For discerning individuals managing global careers and significant assets, the term "no charge after deductible" represents the pinnacle of financial predictability in healthcare. It signifies a policy structure where, once you have met a pre-determined annual deductible, your insurer assumes 100% of all subsequent eligible medical costs for the remainder of the policy year. This eliminates further cost-sharing, providing absolute clarity on your maximum annual healthcare expenditure.

What No Charge After Deductible Truly Signifies

This is not merely an insurance clause; it is a strategic financial instrument. It is engineered to deliver total certainty in the face of unpredictable medical events. For executives and professionals residing in global financial centers such as Singapore, Dubai, or London, this feature is not a luxury—it is an essential component of a sophisticated wealth preservation strategy.

The Core Concept of Financial Certainty

The fundamental purpose of a "no charge after deductible" policy is to establish a definitive limit on your financial liability. Before you meet your deductible, you are responsible for your medical expenses. The moment you cross that threshold, your financial obligation for covered services becomes zero.

This robust mechanism is the hallmark of premium International Private Medical Insurance (IPMI) plans. It is designed to provide you and your family with seamless access to premier medical care worldwide, without the concern of complex and escalating invoices. You can gain further context by exploring our guide to key expat medical insurance policy terms.

Executive Takeaway: With this policy structure, your annual deductible is your out-of-pocket maximum for all covered medical care. It transforms a potentially catastrophic, six-figure medical expense into a predictable and manageable line item in your annual financial plan.

Your Financial Liability at a Glance

This table delineates the financial responsibility within a "no charge after deductible" plan, clarifying precisely who pays for what, and when.

| Scenario | Your Financial Responsibility | Insurer's Responsibility |

|---|---|---|

| Before Deductible is Met | 100% of eligible medical costs, up to the deductible amount. | £0 |

| After Deductible is Met | £0 for all subsequent eligible medical costs for the rest of the policy year. | 100% of all eligible medical costs. |

As illustrated, once the deductible is satisfied, the financial burden for covered care shifts entirely to the insurer for the remainder of the policy term.

Why This Matters for Global Professionals

The value of this feature is magnified when navigating an international lifestyle, where healthcare costs can vary dramatically and without notice. A standard domestic plan might impose confusing co-payments or coinsurance that accumulate long after a deductible has been met.

An IPMI plan with this structure eliminates such ambiguity. It ensures that a major health event in a high-cost jurisdiction does not derail your financial objectives. This is more than insurance; it is a calculated safeguard for your assets.

The tangible benefits include:

- Absolute Cost Predictability: You know your maximum potential medical spend from the outset.

- Simplified Financial Planning: You can budget with precision, removing the need to estimate variable post-deductible costs.

- Peace of Mind: You can concentrate on recovery, confident that your insurer is managing the significant expenses once your threshold is met.

- Access to Premier Care: It empowers you to select the finest physicians and hospitals without financial hesitation after your deductible is satisfied.

How a Deductible Unlocks Full Coverage

To fully appreciate "no charge after deductible," view your deductible not as a barrier, but as the key that unlocks the full value of your benefits.

Once you have paid enough out-of-pocket for eligible care to satisfy your annual deductible, you have effectively turned that key. The vault opens, and your insurer assumes the financial responsibility for all your covered medical care for the balance of the year.

This process unfolds in three distinct stages. Understanding this progression is crucial for effectively managing your healthcare costs and maximizing your policy's value.

The Accumulation Phase

Your policy year commences in the Accumulation Phase. During this period, you are responsible for your eligible medical costs. Every covered expense—a specialist consultation, an MRI, a prescription—contributes to a running total. This is the process of meeting your deductible.

It is imperative to meticulously track every medical expense. Submit every claim to your insurer, even when you know they will not yet issue payment. This is the only method to ensure every pound you spend is officially recorded, moving you closer to the threshold.

The Threshold Point

The Threshold Point is the moment your cumulative out-of-pocket spending on eligible care precisely matches your annual deductible amount. If your plan has a $5,000 deductible, this is the instant your tracked expenses reach $5,000.

This is the most significant event of your policy year. At this point, the financial liability for covered care shifts entirely from you to your insurance company for the remainder of the policy term. For a more detailed analysis, consult our guide on the fine print of excesses and deductibles.

The Critical Handoff: The threshold point signifies a complete transfer of liability. From this moment forward, your financial exposure to covered medical costs for the year is effectively nullified. Your insurer is now financially responsible.

The Full Coverage Phase

Once you cross the threshold, you enter the Full Coverage Phase. This is where a high-quality international medical plan demonstrates its true worth. For the rest of your policy year, your insurer covers 100% of all eligible medical expenses.

This is where the term no charge after deductible becomes your reality. There are no further percentages to calculate, no coinsurance to consider, and no unexpected invoices for covered treatments. You can proceed with any necessary medical care—from major surgery to ongoing therapy—with the assurance that the financial aspects are being managed. This complete financial clarity allows you to focus on what is paramount: your health.

Seeing "No Charge After Deductible" in Action

Theoretical understanding is one matter, but observing how such a policy performs under the pressure of a genuine medical crisis reveals its true value. For global executives and high-net-worth individuals, this is a concrete financial shield.

Let's examine realistic scenarios in key international locations. By analyzing credible cost estimates for complex procedures, you will see precisely how this policy structure converts a potentially ruinous medical bill into a predictable, fixed sum.

Case Study One: A Cardiac Procedure in Hong Kong

Consider a senior investment banker based in Hong Kong requiring complex cardiac surgery. The total cost for the procedure, a stay in a premier private hospital, specialist fees, and follow-up care could easily reach $150,000.

With a high-quality International Private Medical Insurance (IPMI) plan, the calculation is straightforward.

- Total Medical Bill: $150,000

- Your Annual Deductible: Let’s assume it's $5,000.

- Your Total Liability: You pay the initial $5,000 of the medical costs.

- Insurer’s Payment: The insurer covers the remaining $145,000.

Once you have satisfied the $5,000 deductible, every other eligible medical expense for the remainder of that policy year is covered at 100%. There is no charge after deductible. This provides absolute financial certainty.

Case Study Two: A Pediatric Emergency in Singapore

Now, envision an expatriate executive's family in Singapore. Their child experiences a sudden medical emergency requiring immediate hospitalization, diagnostic imaging, and specialist pediatric care. The invoice for a multi-day stay in a top-tier hospital could rapidly escalate to $45,000.

Here, a family deductible structure is particularly advantageous. If the family's policy has a $7,500 annual deductible, the costs are allocated as follows.

- Total Medical Bill: $45,000

- Family's Annual Deductible: $7,500

- Your Total Liability: The family pays the first $7,500.

- Insurer’s Payment: The insurer handles the remaining $37,500.

The moment the deductible is met, the financial stress is eliminated. The family can focus entirely on their child's recovery, secure in the knowledge that any further covered medical needs—for any family member—during that year will incur no additional out-of-pocket costs.

The core benefit is the conversion of a highly unpredictable and emotionally taxing event into a single, manageable expense. This is the strategic power of a well-designed IPMI plan.

This level of protection is especially critical for expatriates. Global medical trend reports from firms like Aon indicate a projected 9.9% average increase in healthcare costs worldwide for 2024, making robust coverage non-negotiable. You can learn more about the factors driving international health insurance costs on AHIX.com.

Case Study Three: Orthopedic Surgery in London

Finally, consider an entrepreneur in London who sustains a serious injury requiring major orthopedic surgery, such as a total hip replacement. The combined costs for the surgeon, anaesthetist, hospital stay, the implant, and extensive physical therapy could total $35,000.

For this individual, the policy functions just as cleanly.

- Total Medical Bill: $35,000

- Your Annual Deductible: Assume it is $4,000.

- Your Total Liability: You are responsible for the first $4,000.

- Insurer’s Payment: The insurer covers the subsequent $31,000.

The critical takeaway from these scenarios is consistency. Regardless of the medical event or the final bill's magnitude, your financial exposure is always capped at your pre-agreed deductible. This powerful feature eliminates the anxiety of escalating costs, enabling you to access the best possible care without financial hesitation. It ensures your health and your wealth are equally protected.

Deductible vs. Coinsurance and Out-of-Pocket Maximums

Mastering your insurance policy's terminology is not an academic exercise—it is fundamental to controlling your finances. In premium health plans, three terms often cause confusion, yet they define your precise financial liability: the deductible, coinsurance, and the out-of-pocket maximum.

Understanding their interplay is the only way to appreciate why a "no charge after deductible" structure offers a superior advantage in financial predictability.

Many standard insurance plans involve a multi-stage financial process. First, you must meet your deductible. Then, you enter the coinsurance phase, where you continue to pay a percentage of every medical bill—typically 10% or 20%—while the insurer covers the remainder.

This continues until your total payments (deductible plus all coinsurance) reach an even higher figure: the out-of-pocket maximum. Only then does the insurance company begin to cover 100% of your costs.

The Problem with Coinsurance

The primary issue with the coinsurance model is the prolonged period of financial uncertainty it creates. Even after meeting your deductible, you continue to pay a percentage of every subsequent bill.

For a major medical event, this involves dozens of invoices: specialist visits, imaging scans, physical therapy, prescription drugs. That 20% share can accumulate rapidly, and you never know precisely when the expenses will cease.

A no charge after deductible policy is specifically designed to eliminate this financial ambiguity. It removes the coinsurance phase entirely. Your deductible is your out-of-pocket maximum for covered services. The financial finish line is clear and absolute from day one.

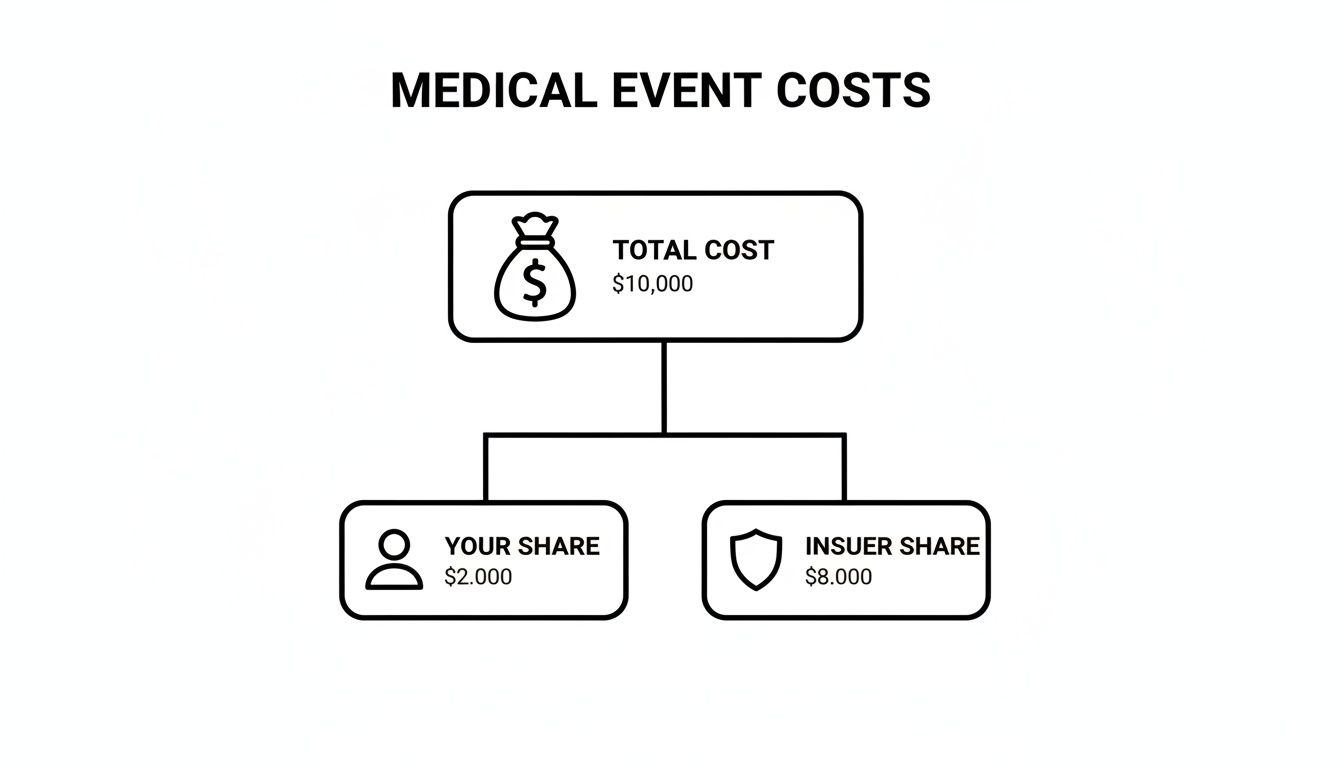

This diagram illustrates the simplified cost-sharing in a serious medical situation.

As you can see, once your share is paid, the insurer assumes the full financial burden.

A Clear Structural Comparison

To fully grasp the powerful simplicity of the no charge after deductible model, let’s compare it side-by-side with a standard coinsurance plan, using a $100,000 medical procedure as our example.

The table below illustrates how the costs diverge, showing your path to reaching 100% coverage under each structure.

Policy Structure Comparison: Your Path to 100% Coverage

| Financial Milestone | Policy A: No Charge After Deductible | Policy B: Standard Coinsurance Model |

|---|---|---|

| Deductible | $5,000 | $5,000 |

| Coinsurance | None. Your liability ends at the deductible. | 20% of the next $75,000 in bills = $15,000 |

| Out-of-Pocket Max | $5,000 (same as deductible) | $20,000 ($5k deductible + $15k coinsurance) |

| Total You Pay | $5,000 | $20,000 |

| Insurer Pays | $95,000 | $80,000 |

The numbers are unequivocal. The core benefit is immediate and total cost certainty the moment your deductible is met. It is a world apart from the prolonged and stressful cost-sharing that defines standard coinsurance models.

For a deeper look into managing your overall financial exposure, consult a clear guide to budgeting for expat medical insurance costs, which often breaks down how different policy structures impact your bottom line.

This structure provides the financial clarity and control that high-net-worth individuals and serious professionals require. By selecting a plan that eliminates the ambiguity of coinsurance, you are choosing maximum financial predictability and protecting your assets from the volatility of healthcare costs.

Reading the Fine Print: Where Coverage Promises Can Unravel

Even the most robust international health insurance policies can contain clauses that create unexpected financial liabilities. The promise of "no charge after deductible" is compelling, but its true value is determined by the contract's fine print. Certain phrases and clauses can create significant financial gaps, undermining the security you sought to acquire.

This requires active asset protection through diligent scrutiny of your policy documents. Knowing where to identify potential pitfalls provides the intelligence to manage your policy and avoid costly errors.

"Eligible Expenses" and "Medically Necessary" Are Gatekeeper Terms

Pay scrupulous attention to two phrases that govern your insurance contract: "Eligible Expenses" and "Medically Necessary." These terms are the ultimate arbiters, determining which treatments, services, and procedures your insurer will cover, both before and after you meet your deductible.

The risk is that your physician may recommend a procedure, but if your insurer's internal guidelines do not define it as "medically necessary" or "eligible," it will not be covered. This can lead to situations where you believe you have full protection, only to discover a high-cost treatment—such as an experimental therapy or a specific type of rehabilitation—is excluded from your policy's scope.

A policy's true worth lies not just in its high coverage limits, but in the clarity and breadth of its definitions. Vague or overly restrictive language around "eligible expense" is a significant red flag that requires immediate clarification from your broker.

Per-Claim vs. Annual Deductibles: A Critical Difference

The structure of your deductible can completely alter your financial risk. While top-tier IPMI plans almost exclusively utilize an annual deductible, some policies may feature a per-claim or per-condition deductible. The difference is profound.

An annual deductible is a single amount you must satisfy over the entire policy year. Once met, your "no charge after deductible" benefit applies to all subsequent eligible claims. It is simple and predictable.

A per-claim deductible, by contrast, resets with each new, unrelated medical issue. You could be forced to pay the deductible multiple times within the same year for different conditions, offering far less financial protection.

- Annual Deductible: The gold standard. You meet your deductible amount once per year, providing predictable, capped liability.

- Per-Claim Deductible: A potential financial drain. You pay a new deductible for each separate medical event, which can lead to escalating out-of-pocket costs.

You must confirm, unequivocally, that your policy operates on a single, consolidated annual deductible. It is the only way to ensure your maximum liability is a known, fixed figure for the year.

The Hidden Cost of Network Restrictions

Finally, you must understand your plan’s network rules. Many IPMI plans promote broad global access, but some may impose financial penalties for using "out-of-network" providers—even after your deductible has been met.

Using an out-of-network provider could result in the insurer covering a much smaller percentage of the bill. In a worse-case scenario, it could invalidate the "no charge after deductible" promise for that service, leaving you with a substantial portion of the final cost. This is related to other coverage limitations, and it is wise to understand how to watch out for policy exclusions that can lead to similar surprise invoices.

Before committing, verify the direct billing network in the countries where you spend the most time. Ensure that the premier hospitals and specialists you would choose to consult are included. This is the only way to guarantee seamless, cashless access to the best care once your deductible is satisfied.

Your Final Pre-Flight Check: Verifying Your Coverage

Making high-stakes decisions is your domain. Selecting an International Private Medical Insurance (IPMI) policy that guarantees financial certainty demands the same rigorous diligence. Consider this checklist your final stress test—a method to probe your policy for weaknesses and confirm it will perform as expected under pressure.

This is about confirming the structural integrity of the "no charge after deductible" promise. Let's ensure it is sound.

Nail Down the Core Policy Features

First, locate the exact clause in your schedule of benefits that confirms the no charge after deductible structure. Do not rely on a verbal assurance. The language must be unambiguous, stating that once the annual deductible is met, the insurer covers 100% of all eligible medical costs for the remainder of the policy year, with no coinsurance.

Next, seek specific clarification on high-cost, long-term medical scenarios. Demand a clear breakdown of how the policy handles:

- Oncology: Is every aspect of cancer care—from initial diagnostics and genetic testing to advanced biologics and ongoing therapies—defined as an eligible expense? You require a definitive "yes."

- Chronic Conditions: Verify that the long-term management of conditions like cardiovascular disease or complex autoimmune disorders falls entirely under the full coverage benefit after the deductible is met.

Validate How It Works in the Real World

A theoretical promise of coverage is meaningless without a robust operational framework to support it. You must scrutinize the direct billing network in your primary country of residence and other frequently visited locations. Are the premier hospitals and specialists you would select on that list? This is crucial for seamless, cashless access to care once your deductible is met.

Equally important is understanding the pre-authorization process for major procedures. You need a clear, efficient protocol for approving surgeries and significant treatments. The last thing you need are delays or denials creating immense stress and financial jeopardy when you most require support.

Ask your insurer directly about their policy on 'reasonable and customary' charges. This is a common mechanism insurers use to limit payouts, leaving you to cover the difference—a practice known as balance billing. A top-tier policy will have a transparent and generous definition to prevent this.

As a professional accustomed to navigating global markets, you understand financial risk. Choosing an IPMI with a no charge after deductible feature is a calculated strategy to mitigate soaring healthcare inflation. For an executive moving from London to Singapore, this is a familiar calculation. Once your deductible is met—with the global average for individual IPMI plans being approximately US$2,517—your coverage should be absolute. This protects you from a market where medical costs in the Asia Pacific region are projected to rise by 11.1% in 2024. You can explore the 2025 global medical trend projections on IPMI Global. This checklist is your tool to ensure your policy performs flawlessly.

Frequently Asked Questions

When evaluating a premium international health policy, several key questions consistently arise. Obtaining direct answers is essential for confidence in your healthcare strategy. Here are the most common inquiries regarding the "no charge after deductible" feature.

My objective is to provide the clarity you need to make informed decisions, ensuring your policy delivers the financial protection you expect.

Do My Monthly Premiums Count Toward My Deductible?

This is perhaps the most frequent and critical question. The answer is an unequivocal no.

Your premium is the fee for maintaining the insurance policy. It is separate from the costs incurred for actual medical care.

Only the funds you pay out-of-pocket for eligible medical services—physician consultations, hospital stays, prescriptions—contribute toward meeting your annual deductible. Premiums are the cost of access; they do not reduce your deductible.

What if a Major Treatment Spans Two Policy Years?

This situation occurs frequently with serious medical conditions. When treatment extends from one policy year into the next, your annual deductible resets.

For example, if you begin a major treatment in December after having met your deductible for that year, all your costs will be covered. However, on January 1st, the policy year renews. Any further treatment costs will be applied toward the new year's deductible until it is met. The "no charge after deductible" benefit does not carry over from one year to the next.

Are Preventative Services Subject to the Deductible?

This is an area where high-quality international medical plans distinguish themselves. Most treat preventative care as a separate benefit. Services such as annual wellness examinations, routine screenings, and vaccinations are often covered at 100% from day one, before you have paid anything toward your deductible.

This is a strategic decision by insurers. They recognize that preventing a catastrophic illness is far more effective and cost-efficient than treating one. Always review your policy documents to confirm which preventative services are covered in this manner.

How Do Family Deductibles Work?

For families, policies typically feature two deductible amounts: one for each individual and a higher one for the family unit. The purpose is to cap the family's total out-of-pocket expenditure for the year.

- Individual Deductible: The amount each person on the policy must meet.

- Family Deductible: A larger, aggregate amount.

Typically, once a specified number of family members (often two or three) have met their individual deductibles, the overall family deductible is considered satisfied. At that point, the "no charge after deductible" benefit activates for every person on the policy for the remainder of the year—even for those who have not met their individual threshold.

At Riviera Expat, our mission is to provide this level of clarity and control for professionals living and working globally. We offer expert, unbiased guidance to help you select an IPMI policy that delivers absolute financial certainty, not just promises. Contact us today for a complimentary consultation.