For the discerning global professional, the question is not if health insurance is required, but rather which tier of coverage is essential to protect your assets, mobility, and well-being. The short answer is an unequivocal yes; comprehensive health insurance is a fundamental requirement.

For high-net-worth individuals, expatriates, and their families, premium health coverage has evolved beyond a prudent choice—it is a critical legal and financial necessity. Many of the world's most desirable jurisdictions for residence and business will not grant long-term status without it.

Why Health Insurance Is a Non-Negotiable Requirement

If you manage your financial portfolio with precision, viewing health insurance as an optional expenditure is a significant miscalculation. Consider it a foundational pillar of a secure international strategy.

Governments in premier global hubs have implemented these mandates not to create administrative burdens, but as a pragmatic measure to ensure the stability of their healthcare systems and to prevent foreign residents from becoming a fiscal liability. This is not merely about satisfying a visa application requirement; it is about insulating your wealth from a catastrophic medical event and guaranteeing access to premier medical care, regardless of your location.

Core Pillars of Mandatory Coverage

The rationale behind these global mandates rests on three essential principles that directly impact you as an expatriate. Understanding them is key to selecting the appropriate international private medical insurance (IPMI).

- Legal Compliance: The most immediate consideration. Numerous countries legally demand proof of adequate health insurance as a prerequisite for issuing a long-term visa or residency permit. Failure to comply results in immediate application rejection or, more severely, the future revocation of your status.

- Financial Protection: A single, unforeseen medical event—a significant accident or a critical illness—can easily generate costs exceeding hundreds of thousands of dollars. The appropriate insurance acts as a critical firewall, shielding your personal assets from depletion.

- Access to Premier Care: Beyond legal compliance, a superior plan provides entry to the finest private hospitals, leading specialists, and advanced medical technologies. It ensures your health and well-being are never compromised by geography.

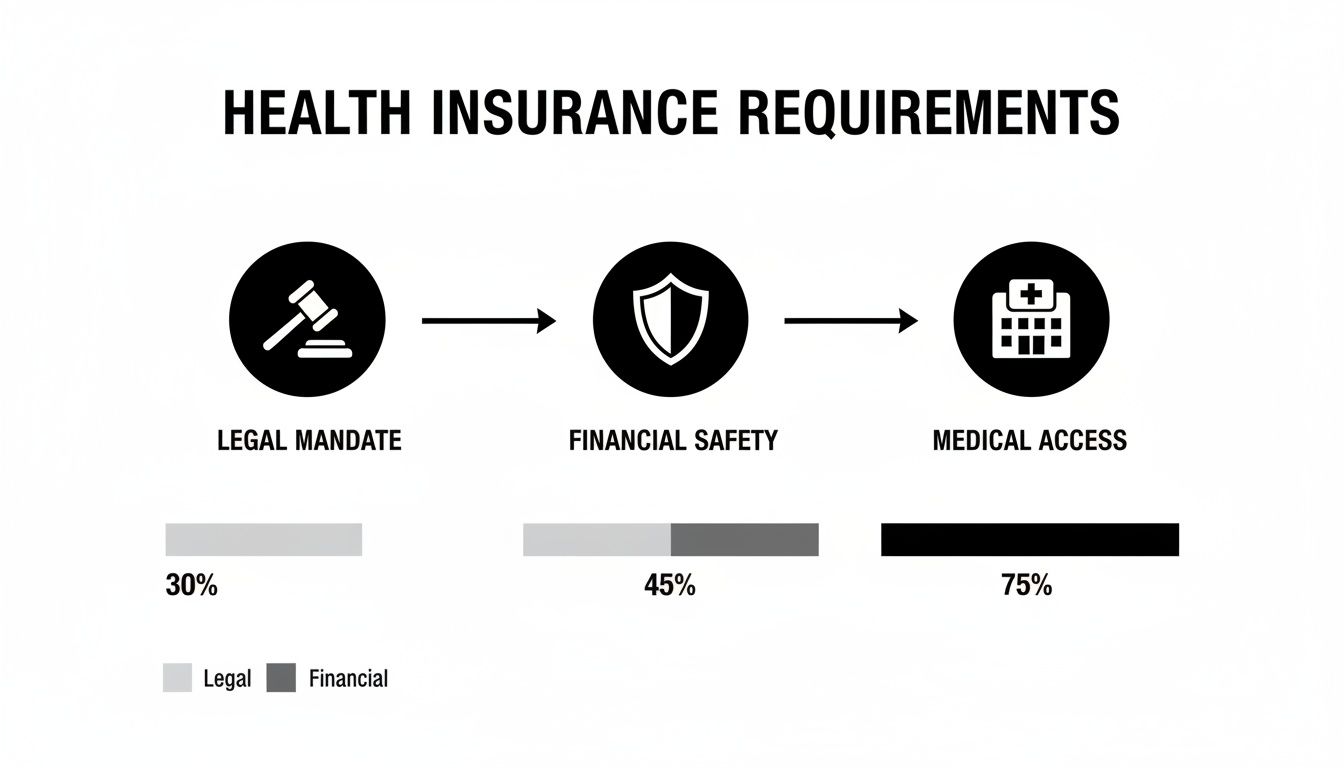

This infographic breaks down the core motivations for having solid health insurance while living abroad.

As you can see, while legal mandates are the initial trigger for about 30% of people, the real drivers are robust financial safety (45%) and ensuring access to top-tier medical services (75%).

Health Insurance Mandates in Key Expat Destinations

Regulations vary significantly between jurisdictions. A policy sufficient for a Dubai visa will not necessarily meet residency requirements in Spain. This table provides a concise overview of requirements in several major international hubs.

| Country/Region | Required for Visa | Required for Residency | Key Consideration |

|---|---|---|---|

| UAE (Dubai) | Yes | Yes | Mandatory for all residents. Employers must provide it, but many expats supplement for better coverage. |

| Singapore | Yes | Yes | Employers must provide basic coverage for certain work pass holders, but comprehensive IPMI is standard. |

| Switzerland | No (for visa) | Yes | You must secure Swiss-compliant health insurance within three months of arriving to get your permit. |

| Spain | Yes | Yes | Required for non-lucrative and other long-stay visas, with specific "no co-payment" policy rules. |

| Portugal | Yes | Yes | Proof of comprehensive coverage is a key part of the D7 visa and residency application process. |

| United Kingdom | Yes | Yes | Applicants pay an Immigration Health Surcharge (IHS) for NHS access, but many opt for private cover too. |

This is merely a starting point. Specific policy requirements—such as minimum coverage amounts and geographic scope—can be exceedingly detailed.

To fully grasp global insurance mandates, it is beneficial to understand the permanent traveler lifestyle and its legal distinctions. This context clarifies why a generic, off-the-shelf policy is seldom adequate for individuals living and conducting business across borders.

As we explore in our various country guides for expats, these regulations can be highly specific. This guide is designed to help you navigate this complex landscape and demonstrate why a robust international health plan is the cornerstone of a secure and successful life abroad.

Meeting Health Insurance Rules for Visas and Residency

For today's global professional, the freedom to live and work anywhere is a priceless asset. However, this freedom now carries a critical condition: proving you possess adequate health insurance. Navigating an international move is no longer about simply booking a flight; it is about meticulously satisfying a list of prerequisites where health coverage is a non-negotiable item.

Many of the world's most sought-after destinations now enforce strict insurance rules before they will consider issuing a long-term visa or residency permit. These are not mere suggestions; they are firm legal requirements designed to protect local healthcare systems and guarantee that expatriates can manage their own medical costs without burdening the state.

The Global Standard for Visa Applications

The entire landscape of international relocation has shifted. Over 40 countries, including the 29-nation Schengen Area, now demand proof of valid health insurance for entry, particularly for those planning a long-term stay. This is especially true for professionals from nations without reciprocal healthcare agreements.

Economic powerhouses like Germany, France, and Switzerland require applicants for long-stay visas to demonstrate at least €30,000 in medical coverage, which must also include repatriation. Failure to meet this baseline results in the certain denial of your visa application. This trend is accelerating as more countries formalize their own universal health coverage frameworks. Discover more insights about global health coverage on who.int).

This requirement extends beyond Europe. The UAE has long mandated health insurance for all residents as a condition of their visa, effectively reserving its public healthcare system for citizens. Thailand has a similar framework, requiring private insurance for its expatriate population while maintaining a public program for Thai citizens.

The message from governments is clear: if you plan to reside here, you must arrive with a credible plan to finance your own healthcare. It is a foundational pillar of modern immigration policy.

Specific Requirements in Key Expat Hubs

While the general principle is consistent, the details are critical. Specific policy requirements can vary dramatically between countries, and understanding these nuances is what distinguishes a smooth relocation from a bureaucratic ordeal.

- The Schengen Area: As mentioned, a policy with at least €30,000 for medical emergencies and repatriation is the absolute minimum. The policy must be valid for the entire duration of your stay and be recognized across all member states—without exception.

- The United Arab Emirates (UAE): In both Dubai and Abu Dhabi, compliant health insurance is mandatory for every resident. By law, employers must provide coverage, but for senior executives and their families, these standard plans often lack the comprehensiveness required, creating a clear need for a superior international plan to fill the gaps.

- Singapore: Employers are legally required to provide basic medical insurance for certain work pass holders. However, the coverage limits are often modest and fall well short of the standards high-net-worth individuals expect, making a robust International Private Medical Insurance (IPMI) plan a practical necessity.

Documentation and Compliance Are Paramount

Securing the right policy is only half the battle. You must be able to prove it. Presenting the correct, officially translated, and properly formatted proof of coverage is as vital as the policy itself. A simple confirmation email from your insurer will almost never suffice for a discerning consulate or immigration officer.

As you prepare your application, it is absolutely crucial to understand the importance of health insurance documents and the specific manner in which they must be presented.

Failure to manage this correctly can lead to more than an inconvenience. It can result in an outright visa denial or, subsequently, the revocation of your residency status, throwing your professional and personal life into disarray. Compliant health coverage is not just another document; it is a foundational component of your international strategy, securing both your legal status and your peace of mind.

Mandatory Coverage in Top Financial Hubs

Visa approval is often just the first step. For high-net-worth professionals relocating to major financial centers, the matter of health insurance quickly transitions from a visa prerequisite to a non-negotiable condition of residency. Once established, many of these elite hubs legally require enrollment in a local, compulsory health insurance system.

This is not a simple administrative task; it is a strictly enforced legal obligation. Jurisdictions like Switzerland, Germany, and the UAE have systems where your right to live and work is directly tied to maintaining compliant health coverage. These schemes are designed to provide universal coverage for all residents, ensuring a high standard of care without straining public resources.

A Look at the Swiss Model

Switzerland provides an exemplary case of achieving universal coverage through a regulated private insurance market. Rather than a state-run system, Swiss law mandates that every resident must purchase a basic health insurance policy from a private, government-approved insurer. This applies to everyone, from Swiss nationals to the expatriate executives in Zurich’s financial sector.

Upon establishing residency, you are typically granted a three-month window to arrange your coverage. This is not optional. The responsibility for compliance rests entirely with you.

In Switzerland, a global financial hub attracting top-tier professionals, health insurance has been mandatory for the entire resident population since 1996. This compulsory private system ensures universal coverage. For high-net-worth individuals relocating for banking or trading roles, failing to secure compliant coverage can result in significant financial penalties or deportation. This makes expert brokerage services invaluable for selecting the optimal plan from the 50+ approved insurers. You can discover more about Switzerland's healthcare system on pmc.ncbi.nlm.nih.gov.

The Real Penalties for Non-Compliance

Ignoring these residency-based insurance mandates carries severe consequences that can immediately jeopardize your professional and personal life. These are not minor infractions.

Governments in these financial centers enforce compliance through several powerful mechanisms:

- Heavy Financial Penalties: Fines can be substantial and often escalate the longer you remain without coverage. Authorities may also back-charge you for the entire uninsured period.

- Revocation of Residency Permits: This is the most serious ramification. Your legal right to reside in the country can be cancelled, compelling an abrupt departure that places your career and family at risk.

- Forced Enrolment: In some jurisdictions, if you fail to select a plan, the local authorities will assign one to you—almost certainly not the best or most cost-effective option—and issue an invoice for the premiums.

Assuming a standard travel insurance policy or your domestic plan from your home country will suffice is a critical error. These policies almost never meet local regulations, leaving you exposed both legally and financially in the event of a medical emergency.

Why You Need Expert Guidance

The sheer complexity of these systems makes professional guidance essential. In the UAE, for example, employers are legally required to provide a basic level of cover, but it frequently falls short of what senior executives require and expect. You can check out our guide on UAE health insurance for expatriates to grasp these details.

A specialized advisor understands the specific legal requirements in each financial hub. They can identify international private medical insurance (IPMI) plans that not only satisfy local laws but also deliver the executive-level care, global portability, and freedom of choice that a high-net-worth individual expects. This approach ensures you are not just compliant, but properly protected with a plan that fits your lifestyle.

Understanding International Versus Local Health Plans

For globally mobile executives and their families, the distinction between a local health plan and a premier International Private Medical Insurance (IPMI) plan is not a minor detail. It is the central pillar of your well-being abroad. The choice you make directly dictates your access to care, your financial risk, and ultimately, your peace of mind.

An error in this decision can have staggering consequences. It reflects a fundamental misunderstanding of two entirely different approaches to healthcare.

Consider a local health plan as a regional key. It is designed to meet domestic regulations and typically restricts you to a specific network of doctors and hospitals within that one country. It functions perfectly for accessing healthcare within that location, but becomes useless the moment you cross a border.

International Private Medical Insurance, in contrast, is engineered specifically for the expatriate lifestyle. It is the master key, designed to provide seamless, comprehensive coverage anywhere in the world.

Defining Boundaries and Freedoms

The true difference lies in geography and choice. Local plans are inherently restrictive, tethering you to a single nation's healthcare infrastructure. While they may satisfy local legal requirements, they are inadequate for the fluid, borderless nature of a high-level international career.

An IPMI plan effectively erases those borders. It grants you the freedom to choose any doctor or hospital, anywhere on the planet. This ensures you always have access to the best medical facilities, whether you are at your primary residence, traveling for a board meeting, or visiting family in your home country. That distinction becomes absolutely critical when you require a world-renowned specialist who is not located in your current country of residence.

A local plan answers the question, "Am I covered here?" An IPMI plan confidently answers, "Am I covered everywhere?" For a global citizen, only the second question truly matters.

Service Expectations and Continuity of Care

Beyond geographic reach, the service experience is dramatically different. Local plans are designed for a domestic audience, which often means support is only available in the local language and during standard business hours—a significant operational risk for a senior executive managing multiple time zones.

IPMI providers, on the other hand, offer a concierge-level service model tailored to the demands of their clientele. This is not an amenity; it is an essential feature. This includes:

- 24/7 Multilingual Support: You have access to dedicated case managers who can coordinate your care across continents and in your preferred language.

- Direct Billing Networks: Extensive global networks allow for cashless access to top-tier hospitals, removing administrative friction and the need for upfront payment for major procedures.

- Medical Evacuation: This is non-negotiable. IPMI includes comprehensive coverage for emergency medical transport to the nearest center of excellence if local facilities are inadequate.

Even in countries with mandatory local health schemes, such as Switzerland, discerning individuals almost always secure a compliant IPMI plan. This dual-coverage strategy ensures they meet legal requirements on the ground while guaranteeing a far superior standard of care. They maintain continuity with their preferred physicians globally and enjoy a service experience that aligns with their expectations.

To see how this works in practice, you can explore the benefits of International Private Medical Insurance in more detail. This is how you transform a simple requirement into a strategic asset for your global lifestyle.

The High Stakes of Inadequate Insurance Coverage

Let us be direct. For a high-net-worth professional who manages complex financial portfolios, choosing to ignore or underestimate health insurance requirements is not a calculated risk. It is a fundamental error with potentially devastating consequences.

The fallout from this single oversight can unravel a career built over decades. The repercussions are not merely financial—they are legal and deeply personal, capable of derailing your entire international life.

The True Cost of Non-Compliance

The most immediate threat is the staggering cost of private healthcare. A single serious accident or a sudden cardiac event can easily generate invoices reaching into the hundreds of thousands of dollars. Without compliant insurance, that liability falls directly to you, placing your liquid assets and long-term investments in jeopardy.

But the financial exposure does not end there. Governments are enforcing compliance with increasing rigor and have their own set of penalties. This can include substantial fines and, in some cases, demands for back-payment of premiums for the entire period you were uninsured.

For example, in Massachusetts, a state with an individual mandate, an eligible adult without health insurance could face a penalty of over $2,000 for the tax year. While this law is specific to residents, it exemplifies a global trend: governments are closing loopholes and enforcing mandatory coverage with significant consequences.

Beyond the financial impact, the personal and professional damage is often permanent.

- Visa Revocation and Deportation: In many countries, your legal right to live and work is directly tied to maintaining compliant health coverage. A lapse can lead to the immediate cancellation of your visa and an order to leave the country.

- Barred from Re-Entry: Deportation for non-compliance can result in being blacklisted, making it impossible to return to that country—or even an entire economic bloc like the Schengen Area.

- Career Disruption: Being forced to exit a country abruptly terminates your career trajectory. It jeopardizes projects, severs professional relationships, and leaves a permanent mark on your record.

The reality is stark: inadequate insurance can dismantle your international career and family stability in an instant. It transforms a manageable risk into a potential catastrophe, proving that comprehensive coverage is not an expense but an essential investment in personal security and career longevity.

A Realistic Scenario Unfolding

Consider this scenario: a senior executive on a multi-year assignment in Singapore. He is successful and presumes his high-end domestic plan from his home country is sufficient.

A sudden medical emergency occurs. He requires complex, urgent surgery and spends a week recovering in one of Singapore’s top private hospitals.

The financial shockwave hits first. The hospital, not recognizing his domestic insurer, demands a substantial upfront deposit. The final bill exceeds $150,000. His insurer begins to dispute the claim, citing geographic limitations and out-of-network clauses. He is forced to start liquidating personal assets to cover the mounting costs.

Subsequently, the professional fallout begins. During a routine visa renewal, immigration officials identify his non-compliant health plan. His residency permit is revoked. Instantly, his assignment is terminated, and he and his family are forced into an unplanned, chaotic departure. The career momentum he spent years building is lost.

This is not a far-fetched narrative. It is a precise illustration of how a simple oversight can cascade into a devastating personal and financial crisis.

The difference between possessing the right coverage and the wrong one is not merely about settling a bill; it's about two entirely different life outcomes. A single event—whether a medical emergency or a visa check—can direct you down one of two very different paths.

Comparing Outcomes With and Without Compliant Insurance

| Scenario | Outcome Without Compliant IPMI | Outcome With Compliant IPMI |

|---|---|---|

| Sudden Medical Emergency | You face huge upfront payment demands. Your assets are at risk as you scramble to cover bills exceeding six figures. Your insurer may deny the claim. | Your IPMI provider guarantees payment directly to the hospital. You focus on recovery, not liquidating your portfolio. Your financial stability is protected. |

| Routine Visa Renewal | Immigration discovers your non-compliant plan. Your renewal is denied, your existing visa is revoked, and you're ordered to leave the country. | Your policy documents meet all local requirements. Your visa is renewed smoothly, ensuring your legal status and career continuity. |

| Accident Requiring Evacuation | Your domestic plan has no provision for international medical evacuation. You're left to coordinate and fund a complex, costly transfer on your own. | Your IPMI plan’s assistance team manages the entire evacuation, from bedside to a center of excellence, with all costs covered. |

| Long-Term Illness Diagnosis | You face the choice of paying astronomical out-of-pocket costs for ongoing care abroad or abandoning your career to return home for treatment. | You have access to top specialists and treatments in your host country, with full coverage for chronic care, protecting both your health and career. |

Ultimately, compliant international health insurance is the critical firewall that separates a manageable inconvenience from a life-altering disaster. It is the instrument that ensures your health, wealth, and legal right to remain in your host country are secure.

Finding an Ally in a Complicated World

Navigating global health insurance requirements independently is an inefficient and high-risk endeavor. The challenge is not just finding a good plan; it is a complex matrix of country-specific laws, visa regulations, and residency obligations. The stakes—your health, your finances, and your legal status—are simply too high for guesswork.

This is where a dedicated, independent advisor becomes an invaluable asset. Our purpose is to eliminate that complexity. Our mission is to provide a clear, objective, side-by-side analysis of the best International Private Medical Insurance (IPMI) plans, benchmarked against the precise legal and lifestyle needs of high-net-worth professionals like you.

We Work for You, Not the Insurance Companies

The fundamental flaw in the traditional insurance market is that most agents are beholden to the insurers, not the client. Their recommendations are often influenced by commission structures, not your best interests.

Our model inverts this dynamic. We are your advocate. By working exclusively on your behalf, our advice remains completely unbiased and aligned with your objectives. We are not salespeople promoting a product; we are your personal advisors.

This distinction is paramount. It allows us to provide the clarity and control necessary to transform a stressful obligation into a simple, confident decision. Our function is to filter out the noise and present the optimal solution for your unique circumstances.

Think of us as your personal advisor in the complex world of global health. The plan you choose serves your agenda, not the insurer's. This is the only real path to peace of mind.

Our entire process is structured around your needs. We are not simply facilitating a policy purchase; we are helping you secure unrestricted access to world-class healthcare, regardless of where your life or career takes you.

A Clear Path to the Right Coverage

The first step is a clear understanding of your requirements. We make that process fast and efficient, providing the right answers without consuming your valuable time. From there, your path forward is clear.

- Objective Analysis: We don't just show you plans; we compare top-tier IPMI options based on your specific residency, travel habits, and healthcare priorities.

- Guaranteed Compliance: We ensure any plan we recommend meets every legal requirement you face, from visa applications to long-term residency permits.

- Unbiased Recommendations: Because we are completely independent, our guidance is free from insurer influence. Our only focus is the best outcome for you and your family.

This partnership provides the clarity and confidence to make the right choice. We manage the complexities so you can focus on what you do best.

Ready to secure the correct coverage from the outset? Schedule a complimentary consultation with our specialists today to receive a clear, personalized recommendation for your international health insurance needs.

Your Questions Answered: Expat Health Insurance Clarified

When planning a life abroad, health insurance questions invariably arise. Here are some of the most common inquiries from global professionals, with direct answers to provide the clarity you require.

Can I Just Use My Health Insurance from Home?

In nearly every instance, the answer is a firm no. Your domestic plan was designed for a single country’s healthcare system, not the one to which you are relocating. It will not provide meaningful long-term coverage abroad.

Crucially, it will almost certainly fail to meet the stringent legal requirements for a visa or residency permit in premier destinations like Switzerland or the UAE. Relying on your home-country plan is a significant financial risk that leaves you non-compliant with local laws. A proper International Private Medical Insurance (IPMI) plan is the only instrument designed for this specific purpose.

Is Travel Insurance Good Enough for an Expat?

Absolutely not. It is analogous to using a hammer to repair a watch—it is the wrong tool for the task and will cause more harm than good. Travel insurance is designed for short-term trips to cover acute emergencies, such as a fractured bone, a sudden illness, or a lost passport.

It is not a substitute for health insurance. It will not satisfy visa requirements and typically excludes routine care, management of chronic conditions, or pre-existing conditions. Attempting to reside abroad on a travel policy is one of the quickest ways to have a visa application denied and, more alarmingly, to find yourself facing a six-figure medical bill without coverage.

What if My Company’s Health Plan Isn’t Perfect?

An employer-provided plan is an excellent foundation, but even the best corporate policies can have limitations, especially for senior executives and their families. Common gaps include restrictive geographical limits, surprisingly low coverage caps for major surgery, or inadequate coverage for dependents who may be traveling or studying elsewhere.

High-net-worth individuals often find that these standardized corporate plans do not deliver the private-room standard of service or the choice of physicians and hospitals to which they are accustomed.

The solution is a supplemental personal IPMI plan. It functions as a top-up, filling in those critical gaps and ensuring your family has seamless, first-class healthcare access anywhere in the world, unconstrained by the limits of your company's policy.

This layered strategy ensures your health coverage is as mobile and flexible as your career demands, providing true global protection.

At Riviera Expat, we cut through the confusion to give you the control you need over your healthcare decisions. Our independent, expert guidance matches you with an IPMI plan that ticks every legal box while meeting your personal standards for excellence. Secure your peace of mind by scheduling a consultation on riviera-expat.com.