For high-net-worth individuals orchestrating a global lifestyle, securing the best international health insurance for expats is not merely a prudent measure—it is a foundational component of a sound asset protection strategy. Premier providers such as Cigna Global, Allianz Care, and GeoBlue have earned their distinguished reputations for valid reasons. They deliver genuinely robust worldwide coverage, extensive direct billing networks, and the caliber of premium service one expects.

A truly superior plan renders borders irrelevant, granting you seamless access to premier medical care whether you are in Singapore or Switzerland.

Securing Your Health as a Global Citizen

Relocating abroad demands a precise strategy for safeguarding your health and well-being. A critical reality many expatriates discover too late is that a domestic insurance policy or a standard travel plan is dangerously inadequate for a sophisticated international life.

Those plans are engineered for short-term emergencies and are strictly constrained by geography. Relying on them leaves you exposed to substantial financial risk and critical gaps in your ongoing care.

An international health insurance plan, by contrast, is architected from the ground up for a life that transcends borders. It provides continuous, comprehensive medical coverage—from routine consultations and preventative screenings to major surgeries and long-term treatment protocols—regardless of your location. This distinction is paramount when it comes to protecting both your health and your assets.

The Growing Demand for Global Coverage

The necessity for this specialized coverage is not merely anecdotal; market trends confirm the narrative. The global international health insurance market is expanding significantly, propelled by a growing expatriate population and the sobering reality of escalating healthcare costs worldwide.

Currently, group health plans constitute the majority of this market as more multinational corporations leverage these benefits to attract and retain premier talent. While North America and Europe have historically been the dominant markets, the Asia-Pacific region is now demonstrating the most rapid growth—a clear indicator of the increasing mobility of professionals from Asian nations. You can discover more about this growing market and its future projections.

For the globally mobile individual, international health insurance is not a luxury—it is a non-negotiable asset. It ensures that your standard of care remains consistently high, whether you are in a major financial hub or a remote destination.

Foundational Pillars of a Superior Plan

Selecting the right plan requires a discerning evaluation of several core components. A superior policy is invariably built on a foundation of clarity, flexibility, and absolute reliability.

When comparing your options, focus meticulously on these key elements:

- Comprehensive Global Network: You require access to a curated network of leading hospitals, clinics, and specialists who can communicate effectively in your language. The emphasis must be on quality, not just quantity.

- Extensive Coverage Limits: Seek high or unlimited annual maximums. This serves as your ultimate protection against a catastrophic medical event that could otherwise be financially devastating.

- Customizable Benefits: A premier plan allows you to build upon a solid core. You should have the option to add wellness, dental, vision, and maternity care to align with your specific requirements.

- Emergency Assistance: Do not overlook this critical component. Robust medical evacuation and repatriation services are absolutely essential for genuine peace of mind.

To aid in your evaluation, the following table breaks down the essential decision factors.

Key Decision Factors for Expat Health Insurance

This table summarizes the essential components to evaluate when selecting a premium international health insurance policy.

| Evaluation Pillar | Key Consideration | Why It Matters for Expats |

|---|---|---|

| Global Reach | Access to a broad, high-quality network of healthcare providers. | Ensures you can find trusted, English-speaking physicians and top-tier facilities wherever your life or business takes you. |

| Coverage Scope | High or unlimited annual limits; inpatient and outpatient care. | Protects your assets from the catastrophic costs of a serious illness or accident, which can rapidly escalate into the millions. |

| Plan Flexibility | Options to add dental, vision, wellness, and maternity modules. | Allows you to construct a policy that matches your personal and family needs without incurring costs for benefits you will not utilize. |

| Emergency Services | Comprehensive medical evacuation and repatriation benefits. | A non-negotiable safety net. It guarantees you can be transported to the best possible medical facility in an emergency. |

| Service & Support | 24/7 multilingual assistance and efficient direct billing. | Removes the stress and administrative burden of managing healthcare in a foreign country, particularly during a crisis. |

Ultimately, these pillars coalesce to form a sophisticated safety net that allows you to embrace your global life with confidence, knowing your health is in expert hands.

Understanding Your Core Coverage Options

To make a judicious investment in your health, you must first understand the architecture of a premium international policy. This is not about memorizing jargon, but about comprehending how each component protects you in adverse circumstances. A truly robust plan is built on distinct pillars of coverage, each playing a critical role in your global health security.

Envision your policy as a multi-layered shield. The most foundational layer—the absolute non-negotiable core—is inpatient and daypatient care. This is your fortress against the major, high-cost medical events that can disrupt your life and finances.

Inpatient care is activated for any treatment requiring formal admission to a hospital, whether for a single night or several weeks. This includes major surgery, a serious illness necessitating constant monitoring, or intensive recovery. Daypatient care applies to procedures where a hospital bed is required for the day but you return home the same evening, such as many minor surgical interventions. This is the bedrock of your protection against worst-case scenarios.

Distinguishing Inpatient and Outpatient Services

The next essential layer is outpatient care. This category encompasses virtually every other medical service that does not require hospital admission. In practice, this is the portion of your plan you will likely utilize most frequently for ongoing health management.

Whether you need to consult a specialist in Geneva, fill a prescription in London, or undergo an MRI, it all falls under outpatient services. Without this coverage, you would be paying out-of-pocket for every consultation and diagnostic test, and these costs accumulate with surprising speed.

A policy that delineates these two coverage types allows for much greater control. You can secure comprehensive inpatient coverage as your non-negotiable foundation, then determine the precise level of outpatient benefit you require based on your lifestyle and health profile. This imparts a more tailored and cost-effective structure to your plan.

Many of the top insurers, including Cigna Global and Bupa, design their plans with this modularity. They offer a core inpatient plan that can be augmented with an optional outpatient module. This flexibility enables you to craft a policy that fits your needs perfectly, ensuring you are not paying for superfluous benefits. For a more detailed understanding of the terminology, our guide on understanding the key terms of an expat medical insurance policy is an excellent resource.

Beyond Treatment: Wellness and Preventative Care

True health security is not merely reactive; it involves a proactive commitment to maintaining well-being. This is the role of wellness and preventative care benefits, a feature commonly found in top-tier plans from providers like Allianz Care.

This coverage is designed to identify potential health issues early and maintain your optimal physical condition. It typically includes services such as:

- Annual Health Screenings: Comprehensive check-ups to establish a baseline and monitor key health indicators.

- Vaccinations: Essential immunizations for general health and for travel to specific regions.

- Preventative Screenings: Lifesaving services like mammograms or colonoscopies that are critical for early detection of serious diseases.

Incorporating wellness benefits into your plan is a strategic decision. It demonstrates a commitment to your long-term health, not just insuring against a catastrophe.

The Critical Lifeline: Medical Evacuation and Repatriation

For any expatriate, this coverage is non-negotiable. If you are residing or traveling in locations where local healthcare infrastructure does not meet international standards, medical evacuation and repatriation are your ultimate safety net. These two services provide a lifeline when local medical facilities are incapable of managing your emergency.

Medical evacuation covers the expense of transporting you from your location to the nearest center of medical excellence equipped to provide the necessary treatment. This could involve a specially equipped air ambulance flight from a remote location to a major metropolitan hospital.

Repatriation, conversely, offers the option of transportation back to your country of nationality. This allows you to receive treatment and recover in a familiar environment, supported by family. The logistical complexity and costs of such an operation can easily exceed $250,000. This coverage is not a luxury; it is an indispensable guarantee that you will receive world-class care, no matter where you are.

Evaluating Global Provider Networks and Healthcare Quality

An insurance policy is a promise. Its true value is realized when you are unwell in a foreign country and require immediate, high-quality care. The bridge between that promise and its fulfillment is the insurer's provider network—the curated collection of hospitals, clinics, and physicians they partner with. This infrastructure allows you to enter a premier clinic in Hong Kong or a leading hospital in London and receive treatment seamlessly.

The best insurers do not simply amass a list of providers. They invest considerable resources in cultivating relationships with internationally accredited facilities and, critically, with English-speaking medical professionals. This meticulous vetting process is what distinguishes a superior plan. It is your assurance of a consistent standard of care, regardless of your global position.

Gauging Network Strength and Regional Quality

The quality of healthcare varies dramatically worldwide. A state-of-the-art hospital in one country might be situated near a poorly equipped clinic. Therefore, a crucial part of your due diligence is to investigate an insurer’s network within the specific countries where you will spend significant time. Do not merely consider the number of facilities; scrutinize their reputations.

Here is how you can conduct a thorough assessment:

- Verify Your Key Locations: Consult the provider’s online directory. Is your primary country of residence well-covered? What about the destinations you frequent for business or leisure?

- Identify Specialists: If you or a family member require specialized care—from a cardiologist, pediatrician, or oncologist, for example—confirm that the network includes highly-regarded experts in those fields.

- Confirm Direct Billing: A robust network is characterized by widespread direct billing. This arrangement, where the hospital bills the insurer directly, is a hallmark of premium service. It eliminates the need for you to settle a substantial bill out-of-pocket and await reimbursement.

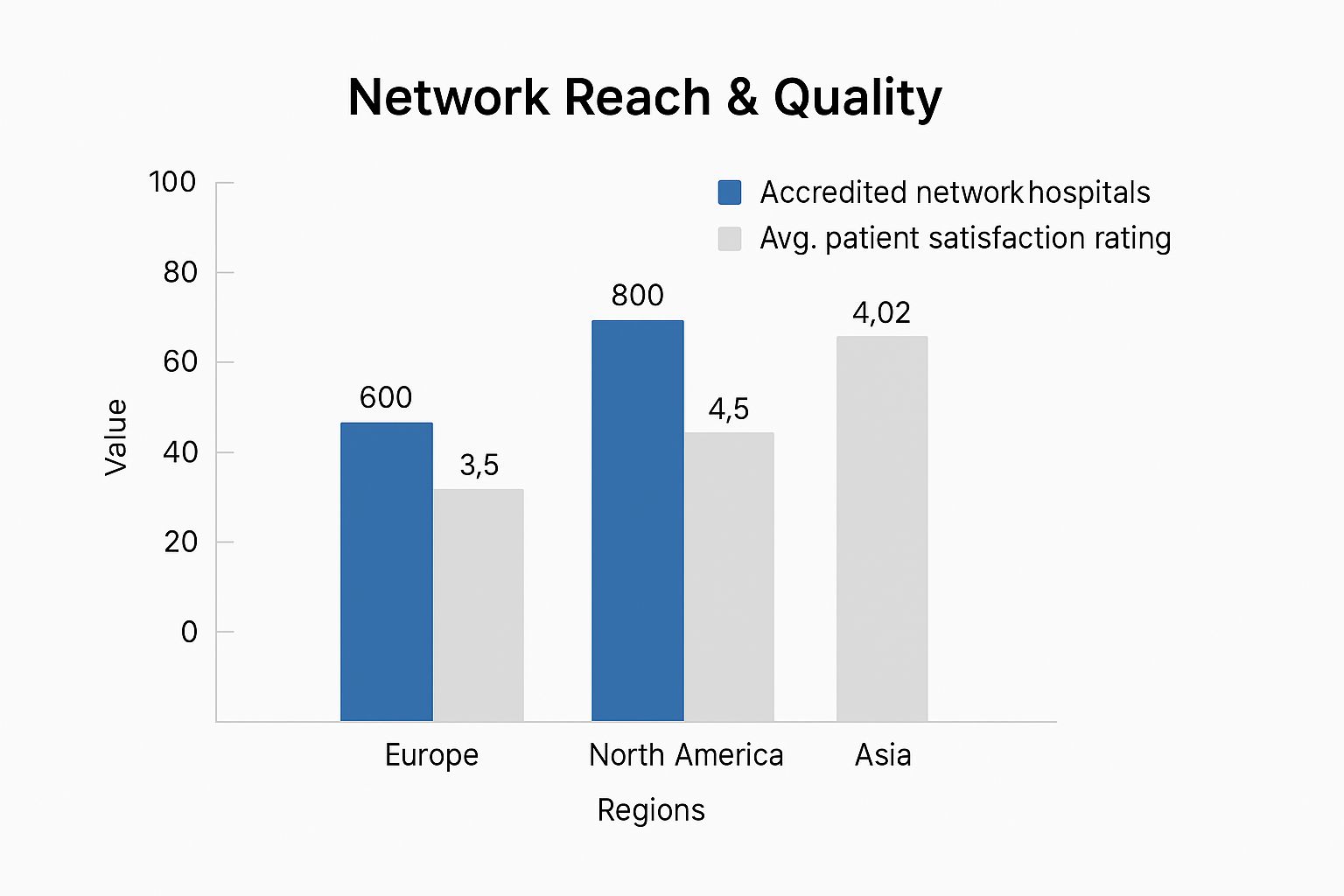

The chart below provides a high-level overview of how network size and patient satisfaction vary across major regions.

As illustrated, Europe is distinguished by its combination of extensive hospital networks and high patient satisfaction, making it a preferred region for many expatriates who prioritize exceptional healthcare.

Benchmarking Against World-Class Healthcare Systems

Certain countries set the global standard for medical care. The best insurance providers ensure their networks are deeply integrated into these top-tier systems. Consider Switzerland and the Netherlands, for example. They consistently rank among the best destinations for expat healthcare, blending mandatory private insurance with universal access to deliver outstanding quality.

In Switzerland, expatriates are required to secure health insurance within three months of arrival. The Netherlands mandates that all residents hold basic private health insurance. Both nations feature advanced digital health infrastructure, a high prevalence of English-speaking medical staff, and highly efficient claims systems. They represent the gold standard.

The strength of an insurer's network within a world-class healthcare system is a powerful indicator of its overall quality. If a provider has deep partnerships in countries like Switzerland, Germany, or Singapore, it reflects a commitment to excellence that likely extends across their entire global network.

While finalizing your core medical coverage, it is also prudent to consider other essential protections. This essential liability coverage guide is a valuable resource for fortifying your broader financial security.

A Practical Approach to Network Verification

Ultimately, you require absolute peace of mind—the knowledge that if a medical issue arises, excellent care is readily accessible. The only way to achieve this confidence is to verify it methodically yourself. Begin by compiling a list of preferred hospitals or specialists in your destination city, then confirm their inclusion in the insurer's network.

A well-organized network also facilitates a smoother experience across the board, from claims submission to pre-authorizations. To delve deeper, our insights on how medical networks operate can provide a more comprehensive understanding of this vital policy component. Selecting the best international health insurance for expats is not about finding the lowest-cost plan; it is about securing a policy backed by a network that delivers world-class care, wherever you are.

Analyzing Policy Costs and Financial Structures

To derive maximum value from your international health insurance, you must approach it as an investor would. Looking beyond the benefit summaries and into the financial architecture of the policy is where you gain real control. This is how you construct a plan that is not only powerful but also fiscally intelligent.

The final premium is not an arbitrary figure. It is the direct outcome of several key variables that you can adjust. Consider them as levers. Adjusting one may lower your premium but potentially increase your out-of-pocket exposure. Understanding how to balance these levers is the key to designing a plan that is perfectly aligned with your financial strategy.

While your age and medical history establish a baseline, the factors you can actively manage are often more impactful. The three most significant cost drivers within your control are your area of coverage, your deductible, and your annual coverage limit.

Deconstructing the Key Cost Drivers

The single most influential lever is your area of coverage. A policy providing worldwide coverage that includes the USA will invariably be the most expensive option. This is a direct reflection of the exceptionally high cost of American healthcare, where a single medical event can exceed the price of a luxury automobile.

By simply selecting a "Worldwide excluding USA" plan, you can reduce your premium substantially, often by 30-50%. For expatriates who do not anticipate needing medical care in the US, this is the most efficient method of optimizing costs without compromising the quality of care anywhere else in the world.

The next critical lever is your deductible, also known as an excess. This is the amount you agree to pay out-of-pocket for medical expenses each year before the insurer's liability begins.

By selecting a higher deductible, you signal to the insurer that you will manage minor expenses yourself, reserving the policy for significant, high-cost events. They reward this shared risk with a considerably lower annual premium. It is a strategic trade-off that places you in command of your financial exposure.

Increasing your deductible from, for instance, $500 to $2,500, can unlock significant premium savings. This allows you to keep more of your capital invested while remaining fully shielded from financially crippling medical expenses. For a detailed exploration of this mechanism, our guide on understanding policy excesses and deductibles provides a complete breakdown.

The Importance of High Annual Limits

While adjusting coverage areas and deductibles is a smart cost-management strategy, one area where you should never compromise is the annual coverage limit. This figure represents the absolute maximum your insurer will pay for your medical care within a policy year.

For high-net-worth individuals, opting for a plan with a low limit is a classic false economy. It introduces an unacceptable level of risk. A single major medical crisis—a complex surgery, a prolonged stay in an intensive care unit—can easily surpass the $1 million threshold.

It is therefore essential to select a policy with a substantial annual maximum, ideally $5 million or higher, or, even better, an unlimited cap. The marginal additional premium for this level of security is negligible compared to the catastrophic financial consequences of being underinsured. Premier providers like GeoBlue and Allianz Care structure their top-tier plans around high or unlimited maximums for precisely this reason.

Impact of Key Variables on Annual Premiums (Illustrative)

To observe how these levers function in practice, consider these examples. The table below illustrates how dramatically your choices can affect the final premium.

| Expat Profile | Coverage Area | Deductible | Illustrative Annual Premium |

|---|---|---|---|

| Banker in Singapore (35) | Worldwide excluding USA | $500 | $5,500 |

| Banker in Singapore (35) | Worldwide excluding USA | $2,500 | $4,200 |

| Trader in London (45) | Worldwide including USA | $1,000 | $9,800 |

| Trader in London (45) | Worldwide excluding USA | $1,000 | $6,500 |

As demonstrated, a single, informed decision regarding your deductible or coverage area can yield thousands of dollars in annual savings. By mastering these financial levers, you can craft a plan that delivers world-class protection and integrates seamlessly into your financial strategy.

Comparing Top-Tier International Insurance Providers

Selecting an insurer is not a simple transaction; it is the establishment of a long-term partnership for your well-being. Having deconstructed the architecture of these policies, let us now transition from theory to practice and examine some of the market's leading providers.

These companies are not merely recognizable brands; they have earned their reputations by consistently serving a discerning global clientele. Our analysis will look beyond marketing materials to focus on what truly matters: financial stability, claims efficiency, client service, and the standout features that define their plans.

This is not an exhaustive list, but a curated overview to help you align your expectations with the provider best equipped to meet them.

Cigna Global: A Leader in Flexibility

Cigna Global is a titan in the expatriate insurance sector, with its primary strength lying in the modular design of its plans. This "build-your-own" architecture is exceptionally effective. You begin with a robust inpatient core and then append only the benefits you require—such as outpatient care, wellness check-ups, or dental services.

Their flagship Platinum plan is particularly noteworthy, offering an unlimited annual maximum and highly comprehensive coverage for mental and behavioral health. This degree of flexibility is ideal if you desire total control over your policy's design, ensuring you do not pay for benefits you will never use. Cigna’s vast direct-billing network also streamlines the process of receiving medical care, significantly reducing administrative burdens.

GeoBlue Xplorer: The Choice for US Citizens Abroad

For American citizens residing overseas, GeoBlue provides a solution that is difficult to surpass. As an independent licensee of the Blue Cross Blue Shield Association, GeoBlue grants you access to the extensive BCBS network within the United States. This is a decisive advantage when returning home for visits.

Their Xplorer Premier plan distinguishes itself by offering unlimited annual and lifetime medical benefits, which affords extraordinary peace of mind. While their plans command a premium price, the value is found in the seamless integration between their international network and the US healthcare system. For any American expatriate who maintains strong ties to home, this is a critical feature.

Securing the right insurance is a key component of a successful life abroad. Despite the challenges of relocation, an informed choice in health coverage can significantly mitigate stress and enhance your well-being.

The expatriate journey is rewarding but presents unique stressors. A Cigna International Health study, Cigna 360 Well-Being Survey 2019: Well and Beyond, revealed that while 82% of expats feel financially secure, 84% report experiencing stress. This underscores the importance of choosing a provider that truly understands the challenges expatriates face. You can read the full research about these expatriate findings to gain a better understanding of this landscape.

Allianz Care: A Reputation for Service Excellence

Allianz Care has cultivated its sterling reputation on exceptional client service and steadfast support. Their approach can be described as high-touch. They provide dedicated case managers for serious medical situations and maintain multilingual support on standby 24/7. When navigating a stressful medical event in a foreign country, that level of personal attention is invaluable.

Their higher-tier plans are well-regarded for their coverage of chronic conditions and for offering extensive wellness and preventative care benefits. If you place a high value on a robust support system and concierge-level service, Allianz is a compelling choice. They ensure you feel like a valued client, not merely a policy number. Finding the best international health insurance for expats often comes down to this exact level of personalized, reliable attention.

Your Final Pre-Flight Checklist Before You Commit

Let us now address the final, critical steps. Selecting an international health insurance plan is a strategic decision to protect your health, assets, and peace of mind while living abroad. This is your final due diligence.

Consider this the final walk-around before a long-haul flight. We will verify every system, confirm every detail, and ensure the plan is perfectly aligned with your destination and needs. Executing this correctly allows you to move forward with complete confidence.

Personal Health and Lifestyle Audit

First, conduct a candid assessment of your personal circumstances. A premier insurance plan is ineffective if it does not match your actual lifestyle. This initial step grounds your search in your reality, not in a generic brochure.

- Disclose Your Medical History: Be entirely transparent about any pre-existing conditions for yourself or your family. You must know precisely how a potential insurer will handle them. Will they be covered in full? Will a waiting period apply? Or will they be excluded entirely? Do not assume—obtain written confirmation.

- Map Your Global Footprint: Where will you actually be? List your primary country of residence, but also include all other locations you frequent for business or leisure. This personal map is the tool you will use to assess the utility of the provider network and to select the correct area of coverage.

- Anticipate Future Needs: What does the next chapter of your life entail? Are you considering starting a family? Do you foresee the potential need for a specific treatment in the future? A well-designed plan offers the flexibility to evolve with you. Planning for these contingencies now is the difference between being prepared and being caught unprepared.

Financial and Policy Scrutiny

With the personal audit complete, it is time to adopt the mindset of a forensic accountant. We now shift from your needs to the specifics of the contract and its financial implications. This is where you identify hidden risks and confirm the plan is as robust as it appears on paper.

An insurance policy's true worth is revealed in its exclusions, not its list of benefits. The single best way to avoid an unpleasant surprise later is to read the fine print now. It is a tedious but essential exercise that aligns your expectations with what the insurer will actually deliver.

With this mindset, meticulously review the policy documents. Focus on definitions, limitations, and the precise procedures for filing a claim or obtaining pre-authorization. A transparent, clearly written document is often an indicator of a trustworthy provider.

Finally, compare your top quotes side-by-side, but look beyond the premium. Assess for value. Manipulate the deductible to see how it impacts your premium. And ensure the annual coverage limit provides genuine protection against a worst-case scenario. You should be targeting a limit of $5 million or higher. This is not about finding the cheapest option; it is about securing the best international health insurance for expats—a plan that is both exceptionally robust and financially intelligent.

Frequently Asked Questions

When navigating the complexities of international health insurance, several key questions consistently arise. Here are direct answers to the most critical inquiries from expatriates.

Does International Health Insurance Cover Me In My Home Country?

This is a crucial point, and the answer is nuanced: typically, yes, but only for short-term visits.

Your international plan is designed for your life abroad. Most premium policies will provide coverage in your country of nationality, but only for a limited duration, commonly 90 or 180 days per year. This is intended for holidays or family visits, not for permanent or semi-permanent relocation back home.

If you anticipate spending significant time in your home country, you must scrutinize the "home country coverage" clause. Some plans exclude it entirely, while others offer it as an optional rider. For U.S. citizens, obtaining coverage for time within the USA is almost always a separate, significantly more expensive module due to the high cost of healthcare there.

What Is the Difference Between Travel and Expat Health Insurance?

This is not a minor distinction; it is a fundamental difference in purpose. Conflating the two presents a massive risk.

Travel insurance is a short-term solution for emergencies. It is designed for a sprained ankle during a two-week vacation or an acute illness on a business trip. It is not structured for routine check-ups, management of chronic conditions, or any form of ongoing care.

Relying on travel insurance as an expat creates significant financial and health risks. It is a temporary solution for a temporary problem, not a sustainable strategy for someone living abroad.

International health insurance, conversely, is your comprehensive health plan for residing overseas for a year or longer. It functions like a domestic plan, covering everything from emergency surgery and specialist consultations to cancer treatment and wellness screenings. It is the robust, long-term protection required for a global life.

How Are Pre-Existing Conditions Handled By Insurers?

An insurer's approach to your medical history is a clear indicator of its quality. During the application process, you will undergo medical underwriting, where you disclose your health history. Based on this confidential review, the insurer may respond in one of four ways:

- Offer Full Coverage: They may accept you without exclusions, often with a higher premium to reflect the increased risk.

- Exclude the Condition: You are issued a policy, but it will not cover any costs related to that specific pre-existing condition.

- Impose a Waiting Period: Known as a moratorium, they may agree to cover the condition only after a set period, often 24 months, has passed without symptoms or treatment.

- Decline Coverage: For very severe or high-cost conditions, the insurer may determine that they cannot offer you a policy.

Absolute transparency on your application is non-negotiable. Concealing information can void your entire policy precisely when you need it most. Honesty ensures your coverage is sound and predictable.

This decision is too important to leave to chance. At Riviera Expat, we specialize in this domain. We assist financial professionals in securing the absolute best international health insurance, providing complete clarity and confidence in your choice. Contact us for a complimentary, personalized consultation today.