As a high-net-worth individual, you are an expert at managing financial risk. Yet, a crucial variable often overlooked, even with a premium international private medical insurance (IPMI) plan, is your personal expenditure on healthcare. Your insurance out of pocket cost is the total sum you must personally finance for eligible medical services before your policy assumes 100% of the liability.

Decoding Your True Healthcare Financial Exposure

Consider your out-of-pocket exposure not as a minor policy detail, but as your portfolio's direct exposure to healthcare market volatility. It is the definitive boundary between your personal funds and the protective shield of your insurance policy. Gaining a precise understanding of this figure is fundamental to asset protection, transforming a potential liability into a calculated, manageable expense.

For individuals accustomed to precision in their financial dealings, the ambiguous nature of healthcare costs can be disconcerting. A comprehensive understanding of what health insurance entails is the bedrock for safeguarding both your well-being and your financial stability. Even with exceptional coverage, certain payments must be made from your personal accounts before the insurer assumes full responsibility. This guide is designed to dissect the terminology and provide a clear framework for understanding and controlling these expenditures.

Why This Matters for Global Professionals

The financial stakes are significantly higher when operating across international borders. Healthcare costs are not uniform; a procedure in Singapore carries a vastly different price tag than the same service in London or Zurich. Your personal out-of-pocket costs are directly correlated with these regional price disparities, rendering any one-size-fits-all approach inadequate.

The primary function of a premium IPMI plan is to introduce predictability into an unpredictable environment. It achieves this through a structured system of cost-sharing that, ultimately, establishes a ceiling on your total financial risk. The key components of this system are:

- Deductibles: The initial sum you pay out-of-pocket before your insurance begins to contribute.

- Copayments and Coinsurance: Your share of the costs after you have met your deductible.

- Out-of-Pocket Maximum: The absolute, hard limit on what you will spend in a policy year on covered services.

By mastering these concepts, you transition from being a passive participant in your healthcare financing to an active strategist. This knowledge empowers you to select a policy that provides true financial security, irrespective of your professional location.

Our objective here is to illustrate precisely how this system functions. We will demonstrate why it is a vital component of wealth management and how you can strategically select the right coverage. A significant part of this involves understanding insurer payment protocols, a topic we explore in our article on pre-authorisation and direct settlement procedures. By the conclusion, you will possess the insights required to align your healthcare coverage with your exacting financial standards.

The Three Pillars Of Your Out Of Pocket Costs

To gain complete control over your healthcare spending, you must understand the three core components that constitute your total insurance out of pocket liability. These are the deductible, copayments, and coinsurance. Each serves a specific function in determining how much you pay, and when.

Consider your insurance policy as a financial partnership. Your insurer is your partner, but you are responsible for the initial capital investment before their substantial resources are deployed. A clear understanding of these three pillars is the key to knowing the precise terms of your commitment.

The Deductible: Your Initial Investment

The deductible is the first financial threshold. It is the fixed amount you must pay for covered medical care each policy year before your insurance company begins to pay. It can be viewed as your annual buy-in to the plan. Once you have satisfied this amount, you enter the next phase of cost-sharing.

For instance, an expatriate in Singapore with a policy featuring a USD 2,500 annual deductible requires a set of diagnostic scans costing USD 4,000. They will be required to pay the first USD 2,500 entirely from personal funds. Only after that USD 2,500 threshold is met will their insurer begin to cover subsequent medical bills for the year.

This upfront payment is a fundamental component of nearly every insurance plan. We dissect how these initial payments function in greater detail in our spotlight on excesses and deductibles. Understanding this first pillar is absolutely essential to leveraging the full benefits of your plan.

The Copayment: The Fixed Service Fee

After meeting your deductible, you will often encounter copayments (or copays). A copay is a straightforward, fixed fee you pay for a specific service, such as a specialist consultation or a prescription. It is a predictable, one-time transaction designed for simplicity.

Imagine the same professional in Singapore now requires a follow-up visit with a cardiologist. Their plan might stipulate a USD 50 copay for any specialist appointment. Whether the cardiologist’s actual fee is USD 300 or USD 500, your financial responsibility is limited to that flat USD 50 fee. The insurance company settles the remainder.

This feature is invaluable for predictability. It facilitates budgeting for routine care by replacing a variable, and potentially surprising, bill with a consistent, manageable fee.

The Coinsurance: The Cost-Sharing Partnership

The third pillar is coinsurance, where the true financial partnership begins. It is the percentage of a medical bill you share with your insurer after your deductible has been paid. Unlike a copayment's fixed fee, coinsurance is a calculated portion of the total cost.

A prevalent coinsurance split is 80/20. This signifies that your insurance company pays 80% of the covered cost, while you are responsible for the remaining 20%. This percentage-based sharing continues until you reach the ultimate financial safeguard of your plan, which we will address next.

Out Of Pocket Cost Components at a Glance

Let us consolidate these three concepts into a quick-reference table for a side-by-side comparison.

| Component | What It Is | When You Pay | Example Amount |

|---|---|---|---|

| Deductible | A fixed amount you pay before your plan pays. | At the beginning of your policy year, for initial covered services. | USD 2,500 per year |

| Copayment | A fixed fee for a specific service. | At the time of service, after the deductible is met. | USD 50 per specialist visit |

| Coinsurance | A percentage of costs you share with the insurer. | After the deductible is met, for services that require it. | 20% of the bill |

These three elements—the deductible, copayment, and coinsurance—work in concert to define your total out-of-pocket spending. Understanding their interaction is the only way to accurately forecast your potential healthcare costs and select the appropriate plan. They are the building blocks that lead to your ultimate financial protection: the out-of-pocket maximum.

The Out-Of-Pocket Maximum: Your Financial Safety Net

While components like deductibles and copays determine your immediate costs, the most critical figure for your financial protection is the out-of-pocket maximum (OOPM). This is your plan’s ultimate safety net—a hard limit on your personal healthcare spending.

Consider it the absolute, non-negotiable ceiling on how much you are required to pay for covered, in-network medical care within a single policy year. It is the definitive line where your financial responsibility ceases and your insurer assumes complete liability.

Once your combined payments for deductibles, copayments, and coinsurance reach this limit, your plan is obligated to cover 100% of all eligible costs for the remainder of the policy year. This feature is what transforms a potentially unbounded financial risk into a manageable, capped expense. For any individual serious about asset protection, a robust OOPM is non-negotiable.

How The OOPM Protects Your Wealth

Imagine a significant medical event: an unexpected surgery followed by months of intensive rehabilitation. The associated bills could easily escalate into the tens or even hundreds of thousands of dollars. Without a cap, your exposure is limitless, posing a direct threat to your savings and investments.

The out-of-pocket maximum prevents this financial catastrophe. If your IPMI policy has an OOPM of USD 10,000, that is the maximum amount you will pay from your own funds for covered care that year. Period. Even if your total medical bills reach USD 250,000, once your share reaches that USD 10,000 threshold, you will not pay another cent for eligible services. It provides the certainty and control that successful professionals require.

This cap is the core value proposition of premium insurance. It ensures that medical decisions are driven by clinical need, not by the fear of an uncapped financial drain.

This protection is particularly vital for expatriates. Healthcare funding models vary dramatically across the globe. According to World Health Organization data, in low-income countries, a staggering 43% of all health spending comes directly from individuals' pockets. That figure drops to just 19% in the high-income nations where many global professionals are based. This disparity highlights the immense value of a robust IPMI plan that shields your assets by strictly limiting your out-of-pocket exposure. You can explore these global differences in this World Health Organization data analysis.

What Does Not Count Toward Your Maximum

It is as important to know what the OOPM covers as it is to know what it excludes. Overlooking these details can lead to significant financial surprises. Precision is paramount.

Generally, the following expenses do not apply toward reaching your out-of-pocket maximum:

- Monthly Premiums: The fixed amount you pay to maintain your policy is the cost of acquiring insurance, not a cost of care.

- Out-of-Network Care: If you consult a physician or use a hospital outside your plan’s approved network, those costs are often subject to separate, much higher limits—or they may not count toward your OOPM at all.

- Non-Covered Services: Any treatment, procedure, or medication that your policy explicitly excludes is 100% your responsibility.

- Costs Above "Usual, Customary, and Reasonable" (UCR) Charges: Insurers define a "reasonable" price for any given service. If your provider charges more than this UCR amount, you may be liable for the difference, and this excess payment typically will not apply to your OOPM.

For globally mobile professionals, it is absolutely critical to scrutinize how an IPMI policy handles out-of-network care across different countries. Selecting a plan with a strong, clearly defined OOPM transforms insurance from a simple expense into a strategic instrument for wealth preservation.

How Global Healthcare Costs Impact Your Bottom Line

For any globally mobile professional, location dictates far more than business opportunities—it fundamentally shapes your potential healthcare costs. The concept of insurance out of pocket spending is not a static figure for which you can budget once; it is a dynamic target, heavily influenced by geography. Costs can fluctuate dramatically between major hubs such as London, Zurich, Singapore, and New York.

This variance exists due to profound differences in local healthcare systems. The UK's publicly funded National Health Service creates a cost environment entirely distinct from the hyper-privatized, market-driven model in the United States. A standard domestic insurance plan is simply not engineered to manage these complex, cross-border financial realities. A proper IPMI plan is the only appropriate financial tool.

Navigating Disparate Cost Structures

Consider the real-world implications. A minor surgical procedure in one country might have a negligible impact on your annual budget. However, that same procedure in another could single-handedly propel you toward your out-of-pocket maximum. These are not trivial differences; they represent a significant financial risk if unmitigated.

This is precisely why a tailored IPMI policy is so critical. It functions as your financial shock absorber, providing a consistent and predictable shield against billing surprises, regardless of your location. It harmonizes these disparate cost structures under a single, coherent policy, allowing you to focus on your health rather than deciphering foreign medical invoices. Understanding this is as crucial as understanding the reasons why medical insurance premiums rise year after year, which is often linked to these same escalating global costs.

The core function of a superior IPMI plan is to convert geographic risk into a predictable, capped liability. It provides a stable financial defense, protecting your personal wealth from the sheer volatility of international healthcare pricing.

A Tale of Two Systems

To illustrate this point with clarity, let us compare two common scenarios for an executive dividing their time between London and New York.

- In London: For a UK resident, accessing care through the NHS involves minimal direct costs, although private options are available for those who prefer to bypass waiting lists. An IPMI plan in this context is primarily for expedited access and greater choice.

- In New York: The cost of care is among the highest in the world. A routine hospital visit can generate an invoice of staggering proportions, making a robust insurance plan with a clear out-of-pocket structure an absolute necessity for asset protection.

Without a global policy, you are effectively self-insuring against the world's most expensive healthcare systems. That is not a financial strategy; it is a gamble. A well-designed IPMI plan anticipates these differences and provides the heavy-duty coverage required for high-cost countries while remaining efficient in lower-cost regions.

The Financial Reality of Global Care

The data is unequivocal. A review of any global cost index reveals massive disparities in out-of-pocket health spending between nations. While the average annual per capita spend in the UK is modest, the USA consistently leads in private healthcare costs, with hubs like Hong Kong and Singapore following closely.

For example, while IPMI premiums in North America for an individual plan may range from USD 3,000-7,000, this investment serves as a critical firewall against potentially ruinous bills. A single hospital stay can easily range from USD 28,000-43,000. You can examine these figures in more detail and see how global healthcare costs compare. This makes it clear that the premium is not merely an expense—it is a calculated investment in your financial security.

Calculating Your Potential Exposure: A Practical Scenario

Concepts such as "deductible" and "coinsurance" remain abstract until they directly impact your financial position. To illustrate how these policy details translate into tangible figures, let us analyze a scenario that every global professional should be prepared for.

Imagine an investment banker based in Hong Kong. She holds a comprehensive International Private Medical Insurance (IPMI) policy with the following structure:

- Annual Deductible: USD 5,000

- Coinsurance: 90/10 split (the insurer pays 90%, she pays 10%)

- Out-of-Pocket Maximum: USD 15,000

During a business trip, she requires an emergency surgical procedure. The final hospital bill totals USD 125,000. Here is a step-by-step breakdown of her financial responsibility.

Step 1: Meeting The Deductible

The first financial obligation in any insurance claim is the deductible. Before the insurance company contributes, our banker is responsible for this initial amount.

- Total Bill: USD 125,000

- Deductible Paid by Client: USD 5,000

- Remaining Bill: USD 120,000

Once she has paid the initial USD 5,000, her cost-sharing benefits are activated, and the calculation toward her annual out-of-pocket maximum begins.

Step 2: Applying The Coinsurance

With the deductible satisfied, the remaining USD 120,000 is now shared between her and the insurer, according to the 90/10 coinsurance agreement.

- Insurer's Share (90%): 0.90 x 120,000 = USD 108,000

- Client's Share (10%): 0.10 x 120,000 = USD 12,000

This USD 12,000 represents her direct coinsurance cost for the surgery. It is the second component of her out-of-pocket expenditure for this single medical event.

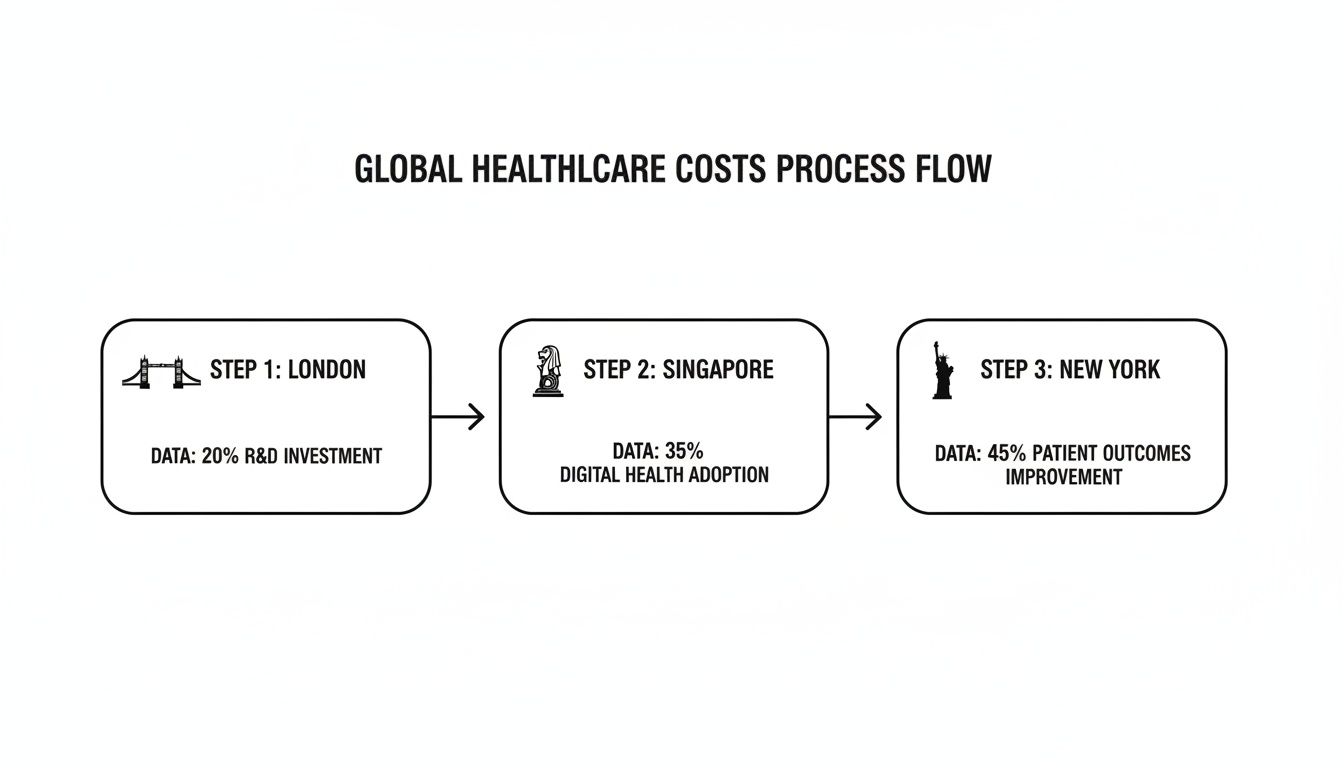

The infographic below illustrates the significant cost variations across major international hubs, underscoring the necessity of these calculations for expatriates.

This flow highlights why a well-designed IPMI plan is not just a benefit—it is a critical financial shield against the exorbitant costs in global business centers.

Step 3: Hitting The Out-Of-Pocket Maximum

Now we arrive at the most critical feature of her plan: the financial safety net. The out-of-pocket maximum prevents a medical crisis from escalating into a financial one. To determine if she has reached it, we sum her payments to date.

- Deductible Paid: USD 5,000

- Coinsurance Paid: USD 12,000

- Total Client Payment: USD 5,000 + USD 12,000 = USD 17,000

Her calculated share is USD 17,000, but her policy’s out-of-pocket maximum is USD 15,000. This is where the plan’s protective cap is enforced.

The policyholder’s total liability is capped at USD 15,000 for the policy year. The insurer covers the remaining USD 2,000 of her calculated share, in addition to their primary portion of the bill.

This illustrates the true value of a premium insurance plan. It converts a potentially ruinous USD 125,000 liability into a predictable, manageable expense of USD 15,000. Furthermore, for any other covered medical care she requires that year, the insurer will cover 100% of the costs, as she has met her maximum.

When considering your own exposure, it is prudent to factor in potential long-term needs, including strategies for protecting assets from nursing home costs.

The cost of major procedures underscores this point. In the U.S., a coronary artery bypass can cost privately insured patients double what public programs pay, and an angioplasty can be over 10 times more expensive than in Germany. Given such disparities, a robust IPMI plan is an intelligent investment to prevent a single procedure from costing you well over USD 50,000.

How To Select The Right IPMI Policy

Choosing the right IPMI policy is a strategic financial decision designed to protect both your health and your wealth, extending far beyond a simple comparison of monthly premiums. It requires looking past the surface-level price to understand the underlying architecture of the plan.

The objective is to identify the optimal balance between your recurring monthly payment and your maximum potential liability in a worst-case scenario—your insurance out of pocket exposure.

A lower premium often corresponds to a higher deductible and a more substantial out-of-pocket maximum. Conversely, a higher premium can secure a more manageable cap on your personal spending. There is no universally "correct" answer; the optimal choice depends entirely on your risk tolerance, anticipated healthcare needs, and overall financial strategy. A sound decision begins with an honest assessment of these factors.

Analyzing The Critical Terms

Before committing to a policy, a thorough analysis of its terms is essential. This is not merely about reading the fine print; it is about comprehending how each clause impacts your bottom line. The goal is to build predictability into your healthcare expenditures, regardless of your global location.

To achieve this, focus on three critical areas:

The Premium and OOPM Interplay: Perform the definitive calculation. Sum the total annual premium and add the out-of-pocket maximum. This figure represents your absolute worst-case financial liability for covered, in-network care in a given year. It is a far more insightful metric than the premium alone.

OOPM Inclusions and Exclusions: Gain absolute clarity on what counts toward your out-of-pocket maximum. Verify that your deductible, copayments, and coinsurance for all essential services are included. Be vigilant for clauses that might exclude certain prescription drugs or specialized treatments from this calculation.

Network Strength and Global Reach: An out-of-pocket maximum is only effective if you can remain within the network. Ensure the policy has a robust and reliable network of physicians and hospitals where you reside and travel frequently. If the network is inadequate, you may be forced to seek out-of-network care, where the financial safety net you are paying for may not apply.

By focusing on these critical areas, you shift the conversation from "How much does this plan cost?" to "How effectively does this plan protect my assets?" This is the fundamental question for any high-net-worth individual evaluating insurance options.

Adopting this structured approach enables you to engage with advisors and insurers from a position of knowledge and authority. It transforms a speculative choice into a calculated decision—one that aligns perfectly with your financial planning and global lifestyle, providing genuine peace of mind.

Frequently Asked Questions

When analyzing insurance out of pocket costs, several key questions invariably arise. Here are direct answers to the most common queries from expatriates and global professionals.

Does My Insurance Premium Count Towards The Out Of Pocket Maximum?

No, it does not. This is a common point of confusion and a critical distinction for accurate financial planning.

Consider your premium as a retainer fee—it is the cost to keep the insurance policy active. The out-of-pocket maximum, conversely, tracks only what you spend when you utilize healthcare services. This means your deductible, copayments, and coinsurance all contribute to reaching that limit. Your premium is a separate, fixed operational cost.

How Does The Out Of Pocket Maximum Work For A Family Plan?

Family plans typically incorporate a two-tiered structure. They feature an individual maximum for each person covered, as well as a larger family maximum for the entire group.

The mechanics are as follows: If one family member incurs significant medical bills, their personal spending is tracked against the individual maximum. Once that threshold is met, the insurance company covers 100% of their eligible costs for the remainder of the year. Concurrently, every dollar spent by all family members is aggregated toward the family maximum. Once this higher, collective limit is reached, the plan covers 100% of costs for every individual on the policy, regardless of whether they have met their individual limit.

What Are The Best Strategies To Lower Annual Out Of Pocket Expenses?

You have considerable control over these expenses. The single most effective strategy is to exclusively use physicians and hospitals within your plan's network. Seeking out-of-network care leads to substantially higher costs, and these expenditures often do not apply toward your primary out-of-pocket limit.

Another intelligent strategy is to align your plan with your anticipated needs. If you foresee significant medical care in the coming year, the lowest-premium plan is likely not the most cost-effective choice. A policy with a higher monthly premium but a lower deductible and out-of-pocket maximum will almost certainly result in significant long-term savings.

Finally, if available, utilize a Health Savings Account (HSA). An HSA is a powerful financial tool that allows you to pay for deductibles, copayments, and other qualified medical expenses with pre-tax funds, yielding a direct and immediate financial benefit.

At Riviera Expat, we specialize in providing the clarity and control you require for your international health coverage. We offer expert, objective guidance to help you select a policy that protects your assets and aligns with your global lifestyle. Secure your financial peace of mind today.