For a high-net-worth professional, moving to Singapore is not merely a change of address—it's a strategic decision that aligns lifestyle aspirations with professional ambition. The city-state presents a rare synthesis of profound political stability, a fiercely pro-business environment, and an unparalleled position as a secure launchpad into Asia's dynamic markets. This is precisely why it remains a premier global destination for elite talent.

A Strategic Overview of Living in Singapore

Relocating to Singapore is far more than an administrative exercise; it is a calculated step toward efficiency, security, and an exceptional quality of life. The city-state’s sterling reputation is built on a foundation of meticulous planning and forward-thinking governance, creating an environment where both enterprise and family can truly thrive.

This guide serves as your executive briefing. We will bypass surface-level generalities to provide the actionable intelligence you require, focusing on the practical realities and strategic advantages that matter most when managing significant personal and professional portfolios.

Key Pillars of a Premier Lifestyle

Singapore's appeal distills into several core elements that coalesce to create a high-performance living environment. Understanding these pillars is the foundational step in orchestrating a seamless and successful transition.

Here’s a breakdown of our analysis:

- Political and Economic Stability: Singapore's consistent governance and robust economic policies create a predictable, secure backdrop for long-term wealth preservation and growth. This is an environment where surprises are minimal.

- Gateway to Asian Markets: Its strategic location, anchored by the world-class Changi Airport, provides effortless connectivity. It functions as the ideal home base for managing business interests across the entire Asia-Pacific region.

- Favorable Tax Framework: An attractive tax regime, which notably includes no capital gains or inheritance tax, offers significant advantages for structuring your wealth with maximum efficiency.

- Exceptional Quality of Life: The city is renowned for its safety, cleanliness, and abundant green spaces, offering a secure and genuinely pleasant setting for families.

Singapore’s design as a "city in a garden" is not a mere branding slogan. It is a deliberate national strategy to guarantee a high quality of life, blending urban density with accessible nature—a rare equilibrium in any global financial hub.

Consider this your initial framework for navigating the logistics of your move. In the subsequent sections, we will delve into the specifics of securing a residence in an exclusive neighbourhood, navigating the top international schools, and mastering the visa process.

For a broader perspective, you may find it useful to explore our other country guides. Our objective is to arm you with the detailed insights necessary to make your transition into a globally connected life both seamless and strategically sound.

Securing Your Premier Residence and Education

When relocating at a senior level, the choice of a home is not simply a matter of accommodation—it is an executive decision. It establishes the foundation for your family's new life and reflects your personal standards. Concurrent with this decision is the selection of the right school, which is nothing short of a strategic investment in your children's future. Perfecting these two pillars is paramount to a smooth and successful transition to life in Singapore.

The property market here offers a distinct class of luxury, from sprawling landed houses to ultra-modern condominiums replete with five-star amenities. The first step is to develop a nuanced understanding of Singapore's most exclusive enclaves. Only then can you identify a residence that genuinely aligns with your personal and professional life.

Finding Your Exclusive Enclave

Singapore’s premier residential districts each possess a unique character. Your choice will likely be determined by your priorities: serene green spaces, immediate access to the city's vibrant pulse, or the exclusive appeal of waterfront living.

- Orchard Road and its Vicinity (Districts 9, 10, 11): This is the nexus of urban sophistication. For those who wish to be at the center of Singapore's commercial and social life, this is the definitive address. The area is dominated by luxury condominiums offering unmatched access to high-end retail, fine dining, and prestigious private clubs.

- Bukit Timah (District 10, 21): Known for its lush greenery and a more tranquil atmosphere, Bukit Timah is where one finds many of Singapore's most prestigious landed properties, including the coveted Good Class Bungalows (GCBs). It is also a hub for top international schools, making it a logical and popular choice for families.

- Sentosa Cove (District 4): This is a world apart. Sentosa offers a unique, resort-style living experience and is the only location in Singapore where foreigners can purchase landed property (subject to government approval). With private yacht berths, stunning waterfront villas, and golf courses at your doorstep, it’s an exclusive escape from the city bustle.

A prudent approach upon arrival is to explore luxury home rentals to secure high-end accommodation. This provides the flexibility to gain firsthand experience of different neighbourhoods before committing to a long-term purchase or lease.

Navigating Elite International Education

Of equal importance to securing your residence is securing a place at one of Singapore's world-class international schools. The standards are exceptionally high, as is the competition for admission. A proactive and strategic approach is therefore non-negotiable.

These schools offer globally recognized curricula designed to provide a pathway to top universities worldwide. The key is to understand their core teaching philosophies to find the optimal fit for your child's learning style and your family's educational ambitions.

The decision between curricula such as the International Baccalaureate (IB), the British system (A-Levels/IGCSE), or the American system (AP) is significant. It not only shapes university options but also defines the entire educational experience and approach to your child's development.

The financial commitment is also substantial. Annual tuition fees for top-tier schools can be expected to exceed S$50,000 per child. This figure does not include ancillary costs such as application fees, building levies, and extracurricular activities, which must be factored into your financial planning.

Comparative Overview Of Premier International Schools

Choosing the right school is one of the most critical decisions for any expatriate family. Below is a snapshot of some of Singapore's leading institutions to assist in comparing their core offerings and specialties.

| School Name | Key Curriculum | Annual Fee Range (Approx.) | Notable Specializations |

|---|---|---|---|

| UWCSEA | IB Programme (IBDP) | S$45,000 – S$55,000 | Strong focus on service, outdoor education, and holistic development. |

| Tanglin Trust School | British (A-Levels, IBDP option) | S$35,000 – S$55,000 | Offers both A-Levels and the IB Diploma, providing academic flexibility. |

| Singapore American School | American (AP courses) | S$40,000 – S$60,000 | Extensive Advanced Placement (AP) program and a broad range of co-curriculars. |

Given the intense demand, it is strongly advised to initiate the application process well in advance of your planned move. Many of these institutions have extensive waiting lists. A meticulously prepared application is essential to secure a place and ensure your children's educational journey continues seamlessly.

Navigating Visas and Tax Residency

Securing the appropriate visa and structuring your tax affairs are among the most critical components of a successful relocation to Singapore. For senior executives and their families, this is not merely an administrative task—it is a core element of your long-term wealth strategy. A firm grasp of how work passes and tax residency function is absolutely essential for a smooth transition.

The process commences with securing the right to work. Singapore has engineered its immigration system to attract top-tier global talent, a fact clearly reflected in the structure of its primary work passes. This focus is a cornerstone of the nation's economic strategy.

Your Primary Work Pass Options

For most high-net-worth professionals, the choice lies between two primary options: the Employment Pass (EP) and the Personalized Employment Pass (PEP). While both authorize employment, they offer distinct levels of freedom and are designed for different career trajectories. Understanding this distinction is crucial.

The Employment Pass (EP) is the standard route. It is tied to a specific employer, necessitating a confirmed job offer for application. Eligibility is assessed via a points-based framework called COMPASS, which evaluates qualifications, salary, and the employer's commitment to hiring local talent. A high salary and strong credentials are non-negotiable prerequisites.

In contrast, the Personalized Employment Pass (PEP) affords significantly more flexibility. It is not linked to a single company, meaning you can transition between roles without reapplying for a new pass. This makes it an excellent choice for seasoned executives who value mobility or anticipate exploring different opportunities after arriving.

The choice between an EP and a PEP is a strategic one. The EP provides a direct path tied to a confirmed role, while the PEP offers unparalleled flexibility for senior professionals who anticipate career changes or consulting work.

Once your own work pass is secured, you may then apply for Dependant's Passes (DPs) for your spouse and any unmarried children under 21. This is a relatively straightforward process that allows your family to join you with minimal administrative burden.

The Pathway to Permanent Residency

For those considering Singapore as a long-term base, obtaining Permanent Residency (PR) is the logical next step—and a highly coveted status. Holding PR provides you and your family with far greater stability, along with benefits such as more favorable conditions for property ownership and better access to local schools for your children.

The most common pathway to PR is for EP and S Pass holders who have resided in the country for a period, contributing to the economy and integrating into society. The government assesses a range of factors during the application, including:

- Your professional background and economic contributions.

- The duration of your residence in Singapore.

- Your personal and family ties to the country.

Securing PR is a significant milestone, cementing your long-term position in Singapore and unlocking a new tier of opportunities. Before embarking on this process, ensure you have considered all aspects by preparing for your move abroad.

Understanding Singapore's Tax Framework

One of the principal attractions for living in Singapore is its highly favorable tax system. It is designed for simplicity, efficiency, and to be genuinely advantageous for residents, making it a major magnet for global finance professionals.

The entire system is founded on a territorial principle. In practice, this means you are taxed primarily on income sourced in Singapore. Foreign-sourced income remitted to the country is generally not taxable, a significant advantage for individuals with global investments. This clarity makes financial planning far more predictable.

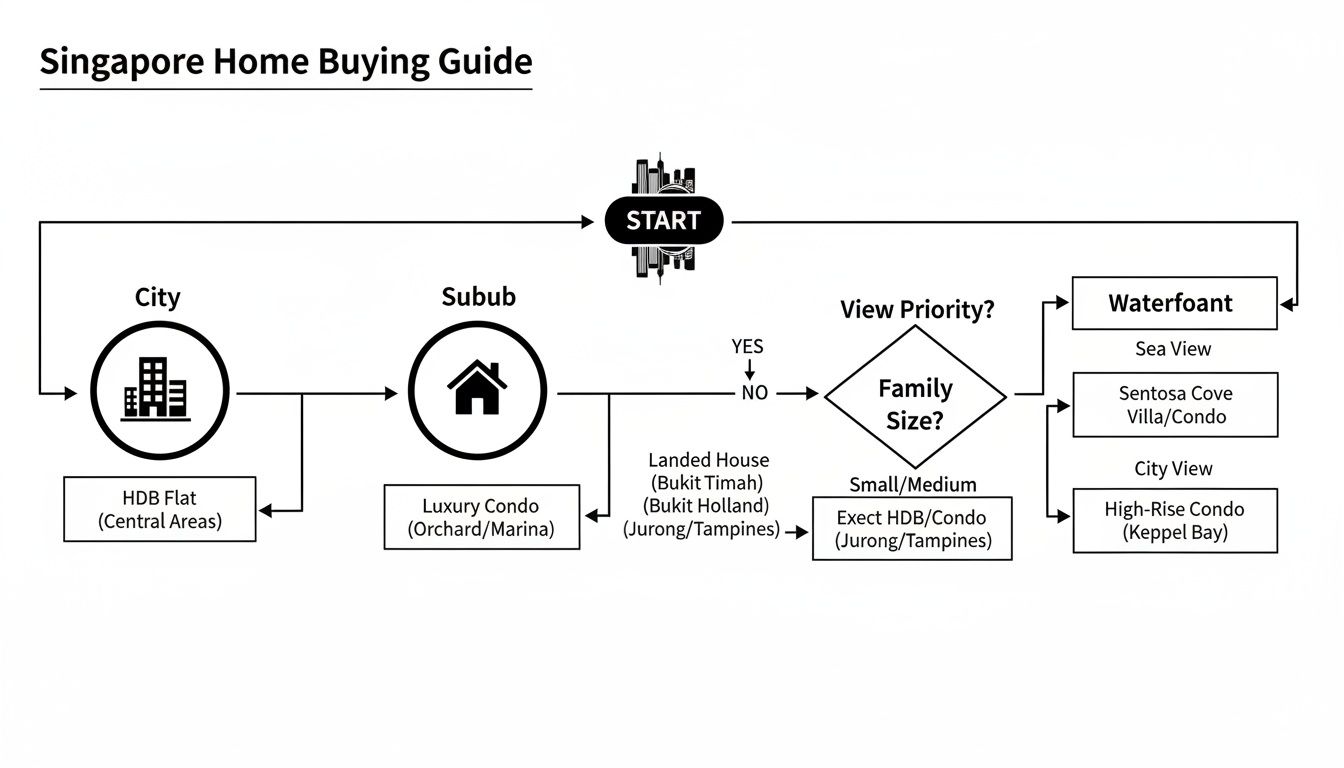

This helpful decision tree provides a simplified guide for choosing a home, a key decision when living in Singapore.

The visualization breaks down key residential choices, helping align your lifestyle preferences with Singapore's distinct neighbourhood characteristics.

Furthermore, personal income tax rates are progressive, commencing at 0% and capped at a very reasonable 24% for the highest income bracket. The most compelling features, however, are that Singapore has no capital gains tax and no inheritance tax. This structure permits incredibly efficient wealth accumulation and transfer, creating a pro-growth environment that continues to attract elite talent.

Reflecting this attraction, Singapore's population reached 5.92 million in June 2023, with much of that growth driven by non-residents, who now constitute 1.77 million of the total. You can explore Singapore's latest demographic trends from SingStat for more detail.

Getting a Grip on the Real Cost of an Executive Lifestyle

To make your wealth work effectively in a new jurisdiction, you must first have a crystal-clear picture of the financial landscape. Singapore's tax advantages are a significant draw, but the cost of living—particularly at an executive level—demands meticulous financial mapping. Generic online calculators fail to capture the nuances of a high-end lifestyle. What is required is realistic data to construct a precise financial blueprint.

However, transitioning your financial life here involves more than just budgeting for new expenses. It requires establishing a robust banking foundation capable of managing your international needs from day one. This means bypassing standard retail accounts and engaging directly with priority banking services designed for clients with significant assets.

Deconstructing Executive Living Expenses in Singapore

Let's be precise. A realistic budget for a premium lifestyle in Singapore must account for several key, and substantial, areas of expenditure. These figures should provide a clear indication of what to expect on a monthly and annual basis.

- Luxury Property Rentals: As previously noted, a high-end condominium in a prime location like Orchard or a landed home in Bukit Timah will command between S$15,000 to S$40,000+ per month.

- International School Tuition: For those with children, this represents a major line item. Top-tier institutions like UWCSEA or Tanglin Trust School have annual fees that frequently exceed S$50,000 per child.

- Premium Household Costs: This extends beyond groceries. It includes full-time domestic help (budget approximately S$1,000 – S$1,500 per month, inclusive of the levy), utilities for a large residence (often S$800 – S$1,200 monthly), and sourcing high-end produce and goods.

- Leisure and Networking: This is where costs can accumulate significantly. Memberships at exclusive private clubs such as The Tanglin Club or Sentosa Golf Club carry substantial one-time entrance fees, often exceeding S$100,000, in addition to significant monthly dues. A fine dining experience for two at a Michelin-starred restaurant can easily exceed S$1,000.

These figures underscore a critical point: while your income tax burden will be refreshingly low, your day-to-day and lifestyle expenditures will be among the highest in the world. Accurate forecasting is not just good practice; it is essential for intelligent wealth management.

Your First Move: Setting Up a Priority Banking Foundation

One of your first priorities upon arrival should be to establish a priority banking relationship. A standard bank account is simply not equipped to handle the complexities of international wealth—large fund transfers, multi-currency requirements, and bespoke investment advice. The leading banks in Singapore all have dedicated divisions for high-net-worth individuals.

Consider it less like opening an account and more like engaging a financial concierge. These services provide you with a dedicated relationship manager, an individual who understands your unique financial profile. They are there to facilitate everything from opening multi-currency accounts to securing preferential rates on mortgages and other financial products.

Establishing the right banking relationship from day one is not a matter of convenience; it is a cornerstone of your entire wealth strategy in Asia. It facilitates seamless capital flow, provides access to expert advice, and connects you to a network of financial specialists.

The Logistics of Transferring Capital and Opening Your Account

Opening a priority account with a top institution such as DBS Treasures, HSBC Premier, or Citibank's Citigold is a structured, professional process. You will typically need to demonstrate a minimum amount of Assets Under Management (AUM), which usually starts around S$200,000 and increases significantly for the higher private banking tiers.

Here is what the process generally entails:

- Initial Consultation: You will meet with a relationship manager to discuss your financial profile, investment objectives, and international banking requirements.

- Documentation: This stage is meticulous. You will need your Employment Pass, passport, and proof of your Singapore address. Banks here adhere to very strict Know Your Customer (KYC) protocols.

- Capital Injection: The next step is arranging the transfer of your initial AUM. Your relationship manager is pivotal here; they will advise on the most efficient and secure methods for moving substantial capital into Singapore, ensuring full compliance with local and international regulations.

Once this account is operational, it becomes the central hub for managing your cost of living in Singapore and the ideal launchpad for structuring your broader investment activities across the region.

Getting into the Singapore Swing: Lifestyle and Culture

To truly thrive in Singapore, one must acclimatize to its unique rhythm—a blend of hyper-efficiency and understated luxury. The public transport system is phenomenal, without question. However, mastering personal transport and accessing the city's exclusive social circles is what truly unlocks the executive lifestyle here.

It is all about seamless logistics. Beyond the pristine MRT trains, many senior professionals still desire the freedom of their own transport. Be advised, however: owning a car is not just a purchase; it is a massive financial undertaking, due to a strict quota system designed to keep the city's roads clear.

Getting Around in Style

For day-to-day convenience, high-end ride-hailing services like Grab Premium are the standard. They offer a reliable, professional mode of travel, removing all logistical friction from your commute.

But if you are determined to own a personal vehicle, you must first acquire a Certificate of Entitlement (COE). This is effectively the right to own a vehicle for ten years, and it must be won through a competitive bidding process.

The COE system is Singapore’s strategic tool against the gridlock that paralyses other major cities. The high cost is not incidental; it is a deliberate policy choice for a better quality of life. This is precisely why private hire services have become such a practical and popular alternative for professionals.

COE prices fluctuate wildly based on demand and can often exceed the cost of the vehicle itself. For many executives, this simple economic reality makes using chauffeured services a far more attractive and sensible option.

Your Access to Premier Leisure and Networking

Beyond the professional sphere, Singapore's social life is built around a network of exclusive private clubs and a truly world-class dining scene. These are not just places for recreation; they are the epicentres of high-level networking and serve as crucial community hubs for expatriate families.

- Exclusive Clubs: Institutions like The Tanglin Club or the Sentosa Golf Club offer more than just five-star facilities. They provide a sanctuary for building powerful professional and personal relationships within a curated community.

- Michelin-Starred Dining: The city is a culinary juggernaut, studded with Michelin stars. These restaurants offer incredible experiences, perfect for entertaining clients or simply enjoying the high standards that define life in Singapore.

Singapore as Your Global Launchpad

Perhaps the greatest lifestyle advantage is Singapore's role as a global hub. Changi Airport is not just an airport; it is a strategic national asset, consistently voted the world's best. Its unparalleled connectivity places the entire Asia-Pacific region at your immediate disposal.

From your new base, you can genuinely conduct business in Hong Kong in the morning and return for dinner. A weekend trip to Bali is practically a commute. This level of access completely transforms your perspective on regional travel, turning major journeys into simple, routine affairs. Singapore is not just a place to live; it is your strategic command centre for both business and personal exploration across Asia and the globe.

Accessing World-Class Private Healthcare

When operating at a high level, a reactive approach to health is not an option; it is a liability. For this reason, a proactive and robust healthcare strategy is non-negotiable, and Singapore's world-renowned private medical ecosystem is designed to meet this exact standard. It provides the certainty required to protect your most valuable asset: your health and that of your family.

While Singapore’s public healthcare system is excellent, the private sector offers a distinct tier of service defined by speed, choice, and premium comfort. For expatriates accustomed to immediate access and personalised care, understanding this distinction is fundamental.

The Private Healthcare Advantage

Opting for private medical care in Singapore means entering an environment of superior service and immediate attention. Premier hospitals such as Mount Elizabeth, Gleneagles, and Raffles Hospital are not merely medical facilities; they are centres of excellence that attract top specialists from around the globe.

The key advantages are tangible and immediate:

- Immediate Specialist Access: You effectively bypass waiting lists, securing prompt appointments with leading consultants and specialists for any concern.

- Choice of Physician: You retain complete control, with the freedom to select your preferred doctor or surgeon based on their expertise and reputation.

- Executive Health Screenings: These institutions offer comprehensive, preventative health assessments tailored to the demands of a high-performance lifestyle, focusing on early detection and health optimisation.

For those who take a data-driven approach to well-being, a proactive blood test for health can offer a clear view of your biological roadmap for longevity, aligning perfectly with the preventative care philosophy of the private sector.

The Cornerstone of Your Strategy: International Private Medical Insurance

The key that unlocks this entire ecosystem is International Private Medical Insurance (IPMI). Relying on a standard local policy or insufficient corporate coverage is a critical misstep for a globally mobile executive and their family. A comprehensive IPMI plan is the true cornerstone of a sound healthcare strategy in Singapore.

An elite IPMI policy is specifically engineered for seamless, borderless coverage, ensuring you receive the best possible care regardless of your location. It extends far beyond basic hospitalisation costs to deliver a suite of services that provide genuine peace of mind.

An IPMI policy is not merely an insurance plan; it is a global access pass to premier medical care. It ensures that your health decisions are driven by medical necessity and personal preference, not by geographical or network limitations.

The right plan is structured to cover the specific needs of high-net-worth expatriates. When selecting a policy, there are several critical components to evaluate to ensure it aligns with your expectations. For a more detailed analysis, you can learn more about finding the right health insurance for expatriates in Singapore in our dedicated guide.

Selecting a Plan That Meets Your High Expectations

A superior IPMI policy must deliver on several non-negotiable fronts. These features ensure your medical needs are handled with the efficiency and discretion you expect in every other aspect of your life.

Your chosen plan must include:

- Comprehensive Global Coverage: The policy must provide robust coverage not only in Singapore but also in your home country and any other locations you frequent for business or leisure.

- Medical Evacuation: This is a critical component. It guarantees that if you fall ill in a location with inadequate medical facilities, you can be transported to a centre of excellence like Singapore without delay.

- Direct Billing Networks: A premium policy offers direct settlement with a vast network of hospitals and clinics. This eliminates the need for you to pay substantial medical bills out-of-pocket and then wait for reimbursement.

- Freedom of Choice: The ability to choose your own doctor and hospital is paramount, ensuring you are always treated by the specialist you trust, wherever they may be.

Ultimately, securing the right IPMI is a strategic decision that provides certainty. It ensures you and your family have immediate access to the best medical care available, allowing you to focus on your professional and personal ambitions with complete confidence.

Got Questions About Your Singapore Move?

Relocating internationally raises numerous questions. To provide clarity, I have compiled direct answers to the most common queries I receive from senior professionals and high-net-worth families planning their move to Singapore.

What's the Real Monthly Cost for an Executive Lifestyle?

Let's be direct: Singapore is expensive. While the income tax is refreshingly low, the day-to-day cost of living at an executive level is among the highest in the world.

For a family requiring a three-bedroom condominium in a prime district like Orchard or Holland Village, with one child enrolled in an international school, a realistic monthly budget would be well over S$25,000. This is not an exaggeration but a practical figure that accounts for high-end housing, school fees, transport, and a commensurate lifestyle.

How Good Is the Private Healthcare, Really?

It is exceptional. Singapore's private healthcare system is genuinely world-class, providing immediate access to top specialists and cutting-edge medical technology. There is a reason it is a global medical tourism destination.

For any expatriate, however, a robust International Private Medical Insurance (IPMI) plan is not merely advisable—it is essential. This is your key to accessing premier hospitals like Mount Elizabeth or Gleneagles without concern for network restrictions or facing staggering out-of-pocket expenses.

Do I Absolutely Need to Own a Car?

No, and in truth, you will likely prefer not to. The government makes car ownership financially punitive through its Certificate of Entitlement (COE) system, where the license to own a car can cost more than the vehicle itself. This is a deliberate strategy to manage traffic congestion.

Most executives and their families operate perfectly with the hyper-efficient public transport (MRT) and ride-hailing services like Grab, which function as a seamless private car service. It is more efficient, cost-effective, and far less stressful.

Can My Spouse Work in Singapore?

Yes, but it is not automatic. If your spouse arrives on a Dependant's Pass (DP), they cannot commence employment immediately. Their prospective employer must apply for a separate work pass for them, such as an Employment Pass or S Pass.

A more direct route is for them to secure a job offer first, after which they can apply for a Letter of Consent (LOC). This ties their right to work directly to their DP, streamlining the process.

What Are the Key Cultural Norms I Should Know?

Singapore is a unique amalgamation of Chinese, Malay, and Indian cultures, with English serving as the lingua franca for business and government. Professional etiquette is paramount. Punctuality is not just appreciated; it is expected. Respect for hierarchy and a somewhat formal communication style are the default settings in most business contexts.

While the day-to-day business environment will feel familiar to those from a Western background, an effort to understand local customs and holidays is highly respected and will be well-received.

To appreciate living here, one must understand the city's design philosophy. Singapore is obsessively planned as a "city in a garden." Even deep within the Central Business District, you are never more than a few steps from a green space or a world-class public amenity. This meticulous planning is a significant contributor to the high quality of life.

This dedication to efficiency and order is woven into the fabric of daily life, from business dealings to your morning commute.

Navigating the complexities of international healthcare is one of the most critical parts of your relocation. At Riviera Expat, our specialty is securing world-class International Private Medical Insurance for professionals like you. Let our experts provide a clear, unbiased comparison of the best plans on the market, so you can be confident your family's health is protected from day one.