Yes, South Korea operates a robust universal healthcare system. It is not merely a social program but a foundational pillar of the country's economic and social framework, managed by the National Health Insurance Service (NHIS).

This is a mandatory, single-payer system that provides coverage for the entire population. Understanding its mechanics is essential for any executive, investor, or high-net-worth individual considering business or residency in South Korea.

The Foundation of South Korean Health Care

The system is constructed on a principle of social solidarity. It functions as a national fund to which all residents contribute, ensuring that every individual—irrespective of income, age, or health status—has access to medical services. This establishes a baseline of high-quality, accessible healthcare that is a direct contributor to the country's impressive public health statistics.

The NHIS serves as the single-payer, positioning the government as the primary financier of healthcare. This model enhances efficiency by streamlining administration and negotiations with medical providers, which facilitates extensive population coverage.

How Does This System Actually Work?

The efficacy of the system is evident in its outcomes. South Korea's health metrics are among the world's best due to a structure designed for accessibility and cost-effectiveness. This fosters a healthy, productive workforce—a significant advantage for any enterprise operating within the country.

When evaluating potential relocation destinations, it is prudent to compare this healthcare framework against others.

The program's success is rooted in several key principles:

- Universal Enrollment: Participation is mandatory for all citizens and long-term foreign residents (after a six-month residency period). This creates a vast, diversified risk pool, ensuring systemic stability.

- Income-Based Contributions: Premiums are calculated based on an individual's income and assets. This equitable model ensures the financial burden is proportional to one's ability to pay.

- Comprehensive Coverage: The NHIS covers a broad spectrum of medical services, including routine consultations, diagnostic tests, major hospitalizations, and prescription medications.

For a clearer perspective, here is a breakdown of the NHIS.

South Korea's NHIS At A Glance

| Feature | Description | Implication for Professionals |

|---|---|---|

| System Type | Single-Payer Universal Healthcare | Centralised, efficient administration. Less complex than multi-payer systems. |

| Enrollment | Mandatory for citizens & long-term residents | You will be automatically enrolled and required to contribute; this is not optional. |

| Funding | Income-based contributions & government subsidies | Contributions are tied to your salary and assets, ensuring an equitable system. |

| Coverage Scope | Inpatient, outpatient, prescriptions, traditional medicine | Covers most routine and major medical needs, reducing out-of-pocket health costs. |

| Copayments | Approximately 20% for inpatient, 30-60% for outpatient | While contributions cover the base, expect out-of-pocket costs for services rendered. |

| Key Exclusions | Cosmetic surgery, specific high-cost drugs, private rooms | Significant gaps exist, particularly for services often included in premier international plans. |

This table outlines the fundamental structure, but the true measure of its success lies in the outcomes it generates.

The results are definitive. Life expectancy in South Korea is a remarkable 83.6 years, significantly above the OECD average. Critical metrics such as childhood vaccination rates reach 97%, demonstrating the system's effectiveness.

This framework supports a healthcare environment that rivals, and often surpasses, those in many Western nations. The NHIS, which achieved universal coverage in 1989, now covers nearly 100% of the population for essential medical services. You can explore these statistics further through official OECD data.

How The National Health Insurance System Is Funded And Operated

Consider South Korea’s universal healthcare system, the National Health Insurance Service (NHIS), as a large-scale, shared financial trust. For any executive or investor, understanding its funding mechanism is key to appreciating its stability—and your role within it. It operates on a single-payer model, meaning the government, through the NHIS, acts as the primary financier for the nation's healthcare.

This system is not funded from general tax revenues. Instead, it is built on a principle of shared social responsibility, with funding derived directly from its members—that is, the entire population. This direct funding stream provides a robust financial base, insulating the healthcare infrastructure from the volatility of government budgets.

The Mandatory Contribution Model

It is critical to understand that enrollment in the NHIS is not optional. It is a legal requirement for all citizens and for any foreign national who has resided in the country for six months or more. This mandatory participation creates an extensive and diverse risk pool, which is fundamental to the system's financial health and long-term sustainability.

Contributions are not a flat fee; they are calculated based on your ability to pay, ensuring an equitable distribution of cost.

The contribution structure is divided into two primary categories:

- For Employees: For individuals on a company's payroll, a set percentage of the monthly salary is automatically deducted. The employer is required to contribute a matching amount. This is a predictable expense for both the individual and the business.

- For the Self-Employed and Others: For entrepreneurs, investors, or any individual not on a standard payroll, the calculation is more complex. Premiums are determined by a formula that assesses not only reported income but also assets such as property and vehicles. This ensures contributions scale appropriately with one's overall financial standing.

This dual approach ensures proportional contributions from all members, creating a stable and predictable revenue stream to meet the nation's healthcare needs.

Operational Efficiency And World-Class Outcomes

The single-payer structure affords the NHIS significant negotiating leverage. By acting as the sole purchaser, it can control the costs of medical services, pharmaceuticals, and equipment, mitigating the price inflation often seen in multi-payer systems. This centralized authority translates directly into public health results that should be of interest to any professional assessing a country's stability.

The system's efficiency is supported by data. South Korea delivers top-tier care with widespread access to advanced medical technology, all while avoiding the runaway costs that affect other developed nations.

This financial discipline enables the country to achieve world-class health outcomes. For example, South Korea’s emphasis on proactive care is evident in its low rate of avoidable hospital admissions, which stands at 144 per 100,000 people, significantly below the OECD average.

This demonstrates a system that is not merely reactive to illness but is actively engaged in prevention—a far more cost-effective long-term model. The country’s health spending was 9.7% of GDP in 2022, a figure that supports a robust system while remaining in line with the OECD average. These are not just statistics; they are indicators of a well-managed national asset, which you can examine further through analyses of the South Korean medical system. This lean, efficient operation is a primary reason South Korea's universal healthcare is regarded as a global benchmark.

Understanding Your Coverage Scope And Financial Exposure

Let us be precise: ‘universal’ healthcare in South Korea signifies universal access, not that all services are free of charge. For the discerning professional, this is the most critical distinction. You must understand precisely where the National Health Insurance Service (NHIS) defines its limits to accurately forecast your financial exposure.

While the system provides an excellent foundation of care, it was intentionally designed with specific limitations and cost-sharing requirements. It is not an all-inclusive financial shield.

The NHIS covers an extensive range of medical services—the bedrock of a healthy society. This includes physician consultations, diagnostics like blood tests and MRIs, hospital stays, and most prescription drugs. It also covers preventative care, such as health check-ups and cancer screenings, reflecting a strategic focus on early detection.

However, relying on assumptions is a flawed strategy. A clear-eyed view of what lies outside this generous scope is essential.

Identifying Key Exclusions And Limitations

For high-net-worth individuals accustomed to premium private care, the exclusions highlight the NHIS's public-system origins. The system draws a firm line between medically necessary treatments and those that are elective or non-essential. Overlooking these gaps can lead to unexpected and substantial expenses.

Services typically not covered by the NHIS include:

- Elective Cosmetic Procedures: Any surgery or treatment performed solely for aesthetic reasons is paid for entirely out-of-pocket.

- Advanced or Non-Standard Dental Care: While routine check-ups and extractions are covered, the NHIS does not typically cover complex procedures like dental implants, orthodontics, or high-end cosmetic dentistry.

- Experimental or Unproven Therapies: Cutting-edge treatments or drugs not yet approved by South Korean health authorities are generally excluded. This may limit access to the very latest medical innovations available elsewhere.

- Private Hospital Rooms: The NHIS covers a bed in a shared, multi-person ward. The cost of a private room, which can be significant, is borne by the patient.

- Select High-Cost Diagnostics: While most standard imaging is covered, some of the most advanced or non-essential diagnostic tests may not be fully subsidized.

This structure ensures the system's resources remain focused on essential health needs. For those who require a higher tier of service and choice, it creates a clear necessity for supplementary private insurance.

Quantifying Your Financial Exposure Co-payments And Maximums

Beyond direct exclusions, the NHIS operates on a co-payment model. Even for covered services, you are responsible for a portion of the bill. This is a deliberate feature designed to encourage responsible utilization of medical services and maintain the system's long-term financial stability.

The core principle is straightforward: while universal health care in South Korea protects you from catastrophic costs, it does not eliminate them entirely. Understanding your potential co-payment liability is a fundamental aspect of financial planning.

The amount you pay depends on the type of care you receive:

- Inpatient Treatment: Expect to cover approximately 20% of the cost of your hospitalization.

- Outpatient Care: Co-payments for visits to general hospitals typically range from 30% to 50%.

- Pharmacies and Clinics: For prescriptions and visits to local clinics, your share is generally around 30% of the total cost.

To prevent financial hardship from a major medical event, the system incorporates an annual out-of-pocket maximum. This cap is linked to your income level, creating a crucial safety net. However, for high-income earners, this "maximum" can still represent a considerable sum.

This financial reality makes it clear: the NHIS is a powerful public utility, but it is not a substitute for a robust private insurance strategy designed to manage these variables and provide complete financial peace of mind.

A Practical Enrollment Guide For Expatriates

Relocating to a new country involves administrative diligence, and for any senior professional, precision is paramount. In South Korea, enrolling in the National Health Insurance Service (NHIS) is not optional for long-term expatriates—it is a mandatory step for a seamless transition. The system is quite efficient at integrating foreign residents, provided you adhere to deadlines and have your documentation in order.

For most foreign nationals, enrollment in the NHIS becomes compulsory after you have resided in South Korea for six months. This applies broadly across visa categories, including D-8 investment visa holders and professionals on other long-term work permits. It is a legal requirement, not an elective benefit.

The Enrollment Timeline And Triggers

The primary trigger is the six-month residency rule. Once you cross this threshold, you are legally obligated to register with the NHIS. The process is not automatic; you must be proactive upon becoming eligible.

This requirement extends to your dependents, such as a spouse and children, who must also be enrolled under your policy. This is how your entire family gains access to the country's healthcare system. Delays in registration can result in liability for back-payment of premiums retroactive to your eligibility date, so timely action is advisable.

Required Documentation: The Non-Negotiables

Preparing your documents in advance is key to an efficient process. The single most important document for any foreign resident in South Korea is your Alien Registration Card (ARC), now often referred to as the Residence Card. This is the foundation of your NHIS application; without it, you cannot proceed.

To ensure your visit to the NHIS office is productive, gather these items beforehand:

- A Valid Passport: The original document is required for identity verification.

- Your Alien Registration Card (ARC): This proves your status as a legal, long-term resident.

- Proof of Residency: A document such as a recent utility bill or your rental contract is sufficient.

- Proof of Income (if applicable): If you are self-employed or an investor, you will need documents to verify your income for the correct calculation of your premium.

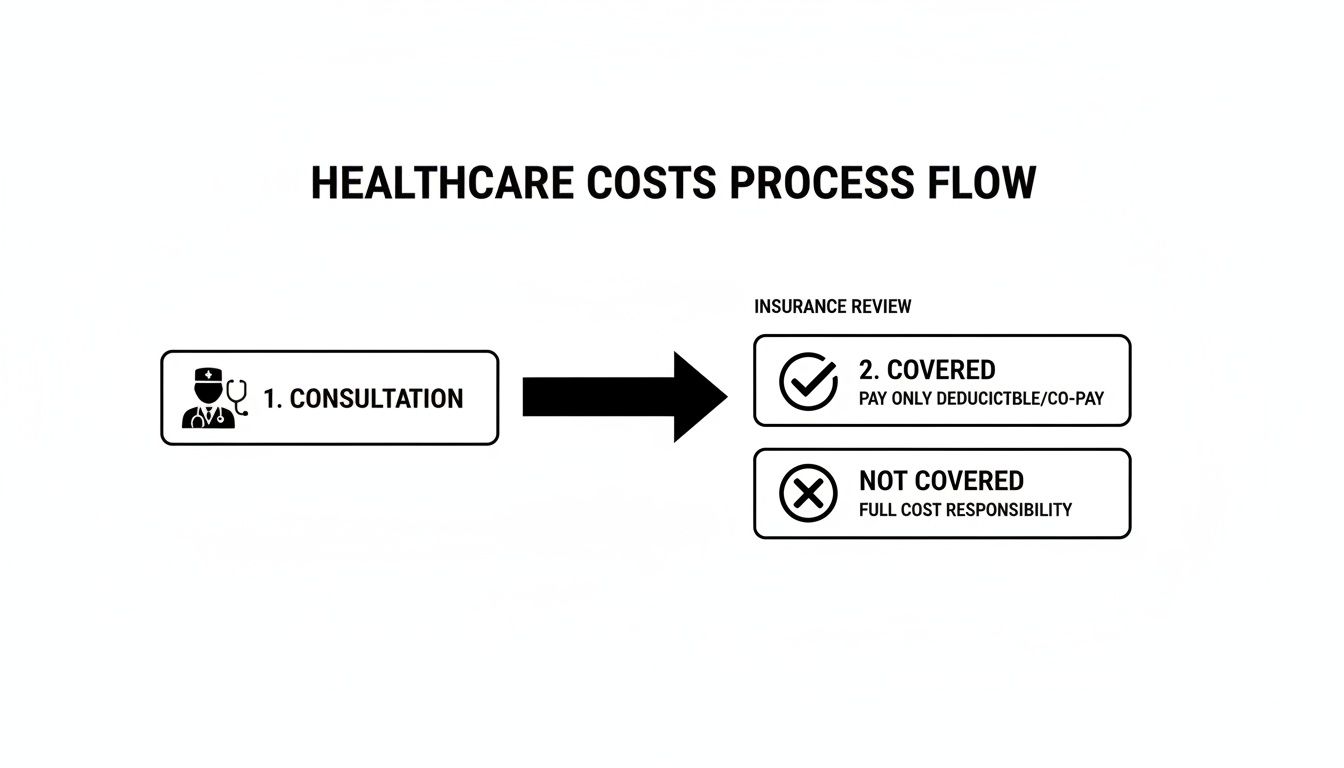

This chart provides a clear illustration of how costs are allocated within the healthcare system—what insurance covers versus what you will pay directly.

As shown, even with excellent NHIS coverage, you should anticipate some out-of-pocket expenses for non-covered services.

The Step-By-Step Registration Process

Once you have surpassed the six-month mark and have your ARC, the registration itself is remarkably straightforward. The process is handled in person, which helps ensure all details are entered correctly from the outset.

- Locate Your Local NHIS Office: Use the official NHIS website to find the branch that serves your residential area. Major cities like Seoul have numerous offices.

- Submit Your Application: Present your documents to the NHIS officer, who will guide you through the application form.

- Receive Your NHIS Certificate: Upon successful registration, you will receive a health insurance certificate immediately. Your official plastic NHIS card will be mailed to your address within a few weeks.

The bottom line: treat this enrollment as a critical component of your relocation checklist. Proactive completion prevents future complications and ensures you and your family can access the healthcare system as soon as you are enrolled.

This is, of course, just one element of the relocation process. For a broader perspective, consider our advice on preparing for your move abroad. By addressing these administrative tasks methodically, you can focus on your primary objectives in Korea.

What's The Real-World Quality Of Korean Healthcare Like?

Beyond policy and statistics, the pertinent question for any discerning professional is: what is the actual quality of care in South Korea? The system is lauded for its outcomes, but a closer examination reveals a landscape of significant strengths alongside tangible operational pressures.

This is not just a public service; it is a high-performance system with distinct advantages and certain vulnerabilities that warrant your understanding.

One of the most notable features is the widespread access to advanced medical technology and facilities. South Korea has one of the highest numbers of hospital beds in the developed world, with 12.8 beds per 1,000 people. This is substantially higher than the OECD average of 4.3 and generally translates to prompt inpatient care when required.

Furthermore, the country is a global leader in the adoption of sophisticated diagnostic tools. It is common for even smaller local clinics to possess MRI machines, CT scanners, and other high-end imaging equipment. For expatriates from Western countries where securing such scans can involve weeks or months of waiting, this level of immediate access is often a striking improvement.

Pockets Of Excellence And Systemic Pressure Points

South Korea's medical community has earned a global reputation in several key specialties. The nation’s specialists are particularly renowned for their expertise in complex cancer treatments, cosmetic and reconstructive surgery, and intricate organ transplants. This is a direct result of high patient volumes and a culture of relentless medical innovation.

However, this high-performance system has its trade-offs. A common frustration is the potential for long waits for non-urgent procedures or appointments with top-tier specialists. While emergency care is typically rapid and efficient, securing a consultation with a leading professor at a major university hospital can require considerable patience.

Objectively, one must acknowledge a dual reality. The average standard of care is exceptionally high, yet the system is strained by its own success. Universal coverage creates immense demand, which can lead to capacity challenges in certain high-demand specialties.

This dynamic creates a clear distinction. The public system is engineered for mass efficiency and excellent outcomes, not for the immediate, on-demand access one might associate with a premium private healthcare experience in other global business centers.

Physician Distribution And The Patient Experience

Another challenge is geographical. The vast majority of top specialists and advanced medical centers are concentrated in Seoul and other major metropolitan areas. While not unique to Korea, this means that accessing the same tier of specialized care can be difficult for those residing outside these urban hubs.

This urban concentration also fosters intense competition among hospitals, which drives quality upward but can sometimes result in a more transactional and hurried patient experience. Concurrently, it is contributing to a concerning shortage of physicians in essential fields like pediatrics, obstetrics, and emergency medicine, particularly in provincial areas.

For the globally mobile professional, the takeaway is clear. South Korea's universal healthcare provides an excellent, high-tech foundation, but it operates with certain constraints. It is a system designed for the collective good, not for bespoke, immediate service. Understanding this operational reality is key to deciding when and how to supplement this robust public system with private insurance to guarantee absolute control and immediacy of care.

The Strategic Case For International Private Medical Insurance

South Korea's universal healthcare is an excellent foundation for medical care. However, for a globally-minded executive or investor, relying solely on the National Health Insurance Service (NHIS) represents a significant strategic blind spot.

The NHIS is built for mass efficiency, not for the bespoke, immediate, and borderless care that senior professionals and their families demand. This is where International Private Medical Insurance (IPMI) becomes non-negotiable—a critical component of your personal risk management strategy.

Consider the NHIS analogous to a top-tier commercial flight: reliable, efficient, and safe. An IPMI policy, in contrast, is the private jet. It offers absolute control over your itinerary, timing, and service level, ensuring your healthcare experience meets the same exacting standards you apply to your business affairs.

Beyond Coverage Gaps: It’s About Control

The case for IPMI extends far beyond merely filling the co-payment and exclusion gaps. At its core, it is about reclaiming control over your health, your time, and your choices.

The public system, by its nature, involves queues, referrals, and inherent limitations. For an executive whose time is their most valuable asset, these delays are not just an inconvenience; they represent a significant cost. IPMI eliminates that friction.

It provides direct and immediate access to specialists without the need for a referral from a general practitioner. This translates to faster diagnosis and a more direct path to treatment—a factor that can be decisive when facing a serious health issue.

More importantly, it unlocks an unrestricted choice of physicians and hospitals, both within South Korea and globally. You are no longer confined to the NHIS network. If the world's foremost expert for your condition is in Singapore, London, or New York, a premier IPMI plan ensures you can consult them without concern for financial barriers.

Ensuring Global Standards And Financial Security

A crucial function of IPMI is bridging the gap between national standards and the global gold standard of medical care. This becomes particularly vital when considering high-cost experimental treatments or groundbreaking pharmaceuticals that may be approved in the US or Europe but are not yet available under the NHIS.

To put it into perspective, here is a direct comparison of the standard system versus a robust IPMI plan.

NHIS vs IPMI: A Strategic Comparison For Executives

| Feature | South Korean NHIS | International Private Medical Insurance (IPMI) |

|---|---|---|

| Choice of Doctor/Hospital | Limited to NHIS-approved network within South Korea. | Unrestricted choice of doctors and hospitals, worldwide. |

| Access to Specialists | Requires referral from a general practitioner, often with wait times. | Direct, immediate access to specialists without referrals. |

| Global Coverage | None. Coverage is domestic only. | Comprehensive worldwide coverage, including planned treatment abroad. |

| Medical Evacuation | Not covered. | Fully covered for evacuation to the nearest center of excellence or home country. |

| Coverage for Exclusions | Significant gaps in dental, vision, and advanced non-covered treatments. | Comprehensive coverage for dental, vision, and wellness. Access to treatments not yet approved locally. |

| Privacy & Comfort | Shared rooms are standard; private rooms incur high out-of-pocket costs. | Private rooms are guaranteed, ensuring comfort and discretion. |

This table makes the distinction clear. The NHIS provides a safety net; IPMI provides a strategic advantage.

An IPMI policy is not a luxury; it's an essential tool for protecting your most valuable assets—your health and your family's well-being—while safeguarding your financial portfolio from unforeseen medical liabilities.

Consider these other decisive advantages that a top-tier IPMI plan offers:

- Medical Evacuation: In a critical emergency, IPMI covers the substantial cost of evacuating you to a world-class medical facility or repatriating you to your home country.

- Comprehensive Ancillary Care: You gain extensive coverage for dental and vision care, far exceeding the minimal provisions of the NHIS.

- Privacy and Comfort: Guaranteed access to private hospital rooms provides the discretion and quiet environment essential for recovery.

Ultimately, the decision to supplement the public system is not merely about healthcare; it is a core element of prudent financial and personal planning. To understand how these policies are structured, you can explore detailed guides on international private medical insurance options. It is about building a framework that ensures no matter what happens, you and your family have immediate access to the best possible care, anywhere in the world.

Common Questions About South Korea's Healthcare

Even with a comprehensive overview, specific questions often arise when navigating a new healthcare system. For executives and investors, obtaining clear answers to these practical points is vital for a smooth transition. Here are some of the most common inquiries we receive.

Can I Choose My Own Doctor Or Hospital Under NHIS?

Yes, you have the freedom to choose your provider, but the system is designed to be used in a tiered manner. The National Health Insurance Service (NHIS) network is vast, encompassing nearly every hospital and clinic in the country, offering ample choice for general care.

However, the system encourages a structured approach. To consult a top-tier specialist at a major university hospital, a referral from a general practitioner at a local clinic is typically required. While it is possible to bypass this step and go directly to a major hospital, doing so will result in significantly higher out-of-pocket costs.

Are English-Speaking Doctors Readily Available?

In major urban centers like Seoul, it is common to find medical professionals who are fluent in English, particularly in larger hospitals and clinics that market to an international clientele. These facilities often have dedicated international patient centers staffed with coordinators to assist with appointments and billing.

Outside of these major cities, however, the availability of English-speaking staff decreases sharply. In smaller towns or local clinics, you should be prepared for potential language barriers. This is an area where the support network and translation services offered by an IPMI provider can be invaluable.

What Happens If I Need Medical Care Before NHIS Enrollment?

This is a critical point that often surprises expatriates. Prior to the completion of your mandatory NHIS enrollment—which occurs after six months of residency—you are 100% financially responsible for any medical care you receive.

While a minor visit to a local clinic may be affordable, an unexpected accident or sudden illness could result in a substantial financial liability. Securing a private international health insurance plan to cover this initial gap is not merely advisable; it is a non-negotiable component of responsible financial planning for your first several months in the country.

How Are NHIS Premiums Billed And Paid?

The payment process is straightforward and linked to your employment status.

- For Employed Professionals: Your contribution is calculated as a fixed percentage of your monthly salary and is automatically deducted from your paycheck. Your employer contributes a matching amount. The process is fully automated.

- For Self-Employed Individuals and Investors: You will receive a monthly bill directly from the NHIS. Your premium is calculated using a formula that assesses your declared income and assets, ensuring your contribution is proportional to your financial standing. This bill can be paid via automatic bank debit, online transfer, or in person at a local bank branch.

Navigating these details is precisely where expert guidance makes a difference. At Riviera Expat, we specialize in structuring international private medical insurance solutions that seamlessly complement South Korea's public system, ensuring you have absolute clarity and control over your healthcare. Explore how we can secure your peace of mind.