of other expat country guides.

At the end of the day, understanding this unique healthcare dynamic is the essential first step. It's how you ensure you end up with a plan that truly has your back in the Kingdom of Wonder.

Anatomy of a Premier Expat Insurance Policy

A top-tier expat insurance Cambodia policy isn’t just a safety net; it is a sophisticated financial instrument. It is engineered with specific, high-value components that work in concert to provide seamless access to elite healthcare. Distinguishing a premier plan from a standard one requires a close examination of its core features, extending far beyond basic hospital benefits.

The distinction is analogous to a bespoke suit versus one off the rack. Both serve the same fundamental purpose, but the custom garment is meticulously constructed from superior materials, fits perfectly, and performs exceptionally. An elite insurance plan is no different—its true value lies in the precision and quality of its components.

The Pillars of Elite Coverage

At the heart of any first-class policy are several non-negotiable elements. These form the foundation of your health security, protecting you from both minor concerns and major medical crises. The starting point is high annual limits. Top-tier plans from insurers like Cigna, Allianz, or AXA often provide coverage from $2,000,000 up to unlimited, shielding you from truly catastrophic costs.

Beyond high limits, the policy must offer genuinely comprehensive care:

- Inpatient and Day-Patient Care: This is the bedrock, covering all aspects of a hospital stay, including the room, surgical procedures, specialist fees, and diagnostic tests.

- Comprehensive Outpatient Services: A premier policy does not treat outpatient care as an ancillary benefit. It fully covers specialist consultations, MRI and CT scans, prescription medications, and physiotherapy without restrictive sub-limits.

- Wellness and Preventative Care: Proactive health management is a key feature. This means your routine health screenings, physicals, and vaccinations are covered, empowering you to maintain your health rather than just reacting to problems.

These core elements ensure that from a routine check-up to major surgery, your medical needs are met without financial friction. The devil is always in the details, and you can get a better handle on the fine print by reading our guide to understanding expat medical insurance policy terms.

The Critical Medical Evacuation Clause

For any executive or professional residing in Cambodia, medical evacuation is arguably the single most important benefit. While private clinics in Phnom Penh are excellent for many conditions, they are not equipped for every complex medical emergency.

When a severe health crisis occurs—such as major trauma, a complex cardiac event, or the need for specialized oncological treatment—the gold standard of care is found in Bangkok or Singapore. An emergency medical evacuation benefit ensures your swift transport to these world-class facilities.

Without this coverage, the cost of an air ambulance and its medical team can easily exceed $50,000. A premier policy covers this entirely, managing all logistics and costs so you receive the best possible care when it matters most.

The Convenience of Direct Billing Networks

Beyond the scope of coverage, the practical experience of using your insurance is paramount. This is where direct billing, or "cashless access," becomes a game-changer. The best international insurers have cultivated strong relationships with top private hospitals and clinics in Cambodia and throughout the region.

This means that when you receive treatment at an in-network facility, the hospital bills the insurer directly. You simply present your insurance card and focus on your recovery. This avoids the need to pay substantial sums out-of-pocket and navigate a tedious reimbursement process. It transforms a potentially stressful financial event into a simple administrative formality—precisely the level of service a busy professional requires.

How to Select the Right International Insurer

Selecting the right provider for your expat insurance Cambodia policy is as critical as choosing the coverage itself. Consider your insurer a partner in your health security. For a high-net-worth professional, that partnership must be built on a foundation of financial strength, operational excellence, and a nuanced understanding of the local landscape.

This is not a matter of comparing prices. It is about vetting an institution's ability to perform when it is most needed. You require an insurer that is unquestionably reliable, ensuring that when you need support—for a routine check-up or a life-threatening emergency—their response is swift, professional, and effective. A lesser-known or financially tenuous insurer introduces an unacceptable level of risk.

Evaluating Insurer Credibility and Financial Health

Your first step should be to scrutinize an insurer's global reputation and financial stability. It is prudent to work with established leaders in the international private medical insurance sector, such as Cigna, Bupa, and Allianz. These companies have served expatriates for decades and possess a proven track record across the globe.

A critical metric to verify is the insurer's financial strength rating from independent agencies like A.M. Best or Standard & Poor's. A high rating, such as 'A' or better, is a direct indicator of their long-term ability to pay claims. This is non-negotiable, as it signifies they have the capital reserves to handle your claims without issue.

Assessing Regional Expertise and Support Systems

A strong global reputation is essential, but specific experience in Southeast Asia provides a distinct advantage. A provider that understands the intricacies of Cambodia's healthcare system—from the best private clinics in Phnom Penh to the precise protocols for medical evacuation to Bangkok—offers superior value.

This regional expertise manifests in several crucial ways:

- A Robust Direct Billing Network: A top-tier insurer will have direct payment agreements with the best hospitals in Cambodia and across the region, granting you cashless access to care during a crisis.

- 24/7 Multilingual Assistance: Your emergency support line should be staffed by professionals who can communicate clearly and coordinate care effectively, irrespective of time zone or language barriers.

- Experienced Claims Teams: You need a team that is intimately familiar with local billing practices. This prevents unnecessary delays or denials that can arise when an insurer does not understand how things operate on the ground.

An insurer's true value isn't revealed when you're paying premiums. It's revealed when you're facing a medical crisis in an unfamiliar country. Their ability to manage logistics, guarantee payment, and provide clear guidance is the ultimate measure of their worth.

Given the very real limitations of Cambodia’s medical infrastructure, securing a proper international health insurance plan is the only sensible option for expatriates. These policies are designed to give you access to high-quality local private care and, crucially, include seamless coverage for treatment in neighboring countries like Thailand or Singapore. They cover high-standard medical care, preventative services, emergency evacuation, and chronic disease management—benefits you simply won't find in the public system. You can explore more on why comprehensive coverage for expats in Cambodia is so vital on ExpatFinancial.com.

The Strategic Role of an International Insurance Broker

As a busy professional, you lack the time to meticulously analyze the fine print of dozens of complex policies from various insurers. This is where engaging a specialist international insurance broker becomes a strategic imperative. A reputable broker works for you, not for the insurance company.

Their role is to provide impartial, expert advice. They leverage deep market knowledge to identify the plans that precisely align with your circumstances and needs. A skilled broker manages the exhaustive comparisons, deciphers the jargon-filled policy wording, and can advocate on your behalf during underwriting or a claims dispute. This level of service ensures you secure the optimal solution without the administrative burden, providing complete confidence that your health is in expert hands.

Customizing Your Coverage and Understanding the Costs

Constructing the right expat insurance Cambodia plan is not about finding the cheapest policy. It is about securing the best value—ensuring your investment procures precisely the protection you require, without allocating funds to benefits you will never use.

Think of it less like buying off-the-shelf insurance and more like commissioning a custom-built financial instrument. Several key factors directly influence the final cost, and understanding how to adjust them allows you to create a plan that fits your life and budget perfectly. While your age and medical history form the baseline for any insurer, the real power lies in how you structure the policy's components.

Key Factors That Drive Your Premium

The cost of your plan is a direct reflection of the coverage you select. A high-performance plan designed for a seasoned professional will naturally have a different cost structure than a basic policy. These are the primary levers for shaping your premium.

Here are the four main factors that will determine your premium:

- Coverage Level: A plan with a $5,000,000 annual limit and extensive outpatient benefits will have a higher premium than one with a $1,000,000 limit focused primarily on major hospital stays.

- Geographical Scope: This is a significant determinant. A worldwide policy that includes the USA—where medical costs are the highest globally—will be considerably more expensive than a plan covering Asia or the world excluding the U.S.

- Deductible Amount: Your deductible is the amount you pay out-of-pocket before the insurance takes effect. Opting for a higher deductible is the single most powerful method for reducing your annual premium.

- Demographics: Your age is a major factor, with premiums increasing over time. Your nationality can also play a role in the underwriting process.

The objective is not to minimize cost but to optimize value. A well-structured plan with a higher deductible can provide elite-level catastrophic coverage at a much more efficient price point. This protects you from major financial disasters while you self-insure for minor routine care and prescriptions.

Strategic Customization for Optimal Value

A sophisticated approach involves manipulating these variables to your advantage. For instance, if you are in good health and possess adequate liquid assets, selecting a deductible of $2,500 or $5,000 can substantially reduce your premium. This strategy is ideal for high-net-worth individuals who can comfortably cover routine medical expenses but demand ironclad protection against a serious accident or illness with costs that could run into the hundreds of thousands.

This demand for tailored, robust protection is fueling growth across the Kingdom. The total insurance market in Cambodia is projected to reach approximately USD 2.09 billion in gross written premiums. This figure reflects a tangible shift among professionals toward asset protection. Expat plans, in particular, are focusing more on comprehensive health coverage and true international portability—an absolutely critical feature given the stark differences in healthcare quality within Cambodia. You can discover more insights about Cambodia's insurance market growth on Statista.com.

By being strategic about your area of coverage and realistic about which add-on benefits you truly require, you can fine-tune your policy. The end result is a powerful financial tool that provides complete medical security and peace of mind, all while fitting seamlessly into your overall financial plan.

Getting Covered and Making a Claim: What to Expect

For a busy professional, the true value of an expat insurance Cambodia plan lies not just in its coverage, but in the seamless execution of its services. The last thing you want is to be encumbered by administrative processes when you should be focused on your work or your health. It all begins with the application.

At the core of any application is medical underwriting. This is the insurer's process of reviewing your health history to assess risk and determine your final premium. Complete transparency is not just advisable; it is mandatory. You must disclose all pre-existing conditions, regardless of how minor they may seem. Concealing information may be tempting, but it can lead to a denied claim or even the cancellation of your policy when you need it most. It is a risk that is never worth taking.

The Application Blueprint

Applying for a top-tier international health plan is a structured, though not complicated, process. While each insurer has its own specific procedures, the path generally follows these steps:

- Initial Consultation: This is where you will confer with a specialist broker to define your precise needs. Will you require coverage only for Cambodia, or do you need regional or global protection? Are you planning to start a family and need maternity benefits? This is the stage to establish the blueprint.

- Medical Underwriting: You will complete a detailed health questionnaire. The insurer may request your medical records or a brief medical examination to obtain a comprehensive health profile.

- Offer and Review: Based on your health profile, the insurer will issue a formal offer. This document will detail all terms, the final premium, and any specific exclusions or additional costs (loadings) related to your pre-existing conditions.

- Policy Activation: Once you have reviewed the offer, accepted the terms, and paid the first premium, your coverage is active. You will receive your policy documents, an insurance card, and the assurance of being properly protected.

Think of the application as the foundation of your relationship with the insurer. When you build it on total transparency, you ensure that if you ever need to file a claim, they'll be a reliable partner ready to pay, not an obstacle looking for a reason to deny.

How Claims Actually Work

When you need to use your insurance, there are two primary mechanisms. Understanding the distinction is key to a frictionless experience.

The most efficient and convenient option is direct billing (also known as cashless access). For a planned procedure at an in-network hospital in Phnom Penh, the process is straightforward. You or the hospital will obtain pre-authorization from your insurer. Once approved, the hospital bills the insurer directly. You will not be billed for anything beyond your policy's deductible. For a deeper dive into how this works, our guide on pre-authorization and direct settlement breaks it all down.

The alternative is the classic reimbursement model. This is typically used for smaller outpatient visits or if you consult a doctor who is not in your insurer's network. You pay for the service upfront, retain all invoices and medical reports, and then submit a claim to your insurer. Leading insurers have streamlined this process with online portals or mobile apps for uploading documents in minutes. Reimbursement is typically processed within a few weeks.

Your Questions About Expat Insurance in Cambodia, Answered

When arranging your affairs in Cambodia, particularly as a high-net-worth professional, you will have specific questions regarding health insurance. Obtaining clear, direct answers is essential for protecting both your health and your finances. Here are the most frequent inquiries we address.

Will My Insurance From Home Work in Cambodia?

It is almost certain that it will not. A domestic health plan is analogous to a local club membership—excellent for use in its home city, but not designed for life on the other side of the world.

These plans almost invariably lack the essential components for an expatriate in Cambodia: access to international private hospitals, direct payment arrangements with premier clinics in Phnom Penh, and—most critically—medical evacuation. Expat health insurance is an entirely different class of product, engineered from the ground up for a global lifestyle. It is portable, international, and requisite for genuine security abroad.

Why Is Medical Evacuation So Heavily Emphasized?

Medical evacuation is not an optional feature; it is the absolute cornerstone of a sound insurance plan in Cambodia. While private clinics in Phnom Penh are excellent for a wide range of medical issues, they are simply not equipped for every major medical crisis.

For a severe accident, a major cardiac event, or specialized oncological treatment, the standard of care requires transport to a world-class medical center in Bangkok or Singapore. Without the appropriate coverage, this will not happen.

Think of medical evacuation as your ultimate safety net. It's the guarantee that if the worst happens, you're not just getting treatment—you're getting the best possible treatment, no matter where it is. It covers all the logistics and the flight, which can easily top $50,000, ensuring a medical crisis doesn't turn into a financial one.

How Do Insurers Deal With Pre-Existing Conditions?

This is a personalized aspect of underwriting, and each insurer has a slightly different approach. The one non-negotiable rule is full and honest disclosure on your application. Attempting to hide a past condition is a reliable way to have a claim denied or your entire policy voided when you need it most.

When you disclose your medical history to a top-tier insurer like Cigna or Allianz, they will review it and respond with one of several outcomes:

- Full Coverage: They will cover the condition, sometimes for a slightly higher premium (known as a "loading").

- Waiting Period: They agree to cover the condition, but only after a specified period has elapsed, such as 24 months.

- Exclusion: The policy will cover everything except for your specific pre-existing condition, which is permanently excluded from coverage.

Determining which insurer will provide the most favorable outcome for your specific health profile is precisely where a specialist broker demonstrates their value. We can advocate on your behalf, presenting your case to the right underwriters to secure the most advantageous terms possible.

At Riviera Expat, our role is to bring this level of clarity to your decision-making. We provide the expert, white-glove guidance necessary to secure an international health plan that truly aligns with your standards and lifestyle in Cambodia.