Let's clarify the terminology. Coinsurance is the specific percentage of a medical bill for which you are financially responsible after you have met your annual deductible.

Consider it a structured cost-sharing arrangement with your insurance provider. You are responsible for the initial portion of your medical expenses for the year (your deductible). Once that threshold is met, your insurer begins to cover a majority of the costs, and you share the remainder according to a predetermined ratio, such as 80/20. This is a fundamental mechanism through which your policy manages substantial medical expenditures.

What Coinsurance Means for Your Health Plan

Your health insurance is more than a recurring expense; it is a critical instrument for asset protection. Coinsurance is a key component of this instrument, dictating your precise financial liability in the event of significant healthcare needs.

It is not merely another fee—it represents a shared financial responsibility. After you have satisfied your deductible out-of-pocket, the cost-sharing mechanism activates.

A prevalent structure is an 80/20 plan. In this arrangement, the insurance company pays 80% of the allowed cost for a covered service, and you are responsible for the remaining 20%. It is imperative to understand that coinsurance applies only after your deductible is met. Prior to that point, you are responsible for 100% of the cost.

A Strategic Partnership with Your Insurer

Think of your deductible as your initial investment in your healthcare for the policy year. Once this "skin in the game" is established, your insurer becomes your financial partner for any subsequent covered services. This structure is designed to maintain manageable costs for all parties involved.

For individuals focused on sophisticated financial management, understanding coinsurance is not about memorizing definitions. It is about the ability to accurately calculate potential financial risk. This transforms your health plan from an opaque document into a predictable tool for safeguarding your wealth against unforeseen medical costs.

This partnership continues until you reach another critical figure in your policy: the out-of-pocket maximum. Understanding how your deductible, coinsurance, and out-of-pocket maximum interact is absolutely essential. For a comprehensive overview of your coverage, you can learn more about key policy terms for expatriates. This knowledge is what enables you to align your health plan with your broader financial strategy.

To make these concepts precise, let's break down how these terms compare side-by-side. The table below provides a quick reference to help you distinguish between the primary cost-sharing components of your plan.

Key Health Insurance Cost-Sharing Terms at a Glance

| Term | Definition | When It Applies |

|---|---|---|

| Deductible | The fixed amount you must pay out-of-pocket before your insurance begins to contribute. | Annually, for most covered medical services, before your plan's cost-sharing begins. |

| Coinsurance | The percentage of costs you share with your insurer for a covered health service. | After your annual deductible has been met, but before you reach your out-of-pocket maximum. |

| Copay | A fixed fee you pay for a specific service, such as a physician's consultation or prescription. | At the time of service, often independent of your deductible status. |

| Out-of-Pocket Maximum | The absolute upper limit you will pay for covered services in a plan year. | After this limit is reached, your insurer pays 100% of covered costs for the remainder of the year. |

Viewing them in this format clarifies the specific role each element plays in your total healthcare expenditure. Coinsurance is the crucial intermediate step, bridging the gap between meeting your deductible and being fully protected by your out-of-pocket maximum.

How Deductibles, Copays, and Coinsurance Work Together

To accurately forecast your healthcare expenditures, you must understand the interplay between your plan's components—the deductible, copays, and coinsurance. These are not arbitrary figures but a sequence of financial events, a relay where each component passes the baton to the next at a specific juncture.

Mastering this sequence is the difference between maintaining financial control and being blindsided by a substantial, unexpected liability. It is how you convert a complex policy document into a reliable tool for asset protection.

The Financial Sequence of Care

Imagine your health plan as a three-stage system designed to manage the financial impact of a medical event. Each stage must execute in the correct order for the system to function as designed. This sequence dictates who pays what—and when.

First is your deductible. This is the sum you are required to pay out-of-pocket for most covered services before your insurance company begins its contributions. It is the initial financial threshold you must clear each policy year.

Next is the copayment (or copay), which functions differently. A copay is a fixed fee for a specific service, like a physician's visit or a prescription, and is often paid regardless of whether you have met your deductible. These represent your predictable, per-service costs.

The most critical element of this sequence is recognizing that coinsurance only activates after you have fully satisfied your deductible. This is the main phase—the percentage-based cost-sharing that defines your true financial partnership with your insurer for significant medical costs.

While coinsurance is not a new concept, its role has expanded significantly, particularly in the U.S. since the 1980s, as insurers sought methods to manage rising healthcare utilization. Although nations with public health systems, such as Canada or the UK, employ different structures, coinsurance remains a dominant feature in private and supplementary insurance plans globally.

Differentiating Key Terms

Distinguishing these terms is essential. While all represent out-of-pocket expenses, their application varies significantly. To gain a deeper understanding of the distinction, particularly between the two most commonly confused terms, you can explore the nuances of Coinsurance vs Copay.

For a major medical event, the financial sequence almost invariably unfolds as follows:

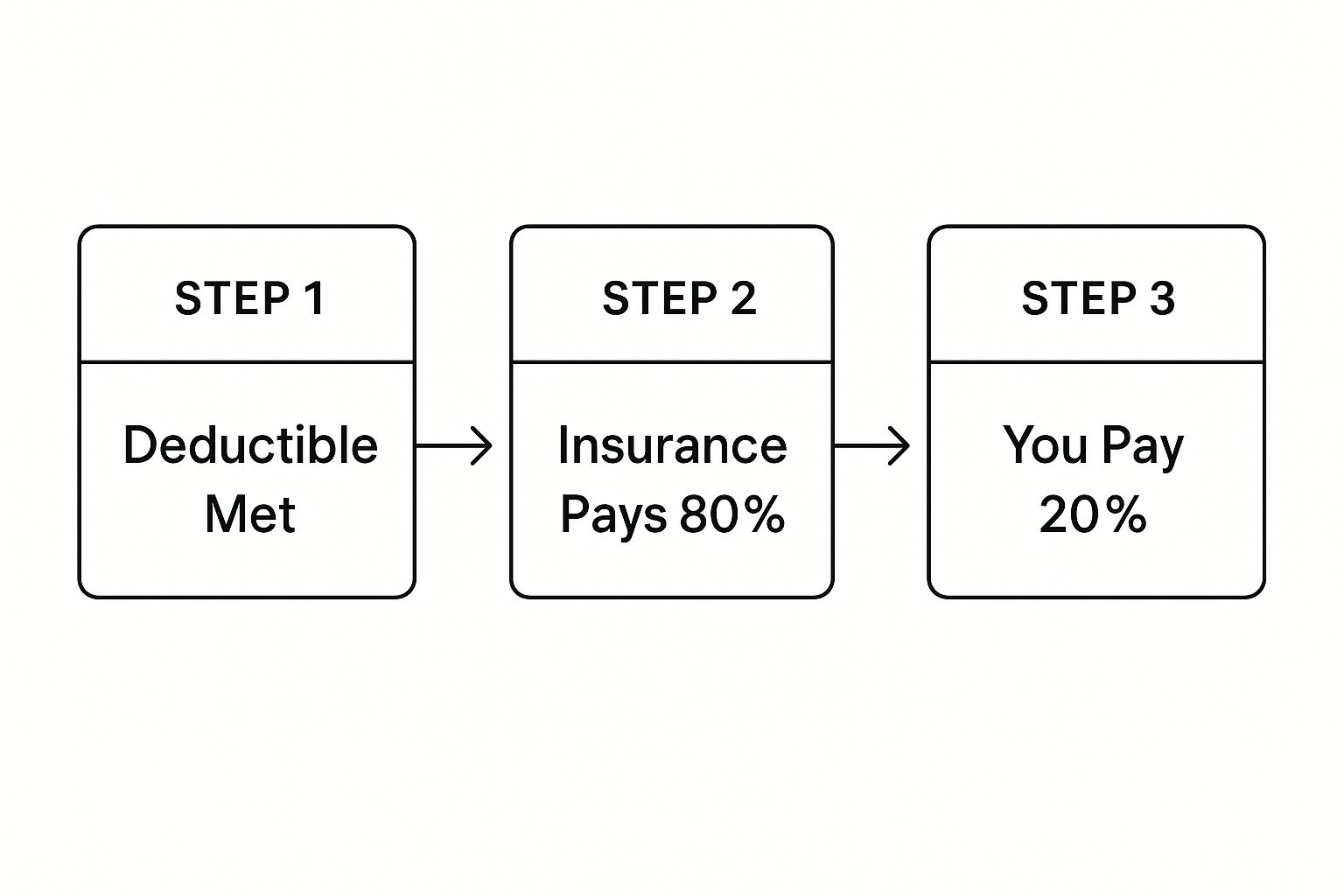

- Step 1: Meet the Deductible: You pay 100% of the allowed amount for services until you satisfy your deductible. The liability is entirely yours at this stage.

- Step 2: Initiate Coinsurance: Once the deductible is paid, cost-sharing commences. If your plan is 80/20, your insurer covers 80% of the bill, and you are responsible for the remaining 20%.

- Step 3: Reach the Out-of-Pocket Maximum: Your payments for the deductible, copays, and coinsurance all accumulate toward your out-of-pocket maximum. Upon reaching this limit, your payments cease for the year. Your insurer assumes 100% of eligible costs, placing a firm ceiling on your financial risk.

Calculating Your Costs: A Real-World Scenario

Abstract definitions are one matter, but observing how the numbers perform during a real medical event is where the practical application becomes clear. To fully grasp coinsurance, we must move beyond theory and into a practical, step-by-step financial breakdown.

Let's hypothesize that you require a complex, non-emergency surgical procedure with a total allowed cost of $150,000. Your health plan specifies a $10,000 deductible, an 80/20 coinsurance split, and a $25,000 out-of-pocket maximum. Here is the precise unfolding of your share of the cost.

The Initial Payment: The Deductible

Before your insurer contributes to the cost of this surgery, you must first satisfy your annual deductible. This constitutes your initial share of the medical liability.

- Total Bill: $150,000

- Your Deductible: $10,000

- Your Initial Payment: You remit $10,000 directly to the provider.

Once you have paid your deductible, the remaining $140,000 of the bill becomes subject to your plan’s coinsurance. This is where the cost-sharing partnership is truly activated.

Applying the Coinsurance Rate

With your deductible satisfied, the outstanding bill is $140,000. Now, the 80/20 coinsurance is applied. It is critical to remember that your 20% share applies to the remaining bill, not the original total.

This diagram illustrates the basic flow of payments after you have met your deductible.

As you can see, once your initial payment is made, the financial responsibility is divided between you and your insurer based on the plan's specific coinsurance percentage.

Let's perform the calculation:

- Remaining Bill: $140,000

- Your Coinsurance Share (20%): $140,000 x 0.20 = $28,000

- Insurer's Coinsurance Share (80%): $140,000 x 0.80 = $112,000

Based on this calculation, your portion would be $28,000. However, this is where the most important feature of your policy comes into play: the out-of-pocket maximum.

Hitting the Financial Safeguard

Your out-of-pocket maximum is the absolute ceiling on what you will pay for covered medical services in a policy year. It is a crucial financial safety net. This limit includes every dollar you have paid toward your deductible and coinsurance.

If we were to simply sum your costs so far, it would be your $10,000 deductible plus the $28,000 coinsurance share, for a total of $38,000. But your plan has a $25,000 out-of-pocket maximum.

This safeguard means your expenditure is capped. You cease paying once you reach that $25,000 limit.

Here is the final breakdown:

- Your Deductible Payment: You pay $10,000. This counts toward your out-of-pocket limit.

- Remaining Out-of-Pocket Limit: $25,000 – $10,000 = $15,000.

- Your Coinsurance Payment: You are only responsible for $15,000 of the calculated $28,000. Why? Because this payment brings your total expenditure to the $25,000 annual limit.

Once you have paid a total of $25,000 (your $10,000 deductible + $15,000 in coinsurance), your financial responsibility for covered care is concluded for the year. The insurance company then covers 100% of the remaining costs for that substantial bill.

This scenario clearly demonstrates why understanding your policy's limits is as vital as knowing the premium, a key factor we explore when explaining why medical insurance premiums rise year after year.

Understanding Your Out-of-Pocket Maximum

While coinsurance signifies you are sharing the cost of significant medical bills, this sharing is not indefinite. Every health plan contains a built-in financial safety mechanism: the out-of-pocket maximum.

Consider it the absolute ceiling on your financial liability for covered medical care within a single policy year. It is the most critical figure in your policy for protecting your assets from the unpredictable nature of healthcare costs. Once your spending reaches this limit, your insurance company assumes responsibility for 100% of all covered services for the remainder of the plan year.

This feature transforms a potentially unlimited financial risk into a predictable, quantifiable expense.

What Counts Toward Your Limit

Knowing what contributes toward that maximum is as important as the number itself. Not every dollar spent on healthcare advances you toward it. Prudent financial planning requires knowing precisely which payments apply.

Generally, the core cost-sharing payments you make are what reduce the remaining amount. This includes every dollar you spend on:

- Your annual deductible: The initial sum you pay before your plan’s cost-sharing activates.

- Your coinsurance payments: Your percentage share of medical bills after your deductible is met.

- Your copayments: The fixed fees for services like physician consultations or prescriptions.

Each time you make one of these payments, you are moving closer to that crucial ceiling.

The out-of-pocket maximum is your plan's definitive financial backstop. It transforms potentially unlimited medical expenses into a fixed, calculable risk, allowing you to integrate healthcare costs into your broader wealth management strategy with confidence.

What Is Typically Excluded

Conversely, certain expenses almost never count toward your out-of-pocket limit. Awareness of these exclusions is critical for accurately forecasting your total annual healthcare spending and avoiding financial surprises.

Common expenses that do not apply toward your out-of-pocket maximum include:

- Monthly Premiums: The fixed cost to maintain your policy is separate from your spending on actual medical care.

- Out-of-Network Care: If you consult a provider outside your plan's approved network, those costs often have a separate, much higher out-of-pocket limit—or may not count at all.

- Non-Covered Services: Any treatment, procedure, or drug that your insurance policy explicitly excludes from coverage.

Understanding this distinction is key to truly grasping the financial implications of coinsurance and your overall health plan.

Choosing a Coinsurance Rate to Match Your Strategy

Selecting a health insurance plan is a significant financial decision. The coinsurance rate is central to that choice, representing the core trade-off between your fixed monthly costs (premiums) and your potential out-of-pocket liability should you require substantial medical care.

This is not simply a matter of selecting a number. It is about aligning your policy's cost-sharing structure with your personal financial position and risk tolerance. Your choice fundamentally comes down to two main strategies, each with a distinct impact on your financial portfolio.

The Lower Premium, Higher Coinsurance Strategy

Opting for a plan with a lower monthly premium typically means accepting a higher coinsurance percentage, such as a 70/30 or 80/20 split. This strategy prioritizes minimizing fixed, predictable monthly expenses.

This approach is logical if you:

- Prefer to maintain high monthly cash flow: You would rather allocate more of your capital to other investments or objectives each month than to high insurance premiums.

- Do not anticipate high healthcare utilization: If you are in excellent health and do not foresee needing major medical services, you are essentially positioning yourself to avoid triggering the higher cost-sharing percentage.

- Are comfortable with a higher level of risk: You accept the possibility of a larger, unexpected bill in exchange for lower guaranteed costs throughout the year.

The objective here is to reduce definite, recurring expenses by shouldering a greater portion of the financial risk for major, but less certain, medical events.

The Higher Premium, Lower Coinsurance Strategy

Alternatively, you can select a plan with a higher premium, which typically offers a more favorable coinsurance rate, such as 90/10. This model involves a larger fixed monthly payment but dramatically reduces your financial liability after your deductible is met.

This is often the preferred strategy for individuals who:

- Prioritize predictability and budget stability: You would rather pay more each month for the assurance that your share of a large medical bill will be small and manageable.

- Anticipate needing more healthcare: If you or a family member has a chronic condition or a major procedure is planned, this structure can result in lower total costs for the year.

- Are risk-averse: Your primary goal is to place a firm cap on your financial exposure and shield your assets from the shock of a massive medical expense.

Choosing your coinsurance rate is a strategic financial exercise. It's about deciding whether you'd rather pay more in predictable premiums for greater protection or pay less upfront while assuming more of the potential cost yourself.

Coinsurance is a standard feature in U.S. private health insurance. For common services like in-network physician visits, it is typical for employees to face coinsurance rates between 10% and 30%. While the average coinsurance for single coverage in employer-sponsored plans is around 20%, this figure varies widely and significantly impacts household healthcare budgeting. More detailed data can be found in findings from the Medical Expenditure Panel Survey.

Ultimately, there is no single “best” coinsurance rate. The correct answer is entirely dependent on your personal situation and financial philosophy. For those of you evaluating options abroad, our guide on choosing the right expat medical insurance policy type for you may prove useful. This decision is about finding the optimal balance between your risk tolerance and your need for predictability.

From Confusion to Confidence: Owning Your Financial Health

Mastering the concept of coinsurance is not merely about learning insurance jargon. It is a critical step toward assuming control of your financial life. We have navigated the key distinctions between deductibles, copays, and the percentage-based cost-sharing of coinsurance, and we have seen how the out-of-pocket maximum serves as your ultimate financial safety net.

The objective is to place you in a position of command over your healthcare spending. When you master these concepts, your health insurance ceases to be a source of anxiety and becomes a powerful tool for wealth preservation, ensuring access to premier care when required.

A deep understanding of your policy’s mechanics transforms it from a financial black box into a predictable, strategic asset. It’s all about turning complexity into clarity.

This knowledge empowers you to evaluate any policy—its deductible, coinsurance rate, and out-of-pocket limit—and see precisely how it aligns with your financial reality. You can confidently select a plan that shields you from catastrophic costs, supports your long-term financial objectives, and provides genuine peace of mind. Your health plan becomes a predictable component of your financial portfolio, not an unpredictable threat.

Frequently Asked Questions About Coinsurance

Developing a firm grasp of health insurance is a core component of sound financial planning. Yet, even with a solid understanding of the fundamentals, specific questions inevitably arise, particularly when dealing with complex medical care or coordinating multiple insurance policies.

Let’s clarify some of the most common—and often perplexing—questions about how coinsurance functions in practical application. This will help you transition from theoretical knowledge to making astute financial decisions.

What Happens with Preventive Care?

This is a significant point of inquiry. How does coinsurance apply to preventive services? Fortunately, the answer is favorable.

Under most contemporary health plans, preventive care—such as annual physicals, routine cancer screenings, and certain immunizations—is covered at 100% before your deductible is applied.

This means you should not anticipate paying a copay or coinsurance for these specific services, provided you utilize an in-network provider. The intent is to encourage proactive health management without cost as a barrier.

A point of caution: if a preventive visit identifies a new health issue requiring diagnosis or treatment, those subsequent services could become subject to your deductible and coinsurance.

How Does Coinsurance Work with Multiple Policies?

It is not uncommon for households, particularly those with dual-income professionals, to have coverage under more than one health plan. In such cases, a process known as coordination of benefits (COB) determines the payment hierarchy. You do not select which plan pays first; established rules designate one plan as "primary" and the other as "secondary."

The primary plan pays its share first, as if it were your sole insurance. The secondary plan then assesses the remaining balance. It may cover some or all of the outstanding bill, including the amount you would have owed for coinsurance.

The outcome depends entirely on the specific terms of both policies.

Understanding how your plans coordinate is of paramount importance. Often, the secondary policy will cover the coinsurance liability you would normally incur. However, the precise amount it covers is dictated by the coordination of benefits rules detailed in the fine print of both insurance contracts.

Does Coinsurance Apply to Prescription Drugs?

Yes, absolutely. Coinsurance is frequently applied to prescription drugs, especially high-cost specialty medications.

While many common prescriptions involve a simple, fixed copay, more expensive or "non-preferred" drugs are typically classified into higher "tiers" within your plan's formulary (drug list).

Drugs in these upper tiers often require you to pay coinsurance instead of a copay. You might be responsible for 25% or more of a specialty drug's cost, even after meeting your deductible. This is a critical detail to investigate when selecting a plan, particularly if you anticipate needing specific or advanced medications, as the financial impact can be substantial.

At Riviera Expat, we specialize in demystifying these complexities for financial professionals. We provide expert, objective guidance to help you select an international private medical insurance plan that aligns perfectly with your financial strategy and personal needs. Get your free, no-obligation consultation today.