When structuring your international health insurance portfolio, your attention must focus on two pivotal figures: the deductible and the out-of-pocket maximum. A precise understanding of these concepts is fundamental to mastering your policy and ensuring it aligns with your financial strategy.

Consider the deductible as the initial capital you are required to outlay for medical services before your insurance carrier begins to contribute. Conversely, the out-of-pocket maximum serves as your ultimate financial safeguard—it is the absolute ceiling on your financial liability for covered services within a policy year.

Your Financial Levers in Global Health Insurance

When managing a significant portfolio of personal assets across multiple jurisdictions, every financial instrument must serve a distinct purpose. Your international private medical insurance (IPMI) policy is a critical component of this framework. Its efficacy is directly proportional to your command of its core financial mechanisms.

The terms "deductible" and "out-of-pocket" are frequently conflated, yet they represent two discrete stages of your financial responsibility. A misunderstanding at this level can lead to unwelcome financial surprises and result in a policy that fails to perform as anticipated.

Defining Your Initial Investment: The Deductible

The most accurate way to conceptualize your deductible is as your initial investment in your healthcare costs for a given policy year. It is a pre-determined sum, for instance $5,000 or $10,000, that you are obligated to pay from your personal funds before your insurer's coverage for most services is activated. This structure is intentional; it is designed to align your interests with those of the insurer, encouraging judicious use of medical services for minor concerns.

For a high-net-worth individual, selecting a deductible is a strategic decision. By opting for a higher deductible, you are effectively agreeing to self-insure for smaller, more predictable medical expenditures. The corresponding benefit is a significantly reduced annual premium. This is a calculated risk that allows your capital to remain productive, while ensuring premier coverage is in place for any major health eventualities. You can explore the fine print of these arrangements to gain a more detailed understanding of their practical application.

Establishing Your Ultimate Financial Shield: The Out-of-Pocket Maximum

Once your deductible has been met, you enter a phase of cost-sharing with your insurer. However, this arrangement is not indefinite. The out-of-pocket maximum represents the absolute, non-negotiable limit on what you will spend on covered medical care for the year. This figure is inclusive of your deductible and any other cost-sharing payments you make, such as copayments or coinsurance.

Your out-of-pocket maximum is the definitive ceiling on your financial exposure. Once you reach this threshold, your insurance provider is obligated to cover 100% of the cost for all other eligible medical care for the remainder of that policy year.

This mechanism transforms your health insurance from a mere payment plan into a formidable financial safeguard. It provides an unequivocal guarantee that even in the face of a significant health crisis, your personal assets are insulated from unbounded medical expenses. For any individual managing a global portfolio, this level of financial predictability is not merely advantageous—it is essential for maintaining peace of mind.

Deductible vs Out-of-Pocket Maximum At a Glance

To render the distinction perfectly clear, here is a direct comparison of the two primary cost-sharing components within your international health policy.

| Financial Component | Definition | Timing of Payment | Impact on Premiums |

|---|---|---|---|

| Deductible | A fixed amount you must pay for covered health services before your insurance plan begins its contribution. | At the commencement of your medical spending for the policy year. | A higher deductible typically results in a lower annual premium. |

| Out-of-Pocket Maximum | The absolute maximum you are required to pay for covered services in a plan year. It includes your deductible, copayments, and coinsurance. | After meeting your deductible, you continue to pay cost-sharing until this cap is reached. | This figure is set by the plan and functions as your ultimate financial protection. |

A thorough understanding of this table is paramount. The deductible is your initial financial threshold, while the out-of-pocket maximum is your final one for major medical expenditures each year.

How Your Deductible Shapes Your Premium

Your deductible is far more than the first medical bill you are required to settle. It should be viewed as the most powerful lever at your disposal for directly controlling the cost of your international health insurance premium.

This arrangement is, in essence, a financial partnership. By selecting a deductible, you are communicating to the insurer the extent of the initial risk you are prepared to assume personally. This, in turn, dictates the level of risk they assume from the outset.

The relationship is both simple and potent: the higher your deductible, the lower your annual premium. For any individual with robust cash flow, this presents a clear strategic advantage. A higher deductible indicates that you will personally cover smaller, routine medical costs, reserving the insurer's comprehensive coverage for a genuinely significant health event.

This calculated decision to self-insure for minor claims is one of the most intelligent methods for managing your premiums. It reduces the administrative burden and cost of frequent, low-value claims for the insurer, and these savings are passed directly to you. It is a strategic move that aligns your policy with a proactive wealth management approach.

Per-Claim vs. Annual Deductibles

Understanding how your deductible is applied is as critical as its monetary value. Within the premium IPMI market, you will generally encounter two structures, each with markedly different implications for a global citizen.

- Annual Deductible: This is the industry standard for sound reason. You have a single, fixed deductible amount (e.g., $5,000) to meet for the entire policy year. Every eligible medical expense you incur contributes to this total. Once met, the insurer begins covering costs for the remainder of the year.

- Per-Claim (or Per-Condition) Deductible: This structure is less prevalent but can present a significant financial liability if not identified. Under this arrangement, you are required to pay a separate deductible for each distinct medical event or condition. You might satisfy a deductible for a hospitalization in January, only to be required to pay a completely separate one for a different condition in July.

For most individuals who prioritize predictable financial planning, an annual deductible is the superior choice. It establishes one clear financial threshold for the year, simplifying the management of your deductible out of pocket expenses.

The Financial Logic of a Higher Deductible

To be clear: choosing a higher deductible is a deliberate financial strategy. By shouldering a greater portion of the initial costs, you are making a confident assertion about your capacity to manage routine health expenses independently. This approach is perfectly logical if you are in good health and view your insurance primarily as a safeguard against a major, unforeseen medical crisis.

By selecting a substantial deductible, you are not simply saving money; you are reallocating capital. The funds that would have gone toward a higher premium remain under your control, available for investment or other financial priorities, while your core protection against catastrophic events remains firmly in place.

This approach transforms your insurance policy from a simple line-item expense into an integrated part of your financial portfolio. However, it is important to remember that premium costs are not static. For a more thorough analysis, you can learn why medical insurance premiums rise year after year in our detailed guide. This context is vital for long-term planning and ensuring your deductible strategy remains effective over time.

The Out-of-Pocket Maximum: Your Financial Safety Net

If the deductible is the initial threshold you must cross, the out-of-pocket maximum is the ultimate destination. Consider it your definitive financial safety net. This figure represents the absolute maximum you will pay for covered medical services within a policy year.

For global executives and high-net-worth families, this is not merely a beneficial feature—it is an indispensable component of a sound financial plan. It converts a standard health insurance policy into a powerful instrument for asset protection. It provides the certainty required to budget for healthcare and insulates your wealth from a catastrophic health event that could otherwise create unlimited financial liability.

This is the definitive line between manageable costs and devastating financial risk.

What Counts Toward Your Out-of-Pocket Limit?

Reaching this ceiling is not a matter of paying a separate, ancillary fee. It is the sum total of all cost-sharing payments you make throughout the policy year.

Every dollar you spend on the following contributes to reaching that limit:

- Your Annual Deductible: The entire deductible amount serves as the first major contribution toward your out-of-pocket maximum.

- Copayments: These fixed fees for physician consultations or prescriptions are added to your running total.

- Coinsurance: This is your percentage-based share of costs after your deductible has been met. If your plan specifies 10% coinsurance, you will pay that percentage on all subsequent bills until your out-of-pocket maximum is reached.

Once the combined total of these payments reaches your out-of-pocket limit, your financial obligations for the year are complete. Your insurer then assumes 100% of all eligible costs from that point forward.

A Critical Tool for Wealth Preservation

For any individual with significant assets to protect, a lower out-of-pocket maximum delivers an invaluable commodity: peace of mind. While a plan with a lower cap will command a higher premium, this is often a strategic investment in financial certainty.

The out-of-pocket maximum acts as a circuit breaker for your personal finances. It guarantees that regardless of the scale of a medical crisis, your wealth remains shielded, allowing you to focus on recovery without the immense pressure of escalating medical bills.

This protection is particularly crucial in nations with exceptionally high healthcare costs. A prime example is the United States, where the 2023 Employer Health Benefits Survey from KFF highlights a significant financial burden on individuals. In 2023, the average annual deductible for single coverage was $2,051. Furthermore, 31% of covered workers now face deductibles of at least $2,000. A review of the complete survey findings underscores why a robust financial backstop is so essential.

Selecting the right deductible out of pocket maximum is not merely a healthcare decision; it is a core component of a sophisticated financial plan. It ensures your health and your wealth are equally protected, no matter where your global endeavors may take you.

Navigating a High-Value Medical Claim

Theoretical knowledge is one thing, but observing how these financial safeguards perform under the duress of a significant medical event is what truly matters. To fully grasp how your deductible and out-of-pocket maximum function in concert, let us examine a tangible scenario involving a major medical expense.

Consider an expatriate family residing in Singapore with a premium international health policy. Their plan is defined by three key financial parameters:

- A $5,000 annual deductible.

- A 10% coinsurance responsibility.

- A $15,000 out-of-pocket maximum.

During the policy year, a family member requires unforeseen surgery, resulting in a final hospital bill of $100,000. Here is a precise, step-by-step breakdown of how the financial responsibility is allocated between the family and their insurer.

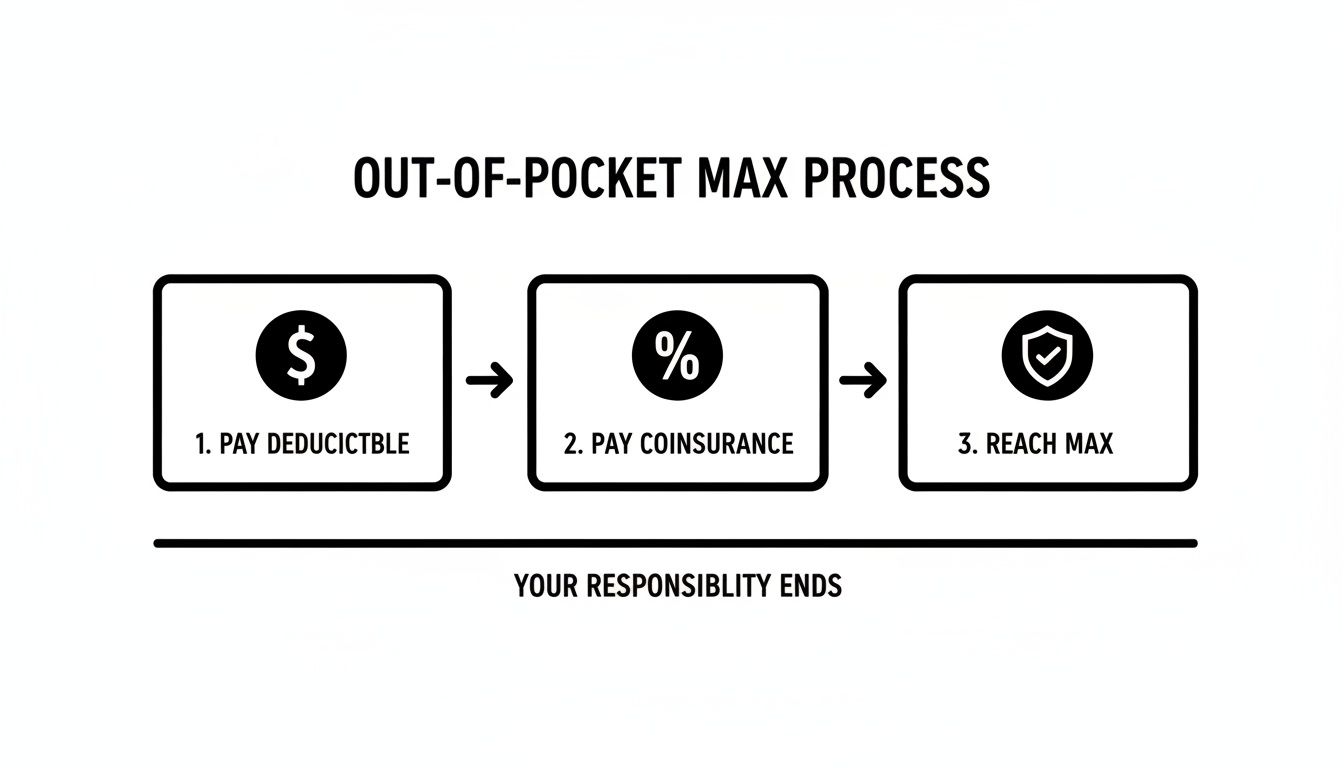

The path to reaching your out-of-pocket maximum is always sequential: first, you satisfy your deductible in full. Subsequently, you engage in cost-sharing via coinsurance until your total expenditure reaches that final cap.

This simple flow illustrates how each payment you make builds upon the last, ultimately triggering the complete financial protection afforded by the out-of-pocket limit.

Stage 1: The Deductible Payment

Your initial responsibility is always the deductible. Before the insurance company contributes any funds, the family must personally cover the initial $5,000 of the medical bill.

This payment acts as the key that unlocks the insurer's financial commitment. Once paid, their deductible is satisfied for the entire year, and they transition to the cost-sharing phase.

At this juncture, $95,000 of the $100,000 bill remains to be addressed.

Stage 2: The Coinsurance Phase

Now, the family and the insurer begin to share the cost of the bill. For every dollar of covered medical expenses, the family pays their 10% share, and the insurance company covers the remaining 90%.

Crucially, this cost-sharing is not perpetual. It applies only until the family's total spending for the year reaches their $15,000 out-of-pocket maximum.

Having already paid the $5,000 deductible, they are only required to pay an additional $10,000 in coinsurance before their financial obligation for the year is concluded.

Stage 3: Hitting the Out-of-Pocket Maximum

Once the family’s total payments ($5,000 deductible + $10,000 coinsurance) reach the $15,000 out-of-pocket limit, their financial responsibility for any further covered medical care falls to zero for the remainder of the policy year.

The insurer assumes complete financial responsibility, paying 100% of all remaining eligible costs. This is a powerful financial backstop. For a claim of this magnitude, it is also essential that you understand your policy’s protocols on pre-authorisation and direct settlement of claims to ensure a seamless process with the hospital and insurer.

To make this perfectly clear, let's deconstruct the $100,000 bill with a table.

Scenario Breakdown for a $100,000 Medical Bill

This table shows precisely how the costs are allocated as the family progresses through the deductible and coinsurance stages until they reach their maximum liability.

| Expense Stage | Amount You Pay (USD) | Amount Insurer Pays (USD) | Your Progress to Out-of-Pocket Max (USD) |

|---|---|---|---|

| Deductible (First $5,000 of bill) | $5,000 | $0 | $5,000 |

| Coinsurance (Next $100,000 of the bill) | $10,000 (Your 10% share, capped) | $85,000 (Insurer's 90% share + remainder) | $15,000 |

| Remaining Bill | $0 (Max reached) | $0 (Bill fully covered by above) | $15,000 (Maximum Reached) |

| TOTALS | $15,000 | $85,000 | $15,000 (Your Final Cost) |

As illustrated, once the family's total expenditure reached $15,000, their financial obligation was complete. The insurer was responsible for the remaining $85,000 of the original $100,000 bill.

This framework is a critical safeguard, transforming a potentially ruinous medical event into a predictable, capped expense. It is the ultimate financial shield in action.

Optimizing Your Policy for Your Global Lifestyle

Now that you have a firm grasp of your policy's mechanics, it is time to transition from theory to application. This is the stage where you actively engineer your international health coverage to serve your specific requirements. Structuring the optimal balance between your deductible out of pocket limits is not a generic formula; it is a highly personalized calculation based on your unique lifestyle and financial strategy.

This strategic alignment requires a dispassionate assessment of several key factors. Your family’s health profile, the frequency and destination of your travel, your primary country of residence, and your personal tolerance for financial risk are all critical inputs in this decision-making process.

Crafting a Strategy Aligned with Your Health Profile

First and foremost, your family's current and anticipated health needs must dictate your policy's structure.

For a young, healthy individual with substantial liquid assets, a high-deductible plan is often the most astute choice. This strategy lowers your fixed annual premium, freeing up capital while retaining robust protection against a major, unexpected medical event. You are, in effect, self-insuring for minor issues—a calculated risk that reflects a low probability of filing significant claims.

Conversely, for a family managing chronic health conditions or planning for a major life event such as childbirth, the financial calculus shifts entirely. In this scenario, cost predictability is paramount. A low-deductible, low-out-of-pocket plan becomes a strategic necessity. The higher premium is a deliberate investment in financial certainty, ensuring that ongoing treatments and specialist consultations are managed with minimal financial friction.

This decision has global implications. The real-world impact of out-of-pocket payments varies dramatically across the world. An analysis of 2019 WHO data reveals that such direct costs financed over 20% of healthcare systems in 100 countries—a threshold that significantly increases a family's risk of facing catastrophic medical expenses. While high-income nations averaged a more manageable 14%, the figure escalates in other regions, highlighting why your protection must be tailored to your geographical footprint.

The Role of Residence and Travel Patterns

Your geographical footprint is another critical component of this strategic puzzle.

If you reside primarily in a country with exceptional but notoriously expensive healthcare—such as Switzerland or the United States—a lower deductible out of pocket structure serves as a vital buffer against exorbitant costs. Similarly, frequent travel to jurisdictions with less predictable medical infrastructure may warrant a more comprehensive, low-deductible plan to ensure you never hesitate to seek high-quality care.

The core principle is straightforward: align your policy's cost-sharing structure with the economic realities of the locations where you are most likely to require medical services. This transforms your insurance from a generic safety net into a bespoke instrument for managing global risk.

For further insights on managing your health and lifestyle, which can indirectly influence your insurance needs, you can explore the articles on xlr8well's blog.

Collaborating with a Specialist Broker

The premier international health insurance policies are not simply purchased; they are constructed. The potential for customization within bespoke IPMI plans is extensive, allowing you to fine-tune every aspect of your coverage. It is here that partnering with a specialized broker becomes indispensable.

A highly skilled broker functions as more than a sales agent; they are your strategic advisor. They will assist you in dissecting your unique risk profile and financial objectives. They can then model different scenarios, demonstrating precisely how various deductible and out-of-pocket combinations would perform under specific circumstances. This collaborative process ensures your final policy is not merely a document, but a seamless extension of your broader wealth management strategy, providing you with clarity, control, and absolute confidence in your global healthcare protection.

Frequently Asked Questions

When dealing with premium international health insurance, the details are of the utmost importance. Here are some of the most common questions we receive from global citizens, with direct, precise answers to help you master your deductible out of pocket strategy.

Do Monthly Premiums Count Toward My Deductible or Out-of-Pocket Max?

No, they do not. This is a common point of confusion, but the answer is unequivocally no.

Your monthly premium should be viewed as the access fee required to keep your insurance policy active. It is the cost of maintaining coverage, not the cost of utilizing it. Your deductible and out-of-pocket maximum are only engaged when you actually receive medical care. Only the funds you spend directly on covered services—your deductible, coinsurance, and copayments—contribute toward meeting these financial thresholds.

Can My Insurer Refuse to Pay After I Meet My Out-of-Pocket Maximum?

Once you have reached your out-of-pocket maximum for the policy year, your insurer is contractually obligated to cover 100% of all subsequent eligible medical expenses. However, the operative word is "eligible."

Your insurer is not providing an unlimited line of credit. They can, and will, decline payment for certain items, even after you have met your maximum. This typically occurs under the following circumstances:

- Non-Covered Services: If your policy explicitly excludes a specific treatment (e.g., certain elective cosmetic procedures), you will always be responsible for the full cost.

- Out-of-Network Providers: Utilizing providers outside your plan’s approved network is a significant financial risk. Depending on your policy terms, you could be liable for a substantial portion of the bill, or even its entirety.

- Exceeding Benefit Limits: Some policies impose specific monetary limits on certain categories of care, such as physical therapy or mental health services. Once you exhaust that specific benefit cap, coverage for that service ceases.

The lesson is to always verify that a service is covered and the provider is in-network before receiving treatment. Reaching your out-of-pocket maximum provides exceptional protection, but only within the clearly defined parameters of your policy.

Is a Higher Deductible Always the Best Financial Strategy?

A high deductible is a powerful tool for reducing your monthly premiums, but it is by no means a universally applicable solution. Any advisor who suggests it is always the superior choice is providing incomplete counsel.

The optimal choice depends entirely on your personal financial situation and your anticipated healthcare requirements.

For a healthy individual with significant cash reserves, a high deductible represents a prudent, calculated risk. You are effectively self-insuring for minor expenses to keep your fixed costs low, thereby preserving capital for investment or other priorities. However, for a family with young children or an individual with ongoing medical needs, that same high deductible can become a source of financial strain. A lower deductible offers predictability, and that predictability itself is a valuable asset worth the higher premium.

The objective is to align your policy's cost structure with your life. This transforms your deductible out of pocket choice from a simple cost-reduction tactic into an integral component of your larger wealth management strategy.

Navigating these financial trade-offs is where expert guidance is indispensable. At Riviera Expat, we specialize in structuring international health insurance that fits perfectly with the financial plans of high-net-worth professionals. Contact us for a complimentary consultation and get clarity and control over your global healthcare strategy.