For a high-net-worth individual moving capital and talent across global markets, an insurance policy isn't merely a document—it's a critical strategic asset. It is the sophisticated safeguard that stands between you and a significant health event that could derail not only your well-being but also your financial stability.

This guide is designed to pull back the curtain on International Private Medical Insurance (IPMI). We will use an insurance policy sample as our blueprint, moving beyond abstract terms to provide a tangible framework for dissecting any plan that comes across your desk.

Your Blueprint for Global Health Security

Think of an IPMI policy as a specialized financial instrument. For expatriates managing substantial portfolios, it is an indispensable part of your personal risk management strategy, designed to insulate you from the considerable costs of premier medical care, no matter where your interests take you.

This is more relevant than ever. The global health insurance market, valued at USD 2.69 trillion in 2023, is projected to reach USD 5.45 trillion by 2033. This growth is fueled by the exact demands of discerning professionals like you in global hubs. You can dive deeper into these trends in the full health insurance market report.

Our goal is to arm you with the ability to scrutinize any policy with the same sharp, analytical eye you apply to your financial decisions.

Mastering Your IPMI Policy

Truly understanding your coverage is not about memorizing pages of legal jargon. It's about knowing where to look and what to look for—recognizing the key components that separate a standard policy from elite coverage truly built for the realities of an expatriate life.

Mastering this means you can:

- Pinpoint Critical Clauses: Instantly find the sections that directly impact your access to care and your financial exposure.

- Evaluate Coverage Limits: Truly grasp the financial guardrails of your policy and how they perform in a worst-case scenario.

- Identify Potential Gaps: Spot the exclusions or limitations that could leave you facing unexpected and significant out-of-pocket costs.

An IPMI policy should be a bespoke agreement that secures your well-being. A thorough analysis of its sample documentation is the first step toward ensuring it aligns perfectly with your international lifestyle and risk tolerance.

By the time you finish this guide, you will be prepared to delve into the fine print. You will be able to assess any insurance policy sample with confidence and precision, transforming you from a passive policyholder into an informed principal in your own health security.

Understanding the Structure of Your IPMI Policy

An International Private Medical Insurance (IPMI) policy is not just a collection of pages; it is a carefully constructed legal document. It specifies exactly what an insurer will—and will not—do for you. To realize the full value of your coverage, you must understand its architecture.

Think of it as reviewing a financial prospectus before making a significant investment. Each section has a specific purpose, and their interplay determines the real-world value you receive.

This overview will walk you through the key components of a high-value policy. By understanding how these pieces connect, you will be able to dissect any insurance policy sample with expertise, spotting the critical details and grasping the insurer's commitments to you.

The Declaration Page: Your Executive Summary

The first document you will encounter is typically the Declaration Page, sometimes called the Policy Schedule. This is the executive summary of your entire agreement—a snapshot of the most critical details, personalized for you.

This page serves as your go-to reference for confirming facts without digging through pages of legal text. It is the definitive proof that the policy is yours and reflects the precise terms you have agreed to.

You will find the essentials here:

- Policyholder and Beneficiaries: Your name and any other covered individuals, such as your family.

- Policy Number and Effective Dates: Your unique identifier and the period your coverage is active.

- Premium Amount: The exact cost of your coverage.

- Overall Policy Limits: The maximum monetary amounts the insurer will pay out under your plan.

The Insuring Agreement: The Core Promise

Immediately following the summary, you arrive at the heart of the policy: the Insuring Agreement. This is where the insurer makes its fundamental promise. It is their core pledge to cover you in exchange for your premiums, provided certain conditions are met.

The language here is intentionally broad, outlining the general scope of what is covered. It establishes the insurer’s contractual duty and sets the stage for the specific details that follow. While other sections will introduce limitations and exclusions, this is the foundational statement that affirms, "We will provide coverage."

The Insuring Agreement is the bedrock of your policy. It is the insurer’s principal commitment, upon which all other clauses, conditions, and limitations are built. Understanding this promise is the first step in assessing the integrity of your coverage.

The Definitions Section: Establishing Clear Terms

No serious contract functions without a precise lexicon, and your IPMI policy is no exception. The Definitions section is the policy's official glossary. It provides specific, legally binding meanings to key terms that appear throughout the document.

Words such as "medically necessary," "pre-existing condition," or "hospitalization" are not left to interpretation; they are given exact definitions here.

This section is required reading because it eliminates ambiguity. How an insurer defines a term directly controls when and how your coverage is applied. Overlooking this section is akin to trading a complex financial instrument without understanding its terminology—a risk no discerning professional would take. Always verify that their definitions align with your expectations.

Analyzing the Critical Clauses That Define Your Coverage

Once you grasp the basic blueprint of an IPMI policy, it is time to inspect the mechanics—the specific clauses that dictate how your insurance actually performs when you need it. This is where the insurer's promises meet real-world application. For a high-net-worth individual, overlooking these details is an invitation for substantial financial risk.

Here, we move from the policy's structure to its substance, dissecting the contractual language that will have the greatest impact on your global healthcare. Think of these clauses as covenants in a complex financial agreement; they establish the boundaries, obligations, and potential liabilities for all parties. A clear understanding is not just advisable, it is essential. Getting this right is your best defense against unexpected insurance discrepancies that can complicate international moves and create significant challenges.

Coverage Limits and Annual Maximums

The most straightforward clause is typically the Coverage Limit, which is simply the maximum amount of money your insurer will pay out. This is generally set as an annual limit, but sometimes lifetime limits are also specified. For a globally mobile professional, a policy with an insufficient annual maximum is a critical vulnerability.

Consider this: a single complex surgical procedure followed by a prolonged stay in a premier private hospital in Singapore or London can easily amount to hundreds of thousands of dollars. An inadequate limit could leave you responsible for a staggering personal bill. Verifying this figure is the first test of whether a policy is suitable for your lifestyle.

Policy Exclusions: What Is Not Covered

Just as important as what is covered is what is explicitly not covered. The Exclusions section is your roadmap to the gaps in your coverage. It is a direct list of conditions, treatments, and situations your insurer will not pay for, and reviewing it is non-negotiable.

Common exclusions you will almost always find include:

- Cosmetic procedures that are not medically necessary.

- Experimental treatments that have not been approved by mainstream medical bodies.

- Injuries from specific high-risk activities, unless you have added a specialized rider to your plan.

The Exclusions clause is the insurer's line in the sand. It clarifies the absolute boundaries of their financial responsibility. Assuming a procedure is covered without first checking this section is a frequent and costly mistake.

Pre-existing Conditions and Underwriting

This is, without question, one of the most critical parts of any health insurance policy. A pre-existing condition is generally defined as any medical issue you had before your policy’s start date. The way an insurer handles these conditions will define your coverage from day one.

Insurers typically take one of two paths:

- Full Medical Underwriting (FMU): You provide a complete, detailed medical history at the time of application. The insurer’s underwriting team then reviews this information and decides whether to cover your existing conditions, exclude them, or cover them with an increased premium (a "loading"). This approach provides complete clarity from the outset.

- Moratorium Underwriting: This is a "wait-and-see" approach. You do not disclose your full medical history upfront. Instead, any pre-existing conditions for which you have had symptoms or received treatment in the recent past (e.g., the last five years) are automatically excluded for a waiting period (e.g., the first two years of the policy). If you remain free of symptoms, treatment, or advice for that condition during the entire waiting period, it may become eligible for coverage.

For any individual who values certainty and wishes to avoid surprises, FMU is almost always the superior choice.

Portability and Medical Evacuation

For a global professional, portability is non-negotiable. This clause ensures your coverage travels with you as you move between countries. A true global IPMI plan should offer seamless protection, meaning you will not have to re-apply for a new policy and undergo underwriting again simply because you have relocated.

Closely tied to this is the Medical Evacuation benefit. This is a crucial safeguard, particularly if you reside or travel in regions where top-tier medical care is not readily available. It covers the cost of transporting you to the nearest center of medical excellence if local facilities cannot provide the necessary care for your condition. The objective is to secure the best possible treatment, not merely the closest.

Provider Networks and Claims Process

Finally, the day-to-day usability of your policy comes down to its Provider Network and Claims Process. The network is the list of hospitals, clinics, and physicians that have a direct billing agreement with your insurer. A robust network in your city of residence means less paperwork and, most importantly, no need for out-of-pocket payments for major treatments.

The claims process dictates how you are reimbursed for any out-of-network care. A slow, confusing, or paper-intensive process adds stress when you are already managing a medical issue. A premium policy will offer a clear, efficient, and often digital claims system that simplifies the experience. To learn more about how out-of-pocket costs are handled, you might find our guide on excesses and deductibles in the fine print helpful.

Before proceeding, let’s consolidate these points into a quick-reference checklist. When you review a policy sample, you can use this table to ensure you have addressed the most important aspects.

Critical Clause Checklist for IPMI Policies

| Clause | What to Look For | Potential Red Flag |

|---|---|---|

| Coverage Limits | High annual maximum (ideally $2M+). Clarity on lifetime vs. annual limits. | Low annual limits (<$1M) that could be exhausted by a single serious event. |

| Exclusions | A clear, concise, and reasonable list. Check for exclusions related to your lifestyle (e.g., specific sports). | Vague language or an unusually long list of exclusions. Exclusions for entire countries. |

| Pre-existing Conditions | Clear terms on how your medical history is handled (FMU or Moratorium). | Automatic exclusion of common conditions without review. Ambiguous waiting periods. |

| Portability | A guarantee that coverage continues seamlessly when you move countries, without re-underwriting. | The need to apply for a new policy upon relocation. Geographic restrictions. |

| Medical Evacuation | Coverage to the "nearest center of excellence," not just the "nearest facility." High benefit limits. | Low monetary caps on evacuation. Vague definitions of "medical necessity." |

| Provider Network | A robust list of high-quality hospitals in your primary country of residence. Direct billing options. | A sparse network, forcing you to pay upfront for most care. Outdated provider lists. |

| Claims Process | A simple, clear process with digital submission options and a guaranteed turnaround time for reimbursement. | A cumbersome, paper-based process. A history of slow or denied reimbursements. |

Think of this table as your first line of defense. If a policy raises red flags in several of these areas, it is a strong signal to either ask more pointed questions or seek alternatives.

Learning from an Annotated Insurance Policy Sample

Theory alone is insufficient. To truly comprehend your IPMI coverage, you must engage directly with the actual policy wording. Consider this section a guided workshop. We will deconstruct key clauses from a typical IPMI policy, translating the dense legal language into clear, actionable advice.

By undertaking this line-by-line analysis, you will learn to read between the lines—to spot the subtle phrasing that distinguishes standard coverage from the elite protection a global lifestyle demands. This is not just about reading a document; it's about learning to see what is truly being offered.

Decoding a Medical Evacuation Clause

For any expatriate, the Medical Evacuation benefit is your ultimate safety net. It is the promise that you can access first-class medical care, even if you are in a location with substandard local facilities. However, the real value of this benefit depends entirely on the specific words used in the policy.

Let's examine a sample clause:

Sample Clause: Medical Evacuation

"The Company shall cover reasonable and customary charges for Medically Necessary transportation, including medical services and supplies incurred en route, to the nearest Centre of Medical Excellence capable of providing the required care when such care is not available at the location of bodily injury or Sickness."

At first glance, this appears comprehensive. But the critical details are in the phrasing. The terms you must focus on are "Medically Necessary" and "nearest Centre of Medical Excellence."

These two phrases grant significant discretionary power to the insurer. Their medical team—not yours or your physician’s—determines what is "Medically Necessary." Furthermore, "nearest" does not mean "best" or "your preferred hospital back home." It means you could be flown to a neighboring country, not necessarily to London, Singapore, or New York. A truly superior policy will offer greater flexibility or provide much clearer definitions.

Getting this right is more critical than ever. The global insurance market is massive and growing. According to Allianz, worldwide insurance premiums are projected to have grown by 7.5% in 2023, with the health insurance segment accounting for EUR 1,682 billion. You can explore the full global insurance report to appreciate the scale of the industry you are navigating.

Unpacking a Pre-Existing Conditions Clause

Next, let's address a clause on pre-existing conditions, specifically one employing a moratorium underwriting approach. Insurers often present this as a simpler, faster alternative to completing extensive medical forms, but you must understand exactly how it functions before agreeing to it.

Here is some sample language you might encounter:

Sample Clause: Pre-existing Conditions (Moratorium)

"Any Pre-existing Condition will be excluded from coverage for a continuous period of 24 months from the Member's policy start date. A Pre-existing Condition is any disease, illness, or injury for which the Member received medical treatment, advice, or medication within the 60 months prior to the policy start date. Coverage may be extended to such a condition after the 24-month waiting period, provided the Member has not experienced symptoms, sought advice, or received treatment for that condition during this period."

The numbers to circle here are the "look-back period" (60 months) and the "waiting period" (24 months).

This means any medical issue for which you have consulted a doctor in the past five years is automatically excluded for the first two years of your policy. For that condition to become covered, you must complete the entire two-year waiting period without any symptoms, treatment, or even advice related to it. Moratorium offers convenience upfront but sacrifices the certainty provided by full medical underwriting. It is a significant trade-off.

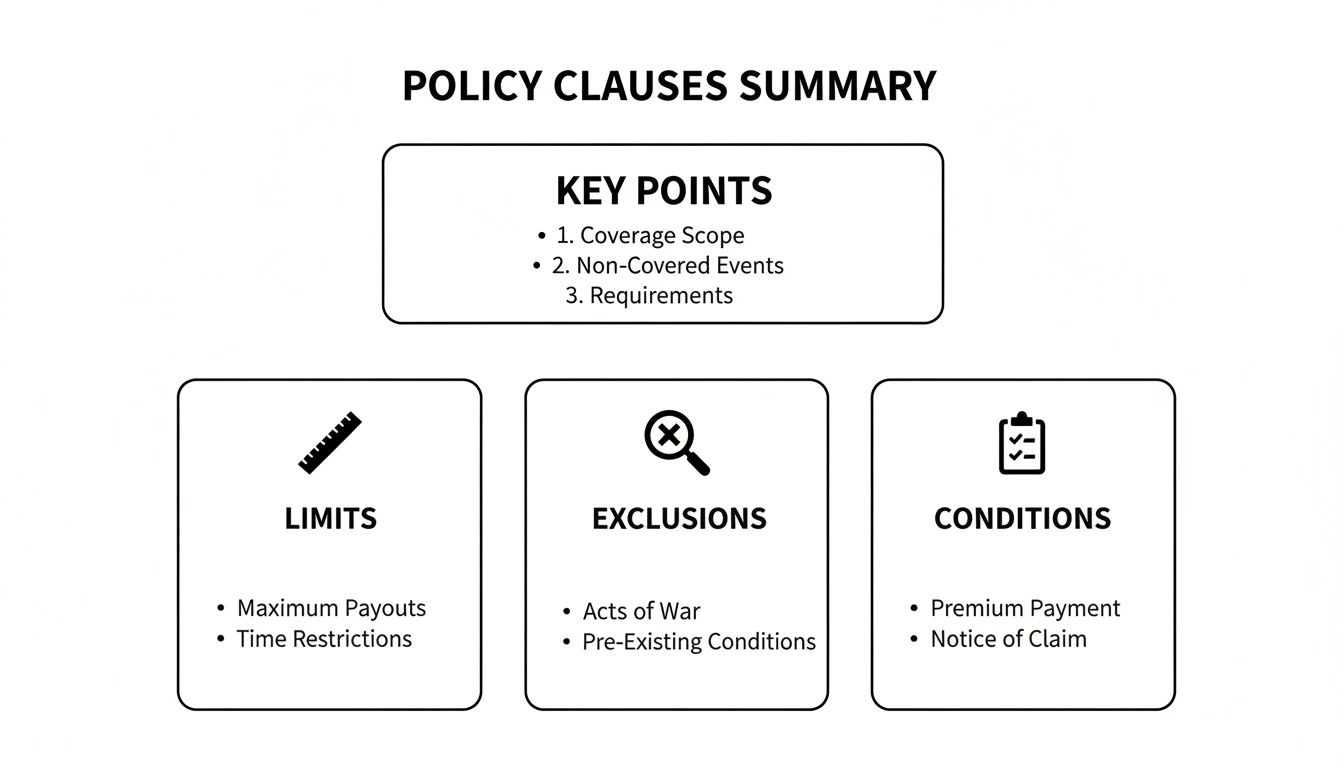

The image below breaks down the three pillars of any policy you must review: the limits, the exclusions, and the conditions.

A policy is only as strong as its weakest link across these three areas. Clarity is paramount.

Key Takeaways from Sample Analysis

Deconstructing an insurance policy sample is not merely a theoretical exercise; it is a critical component of your personal risk management. The fine print embedded in these clauses has very real consequences for your health and your finances.

Here is what to remember:

- Ambiguity Favors the Insurer: Vague terms like "reasonable," "customary," or "necessary" are red flags. They give the insurance company the final say.

- Timeframes Are Everything: Pay laser-focused attention to all dates and durations—waiting periods, look-back periods, and deadlines for filing claims.

- Definitions Are Law: Never assume you understand what a term means. Always locate the official "Definitions" section in the policy document to see how it is defined.

Learning to deconstruct a policy in this manner equips you with the knowledge to ask sharp, specific questions. For a deeper dive into the jargon, our guide where we have more expat medical insurance policy terms explained is an excellent next step. Master this skill, and you can be confident that your health cover is a genuine asset, not just a piece of paper.

Asking the Right Questions About Your Policy

Choosing the right IPMI coverage is not a simple transaction; it is a strategic decision. If you ask generic questions, you will receive generic and, frankly, unhelpful answers. As a high-net-worth individual with a global lifestyle, your healthcare needs are specific. Your questions to a specialist brokerage like Riviera Expat must be equally precise.

This is not about passively receiving a sales pitch. It is about transforming the conversation into a planning session for your global health security. The objective here is to cut through marketing language and see what a policy—and the advisor representing it—can actually deliver. These questions are designed to stress-test a policy's real-world performance.

Probing Provider Network Quality

Simply asking if a policy has a "good network" is ineffective. Your questions must be specific to where you live and travel, and they must focus on the caliber of care you expect. A great network means you can walk into the best facilities, receive treatment, and leave without ever seeing a bill. It is about direct, cashless access that removes the inconvenience of paying large upfront costs and seeking reimbursements.

Try asking your advisor these questions instead:

- "For my primary residence in Singapore, which top-tier hospitals are direct-billing partners, and which are merely 'in-network,' requiring me to pay first and claim later?" This single question immediately distinguishes true convenience from a simple name on a list.

- "What is your process for keeping this network list updated and verified?" This reveals their commitment to maintaining high-quality, accurate partnerships.

- "If I require treatment at a clinic outside the direct-billing network, what is the exact reimbursement timeline I should expect?" A premium policy should be supported by a swift claims process, not months of waiting.

Assessing Complex International Claims Handling

Your life may involve complex medical situations that span multiple countries. How an insurer and your brokerage handle these high-stakes moments is what truly sets them apart. You require absolute confidence in a seamless process, not the fear of a bureaucratic nightmare during a health crisis.

An advisor's real value is tested during a complex claim. Their ability to advocate on your behalf and navigate the insurer's internal processes is just as important as the benefits written in the policy.

To determine if they are capable, ask:

- "Can you walk me through a real-life case study of how you managed a multi-stage, cross-border claim for a client?" This compels them to move beyond hypotheticals and demonstrate proven experience.

- "What is the exact protocol for initiating a medical evacuation, and who will be my single point of contact from start to finish?" There is zero room for ambiguity in this scenario.

Evaluating Technology and Policy Management

The insurance industry is finally embracing technology. The global insurtech market, valued at USD 18.71 billion in 2023, is projected to expand to USD 496.56 billion by 2033, a clear indication that insurance management is evolving. You can read more about how insurtech strategies are shaping IPMI on ipmiglobal.com. Your policy management tools should be modern, not reminiscent of a bygone era.

Therefore, you should definitely inquire about the digital tools available:

- "What digital platform do you use for submitting claims and tracking my policy details? May I see a demonstration?" You are looking for an intuitive, secure mobile application that functions seamlessly.

- "How do you use technology to provide proactive support, such as sending alerts about network changes or reminders for preventative care?"

Armed with these pointed questions, you completely change the dynamic. It is no longer a sales meeting; it is a rigorous audit of a policy's ability to protect your health and wealth with the precision you demand in all other areas of your life. When reviewing any insurance policy sample, this level of detailed questioning is non-negotiable. For more on this, check out our guide on watching out for policy exclusions on medical conditions and cover.

Wrapping It Up: Securing Your Health and Wealth

Ultimately, delving into an insurance policy sample is about one thing: creating certainty in your life abroad. It is the final, decisive step where you transform a dense legal document into a tangible asset—one that safeguards both your health and your financial stability. We have walked through the framework for doing just that, from the high-level structure down to the fine print that truly matters.

For a successful global professional, top-tier international health insurance is not a luxury. It is a core component of a well-managed international life and a critical wealth preservation tool. To ignore its importance would be akin to leaving a significant portion of your investment portfolio completely exposed to catastrophic risk. It is a risk you would not take.

Your Final Gut-Check List

Ensuring your health coverage is as solid and meticulously planned as the rest of your financial world is paramount. Before you consult an advisor or sign any agreement, run through this final checklist:

- Is the Foundation Solid? Have you located the key sections—Declaration Page, Insuring Agreement, Definitions—and do they align with what was presented to you?

- Are the Critical Clauses Clear? Have you personally reviewed the limits, exclusions, portability rules, and medical evacuation terms? Are there any grey areas that seem to favor the insurer?

- Is the Network Practical? Does the provider list include high-quality, direct-billing hospitals and clinics in the locations where you actually live and travel?

- Does the Claims Process Work? Is the reimbursement process straightforward, fast, and supported by modern digital tools?

Working through these points methodically changes the dynamic. You are no longer just purchasing a product; you are making a strategic acquisition. This is what true peace of mind feels like—knowing your coverage is built to handle any eventuality, no matter where your career takes you.

Think of your IPMI policy as the financial backstop for your most valuable asset: your health. A disciplined review ensures that backstop is as strong and reliable as you need it to be.

Of course, a truly strategic health plan extends beyond insurance alone. It also involves being proactive. Pairing a premier policy with solid personal wellness knowledge, such as learning some practical ways to prevent virus infection, creates a much more robust shield.

This level of diligence arms you to ask the sharp, necessary questions that reveal a policy's true worth. When you consult with specialists like us at Riviera Expat, you will be operating from a position of strength and clarity. This ensures the policy you ultimately choose is perfectly matched to the unique demands of your life. That is how you achieve certainty.

Frequently Asked Questions

When you begin to explore the world of International Private Medical Insurance (IPMI), a few key questions invariably arise. For high-net-worth individuals, obtaining direct answers is non-negotiable for making sound decisions about your global health and financial security.

Let's cut through the noise. Here are direct, clear answers to the most common questions we hear, providing the clarity needed to evaluate any insurance policy sample and understand how it performs in the real world.

How Does IPMI Differ From Standard Travel Insurance?

This is a classic point of confusion, but the difference is profound. Think of travel insurance as a first-aid kit for your trip. It is a short-term solution designed to address issues like a cancelled flight, lost luggage, or an acute medical emergency during a two-week holiday. It was never intended to serve as your primary health plan.

IPMI, on the other hand, is your primary health insurance when you live abroad. It is the comprehensive coverage you would expect in your home country, but structured for a global life. It is designed to cover the full spectrum of your healthcare needs, including:

- Routine check-ups and preventative screenings.

- Appointments with specialists.

- Planned surgeries and major hospital stays.

- Ongoing management for chronic conditions.

Attempting to rely solely on travel insurance as an expatriate creates massive, dangerous gaps in your care. For a high-net-worth individual, that represents an unacceptable risk to both your health and your wealth.

What Is the Difference Between Moratorium and Full Medical Underwriting?

These two terms describe how an insurer assesses your pre-existing conditions, which is arguably one of the most critical aspects of any policy.

Full Medical Underwriting (FMU) is a completely transparent process. You provide your full medical history upfront via a detailed questionnaire. The insurer’s underwriting team reviews it and provides a clear, black-and-white decision on exactly what is and is not covered from day one. There are no gray areas or future surprises. You know precisely where you stand.

Moratorium underwriting is the "wait-and-see" approach. The application is simpler and faster because you do not disclose your full history. Instead, any condition for which you have had symptoms, treatment, or advice in the last 5 years is automatically excluded for a waiting period (usually 24 months). If you remain free of symptoms, treatment, or advice for that specific condition for the entire waiting period, it may become eligible for coverage. It offers convenience upfront but sacrifices the absolute certainty you gain with FMU.

For anyone who values precision and control in their financial planning—and their life—Full Medical Underwriting is the only prudent choice. It establishes a completely transparent agreement right from the start.

Can You Clarify Medical Evacuation Versus Repatriation?

Understanding this distinction is vital. It directly impacts where you receive treatment in a serious medical crisis.

Medical Evacuation is focused on transporting you to the nearest center of medical excellence if the local hospitals cannot manage your condition. That "center of excellence" might be in a neighboring country known for its top-tier medical facilities. The objective is to secure the best and most expedient care possible.

Repatriation, in contrast, has one single goal: returning you to your designated home country for treatment. A top-tier IPMI policy will always feature a strong medical evacuation benefit, because in a true emergency, your home country is not always the best—or closest—option for highly specialized care.

At Riviera Expat, providing this kind of clarity is what we do. Our expertise is in making sure you choose an IPMI policy that truly matches the demands of your global career, giving you rock-solid security and peace of mind. To talk through your specific situation, schedule a consultation with our expert advisors today.