Family office wealth management represents the pinnacle of stewarding a family's legacy. It transcends being a mere service; it is your family’s private command center, meticulously engineered to oversee your entire financial and personal universe. This structure provides a level of integration and dedication that traditional advisors cannot offer, creating a bespoke ecosystem to manage every component of your wealth.

Understanding the Family Office Framework

At its core, a family office centralizes the management of a family's affairs to protect and grow assets for future generations.

Imagine, instead of engaging a separate investment manager, tax advisor, and law firm, you establish an integrated organization where these experts collaborate under a single mandate. This model ensures every financial decision—from a complex private equity transaction to a significant philanthropic commitment—is perfectly aligned with your family’s core values and long-term vision.

The objective is to achieve clarity, control, and absolute confidentiality. By consolidating all functions, the family office structure eliminates the fragmented and often conflicting advice that arises from managing separate banks, law firms, and accountants. It creates a single, unified strategy.

The Shift from Advisory to Ownership

What truly distinguishes family office wealth management is the fundamental shift in mindset. You are no longer merely a client; you become the principal. Instead of receiving services from an external firm, the family directs its own dedicated team. This change in perspective delivers significant advantages:

- Complete Customization: Every service, from investment selection to household bill payment, is designed around your family’s unique requirements, risk tolerance, and legacy objectives. Nothing is standardized.

- Conflict-Free Counsel: The office has a singular fiduciary duty: to the family it serves. This structure eliminates the potential for conflicts of interest inherent in traditional banking relationships.

- Enhanced Privacy: All sensitive financial and personal information is contained within a trusted, private entity, affording a level of discretion that is simply unmatched.

A family office is your personal wealth headquarters. It is a dedicated entity structured to manage the financial complexities of a high-net-worth family, acting as the cohesive force that integrates intricate investments, tax strategies, and legacy planning.

This approach provides a powerful defense against financial complexity and market volatility. The teams within these structures are designed to be proactive, constantly anticipating challenges and identifying opportunities with a multi-generational perspective. For further insights on financial topics pertinent to wealth management, you may find valuable content on the FundPilot Blog.

Ultimately, establishing this framework is the most definitive step one can take to ensure a family’s legacy not only endures, but thrives.

The Global Rise of the Modern Family Office

The family office was once a discreet, almost mythical structure, reserved for a select few prominent dynasties. This is no longer the case. Today, it has emerged as a powerhouse in global finance—a significant and rapidly expanding institutional force.

This expansion is fueled by two primary factors: the creation of substantial new generational wealth and an investment landscape that has become profoundly complex.

As families accumulate significant fortunes, they often find that traditional private banks and wealth advisors are inadequate. These services can feel restrictive, often promoting proprietary products and failing to provide the control, alignment, and discretion that discerning families require. The family office model inverts this dynamic, creating a command center that serves one client exclusively: the family itself.

The demand for this dedicated structure has triggered a global surge. By 2025, the number of single-family offices is projected to reach approximately 8,030. Forecasts suggest this figure will climb to 9,030 by year-end and could reach 10,720 by 2030.

Collectively, these offices oversee an estimated US$3.1 trillion in assets, a figure expected to increase by 73% to US$5.4 trillion by 2030. You can find a comprehensive overview of these trends from the specialists at Bolder Group.

From Wealth Preservation to Sophisticated Investing

The traditional stereotype of a family office was that of a defensive fortress, designed solely to protect existing wealth. The modern iteration is entirely different: a nimble, highly capable institutional investor.

Armed with significant "patient capital"—capital not subject to the quarterly pressures of public markets—family offices can adopt a long-term investment horizon measured in decades, not months. This unique position enables them to act with speed and conviction in areas where other investors are constrained.

This freedom facilitates access to complex, exclusive transactions that are unavailable through conventional channels. They have become major participants in:

- Direct Private Equity: Rather than simply investing in a fund, they acquire direct stakes in private companies, affording them greater control and the potential for superior returns.

- Venture Capital: They are at the forefront of innovation, seeding the next generation of disruptive companies and gaining early-stage access to transformative technologies.

- Specialized Real Estate: This includes large-scale development projects, prime commercial properties, and unique land assets across the globe.

This evolution has established family offices as influential players in private markets, often co-investing alongside major private equity firms and institutional funds. Their ability to deploy substantial capital quickly makes them highly sought-after partners.

The Technological Transformation of Operations

Technology is the engine driving this evolution. Not long ago, many family offices operated on spreadsheets and manual processes. Today, advanced software is transforming them into highly efficient, data-driven financial organizations.

The integration of specialized technology has transformed the family office from a traditional administrative hub into a dynamic financial institution. It enables real-time portfolio analysis, robust risk management, and secure communication, all essential for managing a global asset base.

This digital upgrade is no longer optional; it is critical. It allows for the aggregation of financial data from disparate sources—banks, investments, properties—into a single, consolidated dashboard that provides a clear view of the family's entire net worth.

With this clarity, the office can make more informed decisions on asset allocation, identify emerging risks, and securely manage a pipeline of private market transactions. Understanding this technology-driven shift is essential to grasping why a formal family office wealth management structure has become a necessity for effective stewardship.

Choosing Your Family Office Structure

Selecting the appropriate structure is arguably the most critical decision in establishing a family office. It is the foundation upon which all subsequent activities are built. This choice directly impacts your level of control, operational costs, and the privacy of your affairs.

Consider an analogy to private aviation. One could commission a custom jet, join an exclusive private jet club, or charter specialists on an as-needed basis. Each option presents a different combination of control, cost, and convenience—mirroring the three primary family office models.

The objective is not to identify the "best" model, but the one that is the best fit for your family. This requires a thorough assessment of your asset base, desired level of involvement, and tolerance for complexity.

The Single-Family Office (SFO): Your Bespoke Command Center

A Single-Family Office, or SFO, represents the apex of customization and control. It is a private company established from the ground up, dedicated exclusively to managing the financial and personal affairs of one family.

This is the "own your own jet" option. You determine everything: the investment philosophy, the hiring of personnel, the strategic direction. It offers unparalleled privacy and direct oversight.

However, this level of control comes at a significant cost. Establishing a fully staffed SFO is a substantial undertaking. Annual operating costs often start at US$1 million and can escalate considerably. Consequently, an SFO is typically viable only for families with substantial wealth, generally starting at US$250 million in assets, to justify the infrastructure and ongoing expenses.

The Multi-Family Office (MFO): Shared Expertise and Efficiency

For families seeking premier service without the burden of creating an entire organization, the Multi-Family Office (MFO) is a compelling alternative. An MFO is an established firm that provides a full suite of family office services to a select group of affluent families.

This is akin to joining an elite private jet club. You gain access to a world-class fleet, top pilots, and premium service, while sharing the operational costs with other members. MFOs offer significant economies of scale, making this level of wealth management accessible to families with assets typically starting in the US$25 million to US$50 million range.

While you relinquish some of the absolute control afforded by an SFO, you often gain access to a deeper pool of talent and a broader network of opportunities than a smaller, standalone office could cultivate independently. It represents an excellent balance of efficiency and expertise.

The Virtual Family Office (VFO): A Flexible Network of Specialists

The most modern and agile model is the Virtual Family Office, or VFO. It is not a physical office but a coordinated network of your existing independent professionals—your attorney, accountant, and investment advisors—all managed by a central coordinator. This role is typically filled by a chief advisor or trusted consultant who ensures seamless collaboration.

This is the "charter on demand" model. You do not own the aircraft or belong to a club. Instead, you assemble a bespoke team of best-in-class specialists for each specific need, precisely when required. The VFO offers exceptional flexibility and can be highly cost-effective, as you only pay for the expertise you actively utilize.

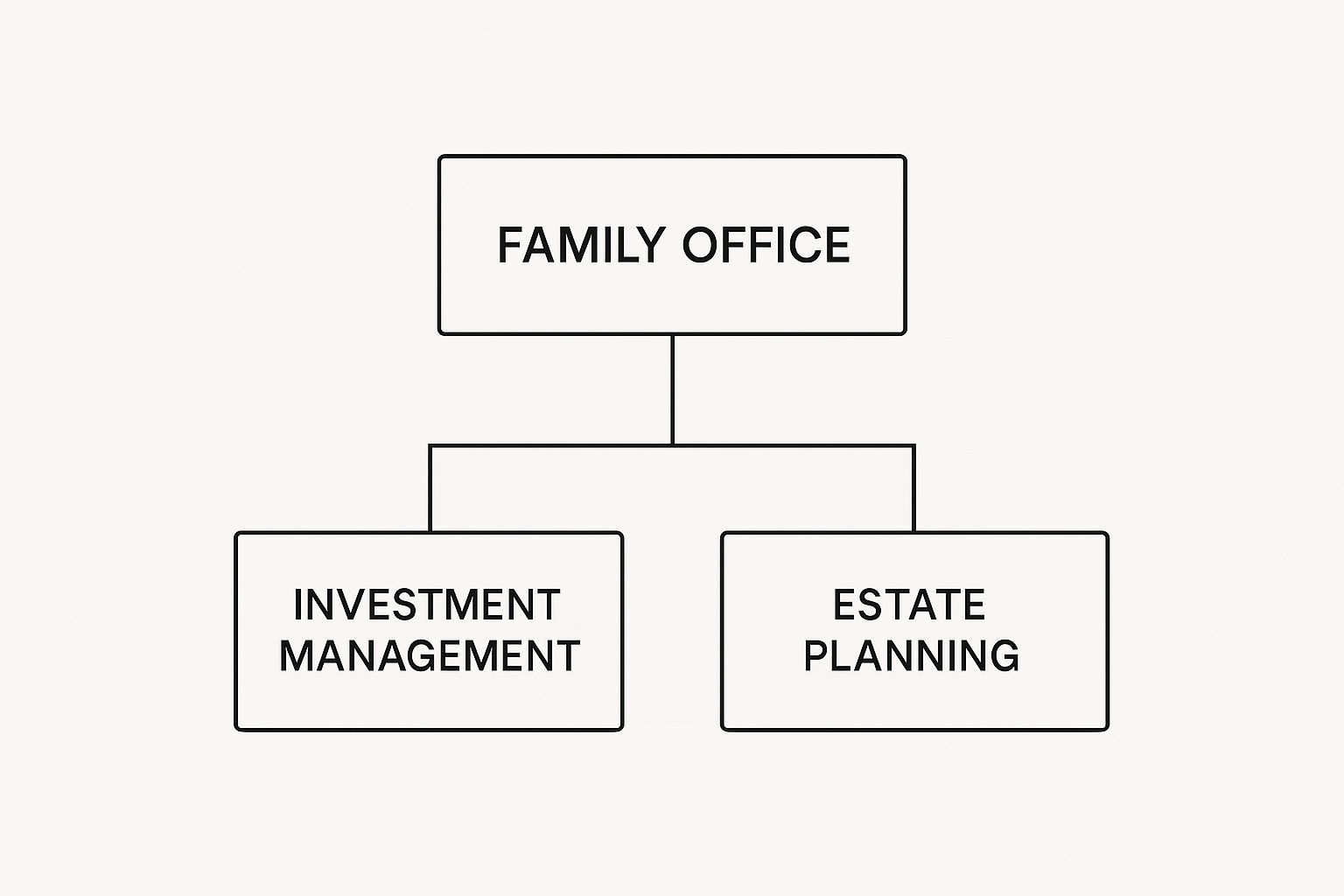

The image below illustrates the core pillars that any family office, virtual or otherwise, must manage. The primary function is the coordination of key areas such as investment management and estate planning.

As shown, integration is the principal task. The primary challenge of a VFO is the coordination required to maintain alignment among independent advisors. It is an ideal solution for families who prioritize flexibility and have already established strong relationships with trusted external experts.

Comparison of Family Office Models

Choosing between these models requires a clear understanding of the trade-offs. The table below outlines the key differences between the SFO, MFO, and VFO to help clarify which structure might best align with your family's objectives.

| Characteristic | Single-Family Office (SFO) | Multi-Family Office (MFO) | Virtual Family Office (VFO) |

|---|---|---|---|

| Control | Complete control over staff, strategy, and operations. | Shared control; influence is indirect. | High control over advisor selection, but requires active coordination. |

| Cost | Very high (US$1M+ annually). Significant setup and fixed costs. | Moderate. Costs are shared among multiple families. | Variable and lower. Pay-for-service model with minimal fixed costs. |

| Typical Asset Threshold | US$250M+ | US$25M – US$50M+ | Flexible, often suitable for US$10M+ depending on complexity. |

| Privacy | Maximum privacy and confidentiality. | High, but information is shared within a trusted firm. | Varies; depends on the coordination and security of the advisor network. |

| Customization | Fully bespoke; tailored to the unique needs of one family. | High, but services are standardized to serve multiple clients. | Highly customizable; assemble best-in-class specialists for each need. |

| Primary Advantage | Unparalleled control and alignment with family vision. | Access to institutional-grade expertise at a lower cost. | Maximum flexibility and cost-efficiency. |

| Primary Challenge | High cost and management complexity. | Potential for conflicts of interest; less personalized culture. | Significant coordination burden on the family or lead advisor. |

Ultimately, the right structure is one that functions as a natural extension of your family’s values and goals. Whether you require a dedicated command center, access to a shared platform of experts, or a flexible network to be called upon as needed, the key is to select the framework that will best serve your family for generations.

The Integrated Services of a True Family Office

A common misconception about family offices is that their primary focus is on investment returns.

However, the real value lies not just in growing wealth, but in managing the complexity that accompanies it. A true family office operates as the central nervous system for your family's entire world—a single command center for a multifaceted life.

Where a traditional advisor might focus solely on investments or taxes, a family office maintains a holistic view. It integrates every element—financial, legal, and personal—into a single, coherent strategy. This seamless coordination is what truly distinguishes the model and delivers genuine peace of mind.

Consider this: a major business decision is never just a business decision. It has immediate implications for your estate plan, tax liabilities, and philanthropic objectives. A family office ensures that no action is taken in isolation.

Core Financial and Strategic Stewardship

At its foundation, a family office provides a suite of deeply interconnected financial services. This is not standard asset allocation; it is the bedrock of preserving wealth for generations.

The goal is to construct a financial architecture that is resilient enough to withstand unpredictable market cycles and inevitable life events. This demands a proactive, rather than reactive, approach to your entire balance sheet.

Key strategic services invariably include:

- Strategic Wealth and Estate Planning: This extends far beyond drafting a will. It is a dynamic, ongoing process of structuring assets—utilizing trusts, holding companies, and other instruments—to ensure a smooth and tax-efficient transfer of wealth to the next generation, all while reflecting your family's core values.

- Global Tax Optimization: Your office does not merely engage a local accountant. It coordinates a team of specialists across multiple jurisdictions to manage your tax exposure from investments, business income, and cross-border assets. The aim is full compliance while legally minimizing tax liabilities.

- Sophisticated Risk Management: This encompasses more than just market volatility. It involves assessing and neutralizing risks related to personal security, properties, liability, and cybersecurity—a significant threat, with a notable percentage of family offices reporting breaches.

A family office is no longer just a financial hub—it is now the nerve center of a multigenerational family enterprise. Its purpose is to manage complexity across every function, from investments to family governance.

This entire framework is designed for one purpose: clarity. It consolidates all the disparate components of your financial life, providing a complete, coherent picture to enable smarter, more strategic decision-making.

Beyond the Balance Sheet: Family Governance and Legacy

What truly elevates an elite family office beyond a mere wealth manager is its focus on the family’s “human capital.”

Managing financial assets is one challenge. Preparing the family to steward that wealth successfully for generations is another entirely.

This is the domain of family governance. It provides the formal framework for communication, decision-making, and conflict resolution, ensuring the family remains united and purposeful as it expands. For high-net-worth individuals navigating international complexities, understanding the nuances of expatriate life can be a vital part of this broader support system; you can explore this topic further on our Riviera Expat blog.

A family office facilitates this crucial work by:

- Organizing Family Council Meetings: It creates a professional, structured forum for family members to discuss finances, strategy, and personal objectives.

- Drafting a Family Constitution: This foundational document codifies the family's mission, vision, and values. It guides everything from investment philosophy to philanthropic focus and clearly defines the rights and responsibilities of each family member.

- Leading Next-Generation Education: It implements formal programs to equip younger family members with the financial literacy and leadership skills required to become responsible stewards of the family’s legacy.

Ultimately, the integrated services of a true family office ensure every aspect of your life is managed with precision and foresight. From overseeing a portfolio of luxury assets like private aircraft and art collections to executing a unified philanthropic strategy, the office acts as your single, trusted advocate. This holistic management is the key to transforming financial success into an enduring legacy.

Inside the Family Office Investment Strategy

Family offices possess a significant advantage over most investors: they are not bound by the quarterly performance reports that constrain traditional fund managers.

Instead, they operate with what is known as "patient capital." This is not a strategy for chasing short-term gains; it is a philosophy built on a multi-generational timeline. Their strategic decisions are framed in decades, not fiscal quarters.

This long-term perspective is transformative. The core mission of family office wealth management is not to capitalize on fleeting market trends. It is to construct a resilient, diversified portfolio capable of withstanding market turmoil and, above all, protecting the family's principal during downturns. It is a dual mandate: disciplined growth combined with rigorous preservation.

Prioritizing Control Through Direct Investments

A significant trend in the family office sector is the shift toward direct investments. Rather than passively allocating capital to external fund managers, they are taking an active role by investing directly into private companies.

This change is driven by a desire for greater control, transparency, and the potential for enhanced returns.

Their primary targets for these direct investments are typically concentrated in a few high-growth alternative asset classes:

- Private Equity: This involves acquiring direct stakes in established private companies, providing them with a board seat to influence strategy, operations, and the eventual exit.

- Venture Capital: They gain early-stage access by funding nascent companies, positioning themselves to benefit from disruptive technologies and innovative business models with substantial growth potential.

- Real Estate: This extends beyond simple property acquisition to include major commercial properties, large-scale development projects, and unique land assets poised for long-term appreciation.

Direct investing affords a level of influence that is unattainable through passive fund investments. The scale of this activity is substantial. The assets under management of Single Family Offices are projected to reach significant multi-trillion dollar figures, with a considerable portion flowing into direct investments, particularly in private equity and venture capital.

Balancing Growth with Enduring Preservation

While direct investments offer the potential for aggressive growth, the paramount rule remains constant: preserve the family's wealth for the next generation.

To achieve this equilibrium, family offices construct highly sophisticated, diversified portfolios. They skillfully blend these illiquid, high-growth assets with more stable, income-producing investments.

A deep understanding of the investment decision making process is fundamental to this strategy. It involves a disciplined cycle of asset allocation, rigorous due diligence, and continuous risk monitoring. The objective is to create a portfolio that not only generates strong returns in favorable economic conditions but also acts as a fortress during market downturns.

A family office's investment strategy is not about maximizing short-term gains. It is about building an enduring financial legacy, where calculated risk-taking is carefully balanced with an unwavering commitment to capital preservation.

This sophisticated balancing act enables modern family offices to pursue ambitious opportunities without jeopardizing the core capital. They are not merely investors; they are strategic capital allocators, constructing a financial engine designed to power the family’s vision for generations.

Anticipating Challenges and Ensuring Sustainability

Building a family office that endures for generations is a marathon, not a sprint. It requires more than astute investments; it demands foresight into the operational, personal, and external threats that can undermine even the most meticulously planned structures. Lasting success is achieved by confronting these challenges directly.

One of the first realities a family office must face is its operational cost. A fully staffed single-family office can easily incur annual expenses exceeding US$1 million for salaries, technology, and compliance. This financial commitment requires a disciplined budget and a clear understanding of the value being delivered to ensure the office does not become a wealth-draining enterprise.

Another persistent challenge is the competition for talent. Family offices compete for the same top-tier professionals as private equity firms and hedge funds, often without the ability to offer equivalent compensation packages. The successful strategy is to provide a superior value proposition: a better work-life balance, a direct connection to a family's legacy, and a culture that attracts and retains high-caliber individuals.

Navigating External and Internal Pressures

Beyond its internal operations, a family office presents a high-value target. As private custodians of immense wealth, they are attractive to cybercriminals. Robust cybersecurity protocols and continuous training for family members and staff are not merely best practices; they are an essential defense for protecting financial data and personal privacy.

Simultaneously, the regulatory environment is in constant flux. Global regulations form a complex and evolving web, and maintaining compliance across multiple jurisdictions demands constant vigilance to avoid significant penalties. The macroeconomic landscape is also a source of concern. According to the UBS Global Family Office Report 2025, the top three concerns for family office executives are macroeconomic issues such as trade disputes, geopolitical instability, and inflation. To review their complete analysis, you can explore the full report on UBS.com.

The true test of a family office isn’t how it performs in a bull market. It’s how it holds up when things get rough. That kind of resilience is forged by expecting the unexpected—from market crashes to family feuds—and building strong governance right into its DNA.

To weather these storms and protect wealth over the long term, it is absolutely critical for family offices to implement effective investment risk management strategies.

The Most Delicate Challenge: Family Dynamics

Ultimately, the most formidable challenge is often internal. Wealth can amplify pre-existing rivalries and create new disagreements over vision, succession, and control. These interpersonal frictions have the potential to fracture a family—and its financial engine.

Constructing a structure that can withstand these pressures depends on strong family governance. This requires more than dialogue; it demands the implementation of formal frameworks:

- Establishing a Formal Family Council: This creates a dedicated forum for open communication and decision-making, ensuring all stakeholders feel heard and respected.

- Creating a Family Constitution: This document serves as the family's governing charter. It articulates the shared mission, values, and rules of engagement, providing a guiding reference during periods of conflict.

- Implementing Education for the Next Generation: Proactively preparing younger family members to be responsible stewards of wealth is the single most critical factor for a seamless transition of both capital and leadership.

By directly addressing these challenges and implementing practical solutions, a family office can establish a foundation that not only survives but thrives from one generation to the next.

Frequently Asked Questions

When exploring the domain of family office wealth management, several key questions consistently arise. Here are concise answers to the most common inquiries to provide you with greater clarity.

What Is the Typical Net Worth to Start a Family Office?

While there is no official threshold, a dedicated single-family office (SFO) generally becomes financially viable when a family possesses between US$100 million and US$250 million in investable assets.

The rationale for this high threshold is the substantial operational cost. Annual expenses for salaries, technology, and compliance can easily exceed US$1 million.

For families with wealth below this range, a multi-family office (MFO) or a virtual family office (VFO) is a more prudent approach. These models provide access to a similar level of expertise without the need to bear the entire financial burden independently.

How Is a Family Office Different from a Private Bank?

The fundamental distinction lies in allegiance. A private bank is a division of a larger financial institution. Its primary function is to distribute the bank's proprietary investment products and lending solutions. Its loyalty is ultimately to the bank, not the client.

A family office, in contrast, is a private firm that serves a single client: your family. Its advice is entirely objective and free from conflicts of interest. It takes a holistic view of your entire financial landscape—from investments and tax planning to philanthropic goals. Its sole agenda is the protection and growth of your family's wealth in accordance with your vision.

Consider this distinction: a private bank aims to sell you its products. A family office functions as your family's personal CFO, providing advice that is 100% tailored to your unique objectives.

What Are the First Steps to Establish a Family Office?

The process begins with achieving alignment within the family. The first and most critical step is to clearly define the family's mission, vision, and values. This is often formalized in a document such as a family charter or constitution, which serves as the guiding principle for all subsequent decisions.

Once this foundation is established, the process typically proceeds as follows:

- A Comprehensive Diagnostic Review: This involves a full and transparent assessment of the family's entire balance sheet, including all assets, liabilities, and long-term objectives, to determine the precise services required.

- Selection of the Appropriate Structure: A decision is then made on the optimal operational model—whether a dedicated SFO, an MFO, or a VFO is most suitable based on the family's needs for control, cost-efficiency, and privacy.

- Hiring of Key Leadership: The team-building phase begins. The first and most crucial hire is typically a trusted CEO or Chief Investment Officer who will lead the new office.

For those embarking on this path, reviewing a broad range of frequently asked questions can provide additional detailed insights.

At Riviera Expat, we understand that true peace of mind is derived from knowing every aspect of your life, including your health, is secure. We provide expert, objective advice on international private medical insurance, empowering you to make the best healthcare decisions with absolute confidence.