Navigating health insurance in the USA for foreigners is not merely an administrative task on your relocation checklist; it is one of the most critical financial decisions you will make. The American healthcare system operates as a sophisticated, high-stakes private marketplace, and a lack of preparation can lead to significant financial exposure.

Unlike many countries where healthcare is treated as a public utility, the U.S. system directly links access to premier care with the quality of one's insurance plan. For high-net-worth individuals accustomed to a certain standard of service and choice, understanding this dynamic is paramount.

Your Guide to US Health Insurance for Foreign Nationals

For the globally mobile individual, the initial challenge is adapting to the unique U.S. healthcare model. It is not a singular, nationalized system but a complex mosaic of private insurers, employer-sponsored plans, and select government programs. This structure creates a direct and unforgiving link between your insurance portfolio and your financial well-being.

Proceeding without adequate coverage is a considerable financial risk. A minor medical incident can quickly escalate into a major financial event. An emergency room visit, a routine surgical procedure, or a brief hospitalization can generate invoices amounting to tens, or even hundreds, of thousands of dollars. A robust insurance plan is not a discretionary expense—it is your primary defense against catastrophic financial liability.

The Financial Realities of US Healthcare

This is not an exaggeration; it is the documented reality of the American system. The potential for substantial medical costs is a factor that surprises many newcomers. In fact, data has consistently shown that a small percentage of the population accounts for a disproportionately large share of healthcare expenditures. For example, recent analyses indicate that the top 5% of the U.S. population in terms of health spending accounts for over half of all medical costs. This highlights how rapidly a serious illness or accident can impact your financial position without premier coverage. You can explore these healthcare financing patterns in greater detail at Our World in Data.

This reality makes selecting the right health insurance in usa for foreigners a pivotal strategic decision. The objective is not simply to hold a policy but to secure one with an expansive network of physicians and medical centers, a manageable deductible, and an out-of-pocket maximum that functions as a reliable financial backstop.

The objective is to reframe health insurance from a recurring expense to a strategic asset. It is a tool that protects your wealth and guarantees access to top-tier medical care precisely when it is most needed.

Your pathway to securing insurance is almost entirely dictated by your visa and residency status. Different circumstances provide access to distinct options, each governed by its own set of regulations and benefits. Let us dissect the most common pathways.

US Health Insurance Pathways for Foreign Nationals

The following table provides a concise overview of the principal insurance options available to foreign nationals, contingent upon their purpose for being in the United States.

| Visa or Residency Status | Primary Insurance Option | Key Consideration |

|---|---|---|

| Work Visa (H-1B, L-1) | Employer-Sponsored Group Plan | Often the most cost-effective and comprehensive choice, directly tied to your professional engagement. |

| Student Visa (F-1, J-1) | University-Mandated Plan | A requirement for most educational institutions; coverage and cost vary significantly by university. |

| Green Card Holder | ACA Marketplace or Employer Plan | Eligible for the same plans as U.S. citizens, including potential subsidies on the Health Insurance Marketplace. |

| Visitor/Tourist Visa | Short-Term or Travel Medical Insurance | Designed exclusively for emergencies and temporary stays; does not satisfy long-term residency requirements. |

Each of these avenues has distinct intricacies, which we will explore in further detail. The crucial first step is to identify your specific category, as this will serve as the foundation for your insurance strategy in the U.S.

Decoding the American Healthcare System

Here is a critical distinction that many foreign nationals encounter when arriving in the U.S.

The American healthcare system is fundamentally different from those in most other developed nations. It is not a single, government-administered service but a vast, competitive marketplace of private entities. Navigating it requires a new financial lexicon.

To illustrate, many countries offer healthcare that resembles a prix-fixe menu—predictable and all-inclusive. The U.S. model is more akin to an à la carte dining experience, where every service—each consultation, diagnostic test, and procedure—is itemized and billed separately. Without the appropriate insurance, the final invoice can be formidable.

The Financial Cornerstones of Your Policy

To navigate this system without adverse financial impact, you must master a few key terms. These three components dictate your out-of-pocket exposure.

- Premium: This is your recurring access fee. It is a fixed amount paid to the insurance company on a monthly or annual basis to maintain your policy's active status, irrespective of whether you utilize medical services.

- Deductible: This is the initial amount you must personally pay for covered medical care before your insurance plan begins to contribute. Consider it your initial share of the risk. Once you have met this amount for covered services, the cost-sharing mechanism is activated.

- Co-pay & Co-insurance: After your deductible is met, you continue to share costs. A co-pay is a fixed fee for specific services, such as $50 for a specialist consultation. Co-insurance is a percentage-based split—for instance, you might pay 20% of the bill while the insurer covers the remaining 80%.

A health insurance policy is, at its core, a financial contract. It establishes a ceiling on your potential medical liability within a given year. Be discerning: a plan with a very low premium often carries a commensurately high deductible, trading a lower fixed cost for significantly increased financial risk in the event of illness or injury.

Mastering U.S. healthcare costs is one facet of your financial transition. For a holistic view on managing your finances as a newcomer, this guide to financial literacy for immigrants offers valuable insights.

Why Employment and Insurance Are So Intertwined

A defining characteristic of health insurance in the USA for foreigners and citizens alike is its deep-rooted connection to employment. If you are in the U.S. on a work visa, your employer is typically your primary portal to obtaining coverage.

This model is a historical artifact of the post-World War II economic landscape. In the 1940s and 1950s, with federal wage controls in place, companies were limited in their ability to attract top talent with higher salaries. Consequently, they began competing on non-wage benefits, and robust health insurance plans emerged as a powerful incentive.

This employer-centric system became deeply embedded in the American economy. Today, it remains the predominant source of health coverage. For most professionals relocating to the U.S., their first and often most advantageous insurance option will be the one offered through their employer. Understanding this historical context clarifies why your professional status plays such a pivotal role in your access to healthcare.

Finding the Right Health Insurance Path in the U.S.

As a foreign national in the USA, your path to securing health insurance is not linear. It is a map with multiple routes, and the optimal one is determined almost entirely by your visa status and purpose of stay.

Selecting the correct path from the outset is a critical financial decision. A misstep, such as relying on a basic travel policy for long-term residency, can leave you dangerously exposed to America's high medical costs. Let us examine the main pathways available, each with its own set of rules, costs, and level of protection.

Employer-Sponsored Plans: The Professional's Route

For most professionals relocating to the U.S. on a work visa, such as an H-1B or L-1, the most direct and often superior option is the employer's group health plan. This is the bedrock of the American healthcare system, covering a substantial portion of the population.

Companies leverage premier benefits to attract skilled talent, so these plans are typically robust. The monthly premiums are generally more favorable than individual market rates, and they provide access to extensive networks of physicians and hospitals. Enrollment is usually integrated into the new-hire onboarding process, with the employer subsidizing a significant portion of the cost.

Private Plans on the ACA Marketplace: For Lawfully Present Immigrants

What if employer-sponsored insurance is not an option? If you are a "lawfully present" immigrant—a broad designation that includes Green Card holders and many other visa categories—you may be eligible to purchase a plan through the Affordable Care Act (ACA) Health Insurance Marketplace. These are comprehensive, long-term plans that cover essential health benefits and cannot deny coverage based on pre-existing conditions.

Navigating the Marketplace, however, requires careful attention. Eligibility is strictly tied to your specific immigration status, and the regulations can be complex. Nonetheless, for those who qualify, it is a dependable method for obtaining comprehensive coverage. For a detailed analysis of how different expat policies compare, this comparison of expat medical insurance policies can help clarify which model aligns with your lifestyle.

The key determinant is purpose. Employer and ACA plans are engineered for ongoing, comprehensive health management. Travel and short-term plans are designed solely for unforeseen emergencies and offer minimal protection.

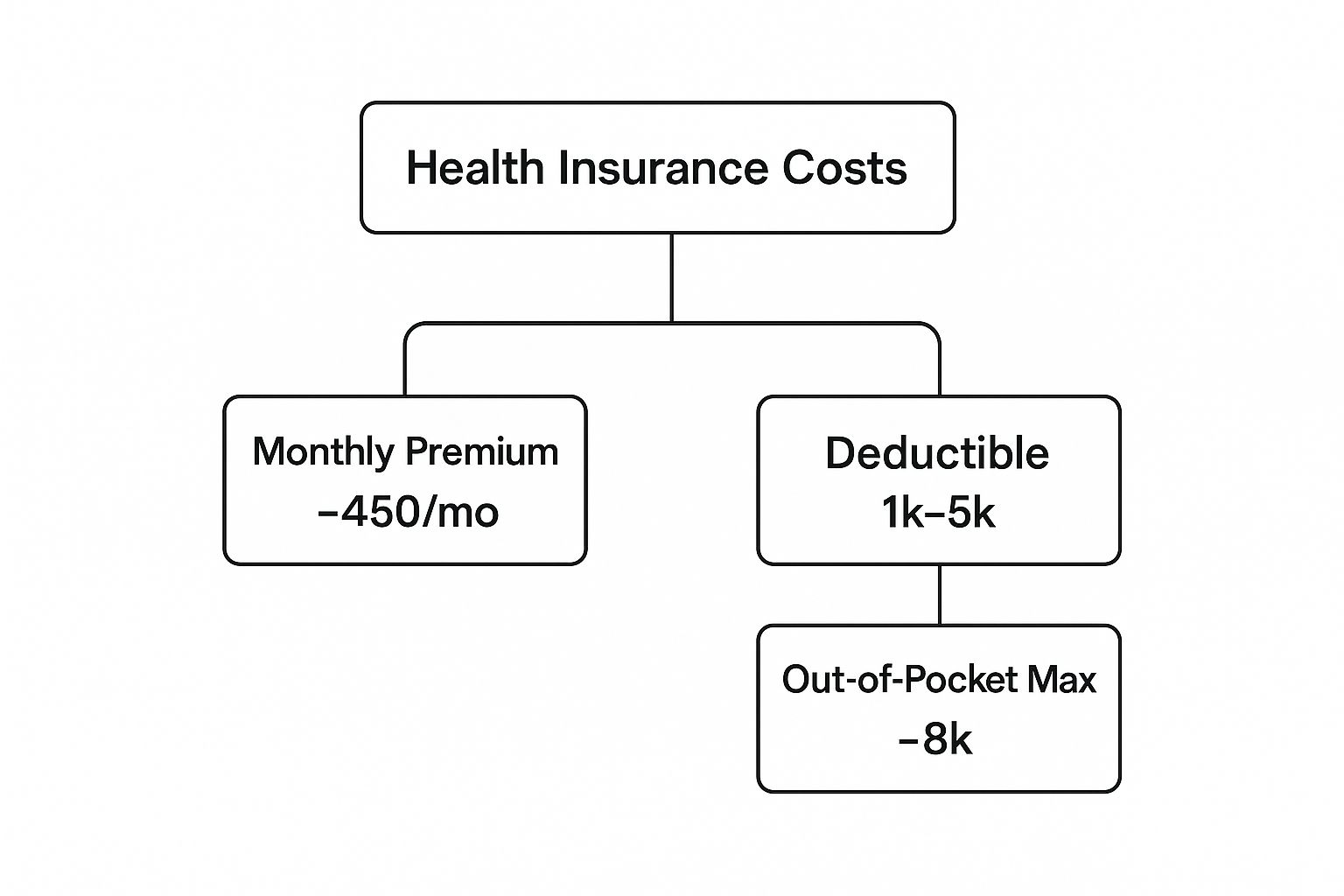

This image clearly illustrates the primary costs associated with any comprehensive U.S. health plan. Your evaluation must extend beyond the monthly premium.

As depicted, your deductible and out-of-pocket maximum are critical determinants of your total potential financial outlay in a given year.

University Plans and Temporary Stopgaps

If you are in the U.S. for academic purposes on an F-1 or J-1 visa, your insurance pathway is typically predetermined. Most American universities mandate enrollment in their student health plan. These plans satisfy visa requirements, but their quality and cost can vary dramatically between institutions.

Finally, there are temporary options. It is vital to understand their intended purpose—and their limitations.

- Short-Term Health Insurance: These plans provide coverage for a limited duration, typically up to one year. Their lower cost reflects their significant limitations: they generally do not cover pre-existing conditions and omit the essential benefits mandated in ACA-compliant plans. They should be viewed as a temporary bridge, not a long-term solution.

- Travel Medical Insurance: This is exclusively for tourists and very short-term visitors. It is intended to cover a sudden accident or illness during a trip and is wholly unsuitable for anyone residing in the U.S. for an extended period.

Comparing Key Insurance Plan Types for Foreigners

To properly assess these choices, a side-by-side comparison is useful. Each plan type is engineered for a distinct individual with specific needs.

| Plan Type | Best Suited For | Coverage Scope | Typical Cost Structure |

|---|---|---|---|

| Employer-Sponsored | Professionals on work visas (H-1B, L-1) | Comprehensive; includes essential benefits and preventive care | Monthly premium, shared with employer; plus deductibles, copays |

| ACA Marketplace | "Lawfully present" immigrants, freelancers, or self-employed | Comprehensive; must cover essential benefits and pre-existing conditions | Monthly premium (subsidies may be available); plus deductibles, copays |

| University Plan | Students on academic visas (F-1, J-1) | Varies by school; meets visa requirements but can be basic | Typically charged per semester with tuition; cost varies widely |

| Short-Term/Travel | Tourists, short-term visitors, or those in a brief coverage gap | Emergency-only; no pre-existing conditions, limited benefits | Lower upfront premium, but very high out-of-pocket costs if used |

Making the correct choice from day one is paramount. Selecting the right category of health insurance in USA for foreigners protects you from costly errors and ensures your coverage aligns with your residency status and health requirements.

Understanding Your Total Financial Commitment

For individuals accustomed to managing significant assets, financial clarity is not a preference—it is a prerequisite. When selecting health insurance in USA for foreigners, focusing solely on the monthly premium is a fundamental and potentially costly error.

A plan's true value, and its actual impact on your finances, is revealed in its total cost structure. The monthly premium is merely the initial cost of entry. To accurately assess your financial risk, you must look beyond this number to the policy's underlying architecture.

Beyond The Premium: The Real Numbers That Matter

It is imperative to understand these three interconnected components. They function sequentially to determine your actual out-of-pocket expenditure in any given year.

-

Deductible: This is your initial financial obligation. It is the amount you must pay for covered medical services before your insurance company begins to contribute. Consider it your primary share of the risk. If your plan has a $1,000 deductible, you are responsible for that first thousand dollars of care.

-

Co-insurance: Once you have satisfied your full deductible, you enter a cost-sharing phase. Co-insurance is the percentage of the subsequent medical bills for which you are responsible. In an 80/20 plan, for example, the insurer covers 80% of the cost, but you are still liable for the remaining 20% until you reach the ultimate financial safeguard.

-

Out-of-Pocket Maximum: This is, arguably, the most critical figure for managing your financial risk. It represents the absolute maximum amount you will be required to pay for covered services within a plan year. Once you reach this ceiling—through your deductible, co-pays, and co-insurance payments—your plan pays 100% of all covered costs for the remainder of that year.

These three figures are inextricably linked. A plan with an appealingly low premium almost invariably entails a higher deductible and a substantially higher out-of-pocket maximum. This trade-off shifts a significant amount of financial risk directly onto you. Remember, your complete financial picture in the U.S. includes other obligations, such as potential remote work tax implications, which can be a significant factor.

A Tale of Two Plans: A Real-World Cost Scenario

Let us translate this into a practical example. Imagine a minor surgical procedure results in a $40,000 medical bill. Here is how two different plans would manage this cost.

Plan A: The Low-Premium Gamble

- Monthly Premium: $400

- Deductible: $7,000

- Co-insurance: 80/20

- Out-of-Pocket Maximum: $9,450

First, you would pay your $7,000 deductible. On the remaining $33,000, your 20% co-insurance would be $6,600. However, your out-of-pocket maximum is $9,450. Therefore, you pay the $7,000 deductible plus an additional $2,450 in co-insurance, which brings you to your maximum. Your total cost for this one procedure is $9,450.

Plan B: The Value-Focused Choice

- Monthly Premium: $750

- Deductible: $1,500

- Co-insurance: 90/10

- Out-of-Pocket Maximum: $4,000

With this plan, you first pay the $1,500 deductible. Of the remaining $38,500, your 10% co-insurance would be $3,850. Since your out-of-pocket maximum is $4,000, you pay your $1,500 deductible plus $2,500 in co-insurance. Your total cost is $4,000. In this scenario, the higher premium yielded a $5,450 savings on a single medical event.

Your health insurance policy is not an expense to be minimized. It is a strategic tool for capping financial risk in the world’s most expensive healthcare market. Evaluating plans based on total potential exposure, not the upfront premium, is the only sound approach.

The high cost of care defines the American system and directly influences insurance plan design. This is not a recent development. U.S. healthcare spending has outpaced that of other developed nations for decades. This long-standing trend has cultivated the high-cost environment of today. If you are interested in the specific factors driving these persistent price increases, you may find our article on why medical insurance premiums rise year after year insightful.

Nailing Your Enrollment: A Step-by-Step Guide

Securing a health insurance policy in the U.S. is a precise, time-sensitive process. Unlike in many countries where coverage can be obtained at any time, the U.S. system operates on strict enrollment windows. Understanding these timelines is the first step to ensuring you are covered without dangerous gaps.

For those purchasing a private plan through the HealthCare.gov Marketplace, the primary window is the annual Open Enrollment Period (OEP). This is a specific period, typically for a few months at the end of the year, when anyone can enroll in a new plan for the upcoming year. Missing this window generally means you are locked out of obtaining an ACA-compliant plan until the next OEP.

Your One-Time Enrollment Opportunity

For individuals relocating to the U.S. from abroad, there is a significant exception: you will almost certainly qualify for a Special Enrollment Period (SEP). An SEP is a personal 60-day window to secure insurance outside of the standard OEP, triggered by a "qualifying life event."

For foreign nationals, the most common qualifying life events include:

- Moving to the U.S. from another country.

- Gaining lawful presence status for the first time.

- Losing other health coverage, such as upon leaving a job with an employer-sponsored plan.

- A change in employment that provides new access to a company health plan.

You must act promptly. This 60-day window is critical. Missing it could leave you uninsured for months—a significant financial risk that is best avoided.

Consider your Special Enrollment Period a one-time invitation to establish foundational coverage. It is essential to have all necessary documentation organized and ready to act the moment you become eligible.

Getting Your Documents in Order

To ensure a seamless application process, whether through a new employer or the Marketplace, you must have your key documents prepared. Insurers require this information to verify your identity and legal presence in the country.

Your essential checklist should include:

- Proof of Identity: Your valid passport with your U.S. visa.

- Proof of Lawful Presence: Your I-94 Arrival/Departure Record, Permanent Resident Card (Green Card), or other relevant employment authorization document.

- Proof of Residency: A utility bill, a copy of your lease agreement, or similar documentation showing your U.S. address.

- Social Security Number (SSN): If you have been issued one. If not, other identification numbers may be acceptable.

You will be submitting a significant amount of personal and financial data online. It is prudent to review a comprehensive guide to secure document sharing to ensure your sensitive information remains protected throughout the process.

Once you are ready to apply on HealthCare.gov or an insurer's portal, proceed with diligence. This is where you make the decisions that truly matter. Scrutinize the provider network: is it a restrictive HMO (Health Maintenance Organization) that requires referrals for specialist care, or a more flexible PPO (Preferred Provider Organization) that offers greater choice? Investigate the prescription drug formulary to confirm that any necessary medications are covered. This level of diligence transforms enrollment from a mere task into a strategic action, ensuring you secure a policy that provides robust protection when you need it most.

For a high-net-worth individual, standard health insurance is not just a defensive measure—it is a strategic asset. It is the buffer between you and a system that can compromise not only your health but also your wealth. Securing the right health insurance in USA for foreigners is about obtaining premier care without compromise.

The first step is non-negotiable: prioritize plans built on broad, national Preferred Provider Organization (PPO) networks. This is the difference between being directed to a limited set of providers and having the freedom to choose any expert you wish. A top-tier PPO allows you to consult leading specialists and access centers of medical excellence across the country directly, without requiring a referral. For a mobile, high-performance lifestyle, this is an essential feature.

Building a Comprehensive Health Portfolio

Your primary medical policy is the foundation, but a truly robust strategy involves layering protection, much like constructing a financial portfolio. You would not concentrate all your assets in a single instrument, and your health should not be left vulnerable with a single line of defense. You need specialized tools to manage specific, high-exposure risks that a standard plan might not fully address.

These ancillary policies are not mere add-ons; they are critical components of a personal risk management framework:

- Dental and Vision Plans: Frequently overlooked, these plans manage significant out-of-pocket costs for both routine care and major procedures—services your primary health insurance almost never covers.

- Critical Illness Insurance: This provides a crucial financial backstop. A diagnosis of a major illness triggers a lump-sum cash payment. This capital can be used at your discretion—to cover non-medical expenses, access experimental treatments, or replace lost income—providing financial stability during a challenging time.

For anyone who travels extensively or maintains strong connections abroad, overlooking medical evacuation and repatriation coverage is a critical error. This specialized insurance ensures that in a serious medical emergency, you can be transported to a hospital of your choice or returned to your home country. Without it, the cost of such a transport can easily exceed $100,000.

Elevating Your Coverage to a Strategic Asset

This level of planning transforms health coverage from a simple safety net into a proactive tool. It requires an understanding of the U.S. healthcare market structure itself. In many states, the market is highly concentrated, with a few large insurance companies controlling the majority of plans. For example, a 2023 analysis by the American Medical Association found that in 73% of U.S. metropolitan areas, the health insurance market was "highly concentrated" according to federal guidelines.

What does this mean for you? It can translate to fewer choices and potentially higher premiums, which makes a discerning selection process even more vital.

By deliberately selecting a plan with a national PPO network and fortifying it with specific supplementary policies, you are not just purchasing insurance. You are implementing a considered strategy to preserve both your health and your assets, ensuring you maintain absolute control over your healthcare decisions, no matter where you are in the United States.

Commonly Asked Questions from Foreign Nationals

Let's be direct. For those moving to the U.S., the healthcare system is often a significant source of uncertainty. It is complex, expensive, and fundamentally different from what you may be accustomed to.

You have practical questions that require clear, specific answers. Obtaining clarity on these points is often the final step toward feeling confident and secure in your relocation. Here are some of the most common questions we hear from foreign nationals.

Can I Just Use My Health Insurance from Home?

This is one of the most frequent—and dangerous—misconceptions. It is a critical point to understand.

While a high-end international policy from your home country might cover a true medical emergency in the U.S., it will almost certainly not be accepted for direct billing by U.S. healthcare providers. You will likely be required to pay the full, often substantial, bill upfront and then navigate the process of seeking reimbursement from your foreign insurer.

More importantly, these plans rarely meet the "qualifying health coverage" standards required for many U.S. visas or for tax compliance purposes. For both practical access to care and legal conformity, a U.S.-based health plan is not merely advisable; it is essential for anyone residing here.

What's the Real Risk of Being Uninsured in the US?

The financial risk of being without adequate U.S. health insurance is catastrophic. There is no way to understate this.

Should you require any medical care—from a visit to the emergency room for a minor injury to an unexpected surgical procedure—you are liable for 100% of the cost. In a country where a single night of hospitalization can easily amount to thousands of dollars, this is not a risk to your budget; it is a direct threat to your entire financial portfolio and personal assets.

Without proof of qualifying U.S. insurance, many hospitals may demand substantial upfront payments before providing non-emergency care. In some instances, they might deny it altogether. This is a financial gamble that no prudent individual should ever take.

Will My Pre-Existing Conditions Be Covered?

This is where the type of plan you choose is of the utmost importance.

All ACA-compliant plans, which include both employer-sponsored insurance and policies purchased from the official Health Insurance Marketplace, are legally mandated to cover your pre-existing conditions. They are also prohibited from charging you a higher premium because of them.

However, here lies a potential pitfall: short-term health plans, which are often marketed as a cheap and easy alternative, do not cover pre-existing conditions. This single exclusion renders them an exceptionally risky and inappropriate choice for anyone who requires reliable, comprehensive medical coverage.

If you have more specific questions about your situation, our detailed Frequently Asked Questions page is an excellent resource.

At Riviera Expat, we bring clarity and control to your international health insurance choices. We offer objective, expert guidance to make sure your coverage is a perfect fit for your sophisticated needs. Secure your financial and medical peace of mind today.