Your health insurance premium is the non-negotiable, recurring payment required to maintain your policy's validity.

Whether settled monthly or annually, this fixed amount guarantees your access to a global network of premier healthcare services. Consider it the membership fee for an exclusive wellness collective. This fee secures your membership, separate from any costs incurred when you utilise the collective's facilities.

Your Health Insurance Premium Explained

The premium is the bedrock of your health insurance agreement. It is the predictable, recurring cost you remit to ensure your coverage remains active, irrespective of whether you require medical consultation. This is fundamentally different from out-of-pocket costs, which are incurred only upon receiving medical care.

A premium is the price of security. In exchange for a regular fee, you transfer the immense financial risk of a significant medical event from your personal portfolio to the insurer. This arrangement provides financial predictability and invaluable peace of mind.

Differentiating Premiums from Other Costs

For individuals accustomed to managing a sophisticated financial portfolio, it is critical to distinguish how the components of your health insurance costs interrelate. The premium is merely the initial expenditure.

- Premium: Your fixed, regular payment (e.g., monthly) to keep your health plan in force. It is non-refundable.

- Deductible: The specific amount you must personally pay for covered healthcare services before your insurance provider begins to contribute.

- Co-payment: A predetermined flat fee for a specific service, such as a specialist consultation, paid after your deductible has been met.

- Coinsurance: The percentage of costs for a covered medical service that you share with your insurer after you have satisfied your deductible.

Consider this framework: your premium secures access. Your other potential costs—deductible, co-payments, and coinsurance—are variables contingent upon your utilisation of healthcare services. This structure enables you to secure access to world-class medical facilities while managing the financial variables of your actual care.

The Architecture of Your Premium Calculation

To fully comprehend your premium, one must look beyond the price and examine the actuarial blueprint behind it.

Insurers do not arbitrarily assign a figure. They execute a complex calculation, analogous to a financial engineer designing a bespoke portfolio. Each component is meticulously selected to yield a single outcome: reliable, robust healthcare coverage, wherever your personal or professional life may lead.

The model functions by pooling all policyholders. This strategy distributes the financial risk of potential medical claims across a large collective, making the unpredictable nature of individual health fiscally manageable for all participants.

This is a substantial enterprise for good reason. The global health and medical insurance market was valued at USD 2.8 trillion in 2023 and is projected to reach USD 4.9 trillion by 2033. This expansion is propelled by escalating healthcare costs and a growing demographic of discerning expatriates who demand superior care. You can find more insights into global health insurance market trends here.

The Core Components of Your Premium

Your premium is constructed from three essential components. Each serves a distinct function, and together they ensure your health plan remains resilient and responsive.

- Anticipated Medical Claims: This constitutes the largest portion of the premium. It is a meticulously calculated forecast, based on extensive actuarial data, that allocates sufficient funds to cover the projected medical costs for the entire insurance pool for the coming year.

- Administrative Costs: This component funds the insurer's global operations. This includes 24/7 client service teams, claims processing departments, and network managers who secure access to premier hospitals. For a first-class international plan, this underwrites the seamless, white-glove service across different countries and time zones.

- Insurer's Margin: A smaller portion is allocated for the insurer’s profit and to maintain its own financial solvency. This margin ensures the company's stability and guarantees it possesses the reserves to pay even the most substantial claims when they arise.

Understanding this structure is paramount. Your premium is not merely a fee; it is a calculated investment in a system engineered for financial resilience and medical security. It ensures the insurer has the liquidity to cover everything from routine check-ups to major medical emergencies.

Key Factors That Influence Your Premium Cost

Grasping the concept of a health insurance premium becomes truly valuable when you understand its construction. Perceive it less as a fixed price and more as a bespoke figure. Insurers evaluate two primary areas when calculating your final premium: your personal risk profile and your specific plan design choices.

These variables function as levers. Each can significantly adjust the final cost to align with your unique risk profile and geographic footprint.

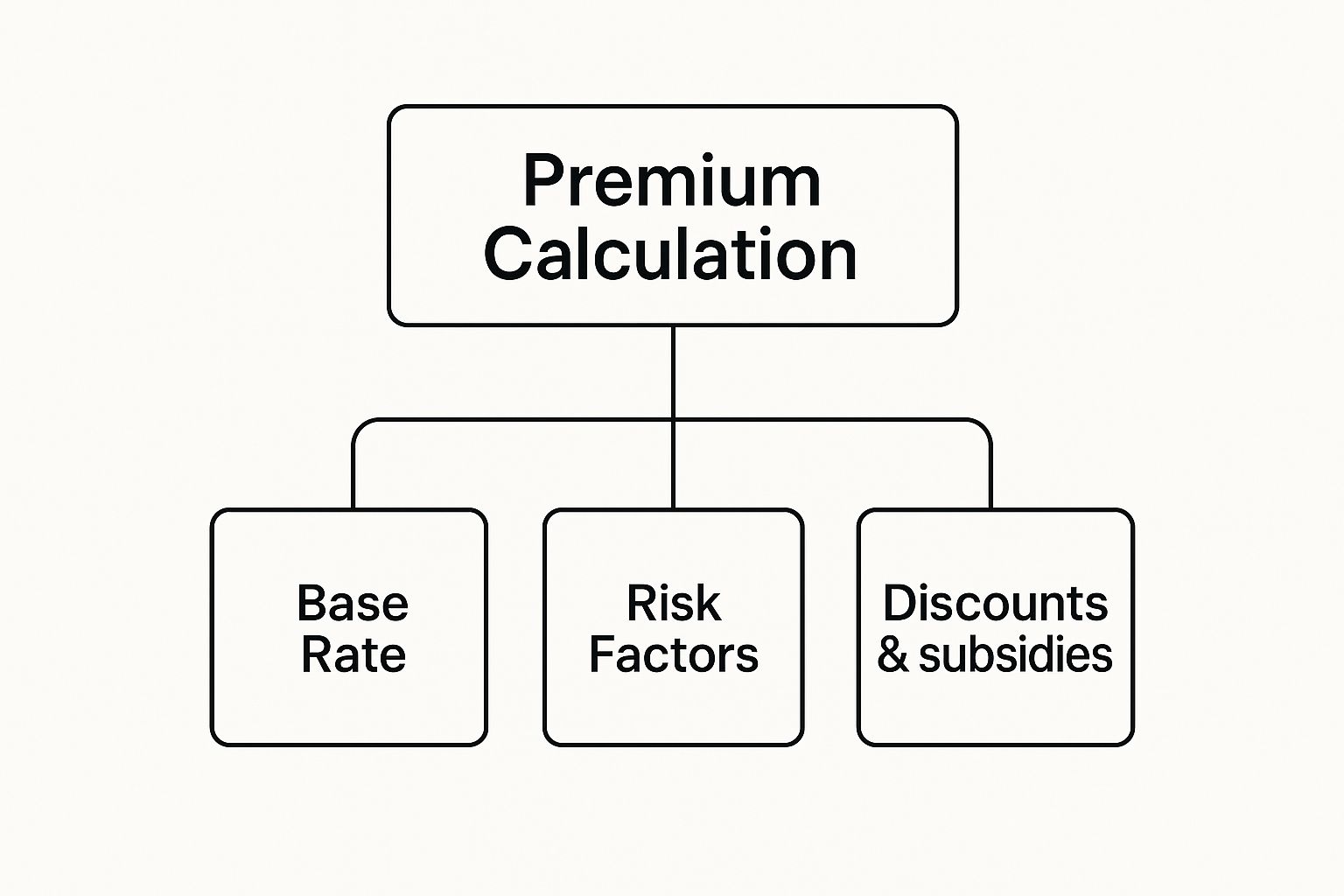

This visual illustrates how these elements converge.

As depicted, your premium is not a singular number. It is a base rate adjusted by specific risk factors and any applicable discounts.

Personal Attributes That Shape Your Premium

Your personal profile establishes the baseline for your premium. Insurers utilise these details to assess the likelihood and potential cost of future claims.

- Age: This is a primary determinant. With advancing age, the statistical probability of requiring medical care increases, which is directly reflected in a higher premium. This is a fundamental principle of actuarial science.

- Geographic Location: Your country of residence and the regions where you require coverage are critical. Healthcare costs in financial hubs like the United States or Hong Kong are substantially higher than in other parts of the world, and your premium will unequivocally reflect this disparity.

- Underwriting Method: Your medical history, and the insurer's assessment thereof, plays a significant role. Opting for full medical underwriting, which involves a comprehensive disclosure of your health history, often results in a more accurately priced—and potentially lower—premium. This contrasts with a moratorium plan, which may exclude pre-existing conditions for a specified period but can carry a higher cost.

It is also important to recognise that premiums tend to rise annually due to external factors, notably medical inflation. For a more detailed analysis, our article on why health insurance premiums increase year after year offers valuable insights.

How Plan Design Choices Affect Cost

This is the area where you exercise the most control. Beyond your personal profile, the architectural choices you make for your plan have a direct and immediate impact on your recurring cost.

This table details how various personal and plan choices directly influence your premium, enabling you to identify areas for strategic optimisation.

How Key Variables Impact Your Health Insurance Premium

| Influencing Factor | Description | Impact on Premium |

|---|---|---|

| Level of Coverage | The scope of your benefits—from a basic inpatient-only plan to a comprehensive policy including outpatient, dental, and wellness services. | More comprehensive coverage leads to a higher premium. |

| Deductible Size | The amount you agree to pay out-of-pocket for medical care before the insurance company begins its contribution. | A higher deductible significantly lowers your premium. |

| Network Limitations | Choosing a plan with a curated list of approved hospitals versus one that grants unrestricted global access. | A limited network generally results in a lower premium. |

By strategically adjusting these variables, you transition from being a passive price-taker to an active architect of your health coverage. This grants you direct control over your premium, ensuring you invest only in the benefits that are of genuine importance to you.

How Global Medical Trends Affect Your Premium

A common misconception regarding health insurance premiums is that the price is determined in isolation.

The reality is that your premium is directly linked to powerful global forces shaping the future of medicine.

Insurers are not raising prices arbitrarily; they are responding to a well-documented and persistent rise in the cost of delivering elite medical care. The same innovations that provide access to extraordinary treatments also escalate underlying expenses, a reality that must be reflected in your premium.

The Impact of Medical Inflation and Technology

The single largest driver of rising premiums is medical cost inflation. This is a specific global trend that consistently outpaces standard economic inflation. For expatriates who demand premier care, this is fuelled by two primary factors: extraordinary advancements in pharmaceuticals and groundbreaking new medical technologies.

Your premium can be viewed as a direct investment in medical progress. While these breakthroughs deliver remarkable outcomes, they entail substantial research, development, and implementation costs that ultimately permeate the entire insurance ecosystem.

Globally, the medical trend rate—the projected growth in per-person medical costs—is expected to be 10.1% in 2024. This is not an abstract figure. It is most acute in key expatriate hubs, with North America anticipating an 8.7% increase and the Asia Pacific region facing a 12.3% rise. These are the real-world cost pressures that your insurer must factor into its financial planning. You can discover more about these global medical trends and their drivers in recent industry analysis.

This surge is largely attributed to a few high-cost factors:

- New Medical Technologies: Nearly 69% of insurers worldwide identify new technologies as a leading cause of rising expenses.

- Advanced Pharmaceuticals: In certain key regions, a significant 55% of insurers cite the escalating price of new drugs as a major force driving claims—and therefore premiums—higher.

Ultimately, your annual premium review reflects the state of modern medicine: dynamic, innovative, and frequently expensive. By understanding these forces, you transition from a passive policyholder to an informed client who recognises the clear correlation between cost and access to world-class healthcare.

Strategic Approaches to Optimize Your Premium

Comprehending the nature of a health insurance premium becomes truly advantageous when you learn how to manage it. For an individual navigating a global lifestyle, the objective extends beyond simply paying a bill—it is to architect your premium. This is not a passive expense; it is a dynamic component of your financial strategy.

The aim is to align your coverage precisely with your lifestyle, eliminating superfluous costs without compromising the quality of care you expect. This is about being a prudent steward of your healthcare investment.

Tailoring Your Plan for Maximum Efficiency

The most direct method for controlling your premium is by adjusting your plan's core components. Every decision has a direct bearing on your recurring cost.

- Select a Higher Deductible: This is a classic optimisation strategy. By accepting a larger share of initial medical costs, you can substantially lower your fixed monthly or annual premium. It is a calculated risk that is often financially advantageous, particularly if you maintain good health.

- Refine Your Geographic Coverage: While a worldwide plan offers comprehensive scope, it is often an expensive luxury. If your life and travels are primarily concentrated in Europe and Asia, excluding North America—where medical costs are exceptionally high—can reduce your premium dramatically.

- Pay Annually: Insurers typically offer a discount for remitting the full annual premium in a single payment rather than in monthly instalments. This simple administrative choice can yield a tangible financial benefit.

The objective is to ensure every dollar of your premium is working effectively for you. By consciously manipulating these levers, you can craft a policy that is a bespoke fit for your life—not a generic, off-the-shelf product.

It is also worth noting that health insurance premiums reflect broader market dynamics. For instance, while the global insurance market index showed a modest overall rate decrease recently, health insurance is subject to unique pressures. The ever-increasing cost and frequency of medical claims consistently push health premiums upward. You can explore more on global insurance market trends from Marsh to see these forces in action.

The Annual Policy Review

Your life is not static; your health insurance should not be either.

One of the most critical—and frequently overlooked—strategies is the annual policy review. This provides a dedicated opportunity to reassess your needs and ensure your plan remains optimally aligned with your circumstances. A change in residency, family status, or travel patterns could render your current plan inefficient or inadequate.

This annual check-in is your moment to make intelligent, strategic adjustments. Our guide on how to choose the right expat health insurance policy provides an excellent framework for this review process. By remaining actively engaged, you ensure your premium delivers maximum value, year after year.

Frequently Asked Questions About Premiums

As one delves deeper into the intricacies of international health insurance, specific questions invariably arise. For high-net-worth expatriates managing a global lifestyle, obtaining clear, direct answers is not merely helpful—it is essential for sound financial decision-making.

Here are responses to the questions we encounter most frequently.

Why Do My Premiums Increase If I Haven't Made a Claim?

This is a common inquiry, stemming from a logical but flawed assumption that an individual's premium is tied to their personal claims history.

In reality, your premium is almost entirely disconnected from your personal usage. It is calculated based on the collective risk and medical costs of the entire insurance pool to which you belong. Annually, insurers analyse macro trends: rising healthcare inflation, the high cost of new medical technologies, and the total claims paid out for the group. Your rate reflects these aggregate costs.

Your premium represents your share of the group's collective risk, not a penalty for your individual health. This "pooling" is the fundamental principle of insurance. It distributes the potentially catastrophic cost of a major medical event across thousands of individuals, ensuring funds are available when a member—perhaps you—requires them.

What Is the Difference Between a Premium and a Deductible?

An analogy may be useful. Consider your premium as the annual membership fee for an exclusive private club. It is the fixed price paid, typically monthly or yearly, to maintain your policy's active status and guarantee your access to care. It is non-refundable.

A deductible, conversely, is a cost incurred only upon utilisation of the club's services. It is the specific amount you are required to pay out-of-pocket for your medical expenses before the insurance company begins to contribute its share. As a general rule, a willingness to accept a higher deductible is rewarded by the insurer with a lower premium.

Are Premiums Ever Negotiable?

For an individual policy, the premium rate itself is not negotiable. Premiums are set by actuaries using extensive data sets—factoring in age, geography, and chosen plan benefits. This formula is applied consistently to all individuals with a similar profile to ensure fairness and maintain the insurer's financial solvency.

While the price point is fixed, you retain absolute control over the final cost. Consider it akin to commissioning a bespoke suit—you cannot negotiate the price of the fabric per metre, but you can select a different fabric. You can strategically lower your premium by adjusting plan variables, such as selecting a higher deductible or a more restricted area of coverage.

You can find more direct answers to your questions on our frequently asked questions page.

For expert, objective guidance in structuring a policy that aligns with your financial strategy, contact Riviera Expat to schedule a complimentary consultation.