For individuals who view health as a holistic asset rather than a series of isolated concerns, the pivotal question is direct: Do premier international health plans cover alternative therapies? The answer is increasingly yes—though it is accompanied by a specific set of stipulations. In this guide, we will analyze how leading International Private Medical Insurance (IPMI) plans are adapting to the growing demand for sophisticated treatments like acupuncture and osteopathy.

The State of Alternative Medicine Insurance Coverage

Alternative therapies have transitioned from the periphery to become a central component of wellness strategies for many high-net-worth individuals. These therapies are often seen as the essential element that solidifies a long-term, proactive health plan.

However, navigating the insurance landscape requires a specific understanding of its protocols. Even top-tier IPMI providers mandate:

- Clear medical justification for any prescribed treatment

- Documentation verifying an approved medical diagnosis

- A precise distinction between “therapeutic” and “wellness” services

Failure to meet these stringent criteria can result in a claim being delayed or denied during the underwriting process.

Distinguishing Covered vs. Excluded Therapies

Insurers typically classify treatments into three distinct categories. Understanding where your preferred therapies are positioned allows for more effective financial planning and policy comparison.

-

Commonly Covered Therapies:

Treatments supported by substantial clinical evidence and regulated by professional bodies. This includes chiropractic adjustments for back pain, osteopathy for musculoskeletal injuries, and acupuncture for specific pain management conditions. -

Conditionally Covered Therapies:

Modalities such as naturopathy or Traditional Chinese Medicine (TCM). Coverage is contingent upon the practitioner’s credentials and the precise terms outlined in your policy. -

Rarely Covered Therapies:

Services primarily aimed at relaxation or general well-being, such as aromatherapy, reiki, or crystal healing. These almost never qualify for reimbursement under a medical insurance policy.

Below is a brief overview of how these therapies typically fare under premium IPMI plans.

Common Alternative Therapies and Their Coverage Likelihood

| Therapy | Commonly Covered | Covered with Restrictions | Rarely Covered |

|---|---|---|---|

| Chiropractic | ✓ | ||

| Acupuncture | ✓ | ||

| Osteopathy | ✓ | ||

| Naturopathy | ✓ | ||

| Traditional Chinese Medicine (TCM) | ✓ | ||

| Reiki | ✓ | ||

| Aromatherapy | ✓ |

This snapshot helps to clarify which benefits to prioritize and where to anticipate out-of-pocket expenditures.

A Market in Transition

The economic data underscores this trend. The global complementary and alternative medicine market was valued at USD 117.2 billion in 2022 and is projected to continue its expansion. Insurers are responding to this demand, but reimbursement limits and strict criteria remain significant considerations for clients aiming to integrate these services into their ongoing health strategies.

The key takeaway is this: Securing alternative medicine insurance coverage requires a strategic approach. It is essential to select plans with explicit benefits for these therapies and to understand that insurers reimburse based on documented medical necessity—not generalized wellness objectives.

How Insurers Define and Classify Holistic Therapies

Securing reimbursement for alternative treatments from your health insurer hinges on one critical factor: communicating in their precise language.

To an insurance underwriter, terms like ‘complementary,’ ‘alternative,’ and ‘integrative’ are not interchangeable wellness concepts; they are technical classifications with significant financial implications.

Understanding these distinctions is paramount and often determines the outcome of a claim. It is the first and most critical step toward obtaining coverage for the treatments you value. A therapy's classification functions as its passport, informing the insurer of its purpose, its relationship to conventional medicine, and its eligibility for reimbursement.

Complementary vs. Alternative: The Decisive Distinction

The fundamental line for nearly every insurer is whether a therapy is used alongside conventional treatment or instead of it. This single factor is often the sole determinant for a claim's approval.

-

Complementary Medicine: These are therapies used to support standard medical care. For instance, utilizing acupuncture to manage nausea during chemotherapy. Because it enhances the efficacy of the primary, medically-approved treatment, it has a high likelihood of being covered.

-

Alternative Medicine: This refers to a non-conventional therapy that replaces standard medical care. An example would be using only an herbal formula to treat a diagnosed bacterial infection. Insurers almost invariably deny these claims, viewing them as a departure from established, evidence-based medical protocols.

The Power of an Integrative Health Model

Integrative health represents the optimal framework. It is a coordinated approach wherein conventional physicians and complementary therapists collaborate, combining methodologies to serve a specific patient's needs. This is not about choosing one discipline over another; it is about creating a unified, patient-centric treatment plan.

From an insurer’s perspective, an integrative framework is the gold standard. When a medical doctor recommends chiropractic care for lower back pain as part of a comprehensive plan that also includes physical therapy, the claim's legitimacy is significantly enhanced. It frames the therapy not as a peripheral add-on, but as a medically necessary component of a structured recovery strategy.

When considering how insurers view these treatments, it is also useful to note their approach to specific conditions. For example, while there are many natural remedies for bloating and other common discomforts, an insurer is unlikely to cover general wellness remedies. However, a therapy prescribed to treat a diagnosed medical issue has a much greater probability of reimbursement.

Why Certain Therapies Receive Preferential Treatment

The inclusion of chiropractic and osteopathy in many premium health plans is not arbitrary. Their acceptance is the result of decades of diligent effort to professionalize their fields, establish robust regulatory bodies, and accumulate a substantial body of clinical evidence that satisfies an insurer's rigorous risk models.

For a therapy to be widely covered, it typically must have:

- A Formal Licensing Body: This ensures practitioners are properly trained and adhere to high ethical and professional standards.

- A Clear Scope of Practice: This defines the specific conditions the therapy is qualified to treat.

- A Substantial Evidence Base: This requires clinical trials and peer-reviewed studies demonstrating the therapy's safety and efficacy.

Therapies lacking this formal infrastructure are often classified as "investigational" or "experimental" by insurers. Regardless of personal conviction, securing coverage for them will be challenging. Understanding this framework is key to aligning your wellness objectives with the realities of your insurance policy.

Meeting the Criteria for Insurance Reimbursement

Obtaining reimbursement for alternative medicine from your premier international health insurance is not a matter of chance. It is a process governed by highly specific rules.

Insurers operate on a strict, evidence-based framework, not on wellness trends or personal beliefs. A successful claim requires methodically satisfying every item on their non-negotiable checklist.

Consider it akin to submitting a formal business proposal. To gain approval, you must present an unimpeachable case supported by verifiable documents and professional medical endorsements. The strength of this case is what separates a promptly paid claim from a denial.

The Cornerstone of Coverage: Medical Necessity

The single most important rule is this: your insurer must classify the treatment as a medical necessity. Reimbursement is not provided for therapies used for general wellness, stress reduction, or personal preference. Coverage is almost exclusively reserved for treatments that directly address a diagnosed medical condition.

This is where a letter of medical necessity (LMN) from your physician is not merely helpful—it is indispensable. This letter serves as the official link between your chosen alternative therapy and a specific health issue, providing the credibility your insurer requires. It is the formal validation that legitimizes your claim.

A well-drafted LMN is more than a referral. It is a formal declaration from a medical doctor confirming that the prescribed therapy—whether chiropractic, acupuncture, or osteopathy—is an essential part of your treatment plan for a specific, diagnosed ailment.

The distinction is critical. A claim for a massage to alleviate general back stiffness will almost certainly be denied. However, a claim for the same therapy prescribed by an orthopedist to treat documented muscle spasms following an injury has a very high probability of approval.

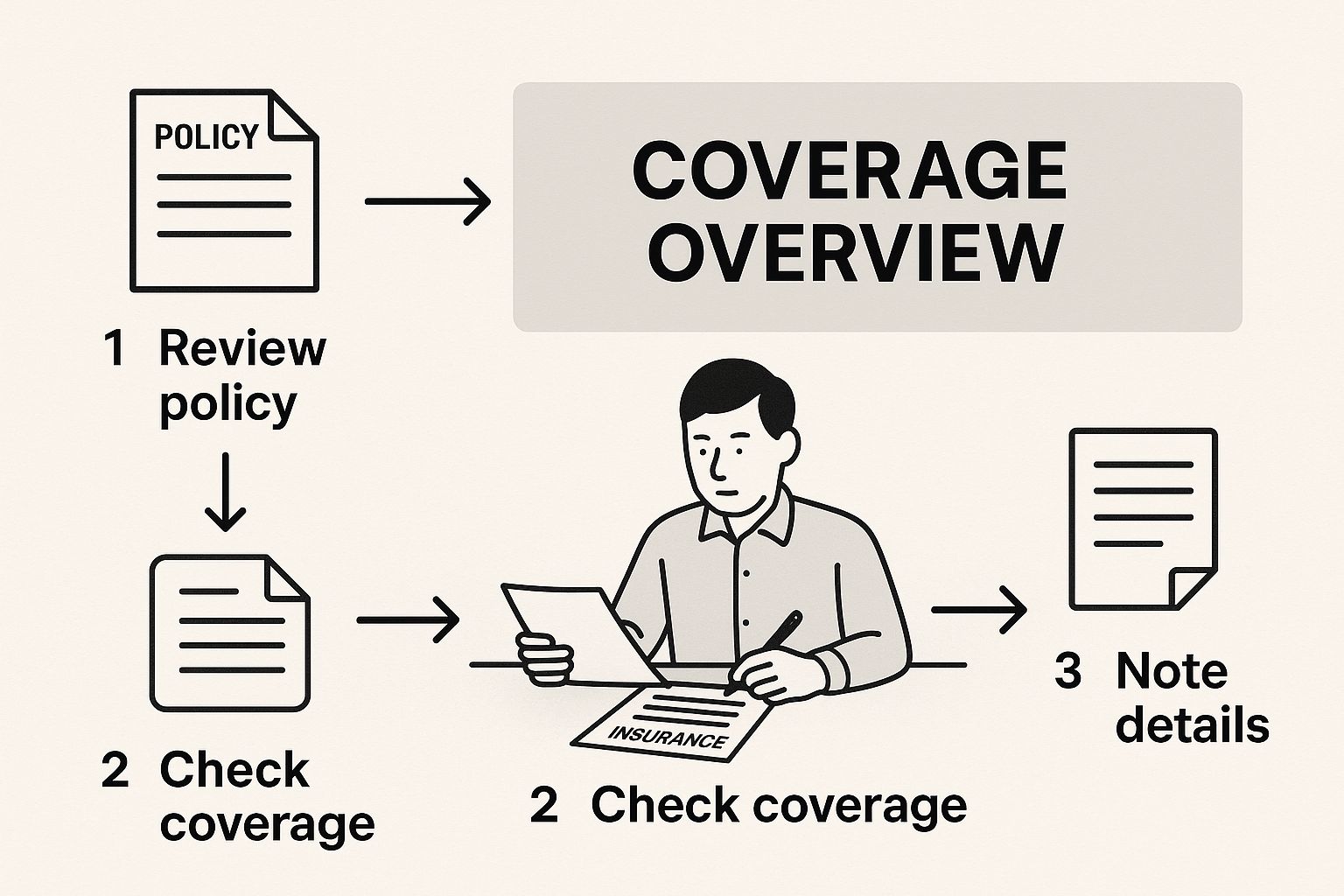

The infographic below illustrates the essential steps for reimbursement, highlighting the crucial role of medical necessity.

As shown, a successful claim invariably begins with a formal diagnosis and a physician’s referral. These are foundational steps that cannot be circumvented.

Practitioner Credentialing: The Mark of Trust

Beyond the reason for treatment, insurers meticulously examine who provides it. They will rigorously vet your practitioner’s credentials as a non-negotiable risk management measure.

Any provider of alternative therapies must be licensed, certified, and recognized by a professional governing body in their country of practice.

- Licensing and Certification: Your insurer requires definitive proof that the practitioner has met stringent educational and professional standards. This is their assurance of competent and safe treatment.

- Professional Recognition: Membership in a recognized professional association demonstrates adherence to a code of ethics and best practices, adding a further layer of credibility.

Before commencing a course of treatment, it is prudent to verify your practitioner’s credentials and confirm their recognition with your insurer. An otherwise perfect claim can be rejected solely because the provider does not meet the insurer’s strict standards.

Understanding Policy Limits and Exclusions

Finally, even when a treatment is medically necessary and the practitioner is fully credentialed, your policy will have defined limits. High-end IPMI plans are generous, but they are not without financial caps. These limits are clearly articulated in your policy documents and are designed to manage costs.

You will commonly encounter these types of limitations:

- Annual Monetary Caps: A maximum total amount your insurer will reimburse for a specific therapy per year (e.g., a $2,500 annual limit for acupuncture).

- Per-Visit Caps: A ceiling on reimbursement for a single session.

- Limits on Number of Visits: A cap on the number of covered sessions per year (e.g., a maximum of 20 chiropractic visits).

The global market for complementary and alternative medicine is projected to reach nearly USD 550 billion by 2030. A significant factor moderating this growth is limited insurance reimbursement, which often necessitates out-of-pocket payment. You can learn more about these market dynamics here.

By understanding these three pillars—medical necessity, practitioner credentials, and policy limits—you can proactively structure your claim for success. This approach transforms a potential point of friction into a smooth and successful reimbursement process.

Finding the Right IPMI Policy for Expat Wellness

For discerning expats and global citizens, International Private Medical Insurance (IPMI) is not merely a safety net—it is the foundation of a proactive, long-term health strategy. While a standard policy will cover emergencies, a truly premium plan should extend further, aligning with your personal commitment to integrative wellness.

Securing the right alternative medicine insurance coverage requires moving beyond marketing brochures to scrutinize the contract language. The objective is to identify a policy that genuinely supports your holistic health philosophy.

This is more complex than selecting a plan with an "alternative care" benefit. Top IPMI providers structure these benefits in vastly different ways. Your task is to find a policy that delivers practical, accessible coverage for the therapies you utilize. The devil is, as always, in the details.

Anatomy of a Wellness-Focused Policy

High-end IPMI plans that genuinely embrace holistic health typically structure these benefits in one of two ways. Understanding this distinction is key to selecting the appropriate plan.

-

Dedicated Complementary Medicine Rider: This is a specific, often optional, add-on to your main policy. It functions as a separate fund designated exclusively for therapies like chiropractic, acupuncture, or osteopathy. This provides absolute clarity on your limits but may have its own rules regarding practitioner networks.

-

Integrated Outpatient Benefits: Other top-tier plans incorporate alternative therapies into their general outpatient benefits. In this model, a visit to your chiropractor is treated identically to a visit to your GP, drawing from the same pool of funds. This can offer greater flexibility, but you must manage that budget across all your outpatient needs.

Each model has advantages. A dedicated rider ensures your conventional medical needs never deplete your budget for alternative care. Conversely, an integrated benefit may offer a much higher overall limit if the plan’s general outpatient coverage is substantial.

The optimal approach is to match the policy structure to your lifestyle and health needs. If you rely on osteopathy for managing a chronic condition, a plan with a significant, dedicated benefit is likely the most prudent choice. It insulates your core healthcare funds from being exhausted by routine wellness treatments.

Navigating Geographic and Practitioner Limitations

While your IPMI policy may be global, the recognition and licensing of alternative practitioners are not. A therapy that is mainstream and highly regulated in London might be considered experimental in Singapore. This geographic variance directly impacts claim reimbursement.

Before committing to a policy, you must consider where you are most likely to seek treatment. Insurers will only cover services from practitioners who meet the licensing standards of the country in which they practice.

This is particularly relevant for therapies that lack a single, global governing body. The credentials of a Traditional Chinese Medicine doctor, for example, are assessed based on the regulations of their specific country. A reputable IPMI provider will maintain clear internal guidelines on which international credentials they accept. A judicious step is to request a list of approved providers in your area before commencing any treatment.

For a broader perspective on selecting the right plan for your life abroad, our guide on choosing the best expat health insurance policies offers invaluable context.

Ultimately, choosing a plan that supports your wellness goals is an exercise in due diligence. It requires a forensic examination of policy documents to find one that doesn't just permit alternative care but actively facilitates it. By scrutinizing benefit structures and verifying practitioner recognition, you can select an IPMI plan that becomes a true partner in your pursuit of long-term health.

Mastering The Claims Process For Alternative Care

A world-class insurance policy is only as valuable as your ability to use it effectively. When it comes to alternative medicine insurance coverage, a precise and meticulous approach to filing claims is not just advisable—it is mandatory.

Mastering this administrative process ensures you derive the full value from your chosen therapies without the common delays and frustrations.

The first element to understand is the payment model. While an insurer may pay a hospital directly for a major procedure, alternative care nearly always operates on a 'pay-and-claim' basis. This means you pay the practitioner out-of-pocket first, then submit detailed paperwork for reimbursement.

Navigating Pay-and-Claim Reimbursement

Under this system, the burden of proof rests entirely with you. Your submission must be flawless, leaving no ambiguity for an adjuster to question. Think of it as constructing a legal case: your documentation is your evidence, and any missing piece can lead to a swift rejection.

To build an undeniable case for reimbursement, every document must be present and accounted for. Each piece serves a specific purpose, from proving medical necessity to confirming the therapist’s credentials.

A successful claim submission tells a complete and coherent story. It clearly explains to the insurer what treatment was received, why it was medically necessary, who performed it, and its exact cost. A missing element can invalidate the entire submission.

This is why a checklist is not merely a helpful tool; it is a critical component of your administrative strategy. For a deeper dive into these payment systems, you can explore the details of direct billing and pre-authorization procedures to better grasp the entire administrative landscape.

Your Definitive Submission Checklist

To construct an airtight claim, meticulously gather every document listed below before submission. This level of organization is your best defense against the administrative roadblocks that impede many claims.

Alternative Therapy Claim Submission Checklist

This checklist outlines the exact documents required to ensure a smooth reimbursement process for your alternative therapy claim.

| Checklist Item | Purpose | Action Required |

|---|---|---|

| Referring Physician’s Letter | Establishes the medical necessity for the therapy. | Obtain a signed letter from your GP or specialist that includes your diagnosis and recommends the specific alternative treatment. |

| Itemized Invoice | Provides a detailed breakdown of services and costs. | Ensure the invoice lists each service, the date of service, the cost per service, and the practitioner’s full name and title. |

| Practitioner Credentials | Confirms the provider meets your insurer’s standards. | The invoice must clearly display the practitioner’s official license or certification number. This is non-negotiable. |

| Proof of Payment | Verifies that you have settled the bill in full. | Include a copy of the credit card receipt or a bank statement highlighting the transaction. |

| Completed Claim Form | The official submission document for your insurer. | Fill out your insurer’s claim form completely and accurately. Double-check that all information aligns with your supporting documents. |

Adhering to this checklist will dramatically increase the probability of a prompt and successful reimbursement.

Anticipating And Overcoming Claim Rejections

Even with meticulous preparation, claims can be rejected. The most common reasons are administrative, not medical—for instance, a missing diagnosis code on the referral letter or submitting a claim for a practitioner whose credentials are not recognized by your insurer.

If your claim is denied, do not simply accept the outcome. You have the right to appeal.

A successful appeal begins with a professional inquiry to your insurer to ascertain the exact reason for the denial. From there, you can correct the specific error—whether it requires an updated form from your doctor or providing additional proof of your practitioner's license—and formally request a re-evaluation of your claim.

The Future of Integrated Health and Insurance

Looking beyond current policy frameworks, a clear and decisive trend is emerging. The growing demand for personalized wellness and preventative care is fundamentally reshaping the insurance industry. Your focus on integrated health is not a niche interest; it aligns precisely with the future trajectory of the market.

As discerning clients demand greater control over their long-term health, insurers are compelled to evolve. The traditional model—reactively paying for treatment after an illness occurs—is gradually being superseded by frameworks that incentivize proactive health management. This shift is driven by both client demand and the escalating costs associated with managing chronic disease.

The Rise of New Insurance Models

We are witnessing the emergence of insurance models that reward healthy behaviors. Imagine policies offering reduced premiums or dedicated wellness funds to clients who actively engage in preventative services.

These programs could completely redefine alternative medicine insurance coverage. In such a model, treatments like acupuncture or osteopathy shift from being a "benefit" to being a core component of an intelligent, preventative health strategy.

While these models are still in development, their underlying logic is sound. It is far more cost-effective for an insurer to support a client's health than to cover the expense of complex, late-stage treatments.

This marks a fundamental shift in mindset. Insurers are beginning to recognize the value of investing in a client’s well-being, not just insuring against their sickness. This positions proven alternative therapies as powerful tools for long-term health preservation and risk management.

Standardizing Evidence-Based Care

The distinction between "alternative" and "mainstream" medicine is progressively blurring, driven by rigorous scientific research. As more studies validate the efficacy of certain therapies for specific conditions, their integration into standard medical care becomes inevitable. This validation process is the key to unlocking broader and more consistent insurance coverage.

When a therapy like chiropractic care for lower back pain demonstrates clear, evidence-based results, it ceases to be "alternative." It becomes a medically accepted treatment protocol. This compels insurers to standardize their benefits, making coverage less of a variable and more of a predictable feature in high-quality health plans.

This change is gradual, but the momentum is undeniable.

Globally, persistent medical cost inflation is placing significant pressure on the insurance system. For 2024, medical costs were projected to increase by a global average of 9.9%. As insurers seek to manage these expenditures, the preventative and cost-effective nature of certain holistic therapies becomes increasingly attractive.

Your current focus on integrated health positions you to benefit from these shifts. By understanding why medical insurance premiums rise annually, you can appreciate the strategic value of a preventative approach. As the industry evolves, those who have already adopted a wellness-focused lifestyle will be the first to capitalize on the next generation of health insurance.

Frequently Asked Questions

Addressing the common questions surrounding alternative medicine and health insurance is key to making informed financial and health decisions.

Are Wellness Treatments Like Yoga or Meditation Covered?

Generally, activities such as yoga classes, meditation apps, or wellness retreats are not covered by standard health insurance policies. Insurers almost always link reimbursement to a specific, diagnosed medical condition.

However, some high-end IPMI plans are beginning to feature a separate 'wellness allowance.' This is a dedicated fund that can be used for such activities. While a valuable perk, it is a distinct benefit, separate from your core alternative medicine coverage.

Is Pre-Authorization Required for Alternative Treatments?

For most routine alternative therapies, such as a chiropractic adjustment or an acupuncture session, pre-authorization is not typically required, especially under a pay-and-claim system. It is not analogous to scheduling major surgery.

That said, it is always prudent to review your policy or contact your insurer before beginning a new course of treatment. A brief conversation can prevent significant administrative complications and ensure you understand the precise requirements for reimbursement.

How Is Coverage for Therapies Supporting Cancer Treatment Handled?

This is an area where insurers often provide the most support. When therapies are used to manage the side effects of conventional cancer treatment—such as acupuncture for nausea or massage therapy for pain—they are typically considered ‘complementary’ and medically necessary.

Insurers are far more inclined to approve these claims, particularly when supported by a strong referral and detailed notes from an oncologist. For broader insights and answers to common questions about holistic approaches, you may find this resource useful: frequently asked questions on holistic services.

Ensuring your plan includes these specific benefits from the outset is vital. By carefully examining the policy details, you can construct a plan that truly supports your comprehensive approach to health.

At Riviera Expat, we specialize in securing premier international health insurance for senior financial services professionals. We provide the expert guidance needed to find a policy that supports your entire wellness strategy, including alternative therapies. Contact us for a complimentary consultation.