Think of global health insurance for expats as your personal healthcare passport. It is a specific type of plan, frequently called International Private Medical Insurance (IPMI), engineered for individuals living and working outside their country of origin. Unlike domestic health insurance, it provides seamless, high-quality medical care across multiple countries, ensuring you are covered no matter where your professional life takes you.

Protecting Your Health and Wealth Across Borders

For a high-net-worth professional moving between financial hubs like Singapore, London, or Dubai, relying on a standard domestic health plan is a significant vulnerability. Those plans are tethered to a specific country. The moment a medical issue arises abroad, they become practically ineffective, leaving you to manage a logistical and financial challenge that can derail your personal and professional life.

This guide addresses that vulnerability head-on. We are not discussing global health insurance for expats as just another line-item expense. It is a fundamental component of your personal risk management strategy—an asset designed to protect your two most valuable resources: your health and your wealth.

A Strategic Asset for Global Professionals

A premier IPMI plan provides a key to the world's leading doctors and hospitals. It means a health concern that appears in Zurich can be handled with the same level of care, discretion, and efficiency as one diagnosed in New York. The entire purpose is to remove geographical barriers to elite medical treatment, so you always receive the best care available.

This is not a luxury; it is a necessity for anyone whose career is not confined to one country. The right plan delivers more than just medical coverage. It provides certainty and control when circumstances become unpredictable.

A well-designed IPMI policy is a financial firewall. It shields your personal wealth from the staggering costs of international private healthcare, which can easily run into the hundreds of thousands of dollars for serious procedures.

Beyond Standard Coverage

Let us be clear about what IPMI is not. It is not a local plan, which is excellent within one country but loses its value the second you cross a border. And it is not travel insurance, which is designed for short-term, trip-related emergencies—not for managing a chronic condition or receiving ongoing specialist care.

True global health insurance for expats is a robust, continuous safety net that moves with you. It is engineered for a life lived in multiple jurisdictions, offering critical benefits that standard policies simply do not have:

- Global Portability: Your coverage follows you from one assignment to the next, so you never have dangerous gaps in your protection.

- Access to Premier Networks: You gain entry to an exclusive network of world-class hospitals and physicians, ensuring you can see the best specialists.

- High Coverage Limits: These policies are built with substantial annual limits to handle major medical events without causing you financial distress.

- Continuity of Care: You can manage long-term health needs consistently under a single policy that knows your medical history, no matter where you are.

Ultimately, this specialized insurance offers unparalleled peace of mind. It frees you to focus on your professional responsibilities, knowing that your health and wealth are secure from unexpected medical crises, no matter where your career takes you.

What Exactly Is International Health Insurance?

To see why global health insurance is such a critical asset for an expat, you must understand how it differs from the insurance you are accustomed to back home. It is not just an enhanced travel policy or a domestic plan with a larger geographical scope. International Private Medical Insurance (IPMI) is built on a completely different framework.

Think of your local health plan as a single-market domestic security—it performs well within its home territory but loses nearly all its value the moment you cross the border.

IPMI, on the other hand, is more like a bespoke global asset management strategy for your health. It is engineered from the ground up for portability, continuity, and access to an elite network of doctors and hospitals anywhere in the world. This design means you receive the same high standard of care whether you require a routine check-up in Dubai or complex surgery in London.

The Core Ideas Behind Global Coverage

At its heart, IPMI is built around a few powerful principles that allow it to work seamlessly across borders. Understanding these is the first step to seeing why this type of plan is non-negotiable for professionals whose careers and lives span multiple countries with vastly different healthcare costs and quality.

A perfect example is the 'area of cover'. This simply defines the geographic region where your policy is active. You can choose worldwide coverage, worldwide excluding the USA (a common choice to manage premiums), Europe only, or other specific regions. This lets you match your protection precisely to your professional and personal footprint, ensuring you are not paying for access you will never use.

Why IPMI Is in a League of Its Own

The shortcomings of other insurance types become glaringly obvious when you view them through an expat’s eyes. Travel insurance, for example, is for short-term emergencies—think a fractured leg on a ski trip or a sudden illness during a business meeting. It was never designed for ongoing or planned medical care. And while knowing specific regional rules like Schengen travel insurance requirements is vital for short trips, it is no substitute for proper long-term coverage.

Local health plans are even more restrictive. They are tied to a single country's healthcare system and often become void the moment you are no longer a resident. This creates dangerous gaps for an executive transferring from Hong Kong to Singapore. IPMI is specifically designed to close those gaps.

The central promise of IPMI is continuity. It guarantees that your standard of healthcare does not decline when you cross a border, providing a consistent and predictable level of elite medical access no matter where you are.

This growing understanding of its necessity is fueling significant market growth. One 2023 market analysis projects the global health insurance market to reach USD 4.15 trillion by 2030, growing at a CAGR of 9.7%. Within this, the IPMI segment is driven by the mobility of professionals who demand superior, cross-border healthcare solutions.

Medical Underwriting: The Key to a Plan That Fits

Another crucial piece of the puzzle is ‘medical underwriting’. This is the process insurers use to gain a clear picture of your health before they issue a policy. By reviewing your medical history in detail, they can structure a plan that is precisely fitted to you, leaving no doubt about what is and is not covered.

This is a world away from many domestic group plans, which often have looser entry requirements but can offer one-size-fits-none protection. For a globally mobile professional, the absolute clarity that comes from full medical underwriting is a significant advantage. It creates a reliable and transparent foundation for your health and financial security abroad, ensuring your global health insurance for expats is a perfect fit.

Core Components of a Premier IPMI Policy

A premier International Private Medical Insurance (IPMI) policy is not an off-the-shelf product. It is a carefully constructed safety net, built to give you absolute certainty no matter where you are in the world. When advising clients, I always tell them to look past the headline numbers and examine the foundational pillars that actually guarantee top-tier medical care.

These core components are non-negotiable. They are what separate a truly superior policy from a standard one that might leave you exposed. Gaining a firm grip on them provides a clear framework for judging whether a plan can truly keep up with the demands of a global career.

Inpatient and Outpatient Care Without Compromise

The bedrock of any elite global health insurance for expats is how it handles inpatient versus outpatient services. You require a plan that offers robust, fully-paid coverage for both, without tricky limitations that could compromise your care when you need it most.

-

Inpatient Care: This covers everything associated with an overnight hospital stay. This includes a private room, surgeon and specialist fees, intensive care, high-cost diagnostics like MRIs, and all medications administered while admitted. For a finance professional, it means if you have a sudden cardiac event in Hong Kong, your policy grants you admission to a leading facility like Gleneagles Hospital without hesitation over cost.

-

Outpatient Care: This covers all medical services that do not require a hospital bed. It includes your GP visits, specialist consultations, prescription drugs from the pharmacy, physiotherapy, and advanced diagnostics. Strong outpatient benefits are critical for managing everything from a common illness to a chronic condition while living abroad.

The Power of a Global Direct-Billing Network

A policy is only as good as its network. A premier plan gives you access to an extensive direct-billing network of world-class hospitals and clinics. This feature allows for genuinely cashless access to care.

Instead of paying a substantial hospital bill with your personal funds and then seeking reimbursement, the insurer settles the cost directly with the medical provider. This completely removes the administrative and financial burden from an already stressful situation. It allows you to focus on one thing: your recovery.

A direct-billing network transforms your insurance card into a key that unlocks immediate access to the best medical facilities on the planet. It is the engine that delivers on the promise of seamless, stress-free care across borders.

This demand for high-quality, accessible care is a key reason the international private medical insurance market was valued at an estimated USD 19.86 billion in 2022, with projections showing continued strong growth. This expansion is fueled directly by multinational firms sending talent to financial hubs like Hong Kong, Singapore, and London.

High Annual Limits and Lifetime Portability

To properly shield your financial portfolio, a top-tier IPMI plan must have a very high annual limit. This is the absolute maximum your insurer will pay out in a policy year. A catastrophic event—a complex surgery followed by a long, difficult recovery—can easily generate a bill of several hundred thousand dollars.

An annual limit of $2 million USD or higher acts as a firewall, protecting your personal assets from being depleted by a serious health crisis. It is also crucial to understand the policy's structure, including any excesses and deductibles that might apply before the coverage begins.

Finally, seamless portability is completely non-negotiable. Your policy must be designed to move with you as your career takes you from one country to the next. This ensures you have uninterrupted coverage, eliminating the risk of being uninsured or, worse, having to go through medical underwriting again with each move—a significant gamble if you have developed any health conditions along the way.

Decoding Premiums and Pre-Existing Conditions

Let us address the financial engineering behind a top-tier global health insurance for expats policy. This is not about pursuing the lowest price; it is about securing undeniable value and completely eliminating any financial surprises regarding your healthcare.

The premium—your regular payment for coverage—is not an arbitrary number. Insurers calculate it with actuarial precision, basing it on key variables that map directly to your personal risk profile and the level of protection you demand.

How Your Premium is Calculated

Think of your policy's cost as having several financial levers. Adjust one, and the overall cost changes. The skill lies in knowing which levers to adjust to align the plan with your budget and lifestyle without ever sacrificing the quality of your care.

Three factors carry the most weight:

- Age: This is a primary factor. Statistically, the likelihood of needing medical care increases with age, and premiums reflect that reality.

- Area of Cover: Geography is a major cost driver. A plan that includes the USA, with its exceptionally high healthcare costs, will be significantly more expensive than one that excludes it.

- Deductible Level: This represents your share of the initial cost. A higher deductible (or excess) means you agree to pay more out-of-pocket, which directly lowers your annual premium.

This is where strategic planning comes in. If your professional world revolves around hubs like Singapore, Dubai, and London, excluding North America is a straightforward way to manage your premium. Likewise, if you are comfortable covering minor, routine medical costs yourself, opting for a higher deductible can make significant financial sense. The dynamics of how these costs are structured can be complex, and for a deeper dive, our article explains in detail why medical insurance premiums rise.

The Critical Issue of Pre-Existing Conditions

For any seasoned professional, how an insurer handles pre-existing conditions is a make-or-break issue. This is where the underwriting process—the insurer's risk assessment of your health history—comes into sharp focus. It dictates exactly how they will approach any health issues you had before the policy began.

You will generally encounter two distinct approaches:

Full Medical Underwriting (FMU): This is the gold standard for anyone who values clarity and certainty. You provide a complete, transparent disclosure of your medical history. The insurer assesses it and gives you a definitive answer: they will cover the condition, cover it with an increased premium (a "loading"), or exclude it. You know exactly where you stand from day one.

The alternative is a more passive, rule-based system that can leave you in a state of uncertainty.

- Moratorium Underwriting: Here, you do not disclose your medical history upfront. Instead, the policy automatically excludes any condition for which you have had treatment, symptoms, or advice in the recent past (usually the last five years). The condition may become eligible for coverage, but only if you go a set period (typically two years) on the new policy without needing any treatment or advice for it.

Let us make this concrete. Imagine you have a well-managed case of Type 2 diabetes.

With Full Medical Underwriting, the insurer reviews your medical records. They might agree to cover it fully, possibly adding a premium loading to account for ongoing care. You receive absolute certainty before you even sign the policy.

Under a Moratorium, your diabetes treatment is automatically excluded from day one. It would only become eligible for coverage after you complete the two-year waiting period with zero symptoms, treatment, or advice—something that is often impossible for a chronic condition. For a high-net-worth individual who cannot afford ambiguity, FMU is almost always the superior choice.

Understanding Standard Policy Exclusions

Finally, every insurance policy has boundaries. These are not hidden traps designed to catch you unawares; they are standard definitions of what the policy is designed to cover. Knowing them upfront allows you to have precise, intelligent conversations with insurers and brokers.

Common exclusions on almost any plan include:

- Elective cosmetic surgery that is not medically necessary.

- Experimental treatments or therapies that are not yet medically proven.

- Costs related to addiction, unless you have specifically added a benefit for it.

Reviewing these limitations is simply good due diligence. It ensures your expectations are perfectly aligned with the protection you are purchasing. This level of transparency is the hallmark of any premier global health plan.

A Strategic Checklist for Picking Your Plan

Choosing the right global health insurance is not about guesswork. It is a critical decision, and for a busy executive, getting it wrong is not an option. Think of it less like shopping and more like crafting a strategic asset that must perform perfectly when you need it.

This checklist breaks down a complex task into a straightforward process. By walking through these steps, you can move from uncertainty to confidence, ensuring the plan you choose actually delivers the security and access you expect.

1. Map Out Your World

First, where will you be? Your ‘area of cover’ is one of the biggest drivers of your premium cost and the plan's real-world usefulness. Do not just think about where you are today. Consider where you might be in the next three to five years.

Are your operations mainly in Asia and Europe? If so, choosing a policy that excludes the notoriously expensive U.S. healthcare system can reduce your premiums without sacrificing the quality of care you will receive everywhere else. Be realistic and look ahead—it is the easiest way to avoid paying for coverage you will never use.

2. Get Honest About Your Health Needs

Next, take a candid look at your health needs and those of your family. This is more than a snapshot of your current health; it is about anticipating what might be around the corner.

- Chronic Conditions: Do you or a family member have a condition that requires ongoing management? Ensure the policy is built for long-term, consistent support.

- Future Plans: Thinking of starting or growing your family? Comprehensive maternity benefits are an absolute necessity, not an optional extra.

- Routine & Preventive Care: How often do you go for check-ups, vaccinations, and other wellness visits? Factor this into your decision.

A clear inventory of your specific health profile is the only way to judge a policy on what it delivers for you, not just on a generic list of benefits.

3. Kick the Tires on the Provider Network

A policy is only as good as its network of hospitals and doctors. Never take an insurer's claim of a "global network" at face value. You must verify that the top-tier medical centers in your key cities are actually in-network.

For example, if you divide your time between Paris and Singapore, you should confirm that world-renowned facilities like The American Hospital of Paris and Gleneagles Hospital Singapore are part of the direct-billing network.

Direct-billing is what makes access to care seamless and cashless. When a hospital has this arrangement with your insurer, they handle the payment directly. This is crucial—it means that in a moment of crisis, your focus is on getting well, not on fronting a massive hospital bill.

Doing this homework upfront prevents the scenario of discovering your preferred hospital is out-of-network right when you need it most, which creates significant financial and administrative stress.

4. Match the Policy to Your Financial Strategy

Your health plan must fit neatly into your broader financial strategy and personal risk tolerance. This means achieving the right balance between your policy limits and deductibles.

Think of your annual benefit limit as a financial firewall. It must be high enough to completely shield your assets from a worst-case medical event.

On the other hand, your deductible—what you pay out-of-pocket before insurance kicks in—is a lever you can pull. If you are comfortable paying for minor medical costs yourself, choosing a higher deductible can dramatically lower your annual premium. This is a smart, common strategy to cut costs without relinquishing major medical protection.

5. Check the Fine Print on Evacuation & Repatriation

Finally, for any professional operating on a global stage, this is your ultimate safety net. Medical evacuation and repatriation benefits are not optional extras; they are fundamental to any serious IPMI plan.

Dig into the specifics. Medical evacuation transports you to the nearest top-tier medical facility if local hospitals are not up to the task. Repatriation gives you the option to return to your home country for treatment or recovery.

Understanding exactly what triggers these benefits, what the limits are, and how the process works provides the kind of deep-seated peace of mind that is, frankly, priceless.

Choosing Your Expert IPMI Advisor

Let us be direct. Navigating the global health insurance for expats market is not a job for a generalist. If you want a plan that truly aligns with your financial standing and international lifestyle, you need a specialist partner—a brokerage that lives and breathes the unique world of high-net-worth professionals.

A dedicated advisor does far more than just present a list of options. They become your advocate. Their entire job is to provide objective, clear-eyed analysis and give you access to a handpicked selection of premier global insurers. It is a consultative approach that puts your specific circumstances first, ensuring every recommendation is a strategic fit, not a generic, off-the-shelf product.

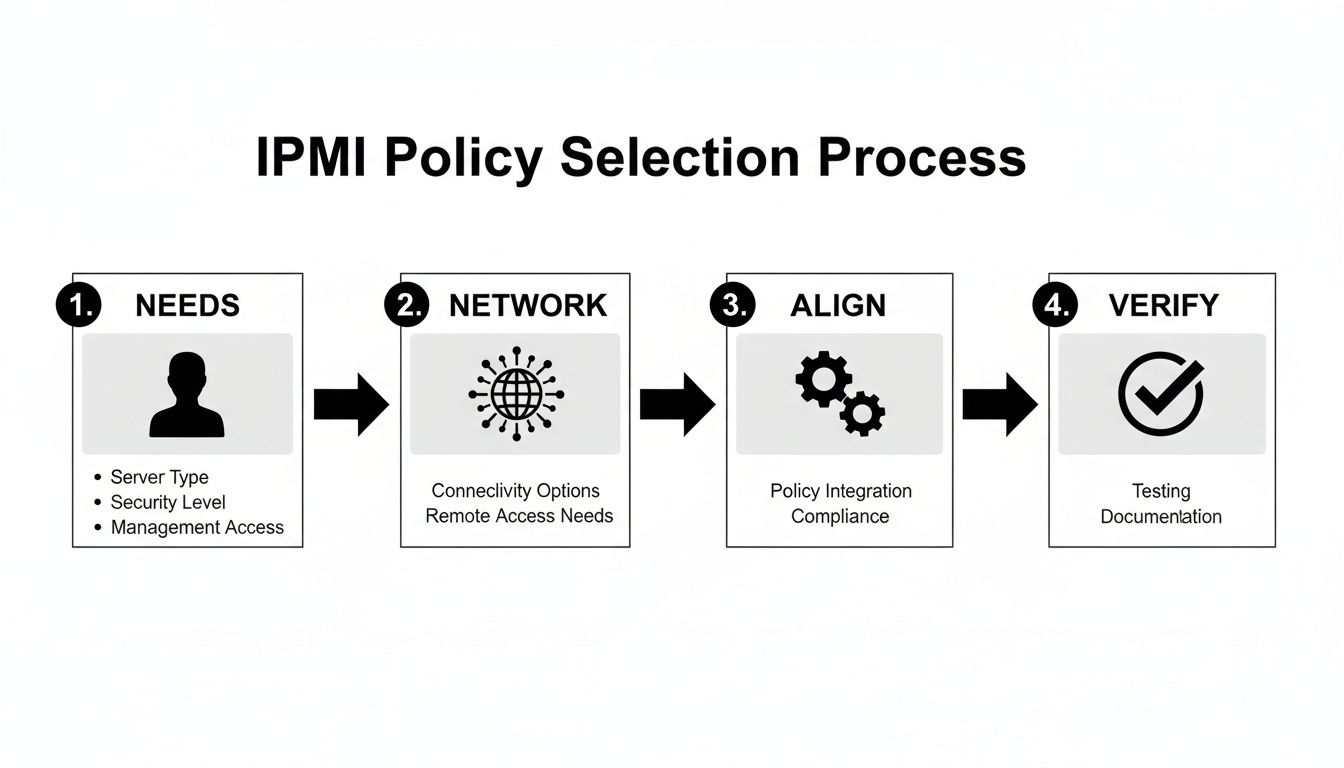

The process a specialist follows is methodical and structured, designed to build your ideal policy from the ground up.

As you can see, a truly robust policy is not just found; it is constructed through deliberate stages, from defining your needs right through to verifying every last detail.

The Value of Deep Market Knowledge

Here is where an advisor’s true value really comes into play: deep, on-the-ground market knowledge, especially in major financial hubs like London, Hong Kong, and Singapore. They know which healthcare facilities are top-tier and which specialist networks are preeminent in these cities. This kind of insight allows them to negotiate better terms and pricing on your behalf, often unlocking benefits you simply could not access on your own.

An expert IPMI advisor transforms a complex purchasing decision into a streamlined strategic process. Their sole focus is to ensure your global health strategy is as robust and meticulously planned as your financial one, delivering control and confidence.

This specialist guidance is absolutely critical when it comes to the administrative side of things, like handling claims. Misunderstanding the fine print in a policy document can be a costly mistake. For a closer look at how insurers manage payments and why expert knowledge is vital, you can learn more about pre-authorisation and direct settlement.

Ultimately, partnering with a specialist firm like Riviera Expat is an investment in certainty. We invite you to have a no-obligation conversation with us to review your current strategy. Let us bring the clarity you need to ensure your health and your wealth are protected without compromise, no matter where your ambitions take you.

Have Questions? We Have Answers.

When arranging global health insurance, a few key questions invariably arise. Here are the direct answers to the ones we hear most often from professionals managing their lives across borders.

Will My Global Health Insurance Cover My Family if They Live in a Different Country?

Yes, in most cases. Premier international plans are designed for precisely this kind of modern, global family structure. You can typically cover your spouse and children, even if they reside in a different country than you.

The mechanism is simple: your policy assigns a specific area of cover to each individual on the plan, based on their country of residence. This ensures everyone receives seamless, comprehensive protection, no matter where they call home.

What's the Real Difference Between Medical Evacuation and Repatriation?

This is a critical distinction, and understanding the difference is key to appreciating your safety net. The terms sound similar, but they serve two very different, very important purposes.

- Medical Evacuation is about transport to the best available care. It covers the cost of moving you to the nearest medical facility capable of treating your condition when local hospitals cannot. An example would be an airlift from a remote location to a major city hospital.

- Medical Repatriation is about returning you home. Once you are medically stable enough to travel, this benefit covers the cost of bringing you back to your home country to continue treatment or recover among your support system.

Both are non-negotiable for an expatriate. One provides access to life-saving care, and the other facilitates recovery in a familiar environment.

How Can I Keep Premiums Down Without Settling for Second-Rate Care?

This is the quintessential question. The most intelligent way to manage your costs without compromising your coverage is by being strategic with your plan's structure.

A common strategy is to adjust your area of cover. If you know you will not require treatment in the USA—by far the most expensive healthcare market in the world—excluding it from your plan can significantly reduce your premiums.

Another powerful tactic is to opt for a higher deductible (sometimes called an excess). By agreeing to pay a larger amount out-of-pocket for initial claims, your annual premium drops substantially. This keeps you fully protected against a catastrophic medical event, which is the primary purpose of insurance, while making your annual costs more manageable. A skilled broker can analyze the figures and identify the optimal balance for you.

Trying to piece all this together on your own is a formidable task. At Riviera Expat, we provide the objective, expert guidance you need to build a global health insurance plan that truly fits your life. Schedule a no-obligation consultation and bring clarity and confidence back into your healthcare strategy.