For financial advisors managing the sophisticated needs of high-net-worth individuals, family offices, and private wealth clients, a generic CRM is simply inadequate. Your technology must be more than a contact database; it must be a secure, intelligent partner that understands the nuances of complex household relationships, multi-generational wealth, and stringent compliance requirements. The right platform automates routine tasks, uncovers opportunities, and provides the 360-degree client view necessary to deliver the bespoke service that defines your practice.

This comprehensive guide moves beyond surface-level marketing claims to provide a direct, fact-checked evaluation of the best CRM for financial advisors. We will dissect the leading platforms, examining their specific strengths in security, integration capabilities, and compliance workflows. For financial advisors, successfully elevating client relationships often starts with effective lead acquisition, making strategies for mastering outbound lead generation crucial for sustained growth.

Each profile in this listicle includes a detailed analysis, screenshots, direct links, and an honest assessment of limitations to help you identify the precise solution that aligns with your firm's operational demands and strategic objectives. Our goal is to equip you with the insights needed to select a platform that not only manages client data but actively enhances your ability to build and preserve lasting, valuable relationships.

1. Salesforce Financial Services Cloud

Salesforce Financial Services Cloud (FSC) stands as the enterprise-grade solution for advisory firms managing significant complexity and scale. It extends the core Salesforce platform with a specialized data model built for wealth management, allowing advisors to track nuanced client details like household relationships, financial accounts, insurance policies, and critical life events in one unified view. This structure makes it one of the best CRM for financial advisors seeking a panoramic perspective of their clients' financial world.

The platform excels in process automation and compliance. Advisors can leverage features like Action Plans to standardize workflows for client onboarding or annual reviews, ensuring consistency and adherence to regulatory requirements. The extensive AppExchange marketplace provides unparalleled integration capabilities, connecting the CRM to portfolio management, financial planning, and marketing automation tools.

Key Considerations

- Ideal User: Best suited for large RIAs, broker-dealers, and family offices that require deep customization, robust security, and the ability to integrate with a wide array of fintech applications.

- Implementation: Due to its complexity, implementing FSC typically requires a certified Salesforce partner or a dedicated internal administrator to configure the platform to your firm's specific needs.

- Pricing: FSC is a premium offering. Pricing is per user, per month, and often involves additional costs for implementation, customization, and add-on applications.

Pros:

- Unmatched customization and scalability

- Vast integration ecosystem via AppExchange

- Advanced workflow automation and compliance tools

Cons:

- Higher total cost of ownership

- Steeper learning curve and implementation complexity

Website: https://www.salesforce.com/financial-services/financial-services-cloud/

2. Redtail CRM (Orion)

Redtail CRM has become a mainstay for independent financial advisors and RIAs, largely due to its straightforward design and wealth management-centric features. It strikes a balance between comprehensive functionality and ease of use, making it an accessible yet powerful tool for managing client relationships. The platform is designed around advisor workflows, offering robust contact management, task automation, and seminar tracking that align with the daily activities of a financial practice.

One of Redtail's most significant advantages is its extensive integration network with other key wealth-tech platforms, including financial planning software, custodians, and portfolio management systems. This deep connectivity allows for a more centralized hub of client information without requiring complex custom development. Features like built-in, compliant texting and document imaging add further value, particularly for firms focused on efficiency and regulatory adherence, making it one of the best CRM for financial advisors seeking a practical, all-in-one solution.

Key Considerations

- Ideal User: Best for small to mid-sized RIAs and independent advisors who need a robust, industry-specific CRM without the complexity and overhead of an enterprise-level system.

- Implementation: Known for its relatively quick and easy onboarding process. Most firms can be up and running within a short period, often without the need for specialized implementation consultants.

- Pricing: Redtail offers a competitive, straightforward pricing model based on a per-database subscription, which includes up to 15 users, making it a cost-effective choice for growing teams.

Pros:

- Fast onboarding and low learning curve

- Extensive integrations with essential advisor tools

- Compliance add-ons like texting are tightly integrated

Cons:

- UI is less customizable than enterprise suites like Salesforce

- Advanced analytics and reporting may require external tools

Website: https://redtailtechnology.com/

3. Wealthbox

Wealthbox has carved out a significant niche by offering a powerful yet refreshingly simple CRM designed specifically for financial advisors. Its modern, intuitive interface stands in stark contrast to more complex systems, allowing for rapid adoption with minimal training. The platform is built around a collaborative activity stream, which provides a social media-style feed of client interactions and team updates, making it easy for everyone in the firm to stay informed. This design philosophy makes it a leading contender for the best CRM for financial advisors who prioritize ease of use and team efficiency.

The platform’s strength lies in its combination of core CRM features-like contact management, tasks, and calendaring-with advisor-specific tools. Native workflows allow firms to standardize multi-step processes for client onboarding or account reviews, ensuring consistent service delivery. Furthermore, its two-way email sync and extensive integration network with over 150 fintech partners, including major custodians and financial planning software, create a highly connected and efficient operational hub for advisory practices.

Key Considerations

- Ideal User: Best for independent RIAs and small to mid-sized advisory teams seeking a modern, user-friendly CRM that requires minimal setup and training. Its collaborative features are excellent for close-knit firms.

- Implementation: Wealthbox is known for its straightforward onboarding process. Firms can often self-migrate data using provided guides, and the intuitive design reduces the need for extensive paid implementation services.

- Pricing: Wealthbox offers transparent, tiered pricing on a per-user, per-month basis. Its straightforward plans are generally more accessible than enterprise-level systems, making it a cost-effective choice.

Pros:

- Exceptional ease of use and high user adoption rates

- Robust integrations with key advisor technology

- Strong collaboration and workflow automation features

Cons:

- Less extensive customization options compared to enterprise platforms

- Reporting capabilities may be too basic for larger, data-intensive firms

Website: https://www.wealthbox.com/

4. AdvisorEngine CRM (formerly Junxure)

Built by advisors for advisors, AdvisorEngine CRM (formerly Junxure) is a long-standing platform known for its deep understanding of advisory practice management. It excels at delivering firm-wide insights and is designed around the specific processes independent RIAs use daily. The system provides robust, templated workflows for everything from client onboarding to complex estate planning, making it a strong contender for firms prioritizing operational efficiency.

The platform’s strength lies in its powerful dashboard and visualization tools, which offer a clear view of firm-wide activities, client engagement, and prospecting pipelines. This comprehensive overview helps principals and managers maintain a pulse on the business. For advisors seeking a solution that aligns closely with established financial service workflows out of the box, AdvisorEngine presents one of the best CRM for financial advisors options available.

Key Considerations

- Ideal User: Best for independent and growth-oriented RIAs that need a structured, workflow-driven CRM without the extensive customization requirements of an enterprise platform.

- Implementation: The system is more intuitive than enterprise solutions, but leveraging its deep workflow capabilities effectively may require dedicated training and a thoughtful setup process to align with firm procedures.

- Pricing: AdvisorEngine offers transparent, SMB-friendly pricing that typically includes unlimited document storage and priority support, providing clear value for growing firms.

Pros:

- Strong alignment with core advisory workflows

- Transparent pricing with robust support included

- Good adoption and reputation among independent RIAs

Cons:

- User interface is evolving and can feel operation-heavy

- Smaller integration catalog than Salesforce-based ecosystems

Website: https://www.advisorengine.com/wealth-management-technology/crm

5. Envestnet | Tamarac CRM

Envestnet | Tamarac CRM is built on the Microsoft Dynamics 365 platform, offering a solution designed specifically for independent RIAs that are deeply integrated into the Envestnet ecosystem. Its primary strength lies in its native connection to Tamarac's Reporting and Trading platforms, creating a unified hub for managing client relationships, portfolio data, and rebalancing workflows. This tight integration makes it an exceptional choice for firms seeking to streamline operations and eliminate data silos between their core systems.

The platform comes equipped with pre-built advisor workflows, dashboards for tracking Required Minimum Distributions (RMDs), and robust Microsoft 365 and Outlook integration. For advisors who heavily rely on portfolio management and trading functions, Tamarac provides a cohesive experience that many generic CRMs cannot match, solidifying its place as one of the best CRM for financial advisors focused on operational efficiency.

Key Considerations

- Ideal User: Best for mid-to-large-sized RIAs already using or planning to adopt the broader Tamarac suite for reporting and trading. It suits firms that prioritize seamless portfolio and custodial data flow within their CRM.

- Implementation: Implementation is typically managed by Envestnet's team, ensuring the CRM is correctly configured to sync with other Tamarac services and third-party custodians like Schwab.

- Pricing: Pricing is not publicly disclosed and is generally positioned for mid-to-enterprise-level budgets. The cost is often bundled with other Tamarac services.

Pros:

- Strong operational integration with portfolio management and rebalancing

- Enterprise-level support from Envestnet

- Frequent enhancements focused on advisor operations

Cons:

- Pricing not publicly listed; mid-to-enterprise budgets typical

- Best suited when using the Tamarac suite; less common as a standalone CRM

Website: https://www.envestnet.com/wealth-management/crm

6. Practifi

Practifi is an enterprise-grade practice management platform built on the Salesforce framework, specifically engineered for RIAs, family offices, and broker-dealers. It combines the robust power of Salesforce with a refined, advisor-centric user experience, delivering prebuilt workflows for critical processes like client onboarding, annual reviews, and compliance tracking. This makes it an exceptional choice for firms that want Salesforce's extensibility without building a custom solution from the ground up.

The platform stands out with its powerful analytics and reporting capabilities, enabling firms to track key performance indicators, manage centers of influence (COIs), and analyze referral sources with precision. Its architecture is designed to support complex, multi-entity firm structures, providing a unified view of clients and operations across different teams or locations. For discerning firms seeking a comprehensive and scalable solution, Practifi solidifies its place as one of the best CRM for financial advisors.

Key Considerations

- Ideal User: Best for growth-oriented RIAs, multi-family offices, and enterprise firms that need a turnkey, yet powerful, practice management system built on a scalable foundation.

- Implementation: Implementation is generally required to configure the platform to a firm’s specific processes and data needs, though Practifi is noted for its strong client success and support teams.

- Pricing: Pricing is not publicly listed and is quoted based on the firm's size and requirements. It is a premium platform compared to lightweight, out-of-the-box CRMs.

Pros:

- Combines Salesforce extensibility with an advisor-specific user experience

- Designed for multi-team and multi-entity firm structures

- Strong client success and onboarding support

Cons:

- Pricing is not public; implementation is usually required

- Heavier platform compared to lightweight SMB CRMs

Website: https://www.practifi.com/

7. SS&C Salentica (Elements and Engage)

SS&C Salentica offers two distinct CRM solutions, Elements and Engage, built upon the powerful foundations of Salesforce and Microsoft Dynamics 365, respectively. This unique dual-platform approach allows advisory firms to select a CRM that aligns with their existing technology stack and team proficiency. Salentica enhances these core platforms with a proprietary wealth management data model, providing pre-built configurations for tracking client relationships, financial accounts, and portfolio details in a comprehensive Client 360 view.

The platform is designed for firms that prioritize institutional-grade governance and process standardization. Its no-code automation builder includes templates for common advisory workflows, complete with access controls to ensure data integrity and compliance. Backed by the extensive infrastructure of SS&C, a global provider of financial services software, Salentica is a strong contender for firms seeking a robust, enterprise-level solution from an established industry player, solidifying its place as one of the best CRM for financial advisors.

Key Considerations

- Ideal User: Best for mid-to-large RIAs, broker-dealers, and asset managers requiring a structured, enterprise-grade CRM with strong governance and a choice between Salesforce or Microsoft ecosystems.

- Implementation: While pre-configured for wealth management, implementation often benefits from a dedicated project lead or partner to tailor the platform and manage data migration.

- Pricing: Pricing is not publicly available. Firms must engage with the Salentica sales team for a discovery process to receive a customized quote, which is typical for enterprise-focused solutions.

Pros:

- Choice of Salesforce (Elements) or Microsoft Dynamics (Engage) platform

- Backed by SS&C's wealth and asset management infrastructure

- Ideal for scaled RIAs and broker-dealers requiring strong governance

Cons:

- Pricing not public; sales-led discovery process is required

- Best value is typically realized with mid-to-large seat counts

Website: https://www.salentica.com/

8. Ebix SmartOffice (Ebix CRM)

Ebix SmartOffice carves out a specific niche as a CRM for financial advisors whose practices are heavily weighted toward insurance and benefits distribution. Originating from the insurance industry, its data model and workflows are built around managing policies, tracking commissions, and supporting producer activities. This makes it a strong contender for hybrid RIAs and insurance agencies where a standard wealth management CRM may lack the necessary depth for insurance-related processes.

The platform combines core CRM functionalities like contact and opportunity management with specialized tools for tracking insurance applications and commissions. Its long-standing presence in the industry means it has established integrations across the insurance and benefits ecosystem, facilitating data flow from various carriers and general agencies. This specialized focus provides a clear advantage for advisors managing complex insurance books of business alongside traditional investments.

Key Considerations

- Ideal User: Best for insurance-focused financial advisors, hybrid RIAs, and agencies that require robust tools for policy management, commission tracking, and producer-centric workflows.

- Implementation: Implementation is typically required to configure the system for your agency's specific product lines and commission structures. Pricing is generally provided upon sales request.

- User Experience: While functionally deep for its niche, the user interface can feel dated compared to more modern, cloud-native CRM platforms, which may present a learning curve for some teams.

Pros:

- Strong fit for insurance-heavy advisory practices

- Long industry presence with established support

- Emphasis on distribution and channel management

Cons:

- User interface feels dated compared to cloud-native tools

- Pricing by sales request; implementation required

Website: https://www.ebix.com/crm

9. XLR8 CRM (by Concenter) on Salesforce

XLR8 CRM offers a unique proposition for advisory firms that want the power of the Salesforce platform without the extensive setup costs and complexity of a ground-up implementation. Developed by Concenter Services, XLR8 is a pre-configured Salesforce overlay designed specifically for wealth management. It bundles Salesforce licensing with advisor-centric objects, workflows, and dashboards right out of the box, significantly accelerating deployment time. This makes it a compelling choice for firms seeking an enterprise-level foundation with a more guided and streamlined onboarding experience.

The platform comes equipped with integrations for common custodians, financial planning software, and document management systems, addressing core operational needs from day one. XLR8's approach provides a robust framework that still allows for customization, positioning it as one of the best CRM for financial advisors who need a balance between a ready-made solution and the long-term scalability of Salesforce. The included support and community resources via XLR8 Exchange add another layer of value for ongoing user education and system optimization.

Key Considerations

- Ideal User: Growing RIAs and wealth management firms that require the scalability and security of Salesforce but prefer a pre-built, industry-specific configuration with transparent pricing and strong implementation support.

- Implementation: The process is more streamlined than a custom Salesforce build. Concenter provides guided setup and data migration, though firms with highly complex or unique workflows may still benefit from a Salesforce administrator for advanced customizations.

- Pricing: XLR8 offers transparent, bundled per-user pricing that includes the underlying Salesforce license. This model simplifies budgeting, but it does require an annual commitment through Salesforce.

Pros:

- Combines Salesforce power with a specialized, out-of-the-box advisor setup

- Transparent, bundled pricing simplifies total cost of ownership

- Strong implementation support and dedicated educational resources

Cons:

- Requires an annual license commitment through Salesforce

- Highly complex custom work may still necessitate a dedicated Salesforce administrator

Website: https://xlr8crm.com/

10. HubSpot for Financial Services

HubSpot for Financial Services positions itself as the all-in-one customer platform for growth-focused RIAs who prioritize inbound marketing and sales automation. It leverages HubSpot's renowned marketing engine, tailoring it to help advisors attract, engage, and delight clients through a unified system. Rather than being a niche wealth management tool, it’s a powerful growth platform that excels at lead generation, nurturing, and converting prospects into long-term clients, making it an excellent CRM for financial advisors focused on scaling their business.

The platform integrates marketing automation, customizable deal pipelines, client service ticketing, and robust reporting into a single, intuitive interface. Its strengths lie in automating the entire client lifecycle, from the first website visit to ongoing service requests. The extensive integration marketplace allows firms to connect essential tools, while embedded AI features help streamline content creation and data analysis.

Key Considerations

- Ideal User: Best suited for independent RIAs and advisory firms that are heavily focused on digital marketing, content creation, and automating their sales and service processes to drive new client acquisition.

- Implementation: While the free tools are easy to start with, unlocking the platform's full potential often involves a strategic setup and potentially an onboarding fee for premium tiers to align the tools with your firm's growth objectives.

- Pricing: HubSpot offers a free CRM, but its powerful features are in the paid 'Hubs' (Marketing, Sales, Service). Costs can escalate significantly at the Professional and Enterprise tiers, especially as your contact list grows.

Pros:

- Starts with a robust free tier and scales with firm growth

- Best-in-class marketing and client lifecycle automation

- Comprehensive educational resources and support

Cons:

- Pricing can become substantial at higher tiers and with larger contact bases

- Onboarding fees and new seat models apply to some premium plans

Website: https://www.hubspot.com/financial-services

11. Zoho CRM for Financial Services

Zoho CRM for Financial Services is a highly configurable and budget-friendly solution, making it a strong contender for cost-sensitive advisory firms and teams. While not a dedicated, out-of-the-box system for wealth management, its flexibility allows firms to build custom modules and workflows that mirror their specific processes. This adaptability makes it one of the best CRM for financial advisors who prioritize affordability and are willing to invest time in initial setup.

The platform shines with its native integration into the broader Zoho ecosystem, connecting seamlessly with Zoho Books, Billing, and Expense for a unified front-to-back-office experience. Higher-tier plans introduce Zia, an AI-powered assistant that helps with task automation, data analysis, and workflow suggestions. With a vast marketplace of third-party integrations, firms can connect Zoho to essential marketing, planning, and communication tools.

Key Considerations

- Ideal User: Best suited for small to mid-sized RIAs and independent advisors who need a powerful, cost-effective CRM and are comfortable with a hands-on approach to customization.

- Implementation: The platform is user-friendly, but creating a financial services-specific environment requires a clear understanding of your firm's data and workflow needs. Third-party consultants are available to assist with complex builds.

- Pricing: Zoho offers highly competitive per-user, per-month pricing, often with significant discounts for annual billing. A free trial and even a free-forever plan for up to three users are available.

Pros:

- Very competitive pricing with a free trial and annual discounts

- Broad feature set including AI and extensive automation

- Strong native integration with Zoho's finance and back-office applications

Cons:

- Requires significant initial customization to fit advisor-specific needs

- Broker-dealer approval and compliance setup can be more complex than with industry-specific CRMs

Website: https://www.zoho.com/crm/solutions/financial-services/

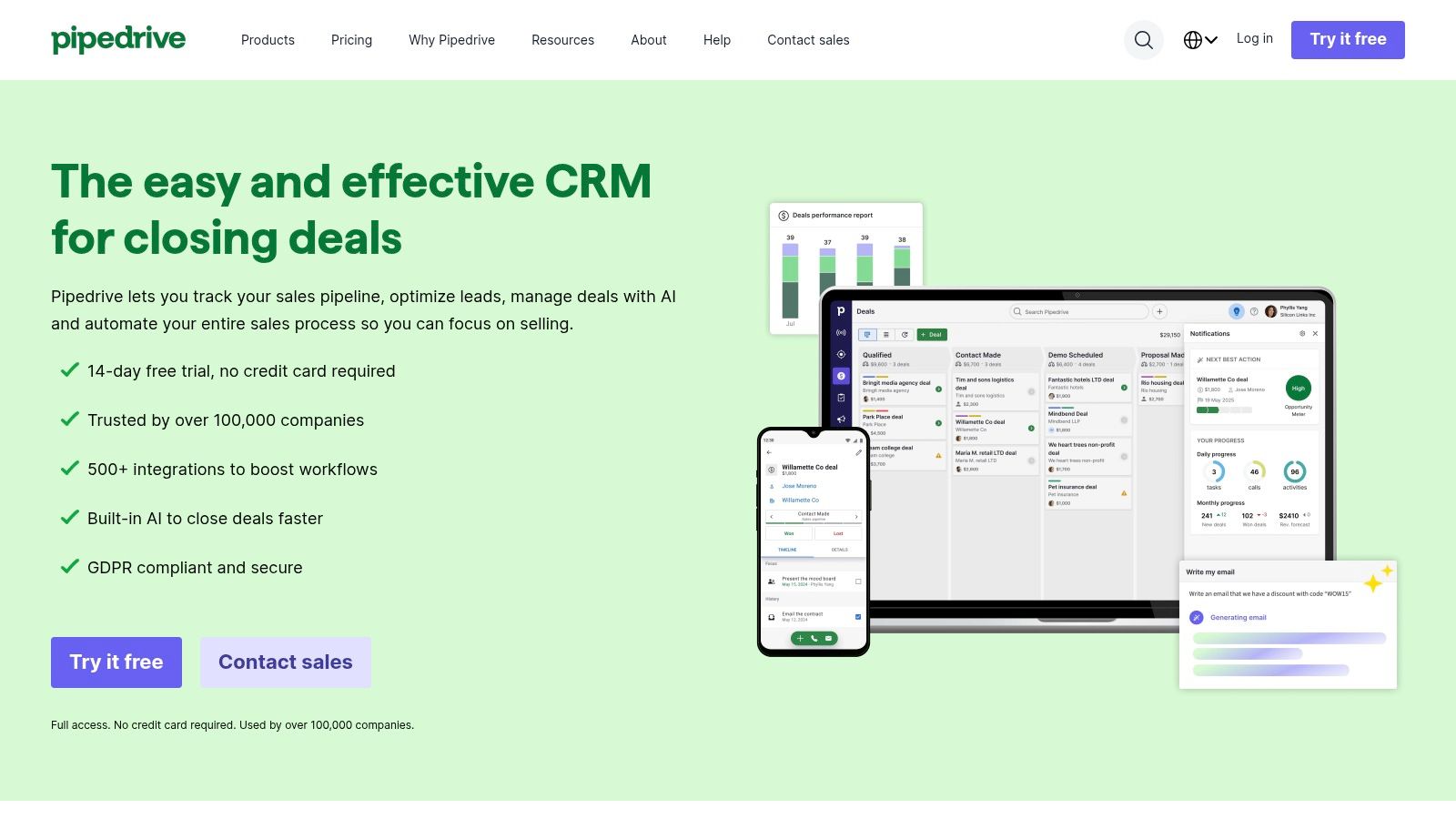

12. Pipedrive

Pipedrive is a highly intuitive, sales-focused CRM that has gained traction among solo financial advisors and lean RIAs for its powerful pipeline management. Its core strength lies in visualizing the entire client acquisition process, from initial contact to onboarding, allowing advisors to track prospecting activities with exceptional clarity. This visual approach helps prioritize efforts and ensures no potential client falls through the cracks.

While not built specifically for wealth management, its simplicity and robust integration marketplace make it a contender for the best CRM for financial advisors focused heavily on growth. With over 500 integrations and add-ons for campaigns and project management, firms can connect Pipedrive to their existing tech stack. Emerging AI features also help streamline sales activities and communications, making it a modern tool for business development.

Key Considerations

- Ideal User: Best for individual advisors, small RIAs, or firms where a strong emphasis is placed on prospecting and new client acquisition. It is excellent for those who value simplicity and a visual workflow over deep, industry-specific compliance features.

- Implementation: Deployment is remarkably fast. Most users can configure their pipelines and begin using the platform within a day without needing specialized technical support.

- Pricing: Pipedrive offers transparent and affordable monthly pricing tiers per user. Costs are predictable, though add-ons for lead generation or marketing will increase the overall investment.

Pros:

- Very quick to deploy and user-friendly

- Affordable and transparent monthly pricing tiers

- Good for prospecting-heavy firms or lead generation agencies

Cons:

- Not advisor-specific; requires compliance add-ons for regulatory needs

- Limited enterprise governance compared to wealth management platforms

Website: https://www.pipedrive.com/

Top 12 CRM Solutions for Financial Advisors: Feature & Pricing Comparison

| CRM Product | Core Features | User Experience / Quality | Value Proposition | Target Audience | Price Points / Notes |

|---|---|---|---|---|---|

| Salesforce Financial Services Cloud | Wealth-specific data model, automation, compliance workflows | Enterprise-grade, customizable, secure | Broadest integrations, mature compliance | Large enterprises & wealth managers | Higher cost; complex implementation |

| Redtail CRM (Orion) | Advisor workflows, integrations, compliance add-ons | Easy onboarding, mobile-friendly | Affordable, fast setup, compliance focused | Small to mid-size advisor firms | Competitive pricing |

| Wealthbox | Clean UI, team collaboration, 150+ integrations | Minimal training, user-friendly | Quick migration, broad integrations | RIAs, small to mid-size firms | Moderate pricing |

| AdvisorEngine CRM | Workflow engine, dashboards, engagement tools | Advisors-aligned, evolving UI | Transparent SMB pricing, strong adoption | Independent RIAs | SMB-priced, priority support |

| Envestnet | Tamarac CRM | Tamarac integration, Microsoft ecosystem | Operationally strong, enterprise support | Portfolio-integrated operations | Multi-advisor RIAs |

| Practifi | Salesforce-based, advanced analytics, workflows | Advisor-specific UX, onboarding | Multi-team support, strong client success | RIAs, multifamily offices, enterprises | Pricing private; requires implementation |

| SS&C Salentica (Elements & Engage) | Wealth data models, no-code automation, mobile access | Enterprise-grade, secure | Salesforce or Dynamics choice | Scaled RIAs, broker-dealers | Pricing private; best for mid-large firms |

| Ebix SmartOffice | Opportunity mgmt, commission tracking, insurance workflows | Established, less modern UI | Insurance-focused, distribution emphasis | Hybrid advisors, agencies | Pricing private; implementation needed |

| XLR8 CRM | Salesforce-based, prebuilt advisor workflows | Specialized setup, good support | Bundled pricing, Salesforce power | Advisors, wealth managers | Annual Salesforce license required |

| HubSpot for Financial Services | Marketing automation, deals, AI, integrations | Scalable, marketing focused | Free tier, inbound growth focus | Growth-focused RIAs | Free start; pricing rises with scale |

| Zoho CRM for Financial Services | Custom workflows, AI assistant, finance integrations | Budget-friendly, configurable | SMB suitable, strong finance linkage | Cost-sensitive advisor teams | Very competitive pricing |

| Pipedrive | Visual pipelines, automation, many integrations | Quick deployment, user-friendly | Affordable, good for prospecting firms | Solo advisors, lean RIAs | Transparent monthly pricing |

Making a Strategic Decision for Your Firm's Future

The journey through the landscape of CRM platforms reveals a clear truth: there is no single "best CRM for financial advisors" that universally fits every practice. The optimal choice is deeply personal to your firm’s unique structure, client base, and strategic ambitions. From the enterprise-grade power of Salesforce Financial Services Cloud to the focused, user-friendly design of Wealthbox, each solution presents a distinct set of capabilities and trade-offs. Your task is not to find a perfect system, but the one that most closely aligns with your operational DNA.

Recapping our analysis, we see clear archetypes emerge. Large, multi-advisor firms with complex needs and a desire for deep customization will gravitate towards platforms like Salesforce, Practifi, or AdvisorEngine. Conversely, independent advisors, RIAs, and smaller practices will find immense value in the streamlined efficiency and intuitive interfaces of Redtail CRM or Wealthbox. Platforms like Envestnet | Tamarac offer a compelling proposition for those seeking a deeply integrated, all-in-one wealth management ecosystem, while SS&C Salentica provides robust options for firms operating within the Microsoft or Salesforce environments.

Key Factors for Your Final Evaluation

As you narrow your selection, move beyond feature lists and consider the long-term partnership you are forming with a technology provider. Your final due diligence should focus on three critical pillars:

- Scalability and Future-Proofing: Does the CRM support your five-year growth plan? Consider its ability to handle more complex client segmentation, additional advisors, and integration with future technology you may adopt. A system that fits perfectly today may become a bottleneck tomorrow if it cannot scale with your success.

- Total Cost of Ownership (TCO): Look past the monthly subscription fee. Factor in one-time implementation costs, data migration expenses, mandatory training programs, and the potential need for third-party consultants. A seemingly affordable platform can become costly when the full scope of implementation is considered.

- Implementation and Data Integrity: The transition to a new CRM is a significant undertaking. The quality of the provider's onboarding support and the ease of data migration are paramount. Successfully moving decades of client history, notes, and financial data requires meticulous planning. Following the best practices for data migration is not just recommended; it is crucial for ensuring a seamless transition and maintaining data integrity from day one.

An Investment in Your Firm's Legacy

Ultimately, selecting a CRM is one of the most consequential technology decisions you will make. It is the central nervous system of your client relationships and the engine for your firm's operational efficiency. This choice will directly impact your ability to deliver the bespoke, high-touch service that high-net-worth clients expect and deserve. Approach this decision with the same rigor and foresight you apply to your clients' financial plans. By investing wisely in the right technological foundation, you are not just buying software; you are architecting a more resilient, efficient, and successful future for your practice.

As you structure your firm for international growth and serve an increasingly global client base, ensuring your own financial and residential arrangements are optimized is critical. Riviera Expat specializes in securing residency and citizenship through investment for discerning individuals, providing the same level of strategic, long-term planning you offer your clients. Explore how Riviera Expat can help you establish your global footprint with confidence.