For high-net-worth individuals, relying on standard insurance is a critical miscalculation. A truly sophisticated risk management strategy requires layering two distinct types of protection: comprehensive health insurance and specialized accident and health insurance.

Consider this: a premier global health plan is the foundation for your long-term well-being. Accident insurance, however, is your financial rapid-response team, delivering a direct cash benefit precisely when you need it most following an injury. This dual-policy approach is the essential framework for shielding your health, your assets, and your global lifestyle from the financial disruption of an unexpected event.

Why High Net Worth Individuals Need Both Policies

For individuals with substantial assets and a dynamic, international lifestyle, a single insurance policy creates a dangerous exposure. Even the most premium health plan is simply not engineered to manage the complex, cascading financial consequences of a serious accident.

The distinction between a health plan and accident coverage is not about redundant policies—it is about creating strategic, overlapping layers of protection.

Your global health plan acts as the primary defender of your physical health. Its sole purpose is to grant you seamless access to the world's finest medical professionals and facilities, covering the direct costs of medical care—from a routine wellness check to major surgery—by paying the providers directly.

Asset Protection Beyond Medical Bills

Accident insurance, conversely, operates on an entirely different principle. Its function is to protect your financial portfolio from the indirect costs that follow an injury—the very expenses a health plan will not address.

These often-overlooked costs can be significant:

- Income Disruption: Covering lost business opportunities or partnership income during a prolonged recovery.

- High Out-of-Pocket Costs: Instantly managing high deductibles, copayments, or treatments that are not fully covered.

- Lifestyle Adjustments: Funding necessary modifications to your home or vehicle, or engaging private transport and in-home care.

This policy delivers a direct, lump-sum cash payment to you, with no stipulations on its use. This immediate liquidity ensures a serious injury does not compel you to liquidate assets or derail your entire financial strategy. For a deeper dive into protecting your wealth, this comprehensive insurance guide for high net worth individuals is an excellent resource.

By integrating both types of policies, you create a robust financial shield. This ensures that a sudden physical setback does not become a lasting financial liability, preserving both your health and your wealth.

Understanding Your Global Health Insurance

For high-net-worth individuals, premier health insurance is not merely a payment mechanism for medical events. It functions as a personal health concierge service, designed to provide immediate, seamless access to the world's best medical facilities and specialists, bypassing conventional referral pathways.

This level of coverage is proactive. It prioritizes your long-term well-being with exceptional preventative care and meticulous management of any chronic conditions. In a world where six in ten adults in the U.S. have at least one chronic disease, this proactive approach is non-negotiable.

The market reflects this demand. The global private health insurance market, valued at approximately USD 2.22 trillion in 2023, is projected to reach USD 3.65 trillion by 2033.

Core Components of a Superior Policy

A top-tier global health policy is engineered for a life without borders. The following are not optional add-ons; they are fundamental features that guarantee your standard of care, regardless of your location.

These are the essential components:

- Comprehensive International Coverage: The plan must deliver consistent, high-level benefits across different countries. This eliminates the uncertainty of navigating varying regional healthcare standards.

- Direct Access to Specialists: You should be able to consult with leading medical experts anywhere, directly, without requiring a referral from a primary care physician.

- Medical Evacuation and Repatriation: This is the ultimate safety net. It ensures you can be transported to a center of medical excellence or repatriated if a serious medical event occurs while you are abroad.

These features are the foundation of any plan worthy of consideration. To observe how these elements function within a real-world policy, our overview of international private medical insurance provides valuable insights.

Beyond Treatment: The Concierge Experience

The defining characteristic of a premium accident and health insurance plan lies not just in the coverage, but in the service. It is akin to retaining a dedicated health advocate who manages the logistical complexities of global healthcare. Your sole focus is your recovery.

This service eliminates the friction from the healthcare experience. It means a dedicated professional is arranging appointments at world-renowned clinics, coordinating second opinions from top specialists, and managing all billing and administrative matters directly with the medical facilities.

Ultimately, this calibre of health insurance is a critical component of your personal risk management strategy. It is an investment in certainty, ensuring that wherever your business or travels take you, your access to premier medical care is never compromised.

The Strategic Role of Accident Insurance

If your global health policy is the foundation for your medical care, accident insurance is a distinct tool in your financial portfolio. It is a specialized layer of defense with one clear objective: to shield your personal and business finances from the immediate and often substantial costs that arise after an accidental injury.

An accident policy is designed to be a rapid infusion of capital during a crisis. When a covered accident occurs, the policy pays a direct, lump-sum payment to you. This is the direct opposite of how health insurance functions, which reimburses medical providers for services rendered.

A Direct Financial Lifeline, Unrestricted

The capital received from an accident policy is yours to allocate as you deem necessary. There are absolutely no restrictions, affording you complete control when it is most needed.

This money is specifically designed to fill the precise financial gaps that even the best health insurance plans do not cover. The immediate aftermath of an accident often brings a cascade of expenses that are not strictly medical but can be just as detrimental to your finances.

For instance, the payout could be utilized for:

- Covering Out-of-Pocket Medical Costs: You can immediately settle high deductibles, co-pays, and any other medical expenses your primary health plan does not fully cover. Understanding your policy's fine print is critical, as detailed in our guide on excesses and deductibles.

- Replacing Lost Income: If you are unable to conduct business during your recovery, this capital can replace lost revenue or partnership income, maintaining your financial stability.

- Funding Lifestyle Modifications: If you require home modifications for accessibility, specialized transportation, or private in-home care, the cash benefit is intended for these purposes.

Protecting Your Financial Portfolio

At its core, accident insurance is a strategic instrument for asset preservation. It is the safeguard that prevents a single, unexpected injury from forcing you to liquidate investments or other assets at an inopportune time to meet immediate cash requirements.

An accident policy contains the financial damage of an injury by providing a fixed cash sum. It allows your health insurance to manage the medical aspects of your recovery, while you use the direct cash benefit to keep your family and business financially stable.

This dual structure is precisely what makes the combination of accident and health insurance so effective. You are creating a robust defense that addresses both your physical well-being and your financial resilience. It ensures one unfortunate event does not derail your long-term financial plan. It is not a replacement for superior health insurance—it is the essential partner that ensures comprehensive protection.

Comparing Health And Accident Policy Benefits

To fully appreciate their unique value, one must examine how health and accident policies function in concert during a real-world event. While both are essential components of a robust protection strategy, they are designed to solve entirely different problems following an accident.

The primary distinction lies in two areas: the trigger for the policy and the method of payout. Your comprehensive health insurance is activated for a wide range of medical needs, from a sudden illness to a serious injury. Its sole purpose is to pay medical providers for the services they render.

Accident insurance, by contrast, is activated only by a covered accidental injury. When it is, it pays a cash benefit directly to you.

Payout Structures: A Real-World Example

Consider a scenario: a skiing accident results in a significant leg injury requiring surgery and extensive rehabilitation.

-

Health Insurance in Action: Your global health plan manages the direct medical bills. It pays the hospital for emergency services, the surgeon for the operation, and the pharmacy for prescriptions, all according to your policy's terms. The financial transactions occur between your insurer and the medical providers, insulating you from the process.

-

Accident Insurance in Action: Concurrently, you file a claim with your accident insurance provider. Once approved, you receive a direct, lump-sum cash payment. This capital is yours to use without restriction, providing immediate funds to address all non-medical challenges the accident has created.

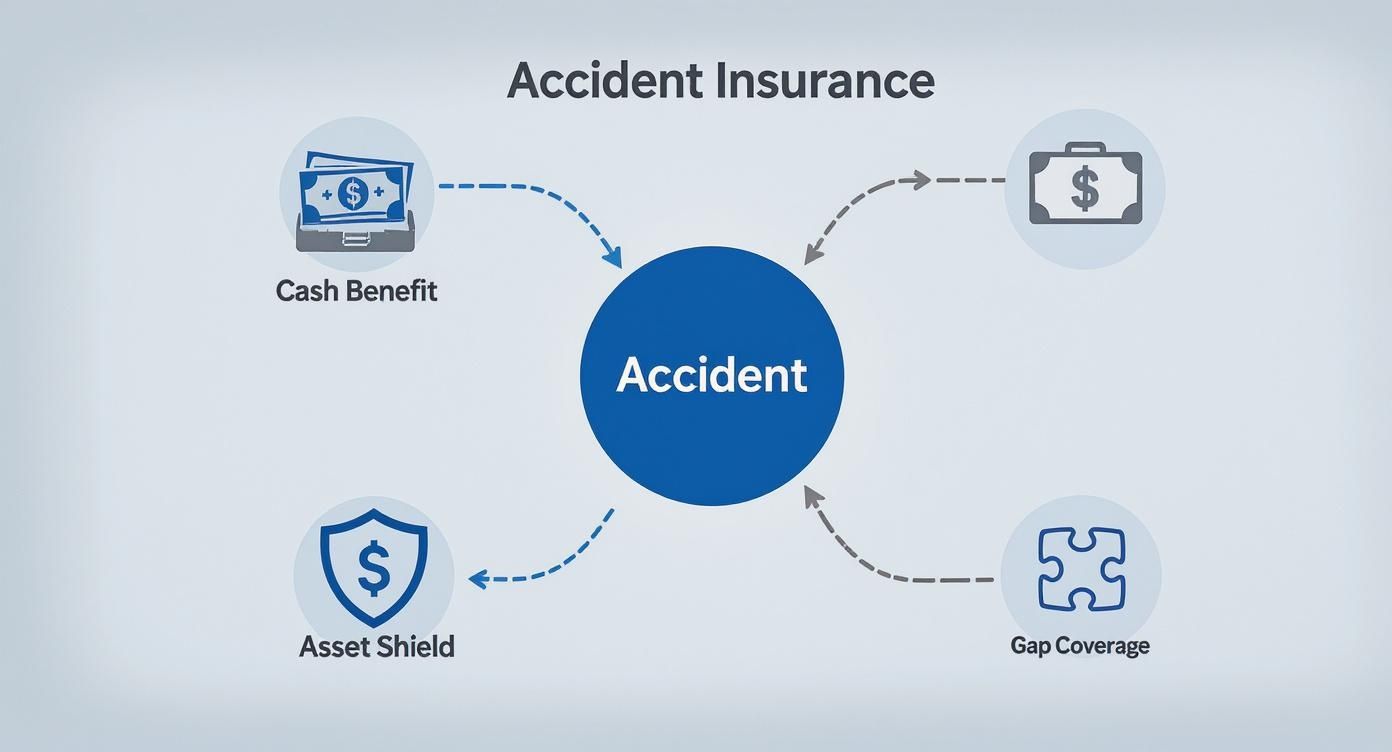

This visual breaks down how an accident policy acts as a direct financial tool.

As illustrated, the accident coverage provides a cash buffer to protect your savings and fill the financial gaps that even the most comprehensive health insurance leaves behind.

Health Insurance vs. Accident Insurance Core Differences

This side-by-side comparison delineates the fundamental differences, highlighting how each policy is triggered, what it covers, and who receives the payment.

| Feature | Comprehensive Health Insurance | Accident Insurance |

|---|---|---|

| Coverage Trigger | Illness or accidental injury requiring medical care | A specific, covered accidental injury |

| Payout Destination | Pays medical providers (hospitals, doctors, clinics) directly | Pays a lump-sum cash benefit directly to you, the policyholder |

| Use of Funds | Restricted to paying for eligible medical treatments and services | Unrestricted cash for any purpose (lost income, bills, travel, etc.) |

| Primary Purpose | To cover the high cost of healthcare and protect you from medical debt | To cover the non-medical financial impact of an accident |

| Typical Benefit Type | Reimbursement of actual medical charges based on policy limits and terms | A fixed, predetermined cash amount based on the type and severity of injury |

This table clarifies that these two policies do not compete; they function as a team to provide complete protection.

Intended Use Of Funds And Strategic Value

The destination of the funds from each policy demonstrates the necessity of holding both. Health insurance funds are restricted—they can only be used for medical care. The cash from your accident policy, however, is completely flexible.

You could use it to cover physical therapy co-pays, hire a driver while you are unable to operate a vehicle, or—most significantly—replace the income you are losing from being unable to work.

This practical comparison illustrates that owning both is not about redundancy; it's about creating a two-pronged defense. One policy protects your health, while the other protects your financial stability and lifestyle continuity.

The global insurance industry has experienced significant growth, with a recent annual increase of over 7.5%, and health insurance premiums alone reaching EUR 1.682 trillion in 2022. This signals a strong demand for health protection, but it also underscores the need to supplement that core coverage with a more specialized instrument like accident insurance.

For a deeper examination of policies designed to cover both unexpected injuries and illnesses, reviewing Accident and Sickness Insurance can be highly informative. By pairing these two powerful policies, you build a financial shield ensuring that one adverse event does not compromise both your physical and financial health.

Building Your Protection Portfolio Piece by Piece

A generic, off-the-shelf insurance plan is inadequate for a dynamic, global lifestyle. The only viable solution is to construct a protection strategy that is meticulously tailored to you, beginning with a rigorous assessment of your personal risk profile. This requires a deep analysis of your unique circumstances.

Your lifestyle directly shapes your risk. Frequent international travel, for example, demands a health plan with seamless global access, not one with geographic exclusions. Similarly, engagement in high-end leisure activities such as equestrian sports, yachting, or heli-skiing introduces specific risks that a standard policy will almost certainly exclude without specialized endorsements.

Analyzing Riders and Enhancements

Beyond the core policy, strategic value is created through the selection of specific riders and endorsements. These are the components that elevate a good plan to one that is truly customized for your needs.

Consider these common enhancements as essential upgrades:

- Disability Income Rider: This is non-negotiable for high earners. If an injury or illness prevents you from working, this rider provides a monthly income stream, protecting your cash flow and your family's financial stability.

- Critical Illness Add-On: This delivers a lump-sum cash payment upon diagnosis of a specified condition, providing immediate capital to manage treatment costs and other expenses without liquidating investments.

- Medical Evacuation and Repatriation: This is an absolute necessity for anyone who travels internationally. It ensures you can be transported to a premier medical facility or repatriated for care, regardless of your location.

These are not ancillary benefits; they are crucial for creating a truly resilient financial safety net. For a deeper look into selecting the right foundational policy, our guide on choosing the right expat medical insurance can offer additional clarity.

The True Cost of Coverage

Understanding the complete financial structure of insurance is paramount. Even employer-sponsored plans have significant costs that often remain hidden until a claim is filed.

The average annual premium for employer-sponsored family health coverage in the U.S. reached $23,968 in 2023, with employees contributing approximately 28% of that cost. Additionally, many workers face an average deductible exceeding $1,700 for individual coverage. This data, from the 2023 KFF Employer Health Benefits Survey, highlights the substantial out-of-pocket exposure that exists even with group plans.

A truly personalized portfolio of accident and health insurance accounts for these gaps. It ensures that deductibles, coinsurance, and non-covered services do not become a financial drain during a medical event.

The objective is to prepare you for strategic, informed discussions with your wealth advisor. By clearly defining your risks and understanding the available tools, you can assemble a highly resilient insurance portfolio—one that protects your health, your assets, and your peace of mind, wherever your endeavors may take you.

Frequently Asked Questions

When constructing a sophisticated protection strategy, specific questions inevitably arise. For high-net-worth individuals managing a global lifestyle, understanding precisely how different policies integrate is key to ensuring there are no vulnerabilities in your financial defense. Here are direct answers to the most common questions regarding accident and health insurance.

The core principle to internalize is the purpose of each policy. Your health plan is for your medical recovery. Your accident policy is for your financial recovery. They are designed to work in parallel, not in opposition.

Is Accident Insurance Necessary with a Premier Health Plan?

Yes. It is an absolutely essential component of a complete risk management strategy. Even the most comprehensive global health plans have inherent out-of-pocket costs, such as significant deductibles or coinsurance, particularly for complex surgeries or long-term care.

An accident insurance policy provides a direct cash benefit specifically to address these financial gaps. More importantly, it manages the non-medical financial consequences of an injury—areas your health insurance will not cover.

This is critical financial support for needs such as:

- Lost Business Income: It compensates for earnings you cannot generate while recuperating.

- Lifestyle Continuity: It funds services required to maintain your household, such as private drivers, in-home nursing care, or necessary home modifications.

- Immediate Liquidity: It provides cash on hand to manage unforeseen costs without compelling the sale of assets.

Consider accident insurance your financial first responder. While your health plan addresses the clinical aspect of a crisis, the accident policy ensures your financial life continues without disruption.

How Does an Active Lifestyle Affect Coverage Needs?

A dynamic, global lifestyle fundamentally alters your risk profile, making tailored coverage non-negotiable. Frequent international travel is a primary factor; your health policy must provide robust, seamless global coverage and, critically, include medical evacuation services.

High-impact activities introduce another layer of risk. Pursuits such as yachting, equestrian events, or alpine skiing are frequently listed as exclusions in standard policies.

This is where an accident policy becomes even more vital. It is designed to pay a cash benefit regardless of where the accident occurs, acting as a crucial safety net when you are far from home. It is almost certain that you will need to add specific policy riders to ensure these activities are fully covered.

This requires a detailed, line-by-line review of both your accident and health insurance policies to identify and eliminate any potential gaps in your protection.

How Do Payouts from These Policies Work Together?

The policies work independently yet concurrently, creating a powerful response to a single accident. They do not offset or reduce each other's benefits in any way.

Consider a scenario where you sustain a serious injury while traveling abroad.

- Health Insurance Response: Your global health insurer acts immediately. They coordinate with the medical team and facility, arranging your care and paying the providers directly, as per your policy terms.

- Accident Insurance Response: Simultaneously, you file a claim with your accident insurer. Upon approval, they transfer a pre-determined, lump-sum cash payment directly to your bank account.

You have total discretion over the use of this capital. You could apply it to your health plan's deductible, cover the cost of a family member's travel to be with you, or simply retain it to offset any loss of business income. This independent operation ensures every facet of the crisis—both medical and financial—is managed swiftly and effectively.

At Riviera Expat, we specialize in architecting bespoke insurance portfolios that protect the complex lifestyles of global professionals. Our expert guidance ensures your coverage is as resilient and borderless as you are.

Secure your complimentary, no-obligation consultation today.