For high-net-worth professionals, private medical insurance is far more than an employee benefit—it is a critical component of your global asset protection strategy. A rigorous private medical insurance comparison reveals that premier policies provide immediate access to world-class healthcare, free from the constraints of public systems or geographical borders. Your career depends on seamless global mobility; making a meticulously informed choice is non-negotiable.

Securing Your Health as a Global Asset

This guide is not a surface-level feature list. It is a detailed private medical insurance comparison designed for the unique demands of executives, finance professionals, and family office managers. We will deconstruct how to evaluate international plans with the same analytical rigor you apply to your financial portfolios.

The objective is to protect your most valuable asset—your health—with absolute clarity and control, no matter where your business takes you.

Why Standard Health Plans Are Insufficient

For any individual operating on a global scale, domestic health insurance policies are fundamentally inadequate. They are typically restricted by geography and do not provide the immediate, high-level access to specialists required when moving between jurisdictions. Travel insurance is not a viable alternative; it serves as a temporary solution for acute emergencies, not a strategy for comprehensive, ongoing medical care.

This is precisely where International Private Medical Insurance (IPMI) demonstrates its value. IPMI plans are engineered to eliminate these critical coverage gaps.

They provide:

- True Global Portability: This is coverage that follows you, whether you are relocating to a new financial hub or travelling for a protracted business engagement.

- Access to Elite Networks: You gain direct, cashless access to leading hospitals and medical experts worldwide, ensuring you receive premier care without administrative friction.

- Comprehensive Coverage Levels: These plans feature high benefit limits that cover everything from routine diagnostics and wellness to complex, long-term treatments and medical evacuations.

In a high-stakes career, your health insurance must be viewed as a strategic instrument. It is not merely a safety net. It is an enabler of global performance and personal well-being, protecting your ability to operate at peak capacity.

A robust IPMI plan is a critical piece of your personal infrastructure.

While your physical well-being is the priority, managing your communications is another vital part of thriving as a global professional. For practical advice on staying connected, especially when you need to know how to make calls without a SIM card as an expat, this guide is an excellent resource.

The market for this specialized coverage is expanding rapidly, driven by professionals in financial centers like Hong Kong, Dubai, and London who require superior healthcare access. Based on Fortune Business Insights data, the global health insurance market is projected to grow from USD 1.87 trillion in 2023 to USD 3.03 trillion by 2030. For our clients at Riviera Expat, this growth fosters greater competition and more sophisticated options. Leveraging an objective comparison engine often uncovers premium efficiencies of up to 30%, without sacrificing access to elite medical networks in over 200 countries. You can delve into the full research on global private health insurance trends to see the data for yourself.

Understanding Medical Underwriting

One of the first—and most critical—concepts you will encounter is medical underwriting. It is the process by which insurers assess your health status to determine your premium and coverage for pre-existing conditions. There are two distinct methodologies.

Moratorium Underwriting: This can be viewed as an expedited, less transparent approach. It is faster because you do not submit a full medical history. Instead, the insurer imposes a waiting period, typically 24 months. Any condition for which you have experienced symptoms, received treatment, or sought advice in the five years prior to the policy's inception will not be covered until you have completed two full years on the policy without any recurrence.

Full Medical Underwriting (FMU): This is the direct opposite. You provide a comprehensive medical declaration upfront. While it requires more time initially, the result is absolute clarity from day one. The insurer reviews your history and provides a definitive statement on what is covered, what is excluded, or what may be covered with an adjusted premium.

For a high-net-worth individual, Full Medical Underwriting is almost always the superior strategic choice. It eliminates ambiguity. You know precisely where you stand before a medical issue arises, which is essential for any serious long-term financial and health planning.

Defining Your Geographical Coverage

The next major decision is your area of cover, which directly dictates where your policy is valid. Insurers generally structure this into two principal zones, and the choice has significant cost implications.

Worldwide Coverage is precisely as it sounds: access to care anywhere, including the United States. It is the most comprehensive option but also the most expensive, driven entirely by the high cost of healthcare in the USA.

Worldwide Excluding USA Coverage provides global access to care in every country except the United States. This single exclusion can reduce your premiums by as much as 50%. If you do not plan to reside, work, or seek extensive medical treatment in the U.S., this is an exceptionally practical way to manage costs without sacrificing quality of care elsewhere.

Finally, do not overlook the insurer's direct billing network. This is a non-negotiable feature. A robust network means the hospital bills the insurer directly, so you are not required to pay substantial sums out-of-pocket and then pursue reimbursement. For a busy professional, this cashless, frictionless experience is invaluable, ensuring you gain access to the best facilities without any administrative delays.

A Nuanced Comparison of Premier IPMI Policies

Conducting an effective private medical insurance comparison means digging deeper than the price and annual limits. For a globally mobile finance professional, the subtle differences between top-tier policies are where true value resides. It is not merely about having coverage; it is about securing the specific access, service, and flexibility your demanding life requires.

This analysis examines the critical, often-overlooked features that separate an adequate plan from an exceptional one. We will explore the real-world impact of provider networks, underwriting philosophies, and benefit structures to provide the clarity needed to make a confident decision.

The Decisive Factor of Medical Networks

The quality of an insurer's medical network is arguably the single most important component of any international plan. It dictates your access to care, the convenience of treatment, and your entire experience at a time of need. A premier network is defined not by size alone, but by quality and depth, especially in major financial hubs.

When comparing your options, disregard the raw number of hospitals. The pertinent questions are:

- Access to Centers of Excellence: Does the plan provide direct, cashless access to world-renowned hospitals for specialized care in fields like oncology, cardiology, or neurology? The best policies have established relationships with these leading institutions across the globe.

- Direct Billing Strength: How widespread is the direct billing (cashless) network? A strong network means you are not burdened with settling large medical bills out-of-pocket and then seeking reimbursement—a critical convenience for any busy professional.

- Specialist Access: Can you consult with top-tier specialists directly, without requiring a referral from a general practitioner? For high-net-worth individuals, immediate access to expert second opinions is non-negotiable.

A policy's true worth is directly correlated to the caliber of its network. A low premium is a false economy if it restricts you to second-tier facilities or forces you through a bureaucratic reimbursement process during a medical crisis. Real value is seamless, immediate access to the best care available.

The scale of the global health insurance market is immense. The private sector's market share is projected to be 57.94% globally by 2026, a trend fueled by the demand for customized plans that public systems cannot offer. Whether you are a portfolio manager in London or a wealth manager in Singapore, this means you have strong policy choices when performing a private medical insurance comparison. You can see more on these health insurance market dynamics and their impact on global professionals.

Underwriting and Pre-Existing Conditions

How an insurer approaches pre-existing conditions is a fundamental point of differentiation. As discussed, Full Medical Underwriting (FMU) provides upfront clarity, which is vital for long-term planning. However, premier insurers distinguish themselves with their flexibility.

Some providers may agree to cover certain stable, chronic conditions by applying a premium loading, while others will simply impose a strict exclusion. This is a critical comparison point. A plan that is willing to underwrite and cover a managed condition provides immeasurably greater peace of mind and security for the future.

Comparing High-Value Benefit Limits

For complex treatments, the benefit limits are paramount. In areas like oncology, organ transplants, or major rehabilitation, subtle differences in policy wording can have massive financial consequences.

A detailed private medical insurance comparison must zero in on:

- Oncology Coverage: Look for plans that go beyond standard chemotherapy to cover advanced treatments like targeted therapies, immunotherapies, and genomic testing. Crucially, check if cancer care has its own separate financial sub-limits.

- Medical Evacuation and Repatriation: The best plans cover medical evacuation to the nearest center of excellence, not just the nearest adequate hospital. They also manage all logistics, offering a "white-glove" service during what is an inherently stressful time.

- Wellness and Preventive Care: Leading insurers are now focusing heavily on proactive health. Compare the sophistication of their wellness programs—these can range from basic health screenings to comprehensive mental health support, nutrition consultations, and full executive health check-ups.

The financial structure of your policy also requires close scrutiny. You can gain a better understanding of how to strategically manage your out-of-pocket costs by reading our detailed guide on excesses and deductibles.

IPMI Feature Comparison for Financial Professionals

To crystallize these differences, the table below offers a comparative look at key policy features from leading international insurers, with a focus on what matters most to high-net-worth individuals and their families.

| Feature/Criteria | Provider A (e.g., Bupa Global) | Provider B (e.g., Cigna Global) | Provider C (e.g., Allianz Care) | Significance for HNWIs |

|---|---|---|---|---|

| Medical Network | Extensive direct billing network; strong presence in major financial hubs. Access to elite "Centers of Excellence." | Broad global network with strong US presence. Direct access to specialists is often a key feature. | Strong European network with growing global reach. Emphasis on digital tools for finding providers. | Crucial: Ensures seamless, cashless access to top-tier care wherever business or life takes you. |

| Underwriting Flexibility | Known for thorough FMU. May offer terms for stable chronic conditions with premium loading. | Generally strict FMU but can be flexible for corporate clients. Individual policies are often less accommodating. | Flexible underwriting approach, frequently willing to consider covering managed pre-existing conditions. | Essential: Provides long-term security and peace of mind, especially for those with manageable health conditions. |

| Oncology Benefits | Comprehensive coverage for advanced treatments like immunotherapy and genomic testing with high limits. | Strong oncology benefits, but sub-limits and lifetime maximums require careful review on specific plans. | Good coverage for standard treatments; advanced therapies may depend on the plan level chosen. | Non-negotiable: Cancer treatment costs are astronomical. This ensures access to the best modern care without financial liability. |

| Evacuation & Repatriation | "White-glove" service, evacuating to the nearest center of excellence, not just the nearest hospital. | Robust evacuation benefits, often with security support options included in top-tier plans. | Solid, reliable evacuation services with a focus on logistical support and case management. | Vital: Guarantees you get to the right facility in a crisis, with all logistics handled for you. |

| Concierge & Privacy | Dedicated account managers and high-touch concierge services are a hallmark of premier plans. | Offers personalized service levels, particularly for high-premium policyholders. | Strong digital service model with 24/7 multilingual support and dedicated claims teams. | High Value: Saves immense time and provides absolute discretion for high-profile individuals. |

This table illustrates that while all major providers offer robust products, the nuances in their approach to networks, underwriting, and service can make a significant difference depending on your specific needs and priorities.

Concierge Services and Privacy Provisions

Finally, for high-profile individuals, the level of service and discretion is a key determinant. The best IPMI providers offer dedicated account managers or concierge teams that handle every administrative detail of your care, from scheduling appointments with world-class specialists to arranging complex medical logistics.

These plans also operate with a profound understanding of the need for absolute privacy. They employ strict data protection protocols and ensure all health matters are handled with the utmost confidentiality. This level of personalized service and security is the true signature of a plan designed for the executive class. By focusing on these nuanced yet critical criteria, you can select a plan that provides not just coverage, but confidence and control over your global health strategy.

Real-World Scenarios for Global Financial Leaders

Theoretical comparisons only provide partial insight. The real test of an international private medical insurance policy is not found in a brochure—it is measured by how it performs under the pressure of a genuine crisis. A plan’s true worth is its ability to deliver seamless, world-class outcomes when you or your family need it most.

Let's move beyond the abstract and examine three scenarios common to senior finance professionals. Each case study demonstrates how specific policy features—from area of cover to network strength—cease to be fine print and become the critical factor shaping your access to care and financial security. This is where a detailed private medical insurance comparison proves its value.

The Private Wealth Manager in Asia

Imagine a senior wealth manager based in Singapore who experiences sudden, acute cardiac symptoms. Her local cardiologist recommends a highly specialized, non-invasive procedure, for which the world-renowned clinic is in the United States.

Immediately, two policy features come into sharp focus.

First, the area of cover. Had she opted for a "Worldwide excluding USA" policy to manage her premiums, access to this specific procedure would be denied. She would be forced to accept a different course of care. Her decision to secure a "Worldwide" plan, however, keeps this best-in-class option available.

Second is the insurer’s direct billing network and concierge services. A premier plan does not just issue payment. Its dedicated case management team springs into action, arranging medical transport, liaising directly with the US clinic to guarantee payment, and handling every logistical detail. It is a frictionless process from start to finish.

For a high-net-worth individual, a health plan's primary function is to remove obstacles. The right policy delivers more than just financial coverage; it provides a sophisticated service infrastructure that executes your healthcare strategy flawlessly, allowing you to focus solely on recovery.

The Investment Banker with a Global Family

Next, consider an investment banker in London with a spouse and two children. One child is at university in Switzerland, while the other is on a gap year in Southeast Asia. This geographically dispersed family structure makes comprehensive, multi-jurisdictional coverage non-negotiable.

When his son in Thailand contracts a severe tropical illness and requires hospitalization, their IPMI plan is put to the test. Here is where the policy’s strengths become evident:

- Robust Global Network: The insurer's deep network in Asia means they can instantly identify the best-equipped private hospital near his son and arrange direct admission. There is no frantic searching or payment disputes.

- Medical Evacuation Provisions: The policy includes full coverage for medical evacuation. If the local facility is not equipped to manage the condition, he can be moved to a regional center of excellence—in this case, Singapore—without question.

- 24/7 Multilingual Support: The family can speak with a dedicated medical team at any hour to receive updates and coordinate care, circumventing any language or time zone barriers.

This scenario proves that for families spread across the globe, a policy’s value is measured by its consistent performance across disparate healthcare systems. It becomes less of a personal safety net and more of a comprehensive family asset protection tool.

The Digital Nomad Trader

Finally, consider a quantitative trader who operates as a digital nomad, spending months at a time in locations like Dubai, Lisbon, and Bangkok. Her lifestyle demands absolute flexibility and certainty of access, making a standard expat plan insufficient.

Her top priority is a policy that guarantees access to elite primary care and emergency services in any location, without administrative friction. When she needs an urgent MRI for a sports injury in Portugal, her plan's features deliver exactly that.

The critical elements here are a powerful mobile application for finding approved specialists and a truly global, cashless network. She can locate a top-rated orthopedic clinic, book an appointment, and have the insurer settle the entire cost of the consultation and scan directly. This level of autonomy and efficiency is non-negotiable for a professional who cannot afford downtime or bureaucratic delays. Her private medical insurance comparison rightly focused on portability and digital service, ensuring her health infrastructure is as mobile as her career.

A Framework for Optimal Plan Selection

Choosing the right private medical insurance is not about browsing brochures; it is a strategic decision that demands a clear, structured approach—one that aligns a policy with the realities of your personal, professional, and financial life. A haphazard comparison almost invariably leads to costly coverage gaps or overpaying for benefits you will never use.

The entire process is about translating your lifestyle, family needs, and global travel into a concrete set of non-negotiable policy features. When this is done correctly, the overwhelmingly complex market becomes a manageable set of intelligent choices.

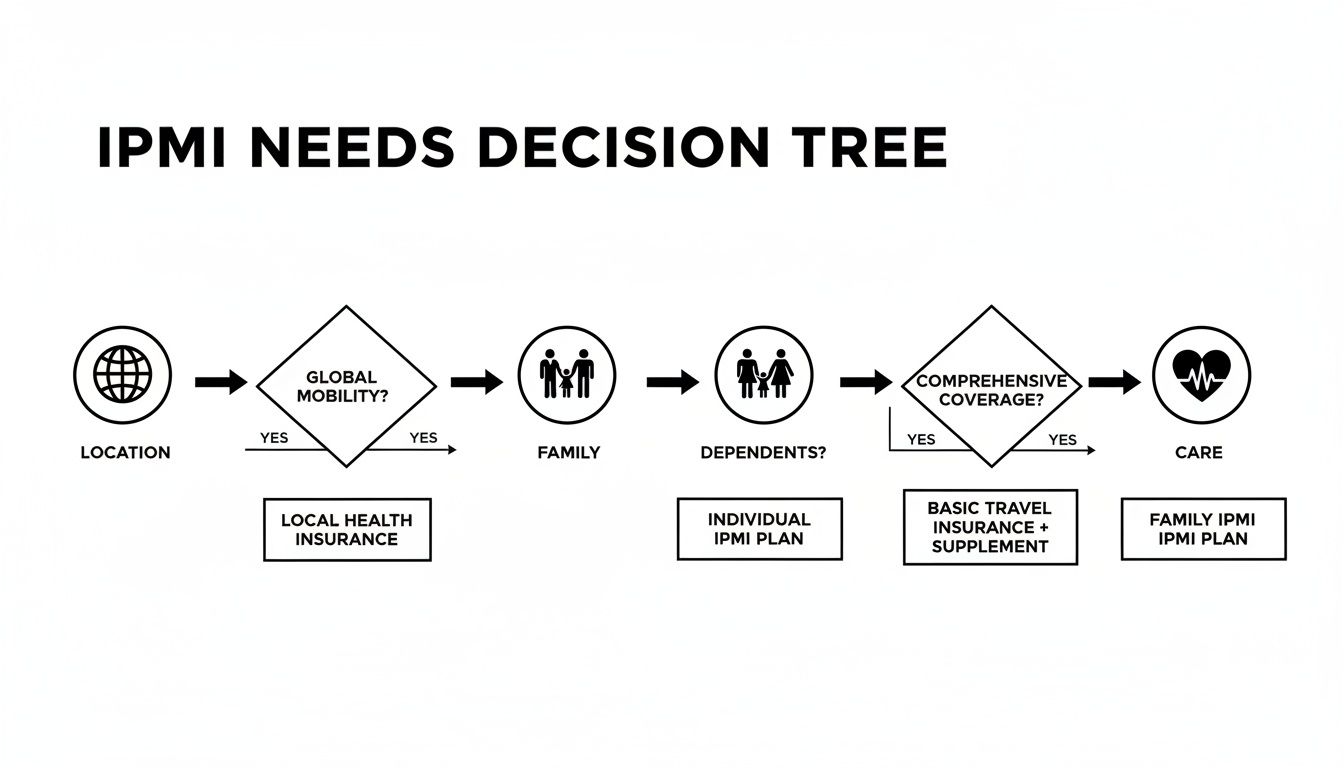

This decision tree cuts through the noise. It maps out the core logic: start with where you will be, consider who needs coverage, and then zero in on the level of care you actually require.

This visual reinforces the single most important principle of IPMI selection: your personal context is paramount. It is the only way to avoid paying for coverage you do not need while ensuring you are not dangerously underinsured against real-world risks.

Define Your Healthcare Priorities and Geography

First, you must create a detailed personal profile. This is more than a quick checklist; it is a strategic assessment of your health needs, both now and in the future. Document everything from routine wellness checks to any known chronic conditions that demand ongoing management.

Give your family’s needs the same rigorous attention. Will you require coverage for dependents studying abroad? Is maternity care a future consideration? These factors are game-changers, dramatically shifting which plan structure offers the most value.

Equally critical is an honest assessment of your geographical footprint. The decision between a "Worldwide" and a "Worldwide excluding USA" policy is one of the most significant cost drivers you will face. Base this choice on concrete plans, not vague possibilities, to ensure your premium accurately reflects your actual risk profile.

Evaluate Underwriting and Total Cost of Ownership

Next, turn your attention to the underwriting process. For a high-net-worth professional, Full Medical Underwriting (FMU) is almost always the correct path. It delivers absolute certainty from day one, eliminating the ambiguities of moratorium underwriting and ensuring any pre-existing conditions are handled with full transparency. For a deeper dive into this crucial topic, you can review our guide where we have expat medical insurance policy terms explained.

Look beyond the monthly premium and calculate the total cost of ownership. This means scrutinizing deductibles, co-payments, and out-of-pocket maximums. A low premium might appear attractive, but it is a false economy if it is tied to a high deductible that leaves you exposed to thousands in upfront costs.

The optimal plan is not the cheapest one; it is the one that delivers the greatest value by providing predictable costs and comprehensive protection against high-severity medical events. True value lies in financial certainty.

Engage an Objective Brokerage for Absolute Clarity

Finally, the single most effective way to cut through marketing language and obtain objective advice is to partner with a specialized brokerage that operates on a transparent fee or disclosed commission basis. This model minimizes conflicts of interest, helping to ensure the guidance you receive is based entirely on what is best for you, not on which provider pays the highest incentive.

A detailed private medical insurance comparison reveals significant premium variances of 20-35% between top-tier insurers like Cigna or Allianz. An objective analysis clarifies these differences, often showing that premium IPMI plans have deductibles that are 10-20% lower and provide access to vast networks of over one million providers globally.

An expert broker uses a proprietary comparison engine to evaluate the entire market against your unique criteria. This process not only validates your own research but also uncovers subtle nuances in policy wording that could have massive financial implications later on. It transforms a complex, frustrating decision into a streamlined, strategic process, giving you the control and confidence you demand in all your financial dealings.

Frequently Asked Questions

When you are operating at a global level, your questions about medical insurance are not about the basics. They concern strategy, risk, and long-term asset protection. Here are the high-stakes questions that arise time and again when financial professionals are comparing their options.

How Does Medical Underwriting Impact Pre-Existing Conditions?

Medical underwriting is the insurer's due diligence on your health history. It is the process that determines how any existing health issues are treated, and for a high-net-worth individual, getting this wrong introduces unacceptable risk. There are two main paths.

- Full Medical Underwriting (FMU): This is the comprehensive review. You provide a complete medical history, and in return, you receive absolute clarity from day one. The insurer makes a binding decision on what is covered, what is excluded, or what might require an additional premium. It requires more effort upfront, but it purchases certainty.

- Moratorium Underwriting: This is the "wait-and-see" approach. It is faster because there is no initial health questionnaire. However, it comes with a crucial caveat: any condition for which you've had symptoms or treatment in the five years before your policy starts is automatically excluded for a two-year "moratorium" period. You only gain coverage for that condition after you complete two full, consecutive years without any symptoms, treatment, or advice for it.

For senior professionals who demand absolute clarity in their financial and personal affairs, Full Medical Underwriting is almost always the superior strategic choice. It eradicates uncertainty and ensures your health coverage is as predictable and reliable as any other core asset in your portfolio.

Differentiating Worldwide and Worldwide Excluding USA Coverage

This is one of the most significant levers you can pull on your premium. Adding the United States to your coverage area can increase the cost by 30-50%, and sometimes more. The reason is straightforward: the high cost of healthcare in the U.S.

The choice comes down to a clear-eyed assessment of your professional and personal life. If you travel to the U.S. frequently for business, have family there, or wish to retain the option to access its world-renowned "Centers of Excellence" for a complex procedure, then including it is non-negotiable.

If your global footprint does not include the U.S., choosing an "excluding USA" plan is the single most effective way to manage your premium without sacrificing quality of care anywhere else in the world.

Can I Maintain My Policy If I Relocate or Retire?

Yes, and this is the core purpose of a true International Private Medical Insurance (IPMI) plan. Unlike a domestic policy that is tied to a single country, a genuine IPMI plan is built for portability. It is designed to move with you, whether you are transferring between financial hubs or settling into retirement abroad.

The key feature to look for is lifetime renewability. This is the insurer's guarantee that they cannot cancel your coverage as you age or if you develop a serious health condition, provided you continue to pay your premiums. For anyone focused on long-term wealth preservation, securing a policy with this guarantee is a foundational step in protecting your future from catastrophic medical costs.

How Do Direct Billing Networks Function?

A direct billing (or "cashless") network is a critical feature that separates a basic policy from a premium one. It signifies that the insurer has established relationships with hospitals and clinics around the world, allowing them to settle your bills directly with the provider.

This completely removes the administrative and financial burden from you. You do not have to pay a substantial hospital bill out-of-pocket and then spend weeks pursuing a reimbursement.

The quality and scale of an insurer's network is a major differentiator. A top-tier network gives you seamless access to elite medical facilities in key global hubs. It transforms the experience of seeking care from a stressful transaction into a white-glove service, allowing you to focus on your health, not the paperwork.

At Riviera Expat, we provide the clarity and control you need to make a confident decision. Our proprietary comparison engine and expert, commission-only advice are tailored to the unique demands of global financial professionals. Secure your health as the global asset it is by getting your free, objective IPMI comparison today.