Securing bespoke health insurance in Spain is a critical component of a successful relocation or investment strategy. This is not merely an administrative task; it is a foundational decision for safeguarding your well-being. Spain’s healthcare landscape is a sophisticated blend of a world-class public service and a dynamic private sector, offering a full spectrum of choices for discerning individuals who value exceptional care and convenience.

Understanding Spain's Dual Healthcare System

Spain's healthcare model is renowned for its quality and accessibility, built upon an intelligent dual structure. A comprehensive public system operates in parallel with a thriving private insurance market. For individuals accustomed to premium services, mastering this dynamic is essential to crafting a healthcare experience that meets your standards.

The public system is the Sistema Nacional de Salud (SNS), a decentralized network of regional health services. It is funded primarily through social security contributions from employees and businesses, with the objective of providing universal coverage to legal residents who are actively contributing to the economy. The SNS is frequently cited as a key factor in Spain's high life expectancy, one of the best in the world.

The Role of Public Healthcare

The SNS forms the bedrock of Spanish healthcare, covering services from primary care consultations to complex surgical procedures. It ensures that any individual legally contributing to the system receives necessary medical attention without direct cost at the point of service.

The system is remarkably effective. Spain allocates approximately 11.5% of its GDP to healthcare, delivering top-tier health outcomes. It provides coverage to an estimated 99% of the population, a figure that underscores its extensive reach. For a granular analysis, you can explore additional details on Spanish healthcare statistics to gain a complete perspective.

The Complementary Private Sector

Operating alongside the public system is a robust private healthcare sector, offering an alternative pathway to medical services. It is the preferred choice for those who place a premium on immediacy, choice, and superior amenities. This is not about replacing the SNS, but rather complementing it with a more exclusive tier of service.

A significant number of residents and expatriates, particularly those who value expedited appointments and personalized care, opt for private health insurance in Spain. The decision is typically driven by several key advantages:

- Immediate Access to Specialists: Bypass the potential waiting lists for non-emergency consultations and procedures that can exist within the public system.

- Choice of Doctors and Facilities: Enjoy the freedom to select your own physicians and access premier private hospitals from an extensive network.

- Enhanced Comfort and Privacy: This typically includes a private room for hospital stays and a more personalized patient experience.

- Multilingual Services: A critical benefit for international clients, guaranteeing access to English-speaking doctors and dedicated support staff.

The appeal of the private sector is clear. Approximately 26% of Spanish residents, translating to over 12 million people, hold private insurance policies. This figure highlights the value placed on the additional control and convenience it affords, cementing Spain's reputation as a country with a secure and flexible dual-track system.

Public Versus Private Healthcare: A Strategic Comparison

Choosing your health coverage in Spain is a strategic decision that will shape your quality of life. It is less about ticking a box and more about defining how you wish to manage your health and well-being. Your selection between the public Sistema Nacional de Salud (SNS) and a private plan will determine your access, convenience, and control.

This choice is integral to the lifestyle you intend to cultivate in Spain.

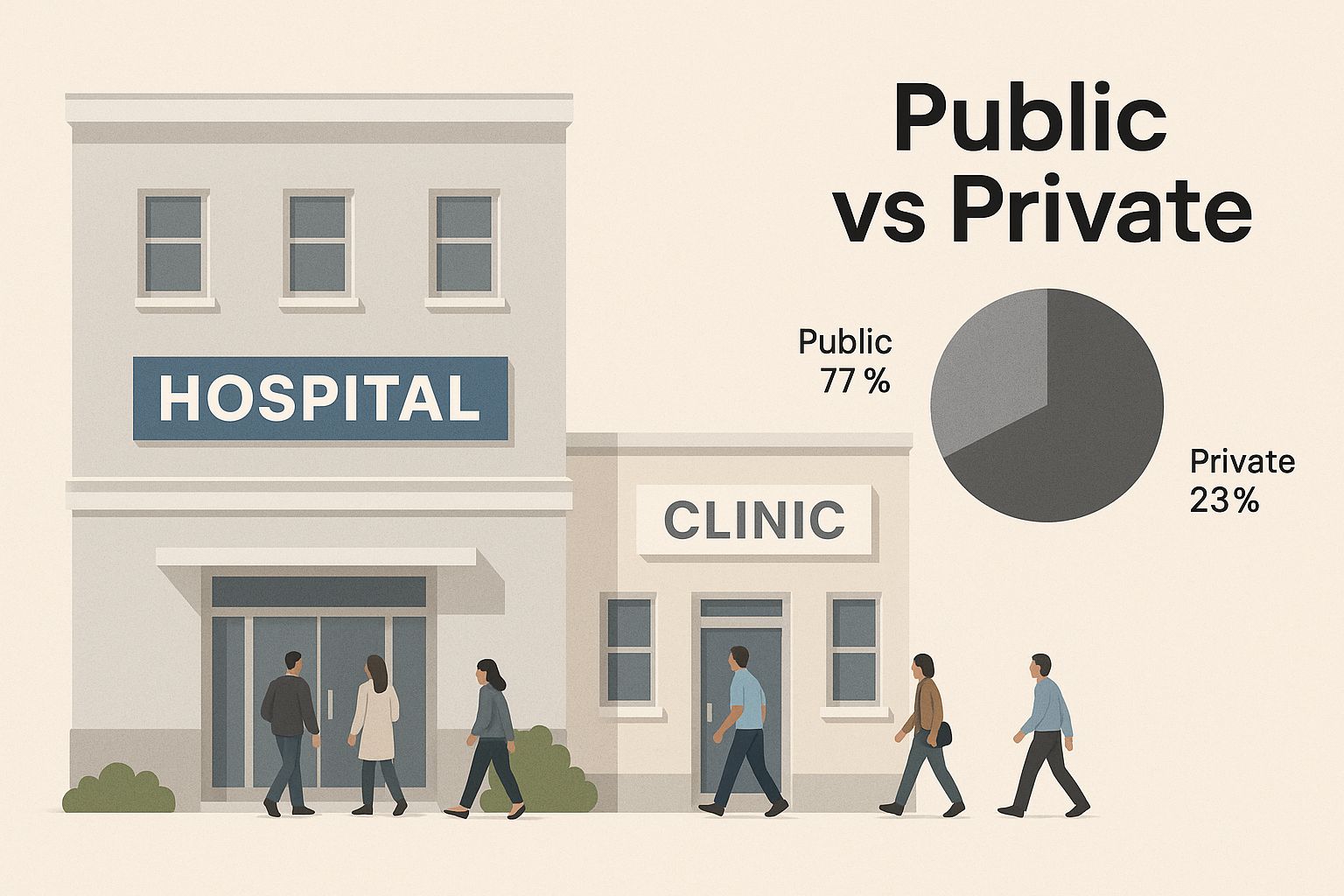

The image below delineates these two distinct pathways.

You have a foundational, community-focused public system on one side, and a premium, service-oriented private alternative on the other. Understanding the real-world implications of each is paramount.

The Public System: An Overview

Spain's public healthcare system, the SNS, holds an excellent reputation for high-quality, universal care. Funded by social security and taxes, it delivers comprehensive services to legal residents contributing to the system through employment or self-employment. From routine check-ups to major surgery, it is covered without cost at the point of service.

However, there are trade-offs. While emergency care is first-rate, securing appointments with specialists or scheduling elective procedures can involve significant waiting periods. Your physician and hospital are generally assigned based on your registered address (empadronamiento), offering limited flexibility. The system is engineered for efficiency at scale, which can sometimes come at the expense of personal choice and rapid service.

The Private Advantage: Unmatched Access and Service

This is where private health insurance in Spain demonstrates its value. For those who prioritize immediate access and greater control, it serves as a powerful supplement to the public system, adding a layer of premium service that many international clients find indispensable.

The definitive value of private insurance lies in immediate access and complete choice. It effectively eliminates waiting lists for specialists and elective treatments, enabling you to address health matters on your own schedule, not the system's.

Spain's healthcare is built on this dual system. The SNS provides a solid safety net for all, but it was not designed for the level of flexibility and rapid access that discerning individuals expect. To delve deeper into the mechanics of these systems, this detailed guide on Spain's health insurance system offers an excellent breakdown of the fundamentals. This structure empowers you to design a healthcare strategy that aligns perfectly with your needs.

Public (SNS) vs. Private Health Insurance in Spain

To fully grasp the implications of this choice, a side-by-side comparison provides the clearest view of the distinctions. This table highlights the features that are most critical when deciding between the two systems.

| Feature | Public Health Insurance (SNS) | Private Health Insurance |

|---|---|---|

| Specialist Access | Requires referral from an assigned GP; expect significant wait times for non-urgent care. | Direct access to specialists, often with appointments available within days. |

| Choice of Providers | Highly limited. You are assigned a primary doctor and local hospital based on your address. | Complete freedom to choose from a wide network of leading doctors and private hospitals. |

| Hospital Stays | Rooms are typically shared, depending on hospital capacity and specific circumstances. | A private, single-occupancy room is standard, ensuring superior comfort and privacy. |

| Language Support | Services are almost exclusively in Spanish. Multilingual staff are not guaranteed. | Access to English-speaking doctors and dedicated international support teams is a core feature. |

| Advanced Treatments | Covers standard, approved treatments. Adoption of the newest technologies can be slower. | Often provides faster access to the latest diagnostic tools and innovative therapies. |

| Wellness & Dental | Dental care is extremely limited (typically only extractions); wellness services are not covered. | Comprehensive dental plans and wellness benefits (e.g., executive check-ups) are common options. |

Ultimately, your decision hinges on your priorities. If certainty, speed, and a premium experience are paramount, a robust private health insurance in Spain policy is not an optional extra—it is a strategic necessity. It delivers the peace of mind that comes from knowing your health will be managed with the same exacting standards you apply to all other aspects of your life.

Securing Your Health Coverage as an Expat

Arranging your Spanish health coverage is one of the most critical steps in your relocation. It is not merely a formality but a foundational element of your new life. The optimal path depends entirely on your residency status and lifestyle in Spain.

For individuals relocating to Spain for professional reasons—either with a company or as a self-employed autónomo—the process is generally straightforward. Your social security contributions automatically grant you and your dependents access to the public Sistema Nacional de Salud (SNS).

However, for retirees or those moving under non-working visas, such as the Non-Lucrative or Golden Visa, the requirements are more specific and demand meticulous attention.

The Private Insurance Mandate for Visas

If you are applying for a Non-Lucrative or Golden Visa, it must be understood that securing the correct private health insurance in Spain is not a suggestion—it is a non-negotiable prerequisite for visa approval. The Spanish government requires absolute certainty that you will not place a burden on its public healthcare system.

The policy you select must adhere to strict criteria. It must be paid in full for the first year, offer coverage comparable to the public SNS, and—this is the critical detail—it must be “sin copagos y sin carencias.” This translates to zero co-payments and no waiting periods for any services.

Failure to meet these specifications is a leading cause of visa application delays or rejections. Spanish consulates are exceptionally scrupulous on this point. A standard travel insurance policy is insufficient. You must procure a policy from a Spanish insurer that explicitly certifies it meets all requirements for residency visas.

Your Essential Documentation Checklist

Regardless of your chosen route, public or private, life in Spain operates on proper documentation. Organizing these core documents is essential for all administrative processes, including healthcare.

You will require:

- NIE (Número de Identidad de Extranjero): Your Foreigner's Identity Number. It is indispensable for nearly every official transaction, from opening a bank account to executing an insurance contract. It serves as your primary identification in Spain.

- Empadronamiento: Your official registration on the local municipal census (ayuntamiento). This serves as your proof of address and is necessary for accessing public services, including registration with a local health center.

- Social Security Number: If you are working, this number is your key to accessing the public health system.

With these foundational documents in place, the subsequent steps for securing either public or private coverage become significantly more streamlined.

Actionable Steps for Securing Coverage

Securing your health coverage can be broken down into a logical sequence. For those requiring private insurance for a visa, the process begins well before your arrival in Spain.

- Select a Compliant Insurer: Conduct due diligence to identify insurance companies specializing in policies tailored for Spanish residency visas.

- Purchase Your Policy: You must pay the entire annual premium upfront. Ensure you receive the certificate and full policy documentation required for your visa submission.

- Secure Your Visa and Relocate: With the correct insurance certificate, you can proceed with your visa appointment with confidence.

Upon arrival and receipt of your residency card, you can complete the final steps, such as registering with a local doctor if you are eligible for the SNS. Understanding policy structures is key; for more on this, it's worth reading about choosing the right expat health insurance policy. For those planning retirement, understanding the broader healthcare considerations for retiring in Europe will provide invaluable context. Diligent preparation ensures you are protected from day one.

Navigating the Premium Private Insurance Market

For those who demand a superior standard of care, Spain's private health insurance market is a robust and competitive landscape designed to deliver top-tier medical services. Making an informed choice requires looking beyond marketing materials to assess the key players, their real-world performance, and the elite networks of hospitals and specialists they provide.

The market's significant growth is a direct response to rising demand from discerning residents and international professionals who value their time and health. The ability to secure immediate appointments, choose from Spain's leading physicians, and receive treatment in modern, comfortable facilities is a powerful incentive. It reflects a preference for control and quality.

The Major Players in Spanish Health Insurance

Spain’s private market is mature, competitive, and dominated by several key institutions. These companies have spent decades cultivating vast networks and solid reputations, becoming synonymous with quality healthcare.

The trend towards private coverage has been pronounced. In 2023, approximately 12.4 million people in Spain—26% of the population—held a private health plan, a notable increase from just 19% a decade prior. The market is led by a few key insurers, with SegurCaixa Adeslas holding a commanding 28.5% market share, followed by Sanitas at 16.5%, and Asisa at 12.6%. You can explore these trends in a recent analysis of Spanish health insurance dynamics from La Vanguardia.

Evaluating Providers for an International Clientele

Market share indicates scale, but it does not determine suitability for your specific needs. For an international executive, investor, or expatriate, the true measure of an insurer is how well it serves a global lifestyle. The best providers deliver more than a policy; they offer a seamless, white-glove service experience.

When comparing options, these factors are paramount:

- International Networks and Portability: Does the plan provide coverage outside of Spain? Premier policies include global assistance for travel or temporary work assignments abroad.

- English-Speaking Support: This is non-negotiable. From the initial inquiry to managing a claim, dedicated English-language support is essential to avoid unnecessary complications.

- Direct Billing and Digital Services: Top-tier insurers have direct billing arrangements with network hospitals, eliminating the need for out-of-pocket payments. They also offer sophisticated mobile applications for managing appointments, accessing records, and obtaining assistance.

A provider's true value lies not just in a list of benefits, but in its ability to anticipate the needs of a sophisticated client. This includes offering high reimbursement limits for out-of-network care and specialized expat plans that meet visa requirements without compromising on quality.

As you weigh these factors, a firm grasp of the financial components is crucial. To make a sound investment in your health, you must first define health insurance premium costs and understand the value proposition. This knowledge empowers you to compare plans based on long-term value, not just superficial features.

Finally, the policy type is as critical as the company. Many executives and seasoned expatriates opt for a comprehensive international private medical insurance plan that serves as a global safety net. To understand how these plans are structured, review our detailed guide on international private medical insurance. It will assist you in identifying a plan with the flexibility and robust protection your lifestyle demands, providing peace of mind wherever your personal or professional life may take you.

Choosing the Right Private Insurance Policy for You

Selecting the right private health insurance in Spain is a decision that impacts your well-being and peace of mind. A successful choice requires looking beyond headline benefits to understand the intricate mechanics of the policy.

The process involves meticulously matching the fine print to the realities of your life in Spain.

Network Plans vs. Reimbursement: The Two Main Flavors

You will find that policies are primarily structured in one of two ways. The most prevalent is the ‘cuadro médico’, or medical network, plan. The insurer provides a pre-approved list of doctors, specialists, and hospitals. Because rates are pre-negotiated, this model is typically more cost-effective.

The alternative is a reimbursement policy, which offers maximum flexibility. You can consult any doctor, anywhere in the world. You settle the bill directly and submit the invoice to your insurer for reimbursement, typically 80-100% of the cost. This is an ideal solution for frequent travelers or individuals who wish to retain a trusted physician outside a specific network.

Digging into the Details That Truly Matter

A superior insurance policy's strength lies in its foundational details. While headline benefits are appealing, the fine print is what protects you from unexpected costs and coverage gaps during times of vulnerability.

Pay close attention to the following:

- Coverage Limits: What is the maximum annual payout of the policy? A high-quality plan should offer a substantial limit, often exceeding €1,000,000, to ensure you are covered for significant medical events, not just routine care.

- International Options: For those who travel for business or leisure, this is non-negotiable. Does the policy cover emergencies abroad? Can it be upgraded to a full international plan for seamless global coverage?

- Dental and Vision: Do not assume these are included as standard. Most insurers offer them as optional add-ons, allowing you to construct a plan that covers everything from routine cleanings to complex dental work.

- Pharmacy Coverage: How does the plan manage prescription costs? Some cover a percentage, while others have specific formularies. This must be clarified before you require medication.

Understanding Co-payments (‘Copagos’) and Waiting Periods (‘Carencias’)

These two Spanish terms are ubiquitous in insurance documents and directly impact your costs and access to care.

A policy ‘con copago’ (with co-payment) features a lower monthly premium. In exchange, you pay a nominal fee—perhaps €5 to €15—for each specialist visit or diagnostic test. For healthy individuals who do not anticipate frequent use, this can be a financially astute choice.

Conversely, a policy ‘sin copago’ (without co-payment) has a higher premium but covers 100% of costs for services within the network. This provides complete cost predictability and the freedom to use services without incurring per-visit fees.

‘Carencias’ are waiting periods. This means certain benefits—such as non-emergency surgery or complex imaging—are unavailable for a set period after your policy begins, typically 3 to 10 months. Critically, for visa applications, Spanish regulations mandate that these waiting periods be waived. Ensure your policy documentation explicitly states this waiver.

Your Checklist for Comparing Insurers

When evaluating proposals, it is easy to become overwhelmed by data. Asking targeted questions allows for an accurate comparison of value.

Use this checklist to ensure clarity:

- Network Quality: How extensive and reputable is the ‘cuadro médico’ in my area of residence? Does it include premier hospital groups like Quirónsalud or HM Hospitales?

- Repatriation: Does the plan cover the full cost of medical repatriation to my home country in the event of a serious medical issue?

- Pre-existing Conditions: How does the insurer handle them? What is the underwriting process? Be transparent and assess their response.

- Direct Billing: Does the hospital bill the insurer directly, or must I pay upfront and seek reimbursement?

- Expat-Friendliness: Is there an English-speaking customer service line? A language barrier is the last thing you need during a medical event.

By taking this structured approach, you are not merely purchasing a policy; you are making an informed investment in your health. You will secure a plan that not only satisfies Spain's visa regulations but also provides real, dependable protection.

Frequently Asked Questions About Spanish Health Insurance

Navigating the complexities of health insurance in a new country raises many questions. For discerning expatriates accustomed to clarity and high service standards, obtaining direct answers is essential. Here are the most common inquiries, with concise responses to help you proceed with confidence.

Is Private Health Insurance Mandatory for a Spanish Visa?

For most non-EU citizens applying for a residency visa, such as the Non-Lucrative Visa or the Golden Visa, the answer is unequivocally yes. Comprehensive private health insurance is a non-negotiable requirement and a foundational component of your application.

Spanish consulates are extremely specific. The policy must be equivalent in coverage to the public SNS system. It must be paid in full for the first year, and, most critically, it must have no co-payments ('sin copagos') and no waiting periods ('sin carencias'). This provides proof that you will not become a financial liability to Spain's public healthcare system.

Can I Use an International Health Policy for My Visa Application?

While technically possible, it presents an unnecessary and significant risk. Many international plans, though excellent, do not meet the highly specific criteria set by Spanish consulates, often leading to delays or rejections.

The primary obstacles are typically the "no co-payment" and "no waiting period" requirements. For an international policy to be considered, these clauses must be explicitly stated in the documentation.

To eliminate ambiguity and the real risk of a visa denial, the most prudent course of action is to secure a policy from a reputable Spanish insurer. They offer plans specifically designed and certified to meet all visa requirements. This is the safest and most reliable path to a successful application.

What Is the Strategic Difference Between Con Copago and Sin Copago?

The choice between a 'con copago' (with co-payment) and a 'sin copago' (without co-payment) plan is a strategic decision about managing your healthcare costs and cash flow.

-

'Sin Copago' (No Co-payment): This is the mandatory model for visa applications. You pay a higher premium, but thereafter, you pay nothing out-of-pocket for any covered service within the network. This model offers complete budget predictability and is ideal for those who want frictionless access to care.

-

'Con Copago' (With Co-payment): This model has a lower premium, but you pay a small, fixed fee—for example, €5 to €20—for each service utilized. For residents who are generally healthy and anticipate infrequent need for medical services, this can be a very cost-effective strategy.

The decision is a trade-off: a higher fixed cost for unlimited use versus a lower fixed cost with variable, pay-as-you-go expenses.

Do I Need Private Insurance After Qualifying for Public Healthcare?

Once you become a legal resident and begin contributing to Spanish social security (either as an employee or as a self-employed autónomo), you gain full access to the public healthcare system (SNS). At this point, private insurance is no longer a legal requirement for residency renewal.

However, the majority of expatriates—and a significant percentage of Spanish nationals—choose to retain their private coverage.

The decision transitions from one of legal compliance to one of personal standards. Individuals maintain their private plans for the tangible benefits: immediate access to leading specialists, the freedom to choose doctors and hospitals, the comfort of a private room, and the convenience of English-speaking staff. It is about preserving an efficient, convenient, and self-directed healthcare experience.

For more answers to common questions, you can also check out our frequently asked questions section for additional insights.

Navigating the complexities of international medical insurance is a challenge, but you are not expected to do it alone. At Riviera Expat, we specialize in sourcing premium health coverage for professionals and investors like you. We ensure your policy not only meets every technical requirement but is perfectly aligned with your lifestyle. Contact us to construct your ideal healthcare plan with total clarity at https://riviera-expat.com.