Using your Health Savings Account (HSA) for therapy is not merely possible—it is a sophisticated financial maneuver for safeguarding your well-being.

An HSA permits you to fund qualified mental health services with pre-tax dollars. This fundamental principle means you are, in effect, securing a discount on every therapy session, transforming a critical personal investment into a powerful financial strategy.

A Strategic Approach to Funding Mental Wellness

For high-net-worth individuals, an HSA is far more than a simple savings vehicle. It is a sophisticated instrument for concurrently managing both health and wealth. Its true power emanates from a feature exceedingly rare in finance: the triple-tax benefit.

Reframe your perspective from simply spending on therapy to making a highly tax-advantaged investment in your own mental resilience and capacity.

The Power of Tax-Advantaged Investing

Your HSA empowers you to allocate funds for mental wellness with exceptional financial advantages. The entire structure is engineered to make your capital work more efficiently for you.

The real genius of an HSA is its dual role. It's a dedicated fund for today's healthcare needs and a tax-sheltered investment account for building future wealth.

Every dollar contributed, every dollar earned through investment, and every dollar withdrawn for qualified therapy is completely shielded from federal income tax. This creates an immediate and tangible return on the investment you make in your own health.

Here is a precise look at how this financial instrument provides a clear advantage:

- Pre-Tax Contributions: Funds are deposited into your HSA before federal taxes are levied, which directly lowers your adjusted gross income for the year.

- Tax-Free Growth: Any funds in your HSA can be invested, and all earnings grow completely tax-free.

- Tax-Free Withdrawals: When you withdraw funds to pay for qualified therapy sessions, those withdrawals are also 100% tax-free.

Making Informed Decisions for Your Health

Integrating mental wellness into your financial plan is a strategic move that demands clarity. A key component of this is understanding different therapy options and their methodologies. When you know precisely what support you require, you can align that personal need perfectly with your financial strategy.

To assist in this endeavor, let us examine the core advantages and tactical considerations you should maintain.

HSA for Therapy: Key Strategic Considerations

The table below summarizes the key strategic takeaways when you decide to utilize your HSA to finance therapy services. It is about more than just settling an invoice; it is about optimizing your financial resources for your personal growth.

| Aspect | Strategic Takeaway for High-Net-Worth Individuals |

|---|---|

| Tax Efficiency | The triple-tax advantage provides an immediate ROI on therapy expenditures by lowering your taxable income and offering tax-free growth. |

| Investment Growth | Unused HSA funds can be invested, transforming your healthcare account into another asset that grows tax-free over the long term. |

| Cost Reduction | Paying with pre-tax dollars effectively provides a discount on therapy services equivalent to your marginal tax rate. |

| Financial Privacy | Utilizing an HSA debit card can offer more discretion than filing claims through a primary employer-sponsored health insurance plan. |

| Flexibility & Control | You determine which qualified therapies to fund and when, without requiring insurance pre-approvals for out-of-network providers. |

| Long-Term Asset | Your HSA balance rolls over annually and remains yours even if you change employment, making it a permanent part of your financial portfolio. |

Ultimately, using an HSA for therapy is about making your capital work with greater intelligence. It transforms an essential expense into a tax-advantaged investment in your most valuable asset: you.

This guide will delineate exactly how to use your HSA for these services, covering everything from eligibility rules and qualified expenses to the precise practical steps required. We will ensure every dollar is allocated to its highest and best use for both your personal and financial gain.

Confirming Your HSA Eligibility and Foundations

Before contemplating the use of a Health Savings Account (HSA) for therapy or any other purpose, there is a critical, non-negotiable first step: ensuring your eligibility.

This is not a mere procedural formality. It is the foundation of your entire strategy. An error here could result in significant tax penalties.

An HSA does not exist in isolation. It is legally tethered to a specific type of health insurance—a High-Deductible Health Plan (HDHP). This is a mandatory pairing.

Consider the HDHP as the key that unlocks the HSA. Without an active, qualifying HDHP, you are statutorily prohibited from opening or contributing to an HSA. The Internal Revenue Service (IRS) is unequivocal on this matter and sets strict standards for what constitutes an HDHP, updating them annually.

For 2024, the IRS mandates that your HDHP must have a minimum deductible of $1,600 for self-only coverage or $3,200 for family coverage. If your plan fails to meet these minimums, you cannot contribute to an HSA.

Navigating Complex Eligibility Scenarios

For any individual managing their finances with precision, the basic rules are merely the starting point. True control comes from understanding the nuanced situations that can lead to disqualification.

Even with a qualifying HDHP, several other factors can render you ineligible to contribute to an HSA.

Be aware of these common impediments:

- You possess other, non-HDHP health coverage. This is a significant factor. It could be secondary coverage from a spouse’s traditional PPO plan or another policy.

- You are enrolled in Medicare. The moment you enroll in any part of Medicare (Part A, B, D, etc.), your eligibility to contribute to an HSA ceases.

- You are claimed as a dependent on another individual's tax return. If you can be claimed as a dependent, you are not permitted to fund your own HSA.

The rules are exceedingly strict. For instance, you could have your own qualifying HDHP, but if your spouse has a general-purpose flexible spending account (FSA) that also covers you, it could nullify your eligibility. This is why a comprehensive review of all your health coverage is essential. For those navigating complex international insurance, a detailed FAQ can provide much-needed clarity. You can find more information about expat health insurance on our FAQ page.

Adhering to eligibility rules is paramount. A misstep could invalidate your contributions, compelling you to pay back taxes and a 20% penalty on any improperly contributed funds.

Ensuring your financial strategy is built on a solid, compliant foundation is non-negotiable. By confirming your HDHP status and double-checking for any disqualifying factors, you establish the groundwork to confidently use your HSA for therapy and other medical needs. The diligence performed now ensures every dollar saved is both powerful and secure.

Identifying Qualified Mental Health Expenses

When leveraging your Health Savings Account (HSA) for mental wellness, precision is critical. The IRS maintains specific regulations defining a qualified medical expense, and non-compliance can lead to penalties. Utilizing your HSA for therapy hinges on one key distinction: medically necessary treatment versus general self-improvement.

Your HSA is designed for expenses that diagnose, treat, or prevent a medical condition. This is the cornerstone of every qualified expense. If a service directly targets a diagnosed mental health issue—such as anxiety, depression, or PTSD—it is almost certain to qualify.

What Is Typically Covered

The list of qualified mental health expenses is broad, provided the services are rendered by a licensed professional. You can confidently use your HSA for a range of treatments that form the backbone of modern mental healthcare.

Here are the services generally considered qualified by the IRS:

- Psychiatric Care: This includes consultations, ongoing treatment, and management of mental health conditions by a psychiatrist (an M.D. or D.O.).

- Psychological Counseling: Sessions with a licensed psychologist (a Ph.D. or Psy.D.) for diagnosis and therapy are fully qualified.

- Therapy with Licensed Professionals: This also encompasses sessions with licensed clinical social workers (LCSW), licensed professional counselors (LPC), and licensed marriage and family therapists (LMFT), provided the therapy is for treating a specific medical condition.

- Prescription Medications: Any drugs prescribed by a medical doctor to treat a mental health condition, such as antidepressants or anti-anxiety medications, are eligible.

- Transportation Costs: The cost of travel to and from these appointments can also be claimed as a qualified medical expense.

The core test for eligibility is whether the service is intended to alleviate or prevent a physical or mental defect or illness. If the primary purpose is medical care, it qualifies.

What Is Not Covered

It is equally important to understand what an HSA cannot be used for. The IRS draws a firm line, excluding expenses for general well-being rather than for treating a diagnosed medical condition. Misusing your funds on a non-qualified expense could subject you to taxes plus a 20% penalty.

Here’s what you generally cannot use your HSA for:

- General Life Coaching: A life coach who is not a licensed medical professional does not qualify.

- Marriage Counseling for General Improvement: While counseling prescribed to treat a diagnosed mental illness is covered, sessions aimed at general relationship improvement are not.

- Wellness Retreats: The general costs of a wellness retreat are not eligible unless a specific portion is prescribed by a physician for direct medical care.

This distinction is paramount. For instance, if couples therapy is prescribed to help treat one spouse's diagnosed depression, it would likely qualify. However, if the same couple attends therapy solely to improve their communication skills, it would not. The key is documented medical necessity.

For those of you managing complex international health plans, understanding these policy details is absolutely vital. You can find more on this in our guide to choosing expat health insurance.

By adhering to these clear guidelines, you can use your HSA with confidence, knowing every dollar is being utilized correctly and in full compliance with tax law.

Maximizing Your Contributions: A Strategic Game Plan

Having confirmed your HSA eligibility, the next phase is converting that eligibility into a potent financial instrument. This is where we transition from theory to action, strategically funding your account to reduce your tax liability while building a reserve for future healthcare needs, including your HSA for therapy.

Think of this not merely as saving, but as a calculated financial maneuver. Executing this correctly is key to unlocking the full power of the HSA without incurring penalties.

First, you must understand the rules of engagement. The IRS sets annual contribution limits, which depend on whether your high-deductible health plan (HDHP) provides self-only or family coverage. For 2024, these limits are $4,150 for self-only coverage and $8,300 for family coverage. These figures are the foundation of your funding strategy.

Planning for the Long Haul

For those approaching their peak earning years, there is an exceptional opportunity to accelerate savings. Individuals aged 55 or older can contribute an additional $1,000 annually as a "catch-up" contribution. This is a significant advantage, allowing you to substantially increase your account balance, creating a larger tax-free fund for any future health expenses.

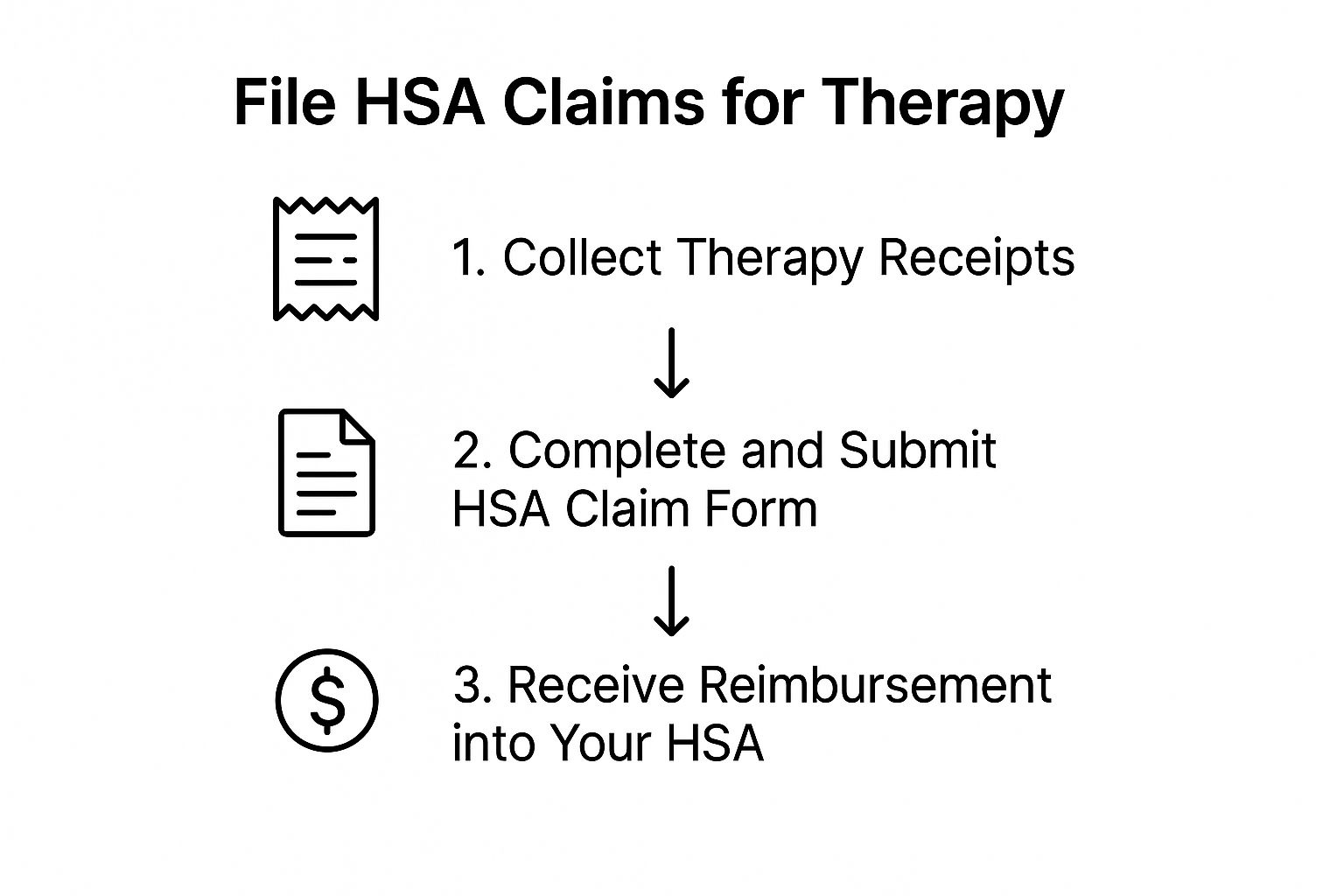

This infographic breaks down the simple process of utilizing these funds for therapy.

As illustrated, the process is disciplined and straightforward: retain your documents, file the claim, and receive your tax-free reimbursement.

The Last-Month Rule: A Powerful Tool with a Caveat

There is a specific rule that demands your full attention, particularly if you become HSA-eligible mid-year. It is called the "last-month rule," and it can be a game-changer. It permits you to contribute the full annual maximum for the year, provided you were eligible on the first day of the last month of that tax year—December 1st for most individuals.

But this opportunity comes with a non-negotiable condition: the "testing period."

To retain that full contribution, you must remain HSA-eligible for the entire following calendar year, from January 1st through December 31st. Failure to meet this requirement has steep consequences.

The IRS enforces these rules rigorously. For example, if you obtain HDHP coverage in November, utilize the last-month rule to maximize your contribution, but then switch to a non-HDHP plan the following June, the rules are unforgiving. You will be required to report the excess contributions as taxable income and pay an additional 10% tax penalty on that amount. You can review the fine print in the official IRS publication about HSAs.

This underscores the need for certainty in your health plan. When executing a significant strategic move like this, precision is everything. You must ensure your intelligent financial planning does not result in a costly and avoidable tax issue.

Now that your strategy is in place, it is time to pay for therapy and maintain immaculate records. This is where your financial plan is put into action.

The process itself is simple, but success lies in precision—particularly in how you pay and track every dollar.

Paying for Therapy: Your Two Main Options

You have two primary methods for using your HSA funds.

The most direct method is the HSA debit card. It functions like any other debit card. You present it at your therapist's office, and the payment is debited directly from your HSA. It is clean, simple, and requires no out-of-pocket expenditure.

Your alternative is to pay for therapy with personal funds first and then reimburse yourself from the HSA. This offers flexibility, especially if you wish to allow your HSA balance to grow through investments. You simply withdraw the exact amount of the therapy expense from your HSA and transfer it to your personal bank account.

Why Meticulous Records are Not Negotiable

Regardless of your payment method, maintaining flawless records is an absolute necessity. The IRS requires you to prove that every withdrawal was for a legitimate, qualified medical expense. Do not view this as a chore. Regard it as protecting your tax-free capital.

In the event of an audit, your records are your sole defense. Without proof, the IRS can reclassify your withdrawals as taxable income and impose a stiff 20% penalty.

Your documentation must be specific. A simple credit card statement showing a charge from a clinic is insufficient.

The burden of proof rests entirely on you, the account holder. The single most important habit you can cultivate is maintaining an organized file—digital or physical—for every HSA expense.

To ensure you are audit-proof, you must collect and save the following for every therapy session funded by your HSA:

- Itemized Receipts: These are crucial. They must show the specific service (e.g., "psychotherapy session"), the date of service, the provider's name, and the exact cost.

- Explanation of Benefits (EOB): If you first process the claim through your health insurance, the EOB is your key document. It details what your insurance covered and your remaining liability. That remaining balance is the exact amount you can legally withdraw from your HSA.

This level of detail leaves no room for ambiguity. It is undeniable proof that you are using your HSA for therapy correctly and in full compliance with IRS regulations, keeping your financial strategy secure.

The HSA as a Long-Term Investment Vehicle

For the discerning investor, a Health Savings Account is far more than a repository for medical funds. It is one of the most powerful tax-advantaged investment vehicles available. This is where your HSA transitions from a mere spending tool to a cornerstone of your wealth-building strategy.

This change in mindset transforms using an HSA for therapy from a simple expense into a long-term financial victory.

Once your account balance reaches a certain threshold—typically a few thousand dollars as set by your HSA administrator—you can begin investing the funds. This opens the door to acquiring stocks, bonds, and mutual funds within your HSA, where every cent of growth is completely tax-free.

A Strategy for Compounding Wealth

The most powerful strategy is to pay for current therapy sessions and other medical expenses out-of-pocket, leaving your HSA funds entirely untouched to grow. While it may seem counterintuitive, this allows your invested balance to compound for years, even decades. The result is a substantial, tax-free fund for retirement or any future health needs.

This shift in perspective is critical. You are not just saving for healthcare; you are building a legacy asset dedicated to your long-term health and financial security.

This approach requires discipline, but the potential payoff is immense. If you are serious about maximizing your HSA’s growth, a firm grasp of the fundamentals is essential. You can delve deeper into the mechanics of investment tax basics, including capital gains and dividend income implications.

The Expanding Role of HSAs

Health Savings Accounts were introduced in the United States in 2003 and have steadily gained traction. As more individuals recognize their financial power, proposed expansions to HSA rules are projected to result in nearly $14.8 billion in foregone federal tax revenue for the 2025 fiscal year alone.

This figure signifies a major trend toward enhancing the versatility of HSAs, cementing their role as a central tool in modern financial planning.

Of course, to execute this type of strategy effectively, particularly as a globally mobile professional, you must be intimately familiar with the details of your insurance coverage. It is always prudent to review our guide on how to decipher expat medical insurance policy terms.

Common Questions About Using Your HSA for Therapy

Even with a robust plan for your HSA, specific questions will invariably arise. This is entirely normal. Let us address some of the most common situations encountered when using HSA funds for mental healthcare.

Can I Use My HSA for My Child's or Spouse's Therapy?

Yes, absolutely. You can use the funds in your Health Savings Account to pay for qualified therapy expenses for your spouse and any dependents you claim on your tax return.

The detail that often surprises people is that your dependent does not need to be covered by your High-Deductible Health Plan (HDHP). As long as the IRS recognizes them as your tax dependent, you can use your HSA funds for their therapy sessions. It is a powerful and frequently overlooked benefit.

What Occurs if I Inadvertently Pay for a Non-Qualified Expense?

Here, you must exercise caution. Using HSA funds for an expense not qualified by the IRS—such as general life coaching—results in significant financial penalties.

First, the amount spent is added back to your gross income for the year, making it subject to income tax. Additionally, if you are under age 65, the IRS imposes an extra 20% tax penalty. This is why meticulous record-keeping is non-negotiable; it ensures every dollar spent on therapy is compliant.

The rule is simple and unforgiving: a non-qualified withdrawal results in both income tax and a steep penalty. Meticulous record-keeping is the only way to protect your account's tax-free status and avoid these costly errors.

Is a "Letter of Medical Necessity" Required for Therapy?

For most standard therapy sessions, it is unlikely. If you are seeing a licensed therapist to treat a diagnosed condition such as anxiety or depression, the service is already considered a medical expense by the IRS. A formal letter is not typically required.

However, in any situation where there is ambiguity, obtaining a Letter of Medical Necessity from a physician is a prudent measure. A simple note confirming your diagnosis and recommending therapy creates an ironclad paper trail. It is an additional layer of protection that can prevent significant complications in the event of an audit.

At Riviera Expat, we specialize in providing the clarity and control you need over your international health insurance. Our expert guidance ensures your healthcare coverage aligns perfectly with your financial strategy, giving you confidence in every decision. Learn more about how Riviera Expat can simplify your global health plan.