For globally mobile executives and financiers, managing diabetes while living or working abroad is not merely a health concern—it is a significant financial consideration. Acquiring comprehensive international health insurance with diabetes is entirely feasible, but a standard domestic plan is inadequate. It lacks the global reach and financial robustness required for life in key financial hubs such as Singapore, Dubai, or London.

You require a specialized International Private Medical Insurance (IPMI) policy. This is the only instrument engineered for the sophisticated healthcare realities of an international career.

The Reality of Securing Global Health Insurance with Diabetes

Let us be direct. For a high-net-worth professional, managing a chronic condition like diabetes across borders introduces a unique layer of complexity. Standard health plans are designed for a different paradigm—one with localized networks, inferior coverage limits, and a superficial grasp of chronic care management. They prove insufficient the moment you require premier care in another country.

This is where IPMI becomes a non-negotiable asset. It is built for your lifestyle.

The primary challenge is not simply finding a policy. It is securing one that delivers robust, reliable coverage without crippling exclusions or unexpected out-of-pocket costs that ambush you later. This guide provides a clear, actionable framework to demystify the underwriting process, affording you the control and clarity you expect in all your financial dealings.

Why Specialized Coverage Is a Financial Imperative

The global rise of diabetes has profound financial consequences for both individuals and the insurers who cover them. The statistics are significant. The International Diabetes Federation projects the number of adults with diabetes will increase from 537 million in 2021 to 783 million by 2045.

This surge has driven diabetes-related health expenditure to an estimated USD 966 billion worldwide as of 2021. This is not merely a statistic; it is a stark indicator of the severe financial risk you face without the correct insurance.

In this high-cost environment, insurers have no alternative but to be meticulous. They must carefully underwrite each applicant to offer sustainable coverage. For you, this means one thing: a well-managed condition is your single greatest asset in securing favorable terms.

An IPMI policy is more than a safety net. It is a strategic tool that guarantees access to world-class medical care anywhere on the globe, protecting both your health and your financial portfolio from the substantial costs of managing a chronic condition abroad.

What to Expect from This Guide

We will move beyond generic advice. This guide is a deep dive into how insurers evaluate risk and structure policies for applicants with diabetes. Our objective is to arm you with the insider knowledge required to navigate this process with confidence.

Here is what we will deconstruct:

- The Underwriting Process: We will analyze how insurers assess your specific condition, from your HbA1c levels to your complete treatment history.

- Premium and Coverage Impact: You will learn precisely how a diabetes diagnosis affects policy costs, what is subject to exclusion, and the waiting periods you can anticipate.

- Strategic Plan Selection: We will provide a checklist to ensure your plan effectively covers the essential medications, equipment, and specialist care you rely on.

- The Role of Expert Brokerage: Discover how a specialist broker can negotiate superior terms on your behalf, transforming a convoluted process into a straightforward, successful outcome.

Navigating the Underwriting Gauntlet with a Pre-Existing Condition

Let us be clear: acquiring top-tier international health insurance with diabetes is not like purchasing a standard off-the-shelf product. It involves a detailed risk assessment by the insurer. Consider it less like completing a simple form and more like presenting a business case for yourself. Your objective is to provide a clear, honest portrait that demonstrates your condition is well-managed and represents a predictable risk, not an unknown liability.

This deep dive allows the insurer to understand your specific health profile. They are not merely looking at the word "diabetes." They are constructing a complete picture to determine the terms of your policy, ensuring it aligns with their risk tolerance while providing you with solid, long-term coverage.

Key Factors Underwriters Scrutinize

Insurers delve into several critical data points when assessing an applicant with diabetes. Each piece of information helps them forecast your future healthcare needs and potential costs. Having this information prepared is your first—and most crucial—step toward a successful application.

Here is what is on their checklist:

- Type of Diabetes: They will immediately differentiate between Type 1, Type 2, and other forms such as gestational diabetes. Type 1, an autoimmune condition typically diagnosed at a young age, is often placed in a higher-risk category than well-managed, lifestyle-related Type 2.

- Age at Diagnosis: An early diagnosis, particularly for Type 1, suggests a longer history with the condition. From an insurer's perspective, this can imply a higher probability of complications developing over a lifetime.

- Control Levels (HbA1c): This is the single most important metric on your application. Your recent HbA1c readings provide a non-negotiable, long-term snapshot of your blood sugar management. A consistent track record of readings below 7.0% signifies excellent control and leads underwriters to view your application much more favorably.

Why a Complete Medical Picture is Non-Negotiable

Beyond the basics, underwriters require a comprehensive view—your current health, your full treatment plan, every detail. If your information is vague or incomplete, you can anticipate delays or an unfavorable decision. Insurers must price in uncertainty and will invariably assume a worst-case scenario if there are gaps in your profile. Navigating the complexities of securing insurance with a pre-existing condition is a critical skill, just as it is when seeking critical illness cover.

Your application must be completely transparent about:

- Current Treatment Plan: This means every single detail. List all medications (oral or injectable), insulin types and delivery methods (pens, pumps), and specific dosages. Mentioning your use of modern therapies demonstrates a proactive approach.

- Related Health Complications: You must disclose any existing complications. This includes neuropathy (nerve damage), retinopathy (eye damage), nephropathy (kidney damage), or any cardiovascular disease. The absence of these complications is a significant advantage, as it proves your condition has been well-managed over the long term.

- Other Health Metrics: They will also examine factors like your Body Mass Index (BMI), blood pressure, and cholesterol levels to build a complete risk profile.

An underwriter's primary goal is to eliminate surprises. A well-documented history of stable HbA1c levels, proactive self-care, and no major complications is your strongest negotiating tool. It transforms your application from a potential problem into a definable and acceptable risk.

Potential Underwriting Outcomes, Demystified

Once the insurer has reviewed your entire file, they will present a decision. It is crucial to understand what these outcomes signify, as they directly impact your coverage and costs. You can gain a better understanding of how insurers frame these decisions by consulting guides on understanding common policy exclusions.

These are the four most common results:

- Acceptance with a Premium Loading: This is a very frequent outcome for well-managed diabetes. The insurer approves your application but adds a surcharge (a "loading") to the standard premium. This additional percentage covers the higher anticipated risk.

- Acceptance with Exclusions: You are offered the policy, but with a significant caveat: specific conditions will not be covered. This typically means any costs directly related to your diabetes or pre-identified complications are entirely excluded.

- A Combination of Loading and Exclusions: For more complex or less-controlled cases, an insurer may apply both. You will pay a higher premium and have your diabetes-related care excluded from coverage.

- Decline: This is less common for well-managed cases, especially when working with a specialist broker. However, an outright decline can occur if your control is poor or you already have significant, costly complications.

How Diabetes Directly Impacts Your Premiums and Coverage

When you apply for international health insurance with a diabetes diagnosis, it is not merely a box to tick on a form. It triggers a specific, calculated risk assessment by the insurer. They are not being arbitrary; they are viewing your condition through a financial lens, quantifying the likelihood of future medical claims.

This assessment translates directly into concrete changes in your policy terms and, most noticeably, your costs.

The most common modification you will encounter is a premium loading. Consider it a surcharge added to the standard premium for an individual without diabetes. This loading, which can range from 50% to 150%—and sometimes higher—is how the insurer prices in the elevated risk of managing a long-term chronic condition. It is designed to preemptively cover the costs of future consultations, medications, and potential complications.

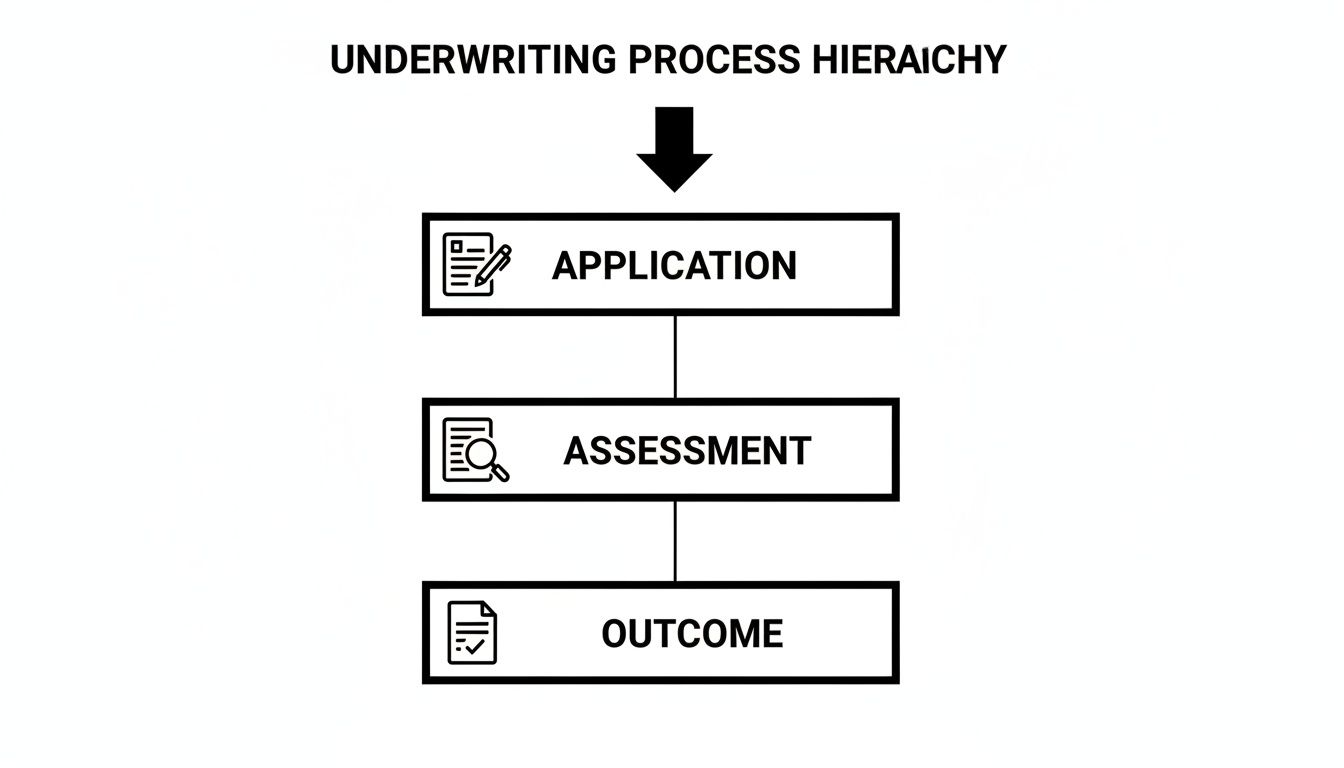

The entire process, from your initial application to the final policy offered, is termed underwriting.

This chart illustrates the direct line from your health disclosures to the insurer's final decision. Every detail you provide directly shapes the terms and cost of your coverage.

Unpacking Exclusions and Waiting Periods

Beyond increasing the premium, insurers employ two other powerful tools to manage their risk: exclusions and waiting periods.

An exclusion is precisely what it sounds like: a clause written into your policy that explicitly states the plan will not cover costs related to your diabetes or specific complications. If you already have complications like retinopathy (eye damage) or nephropathy (kidney damage), you can expect those to be excluded from day one.

A waiting period is another common stipulation. This is a set duration, often 24 months from your policy's start date, during which you cannot make any claims related to your diabetes. It is the insurer's mechanism to ensure they are not immediately liable for expensive, pre-existing issues and to prevent individuals from purchasing a policy solely to cover an imminent, high-cost treatment.

For a high-net-worth individual, the critical distinction is not if a loading or exclusion will be applied, but how it is applied. An overly broad exclusion that denies coverage for unforeseen future complications represents a substantial financial risk. This is where an expert broker demonstrates their value—negotiating these fine points is paramount.

Proactive Management Translates to Superior Terms

The single most important factor that will influence your policy’s outcome is how well you manage your diabetes. Insurers are not just insuring a diagnosis; they are insuring you. An applicant who can demonstrate a decade of stable HbA1c readings and zero complications is a much more predictable, and therefore favorable, risk than someone with a recent, volatile diagnosis.

It is also prudent to understand how specific treatments are handled. For example, you will want to know if advanced therapies like Ozempic medication are covered, as policies can vary widely on which drugs they include. You can also delve deeper into the general mechanics of premium increases in our guide on why medical insurance premiums rise year after year. This due diligence prevents unwelcome surprises when you require your treatment plan to be covered.

To appreciate how much your health management matters, consider the table below. It shows the stark difference in policy outcomes and proves that your proactive efforts can directly lead to better insurance terms and lower long-term costs.

Policy Impact Comparison: Well-Managed vs. Poorly-Controlled Diabetes

| Underwriting Factor | Well-Managed Diabetes (e.g., Stable HbA1c < 7%) | Poorly-Controlled Diabetes (e.g., Volatile HbA1c > 8.5%) |

|---|---|---|

| Premium Loading | A lower loading is likely, perhaps in the +50% to +75% range. | Expect a very high loading, almost certainly +150% or more, if not an outright decline. |

| Coverage Exclusions | Exclusions may be tightly focused on the pre-existing condition itself, with complications potentially remaining covered. | Broad exclusions for diabetes and all related future complications (cardiovascular, renal, optical) are almost guaranteed. |

| Waiting Periods | A standard waiting period for the condition will likely apply. | The insurer may impose longer or more restrictive waiting periods. |

| Overall Outcome | You have a high likelihood of securing a comprehensive plan with manageable, predictable costs. | There is a significant risk of obtaining a policy with limited value, crippling costs, or being declined altogether. |

As you can see, the message from insurers is clear: demonstrate control and stability, and you will be rewarded with a much better, more affordable policy. A history of poor control, conversely, makes securing meaningful coverage exceedingly difficult and expensive.

Your Strategic Checklist for Selecting the Right IPMI Plan

Choosing the right International Private Medical Insurance (IPMI) is not a simple retail transaction. You cannot merely glance at a benefits summary and hope for the best. For a globally mobile executive managing diabetes, your policy must be a precision instrument, finely tuned to your specific medical needs and lifestyle.

This is not a process to be rushed. A single misstep—one overlooked detail in the fine print—can lead to staggering out-of-pocket costs and dangerous gaps in your care, especially when relocating between hubs like Singapore, Dubai, or London. Use this checklist as your framework to dissect policy documents and make a choice that truly supports your long-term health.

Verify Your Essential Medications and Treatments

First and foremost: prescription drugs. A generic statement like "prescription coverage included" is entirely insufficient. You must know, without any ambiguity, that your specific medications are on the insurer's approved list (the formulary) or are covered without a co-payment that would be financially punitive.

Modern therapies, in particular, demand closer scrutiny. The rise of GLP-1 agonists like Ozempic or Mounjaro represents a significant breakthrough for many with Type 2 diabetes, but their high price means coverage is anything but standard. Some insurers require extensive documentation for prior authorization or will only cover them if you have a specific co-diagnosis. You must confirm these details upfront.

- Action Point 1: Obtain the insurer's drug formulary. Verify every single medication you take, down to the brand name and dosage.

- Action Point 2: Pose specific questions about GLP-1 therapies. What are the exact criteria for approval? Are there any limitations on the duration of coverage?

Confirm Access to Top-Tier Specialists and Equipment

Your ability to manage your diabetes effectively hinges on consistent access to specialized care and the right technology. An IPMI plan's true value is measured by the strength of its global provider network and how it handles essential medical equipment.

You require the freedom to consult a top endocrinologist in any major city, without exception. You cannot be constrained by a restrictive, second-rate network. Furthermore, modern diabetes management relies heavily on technology—such as Continuous Glucose Monitors (CGMs) and insulin pumps. Insurers classify these as "durable medical equipment," and their coverage for them can be highly variable.

A premier IPMI plan should not just be for emergencies. It must actively support your day-to-day, proactive management of a chronic condition. That means unrestricted access to specialists and the medical devices that provide critical, real-time data about your health.

The policy must explicitly state how it covers these items. Numerous studies have established that CGMs are now the standard of care, leading to better glycemic control and far superior health outcomes. Ensuring your policy reflects this medical reality is non-negotiable.

Scrutinize Annual Limits and Outpatient Benefits

Finally, you must examine the policy's financial architecture. Pay close attention to the annual benefit limits and the structure of outpatient care. The costs of routine chronic care can accumulate surprisingly quickly, even for high-net-worth individuals.

A plan with a low annual limit poses a massive financial risk. Consider the aggregate costs: specialist visits, regular lab work like HbA1c tests, prescription drugs, and medical supplies. These expenses can easily exceed tens of thousands of dollars annually.

Your checklist for financial security must include:

- High Overall Annual Limit: Do not consider plans with less than a USD 2 million annual limit. This ensures you are protected against both routine costs and any unexpected, high-cost events.

- Comprehensive Outpatient Coverage: Confirm that consultations, diagnostic tests, and prescription drugs are fully covered under the outpatient benefits. Be vigilant for restrictive sub-limits that could leave you with significant out-of-pocket expenses.

- Chronic Condition Provisions: Look for specific language regarding "chronic condition management." The best policies have dedicated benefits for ongoing care, demonstrating the insurer's genuine commitment to supporting your long-term health.

By systematically working through these critical points, you transform the confusing task of choosing health insurance with diabetes into a strategic decision. You ensure your plan is not just a piece of paper, but a robust asset for your global life.

Leveraging an Expert Broker to Negotiate Superior Terms

Acquiring an international private medical insurance (IPMI) policy is not a simple purchase; it is a strategic negotiation. For any high-net-worth individual managing a chronic condition like diabetes, the value of a specialist IPMI broker is immense. Their guidance fundamentally changes the dynamic. You transition from passively accepting an insurer's initial offer to proactively shaping a policy that delivers genuine, long-term financial security.

A specialist broker is your advocate, fluent in the complex dialect of medical underwriting. Their primary function is to frame your medical history in the most favorable light possible. They understand precisely what senior underwriters need to see—a clear, compelling narrative of stable control, proactive management, and minimal complications—and they ensure your application tells that story effectively.

This strategic presentation is critical because the financial stakes are exceptionally high. Without robust coverage, households with a diabetic family member can face severe financial strain. The financial burden of diabetes care is a stark reminder of why expert negotiation is so vital. A well-negotiated IPMI plan must fill any gaps left by national health systems, which often do not cover crucial supplies.

The Broker's Advantage in Underwriting

A key advantage a proficient broker provides is direct access to senior decision-makers within the insurance companies. Instead of your application being processed by a junior underwriter using a rigid checklist, a specialist can escalate your case. They leverage their established relationships to communicate directly with senior underwriters who possess the authority to make nuanced, judgment-based decisions.

This access opens the door to genuine negotiation on the terms that matter most. A broker can challenge overly broad or ambiguous exclusions, advocating for precise language that protects you from future financial surprises. They can also secure agreements for future reviews of any premium loading applied to your policy.

The most valuable asset a broker provides is market intelligence. They possess an insider’s view of which insurers are more amenable to underwriting specific medical profiles, steering your application toward those most likely to offer equitable terms from the outset.

Key Negotiation Points for Diabetes Coverage

An experienced broker will focus on several specific areas to improve the terms of your health insurance with diabetes. These are not minor adjustments; they are fundamental changes that can dramatically enhance the quality and value of your coverage. For a better understanding of how policies are structured, you may also wish to consult our guide on how to interpret key expat medical insurance policy terms.

Here are the critical points a broker will negotiate on your behalf:

- Premium Loading Review: Your broker can negotiate a clause that triggers a review of your premium loading after a set period, typically 24 months, of continued stable health. This creates a clear pathway to potentially reduce your long-term costs.

- Challenging Broad Exclusions: They will push back firmly against vague, catch-all exclusions like "any and all complications arising from diabetes." The objective is to secure specific, named exclusions directly tied to your disclosed medical history, leaving you covered for future, unrelated issues.

- Securing Coverage for Medical Equipment: Brokers can make a powerful case for including essential equipment like Continuous Glucose Monitors (CGMs) and insulin pumps. They will frame this technology not as a luxury, but as a critical tool for maintaining the stable health that benefits both you and the insurer.

Ultimately, engaging a specialist broker completely transforms the process of securing IPMI. It ensures your unique health situation is assessed fairly and that your final policy is a precisely negotiated asset, offering the comprehensive protection and peace of mind you require.

Looking Ahead: What's Next for Chronic Condition Coverage?

Prudent long-term planning requires a forward-looking perspective. The world of international private medical insurance (IPMI) is not static. It is constantly being reshaped by medical breakthroughs, evolving health trends, and new financial realities. To ensure your family’s health coverage remains robust for years to come, you must understand the industry's trajectory.

One of the most significant emerging trends is the escalating cost of lifestyle-linked conditions. For many years, cancer was the undisputed primary driver of insurance claims costs. That is poised to change. According to Bupa Global's 2025 healthcare trend analysis, conditions such as type 2 diabetes and obesity are on track to become the most expensive claims drivers in the IPMI market.

This is not a minor adjustment; it is a fundamental shift that is compelling insurers to completely rethink their approach to chronic conditions.

The Game-Changing Impact of New Drugs

What is accelerating this transformation? A new class of highly effective—and exceptionally expensive—treatments, particularly GLP-1 agonists like Wegovy and Zepbound. These drugs have demonstrated remarkable efficacy for both diabetes and weight management, but their price point is creating significant challenges for insurers.

We are already observing insurers scrambling to adapt. Some are implementing strict policies, covering these drugs only for a primary diabetes diagnosis. They will not cover them for obesity unless the patient also has specific, documented cardiovascular risks.

This adds a new layer of complexity to plan selection. It is no longer sufficient to see "prescription drug coverage" in a brochure. You must delve deeper to confirm that the policy specifically covers the modern therapies that will deliver the best possible health outcome. It is a stark reminder of why a policy built for comprehensive chronic care is non-negotiable.

The Shift to Proactive and Predictive Health Management

Insurers are not merely waiting for billion-dollar claims to accumulate. The most forward-thinking are moving away from a reactive "break-fix" model of healthcare. They are now embedding preventative wellness programs and AI-powered health tools directly into their premium plans. It is a strategic pivot from paying for sickness to investing in health.

These programs are not mere marketing features; they offer real, tangible value by providing personalized support to manage your condition proactively.

- Personalized Wellness Incentives: Expect premium discounts or other rewards for achieving health goals, such as maintaining a stable HbA1c, engaging with a health coach, or utilizing a digital health app.

- AI-Powered Health Monitoring: More plans will integrate with your smartwatch or health applications. These tools use AI to analyze your data, identify potential issues before they become critical, and provide real-time guidance to keep you on track.

- Dedicated Care Management Teams: The best plans now offer access to dedicated nurses or health advisors who specialize in chronic conditions. They become your navigator and advocate, helping you manage complex treatments and navigate administrative hurdles.

This move toward proactive care represents a true win-win scenario. The insurer lowers its risk of covering a catastrophic complication in the future. For you, it means access to powerful tools and expert support to maintain optimal health. Your insurance evolves from a simple safety net into a strategic partner in your long-term well-being.

Your Diabetes & IPMI Questions, Answered

When seeking global health insurance with a pre-existing condition like diabetes, numerous questions naturally arise. Let us address the most common ones with direct, clear answers.

"Will Insurers Automatically Reject Me for Type 1 Diabetes?"

No, not necessarily. A Type 1 diagnosis does not trigger an automatic rejection from the specialist insurers with whom we work. For them, it is not a checkbox exercise but a thorough review of your specific medical history.

They will require a clear picture of how you are managing your condition. Good control, recent HbA1c results, and an absence of complications are the key factors they assess. A solid, documented history of stable management is your most valuable asset and dramatically improves your prospects of obtaining coverage. It will, however, almost certainly result in a higher premium. This is where a specialist broker becomes essential—they know which insurers are better equipped to evaluate your case fairly.

"Can I Get My Premium Loading Reduced or Removed Later?"

Yes, this is an entirely reasonable objective. Consider it a strategic review. Insurers are often willing to reconsider a premium loading after a sustained period of stability, typically around 24 to 36 months.

To initiate this process, you will need to provide updated medical records from your endocrinologist that demonstrate your condition is stable or has improved. Realistically, having the surcharge removed completely is rare, but achieving a reduction is a very attainable outcome. An experienced broker can package this review and present it to the insurer in the most effective manner.

"What About My CGM and Insulin Pump? Are They Covered?"

This is a critical point, and the answer varies significantly from one plan to another. High-end, premier-tier IPMI policies are your best prospect for covering durable medical equipment like Continuous Glucose Monitors (CGMs) and insulin pumps, but it is never guaranteed.

For many, these devices are not mere conveniences; they are the absolute standard of care for managing diabetes effectively. Securing a policy that covers them is not a luxury—it is a core component of a prudent, long-term health strategy.

Coverage often depends on specific requirements, such as a formal letter of medical necessity from your physician. You absolutely must confirm this benefit in the policy's fine print before committing. Scrutinize the sections on ‘Medical Appliances’ or ‘Chronic Condition Management’ to understand the exact wording the insurer uses.

At Riviera Expat, we possess the expertise and market access to secure superior international health insurance terms for professionals managing diabetes. Schedule a confidential consultation with our specialists today to gain the clarity you need.