For any individual whose life and work cross borders, understanding the term acute onset of a pre-existing condition is a matter of significant financial importance. It represents a critical intersection of health and financial security. This specific clause within an international medical insurance policy is designed to cover a sudden and unexpected crisis stemming from a known health issue—one requiring immediate care to prevent serious harm or death. A precise understanding of this distinction is vital to protecting your global assets from an unforeseen medical liability.

A Critical Insurance Clause You Cannot Afford to Ignore

For those accustomed to managing complex risks, the fine print in an international private medical insurance (IPMI) policy is not a mere detail; it is a core component of your financial defense strategy. One of the most frequently misunderstood clauses is the one covering an acute onset of a pre-existing condition. To be clear: this is not for the routine management of an illness you already have. It is an emergency safety net for when that known condition suddenly and unexpectedly deteriorates into a crisis.

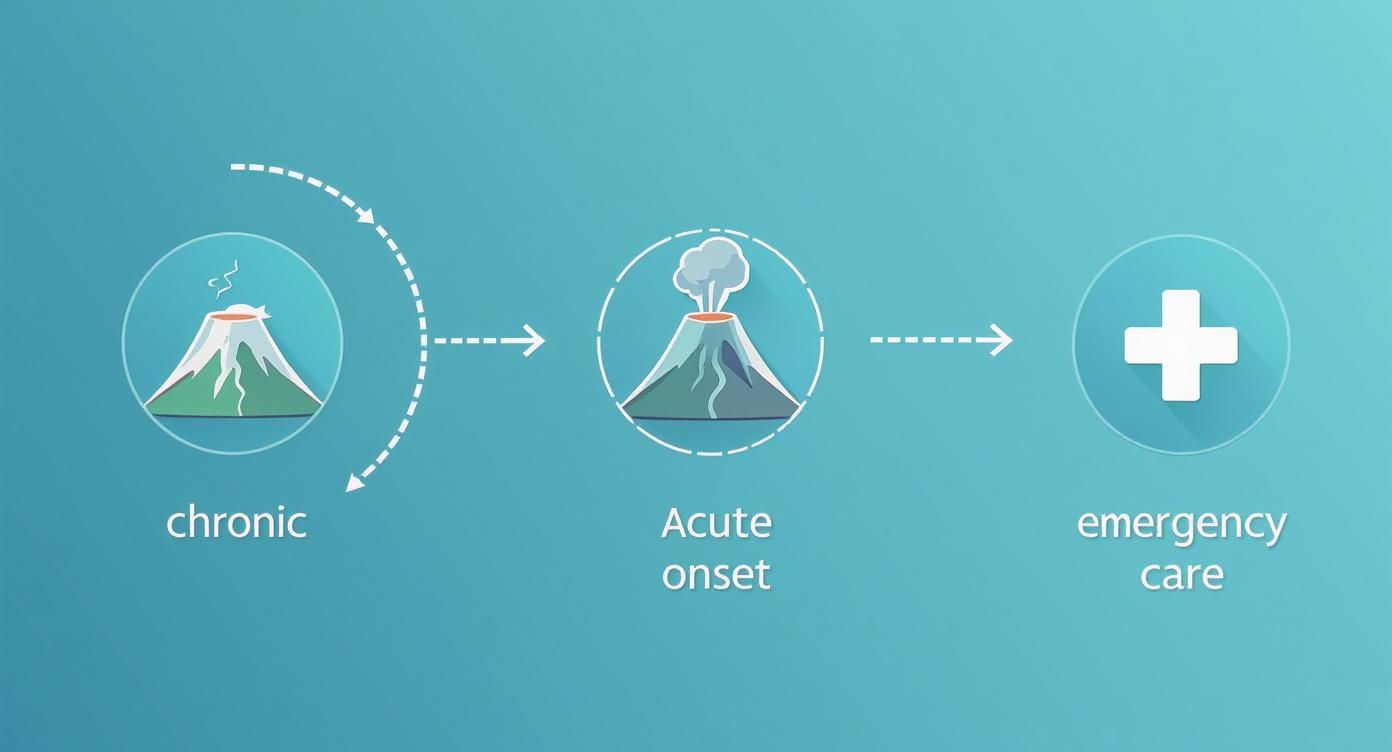

Consider a chronic condition you manage—such as controlled hypertension or stable Type 2 diabetes—as a dormant volcano. For years, it can be predictable, managed with routine consultations and medication. An acute onset is the unforeseen, violent eruption. It is the sudden myocardial infarction, the severe asthma attack you could not have predicted, or any life-threatening flare-up that demands immediate medical intervention.

The Decisive Factor for Coverage

The distinction between a predictable worsening of a condition and a genuine, unforeseen crisis is what determines whether your emergency care abroad is covered. Insurers will meticulously analyze the details of a claim to ascertain if the event meets their highly specific criteria:

- Sudden and Unexpected: The symptoms must have appeared without any substantive warning. If your physician's notes indicate a recent consultation for worsening symptoms, an insurer could reasonably argue the event was predictable, not sudden.

- Requires Immediate Care: The situation must be sufficiently severe that a reasonable person would seek medical attention within 24 hours to avoid serious jeopardy to their health.

- Stabilization, Not Management: This is the key. Coverage is almost invariably limited to the emergency treatment required to achieve a stable medical state. It will not cover the ongoing, long-term management of the underlying condition itself.

The core principle is straightforward but strict: the policy is designed to shield you from the financial shock of a true medical surprise, not to subsidize the expected care of a long-standing issue simply because you are in another country.

You must be familiar with the exact wording in your policy. Too many expatriates face a significant financial shock upon discovering that what they perceive as an emergency does not align with their insurer's contractual definition. To gain a better command of this, it is prudent to review common insurance policy exclusions that can impact your cover. This knowledge transforms your IPMI plan from a simple expense into a strategic asset, safeguarding both your health and your wealth wherever you operate globally.

How Insurers Define an Acute Onset Event

For any globally mobile professional, understanding an insurer's definition of an acute onset of a pre-existing condition is not a semantic exercise—it is a critical element of financial risk management. Insurers employ surgically precise language, and the boundary between a covered emergency and an uncovered complication of a chronic illness is determined by a few key phrases embedded within your policy wording.

These definitions are intentionally stringent. They exist to manage the insurer's risk and are structured to serve as a safety net for a true, unforeseen crisis, not to cover the predictable progression or routine management of a known health issue. A misinterpretation can leave you exposed to a substantial, unexpected liability—the very outcome a well-structured IPMI plan is designed to prevent.

The Litmus Test: Sudden, Unexpected, and Immediate

Insurers typically construct their definitions around three core pillars. For an event to qualify, it must be sudden and unexpected. This means it must manifest without advance warning or symptoms that would have prompted a reasonable person to seek prior medical advice. If your medical records document worsening symptoms or recent specialist consultations regarding that condition immediately preceding the event, an insurer will almost certainly contend that it was not "unexpected."

Next, the flare-up must be severe enough to necessitate immediate medical care. Most policies are extremely specific on this point. Many travel insurance plans, for example, stipulate that for an acute onset to be covered, you must seek treatment within 24 hours of the initial symptoms. This strict timeline serves as evidence of the event's severity and urgency.

Finally, coverage is almost always limited to stabilization. The benefit is intended to pay for the emergency treatment required to navigate the immediate crisis and prevent serious harm or death. It is not designed to cover ongoing care, follow-up consultations, or the long-term management of the underlying condition.

Imagine a dormant volcano. Your chronic condition is the volcano, stable for years. The acute onset is the sudden, violent eruption. That is the moment the insurance is designed to cover.

The essential takeaway is that coverage is triggered at the point of "eruption"—the sudden, unforeseen crisis—not during the long, stable phase of your chronic illness.

Comparing Coverage Across Policy Tiers

The level of protection for an acute onset of a pre-existing condition varies dramatically depending on the type of insurance you hold. These are not minor variations; they represent fundamentally different approaches to risk and have significant implications for your financial security. A basic travel policy offers a completely different class of security compared to a comprehensive IPMI plan. You can explore these nuances further in our guide on how to read and understand expat medical insurance policy terms.

To fully appreciate what is at stake, it is instructive to see how different insurance products handle this benefit.

Acute Onset Coverage Comparison Across Insurance Types

The table below delineates the typical coverage you can expect from different plan types. Note how the scope and financial limits change significantly.

| Policy Feature | Typical Travel Insurance | Short-Term Expat Plan | Comprehensive IPMI Plan |

|---|---|---|---|

| Coverage Scope | Emergency stabilization only. | Broader emergency care, may include limited follow-up. | Full emergency and stabilization, with potential for ongoing care if condition is underwritten. |

| Benefit Limits | Low, fixed sub-limits (e.g., USD 25,000). | Moderate limits, often higher than travel but less than full IPMI. | High limits, often up to the main policy maximum. |

| Exclusions | Numerous exclusions; often excludes specific conditions like cardiac or respiratory issues. | Fewer exclusions than travel insurance, but still restrictive. | Fewest exclusions, especially with Full Medical Underwriting (FMU). |

| Look-Back Period | Typically 60-180 days to define a pre-existing condition. | Varies, but can be 12-24 months. | Can be lifetime, but provides certainty through FMU. |

As is evident, relying on a standard travel insurance policy for a known health condition, even a stable one, is a significant gamble. For any professional whose life and work demand certainty, a comprehensive IPMI plan with clear, favorable terms for acute onset events is the only prudent choice.

The Impact of Underwriting and Waiting Periods

When arranging an international health plan, it is easy to dismiss underwriting and waiting periods as mere administrative formalities. This is a critical error. These are not just procedures; they are the very architecture of your coverage.

They directly dictate how an insurer assesses your medical history and, more importantly, how they will respond in the event of an acute onset of a pre-existing condition. For any high-net-worth individual who relies on absolute certainty, addressing this correctly is non-negotiable.

For professionals operating on a global stage, ambiguity is an unacceptable risk. This is precisely why the choice between the two primary underwriting methods—moratorium and Full Medical Underwriting (FMU)—is of paramount importance.

Moratorium Underwriting: A Calculated Gamble

Moratorium underwriting appears simple on the surface. It does not require you to complete extensive medical history questionnaires upfront. Instead, the insurer applies a blanket exclusion for any condition for which you have had symptoms or treatment in the recent past, typically 24-60 months before your policy commences.

It may be possible to have those conditions covered later, but only after you have completed a "trouble-free" period on the policy. This typically means two consecutive years with no symptoms, treatment, or medical advice for that specific condition.

The fundamental problem here is the profound uncertainty. The decision on whether a pre-existing condition—or a sudden crisis related to it—is covered is only made at the point of claim. You are essentially compelled to wager on a favorable outcome at the very moment you are most vulnerable.

Full Medical Underwriting: The Path to Certainty

In stark contrast, Full Medical Underwriting (FMU) delivers the clarity and control that sophisticated clients demand. The process is more rigorous, requiring a complete and transparent disclosure of your medical history upon application. However, the value received in return is immense.

With FMU, the insurer reviews your health profile and makes a definitive decision from the outset. You will receive one of three outcomes:

- Standard Acceptance: Your condition is considered low-risk and is covered as any new illness would be.

- Premium Loading: The insurer agrees to cover the condition but applies a surcharge to your premium to offset the higher associated risk.

- Exclusion: The insurer will not cover the specific condition or any related ailments.

While an exclusion or a higher premium might not seem ideal, the result is absolute transparency. You know precisely what is and is not covered from day one. This completely eliminates the risk of an unwelcome surprise and a costly dispute during a medical emergency.

For a high-net-worth individual, knowing the exact boundaries of your coverage is a non-negotiable component of wealth preservation. FMU delivers this certainty, transforming your insurance policy from a document of hope into a contract of predictable security.

Waiting Periods and the Acute Onset Safety Net

Finally, it is essential to understand how waiting periods fit into this framework. Many policies have an initial timeframe during which certain benefits are not active, particularly for pre-existing conditions. This is to prevent individuals from purchasing a policy only when they know immediate, expensive treatment is required.

However, the acute onset of a pre-existing condition benefit often serves as a critical safety net during these initial months. While routine consultations for your chronic illness might not be covered until the waiting period expires, this specific clause can provide emergency protection if that same condition suddenly flares up without warning. It builds a bridge, ensuring you are protected from a catastrophic event while the rest of your policy terms mature.

Navigating Real-World Medical Crises Abroad

Policy terminology is merely theoretical until a genuine crisis occurs. You can review the definition of "acute onset of a pre-existing condition" multiple times, but it is an entirely different challenge to navigate a claim while in a hospital thousands of miles from home.

A successful outcome depends on a few critical factors: knowing the precise actions to take, assembling the correct documentation, and understanding the insurer's perspective.

Let us examine three real-world scenarios that globally-focused professionals frequently encounter. Each illustrates what insurers scrutinize and the exact steps required to protect both your health and your financial position.

Scenario 1: The Cardiac Event in Singapore

A private equity partner with a history of well-managed hypertension is in Singapore for a transaction. His condition has been stable for years, perfectly controlled by medication prescribed by his physician in London. Suddenly, he experiences crushing chest pain and dyspnea. He is rushed to the hospital and diagnosed with a myocardial infarction.

- How the Insurer Views It: The claims team will immediately request his entire medical history, focusing on the "stability" of his hypertension. Provided his records show no recent medication changes or physician visits for worsening symptoms, this event will almost certainly meet the "sudden and unexpected" criteria. It is a textbook example of an acute onset.

- Your Critical Action: The attending physician's report is paramount. It must state that this was an acute, unforeseen emergency that required immediate medical intervention. This document is the linchpin of your claim, providing the insurer with the necessary evidence to cover the stabilizing treatment.

Scenario 2: The Respiratory Attack in Dubai

Imagine a tech entrepreneur launching her startup in Dubai. She has mild, well-controlled asthma, using an inhaler only occasionally. One day, a sandstorm occurs—a common trigger—and she suffers a severe respiratory attack. Her usual inhaler is ineffective, forcing her to seek emergency care.

- How the Insurer Views It: The insurer will investigate her medical records to confirm her asthma was genuinely "well-controlled." They will look for red flags—recent hospitalizations, new treatment plans, or specialist consultations suggesting her condition was deteriorating. If her history is clean, the claim is strong.

- Your Critical Documentation: The emergency room report is the key piece of evidence. It needs to detail how rapidly her symptoms escalated and, crucially, confirm she sought treatment immediately (typically within 24 hours). This timeline substantiates the "acute" nature of the event, distinguishing it from a gradual decline of her chronic condition.

Scenario 3: The Gallbladder Attack in Zurich

An art consultant in Zurich has a known history of gallstones, which have caused occasional, minor digestive discomfort. Without warning, she is struck by excruciating abdominal pain. An emergency ultrasound confirms an acute gallbladder attack (acute cholecystitis), requiring immediate surgery.

This is a classic example of an acute onset. The underlying condition (gallstones) was pre-existing and stable, but the attack was a sudden, unpredictable, and dangerous escalation that required urgent medical treatment to prevent severe complications.

In any of these situations, the claims process hinges on clear communication and swift action. A significant part of this is obtaining the correct approvals from your insurer. To avoid being saddled with a substantial bill for a major procedure, it is imperative to understand pre-authorisation and direct settlement for your medical care.

For life-threatening events such as a cerebral hemorrhage, understanding urgent medical triage in acute situations is what makes the difference. These scenarios all underscore one universal truth for global professionals: in a medical emergency, the quality of your documentation is as vital as the quality of your care.

Why Your Documented Medical History Is So Important

In the realm of international private medical insurance, your documented medical history is the ultimate source of truth. It is the single most important factor an insurer's underwriting team will review when assessing a pre-existing condition—and any claim for an acute onset of a pre existing condition. This history narrates the story of your health, and the clarity with which it is told can be the difference between a paid claim and a substantial out-of-pocket expense.

Underwriters are laser-focused on one thing: stability. A health issue that has been well-managed for years, with no recent adjustments to medication or treatment, presents a much more favorable narrative than a condition that is newly diagnosed or constantly fluctuating. Your medical records are the hard evidence that substantiates this stability.

The Power of Meticulous Record-Keeping

Maintaining meticulous records is not just good health practice; for a globally mobile professional, it is a critical financial strategy. Those documents—physician's notes, specialist reports, prescription histories—constitute the evidence you will need to prove an 'acute onset' claim was a genuine, unforeseen event.

Without a clean and consistent medical file, an insurer may struggle to differentiate between a sudden crisis and a predictable decline. To effectively present your case, it helps to have some basic skills in understanding document analysis to extract and present the most relevant information clearly.

Managing underlying health issues is a common reality. For example, data from the U.S. Department of Health and Human Services indicates that between 20% and 50% of non-elderly adults have some type of pre-existing health condition. The likelihood is high that managing a known condition will be a component of your global health strategy.

Think of your medical history as your financial ledger. A well-documented history of stability is your greatest asset, providing undeniable proof that a medical crisis was an unforeseen event, not an anticipated outcome.

What Insurers Scrutinize in Your Records

When you file a claim, your records will be meticulously examined for red flags—anything suggesting the event was not truly sudden or unexpected. The focus will be on several key areas:

- Recent Medication Changes: Have there been any recent dosage adjustments or new prescriptions?

- Worsening Symptoms: Do the physician’s notes mention recent complaints of new or worsening symptoms?

- New Recommendations: Did your doctor recently suggest a new treatment, test, or specialist referral for the condition?

A clean record on these points strengthens your claim immeasurably. Being transparent and proactive with your medical history is the cornerstone of securing robust international health coverage and protecting your assets from a medical emergency.

Selecting the Right IPMI Policy for Your Portfolio

For a globally mobile professional, international private medical insurance is much more than a healthcare plan—it is a strategic asset for wealth preservation. Selecting the right policy demands the same analytical rigor you would apply to any major investment. The objective is to secure a plan that provides transparent, robust protection against the financial shock of a medical crisis, particularly an acute onset of a pre existing condition.

An IPMI policy is not a commodity. The quality of its protection is determined by the precise wording of its clauses, its benefit structure, and the insurer's underwriting philosophy. The right plan provides certainty; the wrong one can introduce catastrophic financial risk at the worst possible moment.

Core Features to Demand

When evaluating options, certain features are non-negotiable. These are the cornerstones of a policy that genuinely protects your interests, providing clarity and control when you need them most.

Your policy review must prioritize these elements:

- High Benefit Limits for Acute Onset Events: Insist on a plan where the acute onset benefit is covered up to the full policy maximum. Low, fixed sub-limits (such as USD 25,000 or USD 50,000) are a significant red flag. A single day in an intensive care unit in a location like Singapore or New York could easily exhaust such a limit.

- Clear and Favorable Definitions: Scrutinize the policy wording for its definition of "acute onset." You are looking for fair, unambiguous language. Avoid policies with overly restrictive clauses, such as those that broadly exclude common conditions like cardiac or respiratory issues from this specific benefit.

- A Strong Preference for Full Medical Underwriting (FMU): Certainty is paramount. FMU delivers upfront clarity on precisely what is and is not covered regarding your pre-existing conditions. This eliminates the risk of a claim being denied later based on an ambiguous detail in your medical history.

Critical Red Flags to Avoid

Knowing what to look for is only half the battle; you must also recognize what to avoid. Certain policy structures and terms are crafted to limit the insurer's liability, creating an unacceptable level of uncertainty for you.

Be vigilant for these warning signs:

- Ambiguous Language: Vague terms like "reasonable and customary" without clear definitions, or clauses that grant the insurer excessive discretion, are significant liabilities.

- Plans Offering Only Moratorium Underwriting: While they may seem simpler, moratorium plans defer coverage decisions until a claim is made. This introduces a significant—and unnecessary—gamble at the moment of a medical emergency.

- Low Sub-Limits for Pre-Existing Conditions: Policies that cap benefits for pre-existing conditions signal that the insurer is unwilling to provide comprehensive protection. These should be viewed with extreme caution.

For a global citizen, an IPMI policy is a cornerstone of personal security. It should be approached not as a mandatory expense, but as a sophisticated financial instrument designed to safeguard your wealth against unforeseen medical events.

Ultimately, the complexity of these policies necessitates expert guidance. Engaging a specialist international insurance broker is a critical step. An expert can dissect the nuanced policy documents from various global insurers, compare definitions side-by-side, and advocate on your behalf to secure a plan that aligns perfectly with your personal and financial risk profile. This strategic partnership transforms the selection process from a complex chore into a confident investment in your security.

Common Questions About Acute Onset Coverage

Even with a robust plan, the fine print surrounding an acute onset of a pre-existing condition can be complex. Here are some of the most frequent questions we receive from global professionals, with the straightforward answers required to manage your international medical insurance with precision.

Does Acute Onset Coverage Mean My Pre-Existing Condition Is Fully Covered?

No, and this is arguably the most critical distinction to grasp. This benefit is purely an emergency lifeline. It is designed for the short-term, stabilizing treatment required immediately following a sudden medical crisis arising from your known condition.

It is never a substitute for comprehensive, long-term coverage for the underlying chronic illness itself.

Once a physician declares you are medically stable, the acute onset benefit ceases. Any ongoing management, follow-up appointments, or prescription refills for that chronic condition will only be covered if your policy was specifically underwritten to include it—often for an increased premium.

What Is the Single Most Important Document for a Successful Acute Onset Claim?

Without question, it is the attending physician’s statement from the treating hospital. This single medical report carries more weight than any other element of your claim.

For the claim to be viable, this document must paint a clear picture of a sudden, unforeseen medical emergency that required immediate care to prevent serious harm. The language used must precisely mirror your policy’s definitions, detailing the rapid onset of symptoms and confirming you sought assistance promptly—usually within 24 hours. This report provides the objective evidence insurers require before approving a potentially substantial claim.

An insurer's decision is based on the signed contract, not merely a doctor’s clinical opinion of an ‘emergency.’ These are two entirely separate concepts, and the policy's definition is the only one that prevails.

Can an Insurer Deny a Claim Even if My Doctor Called It an Emergency?

Absolutely. An insurer can—and frequently will—deny a claim even if your physician repeatedly used the term "emergency." The sole determining factor is whether the event aligns with the rigid, legalistic definition of 'acute onset' as written in your policy.

Consider a classic example: if your medical file shows you recently consulted a doctor about worsening symptoms before you traveled, the insurer has a strong basis to argue the event was not truly ‘unexpected’ or ‘without warning,’ even if it resulted in an emergency room visit. This is precisely why knowing your policy's exact wording and maintaining a clean, consistent medical history is not just advisable—it is essential for protecting your coverage and your financial position.

Navigating the complexities of international health insurance independently is a formidable challenge. At Riviera Expat, we provide the clarity and control required to construct a policy that aligns with your global lifestyle. Contact us for a complimentary consultation and ensure your health and wealth are protected, no matter where your endeavors take you.