Here is a reality many discover only after securing top-tier international health insurance.

You cannot always leverage your full benefits from day one.

You have executed the agreement, remitted the initial premium, and feel secure. However, for certain treatments, the clock has now begun on a waiting period—a predetermined duration you must be enrolled in the plan before you can claim for specific medical care.

While this may seem counterintuitive, it is not an arbitrary impediment. It is a fundamental practice that underpins the stability and fairness of the entire insurance framework for all members.

The Rationale Behind Health Insurance Waiting Periods

When investing in world-class health coverage, it is logical to question any delay in accessing the benefits for which you have paid. These waiting periods, however, are not arbitrary hurdles; they are a core component of how insurers manage risk. Their primary function is to protect the policy's integrity and the shared pool of capital to which all members contribute.

This system is specifically designed to mitigate what the industry terms adverse selection.

Consider this scenario: an individual becomes aware they require an expensive surgical procedure in the near future. They procure a high-end insurance policy, have the surgery covered for a fraction of its actual cost, and subsequently cancel the policy. If this behaviour were widespread, the insurance pool would be rapidly depleted, necessitating substantial premium increases for all long-term, committed members. The system would be rendered unstable.

Think of your insurance plan as an exclusive members' club. The club must ensure new members are joining for the long term, to benefit from the community and facilities, not merely to secure a complimentary prime steak dinner on the first night and never return. Waiting periods serve as a filter, ensuring the club remains financially sound and can continue to offer exceptional benefits to all its loyal members for years to come.

By implementing these initial waiting periods, insurers ensure the plan is utilized for unforeseen future health requirements, not for pre-planned, immediate medical interventions. This practice maintains equitable premiums and guarantees that capital is available when you genuinely require it for an authentic medical emergency or future treatment.

A Global Perspective on Wait Times

It is crucial to distinguish these insurance-mandated waiting periods from the appointment wait times one might encounter within a public or national healthcare system. A common misconception is that universal healthcare invariably leads to long waits, but the data reveals a more nuanced picture.

For instance, a Commonwealth Fund report (note: the user-provided "2025" link points to a page without a specific report, but data from their 2021 and 2023 international surveys is widely cited) showed significant variations in specialist appointment wait times globally. In nations like Canada and Norway, over half of patients waited a month or more to see a specialist. In contrast, Switzerland reported a much lower rate. The United States, which does not have universal coverage, often falls somewhere in the middle, demonstrating that timely access to care is a complex global challenge, not a feature exclusive to one type of health system. You can find more details on this topic here: 2025 report on health care wait times by country.

Your private international health plan is your instrument to bypass these public system queues. To remain sustainable and efficient, however, it operates under its own set of protocols—including these benefit-specific waiting periods. With a well-structured plan, these timelines are not barriers but manageable components of a sophisticated global health strategy.

Decoding Different Types of Waiting Periods

Consider waiting periods in health insurance as distinct lanes on a motorway. Some lanes are designated for rapid transit to address urgent needs, while others are slower, designed for planned journeys. Understanding these different timelines is paramount to planning your healthcare coverage without encountering unexpected obstructions.

These periods are not arbitrary. Insurers meticulously structure them based on the type of medical care, its potential cost, and proprietary risk models. It is a balancing act between providing immediate access for true emergencies and ensuring the long-term sustainability of the plan for all members.

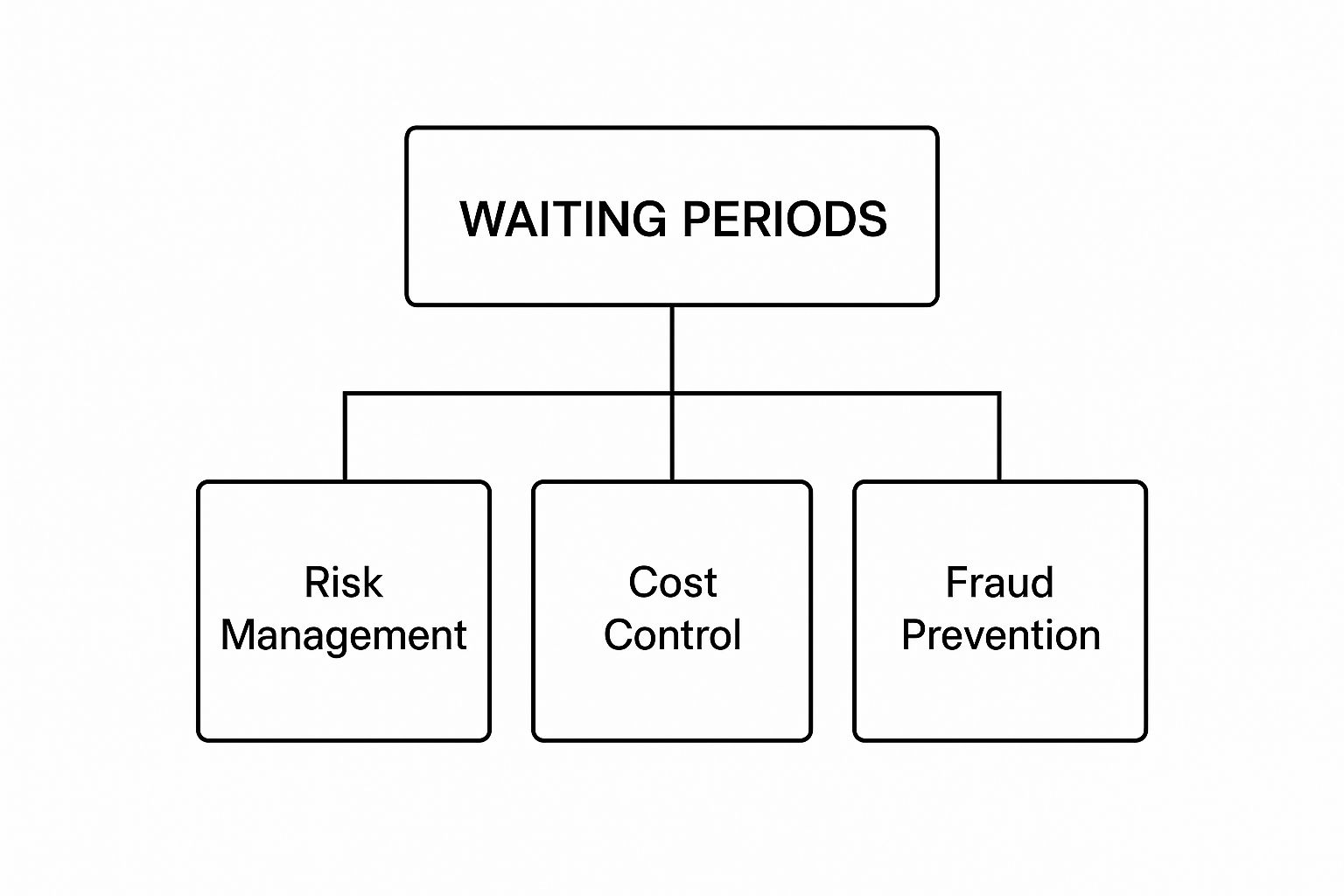

The infographic below deconstructs the core reasons for these waiting periods.

As illustrated, the system is engineered to manage risk, control costs, and prevent moral hazard. These measures ensure the insurance pool remains stable and equitable for every policyholder.

Initial Waiting Period for General Coverage

Upon policy activation, you will encounter what is known as an initial waiting period. This is a short-term, general moratorium on most non-emergency treatments.

Regard it as a brief "settling-in" phase. While genuine accidents and emergencies are covered from day one, this initial wait—typically 30 to 90 days—prevents individuals from enrolling solely to treat a recently manifested illness. It ensures the policy functions as a safeguard for future, unforeseen issues, not as an immediate remedy for existing ones.

Specific Waiting Periods for Designated Illnesses

Beyond the initial period, many policies impose longer waiting periods for a specific list of high-cost, often non-urgent, procedures. These pertain to common conditions that insurers must manage financially to prevent premiums from escalating for all members.

You will often find treatments such as these on the list:

- Cataract surgery

- Joint replacements for a hip or knee

- Hernia repair

- Treatment for kidney stones or gallstones

The waiting period for these is typically longer, often 12 to 24 months. This extended timeline helps distribute the financial impact of these expensive—and frequently plannable—surgeries over a longer duration, which contributes to overall cost stability.

Maternity Coverage Waiting Periods

Maternity and newborn care is a superb benefit, but it almost invariably comes with a significant waiting period. As pregnancy and childbirth are predictable and high-cost events, this is one of the most clearly defined waiting periods in the insurance sector.

Insurers must ensure that maternity coverage is a planned, long-term benefit, not a feature procured only after a pregnancy is confirmed. This approach protects the financial integrity of the maternity benefit for all members of the insurance plan.

For this reason, you can expect a maternity waiting period of between 10 and 24 months. This is a critical detail: the policy must have been active for this entire duration prior to conception for the associated costs to be covered. When planning for a family, foresight is indispensable.

Waiting Periods for Pre-Existing Conditions

This is the most critical area. The most significant, and often longest, waiting periods apply to pre-existing conditions (PECs). A PEC is defined as any health issue, illness, or injury that existed before your policy's inception date, whether you were actively receiving treatment for it or not.

From an insurer's perspective, a PEC represents a known, higher risk. To manage this, they apply a waiting period during which they will not cover any costs related to that specific condition. This period can be substantial, ranging from 24 months to as long as 48 months, depending on the condition and the insurer.

This is a fundamental, non-negotiable component of individual international health insurance. After you have successfully completed this waiting period, the condition can then be covered in accordance with your policy's terms. For a more granular understanding of how these timelines function, particularly with regional regulations, you can review this a detailed guide to health insurance waiting periods in Dubai.

Planning for Elective and Specialized Treatments

When making strategic decisions about your health, elective treatments often play a central role. These are non-emergency procedures planned in advance, and they are frequently a primary motivation for securing top-tier international health coverage.

Consider joint replacements that restore mobility or vision correction that liberates you from corrective lenses. These are not merely medical procedures; they are investments in your quality of life.

However, it is precisely for these high-value treatments that waiting periods in health insurance become a critical factor. From an insurer's viewpoint, elective treatments represent large, predictable expenditures. To maintain the financial health of the entire system for all members, they implement specific waiting periods for this category of care.

This is analogous to a vesting period for a significant corporate benefit. An employer may require a certain tenure of employment before granting substantial stock options. Similarly, an insurer requires a set period of membership before they will cover a costly, planned surgery. This straightforward rule ensures the insurance is utilized for long-term health, not merely as a convenient solution for a pre-planned expense.

Anticipating Timelines for Major Procedures

Waiting periods for elective treatments are not uniform. They directly reflect the procedure's cost, complexity, and the insurer’s risk management strategy. A major joint replacement, for instance, is a far greater financial event for an insurer than a routine dental filling, and the waiting period will be correspondingly longer.

These timelines are not merely arbitrary rules. They are heavily influenced by dynamics within healthcare systems worldwide. Long queues for elective surgeries have been a persistent issue in many national health systems for decades. Data from OECD nations often show average waits for procedures like hip and knee replacements stretching well beyond two months, with some countries experiencing far more significant delays.

Even when governments attempt to address the problem, progress often stagnates. This global bottleneck is a significant reason why private insurance is so valuable for obtaining timely care. To delve deeper into these trends, you can explore the detailed findings on elective surgery wait times.

Your international policy is your key to bypassing those public system delays, but it operates on its own principles to remain sustainable. Understanding the waiting periods health insurance providers establish for elective care is a non-negotiable part of your health strategy.

Common Waiting Periods for High-Demand Treatments

To plan your healthcare journey effectively, you must be aware of the typical timelines. While the exact waiting periods can vary between insurers, a general framework can help you set realistic expectations.

The table below outlines the standard waiting periods you can anticipate for some of the most common elective procedures.

Typical Waiting Periods for Key Elective Procedures

| Elective Procedure or Treatment | Common Waiting Period | Strategic Consideration |

|---|---|---|

| Major Joint Replacement (Hip, Knee, Shoulder) | 24 months | The high cost of surgery and prosthetics makes this one of the longest waiting periods. Plan well in advance if you anticipate this need. |

| Vision Correction (e.g., LASIK) | 12 to 24 months | Often viewed as a lifestyle enhancement, insurers require a significant membership period before covering these procedures. |

| Advanced Dental Work (Crowns, Bridges, Implants) | 6 to 12 months | Major restorative dental work typically has a shorter wait than major surgery, but it still requires planning. |

| Corrective Surgeries (e.g., Hernia Repair) | 12 months | For common, non-emergency surgeries like hernia repair, a standard one-year waiting period is very common. |

By familiarizing yourself with these timelines, you can align your policy purchase with your long-term health objectives. If you foresee the likelihood of needing a specific procedure in the future, procuring your policy sufficiently in advance is paramount.

This kind of foresight transforms a waiting period from a frustrating obstacle into a simple, manageable parameter in your planning.

The good news is that while waiting periods are a standard feature of international health insurance, you do not always have to accept them.

They are not immutable.

For discerning clients, there are legitimate strategies to reduce or even eliminate these delays, ensuring robust protection from the moment your policy commences. Understanding these strategies is essential for anyone for whom a gap in healthcare coverage is unacceptable.

These are not clandestine loopholes. They are established options that insurers offer to clients who can demonstrate continuous prior insurance or are willing to provide a more detailed health history. The two primary avenues are proving continuous coverage and opting for full medical underwriting. Each requires different documentation, but both can secure more favorable terms from the outset.

Obtain Credit for Your Past Coverage

Insurers value responsible, long-term clients. If you can demonstrate that you have maintained uninterrupted health insurance with another company, your new insurer will often agree to waive their waiting periods. This is known as receiving "credit for prior coverage."

Consider it a professional courtesy. You are proving to the new insurer that you are not simply enrolling because you have an expensive surgery scheduled for next week. You are demonstrating that you are a low-risk client who values health security.

To facilitate this, you require official proof from your previous insurer. This typically involves one specific document:

- Certificate of Credible Coverage: This is the gold standard. It is an official document from your previous insurance company that clearly states your policy start and end dates and the level of coverage you held.

- Policy Documents and Termination Letter: In some cases, a copy of your old policy documents accompanied by an official cancellation letter may suffice, but the certificate is unequivocally superior.

The key is to avoid any significant gaps between your old policy's termination and the new one's inception. Most insurers will only grant credit if the gap is less than 63 days, and some are even more stringent.

A seamless transition is paramount. By ensuring your new policy activates the day after your old one expires, you present the strongest possible case for waiving the waiting periods. It signals to the insurer that you are precisely the type of responsible client they seek to attract.

Utilize Medical Underwriting to Your Advantage

The second powerful strategy for circumventing waiting periods is to undergo full medical underwriting.

This is a more hands-on process. You provide the insurer with a complete and transparent overview of your health history. Instead of applying a standard waiting period to all applicants, the insurer conducts a bespoke risk assessment based on your specific profile.

This detailed review allows their underwriting team to make a more nuanced decision. If you are in excellent health, they may perceive you as a low-risk client and agree to waive waiting periods for major benefits like maternity or dental care.

Even if you have pre-existing conditions, this can be advantageous. An insurer might agree to cover a specific condition from day one in exchange for a higher premium, known as a "premium loading." This can be a strategic investment, securing immediate peace of mind for a known cost. This process of obtaining advance approval for coverage is analogous to the pre-authorization required for certain major treatments. For a deeper analysis of how those approvals function, our guide on pre-authorization and direct settlement is an excellent resource.

By choosing full medical underwriting, you are essentially transforming a standard application into a negotiation. It affords you the opportunity to secure terms that are precisely tailored to your health needs and timeline, placing you in control of your immediate healthcare access.

How Your Insurance Plan Influences Access to Care

Here is a detail that many overlook when selecting an international private medical insurance (IPMI) plan. It is not merely a financial safety net. It is a strategic decision that directly dictates your real-world access to healthcare.

While waiting periods are standard practice, the quality and tier of your policy can significantly influence the speed with which you secure appointments with top specialists or schedule diagnostic procedures. This shifts the conversation from merely "what is covered" to "how effectively does this policy perform for me?"

A premier-tier plan functions as an accelerator. It often grants priority access within a network of elite providers.

Consider the difference between flying commercially and flying privately. Both achieve the same objective, but one offers a vastly different experience in terms of speed, efficiency, and service. For a high-performing individual whose time is their most valuable asset, this expedited access is not a luxury—it is an absolute necessity.

The Two-Tier Effect in Healthcare

This dynamic is not unique to IPMI; it is observable in national healthcare systems globally. The way a country structures its insurance often creates different pathways to care, proving that the type of plan you possess is a critical determinant of how long you wait.

Germany’s dual system of statutory and private health insurance is a perfect case study. Both schemes serve the same population, yet they can yield very different outcomes in access speed.

One analysis found that individuals with statutory health insurance had a 10.5% probability of waiting 10 days or more for a primary care appointment. For those with private insurance, that figure dropped to just 7.5%. You can explore more of this data by reviewing the 2018 study on German healthcare access.

This gap highlights a fundamental truth: premium private coverage often secures faster service. For our clients, a top-tier IPMI plan is designed to place them firmly in that "private" category on a global scale, ensuring they receive swift attention, wherever they may be.

Your insurance plan is not just a policy; it is your passport to a more efficient healthcare journey. Selecting a superior plan is an investment in timely access to world-class specialists and facilities, minimizing disruptions to your professional and personal life.

Beyond the Brochure: A Strategic Evaluation

When evaluating an IPMI policy, you must look beyond the summary of benefits and coverage amounts. The true value of a premier plan lies in its practical application—how effectively it delivers the care you need, when you need it.

This requires shifting your mindset from asking, "What is covered?" to "How will this policy perform for me in a real-world scenario?"

Your plan choice effectively determines your position in the queue. A standard policy might cover a specialist consultation, but a premier policy often facilitates that same consultation in days, not weeks.

This difference is absolutely vital when you are managing an uncertain health issue or attempting to plan a major procedure around a demanding schedule. Your policy is the mechanism that ensures waiting periods in health insurance are manageable and that your access to care meets your expectations for excellence and efficiency.

Your Action Plan for Selecting the Right Policy

Navigating the world of international health insurance can feel complex, but it need not be overwhelming.

The key is not merely to compare benefit tables. It is to employ a clear, deliberate strategy.

Approach it as you would any other major investment. A well-chosen plan is a powerful asset that delivers when it matters most, ensuring you receive premier medical care without financial disruption.

Here is a simple, effective framework to ensure your final selection is the correct one.

Conduct a Personal Health and Lifestyle Audit

Before you review a single policy brochure, you must first analyze your own life and circumstances.

This is the foundation. Without it, you are merely speculating. Conduct a thorough review of your current health and, more importantly, consider your future trajectory.

This must be a detailed, candid assessment. Are there hereditary conditions in your family that might necessitate future screenings? Are you planning to start a family, making maternity coverage an essential component? A frank evaluation of your real-life risks is the only way to identify a policy that is truly fit for purpose.

Your policy must mirror your life’s path. A sophisticated health strategy anticipates major life events—such as having a child or planning an elective surgery—and ensures any requisite waiting periods have long since expired before the care is actually needed.

Assemble Your Documentation and Prepare for Underwriting

Once you have defined your requirements, it is time to build your case for the insurer.

If you have a history of continuous health coverage, now is the time to document it. Obtain a Certificate of Credible Coverage from your current or former insurer. This single document is your most potent tool for requesting that a new insurer waive its waiting periods in health insurance.

This document is your leverage. It demonstrates to a new insurer that you are a responsible client, not a high-risk gamble. This makes them far more inclined to grant you credit for your past coverage, streamlining your application and potentially granting you full access to benefits from day one. To delve deeper into this, you can learn how to choose the right type of policy for expats in our detailed guide.

Formulate Key Questions for Your Advisor

Finally, enter into discussions with an advisor armed with precise questions.

An effective consultation transcends "What is my deductible?". You must understand the real-world mechanics of how your plan will function when you require it.

Prepare your questions in advance. Consider these examples:

- What is the exact process for waiving waiting periods using my coverage history?

- For any non-waivable waiting periods, what are the precise start and end dates?

- How does this specific plan facilitate expedited access to specialists and diagnostic tests?

- What are the exact terms for covering my pre-existing conditions once the waiting period has concluded?

Asking these types of detailed questions provides total clarity. It empowers you to make a final decision with complete confidence.

Frequently Asked Questions

When dealing with world-class international health insurance, the details are paramount. One of the areas that most frequently causes confusion is waiting periods in health insurance.

This is not about administrative details; it is about ensuring your health strategy is airtight, with no unforeseen gaps in coverage or unexpected financial liabilities. Let us address some of the most common questions we receive from clients.

Are Accidents and Emergencies Subject to Waiting Periods?

No. A genuine accident or a sudden, unforeseen medical emergency that occurs after your policy's inception is covered immediately. This is a core protection of your insurance—a financial backstop for when the unexpected happens.

However, a critical distinction must be made: there is a difference between a new emergency and an acute exacerbation of an undeclared pre-existing condition. If the emergency is linked to a condition that would have been subject to a waiting period, the insurer will likely treat it as such.

The promise of premier insurance is immediate assistance for genuine emergencies. From day one, you should have access to critical care without delay, anywhere in the world.

Can I Pay a Higher Premium to Eliminate Waiting Periods?

In some specific circumstances, yes, but it is not a standard, universally available option. For large corporate group plans, insurers can offer what is known as 'Medical History Disregarded' (MHD) underwriting. This is the gold standard where all waiting periods are waived for every member of the group.

For an individual policy, you may be able to negotiate coverage for a pre-existing condition from day one through full medical underwriting. This would involve the insurer agreeing to cover the condition immediately in exchange for a significantly higher premium, often called a 'premium loading'. However, certain benefits, particularly maternity, almost always come with fixed, non-negotiable waiting periods to preserve the financial integrity and fairness of the insurance pool for all members.

What Happens If I Need Treatment During a Waiting Period?

The answer is straightforward, if uncompromising: you will be required to pay for the entire cost of that care out-of-pocket. Your insurance policy will not reimburse you for any services that fall within an active waiting period.

Once that waiting period has concluded, any eligible claims for that same service will be covered according to your policy's terms. This reverts to the fundamental principle that insurance is designed to protect against future, unforeseen events. For more answers to specific situations, you can read our FAQ for further insights.

Mastering these details is precisely where expert advice makes the difference. At Riviera Expat, this is our area of specialization. We focus on securing top-tier international health insurance for finance professionals, ensuring your policy is perfectly aligned with your global lifestyle and that you have absolute clarity on every term, especially waiting periods. Secure your expert consultation today.