Navigating the cost of world-class medical care requires a precise understanding of the investment involved. Without a strategically selected insurance plan, the expense for a private consultation can be considerable. As a baseline, one should anticipate an out-of-pocket expenditure of approximately $100 to $250 for a general practitioner (GP) and $250 to over $500 for a specialist in most major financial hubs.

These figures represent the immediate financial liability without bespoke coverage. This underscores why a premier international private medical insurance (IPMI) plan is not a discretionary expense, but a fundamental component of a sound financial strategy for global professionals.

An Executive Briefing on Doctor Visit Costs

For high-net-worth individuals operating globally, mastering healthcare expenditures is a critical element of wealth preservation. There is no single answer to the question, "how much for a doctor visit?" The costs vary significantly based on geographic location, the physician's specialty, and the complexity of one's medical requirements.

Without a robust insurance portfolio, even a routine consultation can manifest as a significant and unplanned liability. This briefing provides a concise, clear overview of the anticipated costs for medical care in the world's leading financial centers, enabling you to precisely quantify the financial risks involved.

Estimated Doctor Visit Costs in Major Financial Hubs

To provide a precise financial picture, the following table outlines typical out-of-pocket costs for physician consultations in key cities where our clients reside and operate. These figures represent average initial consultation fees and do not include ancillary charges for diagnostic tests, treatments, or subsequent follow-up appointments.

| City | GP Visit Cost (USD) | Specialist Visit Cost (USD) |

|---|---|---|

| Hong Kong | $100 – $150 | $200 – $400 |

| Singapore | $90 – $140 | $250 – $500+ |

| Dubai | $100 – $180 | $200 – $450 |

| London | $150 – $200 | $300 – $550 |

| New York | $150 – $250 | $350 – $600+ |

These figures illuminate the direct financial exposure one assumes without a comprehensive insurance strategy tailored for international professionals. A single specialist consultation in New York or London can easily exceed $500 before any diagnostic procedures are performed.

For the discerning professional, healthcare costs are not just expenses; they are manageable risks. The key is to transform unpredictability into a calculated line item through strategic insurance planning.

Furthermore, these costs are dynamic. Recent industry analyses, such as the 2024 Global Medical Trends Survey by WTW, project significant increases in healthcare costs. That survey forecasts a global average increase of 9.9% for 2024. A $100 GP visit today could therefore approach $110 next year without a mechanism to mitigate these escalations.

The consultation fee is merely the entry point. Any requisite blood work, imaging scans, or follow-up appointments will invariably augment the total cost. The layered expense structure of specialized diagnostics is well-documented; for example, how much ADHD testing costs illustrates how quickly ancillary services can multiply the initial expense.

With this foundational data, we can proceed to strategies for effectively controlling these expenditures.

What's Really Driving Your Doctor Bill?

Understanding the average cost of a doctor's visit is foundational. However, for a global professional, comprehending the variables that influence these costs is the key to strategic financial management. The fee for a consultation is not an arbitrary figure; it is the culmination of specific economic, regulatory, and systemic factors unique to each jurisdiction.

Consider the analogy of commissioning a bespoke Savile Row suit versus purchasing one off-the-rack. Both serve the same essential function, but the final price reflects the artisan's expertise, the quality of the materials, and the personalized service rendered. Your medical bill is analogous—a composite of distinct cost drivers. Identifying them is the first step toward effective management of your healthcare investments.

Public vs. Private: The Great Divide

The primary determinant of cost is the distinction between public and private healthcare systems. Public systems, funded through taxation, may offer consultations at subsidized rates or at no direct cost to eligible residents. The trade-off is often measured in time: extended waiting periods and limited choice in physician selection are common.

The private sector, conversely, offers speed, choice, and premium service—the preferred environment for most expatriates and high-net-worth individuals. A private clinic in London or Singapore provides immediate access to leading physicians and advanced facilities, and this premier experience is priced directly into the consultation fee.

Specialists Don't Come Cheap

Specialization is another significant cost driver. A General Practitioner (GP) provides broad, foundational medical care, and their fees reflect this scope.

A specialist, such as a cardiologist or neurologist, has invested years in advanced, highly specific training. This depth of expertise is a high-value asset, enabling them to diagnose and treat complex conditions beyond the purview of a GP. Consequently, their consultation fees are substantially higher, often two to three times that of a GP visit. You are investing in a superior level of diagnostic acumen and therapeutic capability.

The fee for a medical consultation isn't just for the doctor's time. It's a direct reflection of the clinic's infrastructure, the physician's specialized expertise, and how quickly you can get access to care.

Finally, the consultation itself is frequently just the initial component of the cost. Any necessary diagnostic tests—such as blood panels, an MRI, or a CT scan—are billed as separate line items. These can rapidly escalate the total cost of addressing a single medical issue. Understanding the landscape of premier clinics and specialists is vital, and insight can be gained by examining how top-tier medical networks are structured.

How Your Insurance Policy Shapes Your Final Bill

Your International Private Medical Insurance (IPMI) policy is not merely a safety net; it is the primary financial instrument for managing your global healthcare expenditures. Its purpose is to convert the volatility of unpredictable medical bills into a structured, manageable cost.

Operating without a thorough understanding of your policy's terms is akin to signing a blank cheque for every medical consultation. The specific provisions of your plan dictate, dollar for dollar, the precise allocation of costs between you and your insurer. A firm command of these core concepts is the only way to assert genuine control over your healthcare finances.

Key Policy Features and Your Bottom Line

When examining your policy, several key terms directly determine your final out-of-pocket expense. Each one defines a specific component of the cost-sharing agreement between you and your insurance carrier.

Let's dissect how these common IPMI features directly affect your financial liability.

How Key Policy Features Impact Your Out-of-Pocket Costs

| Feature | What It Means for You | Impact on Your Final Bill |

|---|---|---|

| Deductible | The initial, fixed amount you are required to pay each year before your insurance coverage activates. | You are responsible for 100% of medical costs up to this amount. Higher deductibles typically correlate with lower monthly premiums but represent a greater initial financial risk. |

| Co-insurance | After the deductible is satisfied, you share a percentage of the remaining costs with the insurer. An 80/20 split is a common arrangement. | The insurer covers 80% of the approved charges, and you are responsible for the remaining 20%. This is your direct share of every cost post-deductible. |

| Provider Network | A curated list of hospitals and clinics with which your insurer has negotiated preferential, pre-approved rates. | Utilizing in-network providers significantly reduces your costs, as billing is based on these favorable, negotiated prices. Services outside the network often result in higher personal expense. |

These features function in concert to establish a clear financial framework. Mastering them allows you to strategically manage risk and protect your assets from unforeseen healthcare costs.

The Practical Impact on Your Bill

A useful analogy is to view your deductible as the annual membership fee for an exclusive club—you pay it once per year to access the benefits. Thereafter, your co-insurance and in-network savings reduce the cost of every subsequent "service," or medical visit, for the remainder of the policy year.

Your insurance policy is a financial contract that spells out who pays for what. Mastering its terms allows you to strategically shift risk from your personal assets to the carrier, ensuring premium care is accessible without causing financial disruption.

For a more granular analysis of these terms, our complete guide on understanding your expat medical insurance policy provides a detailed breakdown. Leveraging these features effectively is precisely how one secures coverage that protects both health and wealth.

Smart Ways to Keep Your Medical Bills in Check

Possessing a premier insurance policy is the foundational step. To truly optimize your healthcare spending, a proactive approach is required. For a high-level professional, this is not an exercise in austerity but one of making astute financial decisions without compromising the quality of care.

It often comes down to simple due diligence. A brief call to your insurer to confirm coverage prior to a major procedure or an expensive consultation can prevent a substantial, unexpected liability. This single action transforms a potential financial shock into a managed expense—an absolutely critical discipline when operating within unfamiliar healthcare systems.

Getting the Most Out of Your Policy

The most direct method for cost control is to operate intelligently within the framework of your insurance plan. Consider your provider network not merely as a directory, but as a strategic map to high-quality, cost-effective care.

Insurers negotiate preferential rates with their in-network providers. By seeking care from these designated physicians and facilities, you are billed at these lower, pre-agreed prices. Stepping outside this network often means you are liable for the full, undiscounted rate, which can be significantly higher.

Telemedicine is another powerful tool at your disposal. For routine follow-ups or non-urgent consultations, a virtual visit is almost invariably more efficient and cost-effective than an in-person appointment. Leading IPMI providers have integrated robust telehealth platforms, granting you access to expert medical advice from anywhere in the world, saving both time and money.

The ultimate cost-control strategy is thinking ahead about your health. A small investment in preventive care today can help you avoid a massive, complicated, and much more expensive medical crisis down the road.

A Checklist for Proactive Cost Management

Utilizing executive health screenings is another forward-thinking strategy. These comprehensive annual evaluations are designed to identify potential health issues before they escalate into serious conditions. Early detection often allows for simpler, less invasive, and far less costly interventions. Many premium IPMI plans cover these screenings, recognizing their value in maintaining your long-term health and managing future claims costs.

To maintain control over your medical expenditures, adhere to this practical checklist:

- Confirm Your Network: Before scheduling any appointment, always verify that the physician or hospital is part of your insurer's approved network.

- Clarify Coverage: For any procedure beyond a routine visit, obtain pre-authorization from your insurer. This confirms what they will cover and what your share of the cost will be.

- Embrace Telehealth: Leverage virtual appointments for follow-ups, prescription renewals, and minor health concerns to optimize for time and cost.

- Prioritize Prevention: Do not defer your annual check-ups. Schedule regular executive health screenings to stay ahead of potential health issues.

Real-World Cost Scenarios in Key Global Hubs

Theoretical concepts are useful, but concrete financial data brings the value proposition into sharp focus. To demonstrate precisely how a premium International Private Medical Insurance (IPMI) policy performs, let's analyze the actual cost of a doctor's visit in three key expatriate hubs: Hong Kong, Singapore, and London.

We will examine two common scenarios: a straightforward visit to a GP for a minor ailment and a more complex consultation with a specialist. This direct comparison reveals the significant financial exposure you carry without a suitable plan and the immense value a well-structured policy provides.

Comparing Out-of-Pocket Doctor Visit Costs

Let's quantify the financial impact. A routine visit to a private GP in London could easily result in a bill of $200. A consultation with a cardiologist in Singapore could be $450 before any diagnostic tests are ordered. These are the baseline costs that a premium IPMI plan featuring direct billing can eliminate entirely.

Here is how the numbers compare.

Doctor Visit Cost Comparison Across Cities

The table below delineates the typical out-of-pocket costs for a standard GP visit and a specialist consultation in our three focus cities. It contrasts what you would pay without coverage versus with a premium IPMI plan.

| City | GP Visit (No Cover) | GP Visit (Premium IPMI) | Specialist (No Cover) | Specialist (Premium IPMI) |

|---|---|---|---|---|

| Hong Kong | $150 | $0 | $400 | $0 |

| Singapore | $140 | $0 | $450 | $0 |

| London | $200 | $0 | $550 | $0 |

The disparity is stark. A robust IPMI plan transforms an unpredictable health expense into a managed, predictable one, assuming your annual deductible has been met. For high-net-worth professionals, this is not a luxury; it is a core component of sound financial planning.

You can explore a more detailed analysis of healthcare management in our guide on health insurance for expatriates in Hong Kong.

The Escalating Cost Landscape

These figures are not static. The primary variable to consider is medical inflation. The 2024 WTW Global Medical Trends Survey forecasts an average medical cost increase of 9.9% globally, with some regions facing even steeper hikes. That $200 London GP visit today could approach $220 next year.

The true value of a premium IPMI policy is not just in covering today's bill, but in insulating your wealth from the relentless, year-over-year escalation of global medical costs.

This is especially critical for complex diagnostics. For instance, understanding the real cost of ADHD and Autism assessments in the UK reveals how quickly specialized medical requirements can escalate into thousands of dollars. At such a point, comprehensive coverage becomes indispensable.

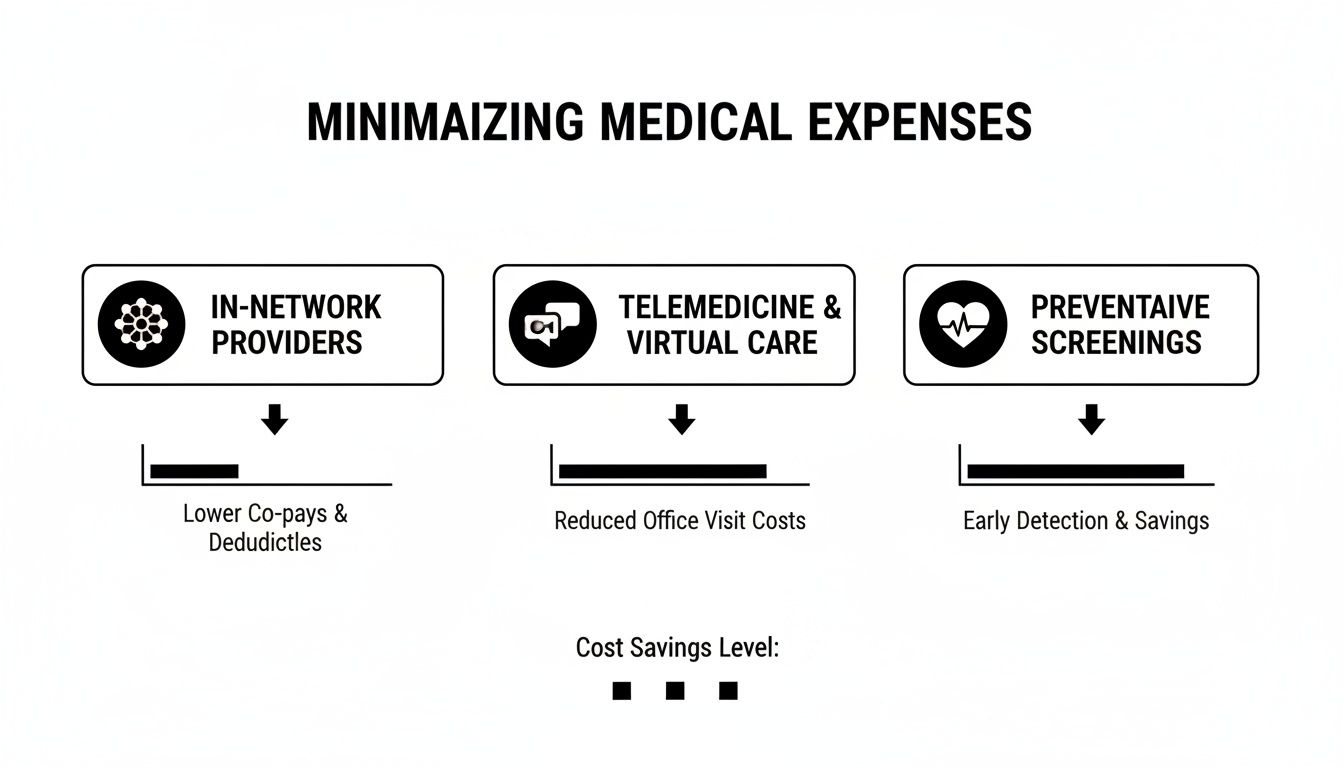

This infographic highlights key strategies you can employ to stay ahead of rising costs.

The key takeaway is both simple and powerful: by actively utilizing your policy’s features, such as adhering to in-network providers and embracing telemedicine, you can exert significant control over your healthcare spending without ever compromising on the quality of care.

Selecting the Right International Medical Insurance

The selection of an International Private Medical Insurance (IPMI) policy is a decision of critical importance. A correct choice ensures access to world-class medical care and shields your wealth from the financial impact of a health crisis. An incorrect one can leave you with inadequate coverage that fails at the critical moment.

For the discerning global professional, the objective is not to find the most inexpensive plan. It is to secure a sophisticated policy that functions as a seamless extension of your lifestyle. It must deliver certainty, flexibility, and exceptional service, regardless of your location.

A Framework for Evaluating Premier IPMI Policies

When you ask, "how much for a doctor visit?", the right insurance can make the answer zero. Achieving that level of seamless care, however, requires focusing on the specific elements that distinguish a standard policy from one engineered for a global executive.

These are the non-negotiable criteria:

- Underwriting Flexibility: Your health profile is unique. A premier insurer will not impose a one-size-fits-all solution. They will offer flexible underwriting options, such as moratorium or full medical underwriting, to structure a policy that accommodates pre-existing conditions without prohibitive restrictions.

- Global Network Access: A policy's value is directly tied to its network. The provider must have deep, established relationships with top-tier hospitals and specialists in your key operational locations. This guarantees access to the best possible care without administrative friction.

- Direct Billing Capabilities: For high-net-worth individuals, the process of paying upfront, submitting claims, and awaiting reimbursement is an unacceptable inefficiency. Direct billing (also known as "cashless access") is essential. The provider bills the insurer directly, allowing you to simply present your membership card and focus on your health.

A truly premium IPMI policy is not a safety net you hope never to use. It is a strategic asset designed for active, seamless integration into your life, ensuring that world-class medical care is always available without financial friction.

When evaluating options, a clear checklist can eliminate ambiguity. The best policies are built upon a foundation of flexibility, access, and robust support systems.

The following table outlines the essential criteria that should guide your selection process, ensuring you choose a plan that performs under pressure.

Key Criteria for Selecting Your IPMI Policy

Essential factors to consider when choosing premier international medical insurance.

| Criteria | Why It Matters |

|---|---|

| Underwriting Options | Determines how pre-existing conditions are handled. Flexible underwriting ensures your unique health history is accommodated fairly, not just excluded. |

| Global Network Depth | The quality of hospitals and specialists available to you. A strong network means guaranteed access to the best care without administrative hurdles. |

| Direct Billing Network | Eliminates out-of-pocket payments for significant medical events. This is the difference between a simple visit and a major financial inconvenience. |

| Customizable Deductibles | Gives you direct control over your financial risk. You can balance your annual premium against your potential out-of-pocket costs to match your strategy. |

| Dedicated Concierge Support | Provides a single point of contact for all your needs. This transforms a stressful medical event into a managed, streamlined process. |

Ultimately, your choice depends on how effectively a policy integrates into your life. The technical features are the starting point; the true value is found in the service and certainty it delivers.

Customization and Support

Beyond these core features, the ability to tailor your plan and receive dedicated support is what truly distinguishes a premier policy. Seek out customizable deductibles that allow you to balance your annual premium against your out-of-pocket exposure, giving you direct control over your financial risk profile.

Finally, insist on dedicated concierge support. When a medical need arises, your point of contact should not be a generic call center. It should be a dedicated professional who understands your policy and can coordinate appointments, arrange second opinions, and manage administrative burdens. This level of service transforms a stressful situation into a manageable one, allowing you to secure the best care with absolute confidence.

Your Questions Answered

Navigating international healthcare brings up a lot of questions. Let's tackle some of the most common ones to give you the clarity you need.

What Really Drives Up Doctor Visit Costs?

A few key factors dictate the final invoice. The most significant is the distinction between public and private healthcare. Private clinics in major hubs like Singapore or Dubai offer five-star service and immediate access to top specialists, and that convenience is priced accordingly.

Beyond that, the physician's specific expertise is a major variable. A consultation with a world-renowned cardiac surgeon will command a fee in a completely different category than a routine check-up with a general practitioner. Finally, the operating jurisdiction matters—the high overheads of running a clinic in central London or New York are inevitably reflected in patient billing.

How Do My Policy Features Actually Work in a Real-Life Scenario?

Consider your IPMI policy features as financial levers that control your out-of-pocket expenses. Your deductible is the first threshold; it is the fixed amount you pay annually before your insurance carrier begins to contribute. It is your yearly buy-in to the plan.

Once your deductible is satisfied, co-insurance is typically activated. This is simply a cost-sharing arrangement. Your insurer might agree to cover 80% of subsequent bills, meaning you are responsible for the remaining 20%. These two features work in tandem to define your precise financial liability for any given treatment.

When Should I Bother Using Concierge Medical Services?

Concierge services are an invaluable asset when you require healthcare to be perfectly seamless and efficient. They are indispensable for securing appointments with specialists who have long waiting lists, organizing complex care across multiple facilities, or simply navigating the medical bureaucracy in a country where you are not fluent in the local language.

For a busy executive, this service is not a luxury—it is a significant time-saving mechanism that converts a logistical challenge into a managed process.

What if I Get a Bill That Looks Way Too High?

First, do not remit payment immediately. If a medical bill appears incorrect or substantially exceeds the initial quote, your next action should be to contact your IPMI provider or your dedicated concierge service.

They are the experts in this domain. They will conduct a line-item review of the invoice, cross-reference it with your policy's terms and their provider agreements, and contest any erroneous charges on your behalf. Leveraging their expertise is unequivocally the most intelligent way to resolve billing disputes and protect your financial interests.

Navigating the world of international health insurance is complex, but you don't have to do it alone. Riviera Expat provides the expert, independent advice you need to find a policy that truly protects your health and your finances. See how we can help at https://riviera-expat.com.